Vitamins Market by Type (Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, & Vitamin K), Application (Healthcare Products, Food & Beverages, Feed, and Personal Care Products), Source (Synthetic and Natural), By Form and Region - Global Forecast to 2028

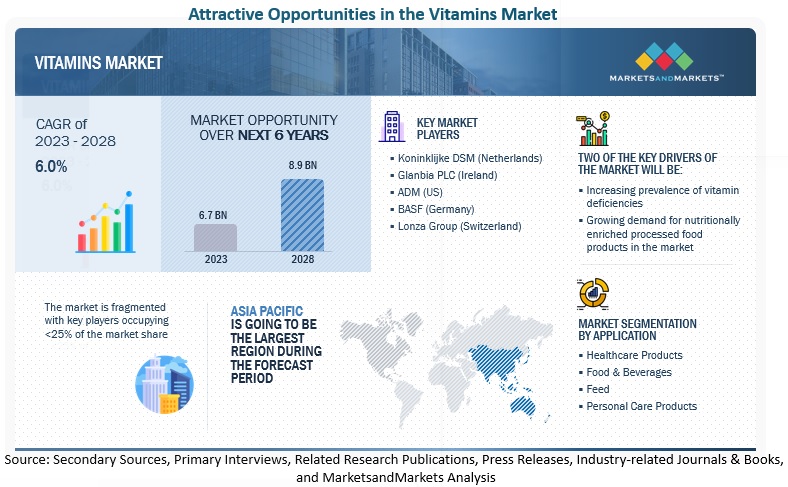

The global vitamins market set to grow from $6.7 billion in 2023 to over $8.9 billion by 2028, with a CAGR of 6.0%. Vitamins are organic compounds that are required in minimal quantity for the proper functioning of the body. These cannot be synthesized internally. Hence needs to be consumed via food. Vitamins work as hormones, enzymes, and coenzymes in the human body. The change in consumers' food and lifestyle habits has led to vitamin deficiencies. These trends demand more vitamin supplements, fortified foods, and beverages, which fuels the vitamins market. According to the USFDA, most of the global population has vitamin deficiencies, and several government bodies around the world are taking precautionary actions to curb the growing micronutrient deficiency.

Consumers are increasingly accepting vitamin supplementation as a part of their daily diet due to the growing disposable income and the trend of caring for one's health. Tennessee Advisory Commission US said overall health expenditure increased to USD 3.6 trillion in 2018. Considering all the above factors, the vitamins market is expected to grow drastically in the upcoming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Vitamins Market Dynamics

Driver: Growing demand for nutritionally enriched processed food products in the market

The major demand for vitamins is seen in food and beverage fortification. Consumers are more inclined towards packed and processed food, as they are convenient to use. To increase the shelf life, taste, texture, and appearance of the foods, it is heavily processed due to which various nutritive value as lost. Vitamins are required to fortify this food to restore the lost nutrients from the food. Additionally, supplements are available that are used as preventive care and to fulfill the daily Recommended Dietary Allowance (RDA) of the human body as per age. So, accordingly, to fulfill the regulatory sanction and make label claims, food companies are increasingly demanding vitamins for their products.

Restraint: Constrained supply of raw materials for natural vitamins coupled with high costs

Natural vitamins are sourced from naturally occurring fruits and vegetables in nature. Different foods have different vitamins in them, and there is an extensive process to extract these naturally occurring vitamins from them. Additionally, these raw materials are produced, transported, or exported to various manufacturing facilities to manufacture vitamins. The increase in supply chain constraining is due to raw material spoilage and high transportation cost to maintain the freshness of raw materials. The manufacturing finally adds to the existing cost. Due to all these factors, the cost of raw material procuring and cost constraints the vitamins market.

Opportunity: Sourcing of natural allergen-free vitamin E

Vitamin E is widely used in different personal care products as a powerful antioxidant. It is a fat-soluble vitamin that is available in several forms. However, alpha-tocopherol is the only one used by the human body. The RDA of vitamin E for males and females above 14 years of age is 15mg/day. For lactating women, more than 19mg/day is recommended. According to an article by Harvard Education, vitamin E deficiency could lead to impaired vision and improper body movements. There are many sources, like wheat germ, soybean, peanuts, etc., from which vitamin E is extracted for commercial use. However, these come with an issue of allergy in some individuals. Hence, other alternatives, like sunflower, avocados, spinach, almond, etc., are considered to obtain vitamin E naturally.

Challenge: Environmental impact resulting in changes in regulatory policies

According to Consumer Survey on Dietary Supplements 2019, supplements have reached an all-time high as most citizens consume dietary supplements. This has a potential impact on the environment. Most vitamins are available through natural means, like omega from fish oil, vitamin c from citrus fruits, vitamin E from seeds, etc. The extraction process is also, for instance, vitamin C pollution, wherein the vitamin C manufacturing company emits carbon. For omega manufacturing, cod liver oil is used, and 20% of the fish cultivated are not directly consumed. These have an impact on the environmental ecosystem, which poses a challenge in the vitamins market.

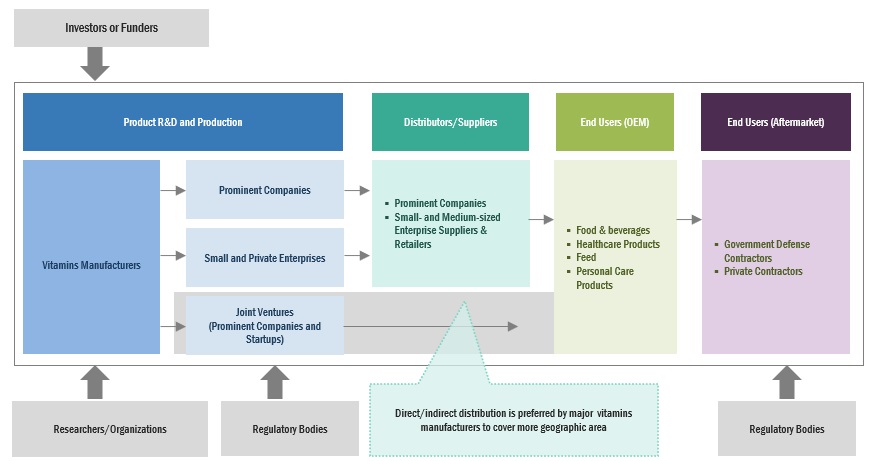

Vitamins Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on Type, Vitamin B is anticipated to dominate the market

Vitamin B helps regenerate complex tissue and has a major role in nerve repair. Different components are vitamin B, like used in manufacturing different cosmetic products, dairy products, dietary supplements, and pharmaceuticals products. Vitamin B is a crucial vitamin during pregnancy. These important and crucial applications of vitamins are set to boost their demand in the future.

The Healthcare segment of the vitamins market is projected to witness the highest CAGR during the forecast period.

Vitamins are required in small quantities by the body to function properly, and their deficiency can lead to serious condition. The growing cases of vitamin deficiency and the increasing need for fortification are leading to the growth of the vitamin market in the healthcare segment. Healthcare products such as multivitamins supplements, dietary supplements, infant foods, and supplements for special needs are fortified with different multivitamins according to the product to fulfill the dietary requirements.

Naturally sourced vitamins are growing at a strong pace owing to their rising use in food products

The naturally sourced vitamins are estimated to grow at the highest CAGR during the forecast period. Naturally sourced vitamins are obtained from whole foods. Naturally sourced vitamins are properly absorbed by the body and perform the proper function. This is because the vitamins are extracted from the natural source along with their enzymes and coenzymes, increasing their efficiency.

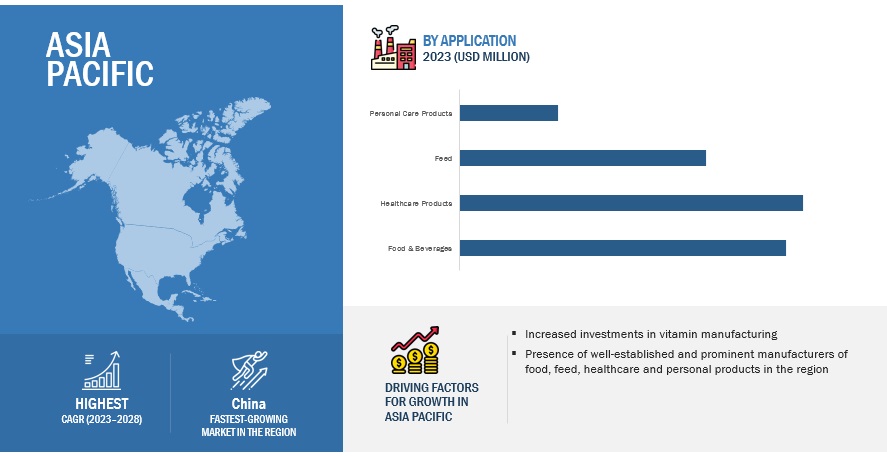

Asia Pacific holds the highest market share during the forecast period

Asia Pacific is the largest and fastest-growing market for vitamins. China is the major contributor, whereas Japan and India have the highest growth opportunities during the forecast period. China is the largest importer of vitamins for application in processed foods, feed, and personal care industries due to the hectic consumer lifestyle and changing consumer food preferences. End-user application segment is the major consumer of vitamins. Due to advanced manufacturing technologies across the region, many end-user manufacturing companies have their manufacturing facility in the Asia Pacific.

Key Market Players

Key players in this market include Koninklijke DSM NV (Netherlands), Glanbia PLC (Ireland), ADM (US), BASF (Germany), Lonza Group (Switzerland), Adisseo (France), Vitablend Nederland BV (Netherlands), SternVitamin GmbH (Germany), Farbest-Tallman Foods Corporation (US), The Wright Group (US), Zhejiang Garden Biochemical High-Tech Co., Ltd (China), NewGen Pharma (US), Rabar Pty Ltd. (Australia), Resonac (Japan), and BTSA BIOTECNOLOGÍAS APLICADAS SL (Spain).

Scope of the Vitamins Market Report

|

Report Metric |

Details |

|

Market size value in 2023 |

USD 6.7 billion |

|

Revenue forecast in 2028 |

USD 8.9 billion |

|

Growth rate |

CAGR of 6.0% from 2023-2028 |

|

Market size available for years |

2023-2028 |

|

Base year for estimation |

2022 |

|

Forecast period |

2023-2028 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Application, Region, Type, Source |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Key companies profiled |

Koninklijke DSM NV (Netherlands), Glanbia PLC (Ireland), ADM (US), BASF (Germany), Lonza Group (Switzerland), Adisseo (France), Vitablend Nederland BV (Netherlands), SternVitamin GmbH (Germany), Farbest-Tallman Foods Corporation (US), The Wright Group (US), Zhejiang Garden Biochemical High-Tech Co., Ltd (China), NewGen Pharma (US), Rabar Pty Ltd. (Australia), Resonac (Japan), and BTSA BIOTECNOLOGÍAS APLICADAS SL (Spain) |

|

Major Drivers |

|

Report Segmentation

The study categorizes the Vitamins Market based on By Source, Type, Application, and Region.

|

By Source |

By Type |

By Application |

By Region |

|

|

|

|

Recent Developments

- In August 2022, MD Pharmaceuticals, a Singapore-based healthcare distributor, has developed a new vitamin D supplement known as Rapid-D with DSM. The collaboration will help expand the vitamin market for DSM in Asia Pacific and capture the customer base.

- In March 2022, Farbest-Tallman Brands was named ZMC's exclusive distributor of Beta Carotene 1% & 22% in North America. Farbest's North American exclusivity partnership with ZMC will extend to two specific products within the Beta Carotene portfolio. Beta-Carotene Oil features vitamin A content of 366,740 IU/g.

- In March 2021, DSM launched Ampli-D, developed as a fast-acting form of vitamin D for dietary supplements. The product is formulated with calcifediol or 25-hydroxyvitamin D3. Ampli-D helps DSM to sustain in the market by providing a unique and innovative product that meets customer requirements.

- ADM Ventures invested in Health for Life Capital (HFLC) Fund II in November 2020. HFLC, a Paris-based management company, is a leading venture capital fund dedicated to health, nutrition, microbiota, and digital health. This will help meet the long-term demand for the convergence of food & pharmaceuticals and bio-actives & nutrition for wellness solutions.

Frequently Asked Questions (FAQ):

What is the expected market size for the global vitamins market in the coming years?

With a robust CAGR of 6.0%, the global vitamins market is set to expand steadily, reaching a projected value of USD 8.9 billion by 2028, as compared to USD 6.7 billion in 2023.

What is the estimated growth rate (CAGR) of the global vitamins market for the next five years?

The global vitamins market is set to grow at a moderate rate, representing a CAGR of 6.0% during the forecast period.

What are the major revenue pockets in the vitamins market currently?

The Asia Pacific region dominates the global vitamins market, with China being the major contributor, and Japan and India presenting the highest growth opportunities over the forecast period. The region's advanced manufacturing technologies have led to the establishment of many end-user manufacturing facilities.

What is the total CAGR expected to be recorded for the healthcare segment market from 2023 to 2028?

The CAGR is expected to be 6.0% from 2023 – 2028

What kind of information is provided in the competitive landscape section?

For the list of players mentioned, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix and key developments associated with the company.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSGROWING MICRONUTRIENT DEFICIENCY

-

5.3 MARKET DYNAMICSDRIVERS- Growing demand for nutritionally enriched processed food products in market- Increasing prevalence of vitamin deficiencies- Feed fortification due to rise in global meat & dairy product consumption and feed productionRESTRAINTS- Constrained supply of raw materials for natural vitamins coupled with high costsOPPORTUNITIES- Sourcing of natural allergen-free vitamin E- Applications of vitamin D in personal care productsCHALLENGES- Scarcity of ingredients and price sensitivity- Environmental impact resulting in changes in regulatory policies

- 6.1 INTRODUCTION

- 6.2 TRENDS IMPACTING CUSTOMERS’ BUSINESS

-

6.3 PRICING ANALYSISAVERAGE SELLING PRICE TREND ANALYSIS

-

6.4 VALUE CHAINRESEARCH & PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGDISTRIBUTIONMARKETING & SALES

-

6.5 MARKET MAPPING AND ECOSYSTEM OF VITAMINSDEMAND SIDESUPPLY SIDE

- 6.6 TRADE DATA: VITAMINS MARKET

-

6.7 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

- 6.8 TECHNOLOGY ANALYSIS

-

6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS IN 2022–2024

-

6.11 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSVITAMIN REGULATIONS IN NORTH AMERICA- US- CanadaVITAMIN REGULATIONS IN EUROPEVITAMIN REGULATIONS IN ASIA PACIFIC- China- India

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIABUYING CRITERIA

-

6.13 CASE STUDIES

- 7.1 INTRODUCTION

-

7.2 VITAMIN BRISING AWARENESS OF VITAMIN B-FORTIFIED FOODS TO BOOST MARKET

-

7.3 VITAMIN ELIFE-THREATENING CONDITIONS CAUSED BY VITAMIN E DEFICIENCY TO BOOST DEMAND

-

7.4 VITAMIN DLESS SUN EXPOSURE AND INCREASING USAGE OF SUNBLOCK CAUSING VITAMIN D DEFICIENCY TO DRIVE DEMAND

-

7.5 VITAMIN CSALES OF VITAMIN C GROWING DUE TO INCREASING APPLICATION IN IRON SUPPLEMENTS

-

7.6 VITAMIN AINCREASING PREVALENCE OF VITAMIN A DEFICIENCY TO DEMAND INCREASED FORTIFICATION

-

7.7 VITAMIN KIMPORTANCE OF VITAMIN K FOR BONE AND BLOOD HEALTH TO FUEL DEMAND

- 8.1 INTRODUCTION

-

8.2 HEALTHCARE PRODUCTSGROWING FOCUS OF HEALTH-CONSCIOUS CONSUMERS ON PREVENTATIVE HEALTHCARE TO DRIVE MARKET

-

8.3 FOOD & BEVERAGESNEED TO FULFILL DIETARY REQUIREMENTS TO CONTRIBUTE TO GROWTH IN DEMANDINFANT FOODDAIRY PRODUCTSBAKERY & CONFECTIONERY PRODUCTSBEVERAGESOTHERS

-

8.4 FEEDGROWING FOCUS OF DEVELOPING ECONOMIES ON ANIMAL NUTRITION TO FUEL DEMAND

-

8.5 PERSONAL CARE PRODUCTSINCREASING DEMAND FOR PRODUCTS CONTAINING ESSENTIAL VITAMINS TO DRIVE GROWTH OF SEGMENT

- 9.1 INTRODUCTION

-

9.2 SYNTHETICLOW PRODUCTION COST OF SYNTHETIC VITAMINS TO FUEL DEMAND

-

9.3 NATURALRISING DEMAND FOR NATURAL PRODUCTS TO BOOST GROWTH

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Rising demand and multiple strategic deals by key players to boost growthCANADA- Growing importance of fortification in human and animal diets to fuel demand for vitaminsMEXICO- High prevalence of lifestyle diseases to demand more health supplements fortified with vitamins

-

10.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Changing lifestyles and preferences for fortified food and dietary supplements to contribute to growthFRANCE- Rising applications of wheat protein in feed sector to drive marketUK- Rising popularity of dietary supplements to fuel growth of vitamins marketITALY- Rising popularity of healthy and functional foods driving demand for vitaminsSPAIN- Growing feed and food ingredients market to fuel demand for vitaminsREST OF EUROPE- Growing economies and rising awareness of health to drive demand for vitamins

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Large geriatric population to fuel demand for vitaminsJAPAN- Significant demand for nutrient-enriched products to support market growthINDIA- Rising popularity of dietary supplements to fuel demand for vitaminsAUSTRALIA & NEW ZEALAND- Changing consumer preferences and increasing health consciousness to drive demandREST OF ASIA PACIFIC- Growing trend of combining beauty solutions with health to augment demand for vitamins

-

10.5 ROWROW: RECESSION IMPACT ANALYSISSOUTH AMERICA- Increased vitamin consumption to fuel growthMIDDLE EAST- Increasing demand for processed food products to drive marketAFRICA- High prevalence of malnutrition and micronutrient deficiencies to fuel demand for vitamin supplements

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSVITAMINS MARKET: PRODUCT FOOTPRINT (KEY PLAYERS)

-

11.6 VITAMINS MARKET: EVALUATION QUADRANT OF STARTUPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESVITAMINS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

-

11.7 COMPETITIVE SCENARIOPRODUCT LAUNCHES

-

12.1 KEY PLAYERSKONINKLIJKE DSM N.V.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGLANBIA PLC- Business overview- Products/Services/Solutions offered- MnM viewADM- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBASF- Business overview- Products/Services/Solutions offered- MnM viewLONZA GROUP- Business overview- Products/Services/Solutions offered- MnM viewADISSEO- Business overview- Products/Services/Solutions offered- MnM viewVITABLEND NEDERLAND B.V.- Business overview- Products/Services/Solutions offered- MnM viewSTERNVITAMIN GMBH & CO. KG- Business overview- Products/Services/Solutions offered- MnM viewFARBEST-TALLMAN FOODS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM VIEWTHE WRIGHT GROUP- Business overview- Products/Services/Solutions offered- MnM viewZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD- Business overview- Products/Services/Solutions offered- MnM viewNEWGEN PHARMA- Business overview- Products/Services/Solutions offered- MnM viewRABAR PTY LTD.- Business overview- Products/Services/Solutions offered- MnM viewRESONAC- Business overview- Products/Services/Solutions offered- MnM viewBTSA BIOTECNOLOGÍAS APLICADAS S.L- Business overview- Products/Services/Solutions offered- Recent developments- MnM view

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 VITAMINS & MINERALS PREMIXES MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.4 VITAMIN D MARKETMARKET DEFINITIONMARKET OVERVIEW

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2022

- TABLE 2 VITAMINS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 VITAMIN DEFICIENCY AND ASSOCIATED RISKS

- TABLE 4 VITAMINS MARKET: AVERAGE SELLING PRICE, BY TYPE & REGION, 2022 (USD/TON)

- TABLE 5 VITAMIN A: AVERAGE SELLING PRICE, BY REGION, 2017–2022 (USD/TON)

- TABLE 6 VITAMIN B: AVERAGE SELLING PRICE, BY REGION, 2017–2022 (USD/TON)

- TABLE 7 VITAMIN C: AVERAGE SELLING PRICE, BY REGION, 2017–2022 (USD/TON)

- TABLE 8 VITAMIN D: AVERAGE SELLING PRICE, BY REGION, 2017–2022 (USD/TON)

- TABLE 9 VITAMIN E: AVERAGE SELLING PRICE, BY REGION, 2017–2022 (USD/TON)

- TABLE 10 VITAMIN K: AVERAGE SELLING PRICE, BY REGION, 2017–2022 (USD/TON)

- TABLE 11 VITAMINS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 12 IMPORT DATA OF VITAMINS, BY COUNTRY, 2019 (USD THOUSAND)

- TABLE 13 IMPORT DATA OF VITAMINS, BY COUNTRY, 2019 (TONS)

- TABLE 14 EXPORT DATA OF VITAMINS, BY COUNTRY, 2019 (USD THOUSAND)

- TABLE 15 EXPORT DATA OF VITAMINS, BY COUNTRY, 2019 (TONS)

- TABLE 16 VITAMINS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 17 PATENTS PERTAINING TO VITAMINS, 2020–2023

- TABLE 18 KEY CONFERENCES & EVENTS IN VITAMINS MARKET, 2023–2024

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VITAMINS

- TABLE 23 KEY BUYING CRITERIA FOR KEY VITAMIN APPLICATIONS

- TABLE 24 CASE STUDY: NEED FOR PLANT-BASED VITAMIN A TO CURB DEFICIENCY

- TABLE 25 VITAMINS MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 26 VITAMINS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 VITAMIN B MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 VITAMIN B MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 VITAMIN B MARKET, BY REGION, 2017–2022 (KT)

- TABLE 30 VITAMIN B MARKET, BY REGION, 2023–2028 (KT)

- TABLE 31 VITAMIN E MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 32 VITAMIN E MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 VITAMIN E MARKET, BY REGION, 2017–2022 (KT)

- TABLE 34 VITAMIN E MARKET, BY REGION, 2023–2028 (KT)

- TABLE 35 VITAMIN D MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 VITAMIN D MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 VITAMIN D MARKET, BY REGION, 2017–2022 (KT)

- TABLE 38 VITAMIN D MARKET, BY REGION, 2023–2028 (KT)

- TABLE 39 VITAMIN C MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 VITAMIN C MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 VITAMIN C MARKET, BY REGION, 2017–2022 (KT)

- TABLE 42 VITAMIN C MARKET, BY REGION, 2023–2028 (KT)

- TABLE 43 VITAMIN A MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 VITAMIN A MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 VITAMIN A MARKET, BY REGION, 2017–2022 (KT)

- TABLE 46 VITAMIN A MARKET, BY REGION, 2023–2028 (KT)

- TABLE 47 VITAMIN K MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 VITAMIN K MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 VITAMIN K MARKET, BY REGION, 2017–2022 (KT)

- TABLE 50 VITAMIN K MARKET, BY REGION, 2023–2028 (KT)

- TABLE 51 VITAMINS MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 52 VITAMINS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 53 HEALTHCARE PRODUCTS: VITAMINS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 HEALTHCARE PRODUCTS: VITAMINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 FOOD & BEVERAGES: VITAMINS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 FOOD & BEVERAGES: VITAMINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 FOOD & BEVERAGES: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 58 FOOD & BEVERAGES: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 FEED: VITAMINS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 FEED: VITAMINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 PERSONAL CARE PRODUCTS: VITAMINS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 62 PERSONAL CARE PRODUCTS: VITAMINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 VITAMINS MARKET, BY SOURCE, 2017–2022 (USD MILLION)

- TABLE 64 VITAMINS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 65 SYNTHETIC: VITAMINS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 66 SYNTHETIC: VITAMINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 NATURAL: VITAMINS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 68 NATURAL: VITAMINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 VITAMINS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 70 VITAMINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 VITAMINS MARKET, BY REGION, 2017–2022 (KT)

- TABLE 72 VITAMINS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 73 NORTH AMERICA: VITAMINS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: VITAMINS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: VITAMINS MARKET, BY TYPE, 2017–2022 (KT)

- TABLE 78 NORTH AMERICA: VITAMINS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 79 NORTH AMERICA: VITAMINS MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: VITAMINS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: VITAMINS MARKET, BY SOURCE, 2017–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: VITAMINS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 83 US: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 84 US: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 85 CANADA: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 86 CANADA: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 MEXICO: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 88 MEXICO: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: VITAMINS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 90 EUROPE: VITAMINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: VITAMINS MARKET, BY SOURCE, 2017–2022 (USD MILLION)

- TABLE 92 EUROPE: VITAMINS MARKET, BY NATURE, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 94 EUROPE: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: VITAMINS MARKET, BY TYPE, 2017–2022 (KT)

- TABLE 96 EUROPE: VITAMINS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 97 EUROPE: VITAMINS MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 98 EUROPE: VITAMINS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 GERMANY: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 100 GERMANY: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 101 FRANCE: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 102 FRANCE: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 103 UK: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 104 UK: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 105 ITALY: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 106 ITALY: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 107 SPAIN: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 108 SPAIN: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 110 REST OF EUROPE: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: VITAMINS MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: VITAMINS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: VITAMINS MARKET, BY SOURCE, 2017–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: VITAMINS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: VITAMINS MARKET SIZE, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: VITAMINS MARKET, BY TYPE, 2017–2022 (KT)

- TABLE 118 ASIA PACIFIC: VITAMINS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 119 ASIA PACIFIC: VITAMINS MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: VITAMINS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 CHINA: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 122 CHINA: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 123 JAPAN: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 124 JAPAN: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 125 INDIA: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 126 INDIA: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 127 AUSTRALIA & NEW ZEALAND: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 128 AUSTRALIA & NEW ZEALAND: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 131 ROW: VITAMINS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 132 ROW: VITAMINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 133 ROW: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 134 ROW: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 135 ROW: VITAMINS MARKET, BY TYPE, 2017–2022 (KT)

- TABLE 136 ROW: VITAMINS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 137 ROW: VITAMINS MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 138 ROW: VITAMINS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 ROW: VITAMINS MARKET, BY SOURCE, 2017–2022 (USD MILLION)

- TABLE 140 ROW: VITAMINS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 141 SOUTH AMERICA: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 142 SOUTH AMERICA: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 143 MIDDLE EAST: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 144 MIDDLE EAST: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 AFRICA: VITAMINS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 146 AFRICA: VITAMINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 147 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 148 MARKET SHARE ANALYSIS OF VITAMINS MARKET, 2022

- TABLE 149 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

- TABLE 150 COMPANY FOOTPRINT, BY APPLICATION (KEY PLAYERS)

- TABLE 151 COMPANY FOOTPRINT, BY SOURCE (KEY PLAYERS)

- TABLE 152 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

- TABLE 153 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 154 VITAMINS MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 155 VITAMINS MARKET: DEALS, 2019–2022

- TABLE 156 VITAMINS MARKET: OTHERS, 2019–2022

- TABLE 157 KONINKLIJKE DSM N.V.: BUSINESS OVERVIEW

- TABLE 158 KONINKLIJKE DSM N.V.: PRODUCTS OFFERED

- TABLE 159 KONINKLIJKE DSM N.V.: PRODUCT LAUNCHES

- TABLE 160 KONINKLIJKE DSM N.V.: DEALS

- TABLE 161 KONINKLIJKE DSM N.V.: OTHERS

- TABLE 162 GLANBIA PLC: BUSINESS OVERVIEW

- TABLE 163 GLANBIA PLC: PRODUCTS OFFERED

- TABLE 164 ADM: BUSINESS OVERVIEW

- TABLE 165 ADM: PRODUCTS OFFERED

- TABLE 166 ADM: DEALS

- TABLE 167 BASF: BUSINESS OVERVIEW

- TABLE 168 BASF: PRODUCTS OFFERED

- TABLE 169 LONZA GROUP: BUSINESS OVERVIEW

- TABLE 170 LONZA GROUP: PRODUCTS OFFERED

- TABLE 171 ADISSEO: BUSINESS OVERVIEW

- TABLE 172 ADISSEO: PRODUCTS OFFERED

- TABLE 173 VITABLEND NEDERLAND B.V.: BUSINESS OVERVIEW

- TABLE 174 VITABLEND NEDERLAND B.V.: PRODUCTS OFFERED

- TABLE 175 STERNVITAMIN GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 176 STERNVITAMIN GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 177 FARBEST-TALLMAN: BUSINESS OVERVIEW

- TABLE 178 FARBEST-TALLMAN: PRODUCTS OFFERED

- TABLE 179 FARBEST-TALLMAN: OTHERS

- TABLE 180 THE WRIGHT GROUP: BUSINESS OVERVIEW

- TABLE 181 THE WRIGHT GROUP: PRODUCTS OFFERED

- TABLE 182 ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD: BUSINESS OVERVIEW

- TABLE 183 ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD: PRODUCTS OFFERED

- TABLE 184 NEWGEN PHARMA: BUSINESS OVERVIEW

- TABLE 185 NEWGEN PHARMA: PRODUCTS OFFERED

- TABLE 186 RABAR PTY LTD.: BUSINESS OVERVIEW

- TABLE 187 RABAR PTY LTD.: PRODUCTS OFFERED

- TABLE 188 RESONAC: BUSINESS OVERVIEW

- TABLE 189 RESONAC: PRODUCTS OFFERED

- TABLE 190 BTSA BIOTECNOLOGÍAS APLICADAS S.L: BUSINESS OVERVIEW

- TABLE 191 BTSA BIOTECNOLOGÍAS APLICADAS S.L: PRODUCTS OFFERED

- TABLE 192 BTSA BIOTECNOLOGÍAS APLICADAS S.L: OTHERS

- TABLE 193 ADJACENT MARKETS TO VITAMINS MARKET

- TABLE 194 VITAMINS & MINERALS PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 195 VITAMINS & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 196 VITAMIN D MARKET, BY FORM, 2019–2021 (USD MILLION)

- TABLE 197 VITAMIN D MARKET, BY FORM, 2022–2027 (USD MILLION)

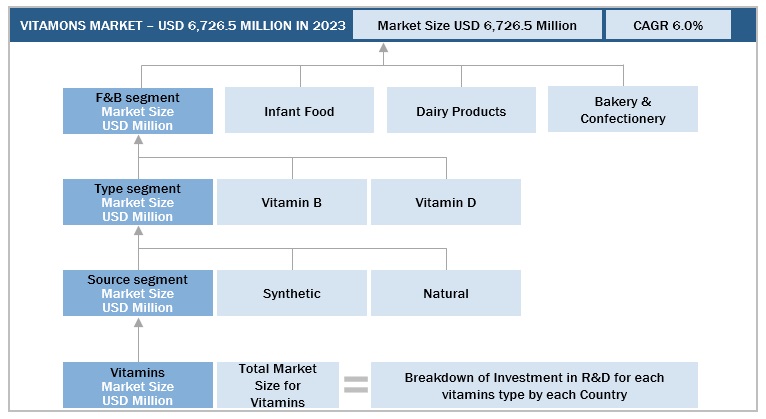

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 VITAMINS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 VITAMINS MARKET: APPROACH ONE (BOTTOM UP)

- FIGURE 5 VITAMINS MARKET: APPROACH TWO (TOP DOWN)

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 RESEARCH ASSUMPTIONS CONSIDERED

- FIGURE 8 STUDY LIMITATIONS AND RISK ASSESSMENT

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 WORLD INFLATION RATE, 2011-2021

- FIGURE 11 GLOBAL GDP, 2011-2021 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON VITAMINS MARKET

- FIGURE 13 GLOBAL VITAMINS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 14 VITAMINS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 VITAMINS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 VITAMINS MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 VITAMINS MARKET SHARE, BY REGION, 2022

- FIGURE 18 GROWTH IN DEMAND FOR FUNCTIONAL AND NUTRITIONALLY ENRICHED PROCESSED FOOD PRODUCTS TO DRIVE DEMAND FOR VITAMINS

- FIGURE 19 CHINA WAS FASTEST-GROWING MARKET GLOBALLY FOR VITAMINS IN 2022

- FIGURE 20 VITAMIN B ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC VITAMINS MARKET

- FIGURE 21 ASIA PACIFIC AND HEALTHCARE PRODUCTS SEGMENTS PROJECTED TO DOMINATE MARKET

- FIGURE 22 VITAMIN B PROJECTED TO DOMINATE DURING FORECAST PERIOD

- FIGURE 23 SYNTHETIC SEGMENT PROJECTED TO DOMINATE VITAMINS MARKET

- FIGURE 24 MARKET DYNAMICS: VITAMINS MARKET

- FIGURE 25 MEAT CONSUMPTION, BY LIVESTOCK MEAT TYPE, 2015–2024 (KT CWE)

- FIGURE 26 TOP 10 FEED-PRODUCING COUNTRIES, 2021 (MMT)

- FIGURE 27 REVENUE SHIFT FOR VITAMINS MARKET

- FIGURE 28 VALUE CHAIN ANALYSIS OF VITAMINS MARKET

- FIGURE 29 VITAMINS: MARKET MAP

- FIGURE 30 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2023

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING VITAMINS FOR DIFFERENT END-USE APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP VITAMIN APPLICATIONS

- FIGURE 33 VITAMINS MARKET, BY TYPE, 2023 VS. 2028

- FIGURE 34 VITAMINS MARKET SHARE, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 35 VITAMINS MARKET, BY SOURCE, 2023 VS. 2028

- FIGURE 36 ASIA PACIFIC TO BE FASTEST-GROWING MARKET, 2023–2028

- FIGURE 37 NORTH AMERICAN VITAMINS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 38 EUROPE: VITAMINS MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: VITAMINS MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2020–2022 (USD BILLION)

- FIGURE 41 VITAMINS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 42 VITAMINS MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- FIGURE 43 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

- FIGURE 44 GLANBIA PLC: COMPANY SNAPSHOT

- FIGURE 45 ADM: COMPANY SNAPSHOT

- FIGURE 46 BASF: COMPANY SNAPSHOT

- FIGURE 47 LONZA GROUP: COMPANY SNAPSHOT

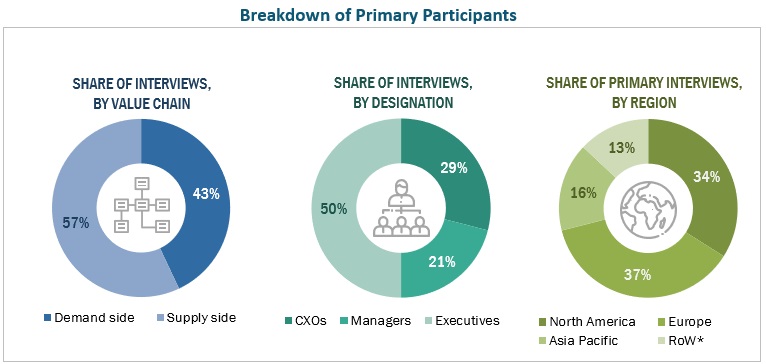

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the vitamins market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the vitamins market.

Breakdown of Primary participants

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the vitamins market includes the following details. Both the top-down and bottom-up approaches were used to estimate and validate the market’s total size. These approaches were also used to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes extensive secondary research of key players, reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Global vitamins market size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global vitamins market size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Vitamins are organic substances that are generally classified as either fat-soluble or water-soluble. Vitamins are micronutrients required by the body to carry out a range of normal functions. However, these micronutrients are not produced in our bodies and must be derived from the food we consume.

Vitamins are essential micronutrients that are commercially available in natural and synthetic forms; they are used in food, feed, healthcare, and personal care industries for enrichment or fortification purposes with the objective of enhancing the nutritional value of the end products.

Stakeholders

- Vitamins manufacturers

- Vitamins traders, distributors, and suppliers

- Food processors & food manufacturers

- Regulatory bodies

- Commercial research & development (R&D) institutions and financial institutions:

- Importers and exporters of vitamins

- Global Alliance for Improved Nutrition (GAIN)

- Food Fortification Initiative (FFI)

- Food and Agriculture Organization (FAO)

- United Nations International Children's Emergency Fund (UNICEF)

- World Health Organization (WHO)

- Animal Feed Manufacturers Association (AFMA)

- World Organization for Animal Health (WOAH)

Report Objectives

- Determining and projecting the size of the vitamins market with respect to Type, Application, Source, and Region

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

-

Providing detailed information about the key factors influencing the market growth

(drivers, restraints, opportunities, and industry-specific challenges) - Providing the regulatory framework and market entry process related to the vitamins market

- Analyzing the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the vitamins market

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the country.

- Providing insights on the key product innovations and investments in the vitamins market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the C4ISR market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the vitamins Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Vitamins Market

Hi Marc Vamden Avenne, Thank you for the writing to us on Vitamins market - Vitamin E acetate(synthetic) market. We have included Vitamin E acetate(synthetic) in the scope of our report. We would be to happy to hear/like to have a quick call and understand your core requirements on Vitamin E acetate(synthetic) market and further. Please feel free to email sales@marketsandmarkets.com / Call us on +1-888-600-6441

How big is the vitamin E acetate (synthetic) market in the world? 90.000 MT feed/food/pharma?