Microprocessor and GPU Market by Architecture, Functionality, GPU Type, Deployment, Application (Consumer Electronics, Server and Data Center, Automotive, BFSI, Industrial), and Geography

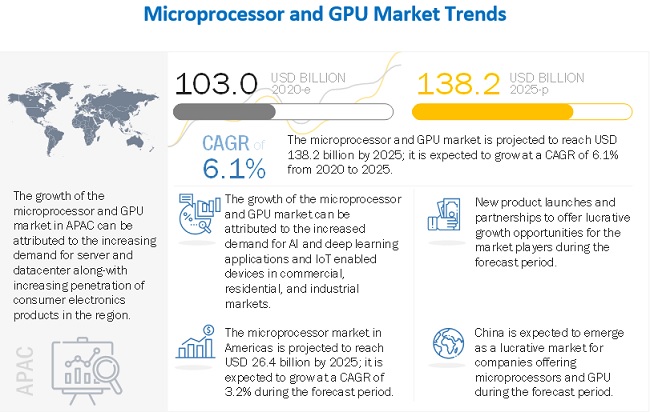

The global microprocessor and GPU market is estimated to be USD 103.0 billion in 2020 and projected to reach USD 138.2 billion by 2025; growing at a CAGR of 6.1% during the forecast period.

The Microprocessor and GPU Market is experiencing substantial growth driven by increasing demand for high-performance computing in gaming, artificial intelligence, and data centers. Key trends include the development of more powerful and efficient chips, with manufacturers focusing on advanced architectures and integration of AI capabilities. Additionally, the rise of cloud gaming and machine learning applications is propelling market expansion. As consumer needs evolve, the microprocessor and GPU sectors are poised for continued innovation and growth in the coming years, making them critical components in modern technology.

Impact of AI in Microprocessor and GPU Market

The impact of artificial intelligence (AI) in the microprocessor and GPU market is profound, as the growing demand for AI-driven applications is driving innovation, performance enhancements, and architectural advancements in processing units. AI workloads require high computational power and parallel processing capabilities, prompting manufacturers to design specialized AI-optimized microprocessors and GPUs that support machine learning, deep learning, and real-time data processing. This trend is accelerating the development of powerful chips for data centers, edge computing, autonomous vehicles, and consumer electronics. Moreover, AI is also being used to optimize chip design processes, improve energy efficiency, and predict system behavior, thereby reshaping the competitive landscape and fueling growth across the microprocessor and GPU market.

The microprocessor and GPU market is at the heart of technological innovation, powering advancements across industries such as consumer electronics, automotive, healthcare, and artificial intelligence. Microprocessors serve as the central processing units (CPUs) in computing devices, while GPUs excel in parallel processing, making them essential for graphics rendering, gaming, and AI applications. With the rapid growth of data-intensive technologies like machine learning, autonomous vehicles, and cloud computing, the demand for high-performance processors and GPUs continues to rise.

Key market drivers include the increasing adoption of IoT devices, the expansion of gaming and entertainment platforms, and the integration of AI into various sectors. Manufacturers are focusing on developing energy-efficient, high-speed processors to meet the evolving needs of businesses and consumers. As industries prioritize digital transformation and computational power, the microprocessor and GPU market is poised for sustained growth, enabling breakthroughs in everything from real-time analytics to immersive digital experiences.

Key factors fueling the growth of this market include the increase in demand for consumer electronics, rise in adoption of Internet of Things (IoT)-enabled devices and equipment and implementation of cloud-based platforms and server environments during the COVID-19 pandemic.

To know about the assumptions considered for the study, Request for Free Sample Report

Microprocessor and GPU Market Dynamics

Driver: Increase in demand for high performance and energy-efficient processors and GPUs

Users, such as architects and graphic designers, rely on affordable workstations for working on image processing-related applications involving 2D and 3D graphics. This requires the processing of complex algorithms, which is made possible by using specialized graphical processors. Advancements in devices, including laptops, television (including smart TV), and speakers, which offer immersive visual experiences, such as 4K and 8K viewing and superior sound quality, by using a high-quality codec and audio processors for sound processing have led to an increase in demand for microprocessors in these devices, encouraging their market growth. The demand for smart applications, such as smart speakers, is increasing as more smart homes come into existence. These smart devices incorporate advanced low power and high-performance processors with AI capabilities. The increase in penetration of these smart devices and wearables is projected to increase worldwide with the growth of the microprocessor and GPU market.

Restraint: Decrease in demand for PCs

The increase in the adoption of smartphones and tablets over the past few years has impacted the demand for PCs. The portability and performance offered by new generation smartphones and tablets have impacted the growth of microprocessors and the GPU market. The processors and GPUs found in PCs are usually high in costs as compared with those used in smartphones and tablets. Desktop PCs witness the highest downfall in the PCs category as more users prefer portable devices for day-to-day operations. In addition, PCs have a long lifecycle, and therefore, cannot be replaced in a short interval of time, resulting in an increase in the overall demand for the PC market.

Opportunity: Increase in demand for artificial intelligence (AI) and deep learning-based applications, such as supercomputers, amidst COVID-19 pandemic

The demand for deep learning training and inference systems has witnessed an increase across various sectors, ranging from automated driving and electronic devices to industrial automation. Deep learning is used for speech translation and automated hearing purposes in smart devices, such as smart speakers and smart TVs. These devices adapt to the surrounding voices and understand user preferences to deliver results. Another industry that has witnessed high adoption of AI-based applications in recent times include the finance and banking industry. The fast-growing cryptocurrency market uses high-performance AI processors for bitcoin mining purposes. Finance companies make use of AI chatbots to offer self-help customer services by incorporating NLP techniques. With the increase in the number of COVID-19 cases globally, the adoption of supercomputers is rising rapidly among research firms, institutions, and governments. These supercomputers utilize high-performance AI processors and GPU accelerators to help in the development of vaccines and therapies, which could cure and combat the COVID-19 virus.

Challenges: Instability in the prices of GPU

Irregularity in the supply of GPUs often leads to fluctuations in the price of GPUs as compared to manufacturer suggested retail pricing (MSRP). For instance, in 2018, the increase in cryptocurrency has led to high adoption of performance-oriented GPUs for bitcoin mining. As a result, there was a shortage in supply for these GPUs among gamers, which resulted in GPUs being sold twice as much as their original prices. Therefore, it is important for the GPU manufacturers to keep a check on the prices and cater to the demand of various user segments of the industry by creating customized offerings in order to maintain the supply-demand graph. Moreover, the instability in prices of GPUs could also impact the competitiveness between the companies involved and affect their ability to innovate.

ARM architecture segment is expected to capture the second market share in 2025

ARM segment is expected to have the second largest market share in 2025, by architecture. The ARM architecture is easy to manage, has a simple design, and is power efficient. Due to its energy-efficient design, the architecture is most compatible with low-powered embedded and portable devices such as smartphones and notebooks. Recent developments in the architectural design of ARM has made these offer high-performance computing capabilities comparable to the ones delivered by x86 architecture-based processors. Arm allows licensing its ISA to any company which agrees to pay a licensing cost and offers them the benefit to either design their cores from scratch or use predefined IP blocks provided by Arm. This allows for the use of Arm-based architecture in a broader spectrum of products across industries.

Discrete GPU to account for largest market share of microprocessor and GPU in terms of value in 2025

Discrete GPU is expected to be the largest market for microprocessor and GPUs by value in 2025, by GPU type. Discrete GPUs are suitable for gaming, visualization, animation, video rendering, and other graphic-intensive applications. These GPUs offer potentially high-performance capabilities, smooth image processing experience, and deliver seamless gaming. the demand for discrete GPUs has increased rapidly with the adoption of advanced technologies, such as machine learning (ML) and deep learning, resulting in their use in advanced driver assistance system (ADAS), computing-intensive servers, the infotainment system in an automobile, and high–performance computing (HPC) solutions including supercomputers. The increasing demand for ray tracing and cloud computing applications is further expected to increase the use of discrete GPUs.

Industrial segment for GPU is expected to witness higher CAGR growth during the forecast period

The industrial segment for GPU in microprocessor and GPU market is expected to register higher CAGR growth during the forecast period, by application. The increasing adoption of industrial PCs that can process data at a high speed has given a boost to the market for GPUs used to power these PCs. These IPCs are rugged in nature to withstand extreme industrial conditions such as temperature, pressure, vibration, and humidity. Due to this critical environment, GPUS used in these PCs are of high quality, with enhanced computational speed to handle fast processing. This, in turn, is expected to drive the GPU market. The use of GPUs in various industrial robots, such as articulated robots, SCARA robots, delta robots, and cartesian coordinate robots, helps to fasten the process with high efficiency and accuracy. The rising demand for such products has been one of the major factors behind the growth of the GPU market for the industrial segment.

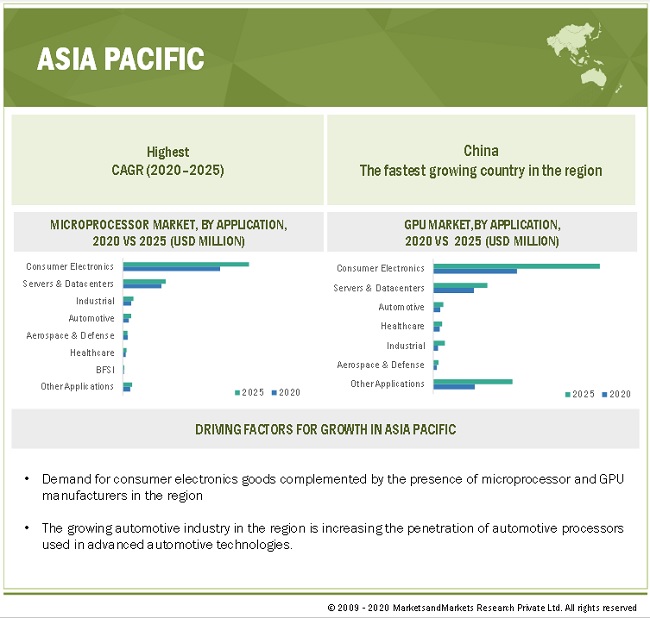

APAC is expected to register largest market share in terms of value and volume for microprocessor and GPU market globally during the forecast period

An increase in the adoption of technologies which enable digital transformation such as deep learning, artificial intelligence (AI), and Internet of Things (IoT) across various sectors such as automotive, consumer electronics, healthcare, and industrial has fueled the demand for microprocessors and GPU in the APAC region. Also, the emergence of APAC as a manufacturing hub and the adoption of automation processes to achieve manufacturing efficiency is leading to rising demand for microprocessors and GPU in the region.

The recent COVID-19 pandemic is expected to impact the global microprocessor and GPU industry. The entire supply chain got disrupted due to limited supply of parts during the first quarter of 2020. For instance, the outbreak of COVID-19 in China resulted in lockdown measures which included the shutdown of manufacturing facilities and warehouses and affected the global exports and shipments of various industries. The lockdown measures announced in several countries across the globe as they got impacted by the COVID-19 pandemic also led to a fall in the domestic and export demand for consumer electronics, automotive vehicles, and other industrial equipment and embedded devices in these countries.

To know about the assumptions considered for the study, download the pdf brochure

Top Microprocessor and GPU Companies - Key Market Players

The microprocessor and GPU market is dominated by a few globally established players such as Intel (US), Qualcomm (US), Samsung (South Korea), Nvidia (US), and AMD (US).

These companies have adopted both organic and inorganic growth strategies such as product launches and developments, partnerships, collaborations, joint ventures, expansions, and acquisitions to strengthen their position in the market.

Microprocessor and GPU Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2016–2025 |

|

Base Year |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

By Architecture, By GPU Type, By Functionality, By Deployment, By Application |

|

Geographic Regions Covered |

APAC, Americas, Europe, and RoW (includes Middle East and Africa (MEA)) |

|

Companies Covered |

The major players include Intel (US), Qualcomm (US), Samsung (South Korea), Nvidia (US), and AMD (US) (Total 25 companies) |

This report categorizes the microprocessor and GPU market based on architecture, GPU type, functionality, deployment, and application at the regional and global level

By Architecture

- X86

- ARM

- Other Architecture Types

By GPU Type

- Discrete

- Integrated

By Functionality

- Real-time systems

- Standalone systems

By Deployment

- On-cloud

- In-premise

By Application

- Consumer Electronics

- Servers & Datacenters

- Automotive

- Banking, Financial Services, and Insurance (BFSI)

- Aerospace & Defense

- Healthcare

- Industrial

- Other Applications

By Region

- APAC

- Americas

- Europe

- RoW (Middle East and Africa)

Recent Developments in Microprocessor and GPU Industry

- In April 2020, Intel announced the launch of its 10th generation Core H series mobile processors. The new processors feature 8 cores and 16 threads, delivering performance with up to 5.3 GHz turbo. The processors also benefit from Intel’s Turbo Boost Max Technology 3.0, Adaptix Dynamic Tuning Technology, Integrated Wi-Fi AX201, and support for Thunderbolt 3 and Intel Optane memory, to offer immersive gameplay, high responsiveness, and intelligent performance tuning.

- In March 2020, Marvell announced its collaboration with Samsung (South Korea) to encourage infrastructure innovation across radio access network (RAN). The company focuses on making use of its OCTEON processor and OCTEON Fusion processors to power the complex beamforming algorithms, which help with the deployment of multiple-input and multiple-output (MIMO) systems, while designing innovative radio unit architecture.

- In January 2020, Qualcomm launched new Snapdragon processors, namely, 720G, 662, and 460. The new processors support dual-frequency (L1 and L5) GNSS to offer improved location positioning accuracy and robustness with additional support for Navigation with Indian Constellation (NavIC). The processors enable high speed 4G connectivity and are offered with integrated Bluetooth 5.1 and WiFi 6 features, while offering fast and seamless connectivity with optimum power efficiency.

- In December 2019, Intel announced acquisition of Habana Labs (Israel), a data center company, which develops programmable deep learning accelerators and AI processors. The acquisition strengthens the company’s AI portfolio and capitalizes on the growth opportunities in the AI silicon market.

- In June 2020, Nvidia announced the GeForce RTX 2060 SUPER, GeForce RTX 2070 SUPER, and GeForce RTX 2080 SUPER GPUs. These GPUs deliver real-time ray tracing and high gaming performance. The new GeForce RTX GPUs offer high artificial intelligence (AI) processing performance, with NVIDIA Deep Learning Super Sampling, and support advanced features, including NVIDIA Adaptive Shading (NAS) and Mesh Shading.

Frequently Asked Questions (FAQ):

What is the current size of the global microprocessor and GPU market?

The global microprocessor and GPU market is estimated to be USD 103.0 billion in 2020 and projected to reach USD 138.2 billion by 2025, at a CAGR of 6.1%. Major factors driving the growth of the microprocessor and GPU market include increase in demand for consumer electronics, rise in adoption of Internet of Things (IoT)-enabled devices and equipment and implementation of cloud-based platforms and server environments during the COVID-19 pandemic.

Who are the winners in the global microprocessor and GPU market?

Companies such as Intel (US), Samsung (South Korea), Qualcomm (US), Nvidia (US), and AMD (US) fall under the winner’s category. These companies cater to the requirements of their customers by providing advanced microprocessor and GPU solutions and technologies with a presence in multiple countries.

What is the COVID-19 impact on microprocessor and GPU suppliers?

The shutdown of manufacturing facilities globally combined with strict restrictions over social movement in various COVID-19 affected countries impacted the operations of microprocessor and GPU manufacturing facilities. Additionally, the first quarter of 2020 also witnessed disruption in global supply chain operations and logistics related services due to limited air and road movement. The slow demand for automobile vehicles, home appliances and other consumer electronics due to lockdown measures had a global impact on the microprocessor and GPU market. This is expected to have led to a delay in the upcoming launches and developments in these segments. All these factors resulted in marginal dip of market size of the microprocessor and GPU devices. After the short-term impact of COVID-19 increase in the penetration of datacenters and servers, industrial segment along-with consumer electronics such as laptop and desktops is however, expected to have a positive impact on the microprocessor and GPU market.

What are the opportunities for the existing players and for those who are planning to enter various stages of the microprocessor and GPU value chain?

There are various opportunities for the existing players to enter the value chain of microprocessor and GPU industry. Some of these include the increase in demand for artificial intelligence (AI) and deep learning-based applications, such as supercomputers, amidst COVID-19 pandemic, increase in adoption of smart factories and industry 4.0, and adoption of remote working practices due to COVID-19 pandemic. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 GENERAL INCLUSIONS & EXCLUSIONS

1.2.2 INCLUSIONS & EXCLUSIONS AT COMPANY-LEVEL

1.2.3 INCLUSIONS & EXCLUSIONS AT ARCHITECTURE LEVEL

1.2.4 INCLUSIONS & EXCLUSIONS AT FUNCTIONALITY LEVEL

1.2.5 INCLUSIONS & EXCLUSIONS AT APPLICATION LEVEL

1.3 SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MICROPROCESSOR AND GPU MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGING SIZE

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 2 MICROPROCESSOR AND GPU MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)—REVENUE GENERATED BASED ON SALES

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2: BOTTOM–UP (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATION OF COMPANIES BASED ON SALES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3: BOTTOM-UP ESTIMATION OF MARKET SIZE, BY PRODUCT TYPE (MICROPROCESSOR)

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for estimating market size using the bottom-up approach (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating market size using the top-down approach (supply-side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 56)

3.1 SCENARIO ANALYSIS

FIGURE 9 IMPACT OF COVID-19 ON THE MICROPROCESSOR MARKET, BY SCENARIO

FIGURE 10 IMPACT OF COVID-19 ON THE GPU MARKET, BY SCENARIO

3.1.1 PRE-COVID-19 SCENARIO

3.1.2 PESSIMISTIC SCENARIO (POST-COVID-19)

3.1.3 OPTIMISTIC SCENARIO (POST-COVID-19)

3.1.4 REALISTIC SCENARIO (POST-COVID-19)

FIGURE 11 THE GPU MARKET IS PROJECTED TO GROW AT A HIGHER CAGR FROM 2020 TO 2025

FIGURE 12 CONSUMER ELECTRONICS TO ACCOUNT FOR LARGEST SIZE OF THE MICROPROCESSOR MARKET IN 2025

FIGURE 13 ARM ARCHITECTURE SEGMENT TO WITNESS THE HIGHEST CAGR OF THE MICROPROCESSOR MARKET FROM 2020 TO 2025

FIGURE 14 MARKET FOR REAL-TIME SYSTEMS TO GROW AT A HIGHER CAGR FROM 2020 TO 2025

FIGURE 15 THE INDUSTRIAL SEGMENT OF THE GPU MARKET TO RECORD A HIGHEST CAGR FROM 2020 TO 2025

FIGURE 16 APAC TO ACCOUNT FOR LARGEST SHARE OF MICROPROCESSOR MARKET IN 2025

4 PREMIUM INSIGHTS (Page No. - 64)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE MICROPROCESSOR AND GPU MARKET

FIGURE 17 INCREASING GLOBAL DEMAND FOR IOT, DATA CENTERS, HIGH-PERFORMANCE COMPUTING (HPC) APPLICATIONS TO SPUR GROWTH OF THE MARKET

4.2 MARKET, BY COUNTRY

FIGURE 18 THE MICROPROCESSOR MARKET IN CHINA PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

4.3 MARKET, BY DEPLOYMENT

FIGURE 19 IN-PREMISE DEPLOYMENT TO ACCOUNT FOR A LARGER SHARE OF THE GPU MARKET IN 2025

4.4 APAC: MICROPROCESSOR MARKET, BY APPLICATION AND COUNTRY

FIGURE 20 CONSUMER ELECTRONICS APPLICATION AND CHINA TO ACCOUNT FOR THE LARGEST SHARE OF THE MICROPROCESSOR MARKET IN APAC IN 2025

5 MARKET OVERVIEW (Page No. - 67)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 MICROPROCESSOR AND GPU MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in demand for high performance and energy-efficient processors and GPUs

5.2.1.2 Rise in the adoption of Internet of Things (IoT)-enabled devices and equipment

FIGURE 22 M2M CONNECTIONS, 2018–2023 (IN BILLION)

FIGURE 23 ESTIMATION OF IOT CONNECTIONS BY 2025 (BILLION)

5.2.1.3 Implementation of cloud-based platforms and server environments during the COVID-19 pandemic

FIGURE 24 DATA CENTER TRAFFIC, BY 2021 (ZETTABYTE)

FIGURE 25 MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Decrease in demand for PCs

5.2.2.2 Rise in adoption of alternative solutions

FIGURE 26 MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in demand for artificial intelligence (AI) and deep learning-based applications, such as supercomputers, amidst COVID-19 pandemic

5.2.3.2 Increase in adoption of smart factories and Industry 4.0

FIGURE 27 SMART FACTORY MARKET SIZE, 2018–2022 (USD BILLION)

5.2.3.3 Adoption of remote working practices due to COVID-19 pandemic

FIGURE 28 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Instability in the prices of GPU

5.2.4.2 Rapid technological changes in the market with high consumer demands

5.2.4.3 Short-term decrease in demand for smartphones and tablets due to the COVID-19 pandemic

FIGURE 29 MARKET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN ANALYSIS OF MICROPROCESSOR AND GPU MARKET

5.4 ECOSYSTEM

FIGURE 31 ECOSYSTEM VIEW

5.5 AVERAGE SELLING PRICE TRENDS

FIGURE 32 AVERAGE SELLING PRICE TREND FOR GPU FROM 2016 TO 2025

5.6 TECHNOLOGY ANALYSIS

5.6.1 CLOUD GPU

5.7 CASE STUDIES

5.7.1 DEPLOYMENT OF AMD EPYC CPU AT THE LHCB EXPERIMENT AT CERN

5.7.2 DEVELOPMENT OF FUJIFILM’S AMULET FOR 3D-DISPLAY-ENABLED MAMOGRAM IMAGING

5.8 REGULATORY UPDATE

6 MICROPROCESSOR MARKET, BY ARCHITECTURE (Page No. - 85)

6.1 INTRODUCTION

FIGURE 33 ARM ARCHITECTURE PROJECTED TO EXHIBIT THE HIGHEST CAGR IN MICROPROCESSOR MARKET FROM 2020 TO 2025

TABLE 1 MICROPROCESSOR AND GPU MARKET, BY ARCHITECTURE, 2016–2019 (USD MILLION)

TABLE 2 MICROPROCESSOR MARKET, BY ARCHITECTURE, 2020–2025 (USD MILLION)

TABLE 3 MICROPROCESSOR MARKET, BY ARCHITECTURE, 2016–2019 (MILLION UNITS)

TABLE 4 MARKET, BY ARCHITECTURE, 2020–2025 (MILLION UNITS)

6.2 X86

6.2.1 VARIOUS SOFTWARE AND OPERATING SYSTEM (OS) SUCH AS DOS, LINUX, WINDOWS, SOLARIS, BSD, AND MAC OS SUPPORT X86 BASED HARDWARE

6.3 ARM

6.3.1 EASY TO MANAGE, SIMPLE, AND POWER-EFFICIENT DESIGN OF THE ARM ARCHITECTURE LEAD TO ITS HIGH COMPATIBILITY WITH LOW-POWERED EMBEDDED AND PORTABLE DEVICES

6.4 OTHER ARCHITECTURE TYPES

6.4.1 HIGH ADAPTABILITY OFFERED BY POWER ARCHITECTURE-BASED PLATFORM TO INTEGRATE AI TECHNOLOGY AND MACHINE LEARNING INTO ITS OPERATIONS DRIVE ITS MARKET GROWTH

7 GRAPHICS PROCESSOR UNIT (GPU) MARKET, BY DEPLOYMENT (Page No. - 91)

7.1 INTRODUCTION

FIGURE 34 IN-PREMISE DEPLOYMENT TO RECORD HIGHER CAGR IN GPU MARKET FROM 2020 TO 2025

TABLE 5 MICROPROCESSOR AND GPU MARKET, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 6 GPU MARKET, BY DEPLOYMENT, 2020–2025 (USD MILLION)

TABLE 7 GPU MARKET, BY DEPLOYMENT, 2016–2019 (THOUSAND UNITS)

TABLE 8 GPU MARKET, BY DEPLOYMENT, 2020–2025 (THOUSAND UNITS)

7.2 ON–CLOUD GPU

7.2.1 INCREASING ADOPTION OF VIRTUAL GPU IN PLACE OF VIRTUAL DESKTOP INFRASTRUCTURE DRIVING THE GROWTH OF ON–CLOUD GPU

7.3 IN-PREMISE GPU

7.3.1 IN-PREMISE GPU BENEFIT FROM DATA SOVEREIGNTY AND PRIVACY, WHICH MAKES THEM SUITABLE FOR USE IN THE HEALTHCARE AND FINANCIAL INDUSTRIES

8 GRAPHICS PROCESSOR UNIT (GPU) MARKET, BY TYPE (Page No. - 96)

8.1 INTRODUCTION

FIGURE 35 GPU MARKET FOR DISCRETE TYPE PROJECTED TO GROW AT A HIGHER CAGR FROM 2020 TO 2025

TABLE 9 MICROPROCESSOR AND GPU MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 10 GPU MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 11 GPU MARKET, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 12 GPU MARKET, BY TYPE, 2020–2025 (MILLION UNITS)

8.2 DISCRETE GPU

8.2.1 INCREASING DEMAND FOR RAY TRACING AND CLOUD COMPUTING APPLICATIONS PROJECTED TO INCREASE THE USE OF DISCRETE GPU

TABLE 13 MARKET FOR DISCRETE GPU, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 14 MARKET FOR DISCRETE GPU, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 15 MARKET FOR DISCRETE GPU, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 16 MARKET FOR DISCRETE GPU, BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 17 MARKET FOR DISCRETE GPU, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 MARKET FOR DISCRETE GPU, BY REGION, 2020–2025 (USD MILLION)

TABLE 19 MARKET FOR DISCRETE GPU, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 20 MARKET FOR DISCRETE GPU, BY REGION, 2020–2025 (MILLION UNITS)

8.3 INTEGRATED GPU

8.3.1 INCREASING SUPPORT FOR AUGMENTED REALITY (AR) AND VIRTUAL REALITY (VR) APPLICATIONS IN SMARTPHONES AND TABLETS INCREASING THE DEMAND FOR INTEGRATED GPUS

TABLE 21 MICROPROCESSOR AND GPU MARKET FOR INTEGRATED GPU, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 22 MARKET FOR INTEGRATED GPU, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 23 MARKET FOR INTEGRATED GPU, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 24 MARKET FOR INTEGRATED GPU, BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 25 MARKET FOR INTEGRATED GPU, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 MARKET FOR INTEGRATED GPU, BY REGION, 2020–2025 (USD MILLION)

TABLE 27 MARKET FOR INTEGRATED GPU, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 28 MARKET FOR INTEGRATED GPU, BY REGION, 2020–2025 (MILLION UNITS)

9 MICROPROCESSOR AND GPU MARKET, BY FUNCTIONALITY (Page No. - 106)

9.1 INTRODUCTION

FIGURE 36 MARKET FOR MICROPROCESSORS USED IN REAL-TIME SYSTEMS PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

TABLE 29 MICROPROCESSOR MARKET, BY FUNCTIONALITY, 2016–2019 (USD BILLION)

TABLE 30 MICROPROCESSOR MARKET, BY FUNCTIONALITY, 2020–2025 (USD BILLION)

TABLE 31 MICROPROCESSOR MARKET, BY FUNCTIONALITY, 2016–2019 (MILLION UNITS)

TABLE 32 MICROPROCESSOR MARKET, BY FUNCTIONALITY, 2020–2025 (MILLION UNITS)

9.2 REAL-TIME SYSTEMS

9.2.1 HIGH ADOPTION OF REAL-TIME SYSTEMS MICROPROCESSOR FOR VARIOUS APPLICATIONS DRIVING THEIR MARKET DEMAND

TABLE 33 MICROPROCESSORS MARKET FOR REAL-TIME SYSTEMS, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 34 MICROPROCESSORS MARKET FOR REAL-TIME SYSTEMS, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 35 MICROPROCESSORS MARKET FOR REAL-TIME SYSTEMS, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 36 MICROPROCESSORS MARKET FOR REAL-TIME SYSTEMS, BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 37 MICROPROCESSORS MARKET FOR REAL-TIME SYSTEMS, BY REGION, 2016–2019 (USD BILLION)

TABLE 38 MICROPROCESSORS MARKET FOR REAL-TIME SYSTEMS, BY REGION, 2020–2025 (USD BILLION)

TABLE 39 MICROPROCESSORS MARKET FOR REAL-TIME SYSTEMS, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 40 MICROPROCESSORS MARKET FOR REAL-TIME SYSTEMS, BY REGION, 2020–2025 (MILLION UNITS)

9.3 STANDALONE SYSTEMS

9.3.1 USE OF STANDALONE SYSTEMS IN DIGITAL CAMERAS, VIDEO GAME CONSOLES, DESKTOPS, WORKSTATIONS, AND INFORMATION KIOSK TO DRIVE THE MARKET

TABLE 41 MICROPROCESSOR AND GPU MARKET FOR STANDALONE SYSTEMS, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 42 MICROPROCESSORS MARKET FOR STANDALONE SYSTEMS, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 43 MICROPROCESSORS MARKET FOR STANDALONE SYSTEMS, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 44 MICROPROCESSORS MARKET FOR STANDALONE SYSTEMS, BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 45 MICROPROCESSORS MARKET FOR STANDALONE SYSTEMS, BY REGION, 2016–2019 (USD MILLION)

TABLE 46 MICROPROCESSORS MARKET FOR STANDALONE SYSTEMS, BY REGION, 2020–2025 (USD MILLION)

TABLE 47 MICROPROCESSORS MARKET FOR STANDALONE SYSTEMS, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 48 MICROPROCESSORS MARKET FOR STANDALONE SYSTEMS, BY REGION, 2020–2025 (MILLION UNITS)

10 MICROPROCESSOR AND GPU MARKET, BY APPLICATION (Page No. - 117)

10.1 MICROPROCESSOR MARKET, BY APPLICATION

10.1.1 INTRODUCTION

FIGURE 37 AUTOMOTIVE SEGMENT PROJECTED TO WITNESS THE HIGHEST CAGR IN MICROPROCESSOR MARKET FROM 2020 TO 2025

TABLE 49 MICROPROCESSOR MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 50 MICROPROCESSOR MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 51 MICROPROCESSOR MARKET, BY APPLICATION, 2016–2019 (MILLION UNIT)

TABLE 52 MICROPROCESSOR MARKET, BY APPLICATION, 2020–2025 (MILLION UNITS)

10.1.2 CONSUMER ELECTRONICS

10.1.2.1 Ease of operation, low setup and maintenance costs, and high reliability expected to drive the market for low-voltage servo motors

TABLE 53 MICROPROCESSOR MARKET FOR CONSUMER ELECTRONICS, BY ARCHITECTURE, 2016–2019 (USD MILLION)

TABLE 54 MICROPROCESSOR MARKET FOR CONSUMER ELECTRONICS, BY ARCHITECTURE, 2020–2025 (USD MILLION)

TABLE 55 MICROPROCESSOR MARKET FOR CONSUMER ELECTRONICS, BY ARCHITECTURE, 2016–2019 (MILLION UNITS)

TABLE 56 MICROPROCESSOR MARKET FOR CONSUMER ELECTRONICS, BY ARCHITECTURE, 2020–2025 (MILLION UNITS)

TABLE 57 MICROPROCESSOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2016–2019 (USD MILLION)

TABLE 58 MICROPROCESSOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2020–2025 (USD MILLION)

TABLE 59 MICROPROCESSOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 60 MICROPROCESSOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2020–2025 (MILLION UNITS)

10.1.2.2 Key applications in consumer electronics

10.1.2.2.1 Desktops

10.1.2.2.2 Laptops

10.1.2.2.3 Smartphones

10.1.2.2.4 Tablets

10.1.2.2.5 Embedded Consumer Electronics

10.1.2.2.5.1 Smart TVs

10.1.2.2.5.2 Smartwatches

10.1.2.2.5.3 E-readers

10.1.2.2.5.4 Gaming consoles

10.1.2.2.5.5 Smart eyewear

10.1.2.2.5.6 Digital media boxes

10.1.3 SERVERS & DATACENTERS

10.1.3.1 High adoption of enterprise AI servers, with support for deep learning training and inference models, leading to the growth of microprocessor used in servers

TABLE 61 MICROPROCESSOR MARKET FOR SERVERS & DATACENTERS, BY ARCHITECTURE, 2016–2019 (USD MILLION)

TABLE 62 MICROPROCESSOR MARKET FOR SERVERS & DATACENTERS, BY ARCHITECTURE, 2020–2025 (USD MILLION)

TABLE 63 MICROPROCESSOR MARKET FOR SERVERS & DATACENTERS, BY ARCHITECTURE, 2016–2019 (THOUSAND UNITS)

TABLE 64 MICROPROCESSOR MARKET FOR SERVERS & DATACENTERS, BY ARCHITECTURE, 2020–2025 (THOUSAND UNITS)

TABLE 65 MICROPROCESSOR MARKET FOR SERVERS & DATACENTERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 66 MICROPROCESSOR MARKET FOR SERVERS & DATACENTERS, BY REGION, 2020–2025 (USD MILLION)

TABLE 67 MICROPROCESSOR MARKET FOR SERVERS & DATACENTERS, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 68 MICROPROCESSOR MARKET FOR SERVERS & DATACENTERS, BY REGION, 2020–2025 (MILLION UNITS)

10.1.4 AUTOMOTIVE

10.1.4.1 Increasing penetration of ADAS system to increase the use of processors

TABLE 69 MICROPROCESSOR MARKET FOR AUTOMOTIVE, BY ARCHITECTURE, 2016–2019 (USD MILLION)

TABLE 70 MICROPROCESSOR MARKET FOR AUTOMOTIVE, BY ARCHITECTURE, 2020–2025 (USD MILLION)

TABLE 71 MICROPROCESSOR MARKET FOR AUTOMOTIVE, BY ARCHITECTURE, 2016–2019 (MILLION UNITS)

TABLE 72 MICROPROCESSOR MARKET FOR AUTOMOTIVE, BY ARCHITECTURE, 2020–2025 (MILLION UNITS)

TABLE 73 MICROPROCESSOR MARKET FOR AUTOMOTIVE, BY REGION, 2016–2019 (USD MILLION)

TABLE 74 MICROPROCESSOR MARKET FOR AUTOMOTIVE, BY REGION, 2020–2025 (USD MILLION)

TABLE 75 MICROPROCESSOR MARKET FOR AUTOMOTIVE, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 76 MICROPROCESSOR MARKET FOR AUTOMOTIVE, BY REGION, 2020–2025 (MILLION UNITS)

10.1.4.2 Key applications in automotive

10.1.4.2.1 Infotainment

10.1.4.2.2 Advanced Driver Assistance Systems (ADAS)

10.1.5 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

10.1.5.1 High penetration of robotics process automation (RPA), which combines robotic automation and artificial intelligence (AI) to boost the market

TABLE 77 MICROPROCESSOR MARKET FOR BFSI, BY ARCHITECTURE, 2016–2019 (USD MILLION)

TABLE 78 MICROPROCESSOR MARKET FOR BFSI, BY ARCHITECTURE, 2020–2025 (USD MILLION)

TABLE 79 MICROPROCESSOR MARKET FOR BFSI, BY ARCHITECTURE, 2016–2019 (MILLION UNITS)

TABLE 80 MICROPROCESSOR MARKET FOR BFSI, BY ARCHITECTURE, 2020–2025 (MILLION UNITS)

TABLE 81 MICROPROCESSOR MARKET FOR BFSI, BY REGION, 2016–2019 (USD MILLION)

TABLE 82 MICROPROCESSOR MARKET FOR BFSI, BY REGION, 2020–2025 (USD MILLION)

TABLE 83 MICROPROCESSOR MARKET FOR BFSI, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 84 MICROPROCESSOR MARKET FOR BFSI, BY REGION, 2020–2025 (MILLION UNITS)

10.1.5.2 Key applications in BFSI

10.1.5.2.1 Automated Teller Machine (ATM)

10.1.5.2.2 Point of Sale (POS)

10.1.6 HEALTHCARE

10.1.6.1 Medical equipment and devices for diagnostics, therapy, and imaging applications needing microprocessors to boost the healthcare market

TABLE 85 MICROPROCESSOR MARKET FOR HEALTHCARE, BY ARCHITECTURE, 2016–2019 (USD MILLION)

TABLE 86 MICROPROCESSOR MARKET FOR HEALTHCARE, BY ARCHITECTURE, 2020–2025 (USD MILLION)

TABLE 87 MICROPROCESSOR MARKET FOR HEALTHCARE, BY ARCHITECTURE, 2016–2019 (MILLION UNITS)

TABLE 88 MICROPROCESSOR MARKET FOR HEALTHCARE, BY ARCHITECTURE, 2020–2025 (MILLION UNITS)

TABLE 89 MICROPROCESSOR MARKET FOR HEALTHCARE, BY REGION, 2016–2019 (USD MILLION)

TABLE 90 MICROPROCESSOR MARKET FOR HEALTHCARE, BY REGION, 2020–2025 (USD MILLION)

TABLE 91 MICROPROCESSOR MARKET FOR HEALTHCARE, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 92 MICROPROCESSOR MARKET FOR HEALTHCARE, BY REGION, 2020–2025 (MILLION UNITS)

10.1.7 AEROSPACE & DEFENSE

10.1.7.1 Increasing penetration of robots for use in surveillance, neutralizing explosive devices, and reconnaissance, in the defense sector strengthen the market growth

TABLE 93 MICROPROCESSOR MARKET FOR AEROSPACE & DEFENSE, BY ARCHITECTURE, 2016–2019 (USD MILLION)

TABLE 94 MICROPROCESSOR MARKET FOR AEROSPACE &DEFENSE, BY ARCHITECTURE, 2020–2025 (USD MILLION)

TABLE 95 MICROPROCESSOR MARKET FOR AEROSPACE & DEFENSE, BY ARCHITECTURE, 2016–2019 (MILLION UNITS)

TABLE 96 MICROPROCESSOR MARKET FOR AEROSPACE & DEFENSE, BY ARCHITECTURE, 2020–2025 (MILLION UNITS)

TABLE 97 MICROPROCESSOR MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2016–2019 (USD MILLION)

TABLE 98 MICROPROCESSOR MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2020–2025 (USD MILLION)

TABLE 99 MICROPROCESSOR MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 100 MICROPROCESSOR MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2020–2025 (MILLION UNITS)

10.1.7.2 Key applications in aerospace & defense

10.1.7.2.1 Unmanned aerial vehicles

10.1.7.2.2 Avionics and defense systems

10.1.8 INDUSTRIAL

10.1.8.1 Penetration of industrial robots and sensors in several industrial sectors could lead to the market growth of microprocessors

TABLE 101 MICROPROCESSOR MARKET FOR INDUSTRIAL, BY ARCHITECTURE, 2016–2019 (USD MILLION)

TABLE 102 MICROPROCESSOR MARKET FOR INDUSTRIAL, BY ARCHITECTURE, 2020–2025 (USD MILLION)

TABLE 103 MICROPROCESSOR MARKET FOR INDUSTRIAL, BY ARCHITECTURE, 2016–2019 (MILLION UNITS)

TABLE 104 MICROPROCESSOR MARKET FOR INDUSTRIAL, BY ARCHITECTURE, 2020–2025 (MILLION UNITS)

TABLE 105 MICROPROCESSOR MARKET FOR INDUSTRIAL, BY REGION, 2016–2019 (USD MILLION)

TABLE 106 MICROPROCESSOR MARKET FOR INDUSTRIAL, BY REGION, 2020–2025 (USD MILLION)

TABLE 107 MICROPROCESSOR MARKET FOR INDUSTRIAL, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 108 MICROPROCESSOR MARKET FOR INDUSTRIAL, BY REGION, 2020–2025 (MILLION UNITS)

10.1.8.2 Key applications in industrial application

10.1.8.2.1 Human-machine interface (HMI)

10.1.8.2.2 Machine vision

10.1.8.2.3 Robotics

10.1.8.2.4 Automated guided vehicles

10.1.8.2.5 Industrial PC (IPC)

10.1.9 OTHER APPLICATIONS

10.1.9.1 Increasing use of smart devices in retail and building automation to boost the market for microprocessors

TABLE 109 MICROPROCESSOR MARKET FOR OTHER APPLICATIONS, BY ARCHITECTURE, 2016–2019 (USD MILLION)

TABLE 110 MARKET FOR OTHER APPLICATIONS, BY ARCHITECTURE, 2020–2025 (USD MILLION)

TABLE 111 MARKET FOR OTHER APPLICATIONS, BY ARCHITECTURE, 2016–2019 (MILLION UNITS)

TABLE 112 MARKET FOR OTHER APPLICATIONS, BY ARCHITECTURE, 2020–2025 (MILLION UNITS)

TABLE 113 MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 114 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 115 MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 116 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (MILLION UNITS)

10.1.10 NEGATIVELY IMPACTED APPLICATION BY COVID-19 IN THE MICROPROCESSOR MARKET

10.1.10.1 Aerospace & defense

FIGURE 38 PRE- AND POST-COVID-19 MARKET COMPARISON FOR AEROSPACE & DEFENSE

TABLE 117 MICROPROCESSOR MARKET FOR AEROSPACE & DEFENSE, BY PRE- AND POST-COVID-19 SCENARIO, 2016–2025 (USD MILLION)

10.1.10.1.1 Impact analysis

10.1.11 LEAST IMPACTED APPLICATION BY COVID-19

10.1.11.1 Healthcare

FIGURE 39 PRE- AND POST-COVID-19 MARKET COMPARISON FOR HEALTHCARE

TABLE 118 MICROPROCESSOR MARKET FOR HEALTHCARE, BY PRE- AND POST-COVID-19 SCENARIO, 2016–2025 (USD MILLION)

10.1.11.1.1 Impact analysis

10.2 GPU MARKET, BY APPLICATION

10.2.1 INTRODUCTION

FIGURE 40 GPU MARKET FOR INDUSTRIAL APPLICATION PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 119 GPU MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 120 GPU MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 121 GPU MARKET, BY APPLICATION, 2016–2019 (THOUSAND UNITS)

TABLE 122 GPU MARKET, BY APPLICATION, 2020–2025 (THOUSAND UNITS)

10.2.2 CONSUMER ELECTRONICS

10.2.2.1 Adoption of workstations supported by powerful GPUs to train deep learning model boosts the market

TABLE 123 GPU MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2016–2019 (USD MILLION)

TABLE 124 GPU MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2020–2025 (USD MILLION)

TABLE 125 GPU MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 126 GPU MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2020–2025 (MILLION UNITS)

10.2.3 SERVERS & DATACENTERS

10.2.3.1 Increasing leverage of custom GPU servers, which handle various high-performance computing (HPC) application, leading to the growth of the GPU market

TABLE 127 GPU MARKET FOR SERVERS & DATACENTERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 128 GPU MARKET FOR SERVERS & DATACENTERS, BY REGION, 2020–2025 (USD MILLION)

TABLE 129 GPU MARKET FOR SERVERS & DATACENTERS, BY REGION, 2016–2019 (THOUSAND UNITS)

TABLE 130 GPU MARKET FOR SERVERS & DATACENTERS, BY REGION, 2020–2025 (THOUSAND UNITS)

10.2.4 AUTOMOTIVE

10.2.4.1 Advancements in GPU have led to the development of tiny AI supercomputers, which are used to provide high computation power to autonomous vehicles

TABLE 131 MICROPROCESSOR AND GPU MARKET FOR AUTOMOTIVE, BY REGION, 2016–2019 (USD MILLION)

TABLE 132 GPU MARKET FOR AUTOMOTIVE, BY REGION, 2020–2025 (USD MILLION)

TABLE 133 GPU MARKET FOR AUTOMOTIVE, BY REGION, 2016–2019 (THOUSAND UNITS)

TABLE 134 GPU MARKET FOR AUTOMOTIVE, BY REGION, 2020–2025 (THOUSAND UNITS)

10.2.5 HEALTHCARE

10.2.5.1 Increasing use of GPUs to power majorly surgical robots and robots that support home-based healthcare

TABLE 135 MARKET FOR HEALTHCARE, BY REGION, 2016–2019 (USD MILLION)

TABLE 136 GPU MARKET FOR HEALTHCARE, BY REGION, 2020–2025 (USD MILLION)

TABLE 137 GPU MARKET FOR HEALTHCARE, BY REGION, 2016–2019 (THOUSAND UNITS)

TABLE 138 GPU MARKET FOR HEALTHCARE, BY REGION, 2020–2025 (THOUSAND UNITS)

10.2.6 AEROSPACE & DEFENSE

10.2.6.1 Low power GPUs are preferred for use in XMC and VNX module-based embedded computers used in aircraft

TABLE 139 MICROPROCESSOR AND GPU MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2016–2019 (USD MILLION)

TABLE 140 GPU MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2020–2025 (USD MILLION)

TABLE 141 GPU MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2016–2019 (THOUSAND UNITS)

TABLE 142 GPU MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2020–2025 (THOUSAND UNITS)

10.2.7 INDUSTRIAL

10.2.7.1 Industrial computers employ GPUs to offer the accelerated performance required in applications involving machine vision and real-time inferencing

TABLE 143 GPU MARKET FOR INDUSTRIAL, BY REGION, 2016–2019 (USD MILLION)

TABLE 144 GPU MARKET FOR INDUSTRIAL, BY REGION, 2020–2025 (USD MILLION)

TABLE 145 GPU MARKET FOR INDUSTRIAL, BY REGION, 2016–2019 (THOUSAND UNITS)

TABLE 146 GPU MARKET FOR INDUSTRIAL, BY REGION, 2020–2025 (THOUSAND UNITS)

10.2.8 OTHER APPLICATIONS

10.2.8.1 Use OF GPUs in the agriculture industry to power AI platforms, which turn satellite data into crucial analytics for crop and soil conditions

TABLE 147 GPU MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 148 GPU MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 149 GPU MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (THOUSAND UNITS)

TABLE 150 GPU MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (THOUSAND UNITS)

10.2.9 NEGATIVELY IMPACTED APPLICATION BY COVID-19

10.2.9.1 Automotive

FIGURE 41 PRE- AND POST-COVID-19 MARKET COMPARISON FOR THE AUTOMOTIVE

TABLE 151 GPU MARKET FOR AUTOMOTIVE, BY PRE- AND POST-COVID-19 SCENARIO, 2016–2025 (USD MILLION)

10.2.9.1.1 Impact analysis

10.2.10 LEAST-IMPACTED APPLICATION BY COVID-19 IN THE GPU MARKET

10.2.10.1 Industrial

FIGURE 42 PRE- AND POST-COVID-19 MARKET COMPARISON FOR INDUSTRIAL

TABLE 152 GPU MARKET FOR INDUSTRIAL, BY PRE- AND POST-COVID-19 SCENARIO, 2016–2025 (USD MILLION)

10.2.10.1.1 Impact analysis

11 GEOGRAPHIC ANALYSIS (Page No. - 176)

11.1 INTRODUCTION

FIGURE 43 MICROPROCESSOR MARKET IN APAC TO GROW AT A HIGHER CAGR THAN THAT OF IN THE AMERICAS AND EUROPE FROM 2020 TO 2025

FIGURE 44 THE GPU MARKET IN APAC TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

TABLE 153 MICROPROCESSOR MARKET SIZE, BY REGION, 2016–2019 (USD BILLION)

TABLE 154 MICROPROCESSOR MARKET SIZE, BY REGION, 2020–2025 (USD BILLION)

TABLE 155 MICROPROCESSOR MARKET SIZE, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 156 MICROPROCESSOR MARKET SIZE, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 157 GPU MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 158 GPU MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 159 GPU MARKET SIZE, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 160 GPU MARKET SIZE, BY REGION, 2020–2025 (MILLION UNITS)

11.2 AMERICAS

FIGURE 45 SNAPSHOT OF THE MICROPROCESSOR AND GPU MARKET IN THE AMERICAS

TABLE 161 AMERICAS: MICROPROCESSOR MARKET SIZE, BY FUNCTIONALITY, 2016–2019 (USD BILLION)

TABLE 162 AMERICAS: MICROPROCESSOR MARKET SIZE, BY FUNCTIONALITY, 2020–2025 (USD BILLION)

TABLE 163 AMERICAS: MICROPROCESSOR MARKET SIZE, BY FUNCTIONALITY, 2016–2019 (MILLION UNITS)

TABLE 164 AMERICAS: MICROPROCESSOR MARKET SIZE, BY FUNCTIONALITY, 2020–2025 (MILLION UNITS)

TABLE 165 AMERICAS: MICROPROCESSOR MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 166 AMERICAS: MICROPROCESSOR MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 167 AMERICAS: MICROPROCESSOR MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 168 AMERICAS: MICROPROCESSOR MARKET SIZE, BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 169 AMERICAS: GPU MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 170 AMERICAS: GPU MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 171 AMERICAS: GPU MARKET SIZE, BY APPLICATION, 2016–2019 (THOUSAND UNITS)

TABLE 172 AMERICAS: GPU MARKET SIZE, BY APPLICATION, 2020–2025 (THOUSAND UNITS)

TABLE 173 AMERICAS: MICROPROCESSOR MARKET SIZE, BY COUNTRY/REGION, 2016–2019 (USD BILLION)

TABLE 174 AMERICAS: MICROPROCESSOR MARKET SIZE, BY COUNTRY/REGION, 2020–2025 (USD BILLION)

TABLE 175 AMERICAS: MICROPROCESSOR MARKET SIZE, BY COUNTRY/REGION, 2016–2019 (MILLION UNITS)

TABLE 176 AMERICAS: MICROPROCESSOR MARKET SIZE, BY COUNTRY/REGION, 2020–2025 (MILLION UNITS)

11.2.1 US

11.2.1.1 The Healthcare industry majorly uses microprocessors in supercomputers to advance the research on vaccines and other research purposes

11.2.2 CANADA

11.2.2.1 Adoption of application processors for PLCs, sensors, and HMIs in automotive manufacturing facilities to spur the market

11.2.3 MEXICO

11.2.3.1 Adoption of smart farming and other AI-enabled cloud-based technologies in the agriculture sector for cloud servers to boost the market growth

11.2.4 SOUTH AMERICA

11.2.4.1 Brazil

11.2.4.1.1 Adoption of smart farming practices to improve productivity and quality of the crops

11.2.4.2 Argentina

11.2.4.2.1 The penetration of GPU-powered AI platforms in hydropower stations could increase for various deep learning models

11.2.5 IMPACT OF COVID-19 ON THE AMERICAS

11.2.5.1 High demand for servers and datacenters in various service- and manufacturing-based industries during and post-COVID-19

FIGURE 46 AMERICAS: COMPARISON OF PRE- & POST-COVID-19 MARKET SCENARIO FOR MICROPROCESSORS, 2016–2025 (USD MILLION)

TABLE 177 AMERICAS: COMPARISON TABLE OF PRE- & POST-COVID-19 MARKET SCENARIO FOR MICROPROCESSORS, 2016–2025 (USD BILLION)

FIGURE 47 AMERICA: COMPARISON OF PRE- & POST-COVID-19 MARKET SCENARIO FOR GPUS, 2016–2025 (USD MILLION)

TABLE 178 AMERICAS: COMPARISON OF PRE- & POST- COVID-19 MARKET SCENARIO FOR GPUS, 2016–2025 (USD MILLION)

11.2.5.2 Impact of COVID-19 on the US

11.2.5.3 Impact of COVID-19 on Canada

11.2.5.4 Impact of COVID-19 on Mexico

11.2.5.5 Impact of Covid-19 on South America

11.3 EUROPE

FIGURE 48 SNAPSHOT OF THE MICROPROCESSOR AND GPU MARKET IN EUROPE

TABLE 179 EUROPE: MICROPROCESSOR MARKET SIZE, BY FUNCTIONALITY, 2016–2019 (USD BILLION)

TABLE 180 EUROPE: MICROPROCESSOR MARKET SIZE, BY FUNCTIONALITY, 2020–2025 (USD BILLION)

TABLE 181 EUROPE: MICROPROCESSOR MARKET SIZE, BY FUNCTIONALITY, 2016–2019 (MILLION UNITS)

TABLE 182 EUROPE: MICROPROCESSOR MARKET SIZE, BY FUNCTIONALITY, 2020–2025 (MILLION UNITS)

TABLE 183 EUROPE: MICROPROCESSOR MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 184 EUROPE: MICROPROCESSOR MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 185 EUROPE: MICROPROCESSOR MARKET SIZE, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 186 EUROPE: MICROPROCESSOR MARKET SIZE, BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 187 EUROPE: GPU MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 188 EUROPE: GPU MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 189 EUROPE: GPU MARKET SIZE, BY APPLICATION, 2016–2019 (THOUSAND UNITS)

TABLE 190 EUROPE: GPU MARKET SIZE, BY APPLICATION, 2020–2025 (THOUSAND UNITS)

TABLE 191 EUROPE: MICROPROCESSOR MARKET SIZE, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 192 EUROPE: MICROPROCESSOR MARKET SIZE, BY COUNTRY, 2020–2025 (USD BILLION)

TABLE 193 EUROPE: MICROPROCESSOR MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION UNITS)

TABLE 194 EUROPE: MICROPROCESSOR MARKET SIZE, BY REGION, 2020–2025 (MILLION UNITS)

11.3.1 GERMANY

11.3.1.1 Increase in demand for automotive processors to power sensors and camera in advanced automotive technologies

11.3.2 FRANCE

11.3.2.1 Increase in the demand for high-performance computing (HPC) solutions, including supercomputers used in unmanned ground vehicles (UGV), warships, and combat to drive the market

11.3.3 UK

11.3.3.1 Government initiatives such as ‘Made Smarter’ to drive growth and transformation in the UK’s manufacturing ecosystem

11.3.4 REST OF EUROPE

11.3.4.1 Continuous demand from automotive, electronics, healthcare, petrochemicals, textile, and other industrial sectors to spur growth

11.3.5 IMPACT OF COVID-19 ON EUROPE

11.3.5.1 The falling demand for automotive vehicles is expected to slow down the growth of the microprocessor and GPU market in the region

FIGURE 49 EUROPE: COMPARISON OF PRE- & POST-COVID-19 MARKET SCENARIO FOR MICROPROCESSORS, 2016–2025 (USD MILLION)

TABLE 195 EUROPE: COMPARISON TABLE OF PRE-& POST-COVID-19 MARKET SCENARIO FOR MICROPROCESSORS, 2016–2025 (USD BILLION)

FIGURE 50 EUROPE: COMPARISON OF PRE- & POST-COVID-19 MARKET SCENARIO FOR GPUS, 2016–2025 (USD MILLION)

TABLE 196 EUROPE: COMPARISON TABLE OF PRE- & POST-COVID-19 MARKET SCENARIO FOR GPUS, 2016–2025 (USD MILLION)

11.3.5.2 Impact of COVID-19 on Germany

11.3.5.3 Impact of COVID-19 on France

11.3.5.4 Impact of COVID-19 on the UK

11.3.5.5 Impact of COVID-19 on Rest of Europe

11.4 APAC

FIGURE 51 SNAPSHOT OF THE MICROPROCESSORS AND GPU MARKET IN APAC

TABLE 197 MICROPROCESSOR MARKET FOR APAC, BY FUNCTIONALITY, 2016–2019 (USD BILLION)

TABLE 198 MICROPROCESSOR MARKET FOR APAC, BY FUNCTIONALITY, 2020–2025 (USD BILLION)

TABLE 199 MICROPROCESSOR MARKET FOR APAC, BY FUNCTIONALITY, 2016–2019 (MILLION UNITS)

TABLE 200 MICROPROCESSOR MARKET FOR APAC, BY FUNCTIONALITY, 2020–2025 (MILLION UNITS)

TABLE 201 MICROPROCESSOR MARKET IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 202 MICROPROCESSOR MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 203 MICROPROCESSOR MARKET IN APAC, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 204 MICROPROCESSOR MARKET IN APAC, BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 205 GPU MARKET IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 206 GPU MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 207 GPU MARKET IN APAC, BY APPLICATION, 2016–2019 (THOUSAND UNITS)

TABLE 208 GPU MARKET IN APAC, BY APPLICATION, 2020–2025 (THOUSAND UNITS)

TABLE 209 MICROPROCESSOR MARKET FOR APAC, BY REGION, 2016–2019 (USD BILLION)

TABLE 210 MICROPROCESSOR MARKET FOR APAC, BY REGION, 2020–2025 (USD BILLION)

TABLE 211 MICROPROCESSOR MARKET FOR APAC, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 212 MICROPROCESSOR MARKET FOR APAC, BY REGION, 2020–2025 (MILLION UNITS)

11.4.1 CHINA

11.4.1.1 Developments related to 5G technology fueling the growth of the microprocessor and GPU market

11.4.2 JAPAN

11.4.2.1 High demand for service robots expected to increase the penetration of processors used in smart edge devices for several industries

11.4.3 INDIA

11.4.3.1 Increasing use of IoT connected devices and mobile robots expected to drive the use of microprocessors

11.4.4 REST OF APAC

11.4.4.1 Growth of the electronics, automotive, and petrochemicals industries expected to boost the microprocessor market

11.4.5 IMPACT OF COVID-19 ON APAC

11.4.5.1 Lockdown measures implemented in China have led to the fall in global shipments of consumer electronics, automotive vehicles, and other industrial equipment and devices

FIGURE 52 COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS FOR THE MICROPROCESSOR MARKET IN APAC, 2016–2025 (USD MILLION)

TABLE 213 COMPARISON TABLE OF PRE- AND POST-COVID-19 SCENARIOS FOR MICROPROCESSOR MARKET IN APAC, 2016–2025 (USD BILLION)

FIGURE 53 COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS FOR THE GPU MARKET IN APAC, 2016–2025 (USD MILLION)

TABLE 214 COMPARISON TABLE OF PRE- AND POST-COVID-19 SCENARIOS FOR GPU IN APAC, 2016–2025 (USD MILLION)

11.4.5.2 Impact of COVID-19 on China

11.4.5.3 Impact of COVID-19 on Japan

11.4.5.4 Impact of COVID-19 on India

11.4.5.5 Impact of COVID-19 on Rest of APAC

11.5 REST OF THE WORLD (R0W)

TABLE 215 MICROPROCESSOR MARKET FOR ROW, BY FUNCTIONALITY, 2016–2019 (USD BILLION)

TABLE 216 MICROPROCESSOR MARKET FOR ROW, BY FUNCTIONALITY, 2020–2025 (USD BILLION)

TABLE 217 MICROPROCESSOR MARKET FOR ROW, BY FUNCTIONALITY, 2016–2019 (MILLION UNITS)

TABLE 218 MICROPROCESSOR MARKET FOR ROW, BY FUNCTIONALITY, 2020–2025 (MILLION UNITS)

TABLE 219 MICROPROCESSOR MARKET IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 220 MICROPROCESSOR MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 221 MICROPROCESSOR MARKET IN ROW, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 222 MICROPROCESSOR MARKET IN ROW, BY APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 223 GPU MARKET IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 224 GPU MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 225 GPU MARKET IN ROW, BY APPLICATION, 2016–2019 (THOUSAND UNITS)

TABLE 226 GPU MARKET IN ROW, BY APPLICATION, 2020–2025 (THOUSAND UNITS)

11.5.1 IMPACT OF COVID-19 ON REST OF THE WORLD (ROW)

11.5.1.1 Adoption of advanced healthcare infrastructure in Africa spurring the growth of the microprocessor and GPU market

FIGURE 54 COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS FOR THE MICROPROCESSOR MARKET IN ROW, 2016–2025 (USD MILLION)

TABLE 227 COMPARISON TABLE OF PRE- AND POST-COVID-19 SCENARIOS FOR MICROPROCESSOR MARKET IN ROW, 2016–2025 (USD BILLION)

FIGURE 55 COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS FOR THE GPU MARKET IN ROW, 2016–2025 (USD MILLION)

TABLE 228 COMPARISON TABLE OF PRE- AND POST-COVID-19 SCENARIOS FOR GPU IN ROW, 2016–2025 (USD MILLION)

11.5.1.2 Impact of COVID-19 on the Middle East

11.5.1.3 Impact of COVID-19 on Africa

12 COMPETITIVE LANDSCAPE (Page No. - 232)

12.1 OVERVIEW

FIGURE 56 COMPANIES ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGIES DURING 2017–2020

12.2 MARKET SHARE ANALYSIS (TOP FIVE PLAYERS)

FIGURE 57 MARKET SHARE ANALYSIS OF TOP FIVE COMPANIES IN THE MARKET, 2019

12.3 COMPANY EVALUATION MATRIX

FIGURE 58 MICROPROCESSOR AND GPU MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2019

12.3.1 STAR

12.3.2 PERVASIVE

12.3.3 EMERGING LEADER

12.3.4 PARTICIPANT

12.4 STRENGTH OF PRODUCT PORTFOLIO (FOR 25 COMPANIES)

FIGURE 59 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

12.5 BUSINESS STRATEGY EXCELLENCE (FOR 25 COMPANIES)

FIGURE 60 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MICROPROCESSOR AND GPU MARKET

12.6 COMPETITIVE SCENARIO

12.6.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 229 TOP 10 PRODUCT LAUNCHES & DEVELOPMENTS (2017–2020)

12.6.2 PARTNERSHIPS, COLLABORATIONS, & JOINT VENTURES

TABLE 230 KEY PARTNERSHIPS, COLLABORATIONS, & AGREEMENTS (2017—2020)

12.6.3 ACQUISITIONS & EXPANSIONS

TABLE 231 KEY ACQUISITIONS & EXPANSIONS (2017–2020)

13 COMPANY PROFILES (Page No. - 246)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products/Solutions Offered, Recent Developments, COVID-19-related Developments, SWOT Analysis, and MnM View)*

13.2.1 INTEL

FIGURE 61 INTEL: COMPANY SNAPSHOT

13.2.2 QUALCOMM

FIGURE 62 QUALCOMM: COMPANY SNAPSHOT

13.2.3 SAMSUNG

FIGURE 63 SAMSUNG: COMPANY SNAPSHOT

13.2.4 NVIDIA

FIGURE 64 NVIDIA: COMPANY SNAPSHOT

13.2.5 AMD

FIGURE 65 AMD: COMPANY SNAPSHOT

13.2.6 BROADCOM

FIGURE 66 BROADCOM: COMPANY SNAPSHOT

13.2.7 MEDIATEK

FIGURE 67 MEDIATEK: COMPANY SNAPSHOT

13.2.8 TEXAS INSTRUMENTS

FIGURE 68 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

13.2.9 MARVELL

FIGURE 69 MARVELL: COMPANY SNAPSHOT

13.2.10 IBM

FIGURE 70 IBM: COMPANY SNAPSHOT

* Business Overview, Products/Solutions Offered, Recent Developments, COVID-19-related Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

13.3 RIGHT TO WIN

13.4 5 YEAR COMPANY REVENUE ANALYSIS

TABLE 232 MARKET REVENUE OF TOP 10 KEY COMPANIES IN MICROPROCESSOR AND GPU MARKET FOR PAST 5 YEARS, FROM 2015-2019 (USD BILLION)

13.5 OTHER COMPANIES

13.5.1 NXP SEMICONDUCTORS

13.5.2 APPLE

13.5.3 HUAWEI

13.5.4 UNISOC COMMUNICATIONS

13.5.5 ALLWINNER TECHNOLOGY

13.5.6 FUJITSU

13.5.7 XILINX

13.5.8 RENESAS

13.5.9 VIA TECHNOLOGIES

13.5.10 IMAGINATION TECHNOLOGIES

14 APPENDIX (Page No. - 300)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

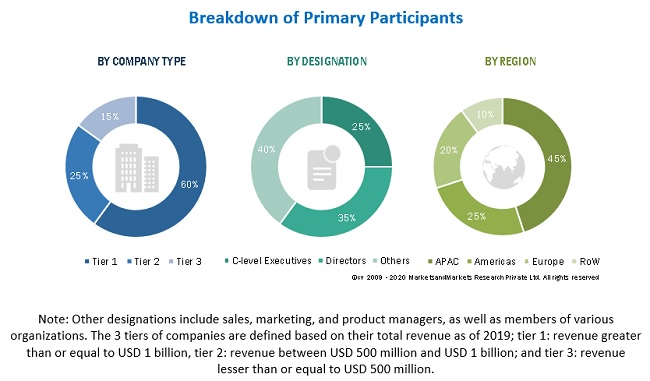

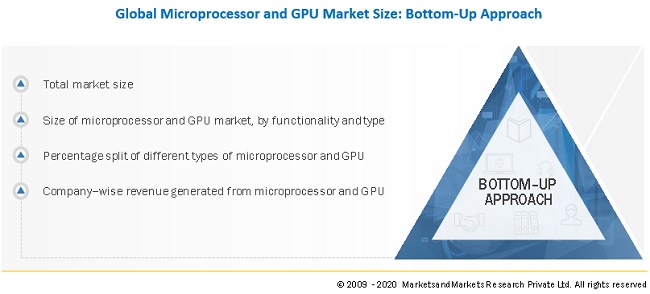

The study involved four major activities for estimating the size of the microprocessor and GPU market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its parent market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the microprocessor and GPU market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the microprocessor and GPU market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. The secondary research referred to for this research study involve microprocessor and GPU industry organizations such as Semiconductor Industry Association (SIA), GSM Association, and European Association for Artificial Intelligence (EURAI). Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the microprocessor and GPU market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the microprocessor and GPU market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across key regions, namely, Americas, Europe, APAC, and Middle East and Africa (MEA). The demand side of this market is characterized by processor and GPU design companies and manufacturers. The supply side is characterized by OSAT companies, IDM firms, and OEM firms. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of microprocessor and GPU market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain and the size of the microprocessor and GPU market, in terms of value and volume, have been determined through primary and secondary research processes

- Several primary interviews have been conducted with key opinion leaders related to microprocessor and GPU market including key OEMs, IDMs, and Tier I suppliers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both demand and supply sides of the microprocessor and GPU market.

Report Objectives

- To describe, segment, and forecast the overall size of the microprocessor and GPU market based on architecture, GPU type, functionality, deployment, application, and region

- To describe, analyze, and forecast the market size for various segments with regard to 4 main regions—Asia Pacific (APAC), Americas, Europe, and Rest of the World (RoW)

- To analyze and forecast the market size, in terms of volume (000’/million units) and value (USD million/billion), for the microprocessor and GPU market

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To briefly describe the microprocessor and GPU value chain

- To segment and forecast the microprocessor and GPU market size by architecture (x86, ARM, Other Architectures)

- To segment and forecast the microprocessor and GPU market size by GPU type (discrete and integrated)

- To segment and forecast the microprocessor and GPU market size by functionality (real-time systems and standalone systems)

- To segment and forecast the microprocessor and GPU market size by deployment (in-premise and on-cloud)

- To segment and forecast the microprocessor and GPU market size for key applications (consumer electronics, automotive, aerospace & defense, healthcare, BFSI, servers & datacenters, industrial)

- To forecast the microprocessor and GPU market size in key regions, namely, Americas, Asia Pacific (APAC), Europe, and Rest of the World (RoW)

- To analyze competitive developments such as product launches and developments, partnerships, collaborations, acquisitions, joint ventures, expansions, and research and development (R&D) activities in the microprocessor and GPU market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of microprocessor and GPU market

- Estimation of the market size of the segments of the microprocessor and GPU market based on different subsegments

Growth opportunities and latent adjacency in Microprocessor and GPU Market