Vitamin and Mineral Premixes Market by Type (Vitamins, Minerals, Vitamin & Mineral Combinations), Application (Food & Beverages, Feed, Healthcare, and Cosmetics & Personal Care), Form (Dry and Liquid), Functionality and Region - Global Forecast to 2027

Vitamin and Mineral Premixes Market Size

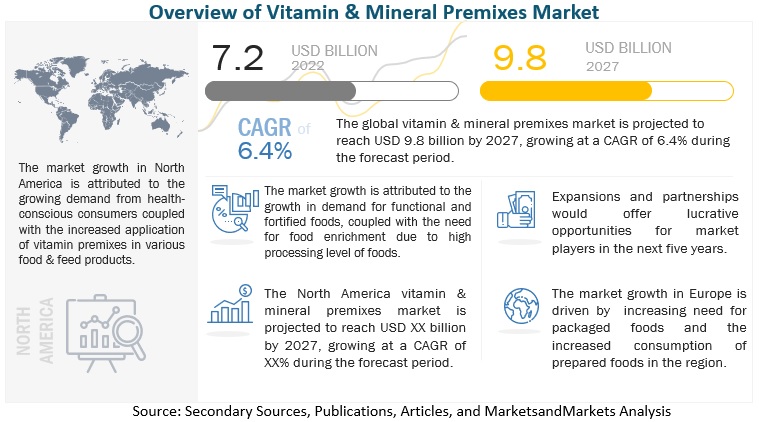

The global vitamin and mineral premixes market is estimated to be valued at USD 7.2 billion in 2022. It is projected to reach USD 9.8 billion by 2027, at a CAGR of 6.4%, in terms of value, between 2022 and 2027. Vitamin & mineral premixes have become crucial ingredients in pet food. They are used to enhance pet food's nutritional content and meet its nutritional requirements. In addition, with the advent of the pandemic, consumers across the globe have become more conscious about their health and have started taking several nutritional supplements. These trends are anticipated to boost the demand for vitamin & mineral premixes over the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Vitamin and Mineral Premixes Market Dynamics

Drivers: Growth in compound feed consumption

According to the FAO Food Outlook, global meat production was estimated to be 311.8 million tonnes in 2014, with a year-on-year growth of 1.1%, due to increased meat consumption. To meet the increasing demand for meat products and as a control measure to reduce transportation and management costs, farmers opted to utilize complete feeds to prepare animal feeds. The rise in the prices of feed ingredients, such as wheat, corn, and soybean, has increased the operational costs of farm activities for livestock farmers. Also, the increased consumption of compound feeds for farm animals' growth and development has enabled feed premixes' growth. On-farm feeds using vitamin and mineral premixes are prepared by farmers to provide balanced feed to animals. The usage of feed premixes has also been prompted by the widening quality norms for exported livestock products and increasing awareness among consumers of healthy foods.

Restraints: Higher costs of fortified and enriched products

The price of fortified and enriched products with respect to non-fortified products is substantially higher. This aspect, coupled with the consumer’s unwillingness to pay a high amount for highly fortified and enriched products, is a restraining factor, especially for developing economies. The intensity of the factor has further increased in countries with a large population living below the poverty line. These people should be exposed to fortified products to deal with malnutrition issues.

Opportunities: Developing countries to emerge as strong consumers in feed application

Asia Pacific and South America account for a significant share of the vitamin & mineral premixes market. People in countries, such as India, China, Indonesia, Vietnam, and Thailand, are expected to consume meat at an annual rate of 2.4% till 2030, according to the FAO report on “World Agriculture: Towards 2015/2030”. This has increased the demand for high-quality feed concentrates and premixes. The key players in the premixes market have sensed this opportunity to start premix production plants in these regions, to meet the growing demand for feed premixes.

In the South American region, Brazil housed the largest cattle population in 2013, with a head count of 211 million. According to the FAO, it is expected to grow at a rate well above the regional average. The rising consumer awareness for nutritious products and the requirement for export quality meat products can establish a strong demand for feed premixes in this region.

Challenges: Inaccurate labeling of food products

Nutritional benefits associated with consuming food products are used as a marketing tool by most food manufacturers to drive their sales revenues. However, in some cases, manufacturers make nutritional claims regarding the content of micronutrients in the food product, which may not be true, giving rise to false claims and doubts about product authenticity. To deal with such malpractices, regional and country-level food authorities strictly emphasize adhering to food labeling laws by food manufacturers, wherein periodical quality testing of food products is conducted to cross-confirm the claims made by the food manufacturer by verifying the level of nutrients present in the product with that indicated on the product label. Penalties are imposed on those identified for non-adherence or false claims.

Thus, to deal with such instances, food manufacturers, especially those offering processed food products with a long shelf-life, are focusing on adding higher nutrient content than the amount mentioned on labels to maintain or match the content of micronutrients mentioned on the product label throughout the shelf-life of the product.

By type, vitamin & mineral combination segment expected to achieve fastest growth during forecast period

The popularity of vitamin & mineral premixes, compared to individually manufactured vitamin premixes and mineral premixes, can be attributed to the increased consumer preference for blends of different functional ingredients to attain optimum health. Also, one of the factors fueling the growth of this market is the occurrences/prevalence of vitamin & mineral deficiencies and anemia in developing countries. Leading manufacturers are tapping this opportunity and addressing malnutrition by introducing vitamin and mineral premixes blends for various applications.

By form, dry form expected to account for largest share during forecast period

Vitamin & mineral premixes are widely used in the powdered form, as they are more stable than the liquid form. The convenient packaging of powdered premixes reduces complexities in supply chain processes, resulting in the increased popularity of this form. Powdered premixes are used across an extensive range of feed and food applications, such as low-fat milk powders, bakery products, health drink powders, soup mixes, and dessert mixes. Vitamin & mineral premixes are used by pharmaceutical and personal care companies in their powder form to manufacture tablets, capsules, toothpaste, face powders, lipsticks, and creams.

By application, food & beverage segment expected to achieve fastest growth over forecast period

The scope of the food & beverages sector includes bakery products, beverages, dairy products, cereals, and others. In the present scenario, with busy lifestyles and high exposure to processed foods, it is difficult to maintain the ideal levels of vitamin & mineral intake daily. Lower intake of such essential nutrients has negatively impacted the population's health and well-being. In such cases, food & beverage products fortified with essential nutrient premixes, such as vitamins & minerals, play an important role in convenience and exposure to ideal levels of essential nutrients.

To know about the assumptions considered for the study, download the pdf brochure

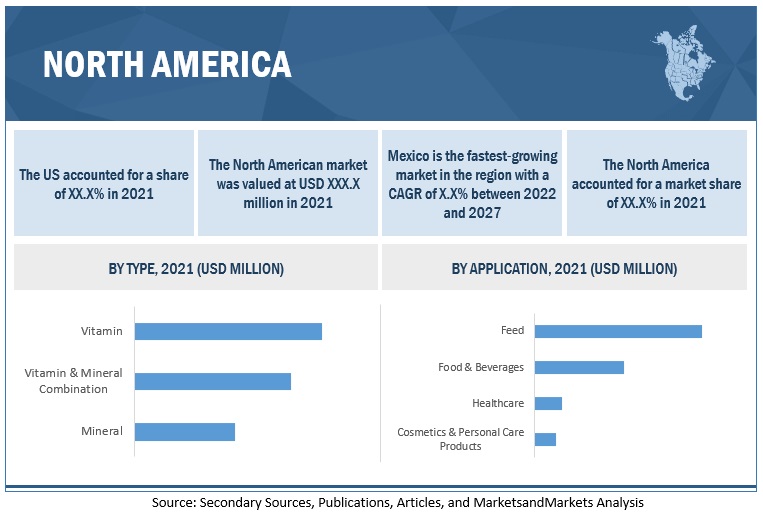

North America is the largest market for vitamin and mineral premixes globally. For this study, the region has been segmented into the US, Canada, and Mexico. The North American market is largely driven by the increase in demand for healthy foods and functional foods & beverages, owing to the low level of exposure to essential nutrients caused by high consumption of processed & convenience foods due to their busy lifestyles. The rise in obesity, heart diseases, and other health issues has led to the demand for high-nutrition dietary products. Vitamin & mineral premixes have been finding their way into new product applications, such as cereal-based products, dairy products, nutritional foods, beverages, infant formulas, and dietary supplements.

Key Market Players:

Key players in this market include DSM (Netherlands), Corbion (Netherlands), Glanbia plc (Ireland), Vitablend Nederland BV (Netherlands), SternVitamin GmbH & Co. KG (Germany), Wright Enrichment Inc. (US), Zagro (Singapore), Nutreco (Netherlands), Farbest-Tallman Foods Corporation (US), Burkmann Industries, Inc. (US), Bar – Magen LTD (Israel), BASF SE (Germany), ADM (US), Innov Ad NV/SA (Belgium), Jubilant Ingrevia Limited (India), IDENA (France), Spansules Pharmatech Pvt. Ltd. (India), Amesi Group (South Africa), SA Premix (South Africa), YesSinergy (Brazil), Phibro Animal Health Corporation (US), DLG (Denmark), Gk Biochemical Corporation (India), Advanced Animal Nutrition Pty Ltd. (Australia), and Credence Remedies Pvt. Ltd. (India).

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 7.2 billion |

|

Revenue forecast in 2027 |

USD 9.8 billion |

|

Growth Rate |

CAGR of 6.4% from 2022 to 2027 |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Type, Form, Application, Ffunctionality, and Region |

|

Growth Drivers |

|

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Key Companies Profiled |

|

Vitamin and Mineral Premixes Market Report Segmentation:

This research report categorizes the vitamin and mineral premixes market based on type, form, application, functionality, and region

By type

- Vitamin & mineral combination

- Vitamin

- Mineral

By form

- Dry

- Liquid

By application

-

Food & beverages

- Bakery Products

- Beverages

- Dairy Products

- Cereals

- Other Food Applications (soups, snacks, and convenience foods)

-

Healthcare

- Nutritional Products

- Dietary Supplements

- Feed

- Cosmetics & personal care products

By functionality (Qualitative)

- Bone health

- Skin health

- Energy

- Immunity

- Digestion

- Other functionalities

By Region:

- North America

- Europe

- Asia Pacific

- South America

-

RoW

- Middle East

- Africa

Target Audience:

- Key companies engaged in vitamin & mineral premixes processing

- Key manufacturers of vitamin & mineral premixes

- Traders, distributors, and suppliers in the vitamin & mineral premixes market

- Traders and suppliers of raw materials to the vitamin & mineral premixes industry

- Livestock farmers

-

Related government authorities, commercial R&D institutions, and other regulatory bodies

- Food and Drugs Organization (FDA)

- European Commission

- European Food Safety Authority (EFSA)

- Food Standards Australia New Zealand (FSANZ)

- Animal Feed Manufacturers Association (AFMA)

Vitamin and Mineral Premixes Market Recent Developments:

- In June 2022, DSM (Netherlands) launched the world’s first bio-based Vitamin A to find extensive applications in cosmetics and personal care products. This aligns with DSM’s vision to make its products carbon-neutral by 2050.

- In September 2021, SternVitamin GmbH & Co. KG (Germany) launched the SternVitality V, which contains vitamins, minerals, and botanicals, and aids in the reduction of fatigue and enhancement of mental performance. This strategic initiative was undertaken to cater to the rising demand for micronutrient premixes.

- In April 2021, Corbion (Netherlands), which produces PURAMEX, a natural lactate mineral for enriching the nutritional content of dairy products, announced the expansion of the production capacity of its lactate minerals. This initiative helps enhance the supply of lactic acid for its customers in the European market.

- In February 2019, Glanbia Plc (Ireland) completed the acquisition of Watson Inc., a US-based manufacturer of high-quality custom nutrient premixes and bakery ingredients for the nutrition, food, and supplement industries. This strategic initiative was undertaken to expand the company’s custom nutrient premix production footprint in the US.

Frequently Asked Questions (FAQ):

Which major applications of vitamin & mineral premixes have been considered in this study. Which segments are expected to have promising growth rates in the future?

All major applications, such as food & beverages, healthcare, feed and, cosmetics & personal care, have been considered in the scope of the study. Feed is currently the dominant segment due to the growing awareness regarding required pet nutrition. This has led to high demand for specialty nutrition and condition-specific pet health formulas, such as vitamin & minerals premixes for feed applications. The food & beverages segment is witnessing the highest growth rate in the application segment, owing to the rising preferences for fortified and functional food & beverage products and the growing level of consumer understanding of nutrition intake and health issues.

I am interested in the North American market for the food & beverages segment. Is customization available for the same? What all information would be included in the same?

Yes, the customization for the North American market for various segments can be provided on various aspects, such as market size, forecast, market trends, company profiles & competitive landscape. Also, exclusive insights on the below-listed countries will be provided:

- US

- Canada

- Mexico

What are the drivers fueling the growth of the vitamin & mineral premixes market?

Global vitamin & mineral premixes market is characterized by the following drivers:

Drivers: Growth in demand for functional and fortified foods

The growth in health-consciousness among consumers due to awareness regarding various diseases, nutritional deficiency, and desire for healthy aging, among other factors, have increased consumer demand for functional and fortified food & beverage products. The increased consumer understanding of nutrition has led to the demand for food products with specific functionalities that will cater to their needs and aid in dealing with heart health, immunity, digestion, weight management, and energy, among other health aspects.

Further, due to busy lifestyles, consumers lack the time and effort required to be invested in home-cooked food and are more inclined toward convenience food products, which are highly processed, resulting in reduced levels of essential nutrient intake for nourishment. To counter these concerns, consumers increasingly prefer functional and fortified foods, owing to the rising demand for vitamin & mineral premix market.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

A detailed explanation of the research methodology can be provided over a scheduled call. It will also enable us to explain all your queries in detail. For a brief overview and knowledge, multiple approaches have been adopted to understand the holistic view of this market. These include,

- Bottom-up approach

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of the below-mentioned players, company profiles provide insights, such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate analyst view on the company. Some of the key players in the market are DSM (Netherlands), Corbion (Netherlands), Glanbia Plc (Ireland), Vitablend Nederland BV (Netherlands), SternVitamin Gmbh & Co. KG (Germany), BASF SE (Germany), ADM (US), Wright Enrichment Inc (US), Zagro (Singapore), and Nutreco (Netherlands).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASE IN RETAIL SALES

-

5.3 VITAMIN & MINERAL PREMIXES MARKET DYNAMICSDRIVERS- Growth in demand for functional and fortified food- Rising need for food enrichment- Increase in compound feed consumption- Growing demand for customized premixes- Rising need for ease of blending nutrientsRESTRAINTS- High costs involved in R&D activities- Customer unwillingness to buy expensive fortified food products- Stringent policies regarding feed fortificationOPPORTUNITIES- Growing consumer inclination toward healthy food- Emergence of emerging economies as major consumers of feedCHALLENGES- Inaccurate labeling of food products- Lack of awareness regarding benefits of premixes

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND DEVELOPMENTRAW MATERIALS AND SOURCINGMANUFACTURINGPACKAGING & STORAGEDISTRIBUTION, SALES, AND MARKETING

-

6.3 TECHNOLOGY ANALYSISULTRASONIC CAVITATION

-

6.4 PRICING ANALYSISAVERAGE SELLING PRICE, BY TYPE, 2020–2022 (USD PER TON)

-

6.5 MARKET MAPPING AND ECOSYSTEM ANALYSISSUPPLY-SIDE ANALYSISDEMAND-SIDE ANALYSIS

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- 6.7 PATENT ANALYSIS

-

6.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT FROM SUBSTITUTESTHREAT FROM NEW ENTRANTS

-

6.9 CASE STUDIESCASE STUDY 1: APEC DESIGNED AUTOMATED PREMIX SYSTEM TO ENABLE PROPER TRACKING AND RECORD KEEPINGCASE STUDY 2: PRISTINE LAUNCHED LACTOVIT FOR MILK FORTIFICATION

- 6.10 KEY CONFERENCES & EVENTS, 2022–2023

- 6.11 TARIFF AND REGULATORY LANDSCAPE

-

6.12 REGULATORY FRAMEWORKREGULATIONS FOR FEED APPLICATIONS- European Union- US- China- Canada- Brazil- Japan- South AfricaREGULATIONS FOR FOOD & BEVERAGE AND HEALTHCARE APPLICATIONS- Dietary Trends- Recommended Nutrient Intake (RNI)- Canada- US- Mexico- European Union- Japan- China- India

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 FOOD & BEVERAGESBAKERY PRODUCTS- Increasing demand for nutrient-rich bakery productsBEVERAGES- Health benefits offered by fortified beveragesDAIRY PRODUCTS- Lack of essential nutrients in dairy productsCEREALS- Rising need to restore nutrients lost due to processingOTHER FOOD APPLICATIONS

-

7.3 HEALTHCARENUTRITIONAL PRODUCTS- Greater need to deal with nutritional deficienciesDIETARY SUPPLEMENTS- Growing need to supplement inadequate diets

-

7.4 FEEDRISING DEMAND FOR FEED INGREDIENTS WITH MULTIFUNCTIONAL HEALTH BENEFITS

-

7.5 COSMETICS & PERSONAL CAREGROWING CONSCIOUSNESS REGARDING PERSONAL GROWTH AND GROOMING

- 8.1 INTRODUCTION

-

8.2 DRYEXTENSIVE INDUSTRIAL APPLICATIONS OF DRY PREMIXES

-

8.3 LIQUIDINCREASE IN ADOPTION OF BEVERAGE FORTIFICATION

- 9.1 INTRODUCTION

-

9.2 BONE HEALTHRISE IN BONE-RELATED DISEASES

-

9.3 SKIN HEALTHINCREASED FOCUS ON WELL-BEING AND OVERALL APPEARANCE

-

9.4 ENERGYRISING INCLINATION TOWARD HEALTH-ORIENTED BEVERAGES

-

9.5 IMMUNITYGROWING DEMAND FOR IMMUNE-BOOSTING PRODUCTS

-

9.6 DIGESTIONSURGE IN GASTROINTESTINAL ISSUES

- 9.7 OTHER FUNCTIONALITIES

- 10.1 INTRODUCTION

-

10.2 VITAMIN & MINERAL COMBINATIONRISING AWARENESS REGARDING HEALTH AND NUTRITION

-

10.3 VITAMINGROWING PET HUMANIZATION

-

10.4 MINERALINCREASING DEMAND FROM FOOD & BEVERAGE INDUSTRY

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAUS- Rising health-consciousnessCANADA- Growing aquaculture industryMEXICO- Large obese population

-

11.3 ASIA PACIFICCHINA- Rising demand for supplements and shift in eating habitsINDIA- Surge in consumption of fortified food productsJAPAN- Growing inclination toward functional food productsAUSTRALIA & NEW ZEALAND- Rising demand for functional beveragesREST OF ASIA PACIFIC

-

11.4 EUROPEUK- Increasing appetite of people for sunshine vitaminGERMANY- Rising demand for healthcare productsFRANCE- Growth in beverage and bakery industriesITALY- Awareness regarding benefits of dietary supplementsSPAIN- Thriving feed industry and efficient supply chainRUSSIA- Rising awareness regarding health and wellnessNETHERLANDS- Inadequate consumption of fruits and vegetablesREST OF EUROPE

-

11.5 SOUTH AMERICABRAZIL- Growing middle-class populationARGENTINA- Surge in demand for dietary supplementsREST OF SOUTH AMERICA

-

11.6 REST OF THE WORLDAFRICA- High consumption of fortified food productsMIDDLE EAST- Rising pet adoption

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 MARKET SHARE ANALYSIS, 2021

- 12.4 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

-

12.5 EVALUATION QUADRANT FOR KEY PLAYERS, 2021STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSVITAMIN & MINERAL PREMIXES MARKET PRODUCT FOOTPRINT

-

12.6 EVALUATION QUADRANT FOR OTHER PLAYERS, 2021PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSDSM- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCORBION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGLANBIA PLC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewVITABLEND NEDERLAND BV- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSTERNVITAMIN GMBH & CO. KG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBASF SE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewADM- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewWRIGHT ENRICHMENT INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewZAGRO- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNUTRECO- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewFARBEST-TALLMAN FOODS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBURKMANN INDUSTRIES, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBAR-MAGEN LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewINNOV AD NV/SA- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewJUBILANT INGREVIA LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM view

-

13.2 OTHER PLAYERSIDENASPANSULES PHARMATECH PVT. LTD.AMESI GROUPSA PREMIXYESSINERGYPHIBRO ANIMAL HEALTH CORPORATIONDLGGK BIOCHEMICAL CORPORATIONADVANCED ANIMAL NUTRITION PTY LTD.CREDENCE REMEDIES PVT. LTD.

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 FEED PREMIX MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.4 FOOD FORTIFYING AGENTS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

- TABLE 2 GLOBAL VITAMIN & MINERAL PREMIXES MARKET SNAPSHOT, 2022 VS. 2027

- TABLE 3 VITAMIN & MINERAL PREMIXES: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD PER TON)

- TABLE 4 VITAMIN & MINERAL COMBINATION: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD PER TON)

- TABLE 5 VITAMIN: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD PER TON)

- TABLE 6 MINERAL: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD PER TON)

- TABLE 7 VITAMIN & MINERAL PREMIXES: AVERAGE SELLING PRICE, BY COMPANY, 2022 (USD PER TON)

- TABLE 8 ECOSYSTEM ANALYSIS

- TABLE 9 PATENTS GRANTED, 2020–2022

- TABLE 10 PORTER’S FIVE FORCES ANALYSIS

- TABLE 11 KEY CONFERENCES & EVENTS, 2022–2023

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 PREVALENCE OF MICRONUTRIENT DEFICIENCY AND RISK FACTORS ASSOCIATED

- TABLE 16 RECOMMENDED NUTRIENT INTAKE FOR SELECTED POPULATION SUBGROUPS (RNIS)

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES

- TABLE 18 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 19 VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 20 VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 21 FOOD & BEVERAGES: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 22 FOOD & BEVERAGES: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 FOOD & BEVERAGES: VITAMIN & MINERAL PREMIXES MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

- TABLE 24 FOOD & BEVERAGES: VITAMIN & MINERAL PREMIXES MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

- TABLE 25 HEALTHCARE: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 26 HEALTHCARE: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 HEALTHCARE: VITAMIN & MINERAL PREMIXES MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

- TABLE 28 HEALTHCARE: VITAMIN & MINERAL PREMIXES MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

- TABLE 29 FEED: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 30 FEED: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 31 COSMETICS & PERSONAL CARE: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 32 COSMETICS & PERSONAL CARE: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2019–2021 (USD MILLION)

- TABLE 34 VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 35 DRY: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 36 DRY: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 LIQUID: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 38 LIQUID: VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 40 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 41 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (KT)

- TABLE 42 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 43 VITAMIN & MINERAL COMBINATION PREMIXES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 44 VITAMIN & MINERAL COMBINATION PREMIXES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 VITAMIN & MINERAL COMBINATION PREMIXES MARKET, BY REGION, 2019–2021 (KT)

- TABLE 46 VITAMIN & MINERAL COMBINATION PREMIXES MARKET, BY REGION, 2022–2027 (KT)

- TABLE 47 VITAMIN PREMIXES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 48 VITAMIN PREMIXES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 VITAMIN PREMIXES MARKET, BY REGION, 2019–2021 (KT)

- TABLE 50 VITAMIN PREMIXES MARKET, BY REGION, 2022–2027 (KT)

- TABLE 51 MINERAL PREMIXES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 52 MINERAL PREMIXES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 53 MINERAL PREMIXES MARKET, BY REGION, 2019–2021 (KT)

- TABLE 54 MINERAL PREMIXES MARKET, BY REGION, 2022–2027 (KT)

- TABLE 55 VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 56 VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 57 VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2019–2021 (KT)

- TABLE 58 VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2022–2027 (KT)

- TABLE 59 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (KT)

- TABLE 64 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 65 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 66 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

- TABLE 68 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

- TABLE 70 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2019–2021 (USD MILLION)

- TABLE 72 NORTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 73 US: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 74 US: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 75 CANADA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 76 CANADA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 77 MEXICO: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 78 MEXICO: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 79 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 80 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 81 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 82 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 83 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (KT)

- TABLE 84 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 85 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 86 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 87 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

- TABLE 88 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

- TABLE 89 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

- TABLE 90 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

- TABLE 91 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2019–2021 (USD MILLION)

- TABLE 92 ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 93 CHINA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 94 CHINA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 95 INDIA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 96 INDIA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 97 JAPAN: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 98 JAPAN: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 99 AUSTRALIA & NEW ZEALAND: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 100 AUSTRALIA & NEW ZEALAND: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 101 REST OF ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 103 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 104 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 105 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 106 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 107 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (KT)

- TABLE 108 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 109 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 110 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 111 EUROPE: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

- TABLE 112 EUROPE: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

- TABLE 113 EUROPE: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

- TABLE 114 EUROPE: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

- TABLE 115 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2019–2021 (USD MILLION)

- TABLE 116 EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 117 UK: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 118 UK: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 119 GERMANY: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 120 GERMANY: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 121 FRANCE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 122 FRANCE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 123 ITALY: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 124 ITALY: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 125 SPAIN: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 126 SPAIN: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 127 RUSSIA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 128 RUSSIA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 129 NETHERLANDS: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 130 NETHERLANDS: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 131 REST OF EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 132 REST OF EUROPE: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 133 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 134 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 135 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 136 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 137 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (KT)

- TABLE 138 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 139 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 140 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 141 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

- TABLE 142 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

- TABLE 143 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

- TABLE 144 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

- TABLE 145 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2019–2021 (USD MILLION)

- TABLE 146 SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 147 BRAZIL: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 148 BRAZIL: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 149 ARGENTINA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 150 ARGENTINA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 151 REST OF SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 152 REST OF SOUTH AMERICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 153 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 154 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 155 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 156 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 157 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (KT)

- TABLE 158 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 159 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 160 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 161 ROW: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

- TABLE 162 ROW: VITAMIN & MINERAL PREMIXES MARKET FOR FOOD & BEVERAGES, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

- TABLE 163 ROW: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

- TABLE 164 ROW: VITAMIN & MINERAL PREMIXES MARKET FOR HEALTHCARE, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

- TABLE 165 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2019–2021 (USD MILLION)

- TABLE 166 ROW: VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 167 AFRICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 168 AFRICA: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 169 MIDDLE EAST: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 170 MIDDLE EAST: VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 171 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 172 MARKET SHARE ANALYSIS, 2021

- TABLE 173 COMPANY FOOTPRINT, BY TYPE

- TABLE 174 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 175 COMPANY FOOTPRINT, BY FORM

- TABLE 176 COMPANY FOOTPRINT, BY REGION

- TABLE 177 OVERALL COMPANY FOOTPRINT

- TABLE 178 VITAMIN & MINERAL PREMIXES MARKET: COMPETITIVE BENCHMARKING, 2021 (OTHER PLAYERS)

- TABLE 179 VITAMIN & MINERAL PREMIXES MARKET: PRODUCT LAUNCHES, 2019–2022

- TABLE 180 VITAMIN & MINERAL PREMIXES MARKET: DEALS, 2019–2022

- TABLE 181 VITAMIN & MINERAL PREMIXES MARKET: OTHERS, 2022

- TABLE 182 DSM: BUSINESS OVERVIEW

- TABLE 183 DSM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 DSM: PRODUCT LAUNCHES

- TABLE 185 DSM: OTHERS

- TABLE 186 CORBION: BUSINESS OVERVIEW

- TABLE 187 CORBION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 CORBION: OTHERS

- TABLE 189 GLANBIA PLC: BUSINESS OVERVIEW

- TABLE 190 GLANBIA PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 GLANBIA PLC: DEALS

- TABLE 192 VITABLEND NEDERLAND BV: BUSINESS OVERVIEW

- TABLE 193 VITABLEND NEDERLAND BV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 STERNVITAMIN GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 195 STERNVITAMIN GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 STERNVITAMIN GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 197 BASF SE: BUSINESS OVERVIEW

- TABLE 198 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 BASF SE: OTHERS

- TABLE 200 ADM: BUSINESS OVERVIEW

- TABLE 201 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 ADM: OTHERS

- TABLE 203 WRIGHT ENRICHMENT INC.: BUSINESS OVERVIEW

- TABLE 204 WRIGHT ENRICHMENT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 ZAGRO: BUSINESS OVERVIEW

- TABLE 206 ZAGRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 ZAGRO: OTHERS

- TABLE 208 NUTRECO: BUSINESS OVERVIEW

- TABLE 209 NUTRECO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 NUTRECO: DEALS

- TABLE 211 NUTRECO: OTHERS

- TABLE 212 FARBEST-TALLMAN FOODS CORPORATION: BUSINESS OVERVIEW

- TABLE 213 FARBEST-TALLMAN FOODS CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 214 FARBEST-TALLMAN FOODS CORPORATION: DEALS

- TABLE 215 BURKMANN INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 216 BURKMANN INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 BAR-MAGEN LTD.: BUSINESS OVERVIEW

- TABLE 218 BAR-MAGEN LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 BAR-MAGEN LTD.: DEALS

- TABLE 220 INNOV AD NV/SA: BUSINESS OVERVIEW

- TABLE 221 INNOV AD NV/SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 INNOV AD NV/SA: DEALS

- TABLE 223 JUBILANT INGREVIA LIMITED: BUSINESS OVERVIEW

- TABLE 224 JUBILANT INGREVIA LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 JUBILANT INGREVIA LIMITED: OTHERS

- TABLE 226 MARKETS ADJACENT TO VITAMIN & MINERAL PREMIXES MARKET

- TABLE 227 FEED PREMIX MARKET, BY INGREDIENT TYPE, 2021–2026 (USD MILLION)

- TABLE 228 FOOD FORTIFYING AGENTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- FIGURE 4 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 5 VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

- FIGURE 6 VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 7 VITAMIN & MINERAL PREMIXES MARKET, BY REGION, 2021

- FIGURE 8 GROWING DEMAND FROM LIVESTOCK AND AQUACULTURE INDUSTRIES COUPLED WITH INCREASING HEALTH AWARENESS

- FIGURE 9 CHINA AND VITAMIN SEGMENT ACCOUNTED FOR SIGNIFICANT MARKET SHARE IN 2021

- FIGURE 10 DRY SEGMENT TO DOMINATE MARKET BY 2027

- FIGURE 11 FEED SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

- FIGURE 12 ASIA PACIFIC AND FEED SEGMENT TO ACCOUNT FOR SIGNIFICANT MARKET SHARE BY 2027

- FIGURE 13 US: RETAIL AND FOODSERVICE SALES, 2021–2027 (USD BILLION)

- FIGURE 14 VITAMIN & MINERAL PREMIXES MARKET DYNAMICS

- FIGURE 15 VALUE CHAIN ANALYSIS

- FIGURE 16 AVERAGE SELLING PRICE, BY TYPE, 2020–2022 (USD PER TON)

- FIGURE 17 VITAMIN & MINERAL PREMIXES MARKET MAPPING

- FIGURE 18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- FIGURE 19 PATENTS GRANTED, 2012–2021

- FIGURE 20 TOP 10 INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 21 LEADING APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- FIGURE 23 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 24 VITAMIN & MINERAL PREMIXES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 25 VITAMIN & MINERAL PREMIXES MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

- FIGURE 26 VITAMIN & MINERAL PREMIXES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 27 INDIA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 28 NORTH AMERICA: REGIONAL SNAPSHOT

- FIGURE 29 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 30 REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD BILLION)

- FIGURE 31 COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- FIGURE 32 COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- FIGURE 33 DSM: COMPANY SNAPSHOT

- FIGURE 34 CORBION: COMPANY SNAPSHOT

- FIGURE 35 GLANBIA PLC: COMPANY SNAPSHOT

- FIGURE 36 BASF SE: COMPANY SNAPSHOT

- FIGURE 37 ADM: COMPANY SNAPSHOT

- FIGURE 38 JUBILANT INGREVIA LIMITED: COMPANY SNAPSHOT

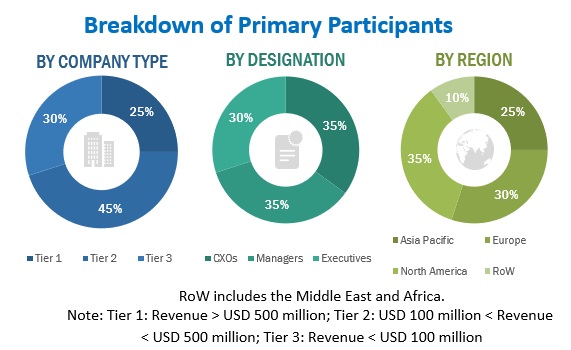

The study involved four major activities in estimating vitamin & mineral premixes market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources, such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to, to identify and collect information. Various sources, such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), European Food Safety Authority (EFSA), Animal Feed Manufacturers Association (AFMA), Food Fortification Initiative, and academic references pertaining to vitamin & mineral premixes, were referred to identify and collect information for this study.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the vitamin & mineral premixes market.

After the complete market engineering (which included calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and to verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types; industry trends; key players; competitive landscape of vitamin & mineral premixes supplied by different market players; and key market dynamics, such as drivers, restraints, opportunities, burning issues, industry trends, and key player strategies.

In the complete market engineering process, top-down and bottom-up approaches were extensively used along with several data triangulation methods to conduct market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Vitamin and Mineral Premixes Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the vitamin & mineral premixes market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the vitamin & mineral premixes market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall vitamin & mineral premixes market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match the data is assumed to be correct.

Report Objectives

- To describe and forecast the vitamin & mineral premixes market, in terms of type, form, application, and region.

- To describe and forecast the vitamin & mineral premixes market, in terms of value, by region– North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market.

- To study the complete value chain of the vitamin & mineral premixes market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the vitamin & mineral premixes market.

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders.

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in the vitamin & mineral premixes market.

Customization Options:

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the European vitamin & mineral premixes market into Poland, Spain, and other EU countries.

- Further breakdown of the Rest of South American vitamin & mineral premixes market into Peru and Colombia.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Vitamin and Mineral Premixes Market