Vision Processing Unit Market by End-Use Application (Smartphones, ADAS, Camera, Drones, AR/VR Products), Vertical (Consumer Electronics, Automotive, Security and Surveillance), Fabrication Process and Geography – Global Forecast to 2025-2035

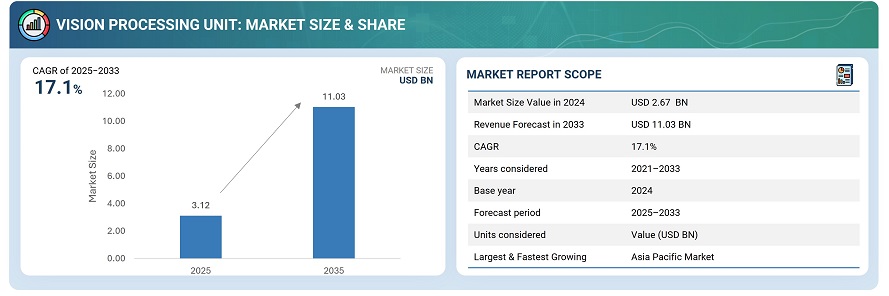

The global vision processing unit market was valued at USD 2.67 billion in 2025 and is estimated to reach USD 11.03 billion by 2035, at a CAGR of 17.1% between 2025 and 2035.

The global vision processing unit market is driven by the growing demand for efficient and low-power image processing in applications such as autonomous vehicles, robotics, drones, and smart surveillance systems. Increasing adoption of artificial intelligence and computer vision technologies is accelerating market growth. VPUs enable real-time image analysis and object recognition while minimizing latency and energy consumption. Manufacturers are focusing on innovation, integration with AI accelerators, and expanding partnerships to enhance performance and meet evolving edge computing requirements.

Vision Processing Units (VPUs) are specialized processors designed to accelerate computer vision and artificial intelligence tasks. They enable efficient image recognition, object detection, and real-time video analysis across devices. With low power consumption and high computational efficiency, VPUs are ideal for applications in autonomous vehicles, drones, robotics, smart cameras, and edge devices requiring rapid visual data processing.

Market by Fabrication Process

≤16 nm Node

The ≤16 nm node segment represents the most advanced fabrication process in the vision processing unit (VPU) market and is expected to register robust growth in the coming years. These VPUs are designed for high-performance computing and energy-efficient AI workloads, supporting complex vision tasks such as real-time object detection, gesture recognition, and scene understanding. The smaller node architecture enhances transistor density, enabling faster processing speeds and lower power consumption—key advantages for applications in mobile devices, autonomous systems, and embedded AI platforms. Moreover, major semiconductor manufacturers are investing heavily in sub-16 nm process technologies to deliver superior inference performance while maintaining compact form factors, further driving adoption across next-generation consumer and automotive electronics.

>16–28 nm Node

VPUs fabricated on >16–28 nm process nodes continue to hold a significant share in the market, particularly due to their cost-effectiveness and reliability. These chips are widely used in applications that require moderate performance levels but demand high stability, such as surveillance cameras, industrial vision systems, and mid-range consumer devices. Their proven design maturity and lower manufacturing complexity make them an attractive choice for OEMs seeking to balance performance and cost. Additionally, the availability of mature design tools and strong ecosystem support ensures scalability and ease of integration for various vision-based applications, maintaining steady demand within this fabrication range.

Market by Vertical

Consumer Electronics

The consumer electronics segment remains one of the largest adopters of vision processing units, driven by growing demand for intelligent imaging and edge AI capabilities in smartphones, laptops, AR/VR headsets, and smart home devices. VPUs enable enhanced functionalities such as facial recognition, image enhancement, augmented reality experiences, and advanced video analytics—all while minimizing latency and energy consumption. As device manufacturers focus on improving user experience through AI-driven imaging, the integration of VPUs has become a key differentiator in product innovation. Moreover, the shift toward on-device AI processing to enhance privacy and reduce cloud dependency further strengthens VPU deployment across consumer devices.

Automotive

The automotive segment is emerging as a high-growth vertical for vision processing units, fueled by the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies. VPUs play a crucial role in enabling real-time image interpretation from multiple sensors, cameras, and LiDAR systems, supporting functions such as lane detection, traffic sign recognition, and obstacle avoidance. The demand for low-latency, energy-efficient, and safety-certified VPUs is accelerating as vehicles become more intelligent and connected. Furthermore, collaborations between semiconductor manufacturers and automotive OEMs are expanding, aimed at developing automotive-grade VPUs that meet stringent reliability and thermal management requirements for next-generation mobility solutions.

Market by Geography

Geographically, the Vision Processing Unit (VPU) market is experiencing strong growth across North America, Europe, Asia Pacific, and the Rest of the World (ROW). Asia Pacific dominates the market, driven by advancements in consumer electronics, widespread adoption of AI-based surveillance systems, and the expanding automotive and robotics sectors. North America follows closely, supported by strong investments in autonomous systems, data centers, and edge AI applications. Europe remains a significant contributor, emphasizing industrial automation, smart manufacturing, and automotive safety innovations. Meanwhile, the Middle East, Africa, and South America are emerging as high-potential regions, fueled by growing smart city initiatives, adoption of intelligent surveillance, and increasing integration of machine vision technologies across commercial and industrial sectors to enhance operational intelligence.

Market Dynamics

Driver: Increasing demand for advanced computing for machine and computer vision

High-performance computing (HPC) aggregates processing power to tackle complex computational problems across sectors like science, engineering, and business. The growth of AI and machine learning has driven demand for cognitive computing across industries, including automotive and consumer electronics. Rapid advancements in video analytics and the security sector’s adoption of advanced technologies have led to the development of AI-capable processors, such as VPUs, which outperform traditional CPUs in memory bandwidth and computation. Rising demand for on-device AI extends applications beyond image and video analytics. Creative professionals, gamers, and designers increasingly rely on VPUs for real-time machine learning in AR, VR, and other visual computing applications.

Restraint: Strong presence of high-capability cpus and gpus

Advancements in semiconductor technology have accelerated the development of powerful processors. Leading chip manufacturers are offering system-on-chip (SoC) solutions that integrate high-end CPUs, graphics processing units (GPUs), and field-programmable gate arrays (FPGAs) to deliver enhanced performance. Recently, several high-performance processors and SoCs have incorporated AI capabilities for applications such as visual analytics and virtual assistance. Industrial customers, especially those unconstrained by size or power limitations, often prefer CPU-based systems for vision processing due to their reliability and versatility. This widespread availability of capable CPUs and GPUs creates competition and can slow the adoption of dedicated vision processing units (VPUs) among consumers and industrial users.

Opportunity: Rising demand for machine vision in industrial applications

Industrial automation is increasingly adopting machine vision technologies to enhance manufacturing efficiency, quality inspection, and process sophistication. Manufacturers are prioritizing automated solutions to reduce throughput time, improve productivity, and gain finer control over operations. The rapid growth of industrial robots, particularly in automotive and consumer electronics, has driven the integration of vision systems with robot controllers. Advanced applications like 3D machine vision, which analyze objects’ depth and height, demand high-end vision processing. While CPUs and GPUs remain preferred, the cost-effectiveness, AI capabilities, and performance advantages of VPUs are expected to drive their growing adoption in industrial applications over the coming years.

Challenge: Technological challenges in VPU development and manufacturing

The growing use of vision processing in edge devices such as drones, surveillance cameras, VR products, and ADAS highlights VPUs’ advantages, including high performance, low power consumption, and cost-effectiveness. However, challenges remain in chip development. High-performance VPUs generate substantial heat, conflicting with the thermal limits of compact devices. Rising wafer processing costs for smaller nodes and increasing computational complexity further complicate manufacturing. While AI accelerators help optimize system data processing, algorithmic uncertainties persist. Consequently, VPU manufacturers face significant scientific and engineering challenges in designing, testing, and modeling chips capable of delivering high-performance, reliable vision processing.

Future Outlook

Between 2025 and 2033, the vision processing unit market is expected to grow significantly, driven by the rising demand for efficient edge-based AI processing in consumer electronics, automotive, robotics, and industrial applications. The expanding use of smart cameras, drones, and autonomous systems will accelerate adoption. Continuous advancements in low-power, high-performance architectures and deep learning capabilities are enabling faster image recognition and object detection. As industries increasingly integrate AI-driven vision for automation, safety, and analytics, VPUs will play a vital role in advancing intelligent devices and supporting the global shift toward connected, adaptive, and autonomous ecosystems.

Key Market Players

Top vision processing unit companies Intel Corporation (US), Samsung (South Korea), NXP Semiconductors (The Netherlands), Cadence Design Systems, Inc. (US) and Ceva Inc. (US)

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 8 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 13)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 VPU Market Opportunities

4.2 VPU Market for Smartphones, By Region

4.3 VPU Market, By Vertical and Region

4.4 Country-Wise Snapshot of VPU Market

4.5 VPU Market in APAC, By Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of Premium Smartphones

5.2.1.2 Growing Adoption of Edge AI

5.2.1.3 Rising Demand for High-End Computing Capabilities for Computer and Machine Vision

5.2.2 Restraints

5.2.2.1 Availability of CPUS and GPUS With High Capabilities

5.2.3 Opportunities

5.2.3.1 Emergence of Autonomous Cars

5.2.3.2 High Requirement of Machine Vision in Industrial Applications

5.2.4 Challenges

5.2.4.1 Technological Challenges in Chip Development and Manufacturing

5.3 Value Chain Analysis

6 VPU Market, By End-Use Application (Page No. - 38)

6.1 Introduction

6.2 Smartphones

6.2.1 Smartphones to Dominate VPU Market During Forecast Period

6.3 ADAS

6.3.1 Emergence of Semi-Autonomous and Autonomous Vehicles Drives VPU Market for ADAS

6.4 Camera

6.4.1 VPU-Based Cameras Gaining Traction in Surveillance Applications

6.5 Drones

6.5.1 Increasing Usage of Drones for Safety, Security, and Tracking Applications With Vision Analysis to Demand VPU Integration

6.6 AR/VR Products

6.6.1 VPU Market for AR/VR to Grow at Highest CAGR During Forecast Period

7 VPU Market, By Vertical (Page No. - 49)

7.1 Introduction

7.2 Consumer Electronics

7.2.1 Consumer Electronics Sector to Dominate VPU Market

7.3 Automotive

7.3.1 Increasing Requirement of Machine Vision for Autonomous Activities to Fuel Market for Automotive Sector

7.4 Security and Surveillance

7.4.1 Security and Surveillance to Be Fast-Growing Segment in VPU Market During Forecast Period

7.5 Others

8 VPU Market, By Fabrication Process (Page No. - 54)

8.1 Introduction

8.2 =16 NM Node

8.2.1 =16 NM Technology Node to Gain Traction in Near Future Owing to Benefits Pertaining to Performance, Scaling, and Power Consumption

8.3 >16–28 NM Node

8.3.1 >16–28 NM Technology Node to Hold Larger Share Owing to Its Wide Usage Across Different Applications

9 Geographic Analysis (Page No. - 59)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US Held Largest Size of VPU Market in North America

9.2.2 Canada

9.2.2.1 Canada Holds Significant Growth Opportunities for VPU Players in North America

9.2.3 Mexico

9.2.3.1 Increasing Demand for Consumer Electronics Products to Contribute to VPU Market in Mexico in Coming Years

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany Holds Largest Share of European VPU Market

9.3.2 France

9.3.2.1 High Adoption of AI-Enabled Products to Drive VPU Market in France in Coming Years

9.3.3 Italy

9.3.3.1 Market in Italy to Grow at High CAGR During Forecast Period

9.3.4 UK

9.3.4.1 Surveillance Applications to Drive VPU Market in UK

9.3.5 Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 China Holds Largest Share of VPU Market in APAC

9.4.2 Japan

9.4.2.1 Increasing Initiatives for Commercialization of Autonomous Cars and Rising Need for Surveillance Solutions Drive Market in Japan

9.4.3 South Korea

9.4.3.1 Presence of Major Consumer Electronics Manufacturers in South Korea Drives Demand for VPU

9.4.4 Rest of APAC

9.5 RoW

9.5.1 South America

9.5.1.1 Growing Economy and Increasing Demand for Consumer Electronics to Contribute to Market Growth in South America

9.5.2 Middle East and Africa

9.5.2.1 Growing Investments in Economic Developments in Middle East and Africa Likely to Drive the Market in This Region

10 Competitive Landscape (Page No. - 77)

10.1 Overview

10.2 Ranking Analysis

10.3 Competitive Scenario

10.3.1 Product Developments/Launches

10.3.2 Partnerships/Agreements/Collaborations

10.3.3 Acquisitions

10.3.4 Investments/Expansions

10.4 Competitive Leadership Mapping

10.4.1 Visionary Leaders

10.4.2 Dynamic Differentiators

10.4.3 Innovators

10.4.4 Emerging Companies

11 Company Profiles (Page No. - 85)

(Business Overview, Products and Services, Recent Developments, SWOT Analysis, MnM View)*

11.1 Key Players

11.1.1 Samsung

11.1.2 Movidius

11.1.3 NXP Semiconductor

11.1.4 Cadence

11.1.5 Ceva

11.1.6 Mediatek

11.1.7 Google

11.1.8 Hisilicon Technologies (Huawei)

11.1.9 Inuitive

11.1.10 Lattice Semiconductor

11.1.11 Synopsys

11.1.12 Verisilicon

11.2 Other Key Companies

11.2.1 Imagination Technologies

11.2.2 Videantis

11.2.3 Morpho

11.2.4 Socionext

11.2.5 Thin Ci

11.2.6 Neurala

11.2.7 Nextchip

11.2.8 Texas Instruments

*Details on Business Overview, Products and Services, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 119)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Report

12.6 Author Details

List of Tables (38 Tables)

Table 1 VPU Market, By End-Use Application, 2017–2024 (Million Units)

Table 2 Vision Processing Unit Market, By End-Use Application, 2017–2024 (USD Million)

Table 3 VPU Market for Smartphones, By Region, 2017–2024 (Million Units)

Table 4 Vision Processing Unit Market for Smartphones, By Region, 2017–2024 (USD Million)

Table 5 VPU Market for ADAS, By Region, 2017–2024 (Thousand Units)

Table 6 Vision Processing Unit Market for ADAS, By Region, 2017–2024 (USD Million)

Table 7 VPU Market for Cameras, By Region, 2017–2024 (Million Units)

Table 8 VPU Market for Cameras, By Region, 2017–2024 (USD Million)

Table 9 Vision Processing Unit Market for Drones, By Region, 2017–2024 (Million Units)

Table 10 VPU Market for Drone, By Region, 2017–2024 (USD Million)

Table 11 Vision Processing Unit Market for AR/VR, By Region, 2017–2024 (Thousand Units)

Table 12 VPU Market for AR/VR, By Region, 2017–2024 (USD Million)

Table 13 Vision Processing Unit Market, By Vertical, 2017–2024 (USD Million)

Table 14 VPU Market, By Vertical, 2017–2024 (Million Units)

Table 15 VPU Market, By Fabrication Process, 2017–2024 (Million Units)

Table 16 VPU Market, By Fabrication Process, 2017–2024 (USD Million)

Table 17 Vision Processing Unit Market for =16 NM Node, By Vertical, 2017–2024 (Million Units)

Table 18 VPU Market for =16 NM Node, By Vertical, 2017–2024 (USD Million)

Table 19 VPU Market for >16–28 NM Node, By Vertical, 2017–2024 (Million Units)

Table 20 Vision Processing Unit Market for >16–28 NM Node, By Vertical, 2017–2024 (USD Million)

Table 21 VPU Market, By Region, 2017–2024 (Million Units)

Table 22 Global VPU Market, By Region, 2017–2024 (USD Million)

Table 23 VPU Market in North America, By End-Use Application, 2017–2024 (Thousand Units)

Table 24 Vision Processing Unit Market in North America, By End-Use Application, 2017–2024 (USD Million)

Table 25 VPU Market in North America, By Country, 2017–2024 (USD Million)

Table 26 VPU Market in Europe, By End-Use Application, 2017–2024 (Million Units)

Table 27 Vision Processing Unit Market in Europe, By End-Use Application, 2017–2024 (USD Million)

Table 28 VPU Market in Europe, By Country, 2017–2024 (USD Million)

Table 29 VPU Market in APAC, By End-Use Application, 2017–2024 (Thousand Units)

Table 30 Vision Processing Unit Market in APAC, By End-Use Application, 2017–2024 (USD Million)

Table 31 VPU Market in APAC, By Country, 2017–2024 (USD Million)

Table 32 VPU Market in RoW, By End-Use Application, 2017–2024 (Thousand Units)

Table 33 Vision Processing Unit Market in RoW, By End-Use Application, 2017–2024 (USD Million)

Table 34 VPU Market in RoW, By Region, 2017–2024 (USD Million)

Table 35 Product Developments/Launches, 2017–2018

Table 36 Partnerships/Agreements/Collaborations, 2016–2018

Table 37 Acquisitions, 2016

Table 38 Investments/Expansions, 2019

List of Figures (39 Figures)

Figure 1 VPU Market Segmentation

Figure 2 Research Flow

Figure 3 VPU Market: Research Design

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Smartphones to Hold Largest Size of VPU Market, in Terms of Volume, During Forecast Period

Figure 8 Consumer Electronics to Hold Largest Size of VPU Market, in Terms of Value, During Forecast Period

Figure 9 >16–28 NM Node to Account for Largest Size of VPU Market, in Terms of Volume, During Forecast Period

Figure 10 North America to Hold Largest Size of VPU Market for Cameras, in Terms of Value, During Forecast Period

Figure 11 VPU Market in APAC, in Terms of Value, to Grow at Highest CAGR During Forecast Period

Figure 12 Vision Processing Unit Market Players to Witness Attractive Growth Opportunities During Forecast Period

Figure 13 North America to Hold Largest Size of VPU Market for Smartphones, in Terms of Value, By 2019

Figure 14 Consumer Electronics and North America Were Largest Shareholders in VPU Market, in Terms of Value, in 2018

Figure 15 Vision Processing Unit Market in China, in Terms of Value, to Grow at Highest CAGR During Forecast Period

Figure 16 China to Register Highest CAGR in VPU Market in APAC, in Terms of Value, During Forecast Period

Figure 17 Growing Adoption of Edge AI and Premium Smartphones Drives VPU Market Growth

Figure 18 AI-Based Premium Smartphone Penetration, 2018

Figure 19 Smartphones to Hold Largest Size of VPU Market, in Terms of Volume, During Forecast Period

Figure 20 Vision Processing Unit Market for ADAS in APAC to Grow at Highest CAGR, in Terms of Volume, During Forecast Period

Figure 21 North America to Hold Largest Size of VPU Market for Cameras, in Terms of Volume, During Forecast Period

Figure 22 Consumer Electronics to Hold Largest Size of VPU Market, in Terms of Value, During Forecast Period

Figure 23 >16 – 28 NM Node to Hold Larger Size of VPU Market During Forecast Period

Figure 24 Geographic Snapshot: APAC Countries Emerging as Potential Markets for VPU During

Figure 25 APAC to Register Highest CAGR in VPU Market, in Terms of Volume, During Forecast Period

Figure 26 North America: Snapshot of VPU Market

Figure 27 Europe: Snapshot of VPU Market

Figure 28 APAC: Snapshot of VPU Market

Figure 29 Companies Adopted Product Developments and Launches as Key Growth Strategies Over the Last 4 Years (2016–2018)

Figure 30 Ranking Analysis of Top 5 Players in VPU Market

Figure 31 Vision Processing Unit Market (Global) Competitive Leadership Mapping, 2018

Figure 32 Samsung: Company Snapshot

Figure 33 NXP Semiconductor: Company Snapshot

Figure 34 Cadence: Company Snapshot

Figure 35 Ceva: Company Snapshot

Figure 36 Mediatek: Company Snapshot

Figure 37 Google: Company Snapshot

Figure 38 Lattice Semiconductor: Company Snapshot

Figure 39 Synopsys: Company Snapshot

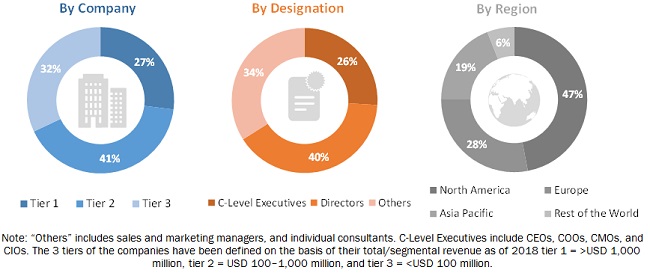

The study involved 4 major activities to estimate the current size of the VPU market. Exhaustive secondary research was conducted to collect information on the market, including the peer market and parent market. This was followed by validating these findings, assumptions, and sizing with industry experts, identified across the value chain, through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Further, market breakdown and data triangulation procedures were used to estimate the size of the market based on segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for the identification and collection of relevant information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research was conducted to obtain key information regarding the supply chain and value chain of industry, total pool of key players, market segmentation according to industry trends (to the bottom-most level), geographic markets, and key developments from market- and technology-oriented perspectives. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information relevant to this report. Several primary interviews were conducted with market experts from both demand (product and component manufacturer across industries) and supply sides. The primary data was collected through questionnaires, e-mails, and telephonic interviews. Primary sources include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from various key companies and organizations operating in the VPU market. Approximately 30% and 70% of the primary interviews were conducted from the demand and supply sides, respectively.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were implemented to estimate and validate the total size of the VPU market. These methods were also used extensively to estimate the size of the markets based on various subsegments. The research methodology used to estimate the market size includes the following steps:

- Key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides across different end-use applications.

Study Objectives

- To describe and forecast the vision processing unit (VPU) market, in terms of value, by end-use application, vertical, and fabrication process

- To describe and forecast the VPU market, in terms of volume, by end-use application, vertical, and fabrication process

- To describe and forecast the market, in terms of value and volume, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges for the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze the competitive growth strategies—collaborations, agreements, partnerships, and acquisitions, product launches and developments, research and development (R&D), and so on—adopted by the major players in the VPU market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional 5 market players

- Geographic analysis

- Immediate customers for VPU

Growth opportunities and latent adjacency in Vision Processing Unit Market