Vitamin D Market by Analog (Vitamin D2, Vitamin D3), Form (Dry, Liquid), Application (Feed & Pet Food, Pharma, Functional Food, and Personal Care), End Users (Adults, Pregnant Women, and Children), IU Strength and Region - Global Forecast to 2027

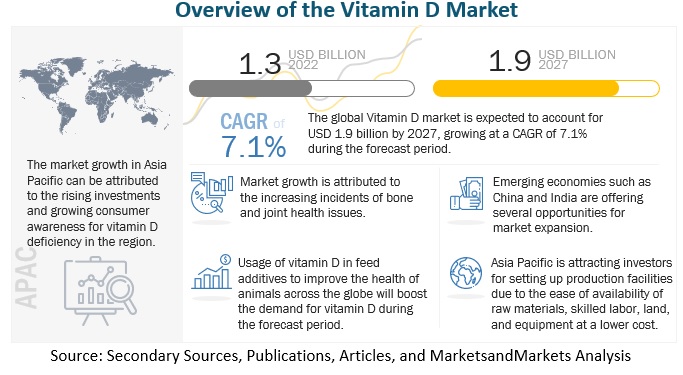

[279 Pages Report] The global vitamin D market is projected to be valued at USD 1.9 billion by 2027. Increasing demand for feed fortification will drive the market for vitamin D during the forecast period. The livestock sector is witnessed to be rapidly growing to meet the increasing global demand for high-value animal products. Due to this increased awareness, consumers give more importance to the texture, color, and flavor of meat and meat products. There has been a rise in the consumption and production of meat, especially in industrialized countries such as the US, supported by factors such as lower prices of beef, pork, and poultry, increased focus on the shelf life, quality, and safety of meat products; and the rise in per capita consumption of meat. According to the USDA, poultry imports are to grow to 17.5 million metric tons by 2031. The increasing consumption of meat products will increase the demand for vitamin D in feed additives, which will help the vitamin d market to grow.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Growing preference for fortified food among consumers

In recent years, health-conscious consumers are looking for not only nutritional foods but also for those that provide essential health ingredients, to prevent possible diseases and improve physical and mental well-being. The increasing demand for food products fortified with healthy ingredients and functional foods has shown that consumers prefer prevention to cure.

Awareness regarding this is encouraging consumers to incorporate fortified food products into their diets. Fortification of food products with vitamins is rapidly gaining traction as consumers in developing and developed regions prefer products such as functional beverages, dietary supplements, and fortified processed foods, which offer additional health benefits. Thus, the increase in consumption of such products among consumers is driving the overall vitamin D market in the food and nutraceutical industries.

Restraints: Scarcity of ingredients coupled with high cost

Sun exposure is the major source of vitamin D; however, due to changing lifestyles, people are not getting an adequate amount of exposure to the sun. There are very few natural foods that provide vitamin D, increasing the risk of deficiency of vitamin D among consumers. Vitamin D and several other vitamins face the problem of raw material unavailability as a result of which there is a price increase. This high price is one of the biggest challenges to the growth of sales of vitamins. The vitamin D market remains one of the most volatile markets concerning prices. Thus, any fluctuation in the availability of raw materials can affect the pricing; the volatile prices stand as the major challenging factor in the growth of the vitamins market.

Opportunities: Rise in demand for feed fortification

The livestock sector is witnessed to be rapidly growing to meet the increasing global demand for high-value animal products. Due to this increased awareness, consumers give more importance to the texture, color, and flavor of meat and meat products. According to the US Department of Agriculture, the per-capita consumption of red meat and poultry stood at 216.9 lbs/person in 2017 in the US, up by 8.1 lbs/person since 2010, and is expected to reach 222.2 lbs/person in 2018. Promising markets for the growth of meat consumption are expected from the developing regions such as Asia Pacific, where countries such as China and Japan present opportunistic prospects for a rise in meat consumption. These factors show a positive outlook for the lucrative vitamin market.

Challenges: Regulatory factors & standardization

The US government limited the indiscriminate addition of nutrients to foods and the fortification of fresh produce: meat, poultry, or fish products. In European countries, the fortification of unprocessed foods is prohibited. Moreover, in the UK, fortifying vitamin D in milk is restricted as non-synthesized milk, which is marketed in the country, claims to maintain the natural vitamin D content of the product. Such standardizations and regulatory factors challenge the trade and usage of vitamin D in the food industry and, consequently, in the overall market.

By analog, the vitamin D2 segment is estimated to grow at a highest rate during the forecast period in terms of volume.

Vitamin D is gaining more importance as it is indicated to treat calcium disorders and parathyroid disorders. It is also the preferred form for patients with chronic kidney disease. Moreover, the benefits of vitamin D2 are multiple. Beyond its importance for immunity, it plays an active role in bone health and helps absorb calcium and phosphorus. It is also essential for muscle and cognitive functions as well as for cell division and healthy teeth.

By application, feed & pet food segment is the largest component in the global vitamin D market in terms of volume.

The feed industry market is perceiving an upward trend in need for improved feed products, that supports the demand for nutritional additives such as vitamin D. Moreover, there is an escalating focus on animal sustenance in developing economies such as India and China, owing to which need for different vitamins is estimated to remain high in the feed industry. Moreover, Increasing demand for high-quality functional pet food has led manufacturers to include nutrients such as vitamin D in their products. Further, the increasing number of pet food retail chains such as PetSmart (US) and PetCo (US) is attributed to the organized pet food sector, which is driving the overall vitamin D market.

By form, dry segment has the highest growth in the vitamin D market over the foreseeable future.

Vitamin D in dry form is characterized by enhanced stability and ease of handling & better storage conditions compared to the liquid form. Pharmaceutical-grade vitamin D3 is packaged majorly in pure crystalline form. The high potency of products allows smaller amounts of the material to be used in formulations. Hence, smaller packaging is preferred. Commercial sources of feed-grade vitamin D are usually vitamin D3 resin, stabilized by spray, or by roll drying a starch or gelatin suspension of the vitamin.

By end user, the adults segment is anticipated to be the segment to grow at a steady rate in the vitamin D market over the foreseeable future.

Vitamin D deficiency is extremely prevalent in adults more than 50 years of age. Severe deficiency results in osteomalacia, osteopenia, and osteoporosis, leading to the thickening of ankles, wrists, and knees.

Moreover, as stated by the National Centre for Biotechnology Information (NCBI), there is a decrease in the concentration of 7- dehydrocholesterol in the epidermis in the older population when compared to that of the younger population, which further disables them to have an adequate response to the UV light, which, in turn, leads to a 50% decrease in the formation of pre-vitamin D3 in their bodies. To avoid this, the elderly need to consume more vitamin D products.

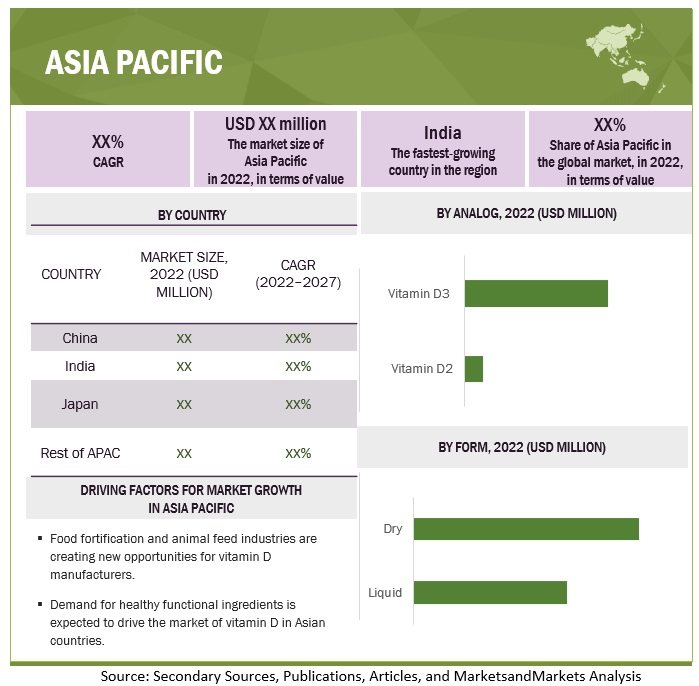

By region, Asia Pacific has the largest regional market for the vitamin D industry

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific accounted for the largest share in the global vitamin D market. According to the International Osteoporosis Foundation (IOF) estimates, more than 50.0% of all osteoporotic fractures will occur in Asia in 2050. China is expected to be affected the most due to its large population of seniors. By 2050, the Chinese population is projected to decrease slightly to 1.3 billion, but those over 50 years will reach almost half (49.0%) of the total population. Osteoporosis, a common chronic disease among the geriatric population, has become one of the top four health problems in this region. Therefore, the region has witnessed an increase in chronic disease incidences, thereby driving the market for healthcare products and fortified food & beverages with contents of essential micronutrients such as vitamin D.

Moreover, China is estimated to be the largest producer, consumer, and exporter of vitamin D in the world. According to the statistics from the China Pharmaceutical Industry Association (CPIA) and China Feed Industry Association (CFIA), China’s vitamin production accounted for ~70.9% of the world's total output in 2017. Along with the local manufacturers, key global players such as DSM (Netherlands) and BASF SE (Germany) have also established their production & distribution facilities and distribution channels for vitamin D in the country.

Key Market Players:

Key players in this market include Zhejiang Garden Biochemical High-Tech Co.,Ltd (China), DSM (Netherlands), Zhejiang Xinhecheng Co., Ltd. (China), Taizhou Haisheng Pharmaceutical Co., Ltd. (China), Xiamen Jindawei Vitamin Co., Ltd. (China), Fermenta Biotech Ltd. (India), Zhejiang Medicine Co., Ltd.(China), BASF (Germany), and Dishman Group (India).

Scope of the Report

|

Report Metrics |

Details |

| Market Size Value in 2021 | USD 1,256.1 million |

| Market Size Value in 2022 | USD 1,344.0 million |

| Market Size Value in 2023 | USD 1,438.1 million |

| Market Size Value in 2027 | USD 1.9 billion |

| Market Growth Rate | CAGR of 7.1% |

| Estimated Year: 2021 | 2022 |

| Market size estimation | 2019–2027 |

| Historical Period | 2019–2020 |

| Base year considered | 2021 |

| Forecast period considered | 2022–2027 |

| Units considered | Value (USD), Volume (MT) |

| Segments covered | Vitamin D Market (Application, Analog, End User, Form, IU Type, and Region) |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Asia Pacific |

| Market Growth Drivers | Growing health-conscious population is driving the overall vitamin D market in the food and nutraceutical industries |

| Market Opportunities | Rise in demand for feed fortification to show a positive outlook for the lucrative vitamin market |

| Largest Growing Region | Asia Pacific |

| Companies studied |

|

Target Audience:

- Raw material suppliers

- Pharmaceutical & nutraceuticals manufacturers

- Regulatory bodies

- Government agencies and NGOs

- Food & beverage manufacturers/suppliers

- Food safety agencies

- Feed manufacturers

- Personal care product manufacturers

- Healthcare organizations

Report Scope:

This research report categorizes the vitamin D market based on application, analog, form, end user, and region.

Market By Application

-

Feed & pet food

- Animal feed

- Pet food

- Pharmaceuticals

- Functional food & beverage

- Personal Care

Market By Analog

- Vitamin D3

- Vitamin D2

Market By End User

- Adults

- Pregnant women

- Children

Market By Form

- Dry

- Liquid

Market By Region

- North America

- Europe

- Asia Pacific

- South America

-

Rest of the World

- South Africa

- The Middle East

- Rest of Africa

Recent Developments

- In August 2022, MD Pharmaceuticals, a Singapore-based healthcare distributor, developed a new Vitamin D supplement known as Rapid-D with DSM.

- In January 2020, Zhejiang Xinhecheng Co., Ltd. and DSM (Netherlands) signed a sales and purchase agreement for cholesterol. Cholesterol is used to produce vitamin D3. This agreement would help the company to increase its capacity and improve its brand awareness in Europe.

Frequently Asked Questions (FAQ):

Which are the major vitamin D segments considered in this study?

All the major vitamin D are segmented into various segments such as application, form, analog, end user and region.

I am interested in the Asia Pacific market for the application segment. Is customization available for the same? What would be included?

Yes, customization for the Asia Pacific market for various segments can be provided on various aspects, including market size, forecast, company profiles, and competitive landscape. Exclusive insights on below Asia Pacific countries will be provided:

- China

- India

- Japan

- Australia

- Japan

- Indonesia

- Thailand

- Rest of Asia Pacific

Also, you can let us know if there are any other countries of your interest

What are some of the drivers fuelling the growth of the vitamin D market?

Global vitamin D market is characterized by the following drivers:

-

Prevalence of vitamin deficiencies

The prevalence of vitamin deficiencies in several developing regions such as the Asia Pacific and Africa is one of the major factors fueling the growth of the vitamin market. According to the World Health Organization (WHO), one-third of total children were affected by vitamin A deficiency. Sub-Saharan African and South Asian regions contributed to the highest affected rates of about 48% and 44%, respectively, in 2013. This presents vitamin manufacturers with prospects for growth in the market. Some vitamin manufacturers are tapping into this opportunity and addressing the issues of malnutrition by introducing blends of vitamin premixes for a wide range of applications.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, a detailed explanation of the research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Bottom-up approach

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of the below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, MnM view to elaborate analyst view on the company. Some of the key players in the market include Zhejiang Garden Biochemical High-Tech Co.,Ltd (China), DSM (Netherlands), Zhejiang Xinhecheng Co., Ltd. (China), Taizhou Haisheng Pharmaceutical Co., Ltd. (China), Xiamen Jindawei Vitamin Co., Ltd. (China), Fermenta Biotech Ltd. (India), Zhejiang Medicine Co., Ltd.(China), BASF (Germany), and Dishman Group (India). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 VITAMIN D MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.6 VOLUME UNIT CONSIDERED

1.7 INCLUSIONS AND EXCLUSIONS

1.8 STAKEHOLDERS

1.9 LIMITATIONS

1.10 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 3 VITAMIN D MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Key data from primary sources

2.1.2.4 Breakdown of primary interviews

2.1.2.5 Key primary insights

2.2 MARKET SIZE ESTIMATION

FIGURE 4 APPROACH ONE - BOTTOM-UP

FIGURE 5 APPROACH ONE - BOTTOM-UP

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 7 VITAMIN D MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 8 MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET, BY ANALOG, 2022 VS. 2027 (USD MILLION)

FIGURE 10 VITAMIN D MARKET, BY IU STRENGTH, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 12 ASIA PACIFIC TO GROW AT HIGHEST CAGR IN VITAMIN D MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN VITAMIN D MARKET

FIGURE 13 HIGH ADOPTION OF VITAMIN D IN DEVELOPING MARKETS TO BOOST MARKET GROWTH

4.2 ASIA PACIFIC: VITAMIN D MARKET, BY ANALOG AND COUNTRY

FIGURE 14 CHINA TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2021

4.3 VITAMIN D MARKET, BY APPLICATION

FIGURE 15 FEED & PET FOOD SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 VITAMIN D MARKET, BY END USER

FIGURE 16 ADULTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.5 VITAMIN D MARKET, BY ANALOG

FIGURE 17 VITAMIN D3 SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.6 VITAMIN D MARKET, BY FORM

FIGURE 18 DRY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.7 VITAMIN D MARKET, BY IU STRENGTH

FIGURE 19 500,000 IU SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.8 VITAMIN D MARKET, BY APPLICATION AND REGION

FIGURE 20 ASIA PACIFIC TO DOMINATE APPLICATION SEGMENT DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.1.1 MACROECONOMIC FACTORS

5.2 MARKET DYNAMICS

FIGURE 21 VITAMIN D MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth in demand for functional and nutritionally enriched processed food products

5.2.1.2 Rise in preference for fortified food among consumers

5.2.1.3 Increase in awareness regarding bone and joint health

5.2.1.4 Prevalence of vitamin deficiencies

5.2.1.5 Feed fortification due to rise in global meat & dairy product consumption

FIGURE 22 MEAT CONSUMPTION, BY LIVESTOCK MEAT TYPE, 2015–2024 (KT CWE)

5.2.2 RESTRAINTS

5.2.2.1 Scarcity of ingredients coupled with high cost

5.2.2.2 Constrained supply of raw materials for natural vitamins

5.2.3 OPPORTUNITIES

5.2.3.1 Usage of vitamin D in personal care products

5.2.4 CHALLENGES

5.2.4.1 Regulatory factors and standardization

6 INDUSTRY TRENDS (Page No. - 66)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

6.2.1 RESEARCH & DEVELOPMENT

6.2.2 SOURCING

6.2.3 MANUFACTURING

6.2.4 PACKAGING AND STORAGE

6.2.5 DISTRIBUTION

6.2.6 END USERS

FIGURE 23 VALUE CHAIN ANALYSIS: VITAMIN D MARKET

6.2.7 PRICING ANALYSIS

6.2.7.1 Average selling price trend analysis

TABLE 2 VITAMIN D MARKET: AVERAGE SELLING PRICE, BY ANALOG, 2019–2022 (USD/KG)

TABLE 3 MARKET: AVERAGE SELLING PRICE, BY END USER, 2019–2022 (USD/KG)

TABLE 4 MARKET: AVERAGE SELLING PRICE, BY FORM, 2019–2022 (USD/KG)

TABLE 5 MARKET: AVERAGE SELLING PRICE, BY IU STRENGTH, 2019–2022 (USD/KG)

TABLE 6 MARKET: AVERAGE SELLING PRICE, BY REGION, 2019–2022 (USD/KG)

TABLE 7 MARKET: AVERAGE SELLING PRICE, BY APPLICATION, 2019–2022 (USD/KG)

6.3 TECHNOLOGY ANALYSIS

6.3.1 FOOD MICROENCAPSULATION

6.3.2 CYCLOSOME DELIVERY TECHNOLOGY

6.4 ECOSYSTEM MAPPING: VITAMIN D MARKET

6.4.1 DEMAND SIDE

6.4.2 SUPPLY SIDE

FIGURE 24 VITAMIN D MARKET: ECOSYSTEM

TABLE 8 VITAMIN D MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 25 VITAMIN D MARKET: TRENDS IMPACTING BUYERS

6.6 PATENT ANALYSIS

FIGURE 26 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2022

TABLE 9 PATENTS PERTAINING TO VITAMIN D, 2020–2022

6.7 TRADE DATA: VITAMIN D MARKET

TABLE 10 IMPORT DATA OF VITAMINS, BY COUNTRY, 2019–2020 (USD MILLION)

TABLE 11 EXPORT DATA OF VITAMINS, BY COUNTRY, 2019–2021 (USD MILLION)

6.8 KEY CONFERENCES & EVENTS IN 2022–2023

6.9 PORTER'S FIVE FORCES ANALYSIS

TABLE 12 VITAMIN D MARKET: PORTER'S FIVE FORCES ANALYSIS

6.9.1 DEGREE OF COMPETITION

6.9.2 BARGAINING POWER OF SUPPLIERS

6.9.3 BARGAINING POWER OF BUYERS

6.9.4 THREAT OF SUBSTITUTES

6.9.5 THREAT OF NEW ENTRANTS

6.10 CASE STUDIES

6.10.1 CASE STUDY 1: OPTIMIZED VITAMIN D PRODUCTION

6.10.2 CASE STUDY 2: CO-INNOVATION BRINGING NEW PRODUCTS TO GROWING MARKET

6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VITAMIN D APPLICATIONS

TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VITAMIN D APPLICATIONS

FIGURE 28 KEY BUYING CRITERIA FOR TOP APPLICATIONS

6.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12 REGULATORY FRAMEWORK

6.12.1 NORTH AMERICA

6.12.1.1 US

6.12.1.2 Mexico

6.12.1.3 Canada

6.12.2 EUROPE

6.12.2.1 France

6.12.2.2 UK

6.12.2.3 Rest of Europe

6.12.3 ASIA PACIFIC

6.12.3.1 India

6.12.3.2 China

6.12.3.3 Japan

6.12.3.4 Australia

6.12.4 SOUTH AMERICA

6.12.4.1 Brazil

6.12.4.2 Argentina

6.12.5 MIDDLE EAST

6.12.6 REST OF THE WORLD

7 CLINICAL REVIEW OF VITAMIN D MARKET (Page No. - 90)

7.1 INTRODUCTION

TABLE 17 RECOMMENDED DIETARY ALLOWANCE OF VITAMIN D, BY LIFE STAGE & GENDER

TABLE 18 INDICATION OF VITAMIN D CONCENTRATION IN BLOOD SAMPLES

7.2 BONE HEALTH

7.2.1 RICKETS

7.2.2 OSTEOPOROSIS

7.3 SKIN HEALTH

7.3.1 PSORIASIS

7.3.2 DEFICIENCY TREATMENT

7.4 IMMUNITY DEVELOPMENT

7.4.1 INFLUENZA

7.5 CFR 172: FOOD ADDITIVES PERMITTED FOR DIRECT ADDITION TO FOOD FOR HUMAN CONSUMPTION

7.5.1 VITAMIN D2

7.5.2 VITAMIN D3

8 VITAMIN D MARKET, BY ANALOG (Page No. - 94)

8.1 INTRODUCTION

FIGURE 29 VITAMIN D3 LEADS MARKET, BY ANALOG, DURING FORECAST PERIOD

TABLE 19 VITAMIN D MARKET, BY ANALOG, 2019–2021 (USD MILLION)

TABLE 20 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 21 MARKET, BY ANALOG, 2019–2021 (MT)

TABLE 22 VITAMIN D MARKET, BY TYPE, 2022–2027 (MT)

8.2 VITAMIN D2

8.2.1 HEALTH AND WELLNESS PRODUCTS DRIVE MARKET

TABLE 23 VITAMIN D2 MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 24 VITAMIN D2 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 VITAMIN D2 MARKET, BY REGION, 2019–2021 (MT)

TABLE 26 VITAMIN D2 MARKET, BY REGION, 2022–2027 (MT)

8.3 VITAMIN D3

8.3.1 GROWING CONSUMPTION OF VITAMIN D3 IN FEED INDUSTRY TO DRIVE DEMAND IN ASIA PACIFIC

TABLE 27 VITAMIN D3 MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 28 VITAMIN D3 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 VITAMIN D3 MARKET, BY REGION, 2019–2021 (MT)

TABLE 30 VITAMIN D3 MARKET, BY REGION, 2022–2027 (MT)

9 VITAMIN D MARKET, BY IU STRENGTH (Page No. - 100)

9.1 INTRODUCTION

FIGURE 30 40 MIU LEADS MARKET, BY IU STRENGTH, DURING FORECAST PERIOD

TABLE 31 VITAMIN D MARKET, BY IU STRENGTH, 2019–2021 (USD MILLION)

TABLE 32 MARKET, BY IU STRENGTH, 2022–2027 (USD MILLION)

TABLE 33 MARKET, BY IU STRENGTH, 2019–2021 (MT)

TABLE 34 MARKET, BY IU STRENGTH, 2022–2027 (MT)

10 VITAMIN D MARKET, BY FORM (Page No. - 104)

10.1 INTRODUCTION

FIGURE 31 DRY FORM LEADS MARKET, BY FORM, DURING FORECAST PERIOD

TABLE 35 VITAMIN D MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 36 MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 37 MARKET, BY FORM, 2019–2021 (MT)

TABLE 38 MARKET, BY FORM, 2022–2027 (MT)

10.2 DRY

10.2.1 CRYSTALLINE FORM OF VITAMIN D TO GAIN TRACTION IN PHARMACEUTICALS INDUSTRY

TABLE 39 DRY MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 40 DRY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 41 DRY MARKET, BY REGION, 2019–2021 (MT)

TABLE 42 DRY MARKET, BY REGION, 2022–2027 (MT)

10.3 LIQUID

10.3.1 LIQUID FORM OFFERS EASY ABSORPTION OF VITAMIN D

TABLE 43 LIQUID MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 44 LIQUID MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 45 LIQUID MARKET, BY REGION, 2019–2021 (MT)

TABLE 46 LIQUID MARKET, BY REGION, 2022–2027 (MT)

11 VITAMIN D MARKET, BY APPLICATION (Page No. - 110)

11.1 INTRODUCTION

FIGURE 32 PHARMACEUTICALS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 47 VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 48 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 49 MARKET, BY FEED & PET FOOD APPLICATION, 2019–2021 (USD MILLION)

TABLE 50 MARKET, BY FEED & PET FOOD APPLICATION, 2022–2027 (USD MILLION)

TABLE 51 MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 52 MARKET, BY APPLICATION, 2022–2027 (MT)

TABLE 53 MARKET, BY FEED & PET FOOD APPLICATION, 2019–2021 (MT)

TABLE 54 VITAMIN D MARKET, BY FEED & PET FOOD APPLICATION, 2022–2027 (MT)

11.2 FEED & PET FOOD

11.2.1 VITAMIN D DEFICIENCY IN LIVESTOCK TO BOOST MARKET

TABLE 55 FEED & PET FOOD MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 56 FEED & PET FOOD MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 57 FEED & PET FOOD MARKET, BY REGION, 2019–2021 (MT)

TABLE 58 FEED & PET FOOD MARKET, BY REGION, 2022–2027 (MT)

11.2.2 ANIMAL FEED

11.2.2.1 Broilers and swine to be major consumers of vitamin D3 in animal feed industry

TABLE 59 ANIMAL FEED MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 60 ANIMAL FEED MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 61 ANIMAL FEED MARKET, BY REGION, 2019–2021 (MT)

TABLE 62 ANIMAL FEED MARKET, BY REGION, 2022–2027 (MT)

11.2.3 PET FOOD

11.2.3.1 Increasing spending on pet health to create opportunity for vitamin D manufacturers in pet food industry

TABLE 63 PET FOOD MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 64 PET FOOD MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 65 PET FOOD MARKET, BY REGION, 2019–2021 (MT)

TABLE 66 PET FOOD MARKET, BY REGION, 2022–2027 (MT)

11.3 PHARMACEUTICALS

11.3.1 RISING INNOVATION TO DRIVE DEMAND FOR VITAMIN D IN PHARMACEUTICALS INDUSTRY

TABLE 67 PHARMACEUTICALS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 68 PHARMACEUTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 69 PHARMACEUTICALS MARKET, BY REGION, 2019–2021 (MT)

TABLE 70 PHARMACEUTICALS MARKET, BY REGION, 2022–2027 (MT)

11.4 FUNCTIONAL FOOD & BEVERAGES

11.4.1 RISING AWARENESS REGARDING FUNCTIONAL FOOD & BEVERAGES TO CREATE OPPORTUNITIES FOR FOOD FORTIFICATION

TABLE 71 SELECTED FOOD SOURCES OF VITAMIN D BY NATIONAL INSTITUTE OF HEALTH OFFICE OF DIETARY SUPPLEMENTS

TABLE 72 FUNCTIONAL FOOD & BEVERAGES MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 73 FUNCTIONAL FOOD & BEVERAGES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 FUNCTIONAL FOOD & BEVERAGES MARKET, BY REGION, 2019–2021 (MT)

TABLE 75 FUNCTIONAL FOOD & BEVERAGES MARKET, BY REGION, 2022–2027 (MT)

11.5 PERSONAL CARE

11.5.1 INCREASING SKIN PROBLEMS AMONG CONSUMERS TO DRIVE DEMAND FOR VITAMIN D IN COSMETICS INDUSTRY

TABLE 76 PERSONAL CARE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 77 PERSONAL CARE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 78 PERSONAL CARE MARKET, BY REGION, 2019–2021 (MT)

TABLE 79 PERSONAL CARE MARKET, BY REGION, 2022–2027 (MT)

12 VITAMIN D MARKET, BY END USER (Page No. - 125)

12.1 INTRODUCTION

FIGURE 33 ADULTS SEGMENT TO LEAD MARKET, BY END USER, DURING FORECAST PERIOD

TABLE 80 VITAMIN D MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 81 MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 82 MARKET, BY END USER, 2019–2021 (MT)

TABLE 83 MARKET, BY END USER, 2022–2027 (MT)

12.2 ADULTS

12.2.1 VITAMIN D DEFICIENCY TO INCREASE CASES OF OSTEOMALACIA, OSTEOPENIA, AND OSTEOPOROSIS

TABLE 84 ADULTS: VITAMIN D MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 85 ADULTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 86 ADULTS: MARKET, BY REGION, 2019–2021 (MT)

TABLE 87 ADULTS: MARKET, BY REGION, 2022–2027 (MT)

12.3 PREGNANT WOMEN

12.3.1 CONSUMPTION OF HEALTH SUPPLEMENTS CONTAINING VITAMIN D BY PREGNANT WOMEN TO DRIVE MARKET

TABLE 88 PREGNANT WOMEN: VITAMIN D MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 89 PREGNANT WOMEN: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 90 PREGNANT WOMEN: MARKET, BY REGION, 2019–2021 (MT)

TABLE 91 PREGNANT WOMEN: VITAMIN D MARKET, BY REGION, 2022–2027 (MT)

12.4 CHILDREN

12.4.1 VITAMIN D DEFICIENCY IN CHILDREN TO INCREASE CASES OF RICKETS

TABLE 92 CHILDREN: VITAMIN D MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 93 CHILDREN: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 94 CHILDREN: MARKET, BY REGION, 2019–2021 (MT)

TABLE 95 CHILDREN: MARKET, BY REGION, 2022–2027 (MT)

13 VITAMIN D MARKET, BY REGION (Page No. - 133)

13.1 INTRODUCTION

FIGURE 34 INDIA TO BE FASTEST-GROWING SUBREGIONAL MARKET

TABLE 96 VITAMIN D MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 97 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 98 MARKET, BY REGION, 2019–2021 (MT)

TABLE 99 MARKET, BY REGION, 2022–2027 (MT)

13.2 NORTH AMERICA

TABLE 100 NORTH AMERICA: VITAMIN D MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (MT)

TABLE 103 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (MT)

TABLE 104 NORTH AMERICA: MARKET, BY ANALOG, 2019–2021 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET, BY ANALOG, 2022–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET, BY ANALOG, 2019–2021 (MT)

TABLE 107 NORTH AMERICA: MARKET, BY ANALOG, 2022–2027 (MT)

TABLE 108 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019–2021 (USD MILLION)

TABLE 111 NORTH AMERICA: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022–2027 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 113 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (MT)

TABLE 114 NORTH AMERICA: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019–2021 (MT)

TABLE 115 NORTH AMERICA: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022–2027 (MT)

TABLE 116 NORTH AMERICA: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET, BY END USER, 2019–2021 (MT)

TABLE 119 NORTH AMERICA: MARKET, BY END USER, 2022–2027 (MT)

TABLE 120 NORTH AMERICA: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET, BY FORM, 2019–2021 (MT)

TABLE 123 NORTH AMERICA: MARKET, BY FORM, 2022–2027 (MT)

TABLE 124 NORTH AMERICA: MARKET, BY IU STRENGTH, 2019–2021 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET, BY IU STRENGTH, 2022–2027 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET, BY IU STRENGTH, 2019–2021 (MT)

TABLE 127 NORTH AMERICA: VITAMIN D MARKET, BY IU STRENGTH, 2022–2027 (MT)

13.2.1 US

13.2.1.1 US to be largest driver for vitamin D market in North America

TABLE 128 US: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 129 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 130 US: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 131 US: MARKET, BY APPLICATION, 2022–2027 (MT)

13.2.2 CANADA

13.2.2.1 Increasing awareness regarding health & wellness among consumers to drive market

TABLE 132 CANADA: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 133 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 134 CANADA: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 135 CANADA: MARKET, BY APPLICATION, 2022–2027 (MT)

13.2.3 MEXICO

13.2.3.1 Rising prevalence of bone and joint diseases to boost market

TABLE 136 MEXICO: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 137 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 138 MEXICO: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 139 MEXICO: MARKET, BY APPLICATION, 2022–2027 (MT)

13.3 EUROPE

TABLE 140 EUROPE: VITAMIN D MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 141 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 142 EUROPE: MARKET, BY COUNTRY, 2019–2021 (MT)

TABLE 143 EUROPE: MARKET, BY COUNTRY, 2022–2027 (MT)

TABLE 144 EUROPE: MARKET, BY ANALOG, 2019–2021 (USD MILLION)

TABLE 145 EUROPE: MARKET, BY ANALOG, 2022–2027 (USD MILLION)

TABLE 146 EUROPE: MARKET, BY ANALOG, 2019–2021 (MT)

TABLE 147 EUROPE: MARKET, BY ANALOG, 2022–2027 (MT)

TABLE 148 EUROPE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 149 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 150 EUROPE: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019–2021 (USD MILLION)

TABLE 151 EUROPE: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022–2027 (USD MILLION)

TABLE 152 EUROPE: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 153 EUROPE: MARKET, BY APPLICATION, 2022–2027 (MT)

TABLE 154 EUROPE: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019–2021 (MT)

TABLE 155 EUROPE: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022–2027 (MT)

TABLE 156 EUROPE: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 157 EUROPE: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 158 EUROPE: MARKET, BY END USER, 2019–2021 (MT)

TABLE 159 EUROPE: MARKET, BY END USER, 2022–2027 (MT)

TABLE 160 EUROPE: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 161 EUROPE: VITAMIN D MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 162 EUROPE: MARKET, BY FORM, 2019–2021 (MT)

TABLE 163 EUROPE: MARKET, BY FORM, 2022–2027 (MT)

TABLE 164 EUROPE: MARKET, BY IU STRENGTH, 2019–2021 (USD MILLION)

TABLE 165 EUROPE: MARKET, BY IU STRENGTH, 2022–2027 (USD MILLION)

TABLE 166 EUROPE: MARKET, BY IU STRENGTH, 2019–2021 (MT)

TABLE 167 EUROPE: VITAMIN D MARKET, BY IU STRENGTH, 2022–2027 (MT)

13.3.1 GERMANY

13.3.1.1 Increasing concern regarding fitness and health of immunity system to drive vitamin D market

TABLE 168 GERMANY: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 169 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 170 GERMANY: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 171 GERMANY: MARKET, BY APPLICATION, 2022–2027 (MT)

13.3.2 FRANCE

13.3.2.1 Increasing consumer interest in functional foods and rising geriatric population to drive vitamin D market

TABLE 172 FRANCE: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 173 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 174 FRANCE: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 175 FRANCE: MARKET, BY APPLICATION, 2022–2027 (MT)

13.3.3 UK

13.3.3.1 Consumer demand for healthier and functional foods to boost vitamin D market

TABLE 176 UK: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 177 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 178 UK: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 179 UK: MARKET, BY APPLICATION, 2022–2027 (MT)

13.3.4 ITALY

13.3.4.1 Scientific experiments, aging population, and changing lifestyles to drive vitamin D market

TABLE 180 ITALY: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 181 ITALY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 182 ITALY: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 183 ITALY: MARKET, BY APPLICATION, 2022–2027 (MT)

13.3.5 SPAIN

13.3.5.1 Rising demand for food supplements and nutraceuticals to drive vitamin D market

TABLE 184 SPAIN: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 185 SPAIN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 186 SPAIN: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 187 SPAIN: MARKET, BY APPLICATION, 2022–2027 (MT)

13.3.6 NETHERLANDS

13.3.6.1 Usage of vitamin D in feed and pet food industries to be major driver for vitamin D market

TABLE 188 NETHERLANDS: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 189 NETHERLANDS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 190 NETHERLANDS: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 191 NETHERLANDS: MARKET, BY APPLICATION, 2022–2027 (MT)

13.3.7 REST OF EUROPE

TABLE 192 REST OF EUROPE: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 193 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 194 REST OF EUROPE: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 195 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (MT)

13.4 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 196 ASIA PACIFIC: VITAMIN D MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 197 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 198 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (MT)

TABLE 199 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (MT)

TABLE 200 ASIA PACIFIC: MARKET, BY ANALOG, 2019–2021 (USD MILLION)

TABLE 201 ASIA PACIFIC: MARKET, BY ANALOG, 2022–2027 (USD MILLION)

TABLE 202 ASIA PACIFIC: MARKET, BY ANALOG, 2019–2021 (MT)

TABLE 203 ASIA PACIFIC: MARKET, BY ANALOG, 2022–2027 (MT)

TABLE 204 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 205 ASIA PACIFIC: VITAMIN D MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 206 ASIA PACIFIC: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019–2021 (USD MILLION)

TABLE 207 ASIA PACIFIC: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022–2027 (USD MILLION)

TABLE 208 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 209 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (MT)

TABLE 210 ASIA PACIFIC: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019–2021 (MT)

TABLE 211 ASIA PACIFIC: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022–2027 (MT)

TABLE 212 ASIA PACIFIC: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 213 ASIA PACIFIC: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 214 ASIA PACIFIC: MARKET, BY END USER, 2019–2021 (MT)

TABLE 215 ASIA PACIFIC: MARKET, BY END USER, 2022–2027 (MT)

TABLE 216 ASIA PACIFIC: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 217 ASIA PACIFIC: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 218 ASIA PACIFIC: VITAMIN D MARKET, BY FORM, 2019–2021 (MT)

TABLE 219 ASIA PACIFIC: VITAMIN D MARKET, BY FORM, 2022–2027 (MT)

TABLE 220 ASIA PACIFIC: MARKET, BY IU STRENGTH, 2019–2021 (USD MILLION)

TABLE 221 ASIA PACIFIC: MARKET, BY IU STRENGTH, 2022–2027 (USD MILLION)

TABLE 222 ASIA PACIFIC: MARKET, BY IU STRENGTH, 2019–2021 (MT)

TABLE 223 ASIA PACIFIC: VITAMIN D MARKET, BY IU STRENGTH, 2022–2027 (MT)

13.4.1 CHINA

13.4.1.1 China to lead vitamin D market in pharmaceutical, food & beverages, and feed additives industry

TABLE 224 CHINA: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 225 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 226 CHINA: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 227 CHINA: MARKET, BY APPLICATION, 2022–2027 (MT)

13.4.2 INDIA

13.4.2.1 Vitamin D deficiency in Indian population to create new opportunities for vitamin D manufacturers

TABLE 228 INDIA: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 229 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 230 INDIA: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 231 INDIA: MARKET, BY APPLICATION, 2022–2027 (MT)

13.4.3 JAPAN

13.4.3.1 Japanese personal care industry to fuel vitamin D market growth

TABLE 232 JAPAN: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 233 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 234 JAPAN: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 235 JAPAN: MARKET, BY APPLICATION, 2022–2027 (MT)

13.4.4 REST OF ASIA PACIFIC

TABLE 236 REST OF ASIA PACIFIC: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 237 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 238 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 239 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (MT)

13.5 SOUTH AMERICA

FIGURE 36 SOUTH AMERICA: MARKET SNAPSHOT

TABLE 240 SOUTH AMERICA: VITAMIN D MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 241 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 242 SOUTH AMERICA: VITAMIN D MARKET, BY COUNTRY, 2019–2021 (MT)

TABLE 243 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (MT)

TABLE 244 SOUTH AMERICA: MARKET, BY ANALOG, 2019–2021 (USD MILLION)

TABLE 245 SOUTH AMERICA: MARKET, BY ANALOG, 2022–2027 (USD MILLION)

TABLE 246 SOUTH AMERICA: MARKET, BY ANALOG, 2019–2021 (MT)

TABLE 247 SOUTH AMERICA: MARKET, BY ANALOG, 2022–2027 (MT)

TABLE 248 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 249 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 250 SOUTH AMERICA: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019–2021 (USD MILLION)

TABLE 251 SOUTH AMERICA: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022–2027 (USD MILLION)

TABLE 252 SOUTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 253 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (MT)

TABLE 254 SOUTH AMERICA: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019–2021 (MT)

TABLE 255 SOUTH AMERICA: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022–2027 (MT)

TABLE 256 SOUTH AMERICA: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 257 SOUTH AMERICA: VITAMIN D MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 258 SOUTH AMERICA: MARKET, BY END USER, 2019–2021 (MT)

TABLE 259 SOUTH AMERICA: MARKET, BY END USER, 2022–2027 (MT)

TABLE 260 SOUTH AMERICA: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 261 SOUTH AMERICA: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 262 SOUTH AMERICA: MARKET, BY FORM, 2019–2021 (MT)

TABLE 263 SOUTH AMERICA: MARKET, BY FORM, 2022–2027 (MT)

TABLE 264 SOUTH AMERICA: MARKET, BY IU STRENGTH, 2019–2021 (USD MILLION)

TABLE 265 SOUTH AMERICA: VITAMIN D MARKET, BY IU STRENGTH, 2022–2027 (USD MILLION)

TABLE 266 SOUTH AMERICA: MARKET, BY IU STRENGTH, 2019–2021 (MT)

TABLE 267 SOUTH AMERICA: MARKET, BY IU STRENGTH, 2022–2027 (MT)

13.5.1 BRAZIL

13.5.1.1 Health problems regarding vitamin D deficiency to dominate market

TABLE 268 BRAZIL: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 269 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 270 BRAZIL: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 271 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (MT)

13.5.2 ARGENTINA

13.5.2.1 Increase in diseases, such as osteopenia and osteoporosis, to drive demand for vitamin D

TABLE 272 ARGENTINA: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 273 ARGENTINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 274 ARGENTINA: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 275 ARGENTINA: MARKET, BY APPLICATION, 2022–2027 (MT)

13.5.3 REST OF SOUTH AMERICA

TABLE 276 REST OF SOUTH AMERICA: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 277 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 278 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 279 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (MT)

13.6 REST OF THE WORLD

TABLE 280 REST OF THE WORLD: VITAMIN D MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 281 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 282 REST OF THE WORLD: MARKET, BY COUNTRY, 2019–2021 (MT)

TABLE 283 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (MT)

TABLE 284 REST OF THE WORLD: MARKET, BY ANALOG, 2019–2021 (USD MILLION)

TABLE 285 REST OF THE WORLD: MARKET, BY ANALOG, 2022–2027 (USD MILLION)

TABLE 286 REST OF THE WORLD: MARKET, BY ANALOG, 2019–2021 (MT)

TABLE 287 REST OF THE WORLD: VITAMIN D MARKET, BY ANALOG, 2022–2027 (MT)

TABLE 288 REST OF THE WORLD: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 289 REST OF THE WORLD: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 290 REST OF THE WORLD: VITAMIN D MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019–2021 (USD MILLION)

TABLE 291 REST OF THE WORLD: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022–2027 (USD MILLION)

TABLE 292 REST OF THE WORLD: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 293 REST OF THE WORLD: MARKET, BY APPLICATION, 2022–2027 (MT)

TABLE 294 REST OF THE WORLD: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2019–2021 (MT)

TABLE 295 REST OF THE WORLD: MARKET, BY FEED & PET FOOD SUB-APPLICATION, 2022–2027 (MT)

TABLE 296 REST OF THE WORLD: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 297 REST OF THE WORLD: VITAMIN D MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 298 REST OF THE WORLD: MARKET, BY END USER, 2019–2021 (MT)

TABLE 299 REST OF THE WORLD: VITAMIN D MARKET, BY END USER, 2022–2027 (MT)

TABLE 300 REST OF THE WORLD: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 301 REST OF THE WORLD: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 302 REST OF THE WORLD: MARKET, BY FORM, 2019–2021 (MT)

TABLE 303 REST OF THE WORLD: MARKET, BY FORM, 2022–2027 (MT)

TABLE 304 REST OF THE WORLD: MARKET, BY IU STRENGTH, 2019–2021 (USD MILLION)

TABLE 305 REST OF THE WORLD: MARKET, BY IU STRENGTH, 2022–2027 (USD MILLION)

TABLE 306 REST OF THE WORLD: MARKET, BY IU STRENGTH, 2019–2021 (MT)

TABLE 307 REST OF THE WORLD: VITAMIN D MARKET, BY IU STRENGTH, 2022–2027 (MT)

13.6.1 SOUTH AFRICA

13.6.1.1 Functional food and healthcare products to drive demand for vitamin D

TABLE 308 SOUTH AFRICA: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 309 SOUTH AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 310 SOUTH AFRICA: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 311 SOUTH AFRICA: MARKET, BY APPLICATION, 2022–2027 (MT)

13.6.2 MIDDLE EAST

13.6.2.1 Highest rate of rickets to create demand for vitamin D

TABLE 312 MIDDLE EAST: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 313 MIDDLE EAST: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 314 MIDDLE EAST: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 315 MIDDLE EAST: MARKET, BY APPLICATION, 2022–2027 (MT)

13.6.3 REST OF AFRICA

TABLE 316 REST OF AFRICA: VITAMIN D MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 317 REST OF AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 318 REST OF AFRICA: MARKET, BY APPLICATION, 2019–2021 (MT)

TABLE 319 REST OF AFRICA: MARKET, BY APPLICATION, 2022–2027 (MT)

14 COMPETITIVE LANDSCAPE (Page No. - 212)

14.1 OVERVIEW

14.2 MARKET SHARE ANALYSIS, 2021

TABLE 320 VITAMIN D MARKET SHARE ANALYSIS, 2021

14.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 37 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2017–2021 (USD BILLION)

14.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

14.4.1 STARS

14.4.2 PERVASIVE PLAYERS

14.4.3 EMERGING LEADERS

14.4.4 PARTICIPANTS

FIGURE 38 VITAMIN D MARKET, COMPANY EVALUATION QUADRANT, 2021

14.4.5 VITAMIN D PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 321 VITAMIN D BY ANALOG FOOTPRINT

TABLE 322 VITAMIN D BY APPLICATION FOOTPRINT

TABLE 323 VITAMIN D FOOTPRINT BY FORM SEGMENT

TABLE 324 VITAMIN D FOOTPRINT BY END USER SEGMENT

TABLE 325 COMPANY REGIONAL FOOTPRINT

TABLE 326 OVERALL COMPANY FOOTPRINT

14.5 VITAMIN D MARKET, OTHER PLAYERS EVALUATION QUADRANT, 2021

14.5.1 PROGRESSIVE COMPANIES

14.5.2 STARTING BLOCKS

14.5.3 RESPONSIVE COMPANIES

14.5.4 DYNAMIC COMPANIES

FIGURE 39 VITAMIN D MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

TABLE 327 VITAMIN D: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

14.6 COMPETITIVE SCENARIO

14.6.1 DEALS

TABLE 328 VITAMIN D MARKET: DEALS, 2019–2022

14.6.2 OTHERS

TABLE 329 VITAMIN D MARKET: OTHERS, 2019–2022

15 COMPANY PROFILES (Page No. - 225)

15.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

15.1.1 DSM

TABLE 330 DSM: BUSINESS OVERVIEW

FIGURE 40 DSM: COMPANY SNAPSHOT

TABLE 331 DSM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 332 DSM: DEALS

15.1.2 BASF SE

TABLE 333 BASF SE: BUSINESS OVERVIEW

FIGURE 41 BASF SE: COMPANY SNAPSHOT

TABLE 334 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.3 FERMENTA BIOTECH LIMITED

TABLE 335 FERMENTA BIOTECH LIMITED: BUSINESS OVERVIEW

FIGURE 42 FERMENTA BIOTECH LIMITED: COMPANY SNAPSHOT

TABLE 336 FERMENTA BIOTECH LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.4 ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD

TABLE 337 ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD: BUSINESS OVERVIEW

TABLE 338 ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.5 DISHMAN GROUP

TABLE 339 DISHMAN GROUP: BUSINESS OVERVIEW

FIGURE 43 FERMENTA BIOTECH LIMITED: COMPANY SNAPSHOT

TABLE 340 DISHMAN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.6 TAIZHOU HAISHENG PHARMACEUTICALS CO., LTD.

TABLE 341 TAIZHOU HAISHENG PHARMACEUTICALS CO., LTD.: BUSINESS OVERVIEW

TABLE 342 TAIZHOU HAISHENG PHARMACEUTICALS CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

15.1.7 ZHEJIANG MEDICINE CO., LTD.

TABLE 343 ZHEJIANG MEDICINE CO., LTD.: BUSINESS OVERVIEW

TABLE 344 ZHEJIANG MEDICINE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.8 PHW GROUP

TABLE 345 PHW GROUP: BUSINESS OVERVIEW

TABLE 346 PHW GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.9 BIO-TECH PHARMACAL

TABLE 347 BIO-TECH PHARMACAL: BUSINESS OVERVIEW

TABLE 348 BIO-TECH PHARMACAL: PRODUCTS OFFERED

15.1.10 DIVI’S NUTRACEUTICALS

TABLE 349 DIVI’S NUTRACEUTICALS: BUSINESS OVERVIEW

TABLE 350 DIVI’S NUTRACEUTICALS: PRODUCTS OFFERED

15.1.11 SYNTHESIA, A.S.

TABLE 351 SYNTHESIA, A.S.: BUSINESS OVERVIEW

TABLE 352 SYNTHESIA, A.S.: PRODUCTS OFFERED

15.1.12 HANGZHOU THINK CHEMICAL CO LTD

TABLE 353 HANGZHOU THINK CHEMICAL CO LTD: BUSINESS OVERVIEW

TABLE 354 HANGZHOU THINK CHEMICAL CO LTD: PRODUCTS OFFERED

15.1.13 KINGDOMWAY NUTRITION, INC.

TABLE 355 KINGDOMWAY NUTRITION, INC.: BUSINESS OVERVIEW

TABLE 356 KINGDOMWAY NUTRITION, INC.: PRODUCTS OFFERED

15.1.14 MCKINLEY RESOURCES INC.

TABLE 357 MCKINLEY RESOURCES INC.: BUSINESS OVERVIEW

TABLE 358 MCKINLEY RESOURCES INC.: PRODUCTS OFFERED

15.1.15 NEWGEN PHARMA

TABLE 359 NEWGEN PHARMA: BUSINESS OVERVIEW

TABLE 360 NEWGEN PHARMA: PRODUCTS OFFERED

15.1.16 TAI ZHOU HISOUND PHARMACEUTICALS CO., LTD

TABLE 361 TAI ZHOU HISOUND PHARMACEUTICALS CO., LTD: BUSINESS OVERVIEW

TABLE 362 TAI ZHOU HISOUND PHARMACEUTICALS CO., LTD: PRODUCTS OFFERED

15.1.17 PHARMAVIT

TABLE 363 PHARMAVIT: BUSINESS OVERVIEW

TABLE 364 PHARMAVIT: PRODUCTS OFFERED

15.1.18 LYCORED

TABLE 365 LYCORED: BUSINESS OVERVIEW

TABLE 366 LYCORED: PRODUCTS OFFERED

15.1.19 STABICOAT VITAMINS

TABLE 367 STABICOAT VITAMINS: BUSINESS OVERVIEW

TABLE 368 STABICOAT VITAMINS: PRODUCTS OFFERED

15.1.20 STERNVITAMIN GMBH & CO. KG

TABLE 369 STERNVITAMIN GMBH & CO. KG: BUSINESS OVERVIEW

TABLE 370 STERNVITAMIN GMBH & CO. KG: PRODUCTS OFFERED

15.1.21 FARBEST-TALLMAN FOODS CORPORATION

TABLE 371 FARBEST-TALLMAN FOODS CORPORATION: BUSINESS OVERVIEW

TABLE 372 FARBEST-TALLMAN FOODS CORPORATION: PRODUCTS OFFERED

15.1.22 RABAR ANIMAL NUTRITION

TABLE 373 RABAR ANIMAL NUTRITION: BUSINESS OVERVIEW

TABLE 374 RABAR ANIMAL NUTRITION: PRODUCTS OFFERED

15.1.23 ADISSEO

TABLE 375 ADISSEO: BUSINESS OVERVIEW

TABLE 376 ADISSEO: PRODUCTS OFFERED

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS (Page No. - 262)

16.1 INTRODUCTION

TABLE 377 MARKETS ADJACENT TO VITAMIN D MARKET

16.2 LIMITATIONS

16.3 VITAMINS MARKET

16.3.1 MARKET DEFINITION

16.3.2 MARKET OVERVIEW

TABLE 378 VITAMINS MARKET, BY TYPE, 2016–2023 (USD MILLION)

TABLE 379 VITAMINS MARKET, BY TYPE, 2016–2023 (KT)

16.4 FEED ADDITIVES MARKET

16.4.1 MARKET DEFINITION

16.4.2 MARKET OVERVIEW

TABLE 380 FEED ADDITIVES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 381 FEED ADDITIVES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 382 FEED ADDITIVES MARKET, BY TYPE, 2017–2020 (USD KT)

TABLE 383 FEED ADDITIVES MARKET, BY TYPE, 2021–2026 (KT)

17 APPENDIX (Page No. - 268)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 CUSTOMIZATION OPTIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

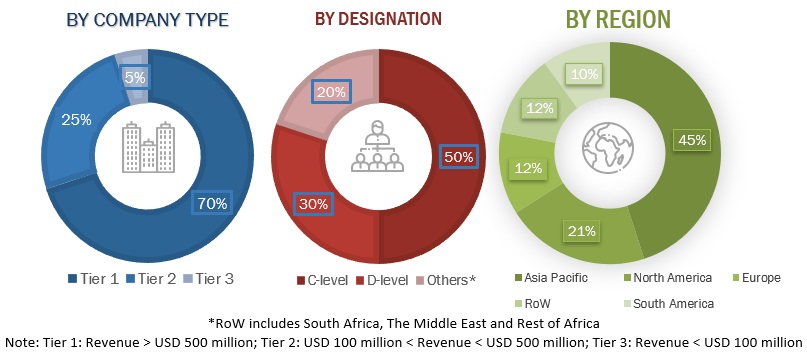

The study involved four major activities in estimating the vitamin D market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both demand-side and supply-side approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as the Food and Agriculture Organization (FAO), Food and Drug Administration (FDA), European Food Safety Authority (EFSA), United States Department of Agriculture (USDA), Food Safety and Standards Authority of India (FSSAI), Food Standards Agency, Agency for Healthcare Research and Quality (AHRQ), were referred to identify and collect information for this study. These secondary sources included annual reports, web releases and investor presentations of companies, news articles, journals, and paid databases.

Primary Research

The market comprises several stakeholders, such as pharmaceutical & nutraceuticals manufacturers, regulatory bodies, government agencies and NGOs, food & beverage manufacturers/suppliers, end users, food safety agencies and feed manufacturers and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of pharmaceutical industries, feed and pet food manufacturing industries, functional food and beverage industries, and personal care industries. The supply side is characterized by the presence of vitamin D manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the vitamin D market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the vitamin D market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To define, segment, and project the global market size for the vitamin D market based on application, analog, end user, form, IU type and regions over a historical period ranging from 2019 to 2021 and a forecast period ranging from 2022 to 2027

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to five regions (along with their respective key countries): North America, Europe, Asia Pacific, South America, and the Rest of the World

- To strategically profile the key players and comprehensively analyze their core competencies

- To analyze competitive developments, such as expansions, mergers & acquisitions, and new product launches in the vitamin D market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

-

Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific vitamin D market, by key country

- Further breakdown of the Rest of the European vitamin D market, by key country

- Further breakdown of the Rest of South America vitamin D market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Vitamin D Market