Biofertilizers Market by Type (Nitrogen-Fixing, Phosphate Solubilizing & Mobilizing, Potassium Solubilizing & Mobilizing), Mode of Application (Soil Treatment, Seed Treatment), Form, Crop Type and Region - Global Forecast to 2028

Biofertilizers Market Overview

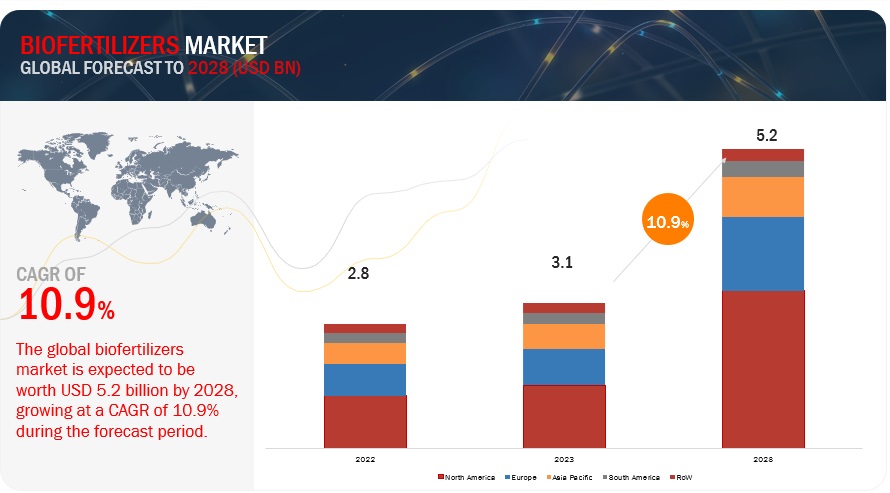

The global biofertilizers market was valued 2.8 billion in 2022 and is projected to reach USD 5.2 billion by 2028, growing at a CAGR of 10.9% during the study period. The market Size is estimated to be valued at USD 3.1 billion in 2023

Through natural processes such as nitrogen fixation; phosphate solubilization; and the production of compounds that stimulate growth, biofertilizers provide nutrients to plants. They boost soil organic matter and aid in restoring the soil's natural nutrition cycle. By using biofertilizers, growers can increase the sustainability and health of the soil and cultivate healthy crops. Only bacteria and other biological elements that are not damaging to the environment are present in biofertilizers. As a result, they contribute to reducing pollution brought on by agricultural activities, particularly soil pollution.

Use of biofertilizers have been proven to lower the cost of agricultural inputs while increasing the overall crop productivity in the long run. Biofertilizers also helps in increasing resistance to various plant diseases and abiotic stresses. These factors are driving the global biofertilizers market during the review period.

To know about the assumptions considered for the study, Request for Free Sample Report

Biofertilizers Market Dynamics

Drivers: Adoption of precision farming and protected agriculture

The goal of precision farming is to produce profitable agricultural output by identifying and analysing spatial and temporal variability using cutting-edge technologies. To boost crop output and yield, agricultural biologicals are employed in precision farming and protected agriculture. The market for biofertilizers is growing as a result of the widespread use of agricultural biologicals in protected agriculture, which promotes the use of biofertilizers. Farmers can track the application of liquid biofertilizer by using fertilisation plans that use GPS-guided geographic information system (GIS) software. Therefore, it is anticipated that the market for biofertilizers will be driven by the rise in land under precision and protected agriculture.

Restraints: Environmental and technological constraints

Biofertilizer products have a limited shelf-life and run a high risk of contamination. When exposed to high temperatures, the microorganisms utilised as biofertilizers become nonviable. As a result, it's crucial to keep them in a dry, cool environment. The survival of microorganisms during storage is the main issue with agricultural inoculation technology; other difficulties revolve around a number of other factors, including culture medium, physiological state of the microorganisms at harvest, dehydration process, rate of drying, temperature maintenance during storage, and water activity of inoculants. The shelf life of microorganisms is impacted by these difficulties.

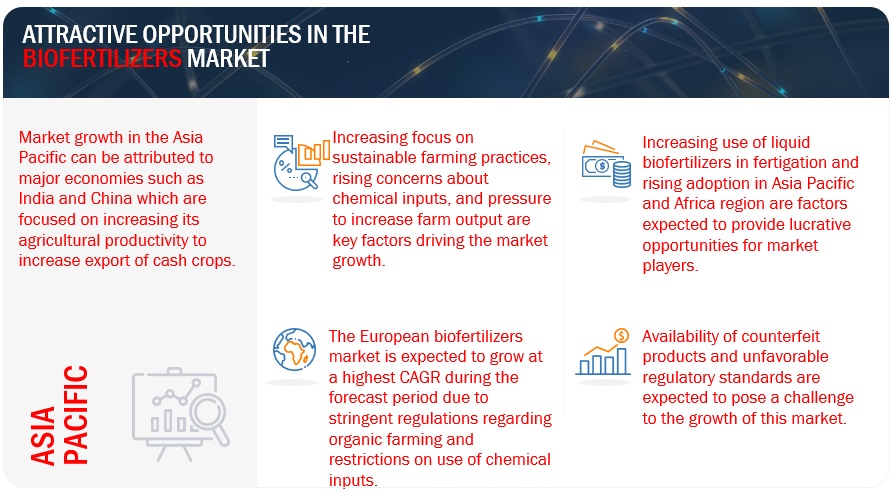

Opportunities: New target markets: Asia Pacific and Africa

The Asia Pacific and Africa regions are one of the largest consumers of fertilizers. Population development, particularly in Asia, has led to an increase in food demand, which will ultimately result in an increase in fertilizer usage. Governments in these regions are placing a strong emphasis on the use of environmentally benign fertilizers, like biofertilizers and organic manure, to mitigate the negative impacts of chemical fertilisers. Government agencies have aided in raising farmer understanding of the benefits of using biofertilizers. Africa has experienced active conventional farming over the past few decades, which has utilized synthetic fertilizers to supply the soil with vital plant nutrients. However, the quality of the soil and the vital nutrients have been compromised by the over application of these fertilizers. The region now needs biofertilizers as a result of this aspect.

To know about the assumptions considered for the study, download the pdf brochure

Challenges: Intense competition and product rivalry due to similar products

A significant problem in the sector is the availability of counterfeit biofertilizers, which harms farmers' perceptions of the finished product and restrains market expansion. Due to their exact chemical qualities and comparable physical traits, counterfeit products have a very cheap production cost and have shown to be impossible for farmers to distinguish from genuine biofertilizers. Poor microbial load, contaminated items, or inappropriate strains are utilised to simulate a product. Due to a highly fragmented market with unorganised participants, counterfeit products are sold in Asian nations.

Market Ecosystem

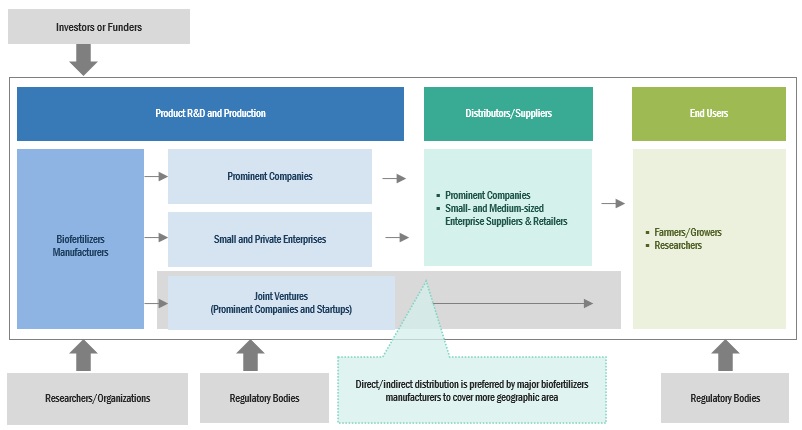

Key players in biofertilizers market have strong distribution network and have strong financial records. These firms have experience of several years, well established manufacturing facilities, r&d centers, and skilled workforce. Prominent players in this market include Novozymes (Denmark), UPL (India), Chr. Hansen Holding A/S (Denmark), Syngenta (Switzerland), T.Stanes and Company Limited (India), and Lallemand Inc (Canada).

By type, nitrogen-fixing biofertilizers is projected to gain largest share in the biofertilizers market during the study period

Increased biological nitrogen fixation, improved nutrient availability or uptake, greater absorption and stimulation of plant growth by hormonal action or antibiosis, or through breakdown of organic wastes are all ways that nitrogen fixing biofertilizers aid in enhancing crop output. Also, the use of nitrogen fixing biofertilizers as a partial replacement for chemical fertilisers reduces their quantity and cost and shields the environment from contamination caused by their heavy usage. Thus, driving the growth of segment in the market.

By crop type, fruits & vegetables is forecasted to account for the largest share in the market during the research period

Biofertilizers are known to increase crop productivity of various fruits & vegetables. Fruits such as bananas have a substantial nitrogen requirement, hence the use of biofertilizer, in particular inoculation with Azotobacter, is utilzsed as an alternative and results in a higher yield than full doses of nitrogen administration. In correlation with VAM fungus, there is a rise in the absorption of nutrients that are mobile, such as nitrogen. Organic farming produces high-quality vegetables, thus more farmers are expected to adopt and use microbial biofertilizers in order for modern agriculture to grow sustainably.

By mode of application, soil treatment segment is anticipated to occupy major share in the biofertilizers market during the study period

When planting legume seeds in hot, dry, highly acidic soils, adverse weather, or when seeds have been treated with chemicals that are toxic to rhizobia bacteria, it is necessary that a liquid biofertilizer formulation must be applied directly to the soil to achieve optimal nodulation. When applied to the soil, fertilizers diffuse their way into the crops. Fertilizers promote increased yield and productivity since the roots of the crop are in close touch with them. Hence, driving the growth of segment during the review period.

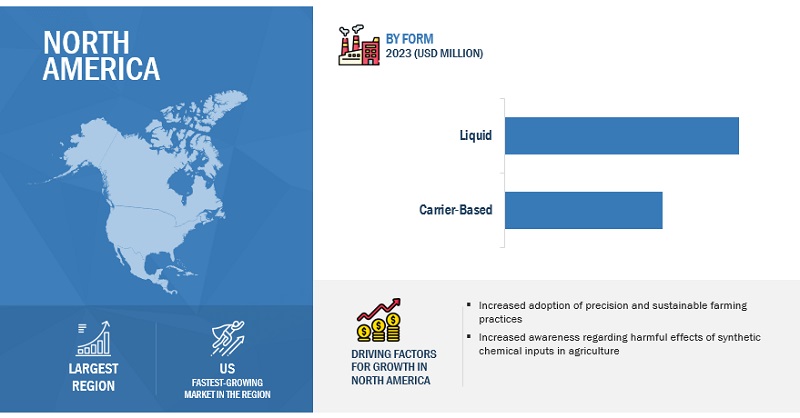

By form, liquid segment is forecasted to gain the major share in the biofertilizers market during the review period

Liquid biofertilizers can be used with modern machinery, can withstand high temperatures up to 45 °C, are easy to handle and use, are easy to add ingredients that enhance the growth of microbial strains, are easy to apply on both seeds and soil, and have a longer shelf life of 1.5 to 2 years, hence liquid biofertilizers are more desirable than solid inoculants. Moreover, liquid biofertilizers have higher microbial densities than carrier based, allowing for lower dosages while yet producing the same results.

North America is projected to gain the largest market share in the global biofertilizers market.

North America is projected to gain the largest market share in the global biofertilizers market. The presence of large number in the region allows farmers/growers in the region, access to wide range of products at competitive prices. The governments in the region are promoting use of agricultural inputs which causes less environmental degradation and hence are encouraging the use of biofertilizers. In countries such as US and Canada, farmers are focused on producing cash crops at larger scale which is also driving the market in the region.

Key Market Players:

Key players in this market include Novozymes (Denmark), UPL (India), Chr. Hansen Holding A/S (Denmark), Syngenta (Switzerland), T.Stanes and Company Limited (India), Lallemand Inc (Canada), Rizobacter Argentina S.A. (Argentina), Vegalab SA (Switzerland), IPL Biologicals Limited (India), and Kiwa Bio-tech Product Group Cooperation (China).

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2023 |

USD 3.1 billion |

|

Revenue forecast in 2028 |

USD 5.2 billion |

|

Growth Rate |

CAGR of 10.9% from 2023 to 2028 |

|

Base year for estimation |

2022 |

|

Forecast period |

2023-2028 |

|

Quantitative units |

Value (USD Million) and Volume (KT) |

|

Segments covered |

Type, Crop Type, Mode of Application, Form, and Region |

|

Regional scope |

North America, Asia Pacific, Europe, South America, and RoW |

|

Dominant Geography |

North America |

|

Key companies profiled |

|

Report Segmentation

The study categorizes the biofertilizers market based on by type, by crop type, by mode of application, by form, and region.

|

By Type |

By Crop Type |

By Mode of Application |

By Form |

By Region |

|

|

|

|

|

Recent Developments

- In May 2022, Syngenta introduced its new nitrogen-fixing biofertilizer, Envita. This product is designed to be used for several crop types such as cereals & grains, pulses & oilseeds, and fruits & vegetables.

- In January 2021, Rizobacter Argentina S.A announced a collaboration with Heliae Development, LLC (US). The collaboration would provide farmers throughout the US and Eastern Canada with new biological solutions that would add value to their farming operations.

- In March 2021, Symborg (Spain) inaugurated its new manufacturing unit located at Alhama de Murcia (Region of Murcia, Spain). The facility would help the company to manufacture with greater efficiency. The total investment in this expansion was USD 29.71 million.

Frequently Asked Questions (FAQ):

What is the projected market value of the global biofertilizers market?

The global biofertilizers market was valued 2.8 billion in 2022 and is projected to reach USD 5.2 billion by 2028

What is the estimated market value of the global biofertilizers market on 2023?

The global biofertilizers market size is estimated to be valued at USD 3.1 billion in 2023

What is the estimated growth rate (CAGR) of the global biofertilizers market for the next five years?

The global biofertilizers market is growing at a CAGR of 10.9% during the study period.

What are the major revenue pockets in the biofertilizers market currently?

North America is projected to gain the largest market share in the global biofertilizers market. The presence of large number in the region allows farmers/growers in the region, access to wide range of products at competitive prices.

What kind of information is provided in the competitive landscape section?

For key players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, and MnM view to elaborate analyst view on the company.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORS INFLUENCING BIOFERTILIZERS MARKETPOPULATION GROWTH AND DEMAND FOR DIVERSE FOOD PRODUCTSINCREASE IN ORGANIC FARM AREAINCREASE IN PRODUCTION OF FRUITS & VEGETABLES

-

5.3 MARKET DYNAMICSDRIVERS- Growth in organic food industry- Increase in awareness of need for sustainable in modern agriculture methods- Hazards of using chemical fertilizers and increase in environmental concerns- Increase in usage of biofertilizers in ranch and private farms- Adoption of precision farming and protected agriculture- Provision of range of phytohormones, macronutrients, and micronutrientsRESTRAINTS- Environmental and technological constraints- Poor infrastructure and high initial investment- Absence of well-constructed marketing routes and surrounding infrastructureOPPORTUNITIES- New target markets: Asia Pacific & Africa- Increase in production and yield of crops- Increase in utilization of liquid biofertilizers and fertigation methodCHALLENGES- Lack of awareness and low adoption rate of biofertilizers- Unfavorable regulatory standards- Supply of counterfeit and less-effective products

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

-

6.3 SUPPLY CHAIN ANALYSISPROMINENT COMPANIESSMALL AND MEDIUM ENTERPRISES (SME)END USERSKEY INFLUENCERS

-

6.4 TECHNOLOGY ANALYSISTECHNOLOGICAL ADVANCEMENTS FOR LIQUID BIO-FERTILIZERS

-

6.5 PRICE TREND ANALYSISAVERAGE SELLING PRICES, BY TYPE

-

6.6 MARKET MAPPING AND ECOSYSTEM ANALYSISSUPPLY-SIDE ANALYSISDEMAND-SIDE ANALYSIS

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS BUSINESS

- 6.8 TRADE ANALYSIS

-

6.9 PATENT ANALYSIS

-

6.10 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.11 CASE STUDIES

- 6.12 KEY CONFERENCES AND EVENTS

- 6.13 TARIFF AND REGULATORY LANDSCAPE

-

6.14 REGULATORY FRAMEWORKNORTH AMERICA- US- CanadaEUROPE- Spain- ItalyASIA PACIFIC- China- Australia- IndiaSOUTH AMERICA- Brazil

-

6.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 NITROGEN-FIXING BIOFERTILIZERSNITROGEN-FIXING BIOFERTILIZERS TO ENHANCE AGRICULTURAL PRODUCTIVITY

-

7.3 PHOSPHATE SOLUBILIZING & MOBILIZING BIOFERTILIZERSLOW AVAILABILITY OF PHOSPHORUS IN SOIL TO IMPACT GROWTH OF PLANTS

-

7.4 POTASSIUM SOLUBILIZING & MOBILIZING BIOFERTILIZERSHIGHER ADOPTION OF CARRIER-BASED POTASH SOLUBILIZING BIOFERTILIZERS FOR BETTER YIELDS

- 7.5 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 CEREALS & GRAINSSUSTAINABLE BENEFITS OF BIOFERTILIZERS TO DRIVE DEMAND FOR CEREAL CROPS

-

8.3 PULSES & OILSEEDSTECHNOLOGICAL ADVANCEMENTS TO ENHANCE PULSE PRODUCTION QUALITY

-

8.4 FRUITS & VEGETABLESSTRINGENT REGULATIONS TO INCREASE USE OF BIOLOGICAL INPUTS

- 8.5 OTHER CROP TYPES

- 9.1 INTRODUCTION

-

9.2 SOIL TREATMENTCONVENTIONAL AGRICULTURAL PRACTICES TO ENCOURAGE SOIL TREATMENT WITH USE OF BIOFERTILIZERS IN ASIA PACIFIC

-

9.3 SEED TREATMENTSEED TREATMENT TO IMPROVE UPTAKE OF NUTRIENTS

-

9.4 OTHER MODES OF APPLICATIONFOLIAR TREATMENT TO PROVIDE FASTER RESULTS FOR NUTRITIONAL DEFICIENCIES

- 10.1 INTRODUCTION

-

10.2 LIQUID BIOFERTILIZERSINCREASE IN TOLERANCE LIMITS OF LIQUID BIOFERTILIZERS TO DRIVE DEMAND

-

10.3 CARRIER-BASED BIOFERTILIZERSLOW SHELF LIFE TO INHIBIT MARKET GROWTH

- 11.1 INTRODUCTION

- 11.2 RHIZOBIUM

- 11.3 AZOSPIRILLUM

- 11.4 AZOTOBACTER

- 11.5 OTHER TYPES OF MICROORGANISM

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICARECESSION IMPACT ANALYSISUS- Strengthening supply channels of organic products for food industries to drive demand for biofertilizersCANADA- Rise in organic farmlands to encourage biofertilizer manufacturers to increase production capacityMEXICO- Rise in exports of fruits & vegetables to increase adoption of biofertilizers among small organic producers

-

12.3 EUROPERECESSION IMPACT ANALYSISGERMANY- Early adoption of EU agricultural standards and policies to drive growth of nitrogen-fixing biofertilizers marketFRANCE- Need for sustainable crop production to encourage farmers to opt for organic practicesITALY- Government initiatives to provide financial support to farmersSPAIN- Increase in R&D activities to provide innovative productsUK- Increased awareness pertaining to need for sustainable farming practicesRUSSIA- Increased focus on production capacity of biofertilizers among agri-input playersNETHERLANDS- Biological inputs to witness increase in application in greenhouse cultivationREST OF EUROPE- High focus on increasing production capacity of biofertilizers among agri-input playersASIA PACIFICRECESSION IMPACT ANALYSIS- IndiaJAPAN- Increase in focus on rice production using both traditional and modern practices to drive demand- China- Thailand- Australia- IndonesiaREST OF ASIA PACIFIC- Increasing awareness regarding sustainable farming practices to drive marketSOUTH AMERICARECESSION IMPACT ANALYSIS- BrazilARGENTINA- High market penetration with help of local companiesREST OF SOUTH AMERICA- Biofertilizers to be used as agricultural solutions for enhancing crop productivityROWRECESSION IMPACT ANALYSISAFRICAMIDDLE EAST

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 MARKET SHARE ANALYSIS

- 13.4 COMPANY REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022

-

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

13.6 START-UP/SME EVALUATION QUADRANT (OTHER PLAYERS)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF OTHER PLAYERS

-

13.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY PLAYERSNOVOZYMES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewUPL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHR. HANSEN HOLDING A/S- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSYNGENTA- Business overview- Products/Solutions/Services offered- Recent developments- Recent developments- MnM viewT. STANES AND COMPANY LIMITED- Business overview- Products/Solutions/Services offered- MnM viewLALLEMAND INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRIZOBACTER ARGENTINA S.A.- Business overview- Products/Solutions/Services offered- MnM viewVEGALAB SA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIPL BIOLOGICALS LIMITED- Business overview- Products/Solutions/Services offered- MnM viewKIWA BIO-TECH PRODUCT GROUP COOPERATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSYMBORG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKAN BIOSYS- Business overview- Products/Solutions/Services offered- MnM viewMAPLETON AGRI BIOTECH PT LTD- Business overview- Products/Solutions/Services offered- MnM viewSEIPASA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGRILIFE- Business overview- Products/Solutions/Services offered- MnM view

-

14.2 OTHER PLAYERSMANIDHARMA BIOTECH PVT LTD- Business overview- Products/Solutions/Services offeredBIOMAX NATURALS- Business overview- Products/Solutions/Services offeredJAIPUR BIO FERTILIZERS- Business overview- Products/Solutions/Services offeredVALENT BIOSCIENCES- Business overview- Products/Solutions/Services offeredAUMGENE BIOSCIENCES- Business overview- Products/Solutions/Services offeredAGRINOSCRIYAGENLKB BIOFERTILIZERVARSHA BIOSCIENCE AND TECHNOLOGY INDIA PVT LTDNUTRAMAX LABORATORIES, INC

- 15.1 INTRODUCTION

- 15.2 RESEARCH LIMITATIONS

-

15.3 AGRICULTURAL BIOLOGICALS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

15.4 INOCULANTS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2021

- TABLE 2 BIOFERTILIZERS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 BIOFERTILIZERS: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

- TABLE 4 BIOFERTILIZERS: AVERAGE SELLING PRICE (ASP), BY TYPE, 2020–2022 (USD/TON)

- TABLE 5 BIOFERTILIZERS MARKET: SUPPLY CHAIN ECOSYSTEM

- TABLE 6 EXPORT VALUE OF ANIMAL OR VEGETABLE FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 7 IMPORT VALUE OF ANIMAL OR VEGETABLE FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 8 EXPORT VALUE OF ANIMAL OR VEGETABLE FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 9 IMPORT VALUE OF ANIMAL OR VEGETABLE FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 10 EXPORT VALUE OF ANIMAL OR VEGETABLE FERTILIZERS, BY KEY COUNTRY, 2019

- TABLE 11 IMPORT VALUE OF ANIMAL OR VEGETABLE FERTILIZERS, BY KEY COUNTRY, 2019

- TABLE 12 PATENTS PERTAINING TO BIOFERTILIZERS, 2020–2022

- TABLE 13 BIOFERTILIZERS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 IDENTIFICATION OF MARKET OPPORTUNITIES FOR BIOFERTILIZERS IN NORTH AMERICA

- TABLE 15 HIGH ADOPTION OF ORGANIC GROWTH STRATEGIES BY KEY PLAYERS

- TABLE 16 KEY CONFERENCES AND EVENTS IN BIOFERTILIZERS MARKET, 2023

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ENVIRONMENTAL STUDY ISSUES TO BE CONSIDERED IN APPLICATION

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPE

- TABLE 23 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 24 RHIZOBACTERIA USED IN PRODUCTION OF BIOFERTILIZERS, AND THEIR IMPACT ON PLANT PRODUCTIVITY

- TABLE 25 BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 26 BIOFERTILIZERS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 28 BIOFERTILIZERS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 29 NITROGEN-FIXING BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 NITROGEN-FIXING BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 NITROGEN-FIXING BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 32 NITROGEN-FIXING BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 33 PHOSPHATE SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 PHOSPHATE SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 PHOSPHATE SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 36 PHOSPHATE SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 37 POTASSIUM SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 POTASSIUM SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 POTASSIUM SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 40 POTASSIUM SOLUBILIZING & MOBILIZING BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 41 OTHER BIOFERTILIZERS TYPES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 OTHER BIOFERTILIZER TYPES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 OTHER BIOFERTILIZERS TYPES MARKET, BY REGION, 2018–2022 (KT)

- TABLE 44 OTHER BIOFERTILIZER TYPES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 45 BIOFERTILIZERS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 46 BIOFERTILIZERS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 47 CEREALS & GRAINS: BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 CEREALS & GRAINS: BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 PULSES AND OILSEEDS: BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 PULSES AND OILSEEDS: BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 FRUITS & VEGETABLES: BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 FRUITS & VEGETABLES: BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 OTHER CROP TYPES: BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 OTHER CROP TYPES: BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 56 BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 57 SOIL TREATMENT: BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 SOIL TREATMENT: BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 SEED TREATMENT: BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 60 SEED TREATMENT: BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 OTHER MODES OF APPLICATION: BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 OTHER MODES OF APPLICATION: BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 BIOFERTILIZERS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 64 BIOFERTILIZERS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 65 LIQUID: BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 LIQUID: BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 CARRIER-BASED: BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 68 CARRIER-BASED: BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 72 BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 73 NORTH AMERICA: BIOFERTILIZERS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 78 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 79 NORTH AMERICA: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 85 US: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 86 US: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 US: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 88 US: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 89 CANADA: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 90 CANADA: BIOFERTILIZERS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 91 CANADA: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 92 CANADA: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 93 MEXICO: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 94 MEXICO: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 95 MEXICO: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 96 MEXICO: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 97 EUROPE: BIOFERTILIZERS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 100 EUROPE: BIOFERTILIZERS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 102 EUROPE: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 103 EUROPE: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 108 EUROPE: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 109 GERMANY: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 110 GERMANY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 GERMANY: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 112 GERMANY: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 113 FRANCE: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 114 FRANCE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 115 FRANCE: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 116 FRANCE: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 117 ITALY: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 118 ITALY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 ITALY: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 120 ITALY: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 121 SPAIN: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 122 SPAIN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 123 SPAIN: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 124 SPAIN: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 125 UK: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 126 UK: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 127 UK: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 128 UK: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 129 RUSSIA: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 130 RUSSIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 131 RUSSIA: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 132 RUSSIA: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 133 NETHERLANDS: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 134 NETHERLANDS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 135 NETHERLANDS: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 136 NETHERLANDS: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 137 REST OF EUROPE: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 138 REST OF EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 139 REST OF EUROPE: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 140 REST OF EUROPE: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: BIOFERTILIZERS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 146 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 147 ASIA PACIFIC: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 153 INDIA: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 154 INDIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 155 INDIA: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 156 INDIA: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 157 JAPAN: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 158 JAPAN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 159 JAPAN: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 160 JAPAN: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 161 CHINA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 162 CHINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 163 CHINA: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 164 CHINA: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 165 THAILAND: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 166 THAILAND: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 167 THAILAND: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 168 THAILAND: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 169 AUSTRALIA: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 170 AUSTRALIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 171 AUSTRALIA: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 172 AUSTRALIA: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 173 INDONESIA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 174 INDONESIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 175 INDONESIA: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 176 INDONESIA: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 181 SOUTH AMERICA: BIOFERTILIZERS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 182 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 183 SOUTH AMERICA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 184 SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 185 SOUTH AMERICA: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 186 SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 187 SOUTH AMERICA: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 188 SOUTH AMERICA: MARKET, BY CROP TYPE, 2023–2028 (MILLION)

- TABLE 189 SOUTH AMERICA: MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 190 SOUTH AMERICA: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 191 SOUTH AMERICA: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 192 SOUTH AMERICA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 193 BRAZIL: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 194 BRAZIL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 195 BRAZIL: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 196 BRAZIL: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 197 ARGENTINA: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 198 ARGENTINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 199 ARGENTINA: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 200 ARGENTINA: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 201 REST OF SOUTH AMERICA: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 202 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 203 REST OF SOUTH AMERICA: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 204 REST OF SOUTH AMERICA: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 205 ROW: BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 206 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 207 ROW: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 208 ROW: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 209 ROW: MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 210 ROW: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 211 ROW: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 212 ROW: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 213 ROW: MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 214 ROW: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 215 ROW: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 216 ROW: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 217 AFRICA: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 218 AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 219 AFRICA: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 220 AFRICA: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 221 MIDDLE EAST: BIOFERTILIZERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 222 MIDDLE EAST: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 223 MIDDLE EAST: MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 224 MIDDLE EAST: MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 225 BIOFERTILIZERS MARKET: DEGREE OF COMPETITION

- TABLE 226 BIOFERTILIZERS: TYPE FOOTPRINT OF KEY PLAYERS

- TABLE 227 BIOFERTILIZERS: FORM FOOTPRINT OF KEY PLAYERS

- TABLE 228 BIOFERTILIZERS: MODE OF APPLICATION FOOTPRINT OF KEY PLAYERS

- TABLE 229 BIOFERTILIZERS: REGION FOOTPRINT OF KEY PLAYERS

- TABLE 230 BIOFERTILIZERS: OVERALL FOOTPRINT OF KEY PLAYERS

- TABLE 231 DETAILED LIST OF OTHER PLAYERS

- TABLE 232 COMPETITIVE BENCHMARKING (OTHER PLAYERS), 2021

- TABLE 233 BIOFERTILIZERS MARKET: PRODUCT LAUNCHES, 2018–2022

- TABLE 234 BIOFERTILIZERS MARKET: DEALS, 2018- 2022

- TABLE 235 BIOFERTILIZERS MARKET: OTHERS, 2018–2022

- TABLE 236 NOVOZYMES: BUSINESS OVERVIEW

- TABLE 237 NOVOZYMES: PRODUCT LAUNCHES

- TABLE 238 NOVOZYMES: DEALS

- TABLE 239 NOVOZYMES: OTHERS

- TABLE 240 UPL: BUSINESS OVERVIEW

- TABLE 241 UPL: DEALS

- TABLE 242 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

- TABLE 243 CHR. HANSEN HOLDING A/S: DEALS

- TABLE 244 SYNGENTA- BUSINESS OVERVIEW

- TABLE 245 SYNGENTA: PRODUCT LAUNCHES

- TABLE 246 SYNGENTA: DEALS

- TABLE 247 T. STANES AND COMPANY LIMITED: BUSINESS OVERVIEW

- TABLE 248 LALLEMAND INC.: BUSINESS OVERVIEW

- TABLE 249 LALLEMAND INC.: PRODUCT LAUNCHES

- TABLE 250 RIZOBACTER ARGENTINA S.A: BUSINESS OVERVIEW

- TABLE 251 RIZOBACTER ARGENTINA S.A.: DEALS

- TABLE 252 RIZOBACTER ARGENTINA S.A.: OTHERS

- TABLE 253 VEGALAB SA: BUSINESS OVERVIEW

- TABLE 254 VEGALAB SA: DEALS

- TABLE 255 IPL BIOLOGICALS LIMITED: BUSINESS OVERVIEW

- TABLE 256 KIWA BIO-TECH PRODUCT GROUP COOPERATION: BUSINESS OVERVIEW

- TABLE 257 KIWA BIO-TECH PRODUCT GROUP COOPERATION: DEALS

- TABLE 258 KIWA BIO-TECH PRODUCT GROUP COOPERATION: OTHERS

- TABLE 259 SYMBORG: BUSINESS OVERVIEW

- TABLE 260 SYMBORG: PRODUCT LAUNCHES

- TABLE 261 SYMBORG: OTHERS

- TABLE 262 KAN BIOSYS: BUSINESS OVERVIEW

- TABLE 263 MAPLETON AGRI BIOTECH PT LTD: BUSINESS OVERVIEW

- TABLE 264 SEIPASA: BUSINESS OVERVIEW

- TABLE 265 SEIPASA: DEALS

- TABLE 266 SEIPASA: OTHERS

- TABLE 267 AGRILIFE: BUSINESS OVERVIEW

- TABLE 268 MANIDHARMA BIOTECH PVT LTD: BUSINESS OVERVIEW

- TABLE 269 BIOMAX NATURALS: BUSINESS OVERVIEW

- TABLE 270 JAIPUR BIO FERTILIZERS: BUSINESS OVERVIEW

- TABLE 271 VALENT BIOSCIENCES: BUSINESS OVERVIEW

- TABLE 272 AUMGENE BIOSCIENCES: BUSINESS OVERVIEW

- TABLE 273 ADJACENT MARKETS

- TABLE 274 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2022–2027 (USD MILLION)

- TABLE 275 INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- FIGURE 1 BIOFERTILIZERS: MARKET SEGMENTATION

- FIGURE 2 BIOFERTILIZERS MARKET: RESEARCH DESIGN

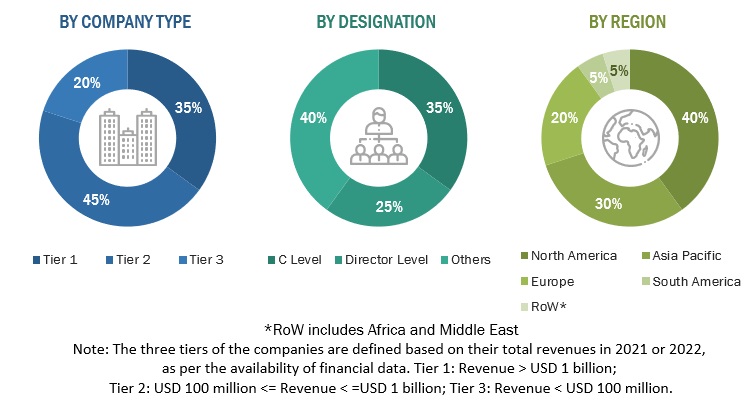

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 BIOFERTILIZERS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 BIOFERTILIZERS MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 BIOFERTILIZERS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 BIOFERTILIZERS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 BIOFERTILIZERS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 BIOFERTILIZERS MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 BIOFERTILIZERS MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 FRANCE AND CEREALS & GRAINS SEGMENTS ACCOUNTED FOR LARGEST RESPECTIVE SHARES IN 2022

- FIGURE 14 NITROGEN-FIXING BIOFERTILIZERS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 FRUITS & VEGETABLES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 SOIL TREATMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 LIQUID FORM TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 POPULATION GROWTH TREND, BY REGION, 1950–2050 (MILLION)

- FIGURE 20 ORGANIC FARM AREA GROWTH TREND, BY KEY COUNTRY, 2016–2019 ('000 HA)

- FIGURE 21 AREA HARVESTED UNDER FRUITS, VEGETABLES, AND OTHER HIGH-VALUE CROPS, 2015-2019 (MILLION HA)

- FIGURE 22 MARKET DYNAMICS: BIOFERTILIZERS MARKET

- FIGURE 23 ORGANIC RETAIL SALES, 2016–2019 (USD MILLION)

- FIGURE 24 ORGANIC RETAIL SALES, 2017 VS 2018 (USD MILLION)

- FIGURE 25 SHARE OF ORGANIC FRESH PRODUCE SALES AND VOLUME 1ST QUARTER, 2021

- FIGURE 26 GROWTH TRENDS OF ORGANIC PRODUCERS, 2016–2019

- FIGURE 27 VALUE CHAIN ANALYSIS OF BIOFERTILIZERS MARKET

- FIGURE 28 BIOFERTILIZERS MARKET: SUPPLY CHAIN

- FIGURE 29 GLOBAL AVERAGE SELLING PRICES, BY TYPE

- FIGURE 30 BIOFERTILIZERS MARKET MAPPING

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

- FIGURE 32 PATENTS GRANTED FOR BIOFERTILIZERS MARKET, 2012–2022

- FIGURE 33 REGIONAL ANALYSIS OF PATENT GRANTED FOR BIOFERTILIZERS MARKET, 2012–2022

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPE

- FIGURE 35 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 36 NITROGEN-FIXING BIOFERTILIZERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 CEREALS & GRAINS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 38 SOIL TREATMENT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 LIQUID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 40 SPAIN IS PROJECTED TO WITNESS HIGHEST GROWTH RATE AMONG COUNTRY-LEVEL MARKETS

- FIGURE 41 NORTH AMERICA: REGIONAL SNAPSHOT

- FIGURE 42 NORTH AMERICA: RECESSION IMPACT ANALYSIS SNAPSHOT

- FIGURE 43 EUROPE: BIOFERTILIZERS MARKET SNAPSHOT

- FIGURE 44 EUROPE: BIOFERTILIZERS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- FIGURE 45 ASIA PACIFIC: BIOFERTILIZERS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- FIGURE 46 SOUTH AMERICA: BIOFERTILIZERS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- FIGURE 47 ROW: BIOFERTILIZERS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- FIGURE 48 REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 49 BIOFERTILIZERS MARKET, COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 50 BIOFERTILIZERS MARKET: COMPANY EVALUATION QUADRANT, 2022 (OTHER PLAYERS)

- FIGURE 51 NOVOZYMES: COMPANY SNAPSHOT

- FIGURE 52 UPL: COMPANY SNAPSHOT

- FIGURE 53 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

- FIGURE 54 SYNGENTA: COMPANY SNAPSHOT

- FIGURE 55 T. STANES AND COMPANY LIMITED: COMPANY SNAPSHOT

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the biofertilizers market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Research Institute of Organic Agriculture (FiBL), The International Federation of Organic Agriculture Movements (IFOAM), and Food & Agriculture Organization (FAO), were referred, to identify and collect information for this study. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, associations, regulatory bodies, trade directories, and paid databases.

Secondary research was mainly used to obtain vital information about the industry’s supply chain, the total pool of key players, the market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain: suppliers, manufacturers, and end-use product manufacturers. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs of the agriculture biologicals industry. The primary sources from the supply side include research institutions involved in R&D activities, key opinion leaders, and manufacturers of biofertilizers.

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

Breakdown of Primary participants

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

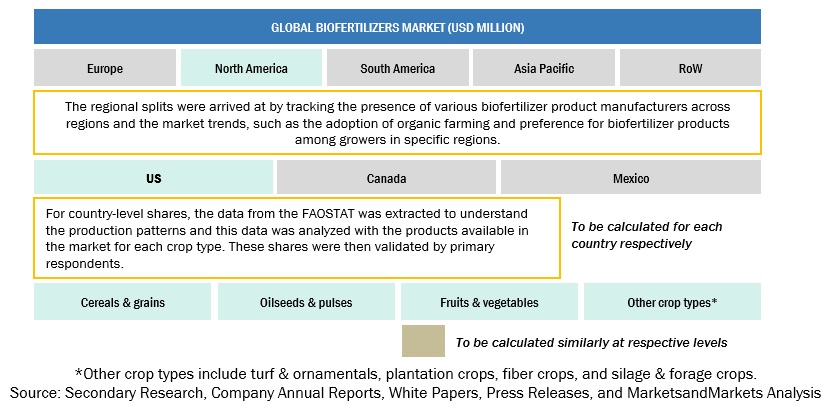

The top-down and bottom-up approaches were used to estimate and validate the total size of the biofertilizers market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the markets were identified through extensive secondary research.

- The biofertilizers market was determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the biofertilizers market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Biofertilizers Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Biofertilizers Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size from the above estimation process using both top-down and bottom-up approaches, the total market was split into several segments and subsegments. To complete the overall biofertilizers market estimation and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to European Biomass Industry Association, biofertilizers are defined as preparations containing living cells or latent cells of efficient strains of microorganisms that help crop plants’ uptake of nutrients by their interactions in the rhizosphere when applied through seed or soil. They accelerate certain microbial processes in the soil, augmenting the availability of nutrients in a form easily assimilated by plants.

Biofertilizers are substances that contain living microorganisms or latent cells. Biofertilizers are made from biological wastes and do not contain any chemicals. The National Center of Organic Farming (NCOF) defines biofertilizers as “products containing carrier-based (solid or liquid) living microorganisms that are agriculturally useful in terms of nitrogen fixation, phosphorus solubilization or nutrient mobilization, to increase the productivity of the soil and/or crop.

Key Stakeholders

- Biofertilizers manufacturers

- Biofertilizers importers and exporters

- Biofertilizers traders, distributors, and suppliers

- Government and research organizations

-

Government regulatory agencies

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- European Food Safety Authority (EFSA)

- World Health Organization (WHO)

- Food and Drug Administration (FDA)

- Environmental Protection Agency (EPA)

- Department of Environment, Food and Rural Affairs (DEFRA)

Report Objectives

- To determine and project the size of the biofertilizers market with respect to by type, by crop type, by mode of application, by form, and region

- To identify the attractive opportunities in the market by determining the largest and fastest growing segments across regions

- To provide detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To provide the regulatory framework for major countries related to the biofertilizers market

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To understand the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- To analyze the value chain and products across the key regions and their impact on the prominent market players

- To provide insights on key product innovations and investments in the global biofertilizers market

Available Customizations

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe's biofertilizers market into Denmark, Belgium, Switzerland, Ireland, and other EU and non-EU countries.

- Further breakdown of the Rest of Asia Pacific biofertilizers market into South Korea, Malaysia, and Vietnam.

- Further breakdown of the Rest of the South American biofertilizers market into Chile, Peru, Colombia, Uruguay, Ecuador, Venezuela.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biofertilizers Market

I am interested in biofertilizers and biostimulants. What is the study scope of this report? Which market segments and regions have been covered?

I am interested in the Biofertilizer market and would like to know the market potential of biofertilizers in India. I would appreciate it if you could share relevant data regarding this.