Water-based Adhesive Market by Resin Type (PAE, PVA Emulsion, VAE Emulsion, SB Latex, and PUD), Application (Tapes & Labels, Paper & Packaging, Woodworking, Building & Construction, and Automotive & Transportation), and Region - Global Forecast to 2023

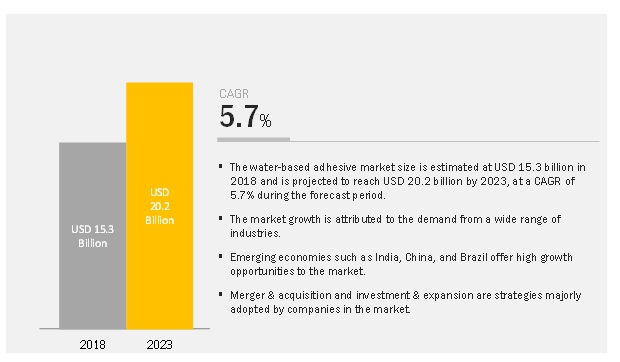

The water-based adhesive market is projected to reach USD 20.2 billion by 2023, at a CAGR of 5.7%. The study involves four major activities to estimate the current market size for water-based adhesive. The exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Water-based Adhesive Market Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study. Secondary sources also include annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; food safety organizations; regulatory bodies; trade directories; and databases.

Water-based Adhesive Market Primary Research

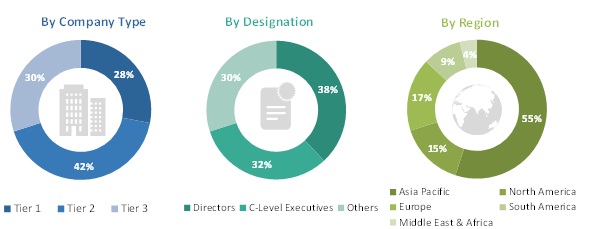

The water based adhesive market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the tapes & labels, paper & packaging, woodworking, building & construction, automotive & transportation, and other application. The supply side is characterized by advancements in technology and diverse applications. Various primary sources from both supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Water-based Adhesive Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the water-based adhesives market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Water-based Adhesive Market Data Triangulation

After arriving at the overall market size-using the estimation process explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides.

Water-based Adhesive Market Report Objectives

- To define, segment, and estimate the global water based adhesive market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To define, describe, and forecast the market size on the basis of resin type, application, and region

- To define, describe, and forecast the market size with respect to the five major regions, namely, North America, Europe, APAC, South America, and The Middle East & Africa along with their key countries

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To track and analyze the competitive developments, such as merger & acquisition, Investment & expansion, new product launch, and partnership & collaboration, in the water-based adhesive market

- To provide strategic profiles of key players in the market and comprehensively analyze their core competencies

Water-based Adhesive Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value(USD Million) and Volume (Kiloton) |

|

Segments covered |

Resin Type, Application, and Region |

|

Geographies Covered |

North America, Europe, APAC, South America, Middle East & Africa |

|

Companies Covered |

Henkel (Germany), H.B. Fuller (US), Arkema (Bostik) (France), and Sika (Switzerland) are the major players of water-based adhesives. |

This research report categorizes the water-based adhesive market based on resin type, application, and region.

On the basis of Resin Type, the water-based adhesive market has been segmented as:

- Acrylic Polymer Emulsion (PAE)

- Polyvinyl Acetate (PVA) Emulsion

- Vinyl Acetate Ethylene (VAE) Emulsion

- Styrene Butadiene (SB) Latex

- Polyurethane Dispersion (PUD)

- Others (Vinyl Acetate Acrylates (VAA), polyvinylpyrrolidone, cellulose ethers, methylcellulose, modified silyl, butadiene-acrylonitrile, dextrin/starch-based adhesives and casein, Polychloroprene adhesives)

On the basis of Application, the water-based adhesive market has been segmented as:

- Tapes & Labels

- Paper & Packaging

- Building & Construction

- Woodworking

- Automotive & Transportation

- Others (consumer & DIY, leather & footwear, sports & leisure, and assembly)

On the basis of Region, the water-based adhesive market has been segmented as:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Water-based Adhesive Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Water-based Adhesive Market Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Water-based Adhesive Market Regional Analysis

- Further breakdown of the water-based adhesive market, by country

Water-based Adhesive Market Company Information

- Detailed analysis and profiling of additional market players (up to five)

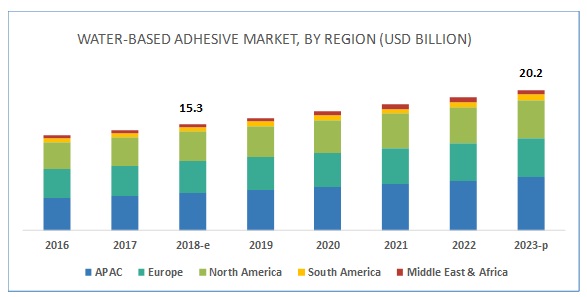

The water-based adhesive market is expected to grow from USD 15.3 billion in 2018 to USD 20.2 billion by 2023, at a CAGR of 5.7% during the forecast period. The growth of several applications such as tapes & labels, paper & packaging, and woodworking is driving the demand for water-based adhesives.

The acrylic polymer emulsion segment is estimated to account for the largest market share during the forecast period.

Acrylic polymer emulsion is an environmentally friendly adhesive that provides an adequate balance between shear, tack, and peel strength of the bond. It is widely preferred in a variety of packaging applications, such as bookbinding, paper bags, cartons, labels, foils, films, paperboard decals, wood assembly, automobile upholstery, and leather binding. Acrylic polymer emulsion is also used to bond backing material in the automotive industry, as it helps to reduce vibrations in vehicle body panels.

The tapes & labels segment is estimated to be the fastest-growing application of water-based adhesive during the forecast period.

The demand for water-based adhesives in the tapes & labels application is high due to its use in medium & heavy-duty carton sealing, gift wrapping & decoration, general purpose repair, bundling & strapping, and stationery. Tapes & labels are mainly used in the packaging of electronic and electrical devices, hygiene and medical packaging, packaging of drug delivery system, packaging of construction materials during transit, packaging related to automotive and logistics, and packaging of consumer and industrial goods. Therefore, the packaging adhesive tapes market is witnessing growth, which, in turn, is driving the demand for water-based adhesives.

The APAC water-based adhesive market is projected to register the highest CAGR during the forecast period.

The APAC water-based adhesives market is segmented into China, Japan, India, South Korea, Thailand, Indonesia, Taiwan, and Rest of APAC. According to the Population Reference Bureau, the fastest-growing consumer markets of China, India, and other APAC countries had a combined population exceeding 4 billion (as of 2016). This large population is projected to become an increasingly important driver for industries such as paper & packaging, woodworking, building & construction, and automotive & transportation over the next two decades. Water-based adhesives have major applications in these industries, which is expected to result in the growth of the market in APAC.

Key Players in Water-based Adhesive Market

Major players operating in the water-based adhesive market include Henkel (Germany), H.B. Fuller (US), Arkema (Bostik) (France), and Sika (Switzerland).

Henkel holds the leading position in the water based adhesive market with its wide range of offering for water-based adhesive products. The company caters to the demand from the automotive & transportation, building & construction, woodworking, electronics, and energy and utilities industries. It focuses on both organic and inorganic growth to increase its production capacity, sales, and market share. For instance, in June 2016, the company launched the Henkel Adhesives Innovation Center (HAIC) in Shanghai, China. This development helped the company expand its R&D capabilities for adhesives and provide innovative market-driven solutions to local customers of APAC.

Recent Developments in Water-based Adhesive Market

- In October 2017, H.B. Fuller acquired Royal Adhesives & Sealants (US). This acquisition provided the customers with a broader portfolio along with expanded development and production capabilities.

- In March 2017, H.B. Fuller expanded its operations in India by opening an R&D center at its plant in Shirwal, Pune. The new R&D center focuses on conducting experiments, running demonstrations, and training customers on its hot melt, water-based, anaerobic, and cyanoacrylate technologies. The expansion also strengthened the company’s business in India and the neighboring countries

- In March 2017, 3M invested USD 40 million to expand its operations in Missouri, US. The expansion produces industrial adhesives and tapes for the aerospace industry and other heavy industrial customers, globally

- In June 2016, Henkel Adhesives Innovation Center (HAIC) was launched in Shanghai, China. This development helped the company expand its R&D capabilities for adhesives and provide innovative market-driven solutions to local customers of APAC.

- In September 2016, Sika opened a new factory for adhesives and acoustic products in Brazil. This expansion helped the company in tapping the future potential of the automotive sector in Latin America by providing stronger, safer, and low-noise vehicles.

Critical Questions the Report Answers:

- What are mid- to long-term impact of these developments on the industry?

- What are the upcoming advancements in water-based adhesive formulations?

- What are the upcoming applications of water-based adhesives?

- What are the key trends in various applications of water-based adhesives?

- Who are the major players in the water-based adhesive market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities for Market Players

4.2 Water-Based Adhesive Market, By Resin Type

4.3 APAC Water-Based Adhesives Market, By Resin Type and Application

4.4 Water Based Adhesive Market, By Key Country

4.5 Water-Based Adhesive Market: Developed vs Developing Countries

4.6 APAC Water Based Adhesives Market, By Country

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Water-Based Adhesives Due to Their Flexibility, Durability, and Economic Feasibility

5.2.1.2 Huge Investments in Emerging Economies of APAC

5.2.1.3 Growing Demand for Lightweight and Low Carbon-Emitting Vehicles

5.2.2 Restraints

5.2.2.1 Lack of Extended Storage Due to the Perishability of Water-Based Adhesives

5.2.2.2 Fluctuating Raw Material Prices

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Green and Sustainable Adhesives

5.2.3.2 Innovations in Water-Based Adhesives

5.2.4 Challenges

5.2.4.1 Stringent Regulatory Policies

5.2.4.2 Competition From Solventless and Hot-Melt Adhesives

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Water-Based Adhesive Market, By Resin Type (Page No. - 44)

6.1 Introduction

6.2 Acrylic Polymer Emulsion

6.2.1 Acrylic Polymer Emulsion is Widely Preferred in Water-Based Adhesive Formulation

6.3 Polyvinyl Acetate Emulsion

6.3.1 Growth of Polyvinyl Acetate Emulsion is Backed By Demand in the Paper & Packaging Application

6.4 Vinyl Acetate Ethylene Emulsion

6.4.1 VAE Emulsion is One of the Important Synthetic Polymers Used in the Paper & Packaging and Woodworking Applications

6.5 Styrene Butadiene Latex

6.5.1 Styrene Butadiene Segment is Expected to Register A Moderate Growth During the Forecast Period

6.6 Polyurethane Dispersions

6.6.1 PUD is Expected to Register High Growth Due to Strong Demand in Profile Lamination for Interior Decoration

6.7 Others

7 Water-Based Adhesive Market, By Application (Page No. - 55)

7.1 Introduction

7.2 Tapes & Labels

7.2.1 Water-Based Adhesive has High Demand From the Tapes & Labels Application

7.3 Paper & Packaging

7.3.1 Regulations on Food Packaging and Safety Drive the Market in the Paper & Packaging Application

7.4 Woodworking

7.4.1 The Market Growth in Woodworking Application is Attributed to Increasing Demand From Furniture in Emerging Economies

7.5 Building & Construction

7.5.1 Water-Based Adhesives of Synthetic Polymers are Widely Preferred in the Building & Construction Application

7.6 Automotive & Transportation

7.6.1 Stringent Oem Standards Drive the Demand for Water-Based Adhesives in the Automotive & Transportation Application

7.7 Others

8 Water-Based Adhesive Market, By Region (Page No. - 67)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.1.1 China Accounted for the Largest Share of the Water-Based Adhesive Market in APAC

8.2.2 Japan

8.2.2.1 Japan Experiences A Decline in Growth Due to the Maturity of the Adhesives Market

8.2.3 India

8.2.3.1 India is the Fastest-Growing Water-Based Adhesive Market in APAC and Globally

8.2.4 South Korea

8.2.4.1 The Various Laws and Regulations for the Use of Chemical Substances Drives the Water-Based Adhesive Market

8.2.5 Indonesia

8.2.5.1 Indonesia Experiences Steady Growth Which is Driven By Domestic Consumption and Improved Infrastructural Investments

8.2.6 Taiwan

8.2.6.1 The Easy Availability of Raw Materials and Low Import Taxes are the Major Factors for the Growth of the Economy of Taiwan

8.2.7 Thailand

8.2.7.1 Rapid Industrialization and Increasing Consumer Spending, are Likely to Trigger the Demand for Water-Based Adhesives

8.2.8 Rest of APAC

8.3 Europe

8.3.1 Germany

8.3.1.1 The Demand for Water-Based Adhesives From Germany is High Due to Its Outstanding R&D Capabilities

8.3.2 France

8.3.2.1 The Fast Growth of the Automotive Industry is Expected to Drive the Demand for Water-Based Adhesives

8.3.3 UK

8.3.3.1 Tapes & Labels is One of the Major Applications of Water-Based Adhesives in the UK

8.3.4 Italy

8.3.4.1 The Growth in the Automotive Industry is Expected to Increase the Demand for Water-Based Adhesives

8.3.5 Russia

8.3.5.1 The Financial Sanctions Imposed By the West, Owing to Its Involvement in the Ukraine Crisis, and Falling Oil Prices are Expected to Affect the Economy Negatively

8.3.6 Turkey

8.3.6.1 Turkey is Rapidly Emerging as One of the Fastest-Growing Markets in Europe Due to the Current Economic Revolution

8.3.7 Rest of Europe

8.4 North America

8.4.1 US

8.4.1.1 Epa and Leed Highly Regulate the US Water-Based Adhesive Market

8.4.2 Mexico

8.4.2.1 Automotive & Transportation is Expected to Be the Fastest-Growing Application Segment of the Water-Based Adhesives Market

8.4.3 Canada

8.4.3.1 The Manufacturing and Building & Construction Industries are the Major Consumers of Water-Based Adhesives

8.5 South America

8.5.1 Brazil

8.5.1.1 Brazil Accounted for the Largest Share of the South American Water-Based Adhesive Market

8.5.2 Argentina

8.5.2.1 The High Dependence on Imports is Restraining the Market Growth

8.5.3 Rest of South America

8.6 Middle East & Africa

8.6.1 Saudi Arabia

8.6.1.1 Synthetic Polymers are Widely Preferred in Water-Based Adhesive Formulations

8.6.2 Africa

8.6.2.1 Limited Applications of Water-Based Adhesives to Pose A Challenge to the Growth of the Market

8.6.3 Rest of Middle East & Africa

9 Competitive Landscape (Page No. - 112)

9.1 Introduction

9.2 Ranking of Key Players

9.3 Competitive Scenario

9.3.1 Merger & Acquisition

9.3.2 Investment & Expansion

9.3.3 New Product Launch

9.3.4 Partnership & Collaboration

10 Company Profiles (Page No. - 118)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Henkel

10.2 H.B. Fuller

10.3 Arkema (Bostik)

10.4 Sika

10.5 Dowdupont

10.6 3M

10.7 Illinois Tool Works

10.8 Ashland

10.9 Mapei

10.10 Pidilite Industries

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.11 Other Key Companies

10.11.1 Akzo Nobel

10.11.2 Ppg Industries

10.11.3 Lord Corporation

10.11.4 Scigrip Adhesives

10.11.5 Ardex

10.11.6 Permabond

10.11.7 Paramelt

10.11.8 Jowat

10.11.9 Delo Industrial Adhesives

10.11.10 Falcon Chemicals

10.11.11 Franklin International

10.11.12 Dymax Corporation

10.11.13 The Reynolds Company

10.11.14 Sealock Adhesives

10.11.15 Kleiberit

10.11.16 Beijing Comens New Materials Co., Ltd.

11 Appendix (Page No. - 146)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (125 Tables)

Table 1 Water-Based Adhesive Market Snapshot, 2018 vs 2023

Table 2 Water Based Adhesive Market Size, By Resin Type, 2016–2023 (USD Million)

Table 3 Water-Based Adhesives Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 4 Acrylic Polymer Emulsion: Application

Table 5 Acrylic Polymer Emulsion: By Market Size, By Region, 2016–2023 (USD Million)

Table 6 Acrylic Polymer Emulsion: By Market Size, By Region, 2016–2023 (Kiloton)

Table 7 PVA Emulsion: Application

Table 8 PVA Emulsion: By Market Size, By Region, 2016–2023 (USD Million)

Table 9 PVA Emulsion: By Market Size, By Region, 2016–2023 (Kiloton)

Table 10 VAE Emulsion: Application

Table 11 VAE Emulsion: By Market Size, By Region, 2016–2023 (USD Million)

Table 12 VAE Emulsion: By Market Size, By Region, 2016–2023 (Kiloton)

Table 13 SB Latex: Application

Table 14 SB Latex: By Market Size, By Region, 2016–2023 (USD Million)

Table 15 SB Latex: By Market Size, By Region, 2016–2023 (Kiloton)

Table 16 PUD: Application

Table 17 PUD: By Market Size, By Region, 2016–2023 (USD Million)

Table 18 PUD: By Market Size, By Region, 2016–2023 (Kiloton)

Table 19 Other Resin Types: Application

Table 20 Others: By Market Size, By Region, 2016–2023 (USD Million)

Table 21 Others: By Market Size, By Region, 2016–2023 (Kiloton)

Table 22 By Market Size, By Application, 2016–2023 (USD Million)

Table 23 By Market Size, By Application, 2016–2023 (Kiloton)

Table 24 Tapes & Labels Application: Substrate and Resin Type

Table 25 By Market Size in Tapes & Labels, By Region, 2016–2023 (USD Million)

Table 26 By Market Size in Tapes & Labels, By Region, 2016–2023 (Kiloton)

Table 27 Paper & Packaging Application: Substrate and Resin Type

Table 28 By Market Size in Paper & Packaging, By Region, 2016–2023 (USD Million)

Table 29 By Market Size in Paper & Packaging, By Region, 2016–2023 (Kiloton)

Table 30 Woodworking Application: Sub-Application and Resin Type

Table 31 By Market Size in Woodworking, By Region, 2016–2023 (USD Million)

Table 32 By Market Size in Woodworking, By Region, 2016–2023 (Kiloton)

Table 33 Building & Construction Application: Sub-Application and Resin Type

Table 34 By Market Size in Building & Construction, By Region, 2016–2023 (USD Million)

Table 35 By Market Size in Building & Construction, By Region, 2016–2023 (Kiloton)

Table 36 Automotive & Transportation Application: Substrate and Resin Type

Table 37 By Market Size in Automotive & Transportation, By Region, 2016–2023 (USD Million)

Table 38 By Market Size in Automotive & Transportation, By Region, 2016–2023 (Kiloton)

Table 39 Other Applications: Substrate and Resin Type

Table 40 By Market Size in Other Applications, By Region, 2016–2023 (USD Million)

Table 41 By Market Size in Other Applications, By Region, 2016–2023 (Kiloton)

Table 42 By Market Size, By Region, 2016–2023 (USD Million)

Table 43 By Market Size, By Region, 2016–2023 (Kiloton)

Table 44 APAC: By Market Size, By Country, 2016–2023 (USD Million)

Table 45 APAC: By Market Size, By Country, 2016–2023 (Kiloton)

Table 46 APAC: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 47 APAC: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 48 APAC: By Market Size, By Application, 2016–2023 (USD Million)

Table 49 APAC: By Market Size, By Application, 2016–2023 (Kiloton)

Table 50 China: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 51 China: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 52 China: By Market Size, By Application, 2016–2023 (USD Million)

Table 53 China: By Market Size, By Application, 2016–2023 (Kiloton)

Table 54 Japan: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 55 Japan: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 56 Japan: By Market Size, By Application, 2016–2023 (USD Million)

Table 57 Japan: By Market Size, By Application, 2016–2023 (Kiloton)

Table 58 India: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 59 India: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 60 India: By Market Size, By Application, 2016–2023 (USD Million)

Table 61 India: By Market Size, By Application, 2016–2023 (Kiloton)

Table 62 Europe: By Market Size, By Country, 2016–2023 (USD Million)

Table 63 Europe: By Market Size, By Country, 2016–2023 (Kiloton)

Table 64 Europe: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 65 Europe: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 66 Europe: By Market Size, By Application, 2016–2023 (USD Million)

Table 67 Europe: By Market Size, By Application, 2016–2023 (Kiloton)

Table 68 Germany: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 69 Germany: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 70 Germany: By Market Size, By Application, 2016–2023 (USD Million)

Table 71 Germany: By Market Size, By Application, 2016–2023 (Kiloton)

Table 72 France: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 73 France: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 74 France: By Market Size, By Application, 2016–2023 (USD Million)

Table 75 France: By Market Size, By Application, 2016–2023 (Kiloton)

Table 76 UK: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 77 UK: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 78 UK: By Market Size, By Application, 2016–2023 (USD Million)

Table 79 UK: By Market Size, By Application, 2016–2023 (Kiloton)

Table 80 Italy: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 81 Italy: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 82 Italy: By Market Size, By Application, 2016–2023 (USD Million)

Table 83 Italy: By Market Size, By Application, 2016–2023 (Kiloton)

Table 84 North America: By Market Size, By Country, 2016–2023 (USD Million)

Table 85 North America: By Market Size, By Country, 2016–2023 (Kiloton)

Table 86 North America: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 87 North America: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 88 North America: By Market Size, By Application, 2016–2023 (USD Million)

Table 89 North America: By Market Size, By Application, 2016–2023 (Kiloton)

Table 90 US: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 91 US: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 92 US: By Market Size, By Application, 2016–2023 (USD Million)

Table 93 US: By Market Size, By Application, 2016–2023 (Kiloton)

Table 94 Mexico: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 95 Mexico: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 96 Mexico: By Market Size, By Application, 2016–2023 (USD Million)

Table 97 Mexico: By Market Size, By Application, 2016–2023 (Kiloton)

Table 98 Canada: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 99 Canada: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 100 Canada: By Market Size, By Application, 2016–2023 (USD Million)

Table 101 Canada: By Market Size, By Application, 2016–2023 (Kiloton)

Table 102 South America: By Market Size, By Country, 2016–2023 (USD Million)

Table 103 South America: By Market Size, By Country, 2016–2023 (Kiloton)

Table 104 South America: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 105 South America: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 106 South America: By Market Size, By Application, 2016–2023 (USD Million)

Table 107 South America: By Market Size, By Application, 2016–2023 (Kiloton)

Table 108 Brazil: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 109 Brazil: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 110 Brazil: By Market Size, By Application, 2016–2023 (USD Million)

Table 111 Brazil: By Market Size, By Application, 2016–2023 (Kiloton)

Table 112 Middle East & Africa: By Market Size, By Country, 2016–2023 (USD Million)

Table 113 Middle East & Africa: By Market Size, By Country, 2016–2023 (Kiloton)

Table 114 Middle East & Africa: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 115 Middle East & Africa: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 116 Middle East & Africa: By Market Size, By Application, 2016–2023 (USD Million)

Table 117 Middle East & Africa: By Market Size, By Application, 2016–2023 (Kiloton)

Table 118 Saudi Arabia: By Market Size, By Resin Type, 2016–2023 (USD Million)

Table 119 Saudi Arabia: By Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 120 Saudi Arabia: By Market Size, By Application, 2016–2023 (USD Million)

Table 121 Saudi Arabia: By Market Size, By Application, 2016–2023 (Kiloton)

Table 122 Merger & Acquisition, 2015–2018

Table 123 Investment & Expansion, 2015–2018

Table 124 New Product Launch, 2015–2018

Table 125 Partnership & Collaboration, 2015–2018

List of Figures (39 Figures)

Figure 1 Water-Based Adhesive Market Segmentation

Figure 2 Water Based Adhesive Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Water-Based Adhesives Market: Data Triangulation

Figure 6 APAC to Dominate the Water Based Adhesives Market

Figure 7 Acrylic Polymer Emulsion to Be the Most Preferred Resin Type

Figure 8 Automotive & Transportation to Be the Fastest-Growing Application of Water-Based Adhesives

Figure 9 APAC Was the Largest Water-Based Adhesive Market in 2017

Figure 10 Emerging Economies to Offer Lucrative Growth Opportunities to Market Players

Figure 11 PUD Resin Type Segment to Register the Highest CAGR in the Water-Based Adhesive Market

Figure 12 Tapes & Labels Segment Was the Largest Application of Water-Based Adhesives

Figure 13 India to Emerge as A Lucrative Water Based Adhesive Market

Figure 14 India to Be the Fastest-Growing Country in the Water-Based Adhesive Market

Figure 15 India to Witness the Highest Growth Rate in the Market

Figure 16 Overview of the Factors Governing the Water-Based Adhesives Market

Figure 17 PUD Segment to Register the Highest CAGR in the Market

Figure 18 Tapes & Labels Application to Lead the Water-Based Adhesive Market

Figure 19 India is Projected to Register the Highest CAGR in the Market

Figure 20 APAC: Water-Based Adhesive Market Snapshot

Figure 21 Europe: Water Based Adhesives Market Snapshot

Figure 22 North America: Water-Based Adhesive Market Snapshot

Figure 23 Merger & Acquisition Was the Key Growth Strategy Adopted By Companies Between 2015 and 2018

Figure 24 Ranking of Key Market Players in 2017

Figure 25 Henkel: Company Snapshot

Figure 26 Henkel: SWOT Analysis

Figure 27 H.B. Fuller: Company Snapshot

Figure 28 H.B. Fuller: SWOT Analysis

Figure 29 Arkema (Bostik): Company Snapshot

Figure 30 Arkema (Bostik): SWOT Analysis

Figure 31 Sika: Company Snapshot

Figure 32 Sika: SWOT Analysis

Figure 33 Dowdupont: Company Snapshot

Figure 34 Dowdupont: SWOT Analysis

Figure 35 3M: Company Snapshot

Figure 36 Illinois Tool Works: Company Snapshot

Figure 37 Ashland: Company Snapshot

Figure 38 Mapei: Company Snapshot

Figure 39 Pidilite Industries: Company Snapshot

Growth opportunities and latent adjacency in Water-based Adhesive Market