Water-soluble Fertilizers Market by Type (Nitrogenous, Phosphatic, Potassic, and Micronutrients), Mode of Application (Foliar and Fertigation), Form, by Crop Type (Field Crop, Horticulture Crop, Turf & Ornaments, Others), and Region - Global Forecast to 2028

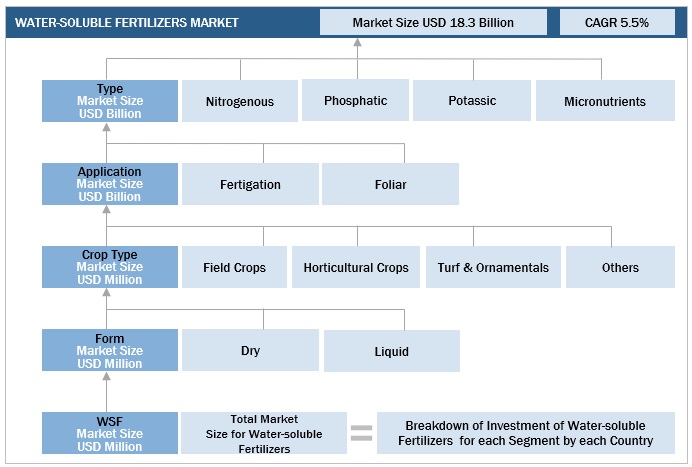

The global water-soluble fertilizers market size is estimated to be valued at USD 18.3 billion in 2023 and it is projected to reach USD 25.1 billion in 2028, growing at a CAGR of 6.5%. Water soluble fertilizers can be dissolved in water and added or leached out of the soil easily. With water-soluble fertilizers, it is easy to control the precise amount of nutrients available to plants. These water-soluble fertilizers contain the NPK number listed on the label, which is not the actual depiction of the concentration, but the grade in which it is available. The N is for nitrogen, the P is for phosphorus, and the K is for potassium or potash. Nitrogen is the most essential nutrient. It controls the processes used to make proteins vital to new protoplasm in the cells. Nitrogen is essential for the production of chlorophyll and is responsible for leaf growth. Phosphorus is necessary for photosynthesis and provides a mechanism for energy transfer within the plant. Potassium, or potash, provides the manufacturing and movement of sugars and starches, as well as growth by cell division. Apart from this, the fertilizer also contains trace amounts of micronutrients for the overall development of the crop.

Growers are increasingly accepting water-soluble fertilizers in their routine program due to the growing awareness regarding precision agriculture which requires frequent and precise application of fertilizers. Additionally, greenhouse production, rising environmental concerns, high effectiveness of water-soluble fertilizers, ease of application, and limited availability of arable land are some of the major factors driving the demand in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Water-soluble Fertilizers Market Dynamics

Driver: Ease of application

Water-soluble fertilizer is a multi-compound fertilizer that can be dissolved in water and is easily absorbed by crops. Its absorption, and utilization is relatively high compared to conventional chemical fertilizers. In some extremely water-scarce areas, large-scale farms and high-quality high-value-added cash crops, people often use a different irrigation system; at the time of irrigation, the fertilizer is dissolved in the water, that is, the integration of water and fertilizer.

Restraint: Growth in the organic fertilizers industry

Organic farming is an agricultural process that uses biological fertilizers and pest control acquired from animal or plant waste. The organic industry witnesses strong growth across emerging economies, with increasing awareness about environmental protection, food safety, and animal welfare. Organic practices in agriculture reduce the usage of chemical fertilizers, which are substituted by organic manures to provide sustained nutrients to plants. Organically produced farm outputs fetch higher premiums over conventional ones, which attracts farmers to opt for organic farming.

Opportunity: Growing demand for water-soluble nutrients

Water soluble fertilizers include NPK, ammonium sulfate, dipotassium phosphate, potassium nitrate, and monopotassium phosphate. The growing population is increasing the demand for food crops, food grains, vegetables, and fruits. The rising adoption of micro irrigation, as it distributes fertilizers evenly and improves growth efficiency, will increase demand for the product. The availability of agricultural loans by the Indian Government, along with the implementation of the “Make in India” policy, will result in fueling the growth of the market.

Challenge: Rising prices of natural gas

According to the World Bank, fertilizer prices have risen since 2022 due to rising input costs, supply disruptions, and export restrictions in China. The Ukrainian conflict has increased concerns about fertilizer affordability. The rising natural gas prices, particularly in Europe, resulted in widespread ammonia production cuts—an important input for nitrogen-based water-soluble fertilizers. Natural gas is a major raw material in the production of water-soluble fertilizers, wherein the price of natural gas decides the margin for manufacturers. Even if fertilizer prices remain constant, the increase in natural gas prices is expected to cut margins.

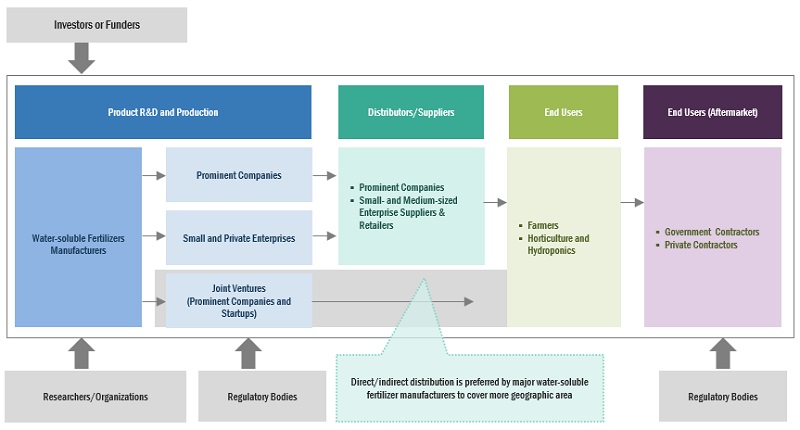

Water-soluble Fertilizers Market Ecosystem

Based on Type, Nitrogenous is anticipated to dominate the market

Nitrogenous fertilizers as per the management practices, are invariably applied at the early growth stages of the crop. The nitrogenous fertilizer industry includes the production of synthetic ammonia, nitric acid, ammonium nitrate, and urea. Nitrogen is absorbed by the plant roots in two forms: nitrate (NO3) and ammonia (NH4). Most crop plants prefer nitrogen in nitrate form. Nitrogen-deficient plants produce smaller than normal fruits, leaves, and shoots and can develop bigger than normal later.

The foliar mode of application is projected to grow at a significant rate during the forecast period.

The foliar mode of the application provides high resistance to diseases & pests, improved drought 7 soil salinity tolerance, rapid utilization of applied nutrients, and high resistance to physiological disorders. Soil nutrients are not always available due to leaching; foliar fertilization applies the nutrients directly on the leaf, where the plant mostly needs them. With foliar applications, all nutritional problems can be tackled because the leaf absorbs all the essential nutrients.

Field crop segments is projected to grow at the fastest rate during the forecast period.

Field crops include corn, rice, sorghum, soybeans, winter wheat, durum wheat, and spring wheat. The effects of climate change on crop production will vary by region and will largely affect soil condition and water quality. The demand for both of these crop types is rising, owing to its increasing demand among consumers, hence,the adoption of the alternative farming method is driving the demand for water-soluble fertilizers in the market.

The liquid segments hold a significant share in the water-soluble fertilizers market by form during the forecast period

Based on form, the market is segmented into dry and liquid. Liquid fertilizers help provide plants with the food they need to survive. These fertilizers are absorbed by plants through leaf pores and roots. They are rich in growth hormones and micronutrients, hence, are widely used to grow crops such as maize.

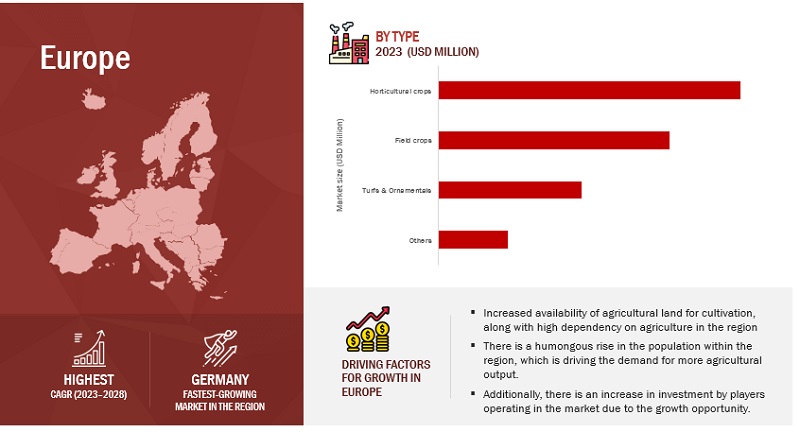

Europe: Water-soluble Fertilizers Market Snapshot

Europe holds the highest market share during the forecast period.

The agriculture industry in Europe is witnessing technological advancements and the farming community is adopting innovative technologies. A majority of the arable farmland in Europe is used for cereal production,as per the data published by the World Bank in 2021. In 2021, approximately 161.5 million hectares of land in the EU were under agricultural cultivation (Source: Eurostat). Agriculture is the main occupation in France and Italy. The land in these countries has mountainous and hilly regions, terrains, and coastal areas. Most of this land is utilized for agriculture. This region witnesses the production of diverse crops and is divided between small-sized farms regulated. The western region witnesses a high adoption of highly intensified farming systems. The extensive research & development activities in the region have helped in the introduction of customized and crop-specific products.

Water-Soluble Fertilizers Market Share

Key players in this market include Nutrien (Canada), Israel Chemical Company (Israel), Sociedad Química y Minera De Chile (SQM) (Chile), K+S Aktiengesellschaft (Germany), Yara International (Norway), Haifa Chemicals Ltd (Israel), Coromandel International Ltd (India), The Mosaic Company (US), Hebei Monband Water Soluble Fertilizer Co., Ltd (China), EuroChem (Switzerland), Agafert (India), SPIC (India), Aries Agro Ltd (India), Azoty Group (Poland), Vaikic-Chim (Bulgaria), Gujarat State Fertilizers & Chemicals Ltd (India), Incitec (Australia), IFFCO (India), Mangalore Chemicals & Fertlizers Ltd (India), and DFPCL (India).

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Warer Soluble Fertilizers Market Forecast period |

2023–2028 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments Covered |

Type, Mode of Application, Crop Type, Form, and Region. |

|

Regions covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Key Companies Profiled |

|

Water-Soluble Fertilizers Market Segmentation

The study categorizes the Water-soluble fertilizers market report based on By Type, Mode of Application, Crop Type, Form, and Region.

Market, By Type

- Nitrogenous

- Phosphatic

- Potassic

- Micronutrient

Market, By Mode of Application

- Fertigation

- Foliar

Market, By Crop Type

- Field Crop

- Horticulture Crops

- Turf & ornaments

- Others

Market, By Form

- Dry

- Liquid

Market By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Water-Soluble Fertilizers Market Recent Developments

- In July 2022, Nutrien announced that the company entered into an agreement to acquire Casa do Adubo, a Brazilian company, for approximately USD 400 million. This acquisition includes 39 retail locations, under the brand Casa do Adubo, and 10 distribution centers, under the brand Agrodistribuidor Casal. This acquisition will strengthen the company’s footprint in the South American market and help to gain share in the water-soluble fertilizers market.

- In June 2022, Israel Chemical Ltd. announced a long-term agreement with India Potash Limited (India) to supply polysulfate with a renewable option. The availability of polysulfate is expected to boost the Government of India’s organic agriculture program. It will also help ICL penetrate and serve the Indian farmers as per their requirements and strengthen its position in the Indian and Asian markets.

- In February 2022, Yara acquired a 14% stake in the Brazilian online farm products trade platform Orbia, majorly owned by Bayer AG (Germany). Yara aimed to derive 25% of its sales from online channels by 2025.

Frequently Asked Questions (FAQ):

Which are the major companies in the water-soluble fertilizers market? What are their major strategies to strengthen their presence?

Some of the key companies operating in the water-soluble fertilizers market are Nutrien (Canada), Israel Chemical Company (Israel), Sociedad Química y Minera De Chile (SQM) (Chile), K+S Aktiengesellschaft (Germany), Yara International (Norway), Haifa Chemicals Ltd (Israel), Compo GmbH (Germany), Coromandel International Ltd (India), The Mosaic Company (US), and many more. In the past few years, the companies have adopted strategies such as joint ventures, partnerships, agreements, etc., to strengthen their water-soluble fertilizers market presence.

What are the drivers and opportunities for the water-soluble fertilizers market?

The growth in greenhouse vegetable production demands water-soluble fertilizers for the overall growth and development of the crops. The purpose of greenhouse is to provide and maintain optimal crop-growing conditions. In modern greenhouse farming, water-soluble fertilizers cover two critical conditions for optimal crop growth: watering and nutrient delivery.

Which region is estimated to hold the highest market share?

The market in Europe will dominate the market share in 2022, showcasing strong demand from companies manufacturing water-soluble fertilizers products. The region is growing drastically by companies investing in manufacturing facilities, which further fuels the demand for different water-soluble fertilizers.

What is the total CAGR projected to be recorded for the potassic segment market from 2023 to 2028?

The CAGR is expected to be 7.0% from 2023 – 2028

What kind of information is provided in the competitive landscape section?

For the list of players mentioned, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix and key developments associated with the company.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSGROWTH IN GLOBAL POPULATION AND POPULATION DENSITYRISE IN FOOD PRICES

-

5.3 MARKET DYNAMICSDRIVERS- High efficiency of water-soluble fertilizers coupled with rise in demand for nutritive food- Ease of application- Rapid growth in greenhouse vegetable production- Decrease in arable land for agriculture- Environmental concernsRESTRAINTS- Growth in organic fertilizers industry- Limited awareness among farmers and high costsOPPORTUNITIES- Government initiatives to increase awareness to adopt agricultural technologies in emerging markets- Growth in demand for water-soluble nutrientsCHALLENGES- Increasing number of players with similar product formulations- Rise in prices of natural gas

- 6.1 INTRODUCTION

- 6.2 TRENDS IMPACTING CUSTOMERS’ BUSINESS

-

6.3 PRICING ANALYSISAVERAGE SELLING PRICE TREND ANALYSIS

-

6.4 VALUE CHAIN ANALYSISRESEARCH & PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGDISTRIBUTIONMARKETING & SALES

-

6.5 MARKET MAPPING AND ECOSYSTEMDEMAND SIDESUPPLY SIDE

- 6.6 TRADE DATA

-

6.7 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

- 6.8 TECHNOLOGY ANALYSIS

-

6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS

-

6.11 TARIFF AND REGULATORY LANDSCAPEREGULATOR BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSNORTH AMERICA: REGULATIONS- USEUROPE: REGULATIONSASIA PACIFIC: REGULATIONS- China- Australia- India

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAINFLUENCE OF STAKEHOLDERS ON BUYING DECISIONSBUYING CRITERIA

-

6.13 CASE STUDYNEED FOR STANDARD NUTRIENT MANAGEMENT PRACTICES WITH LESS UTILIZATION OF FERTILIZERS

- 7.1 INTRODUCTION

-

7.2 NITROGENOUS WATER-SOLUBLE FERTILIZERSVARYING QUANTITIES AND TYPES OF NITROGENOUS FERTILIZERS REQUIRED AT DIFFERENT CROP GROWTH STAGESTYPES OF NITROGENOUS FERTILIZERS- Urea- Ammonia- Ammonia nitrate- Urea-ammonia nitrate

-

7.3 PHOSPHATIC WATER-SOLUBLE FERTILIZERSAWARENESS OF ILL EFFECTS OF LOW PHOSPHORUS IN PLANT GROWTHTYPES OF PHOSPHATIC FERTILIZERS- Phosphoric acid- Monopotassium Phosphate- Monoammonium Phosphate- Diammonium Phosphate- Other Phosphatic Fertilizers

-

7.4 POTASSIC WATER-SOLUBLE FERTILIZERSHIGH REQUIREMENT OF POTASSIUM FOR PROPER NUTRIENT UPTAKETYPES OF POTASSIC FERTILIZERS- Potassium chloride- Potassium nitrate- Potassium sulfate

-

7.5 MICRONUTRIENTSMICRONUTRIENT DEFICIENCY LEADS TO STUNTED PLANT GROWTHTYPES OF MICRONUTRIENTS- Calcium (Ca)- Sulfur (S)- Boron (B)- Chlorine (Cl)- Copper (Cu)- Iron (Fe)- Manganese (Mn)- Molybdenum (Mo)- Zinc (Zn)

- 8.1 INTRODUCTION

-

8.2 FOLIAREFFICIENT NUTRIENT ABSORPTION ALONG WITH HIGH PEST RESISTANCE

-

8.3 FERTIGATIONCOST-EFFECTIVE AND EASY APPLICATION

- 9.1 INTRODUCTION

-

9.2 FIELD CROPSHIGHEST DEMAND AMONG CROP TYPES ACROSS REGIONS

-

9.3 HORTICULTUREINCREASE IN IMPORTANCE OF CONSUMING FRUITS & VEGETABLES AND TREND OF AESTHETIC DECORATIONORCHARD CROPSVEGETABLE & FLOWER CROPS

-

9.4 TURF & ORNAMENTALSVARYING NUTRIENT REQUIREMENTS DEMAND OPTIMUM WATER-SOLUBLE FERTILIZERS

- 9.5 OTHER CROP TYPES

- 10.1 INTRODUCTION

-

10.2 DRYEASE OF USE AND LONGER SHELF LIFE OF DRY FERTILIZERS

-

10.3 LIQUIDUNIFORM NUTRIENT AVAILABILITY AND CONVENIENCE IN APPLICATION

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Advancements in precision farming techniquesCANADA- Rise in demand for food and government supportMEXICO- Demand for sustainable agriculture practices

-

11.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Increase in demand from agricultural industry and potential for crop-specific fertilizersUK- Increase in consumer awareness and government supportFRANCE- Adoption of sustainable agricultureITALY- Demand for high-quality crops and government initiativesSPAIN- Increase in farmer awareness and government initiativesREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- High agricultural potential with larger arable landINDIA- Government initiatives toward drip irrigation and fertilizer subsidiesJAPAN- Need to improve produce yield and qualityAUSTRALIA & NEW ZEALAND- Demand for high-quality cropsREST OF ASIA PACIFIC

-

11.5 REST OF THE WORLD (ROW)ROW: RECESSION IMPACT ANALYSISBRAZIL- Adoption of National Fertilizer PlanSOUTH AFRICA- Growth in popularity of water-soluble fertilizersOTHERS IN ROW

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- 12.4 MARKET SHARE ANALYSIS

-

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSCOMPANY PRODUCT FOOTPRINT (KEY PLAYERS)

-

12.6 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHES

-

13.1 KEY PLAYERSNUTRIEN- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewISRAEL CHEMICAL LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSOCIEDAD QUÍMICA Y MINERA DE CHILE (SQM)- Business overview- Products/Services/Solutions offered- MnM viewK+S AKTIENGESELLSCHAFT- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewYARA INTERNATIONAL- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHAIFA GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCOROMANDEL INTERNATIONAL LIMITED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHE MOSAIC COMPANY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHEBEI MONBAND WATER SOLUBLE FERTILIZER CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewEUROCHEM GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM view

-

13.2 OTHER PLAYERSAGAFERT SRL.- Business overview- Products/Services/Solutions offered- MnM viewSPIC- Business overview- Products/Services/Solutions offered- MnM viewARIES AGRO LIMITED- Business overview- Products/Services/Solutions offered- MnM viewTHE AZOTY GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVAIKIC-CHIM- Business overview- Products/Solutions/Services offered- MnM viewGUJARAT STATE FERTILIZERS & CHEMICALS LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINCITEC PIVOT LTD- Business overview- Products/Solutions/Services offered- MnM viewIFFCOMANGALORE CHEMICALS & FERTILIZERS LTDDFPCL

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 AGROCHEMICALS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.4 SPECIALTY FERTILIZERS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2022

- TABLE 2 WATER-SOLUBLE FERTILIZERS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 GLOBAL POPULATION DENSITY, 2020

- TABLE 4 NITROGENOUS WATER-SOLUBLE FERTILIZERS MARKET: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 5 PHOSPHATIC WATER-SOLUBLE FERTILIZERS MARKET: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 6 POTASSIC WATER-SOLUBLE FERTILIZERS MARKET: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 7 MICRONUTRIENT-BASED WATER-SOLUBLE FERTILIZERS MARKET: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 8 WATER-SOLUBLE FERTILIZERS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 9 IMPORT VALUE OF FERTILIZERS INCLUDING MONO AMMONIUM PHOSPHATE, SULFATE OF POTASH, AND AMMONIUM NITRATE FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 10 EXPORT VALUE OF FERTILIZERS INCLUDING MONO AMMONIUM PHOSPHATE, SULFATE OF POTASH, AND AMMONIUM NITRATE FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 11 WATER-SOLUBLE FERTILIZERS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 12 PATENTS PERTAINING TO WATER-SOLUBLE FERTILIZERS, 2020–2023

- TABLE 13 KEY CONFERENCES & EVENTS IN WATER-SOLUBLE FERTILIZERS MARKET, 2023–2024

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR WATER-SOLUBLE FERTILIZERS

- TABLE 18 KEY BUYING CRITERIA FOR KEY WATER-SOLUBLE FERTILIZER TYPES

- TABLE 19 WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 20 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 21 MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 22 MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 23 NITROGENOUS WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 MARKET FOR NITROGENOUS WATER-SOLUBLE FERTILIZERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 MARKET FOR NITROGENOUS WATER-SOLUBLE FERTILIZERS, BY REGION, 2018–2022 (KT)

- TABLE 26 MARKET FOR NITROGENOUS WATER-SOLUBLE FERTILIZERS, BY REGION, 2023–2028 (KT)

- TABLE 27 PHOSPHATIC WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 MARKET FOR PHOSPHATIC WATER-SOLUBLE FERTILIZERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 MARKET FOR PHOSPHATIC WATER-SOLUBLE FERTILIZERS, BY REGION, 2018–2022 (KT)

- TABLE 30 MARKET FOR PHOSPHATIC WATER-SOLUBLE FERTILIZERS, BY REGION, 2023–2028 (KT)

- TABLE 31 POTASSIC WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 MARKET FOR POTASSIC WATER-SOLUBLE FERTILIZERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 MARKET FOR POTASSIC WATER-SOLUBLE FERTILIZERS, BY REGION, 2018–2022 (KT)

- TABLE 34 MARKET FOR POTASSIC WATER-SOLUBLE FERTILIZERS, BY REGION, 2023–2028 (KT)

- TABLE 35 MICRONUTRIENT-BASED WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 MARKET FOR MICRONUTRIENT-BASED WATER-SOLUBLE FERTILIZERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 MARKET FOR MICRONUTRIENT-BASED WATER-SOLUBLE FERTILIZERS, BY REGION, 2018–2022 (KT)

- TABLE 38 MARKET FOR MICRONUTRIENT-BASED WATER-SOLUBLE FERTILIZERS, BY REGION, 2023–2028 (KT)

- TABLE 39 WATER-SOLUBLE FERTILIZERS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 40 MARKET FOR WATER-SOLUBLE FERTILIZERS, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 41 FOLIAR WATER-SOLUBLE FERTILIZER APPLICATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 FOLIAR WATER-SOLUBLE FERTILIZER APPLICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 FERTIGATION WATER-SOLUBLE FERTILIZER APPLICATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 FERTIGATION WATER-SOLUBLE FERTILIZER APPLICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 MARKET FOR WATER-SOLUBLE FERTILIZERS,, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 46 MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 47 WATER-SOLUBLE FERTILIZERS MARKET IN FIELD CROPS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 MARKET IN FIELD CROPS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 WATER-SOLUBLE FERTILIZERS MARKET IN HORTICULTURE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 MARKET IN HORTICULTURE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 WATER-SOLUBLE FERTILIZERS MARKET IN TURF & ORNAMENTALS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 MARKET IN TURF & ORNAMENTALS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 WATER-SOLUBLE FERTILIZERS MARKET IN OTHER CROP TYPES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 MARKET IN OTHER CROP TYPES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 ADVANTAGES AND DISADVANTAGES OF LIQUID AND DRY WATER-SOLUBLE FERTILIZERS

- TABLE 56 WATER-SOLUBLE FERTILIZERS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 57 MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 58 DRY WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 DRY WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 LIQUID WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 LIQUID WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 MARKET FOR WATER-SOLUBLE FERTILIZERS, BY REGION, 2018–2022 (KT)

- TABLE 65 MARKET, BY REGION, 2023–2028 (KT)

- TABLE 66 NORTH AMERICA: WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY REGION, 2018–2022 (KT)

- TABLE 69 NORTH AMERICA: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 70 NORTH AMERICA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 73 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 74 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 80 US: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 81 US: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 82 US: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 83 US: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 84 CANADA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 85 CANADA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 86 CANADA: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 87 CANADA: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 88 MEXICO: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 89 MEXICO: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 90 MEXICO: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 91 MEXICO: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 92 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 93 EUROPE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY REGION, 2018–2022 (KT)

- TABLE 95 EUROPE: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 96 EUROPE: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 99 EUROPE: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 100 EUROPE: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 106 GERMANY: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 107 GERMANY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 108 GERMANY: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 109 GERMANY: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 110 UK: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 111 UK: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 112 UK: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 113 UK: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 114 FRANCE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 115 FRANCE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 116 FRANCE: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 117 FRANCE: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 118 ITALY: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 119 ITALY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 120 ITALY: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 121 ITALY: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 122 SPAIN: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 123 SPAIN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 124 SPAIN: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 125 SPAIN: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 126 REST OF EUROPE: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 127 REST OF EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 128 REST OF EUROPE: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 129 REST OF EUROPE: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 130 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (KT)

- TABLE 133 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 134 ASIA PACIFIC: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 137 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 138 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 144 CHINA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 145 CHINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 146 CHINA: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 147 CHINA: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 148 INDIA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 149 INDIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 150 INDIA: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 151 INDIA: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 152 JAPAN: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 153 JAPAN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 154 JAPAN: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 155 JAPAN: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 156 AUSTRALIA & NEW ZEALAND: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 157 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 158 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 159 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 160 REST OF ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 163 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 164 ROW: WATER-SOLUBLE FERTILIZERS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 165 ROW: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 166 ROW: MARKET, BY COUNTRY, 2018–2022 (KT)

- TABLE 167 ROW: MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 168 ROW: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 169 ROW: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 170 ROW: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 171 ROW: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 172 ROW: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 173 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 174 ROW: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 175 ROW: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 176 ROW: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 177 ROW: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 178 BRAZIL: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 179 BRAZIL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 180 BRAZIL: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 181 BRAZIL: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 182 SOUTH AFRICA: WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 183 SOUTH AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 184 SOUTH AFRICA: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 185 SOUTH AFRICA: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 186 OTHERS IN ROW: MARKET FOR WATER-SOLUBLE FERTILIZERS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 187 OTHERS IN ROW: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 188 OTHERS IN ROW: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 189 OTHERS IN ROW: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 190 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 191 SHARE ANALYSIS OF WATER-SOLUBLE FERTILIZERS MARKET, 2022

- TABLE 192 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

- TABLE 193 COMPANY FOOTPRINT, BY CROP TYPE (KEY PLAYERS)

- TABLE 194 COMPANY FOOTPRINT, BY MODE OF APPLICATION (KEY PLAYERS)

- TABLE 195 COMPANY FOOTPRINT, BY FORM (KEY PLAYERS)

- TABLE 196 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

- TABLE 197 COMPETITIVE BENCHMARKING (KEY PLAYERS)

- TABLE 198 WATER-SOLUBLE FERTILIZERS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 199 MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 200 MARKET FOR WATER-SOLUBLE FERTILIZERS: DEALS, 2019–2022

- TABLE 201 MARKET: OTHERS, 2019–2022

- TABLE 202 NUTRIEN: BUSINESS OVERVIEW

- TABLE 203 NUTRIEN: PRODUCTS OFFERED

- TABLE 204 NUTRIEN: DEALS

- TABLE 205 ISRAEL CHEMICAL LTD.: BUSINESS OVERVIEW

- TABLE 206 ISRAEL CHEMICAL LTD.: PRODUCTS OFFERED

- TABLE 207 ISRAEL CHEMICAL LTD.: DEALS

- TABLE 208 ISRAEL CHEMICAL LTD.: OTHERS

- TABLE 209 SOCIEDAD QUÍMICA Y MINERA DE CHILE (SQM): BUSINESS OVERVIEW

- TABLE 210 SOCIEDAD QUÍMICA Y MINERA DE CHILE (SQM): PRODUCTS OFFERED

- TABLE 211 K+S AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- TABLE 212 K+S AKTIENGESELLSCHAFT: PRODUCTS OFFERED

- TABLE 213 K+S AKTIENGESELLSCHAFT: DEALS

- TABLE 214 K+S AKTIENGESELLSCHAFT: OTHERS

- TABLE 215 YARA INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 216 YARA INTERNATIONAL: PRODUCTS OFFERED

- TABLE 217 YARA INTERNATIONAL: DEALS

- TABLE 218 HAIFA GROUP: BUSINESS OVERVIEW

- TABLE 219 HAIFA GROUP: PRODUCTS OFFERED

- TABLE 220 HAIFA GROUP: DEALS

- TABLE 221 HAIFA GROUP: OTHERS

- TABLE 222 COROMANDEL INTERNATIONAL LIMITED: BUSINESS OVERVIEW

- TABLE 223 COROMANDEL INTERNATIONAL LIMITED: PRODUCTS OFFERED

- TABLE 224 COROMANDEL INTERNATIONAL LIMITED: OTHERS

- TABLE 225 THE MOSAIC COMPANY: BUSINESS OVERVIEW

- TABLE 226 THE MOSAIC COMPANY: PRODUCTS OFFERED

- TABLE 227 THE MOSAIC COMPANY: PRODUCT LAUNCHES

- TABLE 228 THE MOSAIC COMPANY: DEALS

- TABLE 229 HEBEI MONBAND WATER SOLUBLE FERTILIZER CO., LTD.: BUSINESS OVERVIEW

- TABLE 230 HEBEI MONBAND WATER SOLUBLE FERTILIZER CO., LTD.: PRODUCTS OFFERED

- TABLE 231 EUROCHEM GROUP: BUSINESS OVERVIEW

- TABLE 232 EUROCHEM GROUP: PRODUCTS OFFERED

- TABLE 233 EUROCHEM GROUP: DEALS

- TABLE 234 EUROCHEM GROUP: OTHERS

- TABLE 235 AGAFERT SRL.: BUSINESS OVERVIEW

- TABLE 236 AGAFERT SRL.: PRODUCTS OFFERED

- TABLE 237 SPIC: BUSINESS OVERVIEW

- TABLE 238 SPIC: PRODUCTS OFFERED

- TABLE 239 ARIES AGRO LIMITED: BUSINESS OVERVIEW

- TABLE 240 ARIES AGRO LIMITED: PRODUCTS OFFERED

- TABLE 241 THE AZOTY GROUP: BUSINESS OVERVIEW

- TABLE 242 THE AZOTY GROUP: PRODUCTS OFFERED

- TABLE 243 THE AZOTY GROUP: OTHERS

- TABLE 244 VAIKIC-CHIM: BUSINESS OVERVIEW

- TABLE 245 VAIKIC-CHIM: PRODUCTS OFFERED

- TABLE 246 GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED: BUSINESS OVERVIEW

- TABLE 247 GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED: PRODUCTS OFFERED

- TABLE 248 GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED: PRODUCT LAUNCHES

- TABLE 249 INCITEC PIVOT LTD: BUSINESS OVERVIEW

- TABLE 250 INCITEC PIVOT LTD: PRODUCTS OFFERED

- TABLE 251 ADJACENT MARKETS

- TABLE 252 AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2018–2022 (USD MILLION)

- TABLE 253 AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2023–2028 (USD MILLION)

- TABLE 254 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

- TABLE 255 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- FIGURE 1 WATER-SOLUBLE FERTILIZERS MARKET SEGMENTATION

- FIGURE 2 MARKET: REGIONAL SEGMENTATION

- FIGURE 3 MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 WATER-SOLUBLE FERTILIZERS MARKET: APPROACH ONE (BOTTOM-UP)

- FIGURE 6 MARKET: APPROACH TWO (TOP-DOWN)

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 MARKET RESEARCH ASSUMPTIONS CONSIDERED

- FIGURE 9 STUDY LIMITATIONS AND RISK ASSESSMENT

- FIGURE 10 INDICATORS OF RECESSION

- FIGURE 11 GLOBAL INFLATION RATE, 2011–2021

- FIGURE 12 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 13 RECESSION INDICATORS AND THEIR IMPACT ON WATER-SOLUBLE FERTILIZERS MARKET

- FIGURE 14 GLOBAL WATER-SOLUBLE FERTILIZERS MARKET: PREVIOUS FORECAST VS. RECESSION IMPACT FORECAST

- FIGURE 15 WATER-SOLUBLE FERTILIZERS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 MARKET SHARE, BY REGION, 2022

- FIGURE 20 GROWTH IN DEMAND FOR HIGH-VALUE CROPS, SCARCE WATER RESOURCES, AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET DEMAND

- FIGURE 21 US WAS LARGEST GLOBAL MARKET FOR WATER-SOLUBLE FERTILIZERS IN 2022

- FIGURE 22 NITROGENOUS WATER-SOLUBLE FERTILIZERS ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC

- FIGURE 23 EUROPE AND NITROGENOUS TYPE TO DOMINATE RESPECTIVE SEGMENTS

- FIGURE 24 HORTICULTURAL CROPS TO LEAD DURING FORECAST PERIOD

- FIGURE 25 DRY WATER-SOLUBLE FERTILIZERS TO DOMINATE MARKET

- FIGURE 26 FERTIGATION TO LEAD OVER FOLIAR MODE OF APPLICATION

- FIGURE 27 BENEFITS OF WATER-SOLUBLE FERTILIZERS

- FIGURE 28 GLOBAL POPULATION, 1970–2050

- FIGURE 29 MARKET DYNAMICS: WATER-SOLUBLE FERTILIZERS MARKET

- FIGURE 30 ANNUALLY AVAILABLE ARABLE LAND, 1950–2020 (HECTARES/PERSON)

- FIGURE 31 INDIA: AREA UNDER ORGANIC CERTIFICATION PROCESS, 2018–2021 (MILLION HECTARES)

- FIGURE 32 TREND INVOLVING REVENUE SHIFT FOR WATER-SOLUBLE FERTILIZERS MARKET

- FIGURE 33 VALUE CHAIN ANALYSIS OF WATER-SOLUBLE FERTILIZERS MARKET

- FIGURE 34 WATER-SOLUBLE FERTILIZERS MARKET ECOSYSTEM MAP

- FIGURE 35 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2023

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING DIFFERENT TYPES OF WATER-SOLUBLE FERTILIZERS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP WATER-SOLUBLE FERTILIZER TYPES

- FIGURE 38 WATER-SOLUBLE FERTILIZER MACRONUTRIENTS: MAJOR FUNCTION

- FIGURE 39 MARKET FOR WATER-SOLUBLE FERTILIZERS, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 40 BENEFITS OF NITROGENOUS WATER-SOLUBLE FERTILIZERS

- FIGURE 41 BENEFITS OF PHOSPHATIC WATER-SOLUBLE FERTILIZERS

- FIGURE 42 BENEFITS OF POTASSIC WATER-SOLUBLE FERTILIZERS

- FIGURE 43 WATER-SOLUBLE FERTILIZERS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 44 MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 45 MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 46 GEOGRAPHIC SNAPSHOT (2023–2028): RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOTSPOTS

- FIGURE 47 NORTH AMERICA: MARKET FOR WATER-SOLUBLE FERTILIZERS, RECESSION IMPACT ANALYSIS, 2022–2023

- FIGURE 48 EUROPE: WATER-SOLUBLE FERTILIZERS MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: WATER-SOLUBLE FERTILIZERS SNAPSHOT

- FIGURE 50 REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD BILLION)

- FIGURE 51 WATER-SOLUBLE FERTILIZERS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 52 MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- FIGURE 53 NUTRIEN: COMPANY SNAPSHOT

- FIGURE 54 ISRAEL CHEMICAL LTD.: COMPANY SNAPSHOT

- FIGURE 55 SOCIEDAD QUÍMICA Y MINERA DE CHILE (SQM): COMPANY SNAPSHOT

- FIGURE 56 K+S AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 57 YARA INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 58 COROMANDEL INTERNATIONAL LIMITED: COMPANY SNAPSHOT

- FIGURE 59 THE MOSAIC COMPANY: COMPANY SNAPSHOT

- FIGURE 60 EUROCHEM GROUP: COMPANY SNAPSHOT

- FIGURE 61 SPIC: COMPANY SNAPSHOT

- FIGURE 62 ARIES AGRO LIMITED: COMPANY SNAPSHOT

- FIGURE 63 THE AZOTY GROUP: COMPANY SNAPSHOT

- FIGURE 64 GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED: COMPANY SNAPSHOT

- FIGURE 65 INCITEC PIVOT LTD: COMPANY SNAPSHOT

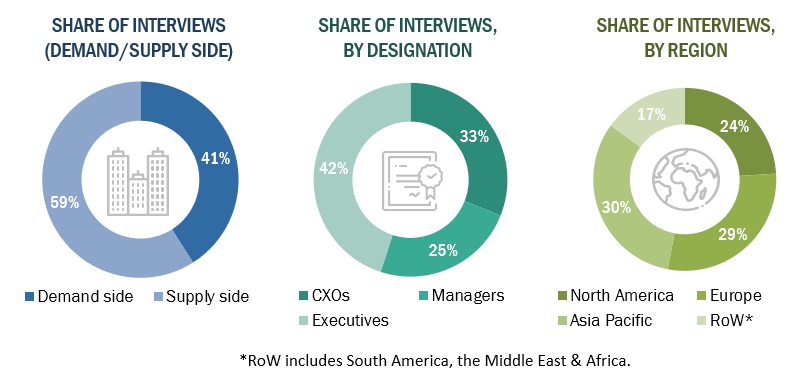

This research study involved the extensive use of secondary sources directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the water-soluble fertilizers market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources, such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the water-soluble fertilizers market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the water-soluble fertilizers market includes the following details. The top-down and bottom-up approaches were used to estimate and validate the market’s and various dependent submarkets’ size The research methodology used to estimate the market size includes extensive secondary research of key players, reports, reviews, and newsletters of top market players, along with extensive interviews from leaders, such as CEOs, directors, and marketing executives.

Global Water-Soluble Fertilizers market size: Bottom-Up Approach

Global water-soluble fertilizers market size: Top- Down Approach

Data Triangulation

The data triangulation and market breakdown procedures explained above were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Water-soluble fertilizers are substances that are dissolved in water and applied to crops at the base or foliage throughout the growing season. These are ideal for crops with low nitrogen requirements. They act fast and provide nutrients to the crops immediately.

Water-soluble fertilizers comprise water-soluble salts and foliar fertilizers. Foliar fertilizers are substances that contain primary nutrients and micronutrients, which are applied to leaves and absorbed by them. Urea is widely used for foliar application owing to its high solubility in water and rapid absorption by plants through leaves. Foliar fertilizers are applied to cure both obvious as well as hidden nutrient deficiencies.

Stakeholders

- Raw material suppliers and manufacturers

- Key manufacturers of water-soluble fertilizers

- Water-soluble traders, suppliers, and distributors

- Importers and exporters

- Regulatory bodies

- Food and Drug Administration (FDA)

- Food and Agriculture Organization (FAO)

- The United States Department of Agriculture (USDA)

- European Commission (EC)

- Commercial research & development (R&D) institutions and financial institutions:

- Associations

- International Fertilizer Association (IFA)

- Micronutrient Manufacturers Association (MMA)

- The Organization for Economic Co-operation and Development (OECD)

Report Objectives

- Determining and projecting the size of the water-soluble fertilizers market with respect to type, mode of application, crop type, form, and region

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

-

Providing detailed information about the key factors influencing the water-soluble fertilizers market growth

(drivers, restraints, opportunities, and industry-specific challenges) - Providing the regulatory framework and market entry process related to the water-soluble fertilizers market

- Analyzing the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the water-soluble fertilizers market

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the country

- Providing insights on the key product innovations and investments in the water-soluble fertilizers market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Water-Soluble Fertilizers market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the water-soluble fertilizers market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Water-soluble Fertilizers Market

Is market data for organic fertilizers covered in the report? If yes, interested in buying the report.