Soil Treatment Market by Type (Soil protection, Organic amendments, pH adjusters), Technology (Physiochemical, Biological, and Thermal), & by Region - Global Forecasts to 2020

The soil treatment market is estimated to be valued at USD 24.11 Billion in 2015. It is projected to grow at a CAGR of 8.5% through 2020. With the increasing awareness about food security in North American, European, and Asian economies and shrinking arable land, the demand for soil treatment products is expected to enhance the market growth in the near future. The global market is segmented on the basis of its types into soil protection, organic amendments, and pH adjusters. It is further segmented on the basis of regions into North America, Europe, Asia-Pacific, and Rest of the World (RoW).

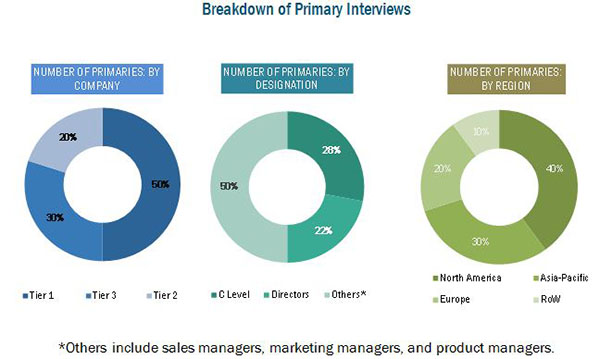

This report includes estimations of market sizes for value (USD million) and volume (KT). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global soil treatment market and to estimate the size of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources. The figure below shows the breakdown of profiles of industry experts who participated in the primary discussions.

The biotechnology and chemical manufacturers offer soil treatment products to meet the needs of the farmers. The major key players that are profiled in the report include Syngenta AG (Switzerland), BASF SE (Germany), Adama Agricultural Solutions Ltd. (Israel), Monsanto Company (U.S.), and Solvay S.A. (Belgium).

This report is targeted at the existing players in the industry, which include agrochemical manufacturers, organic food manufacturers, soil associations, biotechnology companies, and research institutions. Key participants in the supply chain of soil treatment are raw material suppliers, government bodies, distributors, and end users such as governments, farmers, and researchers.

This report provides qualitative and quantitative analyses of the soil treatment market, the competitive landscape, and the preferred development strategies of key players. The key players preferred acquisitions and partnerships, agreements, collaborations, & joint ventures as strategies to gain a larger share in the market. The report also analyzes the market dynamics and market share of leading players.

The study answers several questions for stakeholders, primarily which market segments to focus on in next two to five years for prioritizing efforts and investments.

Scope of the Report

On the basis of type, the global market is segmented as follows:

- Organic amendments

- pH adjusters

- Soil protection

On the basis of type, the organic amendments market is segmented as follows:

- Animal dung

- Crop residue

- Compost

- Sewage sludge

On the basis of type, the pH adjusters market is segmented as follows:

- Aglime

- Gypsum

On the basis of type, the soil protection market is segmented as follows:

- Weed control

- Pest control

On the basis of type, the weed control market is segmented as follows:

- Glyphosate

- Atrazine

- Acetochlor

- 2,4-D

On the basis of technology, the market is segmented as follows:

- Physiochemical

- Biological

- Thermal

On the basis of region, the market is segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

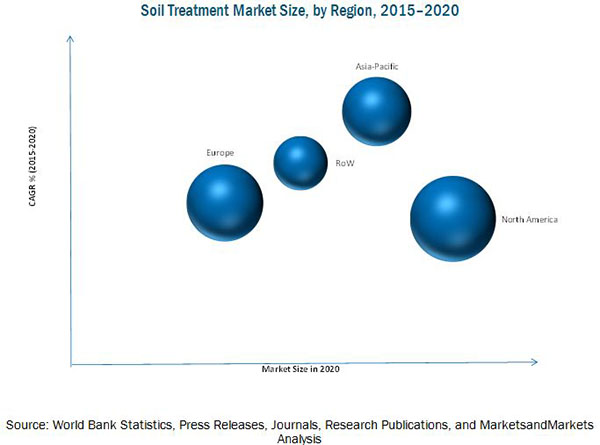

The soil treatment market is projected to grow at a CAGR of 8.5% from 2015, to reach a projected value of USD 36.29 Billion by 2020. The market growth is driven by rising concerns about food security and shrinking arable land. The market is further driven by factors such as changing farming practices and increasing demand for organic food.

Based on the type, the global market is estimated to be led by the soil protection segment, followed by the organic amendments segment, in terms of value. In terms of volume, the soil treatment market was led by the organic amendments segment in 2014. Soil treatment products are used on a large scale in regions where there is a high demand for arable land.

Among the varied types for organic amendments products, such as crop residue, animal dung, compost, and sewage sludge, crop residue accounted for the largest market share in 2014, followed by animal dung and compost. Crop residue and animal dung are largely used in European and Asian countries and is making its way into regular agricultural usage in most of the North American regions.

North America accounted for the largest market share for soil treatment, followed by Europe and Asia-Pacific. Soil treatment products such as soil protection, organic amendments are among the widely used products in this region; changing farming practices is one of the major factors driving the soil treatment market in this region. The Asia-Pacific region is projected to be the fastest-growing market with investments from several multinational manufacturers, especially in countries such as China, India, and Japan.

Adherence to government regulations for the usage of soil treatment products poses as one of the restraints for this market. Also, the increasing awareness about ill effects of agrochemicals on soil health hinders the growth of this market.

The soil treatment market is fragmented and competitive, with a large number of players operating at regional and local levels. The key players in the market adopted acquisitions, new product launches, expansion & investments, and agreements, partnerships, collaborations, and joint ventures as their preferred strategies. Prominent players such as Syngenta AG (Switzerland), BASF SE (Germany), Adama Agricultural Solutions Ltd. (Israel), Monsanto Company (U.S.), and Solvay S.A. (Belgium) have been profiled in the report.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Overview of the Agrochemical Industry

2.2.3 Demand-Side Analysis

2.2.3.1 Increasing Patents in Agrochemical Industry

2.2.3.2 Increasing Demand for Organic Products

2.2.3.3 Population Pressure on Agricultural Land Increasing Demand for Soil Treatment Products

2.2.4 Supply-Side Analysis

2.2.4.1 Advancements in the Chemical Industry

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

2.6 Limitations of the Research Study

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in this Market

4.2 Soil Protection to Dominate Among Soil Treatment Types

4.3 U.S. to Dominate Soil Treatment Market in North America in 2015

4.4 U.S. to Dominate the Global Market By 2020

4.5 Soil Treatment Market: Country-Level Market Leaders

4.6 Soil Protection Accounted for the Largest Share in the Soil Protection Market, 2014

4.7 Soil Treatment Market: Life Cycle Analysis, By Region

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 Soil Treatment Market, By Type

5.3.2 Soil Treatment Market, By Technology

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Ensuring Food Security

5.4.1.2 Change in Farming Practices

5.4.1.3 Growing Organic Food Market

5.4.1.4 Shrinking Arable Land

5.4.2 Restraints

5.4.2.1 Emergence of Bio-Tech Seeds

5.4.2.2 Technical Knowledge Barriers

5.4.3 Opportunities

5.4.3.1 Rapid Growth in the Bio-Agrochemical Market

5.4.3.2 Emerging Markets Post High Growth

5.4.4 Challenges

5.4.4.1 Market Saturation

5.4.4.2 Evolution of Biotechnology

5.4.4.3 Stringent Regulations

5.5 Regulatory Requirements for Soil Treatment Products Market

5.5.1 European Union

5.5.2 Legal Citations Provided By Environment Protection Agency

5.5.3 the Agricultural Chemicals Regulation Law

6 Industry Trends (Page No. - 51)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Value Chain Analysis

6.4 Porters Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

7 Soil Treatment Market, By Technology (Page No. - 57)

7.1 Introduction

7.2 Physiochemical Treatment

7.2.1 Soil Vapor Extraction (Sve)

7.2.2 Solidification & Stabilization

7.2.3 Chemical Oxidation

7.2.4 Electro Kinetic Separation

7.2.5 Fracturing

7.2.6 Soil Flushing

7.3 Biological Treatment

7.3.1 Bioventing

7.3.2 Enhanced Bioremediation

7.3.3 Phytoremediation

7.4 Thermal Treatment

8 Soil Treatment Market, By Type (Page No. - 62)

8.1 Introduction

8.2 Organic Amendments

8.2.1 Animal Dung

8.2.2 Crop Residue

8.2.3 Compost

8.2.4 Sewage Sludge

8.2.5 Other Organic Amendments

8.3 pH Adjusters

8.3.1 Aglime

8.3.2 Gypsum

8.3.3 Others

8.4 Soil Protection

8.4.1 Weed Control

8.4.1.1 Glyphosate

8.4.1.2 Atrazine

8.4.1.3 Acetochlor

8.4.1.4 2,4-D

8.4.1.5 Other Weed Control

8.4.2 Pest Control

9 Soil Treatment Market, By Region (Page No. - 80)

9.1 Introduction

9.2 North America

9.2.1 U.S

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 U.K.

9.3.2 Germany

9.3.3 France

9.3.4 Italy

9.3.5 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Australia

9.4.5 Rest of Asia-Pacific

9.5 Rest of the World (RoW)

9.5.1 Brazil

9.5.2 Argentina

9.5.3 South Africa

9.5.4 Other RoW Countries

10 Competitive Landscape (Page No. - 106)

10.1 Overview

10.2 Competitive Situation & Trends

10.2.1 New Product Launches

10.2.2 Expansions & Investments

10.2.3 Agreements, Partnerships, Collaborations & Joint Ventures

10.2.4 Acquisitions

11 Company Profiles (Page No. - 115)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Introduction

11.2 Syngenta AG

11.3 BASF SE

11.4 ADAMA Agricultural Solutions Ltd.

11.5 Solvay S.A.

11.6 Monsanto Company

11.7 American Vanguard Corporation

11.8 Arkema S.A.

11.9 Novozymes A/S

11.10 Platform Specialty Products

11.11 Kanesho Soil Treatment

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 142)

12.1 Discussion Guide

12.2 Introducing RT: Real-Time Market Intelligence

12.3 Available Customizations

12.4 Related Reports

List of Tables (78 Tables)

Table 1 Soil Treatment Market Size, By Type, 20132020 (USD Million)

Table 2 Market Size, By Type, 20132020 (KT)

Table 3 Organic Amendments Market Size, By Type, 20132020 (USD Million)

Table 4 Organic Amendments Market Size, By Region, 20132020 (USD Million)

Table 5 Organic Amendments Market Size, By Region, 20132020 (KT)

Table 6 Animal Dung Market Size, By Region, 20132020 (USD Million)

Table 7 Crop Residue Market Size, By Region, 20132020 (USD Million)

Table 8 Compost Market Size, By Region, 20132020 (USD Million)

Table 9 Sewage Sludge Market Size, By Region, 20132020 (USD Million)

Table 10 Other Organic Amendments Market Size, By Region,20132020 (USD Million)

Table 11 pH Adjusters Market Size, By Type, 20132020 (USD Million)

Table 12 pH Adjusters Market Size, By Region, 20132020 (USD Million)

Table 13 pH Adjusters Market Size, By Region, 20132020 (KT)

Table 14 Aglime Market Size, By Region, 20132020 (USD Million)

Table 15 Gypsum Market Size, By Region, 20132020 (USD Million)

Table 16 Other pH Adjusters Market Size, By Region, 20132020 (USD Million)

Table 17 Soil Protection Market Size, By Type, 20132020 (USD Million)

Table 18 Market Size, By Region, 20132020 (USD Million)

Table 19 Market Size, By Region, 20132020 (KT)

Table 20 Weed Control Market Size, By Type, 20132020 (USD Million)

Table 21 Weed Control Market Size, By Region, 20132020 (USD Million)

Table 22 Glyphosate Market Size, By Region, 20132020 (USD Million)

Table 23 Atrazine: Weed Control: Soil Treatment Market Size, By Region,20132020 (USD Million)

Table 24 Acetochlor Market Size, By Region, 20132020 (USD Million)

Table 25 2,4-D Market Size, By Region, 20132020 (USD Million)

Table 26 Other Weed Control Market Size, By Region, 20132020 (USD Million)

Table 27 Pest Controlmarket Size, By Region, 20132020 (USD Million)

Table 28 Soil Treatment Market Size, By Region, 20132020 (USD Million)

Table 29 Market Size, By Region, 20132020 (KT)

Table 30 North America: Soil Treatment Market Size, By Country,20132020 (USD Million)

Table 31 North America: Market Size, By Type, 20132020 (KT)

Table 32 North America: Market Size, By Type,20132020 (USD Million)

Table 33 North America: Organic Amendments Market Size, By Type,20132020 (USD Million)

Table 34 North America: pH Adjuster Market Size, By Type, 20132020 (USD Million)

Table 35 North America: Soil Protection Market Size, By Type,20132020 (USD Million)

Table 36 North America: Weed Control Market Size, By Type,20132020 (USD Million)

Table 37 U.S.: Soil Treatment Market Size, By Type, 20132020 (USD Million)

Table 38 Canada: Market Size, By Type, 20132020 (USD Million)

Table 39 Mexico: Market Size, By Type, 20132020 (USD Million)

Table 40 Europe: Market Size, By Country, 20132020 (USD Million)

Table 41 Europe: Market Size, By Type, 20132020 (KT)

Table 42 Europe: Market Size, By Type, 20132020 (USD Million)

Table 43 Europe: Organic Amendments Market Size, By Type,20132020 (USD Million)

Table 44 Europe: pH Adjusters Market Size, By Type, 20132020 (USD Million)

Table 45 Europe: Soil Protection Market Size, By Type, 20132020 (USD Million)

Table 46 Europe: Weed Control Market Size, By Type, 20132020 (USD Million)

Table 47 U.K.: Soil Treatment Market Size, By Type, 20132020 (USD Million)

Table 48 Germany: Soil Treatment Market Size, By Type, 20132020 (USD Million)

Table 49 France: Soil Treatment Market Size, By Type, 20132020 (USD Million)

Table 50 Italy: Soil Treatment Market Size, By Type, 20132020 (USD Million)

Table 51 Rest of Europe: Soil Treatment Market Size, By Type,20132020 (USD Million)

Table 52 Asia-Pacific: Soil Treatment Market Size, By Country,20132020 (USD Million)

Table 53 Asia-Pacific: Market Size, By Type, 20132020 (KT)

Table 54 Asia-Pacific: Market Size, By Type, 20132020 (USD Million)

Table 55 Asia-Pacific: Organic Amendments Market Size, By Type,20132020 (USD Million)

Table 56 Asia-Pacific: pH Adjuster Market Size, By Type, 20132020 (USD Million)

Table 57 Asia-Pacific: Soil Protection Market Size, By Type, 20132020 (USD Million)

Table 58 Asia-Pacific: Weed Control Market Size, By Type, 20132020 (USD Million)

Table 59 China: Soil Treatment Market Size, By Type, 20132020 (USD Million)

Table 60 Japan: Soil Treatment Market Size, By Type, 20132020 (USD Million)

Table 61 India: Soil Treatment Market Size, By Type, 20132020 (USD Million)

Table 62 Australia: Soil Treatment Market Size, By Type, 20132020 (USD Million)

Table 63 Rest of Asia-Pacific: Soil Treatment Market Size, By Type,20132020 (USD Million)

Table 64 RoW: Soil Treatment Market Size, By Country 20132020 (USD Million)

Table 65 RoW: Market Size, By Type 20132020 (KT)

Table 66 RoW: Market Size, By Type 20132020 (USD Million)

Table 67 RoW: Organic Amendments Market Size, By Type 20132020 (USD Million)

Table 68 RoW: pH Adjuster Market Size, By Type 20132020 (USD Million)

Table 69 RoW: Soil Protection Market Size, By Type 20132020 (USD Million)

Table 70 RoW: Weed Control Market Size, By Type 20132020 (USD Million)

Table 71 Brazil: Soil Treatment Market Size, By Type, 20132020 (USD Million)

Table 72 Argentina: Soil Treatment Market Size, By Type, 20132020 (USD Million)

Table 73 South Africa: Soil Treatment Market Size, By Type,20132020 (USD Million)

Table 74 Other RoW Countries: Soil Treatment Market Size, By Type,20132020 (USD Million)

Table 75 New Product Launches, 20102015

Table 76 Expansions & Investments, 20112015

Table 77 Agreements, Partnerships, Collaborations & Joint Ventures, 20102015

Table 78 Acquisitions, 20102015

List of Figures (52 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Global Population is Projected to Reach ~9.5 Billion By 2050

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Assumptions of the Research Study

Figure 8 Limitations of the Research Study

Figure 9 Organic Amendments to Dominate the Market in Terms of Volume (KT) From 2014 to 2020

Figure 10 Weed Control to Dominate the Market in Terms of Value (USD Billion) From 2014 to 2020

Figure 11 Glyphosate Segment to Dominate the Weed Control Market in Terms of Value (USD Billion) From 2014 to 2020

Figure 12 North America to Capture Highest Market Share for Soil Treatment in 2014

Figure 13 Agreements, Partnerships, Collaborations, and Joint Ventures to Form the Most Preferred Strategy for Top Companies

Figure 14 Emerging Economies Offer Attractive Opportunities in the Soil Treatment Market

Figure 15 pH Adjusters Type in the Soil Treatment Market to Grow at the Highest CAGR From 2015 to 2020

Figure 16 Soil Protection Dominated the North American Market, Followed By pH Adjusters, in 2014

Figure 17 India is Projected to Be Fastest-Growing Country-Level Market for Soil Treatment From 2015 to 2020

Figure 18 Emerging Asian Economies to Grow Faster Than Developed Markets

Figure 19 Soil Protection Segment to Dominate the Global Soil Treatment Market, Followed By Organic Amendments in 2015

Figure 20 Soil Treatment Market in Asia-Pacific to Enter the Exponential Growth Phase By 2020

Figure 21 Evolution

Figure 22 By Type

Figure 23 By Technology

Figure 24 Higher Productivity Requirement Driving this Market

Figure 25 Supply Chain Analysis: Soil Treatment Market

Figure 26 Research & Development Contributes A Major Value Addition to the Value Chain

Figure 27 Porters Five Forces Analysis: Organic Amendments to Soil Gain Importance as Substitutes

Figure 28 Soil Protection Segment is Estimated to Dominate this Market, By Value, in 2015

Figure 29 Europe is Estimated to Dominate the Organic Amendments Segment of Market, By Value, in 2015

Figure 30 Geographic Snapshot: Decreasing Arable Land Fueling the Need for Soil Treatment

Figure 31 North American Soil Treatment Market: A Snapshot

Figure 32 European Soil Treatment Market: A Snapshot

Figure 33 Asia-Pacific Soil Treatment Market: A Snapshot

Figure 34 Key Companies Preferred Strategy of Partnerships, Agreements,& Collaborations and Acquisitions From 2010 to 2015

Figure 35 Soil Treatment Market Share (Segmental Revenue), By Key Player, 2014

Figure 36 Key Players Extensively Adopted Agreements, Partnerships, Collaborations & Joint Ventures Startegies to Fuel Growth of Soil Treatment Market From 2010 to 2015

Figure 37 Annual Developments in the Global Soil Treatment Market, 20102015

Figure 38 Geographical Revenue Mix of Top 5 Market Players

Figure 39 Syngenta AG: Company Snapshot

Figure 40 Syngenta AG: SWOT Analysis

Figure 41 BASF SE: Company Snapshot

Figure 42 BASF SE: SWOT Analysis

Figure 43 ADAMA Agricultural Solutions Ltd.: Company Snapshot

Figure 44 ADAMA Agricultural Solutions Ltd.: SWOT Analysis

Figure 45 Solvay S.A: Company Snapshot

Figure 46 Solvay S.A: SWOT Analysis

Figure 47 Monsanto Company: Company Snapshot

Figure 48 Monsanto Company: SWOT Analysis

Figure 49 American Vanguard Corporation: Company Snapshot

Figure 50 Arkema S.A: Company Snapshot

Figure 51 Novozymes A/S: Company Snapshot

Figure 52 Platform Specialty Products: Company Snapshot

Growth opportunities and latent adjacency in Soil Treatment Market