Water Soluble Packaging Market by Raw Material (Polymer, Surfactant, and Fiber), End Use (Industrial, and Residential), Solubility Type (Cold Water Soluble and Hot Water Soluble), Packaging Type, and Region - Global Forecast to 2025

Water Soluble Packaging Market

Water Soluble Packaging Market Key Drivers, Restraint & Challenge:

Water soluble packaging is an innovative package type that is used in place of the traditional plastic ones. The usage of plastic or plastic-based products is growing at a fast pace, however, governments across the world are working on curbing its usage. Plastics have become a crucial part of our lives through their applications and strength. The growth in the usage of single use plastics has affected the overall environmental sustainability and has, therefore, been quite a huge challenge for governments to work on.

Key Drivers:

- Growing environmental and sustainability concerns

- Usage of water soluble packaging in multiple applications

- Ban on single-use plastics

Key Restraint and Challenge:

- Secondary packaging requirements

- Higher acceptability of bioplastics

Solubility Type in Water Soluble Packaging :

Water soluble packaging solutions are packaging solutions with water soluble and biodegradable characteristics and specifications based on the packaging material solubility. The classification is based on the applications majorly considering agricultural, chemical, and water treatment industries. Due to rise in consumer awareness of the safe usage of hazardous and environment-friendly materials by eliminating non-biodegradable materials for packaging and water-soluble packaging in many countries is gaining traction.

- Cold Water

- Hot Water

Top 10 players in Water Soluble Packaging industry:

The competitive landscape provides an overview of the relative market position of the key players operating in the water soluble packaging market, based on the strength of their project offerings and business strategies, analyzed based on a proprietary model. Key players in the market have majorly adopted strategies such as new product launches, agreements, collaborations, and joint ventures, expansions, and acquisitions. Some of the major players in the market are:

- Lithey

- Mondi Group

- Sekisui Chemicals

- Kuraray Co Ltd

- Mitsubishi Chemical Holdings

- Aicello Corporation

- AquapaK Polymers

- Lactips

- Cortec Corporation

- Acedag Ltd

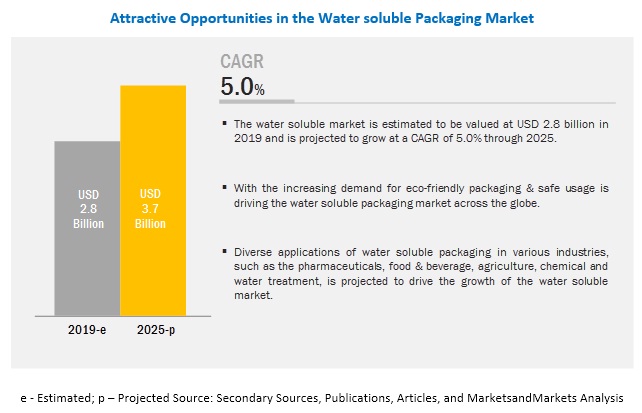

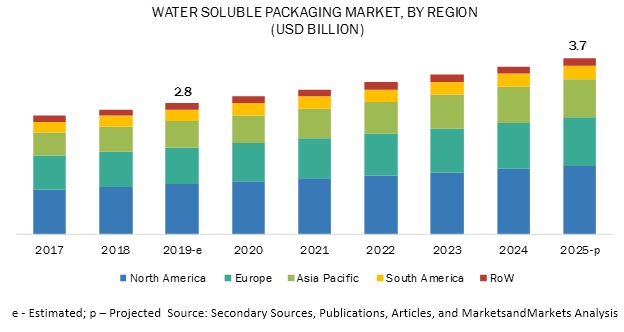

[155 Pages Report] According to MarketsandMarkets, the global water soluble packaging market is estimated to be valued at USD 2.8 billion in 2019 and is projected to reach USD 3.7 billion by 2025, recording a CAGR of 5.0%. The rising application of water soluble packaging in multiple industries and the growing environmental and sustainability concerns led to a surge in demand for biodegradable packaging. The rise in awareness regarding the drawbacks of using single-use plastics and government intervention in banning the use of such plastics affecting the environment adversely have significantly driven the growth of the water soluble packaging market.

By raw material, the polymer segment is projected to account for the largest share in the water soluble packaging market

The polymer-based water soluble packaging segment is projected to dominate the market, on the basis of raw material, during the forecast period. This is attributed to the increasing use of water soluble packaging that provides a sustainable and environment-friendly solution for packaging in multiple applications. PVOH (Polyvinyl alcohol) is a clear and water soluble thermoplastic derives from polyvinyl acetate. It is extremely hydrophilic in nature, and thus, is used as a perfect raw material for manufacturing of water soluble films and packaging. In addition, the use of water soluble packaging made of PVOH has gained its popularity in the agriculture sector to cover harmful fertilizers so that it becomes easier for the farmers to handle such toxic chemicals without touching them. Moreover, PVOH is approved by FDA to be used as a packaging material in the food industry as well and considered to be safe, which is one of the major factors to support its growth in the market.

By end use, the industrial chemical segment accounted for the largest market size in the water soluble packaging market during the forecast period

The demand for water soluble packaging is increasing significantly due to the associated benefits, especially in the industries where the workers need to deal with harmful chemicals. To avoid direct contact, packaging would provide a safer option for the workers to handle such chemicals. Most of the industries are avoiding usage of plastics as it generates a lot of waste, require a large space to keep such plastics and large amount of disposal cost are incurred. Instead use of water soluble material for packaging leads to the reduction of cost of labor in cleaning and makes the manufacturing process more sustainable.

North America is projected to account for the largest market share during the forecast period

In 2018, North America accounted for the largest market share in the water soluble packaging market. This is attributed to the high adoption of water soluble packaging in various industries. The problem of plastics waste generation is intensifying by the day. According to EPA, in the US, 70% of the plastics end up in landfills, and this is because of the popular throw-away culture. However, the growing awareness among the people regarding the need for reduction of single-use plastics usage, coupled with government interventions to ban their use, drives the market for water soluble packaging in the North American region.

Key Market Players

The key players in this market include Kuraray Co. Ltd (Japan), Aicello Corporation (Japan), Cortec Corporation (US), Mondi Group (Austria), Sekisui Chemicals (Japan), Aquapak Polymer Ltd. (UK), and Mitsubishi Chemicals Holdings (Japan).

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

20172025 |

|

Base year considered |

2018 |

|

Forecast period considered |

20192025 |

|

Units considered |

Value (USD) |

|

Segments covered |

Raw material, end use, solubility type, packaging type, and region |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Companies studied |

|

This research report categorizes the water-soluble packaging market based on raw material, end use, solubility type, and packaging type,

Target Audience

- Water soluble films manufacturers and suppliers

- Water soluble packaging distributors importers and exporters

- Raw material manufacturers

- Research institutions

- Government bodies

- Distributors

- End users (Food & beverage industry, pharmaceutical industry, agriculture industry, water treatment, other chemical industries, and residential usage)

Report Scope

Raw Material

- Polymers

- Surfactants

- Fibers

End Use

- Industrial

- Food & beverages

- Pharmaceuticals

- Agriculture

- Chemicals

- Water treatment

- Residential

Packaging Type

- Bags

- Pouches

- Pods & capsules

Solubility Type

- Cold water soluble

- Hot water soluble

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In October 2019, hot water soluble laundry bags, made by Aquapak Polymer Ltd. (UK) have been launched by Australian distributor, DB Packaging. The development aims at widening the range of water soluble packaging product lines offered by the company.

- In October 2019, Aquapak Polymer Ltd. (UK) launched Garment packaging bags made from Aquapak polymer, which will be launched by the Finisterre garment company. The company aims to replace traditional packaging with soluble packaging.

- In June 2018, Mondi Group (Austria) acquired Powerflute Group, a division of Nordic Packaging and Container Holdings, in order to strengthen its innovative packaging business in Europe.

- In March 2018, Kuraray Co. Ltd. (Japan) established a water soluble film manufacturing facility in Indiana, US. The development would help the company to strengthen its manufacturing capacities.

Key Questions Addressed by the Report

- What are the growth opportunities in the water soluble packaging market?

- What are the major raw materials used for manufacturing water soluble packaging?

- What are the key factors affecting market dynamics?

- What are some of the significant challenges and restraints that the industry faces?

- Which are the key players operating in the market, and what initiatives have they undertaken over the past few years?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Regional Segmentation

1.3.2 Periodization Considered

1.4 Currency Considered

1.5 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions for the Study

2.5 Limitations of the Study

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 37)

4.1 Opportunities in the Water Soluble Packaging Market

4.2 Water Soluble Packaging Market, By End Use, 2018

4.3 North America: Water Soluble Packaging Market, By Packaging Type and Key Country

4.4 Water Soluble Packaging Market, By Raw Material and Region, 2018

4.5 Water Soluble Packaging Market, By Key Country, 2018

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Macroeconomic Indicators

5.2.1 High-Growth Potential in the Green Packaging Market

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Environmental and Sustainability Concerns

5.3.1.2 Usage of Water Soluble Packaging in Multiple Applications

5.3.1.3 Ban on Single-Use Plastics

5.3.2 Restraints

5.3.2.1 Secondary Packaging Requirements

5.3.3 Opportunities

5.3.3.1 Development of Plant-Based Sources for the Extraction of Water Soluble Materials

5.3.3.2 Growth Opportunities and High Potential in the Packaging Sector in Developing Countries

5.3.4 Challenges

5.3.4.1 Higher Acceptability of Bioplastics

5.4 Patent Analysis

5.5 Yc and Ycc Shift

6 Water Soluble Packaging Market, By Raw Material (Page No. - 49)

6.1 Introduction

6.2 Polymers

6.2.1 Wide Application of Polymers for Water Soluble Packaging Due to Their High Solubility

6.3 Surfactants

6.3.1 Binding Properties of Surfactants Expected to Drive Their Growth in the Water Soluble Packaging Market

6.4 Fibers

6.4.1 Dissolution Properties of Fibers Expected to Drive Their Growth in the Water Soluble Packaging Market

7 Water Soluble Packaging Market, By Packaging Type (Page No. - 55)

7.1 Introduction

7.2 Bags

7.2.1 Growing Demand for Bags Across the Pharmaceutical Industry Expected to Drive the Market for Bags

7.3 Pouches

7.3.1 Convenience and Ease of Disposability Remain the Key Factors Boosting the Growth of Pouch-Based Water Soluble Packaging

7.4 Pods & Capsules

7.4.1 Growth in the Food and Soap & Detergent Industries to Drive the Growth of Pods & Capsules in the Water Soluble Packaging Market

8 Water Soluble Packaging, By Solubility Type (Page No. - 60)

8.1 Introduction

8.2 Cold Water

8.2.1 Cold Water Soluble Films are Majorly Used for the Formulation of Detergent Packaging

8.3 Hot Water

8.3.1 Application of Hot Water Soluble Packaging Solutions in Hospitals to Drive the Market Growth

9 Water Soluble Packaging, By End Use (Page No. - 64)

9.1 Introduction

9.2 Industrial

9.2.1 Food & Beverage

9.2.1.1 Water Soluble Packaging for Instant Coffee is Gaining Popularity Across Regions

9.2.2 Pharmaceuticals

9.2.2.1 Water Soluble Packaging Helps to Maintain Hygiene in Hospitals

9.2.3 Agriculture

9.2.3.1 Pvoh Film-Based Packages of Fertilizers Ensure the Safety of Workers on Agricultural Fields

9.2.4 Chemical

9.2.4.1 The Chemical Industry to Be the Major Consumer of Soluble Packaging Solutions

9.2.5 Water Treatment

9.2.5.1 Maintaining Sustainability for Treating Water to Drive the Demand for Water Soluble Packages in the Industry

9.3 Residential

9.3.1 The Increase in Consumer Preference for Sustainable Packages to Drive the Growth of the Water Soluble Packaging Market for Residential Purposes

10 Water Soluble Packaging Market, By Region (Page No. - 71)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Restriction of Plastic Waste Imports From Asian Countries to Create Opportunities for Packaging Innovations

10.2.2 Canada

10.2.2.1 Government Initiatives for Promoting Sustainable Packaging to Drive the Growth of the Water Soluble Packaging Market

10.2.3 Mexico

10.2.3.1 Government Initiatives for Promoting Sustainability and Growth of the Industrial Sector Will Promote the Application of Water Soluble Packaging

10.3 Europe

10.3.1 UK

10.3.1.1 Government Initiatives and Regulations Around Sustainable Packaging Driving the Market for Water Soluble Packaging

10.3.2 Germany

10.3.2.1 Need for Recycling Packaging Materials in an Environmentally Friendly and Economically Efficient Manner

10.3.3 France

10.3.3.1 Ban on the Usage of Single-Use Plastics and Non-Biodegradable Bags Expected to Increase the Demand for Water Soluble Packaging

10.3.4 Italy

10.3.4.1 Energy Recovery Conservation Efforts to Promote the Usage of Sustainable Packaging and Growth in Water Soluble Packaging

10.3.5 Spain

10.3.5.1 Positive Mindset of Consumers Toward the Usage of Recyclable Or Sustainable Materials

10.3.6 Belgium

10.3.6.1 Enforcement of Legislative Norms, in Relation to Sustainable Or Innovative Packaging, Boosting the Demand for Water Soluble Packaging

10.3.7 Rest of Europe

10.3.7.1 Increase in Focus Toward the Usage of Bio-Based Material Promoting the Growth of Water Soluble Packaging

10.4 Asia Pacific

10.4.1 China

10.4.1.1 High Industrial Growth and Increasing Investments to Promote Biodegradable Packaging Across Industries in China and Will Help in the Growth of the Water Soluble Packaging Market

10.4.2 India

10.4.2.1 Growth in Governmental Norms to Boost the Usage of Sustainable Packaging

10.4.3 Japan

10.4.3.1 Strong Presence of Major Manufacturers in the Region, Along With the Growth of Industrialization, Will Help Increase the Demand for Water Soluble Packaging

10.4.4 Australia

10.4.4.1 High Demand for Biodegradable Packaging Will Boost the Growth of the Water Soluble Packaging Market

10.4.5 Indonesia

10.4.5.1 Rise in Job Opportunities in the Developing Economy of Indonesia to Promote Sustainable Packaging Will Drive the Demand for Water Soluble Packaging

10.4.6 Rest of Asia Pacific

10.4.6.1 Ban on the Usage of Single-Use Plastic and Non-Biodegradable Bags Will Increase the Demand for Water Soluble Packaging

10.5 South America

10.5.1 Brazil

10.5.1.1 Growing Demand for Environmentally Sustainable Packaging as A Result of Growing Plastic Packaging Waste Will Drive the Water Soluble Packaging Market in Brazil

10.5.2 Argentina

10.5.2.1 Growing Agriculture Industry That Uses Agrochemical Through Water Soluble Packaging Will Boost the Market

10.5.3 Rest of South America

10.5.3.1 Government Regulations Across the South American Countries to Promote Alternative Packaging Solutions Will Increase the Demand for Water Soluble Packaging

10.6 Rest of the World

10.6.1 Africa

10.6.1.1 Sustainability Issues in Food Packaging to Create Growth Opportunities for Water Soluble Packaging in Africa

10.6.2 Middle East

10.6.2.1 The Water Soluble Packaging Market in the Region Witnesses Slow Growth Due to the Increasing Focus of Governments on Recycling Plastics

11 Competitive Landscape (Page No. - 114)

11.1 Overview

11.2 Competitive Leadership Mapping

11.2.1 Dynamic Capitalizers

11.2.2 Innovators

11.2.3 Visionary Leaders

11.2.4 Emerging Companies

11.3 Competitive Benchmarking

11.3.1 Strength of Product Portfolio

11.3.2 Business Strategy Excellence

11.4 Competitive Scenario

11.4.1 Expansions & Investments

11.4.2 Acquisitions

11.4.3 New Product Launches

12 Company Profiles (Page No. - 122)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Lithey Inc.

12.2 Mondi Group

12.3 Sekisui Chemicals

12.4 Kuraray Co. Ltd.

12.5 Mitsubishi Chemical Holdings

12.6 Aicello Corporation

12.7 Aquapak Polymers Ltd.

12.8 Lactips

12.9 Cortec Corporation

12.10 Acedag Ltd.

12.11 Msd Corporation

12.12 Prodotti Solutions

12.13 Jrf Technology LLC

12.14 Amtopack Inc.

12.15 Smartsolve Industries

12.16 Guangdong Proudly New Material Technology Corporation

12.17 Arrow Greentech Ltd.

12.18 Amtrex Nature Care Pvt. Ltd.

12.19 Solupak

12.20 Decomer Technology

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 148)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Related Reports

13.4 Author Details

List of Tables (106 Tables)

Table 1 USD Exchange Rates, 20142018

Table 2 Water Soluble Packaging Market Snapshot, 2019 vs. 2025

Table 3 List of Important Patents for Water Soluble Packaging, 20132018

Table 4 Water Soluble Packaging Market Size, By Raw Material, 20172025 (USD Million)

Table 5 Water Soluble Packaging Market Size for Polymers, By Subtype, 20172025 (USD Million)

Table 6 Polymers: Water Soluble Packaging Market Size, By Region, 20172025 (USD Million)

Table 7 Surfactants: Water Soluble Packaging Market Size, By Region, 20172025 (USD Million)

Table 8 Fibers: Water Soluble Packaging Market Size, By Region, 20172025 (USD Million)

Table 9 Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 10 Bags: Water Soluble Packaging Market Size, By Region, 20172025 (USD Million)

Table 11 Pouches: Water Soluble Packaging Market Size, By Region, 20172025 (USD Million)

Table 12 Pods & Capsules: Water Soluble Packaging Market Size, By Region, 20172025 (USD Million)

Table 13 Water Soluble Packaging Market Size, By Solubility Type, 20172025 (USD Million)

Table 14 Cold Water Soluble Packaging Market Size, By Region, 20172025 (USD Million)

Table 15 Hot Water Soluble Packaging Market Size, By Region, 20172025 (USD Million)

Table 16 Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 17 Industrial Water Soluble Packaging Market Size, By Type 20172025 (USD Million)

Table 18 Food & Beverage Water Soluble Packaging Market Size, By Subtype, 20172025 (USD Million)

Table 19 Industrial: Water Soluble Packaging Market Size, By Region, 20172025 (USD Million)

Table 20 Residential: Water Soluble Packaging Market Size, By Region, 20172025 (USD Million)

Table 21 Water Soluble Packaging Market Size, By Region, 20172025 (USD Million)

Table 22 North America: Water Soluble Packaging Market Size, By Country, 20172025 (USD Million)

Table 23 North America: Water Soluble Packaging Market Size, By Raw Material, 20172025 (USD Million)

Table 24 North America: Water Soluble Packaging Market Size for Raw Material, By Polymer, 20172025 (USD Million)

Table 25 North America: Water Soluble Packaging Market Size, By Solubility Type, 20172025 (USD Million)

Table 26 North America: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 27 North America: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 28 North America: Industrial Water Soluble Packaging Market Size, By Type, 20172025 (USD Million)

Table 29 North America: Food & Beverage Water Soluble Packaging Market Size, By Subtype, 20172025 (USD Million)

Table 30 US: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 31 US: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 32 Canada: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 33 Canada: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 34 Mexico: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 35 Mexico: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 36 Europe: Water Soluble Packaging Market Size, By Country, 20172025 (USD Million)

Table 37 Europe: Water Soluble Packaging Market Size, By Raw Material, 20172025 (USD Million)

Table 38 Europe: Water Soluble Packaging Market Size for Polymers, By Subtype, 20172025 (USD Million)

Table 39 Europe: Water Soluble Packaging Market Size, By Solubility Type, 20172025 (USD Million)

Table 40 Europe: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 41 Europe: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 42 Europe: Water Soluble Packaging Market Size for Industrial Use, By Subtype, 20172025 (USD Million)

Table 43 Europe: Water Soluble Packaging Market Size for Food & Beverages, By Subtype, 20172025 (USD Million)

Table 44 UK: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 45 UK: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 46 Germany: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 47 Germany: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 48 France: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 49 France: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 50 Italy: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 51 Italy: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 52 Spain: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 53 Spain: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 54 Belgium: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 55 Belgium: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 56 Rest of Europe: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 57 Rest of Europe: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 58 Asia Pacific: Water Soluble Packaging Market Size, By Country, 20172025 (USD Million)

Table 59 Asia Pacific: Water Soluble Packaging Market Size, By Raw Material, 20172025 (USD Million)

Table 60 Asia Pacific: Water Soluble Packaging Market Size for Raw Material, By Polymer, 20172025 (USD Million)

Table 61 Asia Pacific: Water Soluble Packaging Market Size, By Solubility Type, 20172025 (USD Million)

Table 62 Asia Pacific: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 63 Asia Pacific: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 64 Asia Pacific: Industrial Water Soluble Packaging Market Size, By Type, 20172025 (USD Million)

Table 65 Asia Pacific: Water Soluble Packaging Market Size in Food & Beverages, By Subtype, 20172025 (USD Million)

Table 66 China: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 67 China: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 68 India: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 69 India: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 70 Japan: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 71 Japan: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 72 Australia: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 73 Australia: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 74 Indonesia: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 75 Indonesia: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 76 Rest of Asia Pacific: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 77 Rest of Asia Pacific: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 78 South America: Water Soluble Packaging Market Size, By Country, 20172025 (USD Million)

Table 79 South America: Water Soluble Packaging Market Size, By Raw Material, 20172025 (USD Million)

Table 80 South America: Water Soluble Packaging Market Size for Polymers, By Subtype, 20172025 (USD Million)

Table 81 South America: Water Soluble Packaging Market Size, By Solubility Type, 20172025 (USD Million)

Table 82 South America: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 83 South America: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 84 South America: Water Soluble Packaging Market Size for Industrial Use, By Subtype, 20172025 (USD Million)

Table 85 South America: Water Soluble Packaging Market Size for Food & Beverages, By Subtype, 20172025 (USD Million)

Table 86 Brazil: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 87 Brazil: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 88 Argentina: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 89 Argentina: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 90 Rest of South America: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 91 Rest of South America: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 92 RoW: Water Soluble Packaging Market Size, By Region, 20172025 (USD Million)

Table 93 RoW: Water Soluble Packaging Market Size, By Raw Material, 20172025 (USD Million)

Table 94 RoW: Water Soluble Packaging Market Size for Polymers, By Subtype, 20172025 (USD Million)

Table 95 RoW: Water Soluble Packaging Market Size, By Solubility Type, 20172025 (USD Million)

Table 96 RoW: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 97 RoW: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 98 RoW: Water Soluble Packaging Market Size for Industrial Use, By Subtype, 20172025 (USD Million)

Table 99 RoW: Water Soluble Packaging Market Size for Food & Beverages, By Subtype, 20172025 (USD Million)

Table 100 Africa: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 101 Africa: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 102 Middle East: Water Soluble Packaging Market Size, By Packaging Type, 20172025 (USD Million)

Table 103 Middle East: Water Soluble Packaging Market Size, By End Use, 20172025 (USD Million)

Table 104 Expansions & Investments, 20122019

Table 105 Acquisitions, 20142019

Table 106 New Product Launches, 20142019

List of Figures (32 Figures)

Figure 1 Water Soluble Packaging: Market Segmentation

Figure 2 Water Soluble Packaging Market: Research Design

Figure 3 Data Triangulation Methodology

Figure 4 Water Soluble Packaging Market Size, By Raw Material, 2019 vs. 2025 (USD Million)

Figure 5 Water Soluble Packaging Market Size, By Packaging Type, 2019 vs. 2025 (USD Million)

Figure 6 Water Soluble Packaging Market Size, By Solubility Type, 2019 vs. 2025 (USD Million)

Figure 7 Water Soluble Packaging Market Size, By End Use, 2019 vs. 2025 (USD Million)

Figure 8 Water Soluble Packaging Market Share & Growth (Value), By Region

Figure 9 Growing Concerns About Sustainability and Plastic Packaging Waste Disposal Driving the Market for Water Soluble Packaging

Figure 10 The Industrial Sector Accounted for A Larger Share in the Water Soluble Packaging Market

Figure 11 North America: Higher Adoption for Innovative Packaging Solutions Witnessed in the US

Figure 12 North America Accounted for the Largest Share of the Water Soluble Packaging Market for Polymers in 2018

Figure 13 The US Accounted for the Largest Market Share in 2018

Figure 14 Global Green Packaging Market (20152020)

Figure 15 Water Soluble Packaging Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Recycling and Recovery Rate for All Packaging Waste, Eu-28, 20072016

Figure 17 Global Production Capacities of Bioplastics (20172023)

Figure 18 Number of Patents Approved for Water Soluble Packaging, By Applicant, 20182019

Figure 19 Geographical Analysis: Patent Approval for Water Soluble Packaging, 20182019

Figure 20 Water Soluble Packaging Market Size, By Raw Material, 2019 vs. 2025 (USD Million)

Figure 21 Water Soluble Packaging Market Size, By Packaging Type, 2019 vs. 2025 (USD Million)

Figure 22 Water Soluble Packaging Market Size, By Solubility Type, 2019 vs. 2025 (USD Million)

Figure 23 Water Soluble Packaging Market Size, By End Use, 2019 vs. 2025 (USD Million)

Figure 24 China and India to Witness Significant Market Growth in the Water Soluble Packaging Market (20192025)

Figure 25 North America: Market Snapshot

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Water Soluble Packaging Market: Competitive Leadership Mapping, 2018

Figure 28 Key Developments of the Leading Players in the Water Soluble Packaging Market, 20122019

Figure 29 Mondi Group: Company Snapshot

Figure 30 Sekisui Chemicals: Company Snapshot

Figure 31 Kuraray Co. Ltd.: Company Snapshot

Figure 32 Mitsubishi Chemical Holdings: Company Snapshot

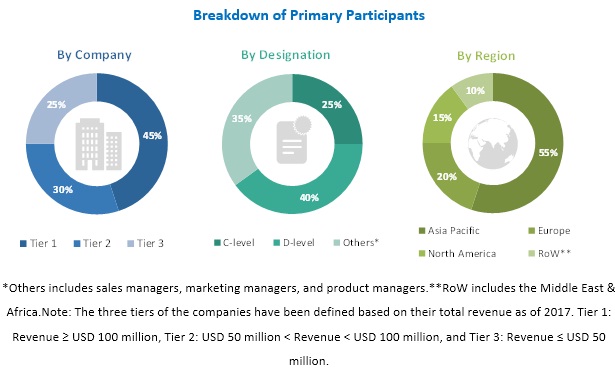

The study involved four major activities in estimating the market size for water soluble packaging. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, in order to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand-side of the market is characterized by the presence of various industrial products processors such as food & beverage, pharmaceuticals, industrial chemicals, water treatment and agriculture, importers/exporters, and research institutions. The supply-side is characterized by the presence of key water-soluble raw material manufacturers, suppliers, distributors, researchers, and service providers. Various primary sources from both the supply- and demand-sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the water soluble packaging market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the water soluble packaging market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted-top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To describe and forecast the water soluble packaging market, in terms of raw material, solubility type, end-use, packaging type, and region

- To describe and forecast the water soluble packaging market, in terms of value, by regionAsia Pacific, Europe, North America, South America and the Rest of the World-along with their respective countries

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of water soluble packaging market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the water soluble packaging market

- To strategically profile the key players and comprehensively analyze their market position, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches such as acquisitions & divestments, expansions, product launches & approvals, and agreements in the water soluble packaging market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Geographic Analysis

- Further breakdown of the Rest of the World water-soluble packaging market into the Middle East & Africa

- Further breakdown of the Rest of Asia Pacific water-soluble packaging market into Vietnam, Malaysia, Thailand, the Philippines, and South Korea

- Further breakdown of the Rest of Europe water-soluble packaging market intoAustria, Portugal, Ireland, Sweden, Bulgaria, Belgium, Turkey, Russia, Poland, and Denmark

Segment Analysis

- Further breakdown of the water-soluble packaging applications market, by country

Growth opportunities and latent adjacency in Water Soluble Packaging Market