Agrochemicals Market by Type (Fertilizers, Pesticides), Crop Type (Cerelas & Grains, Oilseeds & Pulses, Fruits & Vegetables), Fertilizers Type, Pesticide Type (Insecticides, Herbicides, Fungicides, Nematicides) and Region - Global Forecast to 2028

The global agrochemicals market is expected to grow from USD 235.2 billion in 2023 to USD 282.2 billion by 2028, at a CAGR of 3.7% during the forecast period. Agrochemicals include fertilizers, pesticides, adjuvants, and plant regulators. Agrochemicals reduce crop loss by protecting crops from disease-causing pathogens, increasing crop yield, and maintaining crop yield quality. The rapid growth in human population increased the demand for food supply, resulting in agricultural intensification during the last few decades. According to World Population Prospects 2022, the population of the world reached an all-time high of 8 billion. The growing population puts immense pressure on limited agricultural land for higher yields. In order to meet growing food demand, agrochemicals in the form of fertilizers and diverse pesticides are rigorously used in agriculture and bridge the gap between food production and consumption. The agrochemicals market is highly fragmented, with many players offering a wide product portfolio catering to different agricultural applications. Companies such as BASF SE (Germany), Bayer AG (Germany), YARA (Norway), and UPL (India) are some of the major players in the agrochemicals market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Change in climatic conditions lead to increase in pest and disease infestation

The growth and spread of agronomical pests, which include diseases, insects, and weeds, are causative agents of great threat to agricultural production and global crop yields. This has been worsened by the dynamism of climate change effects, as it changes the environment to culminate in new challenges in pest management within major cropping systems. The shift in rainfall patterns, rising temperature drive new demands for novel and effective chemicals on crop protection. For example, a shift in precipitation patterns that brings more humidity and wetness can trigger fungal outbreaks in crops like rice and wheat, which will now call for more sophisticated fungicides. Likewise, high levels of CO2 can lead to more aphids on soybean plants and, therefore, calls for better insecticides and integrated pest management strategies. Weeds, animal pests, and pathogens are major contributors to these losses. On average, pests are responsible for reducing global yields by 20-40%, costing the combined global economy about USD 290 billion.

Restraint : Regulatory hurdles

Regulatory restraints create high barriers to entry into the agrochemicals market and hence raise the costs associated with developing new products. Extremely tight regulatory environments mean that every new agrochemical product would have a full environmental, health, and safety profile be built for it, and be subject to that profile in terms of safety and efficacy. Such regulations ensure that only high standards of products circulate, but they add to the long approval times. Overall, this is a long and complex process that delays the entry of innovative products to the market, increasing costs for manufacturers who must conduct studies, trials, and compliance tasks. In Europe, plant protection products are subject to an authorisation procedure under Regulation No. (EC) 1107/2009, which establishes the period of approval for active substances and authorisation at EU level for plant protection products. The consequence would be the full review in terms of safety, efficacy, and environmental impacts of the product. On that basis, the indicative evaluation periods according to the timetables laid down in Regulation (EC) No 1107/2009 shall be from 2.5 to 3.5 years from the date when an application is declared admissible to the date when a Regulation granting or refusing approval for the initial authorization of an active substance, safeners, or synergists.

Opportunity: Integration of agrochemicals in precision farming

The following tools of precision agriculture help farmers monitor the conditions of crops' needs for nutrients: 4Rs—right source, right rate, right time, right place; soil sensors; variable rate prescriptions; yield maps; decision support software; soil mapping; multispectral imaging; auto-guidance systems; and leaf color charts. Precision farming also combines data analytics, AI, and sensor systems in determining the amount of fertilizer and water that plants require at any given time by using autonomous vehicles to deliver nutrient in prescribed amounts and locations.

Fertilizer application is important to improve soil productivity. Overfertilization, however, can lead to drastic impacts on soil health. In 2022, researchers from Imperial College London created a new predictive testing kit that helps producers know how much ammonia and nitrate are currently in the soil and how much could be in it going forward, based on the climate. This can help in tailoring the fertilizer to individual soil and crop needs.

Challenge: Increase in resistance to agrochemicals

Prolonged use of chemical pesticides has resulted in pesticide-resistant pests and weeds, thus causing a huge dent in the efficacy of the currently available control measures. One of the major factors affecting the agrochemicals market is pesticide resistance since it reduces the effectiveness of the products farmers rely on for protecting their crops. These new solutions to counter this problem range from new active ingredients to formulations that would improve environmental degradability, new systemic action, and strategic rotation plans to maintain the efficacy of pesticides as long as possible.

Syngenta AG has developed the multi-active derived herbicide, Acuron, to combat weed resistant to glyphosate. It contains several active ingredients, all with complementary modes of action. Bringing down the pocituation at hand reduces the odds of developing resistance by attacking the weeds via various paths of attack at varying biochemical pathways.

AGROCHEMICALS MARKET ECOSYSTEM

Key players within this market consist of reputable and financially robust agrochemicals manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, advanced technologies, and robust global sales and marketing networks. Prominent companies in this market include Bayer AG (Germany), BASF SE (Germany), Syngenta (Switzerland), Eurochem Group (Switzerland), Corteva (US), Compass Minerals (US), UPL (India), K+S Aktiengesellschaft (Germany), Sociedad Química y Minera de Chile (Chile), Sumitomo Chemical Co., Ltd. (Japan), Nutrien Ltd. (Canada), YARA (Norway), ICL (Isarel), Isagro S.p.A (Italy), and Verdesian Life Sciences (US).

In crop type segment, cereals & grains holds significant market share in the global agrochemicals market.

The consumption of cereals and grains is crucial for meeting the dietary needs of a growing population. There is a need to enhance cereals & grains yield to fulfill the growing demand. The application of agrochemicals is helping to fulfill the demand. According to the FAO reports, global cereal utilization for the year 2023/24 is likely to show an upward movement tendency compared to previous years. More global stocks of cereals are forecast by 2024. This suggests a steady supply of cereals to meet demand. The growing demand for cereals highlights the importance of improving agricultural productivity, potentially leading to greater use of agrochemicals to optimize yields and meet global requirements.

In 2022, nitrogeneous fertilizers stood as the major segment within the by fertilizer type segment of the agrochemicals market.

The nitrogenous fertilizers stimulates photosynthesis and the overall plant productivity. Urea is the most used Nitrogenous Fertilizer in countries across the globe because of its high N content of 46%N, hence it is one of the most widely used dry granular nitrogen sources. The fertilizer manufacturing industry prefers it since it is relatively easy to manufacture. On a ton-for-ton basis, urea contains 35 percent more nitrogen than ammonium nitrate. This has implications for the storage and transport of nitrogen fertilizer products. While considered a relatively stable product to store and transport, urea transportation is considered very cost-effective compared with its most common alternative, ammonium nitrate. A 2022 report from the World Economic Forum establishes that ammonia is an important chemical used either as an intermediate or finished good in the fertilizer sector, accounting for 70%, and other sectors accounting for 30%. Basically, ammonia is important for the agricultural sector, and their food supply security in the world directly depends on it.

Fungicide segment to grow at highest rate in the by pesticide segment, in the agrochemicals market

The demand of fungicides is driven by the rise in fungal diseases that quite often threatens the yield and even quality of crops. Growing climate variability and alteration in agricultural practices raise the risk of fungal disease, and hence demand for better solution keeps rising to protect crops from fungal infections. Agricultural industries are more and more adopting advanced technologies to overcome the limitations of traditional pesticide formulations, which generally lack in efficacy and cause an environmental impact. More particularly, innovations are focused on microencapsulation and nanotechnology. Vive Crop Protection and Aqua-Yield deliver nanoparticle-based delivery systems for crop protection products. Global technology leader Syngenta Group continues to drive the fungicide segment by constantly pushing boundaries through its patented ADEPIDYN technology: pydiflumetofen, and globally launched TYMIRIUM technology in 2022. New technological developments in crop-protection chemicals, such as more potent, green, and specific products, are helping to drive the fungicides segment.

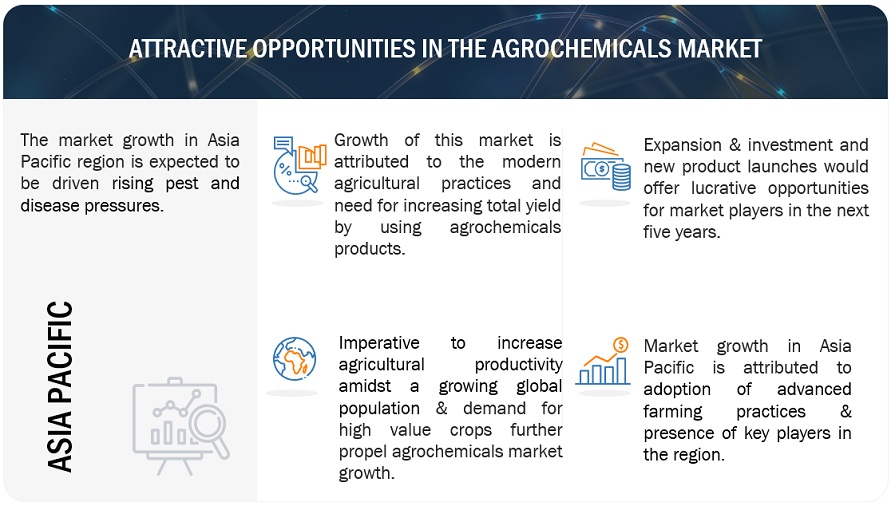

Asia Pacific to dominate the agrochemicals market during the forecast period.

Asia Pacific will dominate the agrochemicals market. Asia Pacific includes countries with huge lands fit for agriculture, like India, China, Japan, Australia, and Indonesia, where the per capita income of the region depends mainly on agricultural pursuits. There is wide acceptance and practice of agricultural technologies in this region. Asia Pacific Plant Protection Commission protects plant, human, and animal health; protects the environment; facilitates trade; and ensures agriculture sustainability. It represents one of the main mandates of the Commission: to provide a regional platform for cooperation and comprehensive implementation of the Plant Protection Agreement in the Asia-Pacific region. This it does by developing standards on plant protection measures, including regional standards for phytosanitary measures, promoting integrated pest management, and ensuring adherence to the Code of Conduct for the Distribution and Use of Pesticides.

Key Market Players

The key players in this market include Bayer AG (Germany), BASF SE (Germany), Syngenta (Switzerland), Eurochem Group (Switzerland), Corteva (US), Compass Minerals (US), UPL (India), K+S Aktiengesellschaft (Germany ), Sociedad Química y Minera de Chile (Chile), Sumitomo Chemical Co., Ltd. (Japan), Nutrien Ltd. (Canada), YARA (Norway), ICL (Isarel), Isagro S.p.A (Italy), and Verdesian Life Sciences (US). These market participants are emphasizing the expansion of their footprint via agreements and partnerships. They maintain a robust presence in North America, Asia Pacific, South America, RoW, and Europe, and they are supported by manufacturing facilities and well-established distribution networks spanning these regions

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD Million) |

|

Segments Covered |

By Type, Fertilizer Type, Pesticide Type, Crop Type, and Region |

|

Regions covered |

North America, Europe, South America, Asia Pacific, and RoW |

|

Companies studied |

|

This research report categorizes the agrochemicals market based on type, pesticide type, fertilizer type, crop type, and region.

Target Audience:

- Raw material suppliers of chemicals

- Agrochemical manufacturers & suppliers

- Agrochemical traders, retailers, and distributors

- Commercial research & development (R&D) institutions

- Government, regulatory bodies, and research organizations

- Technology providers to pesticide & microbial companies

- Public hygiene organizations, government regulatory institutions, and food safety agencies

- Agricultural co-operative societies

- Farmers, wholesalers, retailers, agro-manufacturers, media, researchers, and NGOs

- Pesticide associations and industry bodies:

- Food and Agriculture Organization (FAO)

- European Crop Protection Agency (ECPA)

- Pesticides Manufacturers and Formulators Association (PMFAI)

- China Crop Protection Industry Association (CCPIA)

- Fertilizer associations and industry bodies:

- Food and Agriculture Organization (FAO)

- International Fertilizer Association (IFA)

- The Fertilizer Institute (TFI)

Scope of the Report

Agrochemicals Market:

By Type

- Fertilizers

- Pesticides

By Pesticide Type

- Insecticides

- Herbicides

- Fungicides

- Nematicides

- Other Pesticide Types

By Fertilizers Type

-

Nitrogenous Fertilizers

- Urea

- Ammonium Nitrate

- Ammonium Sulfate

- Ammonia

- Calcium Ammonium Nitrate

- Other Nitrogenous Fertilizers

-

Phosphatic Fertilizers

- Diammonium Phosphate

- Monoammonium Phosphate

- Triple Superphosphate

- Other Phosphatic Fertilizers

-

Potassic Fertilizers

- Potassium Chloride

- Potassium Sulfate

- Other Potassic Fertilizers

By Crop Type:

-

Cereals & Grains

- Corn

- Wheat

- Rice

- Other Cereals & Grains

-

Oilseeds & Pulses

- Soybean

- Sunflower

- Other Oilseeds & Pulses

-

Fruits & Vegetables

- Apples

- Cucumbers

- Grapes

- Pears

- Potatoes

- Bananas

- Avocado

- Tomatoes

- Cucurbits

- Other Fruits & Vegetables

- Other Crop Types

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- ADAMA announced the launch of Avastel, Maganic, Maxentis, and Forapro fungicides in April 2024. This expansion broadened ADAMA's product portfolio.

- In April 2024, UPL announced the completion of the acquisition of Corteva Agriscience's global Mancozeb fungicide business ex-China, Japan, South Korea, the UK, Switzerland, and the countries in the EU. Mancozeb is a highly effective fungicide used for preventing plant diseases across various crops and was part of the acquired business.

- In August 2023, Bayer AG invested USD 231.3 million in the construction and development of a new R&D facility at its Monheim site. This was the largest single financial investment in crop protection made in Germany within the past forty years. The R&D facility was meant to accommodate some 200 employees. Bayer was well on the way to developing the next generation of safe and sustainable crop protection products, with a number of advanced safety measures, including early safety screens and artificial intelligence.

Frequently Asked Questions (FAQ):

Which are the major companies in the agrochemicals market? What are their major strategies to strengthen their market presence?

The key players in this include Bayer AG (Germany), BASF SE (Germany), Syngenta (Switzerland), Eurochem Group (Switzerland), Corteva (US), Compass Minerals (US), UPL (India), K+S Aktiengesellschaft (Germany), Sociedad Química y Minera de Chile (Chile), Sumitomo Chemical Co., Ltd. (Japan), Nutrien Ltd. (Canada), YARA (Norway), ICL (Isarel), Isagro S.p.A (Italy), and Verdesian Life Sciences (US). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities and strong distribution networks across these regions.

What are the drivers and opportunities for the agrochemicals market?

The agrochemicals market is also driven by increasing agricultural productivity to feed the rising global population, particularly in countries with a low arable land area. Improved farming practices, such as precision agriculture alongside genetically engineered crops, also encouraged the adoption of agrochemicals in an effort to achieve the highest possible yields. This can thus be tied to digital farm management and decision-making platforms for product bundling with the agro-chemicals and digital solutions that bring value addition to products and engage farmers. This growing demand for bio-based agrochemicals is an absolute opportunity for agrochemical manufacturers.

Which region is expected to hold the highest market share?

The Asia Pacific region holds the highest portion of the agrochemicals market status because of the continent's extremely vast agricultural landscape and the high demand for food to feed the large and growing human populace. High demand for agrochemicals in terms of improving crop yields and national food security has been a significant driver for this region. In addition, with a high level of industrialization and embracing modern types of farming, agrochemical usage in this region has been tremendously increased, therefore making the Asia Pacific dominant in the global market.

What are the key technology trends prevailing in the agrochemicals market?

The pesticide and fertilizer markets are focused on sustainability and precision. In the case of pesticides, there is a growing trend toward biopesticides and IPM, which underline the use of natural and less harmful products. Applications are able to be made more and more specific with precision agriculture technologies such as drones and data analytics, hence reducing environmental impact in regard to pesticides. The trend is toward more sophisticated, cleaner, and controlled, slow-release, and biofertilizers that improve the condition of the soil without abusing synthetic chemicals. Besides, both industries are turning to digital tools and AI for smarter rate and timing applications within a greater trend of smarter and more sustainable agriculture practices.

What is the total CAGR expected to be recorded for the agrochemicals market during 2023-2028?

The CAGR is expected to record as of 3.7% from 2023-2028.

What is the demand for agrochemicals?

What are the three main types of agrochemicals?

What is the most widely used pesticide in the US?

Is agriculture high in demand?

What is the outlook for the agrochemicals industry?

Which is the largest producer of agrochemicals in the world?

What are the top 20 agrochemical companies?

Who is the largest agricultural producer in the US?

What is the global market for agrochemicals?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

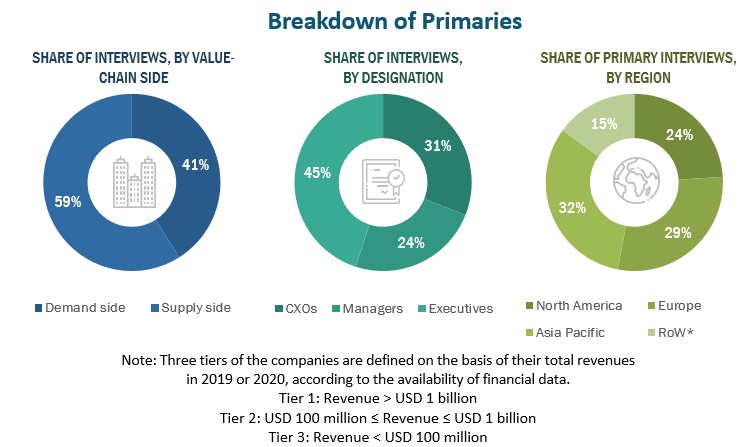

This research study involved the extensive use of secondary sources—directories and databases such as the Food and Agriculture Organization and World Health Organization—to identify and collect information useful for a technical, market-oriented, and commercial study of the agrochemical market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure depicts the research design applied in drafting this report on the agrochemicals market.

Secondary Research

In the secondary research process, various sources such as website information, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the agrochemicals market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- Both the top-down and bottom-up approaches were used to estimate and validate the total size of the agrochemicals market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- All macroeconomic and microeconomic factors affecting the growth of the agrochemicals market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for agrochemicals on the basis of type, fertilizer type, pesticide type, crop type and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyse the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyse the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyse their market position and core competencies.

- To analyse the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the agrochemicals market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakdown of the Rest of Europe agrochemicals market into Poland, Netherlands, Denmark, Belgium, Switzerland, Sweden, Greece, and other EU and non-EU countries.

- Further breakdown of the Rest of Asia Pacific agrochemicals market into Malaysia, Thailand, Singapore, Indonesia, Philippines, Vietnam, South Korea, and other ASEAN countries.

- Further breakdown of the Rest of South America agrochemicals market into Colombia, Peru, Paraguay, Chile, and Venezuela.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agrochemicals Market

Looking for global agrochemicals market by fertilizers and pesticides forecasted to 2020

Interested in Agrochemicals market in Europe, North and Latin America, registration requirements; market trends, off-patent chemicals