Virtual Private Cloud Market by Component (Software and Services), Service (Training and Consulting, Integration and Deployment, Support and Maintenance, and Managed Services), Organization Size, Vertical, and Region - Global Forecast to 2024

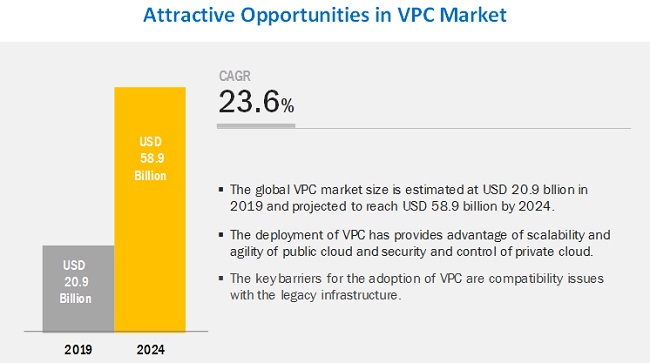

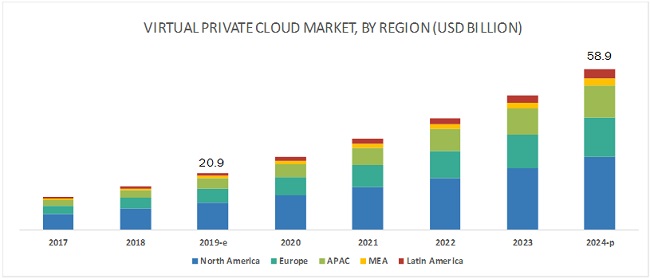

[103 Pages Report] The global Virtual Private Cloud Market size is expected to grow from USD 29.9 billion in 2019 to USD 58.9 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 23.0% during the forecast period. Increased security, automation and agility, the need for IT modernization, automation of manual processes, and increased cost savings are the major growth factors for the Virtual Private Cloud market. However, compatibility issues with legacy systems may restrain the growth of the VPC market.

By component, the solution segment to be a larger contributor to the Virtual Private Cloud market growth during the forecast period

VPC enables compliant and isolated environment, which proves to be an ideal alternative for enterprises to extend their on-premises infrastructure to a secure cloud. It provides a secure environment for mission-critical enterprise applications as VPC can easily cater to the needs of the most demanding applications without any additional cost. VPC can be deployed for applications, such as backup and disaster recovery, and dev-test environment. VPC is ideal for companies seeking high levels of security, privacy, and control, such as healthcare and financial organizations dealing with regulatory compliance.

By vertical, the BFSI segment to be a larger contributor to the Virtual Private Cloud market growth during the forecast period

The banking industry is gaining worldwide importance in this market, due to the increasing customer concerns in this vertical. Cloud computing helps customers in simplifying transactions anytime and anywhere, resulting in reduced efforts and time for customers to complete the process. Moreover, cloud computing services help BFSI vendors focus more on the customer-centric model by creating a multi-channel relationship with customers at every step of service provided by them. These factors are leading to the increased adoption of cloud computing services. The BFSI vertical is adopting digitalization initiatives at a rapid pace to meet the rising customer expectations and sustain the highly competitive market. BFSI companies deal with large volumes of data that need to be processed, stored, and reproduced, repetitively. Financial service providers are required to deal with key issues related to data storage, recovery, and cybersecurity. VPC solutions are out-of-the-box solutions that provide benefits of private cloud on a public cloud environment.

North America to have largest market share of Virtual Private Cloud market during the forecast period

The region is a mature market due to the presence of several players offering VPC. Organizations shifting toward the adoption of emerging technologies and the increasing adoption of digital business strategies are the major factors for the adoption of cloud computing offerings in North America. Enterprises’ increasing budget allocation for cloud services is expected to drive the market in North America. The US and Canada are the top North American countries that are expected to contribute to the VPC market.

Key Virtual Private Cloud Market Players

Google (US), Microsoft (US), Alibaba (China), AWS (US), OVH (France), Huawei (China), Rackspace (US), CenturyLink (US), DXC (US), and Atos (France).

Microsoft is an eminent player in the VPC market. To maintain its leadership position in the global competitive environment, Microsoft concentrates on innovations, cloud integration, and technology partnerships. The company delivers a delightful experience to its customers and partners using a wide range of products, services, and support offerings. It follows the strategy of developing a complete portfolio by conducting R&D at a global level. The company invested a substantial amount of USD 14.7 billion toward R&D in 2018. The company aims to deliver innovative solutions and improved performance to enterprises.

Scope of the Virtual Private Cloud Market Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Component, Service, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA) |

|

Companies covered |

Google (US), Microsoft (US), Alibaba (China), AWS (US), OVH (France), Huawei (China), Rackspace (US), CenturyLink (US), DXC (US), and Atos (France). |

The research report categorizes the VPC market to forecast the revenues and analyze the trends in each of the following subsegments:

Virtual Private Cloud Market By Component

- Software

- Service

- Training and Consulting

- Integration and Deployment

- Support and Maintenance

- Managed Services

Virtual Private Cloud Market By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

Virtual Private Cloud Market By Vertical

- Banking, Financial Services, and Insurance

- IT and Telecom

- Government and Defense

- Healthcare

- Media and Entertainment

- Retail

- Manufacturing

- Others

Virtual Private Cloud Market By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- Australia and New Zealand

- Japan

- China

- Rest of APAC

- MEA

- Kingdom of Saudi Arabia (KSA)

- South Africa

- United Arab Emirates (UAE)

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long-term?

- What are the upcoming verticals for the Virtual Private Cloud market?

- Which segment provides the most opportunity for growth?

- Which are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

Frequently Asked Questions (FAQ):

How is virtual private cloud defined in the report?

Who are the major providers of virtual private cloud market?

What vertical are the top adopters of virtual private cloud ?

What is the market size of virtual private cloud market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries’ Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down and Bottom-Up Approaches

2.4 Market Forecast

2.5 Competitive Leadership Mapping Research Methodology

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Growth Opportunities in the Virtual Private Cloud Market

4.2 Market By Component, 2019

4.3 Market By Service, 2019

4.4 Market By Vertical, 2019

4.5 Market Investment Scenario, 2019–2024

5 Virtual Private Cloud Market Overview and Industry Trends (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Automation and Agility Practice Across Industries

5.2.1.2 Focus on Reducing OPEX and CAPEX

5.2.1.3 Growing Need for Providing Enhanced Customer Experience

5.2.2 Restraints

5.2.2.1 Lack of Experts

5.2.3 Opportunities

5.2.3.1 Large Number of SMEs to Create New Revenue Opportunities for VPC Vendors

5.2.3.2 Need for Secure Cloud Environments to Increase Significantly

5.2.3.3 Deployments in Disaster Recovery Application and Devtest Environment

5.2.4 Challenges

5.2.4.1 Complying With Mandatory Regulations

5.2.4.2 Compatibility Issues With Legacy Systems

6 Virtual Private Cloud Market By Component (Page No. - 34)

6.1 Introduction

6.2 Software

6.2.1 VPC Offers the Scalability and Cost Effectiveness of Public Cloud as Well as the Privacy and Security of Private Cloud

6.3 Services

6.3.1 Training and Consulting

6.3.1.1 Training and Consulting Services Help in Assessment, Design, Deployment, and Optimization of Cloud Environment

6.3.2 Integration and Deployment

6.3.2.1 Integration and Deployment Services Aid in Streamlining Adoption, Improving Operational Efficiency, and Managing Disruption

6.3.3 Support and Maintenance

6.3.3.1 Support Services Empower Organizations to Efficiently Tackle End-User and Technical Issues

6.3.4 Managed Services

6.3.4.1 Managed Services Help Organizations Increase Efficiency, Reduce Deployment Time, and Save Costs

7 Virtual Private Cloud Market By Organization Size (Page No. - 41)

7.1 Introduction

7.2 Small and Medium-Sized Enterprises

7.2.1 Small and Medium-Sized Enterprises to Increasingly Adopt Virtual Private Cloud Solution Owing to Its Scalability and Cost Efficiency

7.3 Large Enterprises

7.3.1 Need to Store and Manage Data Securely, Improve Scalability, and Avoid Redundancy and Duplication of Data to Drive the Adoption of VPC Among Large Enterprises

8 Virtual Private Cloud Market By Vertical (Page No. - 45)

8.1 Introduction

8.2 Banking, Financial Services, and Insurance

8.2.1 Banking, Financial Services, and Insurance Vertical to Increasingly Deploy Virtual Private Cloud Solution to Enhance Security Over Cloud Deployments

8.3 IT and Telecom

8.3.1 Virtual Private Cloud Enables Dynamic Resource Allocation to Provide Flexibility, Cost Efficiency, and Enhanced Control Over the Cloud for IT and Telecom Vertical

8.4 Government and Defense

8.4.1 The Need to Ensure Data Security has Propelled the Adoption of Virtual Private Cloud Solutions By Government Agencies

8.5 Healthcare

8.5.1 Healthcare Vertical to Increasingly Adopt Virtual Private Cloud to Enhance Data Security and Data Access

8.6 Media and Entertainment

8.6.1 Need for Managing Content Ownership, Digital Rights, Managing Huge Data Sets Fuelling the Adoption of Virtual Private Cloud in Media and Entertainment Vertical

8.7 Retail

8.7.1 Virtual Private Cloud Provides Cost Effectiveness, Enhances Productivity, and Gives Competitive Advantage to Retailers

8.8 Manufacturing

8.8.1 Manufacturing Vertical Increasingly Using Virtual Private Cloud to Securely Digitalize Their Operations

8.9 Others

9 Virtual Private Cloud Market By Region (Page No. - 55)

9.1 Introduction

9.2 North America

9.2.1 Growing Adoption of Public Cloud to Fuel the Market Growth in North America

9.3 Europe

9.3.1 Need of Reducing CAPEX and OPEX to Fuel the Market Growth in Europe

9.4 Asia Pacific

9.4.1 Asia Pacific to Increasingly Implement Virtual Private Cloud for Handling OPEX Cost of Private Cloud

9.5 Middle East and Africa

9.5.1 Increased Spending on IT Infrastructure By Government and Manufacturing Verticals to Drive the Market in Middle East and Africa

9.6 Latin America

9.6.1 Local Enterprises Collaborating With Leading Vendors to Address the Growing Need for Virtual Private Cloud in Latin America

10 Competitive Landscape (Page No. - 71)

10.1 Overview

10.2 Competitive Scenario

10.2.1 Product/Solution Launches and Enhancements

10.2.2 Business Expansions

10.2.3 Acquisitions

10.2.4 Partnerships, Contracts, and Collaborations

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

11 Company Profiles (Page No. - 77)

11.1 Introduction

(Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.2 Google

11.3 Microsoft

11.4 Alibaba

11.5 AWS

11.6 OVH

11.7 Huawei

11.8 Rackspace

11.9 CenturyLink

11.10 DXC

11.11 Atos

*Details on Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 97)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (52 Tables)

Table 1 United States Dollar Exchange Rate, 2016–2018

Table 2 Factor Analysis

Table 3 Virtual Private Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 4 Software: Market Size By Region, 2017–2024 (USD Million)

Table 5 Services: Market Size By Type, 2017–2024 (USD Million)

Table 6 Services: Market Size By Region, 2017–2024 (USD Million)

Table 7 Training and Consulting Market Size, By Region, 2017–2024 (USD Million)

Table 8 Integration and Deployment Market Size, By Region, 2017–2024 (USD Million)

Table 9 Support and Maintenance Market Size, By Region, 2017–2024 (USD Million)

Table 10 Managed Services Market Size, By Region, 2017–2024 (USD Million)

Table 11 Virtual Private Cloud Market Size, By Organization Size, 2017–2024 (USD Million)

Table 12 Small and Medium-Sized Enterprises: Cloud Market Size By Region, 2017–2024 (USD Million)

Table 13 Large Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 14 Virtual Private Cloud Market Size, By Vertical, 2017–2024 (USD Million)

Table 15 Banking, Financial Services, and Insurance: Market Size By Region, 2017–2024 (USD Million)

Table 16 IT and Telecom: Market Size By Region, 2017–2024 (USD Million)

Table 17 Government and Defense: Market Size By Region, 2017–2024 (USD Million)

Table 18 Healthcare: Virtual Private Cloud Market Size By Region, 2017–2024 (USD Million)

Table 19 Media and Entertainment: Market Size By Region, 2017–2024 (USD Million)

Table 20 Retail: Market Size By Region, 2017–2024 (USD Million)

Table 21 Manufacturing: Market Size By Region, 2017–2024 (USD Million)

Table 22 Others: Market Size By Region, 2017–2024 (USD Million)

Table 23 Virtual Private Cloud Market Size, By Region, 2017–2024 (USD Million)

Table 24 North America: Market Size By Component, 2017–2024 (USD Million)

Table 25 North America: Market Size By Service, 2017–2024 (USD Million)

Table 26 North America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 27 North America: Market Size By Vertical, 2017–2024 (USD Million)

Table 28 North America: Market Size By Country, 2017–2024 (USD Million)

Table 29 Europe: Virtual Private Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 30 Europe: Market Size By Service, 2017–2024 (USD Million)

Table 31 Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 32 Europe: Market Size By Vertical, 2017–2024 (USD Million)

Table 33 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 34 Asia Pacific: Virtual Private Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 35 Asia Pacific: Market Size By Service, 2017–2024 (USD Million)

Table 36 Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 37 Asia Pacific: Market Size By Vertical, 2017–2024 (USD Million)

Table 38 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 39 Middle East and Africa: Virtual Private Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 40 Middle East and Africa: Market Size By Service, 2017–2024 (USD Million)

Table 41 Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 42 Middle East and Africa: Market Size By Vertical, 2017–2024 (USD Million)

Table 43 Middle East and Africa: Market Size By Country, 2017–2024 (USD Million)

Table 44 Latin America: Virtual Private Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 45 Latin America: Market Size By Service, 2017–2024 (USD Million)

Table 46 Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 47 Latin America: Market Size By Vertical, 2017–2024 (USD Million)

Table 48 Latin America: Market Size By Country, 2017–2024 (USD Million)

Table 49 Product/Solution Launches and Enhancements, 2016–2019

Table 50 Business Expansions, 2017–2019

Table 51 Acquisitions, 2017–2019

Table 52 Partnerships, Contracts, Collaborations, 2017–2019

List of Figures (34 Figures)

Figure 1 Virtual Private Cloud Market: Research Design

Figure 2 Market Top-Down and Bottom-Up Approaches

Figure 3 Virtual Private Cloud Microquadrant: Criteria Weightage

Figure 4 Global Virtual Private Cloud Market Size, 2017–2024 (USD Million)

Figure 5 Segments With the Highest CAGR in the Market

Figure 6 North America to Account for the Highest Market Share in 2019

Figure 7 Various Benefits of Virtual Private Cloud to Drive Its Adoption Among Companies Across Industries

Figure 8 Software Segment to have A Higher Market Share in 2019

Figure 9 Managed Services to Hold the Largest Market Size in 2019

Figure 10 Banking, Financial Services, and Insurance Vertical to Hold the Largest Market Size in 2019

Figure 11 Asia Pacific to Emerge as the Best Market for Investments Over the Next 5 Years

Figure 12 Virtual Private Cloud Market: Drivers, Restraints, Opportunities, and Challenges

Figure 13 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 14 Support and Maintenance Segment to Grow at the Highest CAGR During the Forecast Period

Figure 15 Small and Medium-Sized Enterprises Segment to Grow at A Higher CAGR During the Forecast Period

Figure 16 Retail Vertical to Grow at the Highest Rate During the Forecast Period

Figure 17 Asia Pacific to Grow at the Highest Rate During the Forecast Period

Figure 18 North America: Virtual Private Cloud Market Snapshot

Figure 19 Asia Pacific: Market Snapshot

Figure 20 Key Developments in the Virtual Private Cloud Market, 2016–2019

Figure 21 Market Evaluation Framework

Figure 22 Virtual Private Cloud Market (Global) Competitive Leadership Mapping

Figure 23 Google: Company Snapshot

Figure 24 SWOT Analysis: Google

Figure 25 Microsoft: Company Snapshot

Figure 26 SWOT Analysis: Microsoft

Figure 27 Alibaba: Company Snapshot

Figure 28 SWOT Analysis: Alibaba

Figure 29 AWS: Company Snapshot

Figure 30 SWOT Analysis: Accenture

Figure 31 Huawei: Company Snapshot

Figure 32 CenturyLink: Company Snapshot

Figure 33 DXC: Company Snapshot

Figure 34 Atos: Company Snapshot

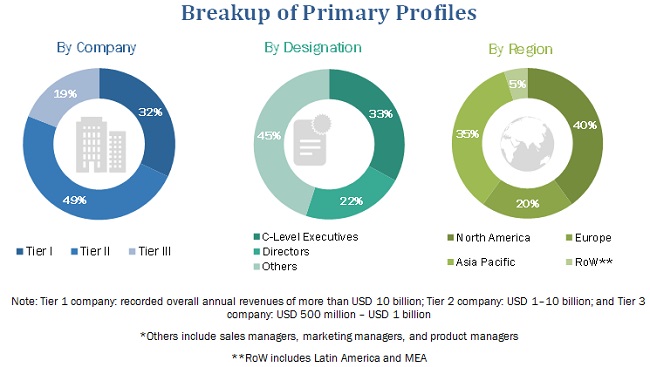

The study involved 4 major activities to estimate the current market size of Virtual Private Cloud (VPC). Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the Virtual Private Cloud Market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. Secondary sources such as Factiva and D&B Hoovers were also considered for this study. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing VPC. The primary sources from the demand side included the end-users of VPC, which included Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Virtual Private Cloud Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Virtual Private Cloud Market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- VPC percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the Virtual Private Cloud market.

Report Objectives

- To define, segment, and project the global market size of the Virtual Private Cloud Market

- To understand the structure of the VPC market by identifying its various subsegments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the 5 major regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments, such as expansions and investments, new product launches, mergers and acquisitions, joint ventures, and agreements, in the Virtual Private Cloud market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Growth opportunities and latent adjacency in Virtual Private Cloud Market