Voice Analytics Market by Component (Solution and Services), Application (Sentiment Analysis, Sales and Marketing Management, and Call Monitoring), Deployment Model, Organization Size, Vertical, and Region - Global Forecast to 2024

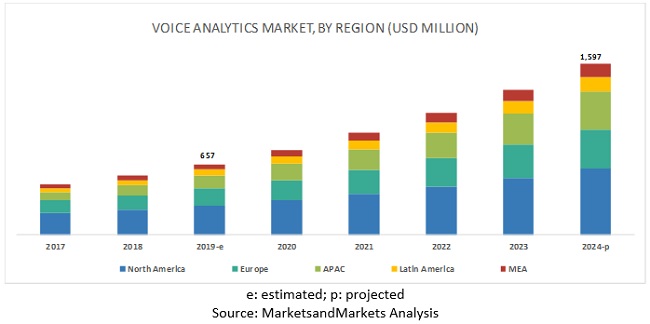

[141 pages Report] The voice analytics market size expected to grow from USD 657 million in 2019 to USD 1,597 million by 2024, at a Compound Annual Growth Rate (CAGR) of 19.4% during the forecast period. Factors such as growing need to extract insights from customer interactions, rising demand to monitor improve agent performance, and growing focus on risk and fraud detection are expected to drive the market growth. Moreover, growing impact of AI and improving individual experience and increasing adoption of cloud-based solutions are expected to create ample opportunities for voice analytics solution vendors.

Solution segment to hold a larger market size during the forecast period

The voice analytics market by component covers solution and services. The solution segment outperforms the services segment and would see growth in the future, due to higher adoption of solution. The voice analytics solution empowers users to analyze recordings or conversations to identify emotion and intent of the speakers. It analyzes the audio patterns for certain features, such as tone, stress, tempo, pitch, and rhythm. It helps enhance customer satisfaction and competitive intelligence, reduce customer churn by predicting at-risk customers, and identify risks and frauds.

Consulting segment to grow at the highest CAGR in Voice Analytics Market during the forecast period

Consulting services mainly steer around the critical issues and opportunities related to strategies, marketing, operations, technologies, mergers and acquisitions, and finance, leading to increased effectiveness, improved performance, reduced costs, and enhanced resilience. Consulting services are required by retail stores, retail planners, and merchandisers for enhanced strategic outlook, improved performance efficiencies, and transformed business operations of retail-related activities into more efficient and cost-effective operations.

Large enterprises to boost adoption of financial analytics solutions

Large enterprises generate huge volumes of data due to their broad client base. Enterprises are concentrating on their core strengths and capabilities to maintain their competitive edge over other players. These enterprises need better insights into customer responses and help the companies to drive more revenue and value for their shareholders. They are also utilizing speech analytics solutions for improving their business processes, market intelligence, and customer experience. However, the deployment of voice analytics solutions on-premises has been much preferred by the large enterprises, as it helps them to have a hold on their processes and activities.

North America to account for the largest market size during the forecast period

The global voice analytics market by region covers 5 major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America. North America is expected to account for the largest market size during the forecast period. The adoption of voice analytics solution is expected to be the highest in North America, as compared to the other regions. This is mainly because of the presence of various developed economies, such as Canada and US, and the increasing focus on innovations obtained from R&D and technology.

Key Market Players

The voice analytics market comprises major solution providers, such as Verint Systems (US), NICE (Israel), Avaya (US), ThoughtSpot (US), Uniphore (India), Calabrio (US), Talkdesk (US), RankMiner (US), VoiceBase (US), Beyond Verbal (Israel), VoiceSense (Israel), SESTEK (Turkey), audEERING (Germany), Invoca (US), and Xdroid (Hungary).

The study includes an in-depth competitive analysis of these key players in the voice analytics market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Component, Application, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe, Latin America, and MEA |

|

Companies covered |

Verint Systems (US), NICE (Israel), Avaya (US), ThoughtSpot (US), Uniphore (India), Calabrio (US), Talkdesk (US), RankMiner (US), VoiceBase (US), Beyond Verbal (Israel), VoiceSense (Israel), SESTEK (Turkey), audEERING (Germany), Invoca (US), and Xdroid (Hungary) |

This research report categorizes the voice analytics market based on component, application, deployment mode, organization size, vertical, and region.

Based on the Components, the market has been segmented as follows:

- Solution

-

Services

- Managed Services

-

Professional Services

- Support and Maintenance

- Consulting Services

Based on Applications, the market has been segmented as follows:

- Sentiment Analysis

- Sales and Marketing Management

- Risk and Fraud Detection

- Call Monitoring

- Others (Reporting and Workforce Management)

Based on Deployment Mode, the market has been segmented as follows:

- On-premises

- Cloud

Based on Organization Sizes, the voice analytics market has been segmented as follows:

- SMEs

- Large Enterprises

Based on Verticals, the market has been segmented as follows:

- BFSI

- Retail and eCommerce

- Healthcare

- Telecommunication

- Government and Defense

- Others

Based on Regions, the market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Middle East

- Africa

-

Latin America

- Mexico

- Brazil

- Rest of Latin America

Recent Developments:

-

In April 2019, Verint Systems offers a product designed to help companies automate input and prioritize improvements to customer experiences. This tool tracks sudden and significant changes in CX scores across channels and touchpoints and determines causes by analyzing thousands of data combinations.

Key Questions addressed by the report:

- What are the opportunities in the voice analytics market?

- What is the competitive landscape in the market?

- What are the emerging technologies impacting the overall market?

- What are the key use cases existing in the market?

- What are the key trends and dynamics existing in themarket?

Frequently Asked Questions (FAQ):

What is Voice Analytics?

Voice analytics is a solution that applies speech-to-text and Natural Language Processing (NLP) technologies to analyze recordings or conversations to identify the emotion and intent of the speakers. It analyzes the audio patterns for certain features, such as tone, stress, tempo, pitch, and rhythm. It helps enhance customer satisfaction, augments competitive intelligence, reduce customer churn by predicting at-risk customers, and identify risks and frauds. Such voice analytics solutions find major adoption across Banking, Financial Services, and Insurance (BFSI), telecommunication, retail, healthcare, and government verticals.What are the top vendors in voice analytics market?

Major vendors offering voice analytics solutions and services includes Verint Systems NICE, Avaya, ThoughtSpot, and Uniphore. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, partnerships and collaborations, and mergers and acquisitions to expand their offerings in the market.What are the benefits of voice analytics?

Voice analytics software brings with its enormous benefit. Companies in a range of industries including insurance, technology, financial services, and healthcare are leveraging this technology to generate insights into customer needs. Voice analytics can boost customer service and call center performance levels by automatically identifying the following insights:

- Customer satisfaction: Voice analytics software identifies recurring themes, trends, and hot topics that can rapidly highlight customer satisfaction levels.

- Competitive intelligence: Customer can identify competitive intelligence in conversation data with new and at-risk customers who may ask for features etc. provided by leading vendors.

- Underperforming agents: It helps companies to quickly see who the underperforming agents in customer service team are and figure out how to fix the issue.

- Share best practices and messaging that works: Help employees who are B performers to turn into A performers by identifying the messaging and conversation techniques that bring results and produce high levels of customer satisfaction.

What are the regulations impacting the voice analytics market?

The acts or regulations having impact on the growth of voice analytics market include General Data Protection Regulation, Health Insurance Portability and Accountability Act (HIPPA), Dodd-Frank Wall Street Reform and Consumer Protection, Market Abuse Regulation, 2nd Revision of Markets in Financial Instruments Directive, European Banking RegulationsTo speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Competitive Leadership Mapping Research Methodology

2.5.1 Vendor Inclusion Criteria

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Voice Analytics Market

4.2 Market By Application (2019-2024)

4.3 Market By Organization Size

4.4 arket Share Across Regions

5 Market Overview and Industry Trends (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Need to Extract Insights From Customer Interactions

5.2.1.2 Rising Demand to Monitor and Improve Agent Performance

5.2.1.3 Growing Focus on Risk and Fraud Detection

5.2.2 Restraints

5.2.2.1 Lack of Accuracy in User Authentication

5.2.3 Opportunities

5.2.3.1 Impact of AI to Improve Individualized Experiences

5.2.4 Challenges

5.2.4.1 Lack of Skilled Workforce

5.2.4.2 Expensive Integration of Voice Analytics Solutions With Predictive Analytics

5.3 Use Cases

5.3.1 Use Case: Scenario 1

5.3.2 Use Case: Scenario 2

5.3.3 Use Case: Scenario 3

5.4 Innovation Spotlight

5.4.1 Advent of AI and ML Into Voice Analytics

5.4.2 Emergence of Real-Time Into Voice Analytics

5.5 Regulatory Implications

5.5.1 General Data Protection Regulation

5.5.2 Health Insurance Portability and Accountability Act (Hippa)

5.5.3 Dodd-Frank Wall Street Reform and Consumer Protection

5.5.4 Market Abuse Regulation

5.5.5 2nd Revision of Markets in Financial Instruments Directive

5.5.6 European Banking Regulations

6 Voice Analytics Market By Application (Page No. - 43)

6.1 Introduction

6.2 Sentiment Analysis

6.2.1 Need for Real-Time Insights Into Customer Interactions to Drive the Adoption of Voice Analytics Solutions for Sentiment Analysis

6.3 Sales and Marketing Management

6.3.1 Need to Enhance Brand Reputation to Maintain Competitive Edge Driving the Adoption of Voice Analytics Solutions in Sales and Marketing Management

6.4 Risk and Fraud Detection

6.4.1 Need to Mitigate Risk and Reduce Loss to Drive the Adoption of Voice Analytics Solutions in Risk and Fraud Detection

6.5 Call Monitoring

6.5.1 Need to Reduce Customer Churn and Improve Agent Performance to Drive the Adoption of Voice Analytics Solutions in Call Monitoring

6.6 Others

7 Voice Analytics Market By Component (Page No. - 50)

7.1 Introduction

7.2 Solution

7.2.1 Need for Analyzing Real-Time Customer Behaviour to Drive the Adoption of Voice Analytics Solutions

7.3 Services

7.3.1 Managed Services

7.3.1.1 Need for Monitoring and Maintaining Software Operations and Reducing Overhead Costs to Drive the Demand for Managed Services

7.3.2 Professional Services

7.3.2.1 Need for a Strategic Outlook Exploring New Avenues for Improving Business Performance to Drive the Growth of Professional Services

7.3.2.1.1 Support and Maintenance

7.3.2.1.2 Consulting Services

8 Voice Analytics Market By Deployment Mode (Page No. - 57)

8.1 Introduction

8.2 Cloud

8.2.1 Growing Implementation, Data Accessibility, Scalability, and Ease of use to Drive the Adoption of Cloud-Based Voice Analytics Solutions

8.3 On-Premises

8.3.1 Flexibility to Integrate With a Variety of Third-Party Solutions Driving the Adoption of On-Premises Voice Analytics Solutions

9 Voice Analytics Market By Organization Size (Page No. - 61)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.2.1 Need for Viable Cloud-Based Analytics Solutions to Drive the Adoption of Voice Analytics Solutions in Small and Medium-Sized Enterprises

9.3 Large Enterprises

9.3.1 Increasing Adoption of Advanced Technologies to Drive the Adoption of Voice Analytics Solutions in Large Enterprises

10 Voice Analytics Market By Vertical (Page No. - 65)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.2.1 Focus on Compliance With Regulations and Financial Standards to Increase the Demand for Voice Analytics Solutions in BFSI

10.3 Retail and Ecommerce

10.3.1 Understanding Customer Behavior in Real-Time to Boost the Adoption of Voice Analytics Solutions in Retail and Ecommerce

10.4 Telecommunication

10.4.1 Benefits Such as Reduced Churn Rate, Improved Services, and Enhanced Customer Loyalty to Fuel the Adoption of Voice Analytics Solutions in Telecommunication

10.5 Healthcare

10.5.1 Growing Demand to Achieve Better Patient Experience and Meet Regulations to Fuel the Adoption of Voice Analytics Solutions in Healthcare

10.6 Government and Defense

10.6.1 Need to Improve Reliability and Efficiency of Processes to Drive the Adoption of Voice Analytics Solutions in Government and Defense

10.7 Others

11 Voice Analytics Market By Region (Page No. - 73)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 Need to Extract Maximum Value From Customer Interactions to Fuel the Demand for Voice Analytics Solutions in the US

11.2.2 Canada

11.2.2.1 Increase in Investments and Research Activities to Drive the Adoption of Voice Analytics Solutions in Canada

11.3 Europe

11.3.1 United Kingdom

11.3.1.1 Strong Infrastructure and Increasing Investments to Drive the Adoption of Voice Analytics Solutions in the UK

11.3.2 Germany

11.3.2.1 Government’s Focus on Innovation and Research to Fuel the Adoption of Voice Analytics Solutions in Germany

11.3.3 France

11.3.3.1 Focus on R&D and Heavy Inflow of Capital From Global Players and Investors to Fuel the Adoption of Voice Analytics Solutions in France

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Increasing Focus on Integrating AI and Deep Learning Technologies to Drive the Adoption of Voice Analytics Solutions in China

11.4.2 Japan

11.4.2.1 Increasing Investment in R&D By Top Companies to Drive the Adoption of Voice Analytics Solutions in Japan

11.4.3 India

11.4.3.1 Demand for Superior Customer Experience to Boost the Adoption of Voice Analytics Solutions in India

11.4.4 Rest of Asia Pacific

11.5 Latin America

11.5.1 Brazil

11.5.1.1 Need to Diversify and Offer Enhanced Services to Drive the Growth of Voice Analytics Market in Brazil

11.5.2 Mexico

11.5.2.1 Need to Enhance Customer Experience and Reduce Costs to Drive the Growth of Market in Mexico

11.5.3 Rest of Latin America

11.6 Middle East and Africa

11.6.1 Middle East

11.6.1.1 Need to Differentiate Among Competitors and Improve Business Processes to Drive the Growth of Market in the Middle East Region

11.6.2 Africa

11.6.2.1 Improving Economy and Favorable Government Policies to Drive the Growth of Market in the African Region

12 Competitive Landscape (Page No. - 101)

12.1 Competitive Leadership Mapping

12.1.1 Visionary Leaders

12.1.2 Innovators

12.1.3 Dynamic Differentiators

12.1.4 Emerging Companies

12.2 Business Strategy Excellence

12.3 Strength of Product Offerings

12.4 Ranking of Key Players in the Voice Analytics Market 2019

13 Company Profiles (Page No. - 105)

13.1 Introduction

(Business Overview, Products, Solutions & Software, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.2 Verint Systems

13.3 NICE

13.4 Avaya

13.5 ThoughtSpot

13.6 Uniphore

13.7 Calabrio

13.8 Talkdesk

13.9 RankMiner

13.10 VoiceBase

13.11 Beyond Verbal

13.12 VoiceSense

13.13 SESTEK

13.14 Xdroid

13.15 Invoca

13.16 Audeering

*Details on Business Overview, Products, Solutions& Software, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 133)

14.1 Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (63 Tables)

Table 1 Evaluation Criteria

Table 2 Voice Analytics Market Size and Growth Rate, 2017–2024 (USD Million, Y-O-Y %)

Table 3 Market Size By Application, 2017-2024 (USD Million)

Table 4 Sentiment Analysis: Market Size By Region, 2017–2024 (USD Million)

Table 5 Sales and Marketing Management: Market Size By Region, 2017–2024 (USD Million)

Table 6 Risk and Fraud Detection: Market Size By Region, 2017–2024 (USD Million)

Table 7 Call Monitoring: Market Size By Region, 2017–2024 (USD Million)

Table 8 Others: Market Size By Region, 2017–2024 (USD Million)

Table 9 Voice Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 10 Solution: Market Size By Region, 2017–2024 (USD Million)

Table 11 Services: Market Size By Region, 2017–2024 (USD Million)

Table 12 Services: Market Size By Type, 2017–2024 (USD Million)

Table 13 Managed Services: Market Size By Region, 2017–2024 (USD Million)

Table 14 Professional Services: Market Size By Region, 2017–2024 (USD Million)

Table 15 Voice Analytics Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 16 Cloud: Market Size By Region, 2017–2024 (USD Million)

Table 17 On-Premises: Market Size By Region, 2017–2024 (USD Million)

Table 18 Voice Analytics Market Size, By Organization Size, 2017–2024 (USD Million)

Table 19 Small and Medium-Sized Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 20 Large Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 21 Voice Analytics Market Size, By Vertical, 2017-2024 (USD Million)

Table 22 BFSI: Market Size, By Region, 2017–2024 (USD Million)

Table 23 Retail and Ecommerce: Market Size By Region, 2017–2024 (USD Million)

Table 24 Telecommunication: Market Size By Region, 2017–2024 (USD Million)

Table 25 Healthcare: Market Size By Region, 2017–2024 (USD Million)

Table 26 Government and Defense: Market Size By Region, 2017–2024 (USD Million)

Table 27 Others: Market Size By Region, 2017–2024 (USD Million)

Table 28 Voice Analytics Market Size, By Region, 2017–2024 (USD Million)

Table 29 North America: Voice Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 30 North America: Market Size By Service, 2017–2024 (USD Million)

Table 31 North America: Market Size By Application, 2017–2024 (USD Million)

Table 32 North America: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 33 North America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 34 North America: Market Size By Vertical, 2017–2024 (USD Million)

Table 35 North America: Market Size By Country, 2017–2024 (USD Million)

Table 36 Europe: Voice Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 37 Europe: Market Size By Service, 2017–2024 (USD Million)

Table 38 Europe: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 39 Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 40 Europe: Market Size By Application, 2017–2024 (USD Million)

Table 41 Europe: Market Size By Vertical, 2017–2024 (USD Million)

Table 42 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 43 Asia Pacific: Voice Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 44 Asia Pacific: Market Size By Service, 2017–2024 (USD Million)

Table 45 Asia Pacific: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 46 Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 47 Asia Pacific: Market Size By Application, 2017–2024 (USD Million)

Table 48 Asia Pacific: Market Size By Vertical, 2017–2024 (USD Million)

Table 49 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 50 Latin America: Voice Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 51 Latin America: Market Size By Service, 2017–2024 (USD Million)

Table 52 Latin America: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 53 Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 54 Latin America: Market Size By Application, 2017–2024 (USD Million)

Table 55 Latin America: Market Size By Vertical, 2017–2024 (USD Million)

Table 56 Latin America: Market Size By Country, 2017–2024 (USD Million)

Table 57 Middle East and Africa: Voice Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 58 Middle East and Africa: Market Size By Service, 2017–2024 (USD Million)

Table 59 Middle East and Africa: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 60 Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 61 Middle East and Africa: Market Size By Application, 2017–2024 (USD Million)

Table 62 Middle East and Africa: Market Size By Vertical, 2017–2024 (USD Million)

Table 63 Middle East and Africa: Market Size By Country, 2017–2024 (USD Million)

List of Figures (37 Figures)

Figure 1 Global Voice Analytics Market: Research Design

Figure 2 Market Top-Down and Bottom-Up Approaches

Figure 3 Factor Analysis

Figure 4 Voice Analytics Market Overview

Figure 5 Market to Witness High Growth During the Forecast Period

Figure 6 Market By Component (2019 Vs. 2024)

Figure 7 Market By Deployment Model (2019–2024)

Figure 8 Growing Need to Enhance Customer Experience to Drive the Voice Analytics Market

Figure 9 Voice Analytics Market, By Application (2019–2024)

Figure 10 Market By Organization Size (2019 Vs.2024)

Figure 11 North America to Account for the Highest Market Share in 2019

Figure 12 Drivers, Restraints, Opportunities, and Challenges: Voice Analytics Market

Figure 13 Sentiment Analysis to Witness the Highest CAGR During the Forecast Period

Figure 14 Services Segment to Grow at a Higher CAGR During the Forecast Period

Figure 15 Managed Services Segment to Grow at a Higher CAGR During the Forecast Period

Figure 16 Cloud Deployment Mode to Grow at a Higher CAGR During the Forecast Period

Figure 17 Small and Medium-Sized Enterprises Segment to Grow at a Higher CAGR During the Forecast Period

Figure 18 Retail and Ecommerce Vertical to Witness the Highest CAGR During the Forecast Period

Figure 19 North America to Hold the Largest Market Size During the Forecast Period

Figure 20 Japan to Hold the Highest CAGR During the Forecast Period

Figure 21 Asia Pacific to Hold the Highest CAGR During the Forecast Period

Figure 22 North America: Market Snapshot

Figure 23 Healthcare to Grow at the Highest CAGR During the Forecast Period in North America

Figure 24 Healthcare Vertical to Grow at the Highest CAGR During the Forecast Period in Europe

Figure 25 Asia Pacific: Market Snapshot

Figure 26 Retail and Ecommerce Vertical to Grow at the Highest CAGR During the Forecast Period in Asia Pacific

Figure 27 Healthcare Vertical to Grow at the Highest CAGR During the Forecast Period in Latin America

Figure 28 Retail and Ecommerce Vertical to Grow at the Highest CAGR During the Forecast Period in Middle East and Africa

Figure 29 Voice Analytics Market (Global) Competitive Leadership Mapping, 2019

Figure 30 Verint Systems: Company Snapshot

Figure 31 Verint Systems: SWOT Analysis

Figure 32 NICE: Company Snapshot

Figure 33 NICE: SWOT Analysis

Figure 34 Avaya: Company Snapshot

Figure 35 Avaya: SWOT Analysis

Figure 36 ThoughtSpot: SWOT Analysis

Figure 37 Uniphore: SWOT Analysis

The study involved 4 major activities in estimating the current market size of voice analytics solution and services. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred for, to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

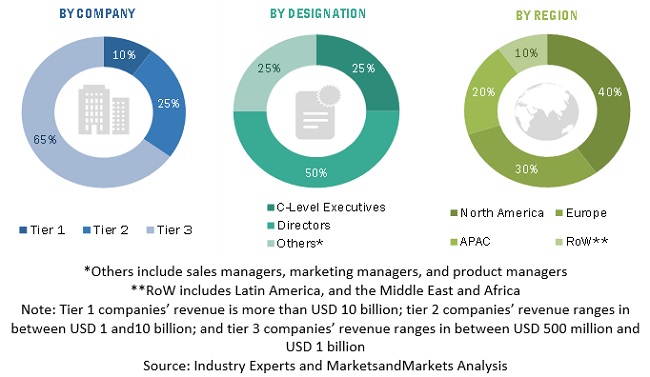

Various primary sources from both the supply and demand sides of the voice analytics market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the market, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Voice Analytics Market Size Estimation

For making market estimates and forecasting the voice analytics market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the voice analytics market by component (solution and services), application, deployment mode, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the market

- To forecast the market size of the market segments with respect to the 5 main regions, namely, North America, Europe, Middle East and Africa (MEA), Asia Pacific (APAC), and Latin America.

- To profile the key players of the voice analytics market and comprehensively analyze their market size and core competencies in the market

- To track and analyze the competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations, in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Voice Analytics Market