Edible Packaging Market by Source(Plant & Animal), Raw Material(Seaweeds & Algae, Polysaccharides, Lipids),End Use, Packaging Process(Antimicrobial, Nanotechnology, Electrohydrodynamic, Coatings, Microorganisms), Region - Global Forecast to 2025

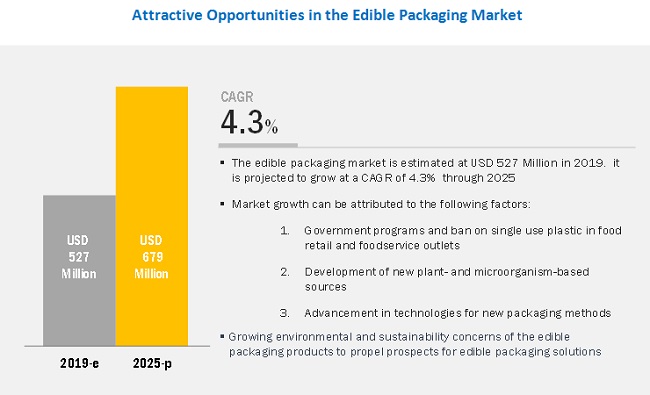

[161 Pages Report] The global edible packaging market size is projected to grow from USD 527 million in 2019 to USD 679 million by 2025, at a CAGR of 4.3%. The rise in the popularity of edible packaging solutions can be attributed to government initiatives, advancements in packaging technologies, and the development of new sources for edible packaging solutions. China, Indonesia, and India are among the key markets targeted by edible packaging manufacturers and distributors due to the government policies favoring edible packaging solutions and established base for raw materials in terms of plant-based sources that support the growth of edible packaging solutions in the region.

On the basis of source, the plant segment is projected to be the largest contributor in the edible packaging market during the forecast period

The edible packaging industry has been segmented on the basis of source into plant and animal. The market for plant-based sources is projected to record a larger market share between 2019 and 2025. Edible packaging has been gaining significance among manufacturers and consumers alike due to the growing concerns over single-use plastics and their potential ban. Advancements in sources for edible packaging have also helped bolster prospects among manufacturers. Edible packaging helps reduce waste otherwise generated from single-use plastics while also posing a sustainable alternative for container applications in foodservice and delivery applications.

Easy availability and established manufacturing facilities drive prospects for seaweed and algae sources in the edible packaging market

Seaweed and algae have emerged as popular raw material sources in the manufacturing of edible packaging products. The inherent nature of seaweed as a nutrient-rich source of food further bolsters the adoption of seaweed in packaging applications without the need for additional chemicals. Commercial seaweed farming across countries in the Asia Pacific region has also helped supply the industry with sufficient raw material inputs and is seen as a sustainable source to meet industry packaging requirements. Seaweed can also be adapted across multiple food & beverage applications and can be processed into different forms, thereby granting a higher degree of flexibility to manufacturers.

Increasing use in beverages and pharmaceutical applications drives the growth of edible packaging solutions.

The edible packaging market is segmented on the basis of end use into food, beverages, and pharmaceutical applications. Beverages have proven to be a strong sector for growth in the market and is driven by its use in water, juices, and even alcoholic beverages. Foodservice industries are seeking to integrate edible packaging into their product lines, including their use as wrapping paper, containers, and replacements for plastic sachets.

North America is projected to account for the largest market size during the forecast period

The North American edible packaging market is estimated to be the largest between 2019 and 2025, while Asia Pacific is projected to grow at the highest CAGR. North America accounts for a large consumer base in edible packaging solutions. The region is marking a paradigm shift from the use of single-use plastics to edible alternatives as a key method for reducing packaging waste. Food & beverage manufacturers as well as foodservice outlets in the region are adopting edible packaging solutions into their product formats in an effort to reduce wastage and are incentivized through federal tax breaks.

Key Market Players

The key edible packaging manufacturers in this market include Monosol LLC (US), JRF Technology (US), Evoware (US), Tipa Corp. (Israel), Nagase America (US), Notpla Ltd. (UK), Avani (Indonesia), Wikicell Designs (US), Amtrex Nature Care Pvt. Ltd. (India), EnviGreen Biotech Pvt. Ltd. (India), Regeno Bio-Bags (India), Devro Plc (UK), Apeel Sciences (US), Coolhaus (US), Do Eat (Belgium), Ecoactive (US), Mantrose UK Ltd. (UK), Dental Development Systems LLC (US), Tomorrow Machine (Sweden), and Lactips (France). These players are undertaking a strategy involving new product launches, acquisitions, and collaborations & agreements to improve their market position and extend their competitive advantage.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2019–2025 |

|

Base year considered |

2018 |

|

Forecast period considered |

2019–2025 |

|

Units considered |

Value (USD) |

|

Segments covered |

End Use, Packaging Process, Source, Raw Material, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Companies studied |

MonoSol LLC (US), JRF Technologies (US), Evoware (Indonesia), Nagase America LLC (US), and Notpla Ltd. (UK) |

Target Audience

- Edible packaging manufacturers and suppliers

- Edible packaging distributors, importers, and exporters

- Research institutions

- Government bodies

- Distributors

- End users (food & beverage manufacturers, pharmaceutical manufacturers, and personal care product manufacturers)

Report Scope

End Use

-

Food

- Fresh foods

- Bakery & confectionery products

- Frozen foods

-

Beverages

- Non-alcoholic beverages

- Alcoholic beverages

- Pharmaceuticals

Source

- Plant

- Animal

Packaging Process

- Antimicrobial

- Nanotechnology

- Electrohydrodynamic

- Coatings

- Microorganisms

Raw Material:

- Seaweeds and algae

- Polysaccharides

- Lipids

- Others (Surfactant, Composites, Carbohydrates)

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming commercial prospects for edible packaging?

- What is the impact of the plant and animal sources in edible packaging?

- What are the new raw materials being introduced in edible packaging?

- What are the latest trends in edible packaging?

Frequently Asked Questions (FAQ):

What is the research methodology adopted for market estimation of edible packaging market?

Multiple approaches have been adopted to understand the holistic view of this market:

- Top down approach based on the parent market (eco-friendly packaging)

- Bottom-up approach from regional level

- Primary interviews with industry experts and KOLs

- Revenue mapping of key players and analyzing their market share

- Data triangulation

Which regions are covered in the study?

The report analyzes new growth opportunities at a global level, including below markets:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (Middle East and Africa)

What are the region included in edible packaging market?

The region included in edible packaging are as follows:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (Middle East & Africa)

Does the report include packaging equipment also?

However, we can provide you equipment as a part of separate customization.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Regional Segmentation

1.3.2 Periodization Considered

1.4 Currency Considered

1.5 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Secondary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Approach One (Based on Raw Material, By Region)

2.2.2 Approach Two (Based on the Global Market)

2.3 Data Triangulation

2.4 Assumptions for the Study

2.5 Limitations of the Study

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Opportunities in the Edible Packaging Market

4.2 Edible Packaging Market, By Raw Material

4.3 North America: Edible Packaging Market, By End Use & Country

4.4 Edible Packaging Market, By Source

4.5 Edible Packaging Market Share, By Region

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Ban on Single-Use Plastics

5.2.1.2 Increase in the Shelf Life of Products Without Additional Logistical Support

5.2.1.3 Growth in Environmental and Sustainability Concerns

5.2.2 Restraints

5.2.2.1 Low Tensile Strength as Compared to Traditional Plastic

5.2.2.2 Secondary Packaging Requirement

5.2.3 Opportunities

5.2.3.1 Advancements in Technologies for New Packaging Methods

5.2.4 Challenges

5.2.4.1 Higher Acceptability of Water-Soluble and Biodegradable Packaging

5.3 Yc-Ycc Shift for Edible Packaging Market

5.4 Value Chain

5.5 Patent Analysis

6 Edible Packaging Market, By Source (Page No. - 49)

6.1 Introduction

6.2 Plant

6.2.1 Plant Sources Used as Packages are Not Only Sustainable But Also Edible and Easily Compostable

6.3 Animal

6.3.1 Animal Sources are Used for Manufacturing Edible Casings and Films That Preserve Food Products and Extend Shelf-Life of Products

7 Edible Packaging Market, By Raw Material (Page No. - 53)

7.1 Introduction

7.2 Seaweeds & Algae

7.2.1 Benefits Such as Low Cost Driving the Market for Seaweeds & Algae in the Edible Packaging Market

7.3 Polysaccharides

7.3.1 Good Barrier-Forming Properties and Strength Makes Polysaccharides A Preferred Choice

7.4 Lipids

7.4.1 Lipids Possess Low Polarity and Block the Passage of Moisture Into the Food Product

7.5 Others

7.5.1 Surfactants Operate Efficiently When Used in Combination With A Plasticizer in the Production of Edible Packaging

8 Edible Packaging Market, By End Use (Page No. - 59)

8.1 Introduction

8.2 Food

8.2.1 Raw & Processed Food

8.2.1.1 Convenience in Cooking and Consumption Influence Raw & Processed Food Market

8.2.2 Bakery & Confectionery Products

8.2.2.1 Focus on Reducing the Usage of Non-Biodegradable Plastics in Bakery & Confectionery Products

8.2.3 Frozen Foods

8.2.3.1 Focus on Sustainable Packaging and Increasing Shelf-Life of Products

8.3 Beverages

8.3.1 Non-Alcoholic Beverages

8.3.1.1 Water, Juices, and Flavor Extracts Can Be Dissolved in the Water Or Solution Along With the Extracts for Consumption

8.3.2 Alcoholic Beverages

8.3.2.1 Alcoholic Beverages Wrapped in Edible Thin Film Balls are Grabbing the Attention of Consumers at Foodservice Outlets

8.4 Pharmaceuticals

8.4.1 Increase in Adoption of Starch and Pullulan in Pharmaceutical Packaging Bolsters Growth Prospects

9 Edible Packaging Market, By Packaging Process & System (Page No. - 69)

9.1 Introduction

9.2 Antimicrobial

9.2.1 Avoiding the High Risk of Contamination of the Product Makes It One of the Important Aspects in Food Packaging

9.3 Nanotechnology

9.3.1 Development of Nanoplates and Acceptance in Processed Foods Drives Nanotechnology-Based Packaging

9.4 Electrohydrodynamics

9.4.1 Improvements in Production Standards to Improve Industrial Outlook for Electrohydrodynamic Packaging

9.5 Coatings

9.5.1 Easy Application and Widespread Availability Drive Market Growth for Coatings in Fresh Foods

9.6 Microbials

9.6.1 Development in Specialized Applications to Support Microbial Growth in Packaging

10 Edible Packaging Market, By Region (Page No. - 76)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Focus on Reducing the Usage of Non-Renewable Sources Drive the Demand for Edible Packaging in the US

10.2.2 Canada

10.2.2.1 Reducing Usage of Cans and Bottles to Fuel the Growth of Edible Packaging

10.2.3 Mexico

10.2.3.1 Socio-Economic Changes Along With High Demand for Fast Food Products to Drive Market Growth

10.3 Europe

10.3.1 Germany

10.3.1.1 Potential Ban on the Single-Use Plastics and Increasing Consumer Awareness is Projected to Drive the Adoption of Edible Packaging in Germany

10.3.2 France

10.3.2.1 Critical Impact of Plastic Pollution and Favorable Legislation to Drive the Growth of the Edible Packaging Market in France

10.3.3 UK

10.3.3.1 Government Funding and Increasing Interest of Consumers and Businesses to Encourage Edible Packaging Adoption

10.3.4 Italy

10.3.4.1 High Adoption in the Food & Beverage Industry to Drive the Demand for Edible Packaging Solutions in Italy

10.3.5 Spain

10.3.5.1 The Active Involvement of Manufacturers in the Development of Sustainable Packaging Solutions to Encourage the Growth of the Spanish Market

10.3.6 Belgium

10.3.6.1 Increase in Demand for Eco-Friendly Packaging Alternatives to Drive the Demand for Edible Packaging in Belgium

10.3.7 Rest of Europe

10.4 Asia Pacific

10.4.1 Japan

10.4.1.1 Companies in Japan are Investing in the Production of Edible Packaging Products to Reduce Plastic Waste

10.4.2 India

10.4.2.1 Government Initiatives Estimated to Drive the Market for Edible Packaging in the Country

10.4.3 China

10.4.3.1 China Generates High Amount of Waste Owing to A Larger Rural Population

10.4.4 Australia & New Zealand

10.4.4.1 Australia & New Zealand Shifts Focus Toward Edible Packaging to Reduce Solid Waste Generation

10.4.5 Indonesia

10.4.5.1 Higher Production of Varieties of Seaweed Drives the Market for Edible Packaging in the Country

10.4.6 Rest of Asia Pacific

10.4.6.1 Consumer Awareness About Waste Management in the Region Driving the Market for Edible Packaging

10.5 South America

10.5.1 Brazil

10.5.1.1 Rise in Awareness Among Consumers for Reducing the Usage of Plastic and Paper Packaging is Expected to Drive the Market for Edible Packaging in the Country

10.5.2 Argentina

10.5.2.1 Argentina is Experiencing Growth and Expansion of Supermarkets and Hypermarkets

10.5.3 Rest of South America

10.6 Rest of the World (RoW)

10.6.1 Middle East

10.6.1.1 Demand and Consumption of Processed Foods Lead to Increased Growth and Investment Opportunities for Edible Packaging in the Middle East

10.6.2 Africa

10.6.2.1 Necessary Measures to Ban the Use of Plastic Packaging

11 Competitive Landscape (Page No. - 117)

11.1 Overview

11.2 Competitive Leadership Mapping

11.2.1 Visionary Leaders

11.2.2 Innovators

11.2.3 Dynamic Differentiators

11.2.4 Emerging Companies

11.3 Ranking of Key Players, 2018

11.4 Competitive Scenario

11.4.1 New Product Launches

11.4.2 Expansions

11.4.3 Acquisitions

12 Company Profiles (Page No. - 125)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Nagase America

12.2 Devro PLC

12.3 Monosol LLC

12.4 JRF Technology

12.5 Evoware

12.6 Notpla Ltd

12.7 Tipa Corp

12.8 Avani

12.9 Incredible Foods Inc.

12.10 Amtrex Nature Care Pvt Ltd.

12.11 Envi Green Biotech Pvt Ltd

12.12 Regeno Bio Bags

12.13 Apeel Sciences

12.14 Coolhaus

12.15 Do Eat

12.16 Ecoactive

12.17 Mantrose UK Ltd.

12.18 Dental Development Systems LLC

12.19 Cuantec

12.20 Lactips

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 153)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (106 Tables)

Table 1 USD Exchange Rate, 2014–2018

Table 2 Edible Packaging Market Snapshot, 2019 vs. 2025

Table 3 Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 4 Plant: Edible Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 5 Animal: Edible Packaging Market Size, By Region, 2017–2025 (USD Thousand)

Table 6 Edible Packaging Market Size, By Raw Material, 2017–2025 (USD Million)

Table 7 Seaweeds & Algae: Edible Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 8 Polysaccharides: Edible Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 9 Lipids: Edible Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 10 Others: Edible Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 11 Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 12 Edible Food Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 13 Edible Raw & Processed Food Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 14 Edible Bakery & Confectionery Product Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 15 Edible Frozen Food Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 16 Edible Beverage Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 17 Edible Non-Alcoholic Beverage Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 18 Edible Alcoholic Beverage Packaging Market Size, By Region,2017–2025 (USD Million)

Table 19 Edible Pharmaceutical Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 20 Edible Packaging Market Size, By Packaging Process & System, 2017–2025 (USD Million)

Table 21 Antimicrobial Edible Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 22 Nanotechnology-Based Edible Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 23 Electrohydrodynamic Edible Packaging Market Size, By Region, 2017–2025 (USD Thousand)

Table 24 Edible Packaging Coatings Market Size, By Region, 2017–2025 (USD Million)

Table 25 Microbial Edible Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 26 Edible Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 27 North America: Edible Packaging Market Size, By Country, 2017–2025 (USD Million)

Table 28 North America: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 29 North America: Edible Packaging Market Size, By Raw Material, 2017–2025 (USD Million)

Table 30 North America: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 31 North America: Edible Packaging Market Size, By Food Subtype, 2017–2025 (USD Million)

Table 32 North America: Edible Packaging Market Size, By Beverage Subtype, 2017–2025 (USD Million)

Table 33 North America: Edible Packaging Market Size, By Packaging Process & System, 2017–2025 (USD Million)

Table 34 US: Edible Packaging Market Size, By End-Use, 2017–2025 (USD Million)

Table 35 US: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 36 Canada: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 37 Canada: Edible Packaging Market Size, By Source, 2017–2025 (USD Thousand)

Table 38 Mexico: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 39 Mexico: Edible Packaging Market Size, By Source, 2017–2025 (USD Thousand)

Table 40 Europe: Edible Packaging Market Size, By Country, 2017–2025 (USD Million)

Table 41 Europe: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 42 Europe: Edible Packaging Market Size, By Raw Material, 2017–2025 (USD Million)

Table 43 Europe: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 44 Europe: Edible Packaging Market Size, By Food Subtype, 2017–2025 (USD Million)

Table 45 Europe: Edible Packaging Market Size, By Beverage Subtype, 2017–2025 (USD Million)

Table 46 Europe: Edible Packaging Market Size, By Packaging Process & System, 2017–2025 (USD Million)

Table 47 Germany: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 48 Germany: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 49 France: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 50 France: Edible Packaging Market Size, By Source, 2017–2025 (USD Thousand)

Table 51 UK: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 52 UK: Edible Packaging Market Size, By Source, 2017–2025 (USD Thousand)

Table 53 Italy: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 54 Italy: Edible Packaging Market Size, By Source, 2017–2025 (USD Thousand)

Table 55 Spain: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 56 Spain: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 57 Belgium: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 58 Belgium: Edible Packaging Market Size, By Source, 2017–2025 (USD Thousand)

Table 59 Rest of Europe: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 60 Rest of Europe: Edible Packaging Market Size, By Source, 2017–2025 (USD Thousand)

Table 61 Edible Packaging Market Size, By Country, 2017–2025 (USD Million)

Table 62 Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 63 Edible Packaging Market Size, By Raw Material, 2017–2025 (USD Million)

Table 64 Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 65 Edible Packaging Market Size, By Food Subtype, 2017–2025 (USD Million)

Table 66 Edible Packaging Market Size, By Beverage Subtype, 2017–2025 (USD Million)

Table 67 Edible Packaging Market Size, By Packaging Process & System, 2017–2025 (USD Million)

Table 68 Japan: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 69 Japan: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 70 India: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 71 India: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 72 China: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 73 China: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 74 Australia & New Zealand: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 75 Australia & New Zealand: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 76 Indonesia: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 77 Indonesia: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 78 Rest of Asia Pacific: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 79 Rest of Asia Pacific: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 80 South America: Edible Packaging Market Size, By Country, 2017–2025 (USD Million)

Table 81 South America: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 82 South America: Edible Packaging Market Size, By Raw Material, 2017–2025 (USD Million)

Table 83 South America: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 84 South America: Edible Packaging Market Size, By Food Subtype, 2017–2025 (USD Million)

Table 85 South America: Edible Packaging Market Size, By Beverage Subtype, 2017–2025 (USD Million)

Table 86 South America: Edible Packaging Market Size, By Packaging Process & System, 2017–2025 (USD Thousand)

Table 87 Brazil: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 88 Brazil: Edible Packaging Market Size, By Source, 2017–2025 (USD Thousand)

Table 89 Argentina: Edible Packaging Market Size, By End Use, 2017–2025 (USD Thousand)

Table 90 Argentina: Edible Packaging Market Size, By Source, 2017–2025 (USD Thousand)

Table 91 Rest of South America: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 92 Rest of South America: Edible Packaging Market Size, By Source, 2017–2025 (USD Million)

Table 93 RoW: Edible Packaging Market Size, By Region, 2017–2025 (USD Million)

Table 94 RoW: Edible Packaging Market Size, By Source, 2017–2025 (USD Thousand)

Table 95 RoW: Edible Packaging Market Size, By Raw Material, 2017–2025 (USD Thousand)

Table 96 RoW: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 97 RoW: Edible Packaging Market Size, By Food Subtype, 2017–2025 (USD Million)

Table 98 RoW: Edible Packaging Market Size, By Beverage Subtype, 2017–2025 (USD Million)

Table 99 RoW: Edible Packaging Market Size, By Packaging Process & System, 2017–2025 (USD Million)

Table 100 Middle East: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 101 Middle East: Edible Packaging Market Size, By Source, 2017–2025 (USD Thousand)

Table 102 Africa: Edible Packaging Market Size, By End Use, 2017–2025 (USD Million)

Table 103 Africa: Edible Packaging Market Size, By Source, 2017–2025 (USD Thousand)

Table 104 New Product Launches, (2016–2019)

Table 105 Expansions, (2017–2019)

Table 106 Acquisitions, 2019

List of Figures (35 Figures)

Figure 1 Edible Packaging Market Segmentation

Figure 2 Edible Packagings Market: Research Design

Figure 3 Data Triangulation Methodology

Figure 4 Edible Packaging Market Size, By Raw Material, 2019 vs. 2025 (USD Million)

Figure 5 Edible Packaging Market Size, By End-Use, 2019 vs. 2025 (USD Million)

Figure 6 Edible Packaging Market Size, By Source, 2019 vs. 2025 (USD Million)

Figure 7 Edible Packaging Market Size, By Packaging Process, 2019 vs. 2025 (USD Million)

Figure 8 Edible Packaging Market Share & Growth (Value), By Region

Figure 9 Increase in Consumer Awareness of Using Plastic Packaging is Driving the Market for Edible Packaging

Figure 10 The Polysaccharides Segment Dominated the Global Edible Packaging Market, By Raw Material

Figure 11 The Pharmaceuticals Segment Dominated the North American Region, By End Use, in 2018

Figure 12 Edible Packaging Made of Plant Source is Most Preferred By Consumers Globally in 2018

Figure 13 The US Accounted for the Largest Share of Edible Packaging Market in 2018

Figure 14 Percent of Total Waste Generation and Disposal of Municipal Solid Waste in the Us, 2015

Figure 15 Global Plastic Waste Generation By Industrial Sector, 2015

Figure 16 Market Dynamics: Edible Packaging Market

Figure 17 Recycling and Recovery Rate for All Packaging Waste, Eu-28, 2007–2016

Figure 18 Edible Packaging Market: Value Chain

Figure 19 Trend of Patent Filing 2015–2019

Figure 20 Edible Packaging Market Size, By Source, 2019 vs. 2025 (USD Million)

Figure 21 Edible Packaging Market Size, By Raw Material, 2019 vs. 2025 (USD Million)

Figure 22 Edible Packaging Market Size, By End Use, 2019 vs. 2025 (USD Million)

Figure 23 Edible Packaging Market Size, By Packaging Process, 2019 vs. 2025 (USD Million)

Figure 24 Edible Packaging Market: By Key Country, Cagr (2019–2025)

Figure 25 Edible Packaging Market, By Region, 2019 vs. 2025 (USD Million)

Figure 26 North America: Regional Snapshot

Figure 27 Total Municipal Solid Waste (MSW) Generated By Material in US, 2017

Figure 28 Marine Waste Type on European Beaches, 2016 (Single-Use Plastic)

Figure 29 Asia Pacific Edible Packaging Market Snapshot

Figure 30 Top Cultivated Species of Seaweeds in China, 2015

Figure 31 Global Edible Packaging Market: Competitive Leadership Mapping, 2019 (Top 20)

Figure 32 Key Developments of the Leading Players in the Edible Packaging Market, 2014–2019

Figure 33 Nagase America Led the Edible Packaging Market in 2018

Figure 34 Nagase America: Company Snapshot

Figure 35 Devro PLC: Company Snapshot

The study involved four major activities in estimating the market size for edible packaging. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

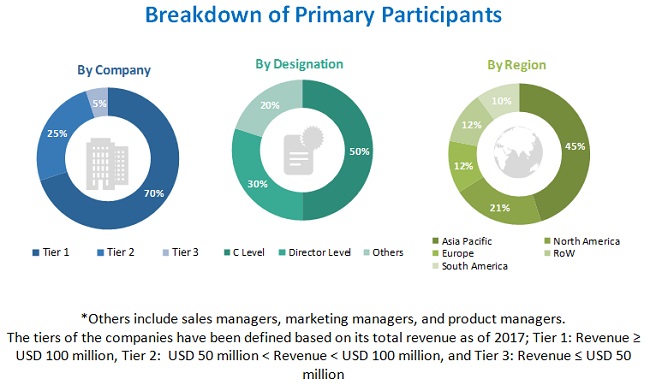

The market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of edible packaging sources, including but not limited to algae, seaweeds, surfactants, and proteins. The supply side is characterized by advancements in packaging technologies and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the edible packaging market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the edible packaging market, in terms of end use, packaging process, source, raw material, and region

- To describe and forecast the edible packaging market, in terms of value, by region—Asia Pacific, Europe, North America, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of edible packaging

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the edible packaging ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches such as acquisitions, expansions, product launches and approvals, agreements, collaborations, and partnerships in the edible packaging market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further country-wise breakdown of the market in North America and Europe based on site of operation

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Edible Packaging Market