Cloud Storage Gateway Market by Type (Virtual Cloud Storage Gateway Appliances, Physical Cloud Storage Gateway Appliances) - Worldwide Forecast and Analysis (2015 - 2020)

[138 Pages Report] The cloud storage market is estimated to grow from USD $909.2 Million in 2015 to USD $3579.2 Million by 2020, at a Compound Annual Growth Rate (CAGR) of 31.5% from 2015 to 2020.

Major growth drivers of the cloud storage gateway market includes continuous rise in data, need to integrate cloud storage with legacy/local object storage, and rising need for data encryption.

Objective of the Study:

The main objective of this report is to define, describe, and forecast the global cloud storage gateway market on the basis of type, deployment models, organization size, verticals, and regions. The report provides detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges). The report aims to strategically analyze micro-markets with respect to individual growth trends, future prospects, and contribution to the total market. The report attempts to forecast the market size with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), the Middle East and Africa (MEA), and Latin America. The report strategically profiles key players and comprehensively analyzes their core competencies. This report also tracks and analyzes competitive developments such as joint ventures, Mergers and Acquisitions (M&A), new product developments, and Research & Development (R&D) activities in the cloud storage gateway market.

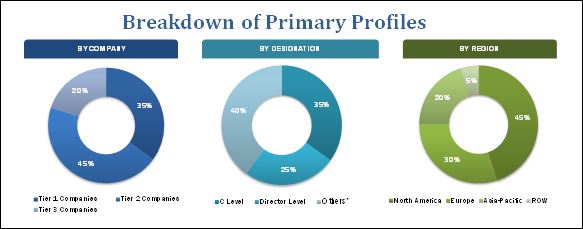

The research methodology used to estimate and forecast the market begins with capturing data on key vendors’ revenues through secondary research sources, such as companies’ websites, Factiva, and Hoovers, among others. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global cloud storage gateway market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary interviews is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The cloud storage gateway ecosystem comprises vendors, such as Agosto (U.S.), Amazon Web Services (U.S.), CTERA Network Corporation (New York), EMC Corporation (U.S.), Emulex Corporation (U.S.), Hewlett-Packard (U.S.), Maldivica Inc. (U.S.), Microsoft Corporation (U.S.), Nasuni (U.S.), NetApp (U.S.). Major stakeholders of the cloud storage gateway market include cloud storage gateway, storage gateway vendors, storage software and hardware vendors, data security providers, support and maintenance service providers, managed service providers and investors.

The target audiences of the cloud storage gateway market report are given below:

- Independent software vendors

- Cloud service providers

- Application design and software developers

- System integrators

- IT service providers

“Study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments.”

Scope of the Report

The research report categorizes the cloud storage gateway market to forecast the revenues and analyze the trends in each of the following subsegments:

By Type

- Virtual Cloud Storage Gateway Appliances

- Physical Cloud Storage Gateway

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- SMBs

- Large Enterprises

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Healthcare and Life Sciences

- Retail and Consumer Goods

- Research and Education

- High Tech and Electronics

- Media and Entertainment

- Others

By Region

- North America

- Europe

- Middle East and Africa (MEA)

- Asia-Pacific (APAC)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American cloud storage gateway market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The cloud storage gateway market is estimated to grow from USD $909.2 Million in 2015 to USD $3579.2 Million by 2020, at a high Compound Annual Growth Rate (CAGR) of 31.5% during the forecast period. The cloud storage gateway appliances are gaining traction among the users due to continuous rise in data, need to integrate cloud storage with legacy/local object storage, and rising need for data encryption. Hence, the adoption of cloud storage gateway appliances (Physical and Virtual) in various industries is increasing, which is one of the factors driving this market.

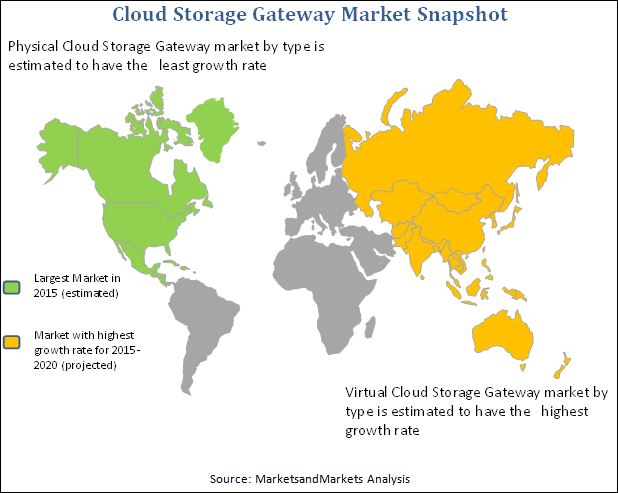

The report provides detailed insights into the global cloud storage gateway market, which is segmented on the basis of type, deployment models, organization size, verticals, and regions. In type segment, the physical cloud storage gateway segment holds a higher market share and is gaining significant importance among corporates and enterprises because of the fact that major vendors such as AWS offer cloud-based storage that works with the Representational State Transfer (REST) architecture or with the web protocols such as Simple Object Access Protocol (SOAP). However, local applications expect storage resources with a block-based interface such as the Internet Small Computer System Interface (iSCSI) or with a file-based interface such as the Network File System (NFS) or the Common Internet File System (CIFS). To streamline this incompatibility and to integrate the cloud storage with the legacy systems seamlessly, the cloud storage gateways are utilized as a bridge.

In terms of deployment model, public cloud is expected to dominate the cloud storage gateway market and is expected to contribute the largest market share, whereas hybrid cloud deployment model is expected to grow at the highest rate during the forecast period. In 2015, the public cloud has shown huge adoption compared to private cloud and hybrid cloud deployment model. The public cloud deployment model for cloud-based solution is considered as a standardized, simple, and efficient model which is utilized by business organizations working in and across a number of industries including Banking, Financial Services, and Insurance (BFSI), retail and consumer goods, healthcare and life sciences, manufacturing, high tech and electronics, media and entertainment, and research and education for high end storage and computing applications. The BFSI industry has been estimated to have the highest market share among all the verticals due to the growing requirements to securely manage and recover data stored on cloud. The research and education industry is poised to grow at the highest rate during the forecast period owing to improved process where the cloud storage gateways are deployed in educational institutes to provide smooth access to the files shared and stored in cloud.

The report covers all the major aspects of the cloud storage gateway market and provides an in-depth analysis across the regions comprising North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America. The market in North America is expected to hold the largest share of the market. The APAC region is projected to have great opportunities in this market and would grow at the highest CAGR during the forecast period. In APAC region, numerous business organizations operating in and across various industries are looking for a highly secure, reliable, quick, and smoothly accessible storage environment. Thus, the adoption rate of cloud-based storage solutions is growing rapidly which is also driving the cloud storage gateway market in the APAC region.

Data security concerns and low WAN speed & latency in remote areas are acting as the restraining factors for the cloud storage gateway market. Business organizations are deploying cloud storage solutions for better overall connectivity, scalability, and agility. However, they are still concerned about the security aspect of the information as the transmission of data to the cloud is prone to security breaches and subsequent replication.

Most of the vendors have adopted new product developments as their key strategy to innovate in this market. For instance, in March 2015, Amazon announced the launch of Amazon cloud drive to provide the unlimited cloud storage to the customers. Partnerships and collaborations have also been adopted by top players to enhance client base and customer experience. For example, in March 2013, CTERA Networks collaborated with Telefonica, the world’s largest telecommunication provider. This collaboration helped Telefonica to increase its customer base.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Cloud Storage Gateway Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.3.1 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities

4.2 Cloud Storage Gateway Market: Market Share of Solutions

4.3 Lifecycle Analysis, By Region

4.4 Market Investment Scenario

4.5 Product Growth Matrix

4.6 Regional Adoption Scenario

5 Cloud Storage Gateway Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market, By Type

5.2.2 Market, By Deployment Model

5.2.3 Market, By Organization Size

5.2.4 Market, By Vertical

5.2.5 Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Continuous Rise in Data

5.3.1.2 Need to Integrate Cloud Storage With Legacy/Local Object Storage

5.3.1.3 Rising Need for Data Encryption

5.3.2 Restraints

5.3.2.1 Data Security Concerns

5.3.2.2 Wan Speed and Latency in Remote Areas

5.3.3 Opportunities

5.3.3.1 Demand for Efficient Disaster Recovery and Backup

5.3.3.2 High Cost Associated With Traditional Storage

5.3.3.3 Higher Deployment Rate of Cloud-Based Solutions

5.3.4 Challenges

5.3.4.1 Complexities in Data Handling

5.3.4.2 Seamless Integration With the Existing It Infrastructure

6 Cloud Storage Gateway Market: Industry Trends (Page No. - 45)

6.1 Value Chain

6.2 Ecosystem

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Rivalry

6.4 Strategic Benchmarking

7 Cloud Storage Gateway Market, By Type (Page No. - 51)

7.1 Introduction

7.2 Virtual Cloud Storage Gateway Appliances

7.3 Physical Cloud Storage Gateway Appliances

8 Cloud Storage Gateway Market, By Deployment Model (Page No. - 59)

8.1 Introduction

8.2 Public Cloud

8.3 Private Cloud

8.4 Hybrid Cloud

9 Cloud Storage Gateway Market, By Organization Size (Page No. - 63)

9.1 Introduction

9.2 SMB

9.3 Large Enterprise

10 Cloud Storage Gateway Market, By Vertical (Page No. - 66)

10.1 Introduction

10.2 BFSI

10.3 Manufacturing

10.4 Healthcare and Life Sciences

10.5 Retail and Consumer Goods

10.6 Research and Education

10.7 High Tech and Electronics

10.8 Media and Entertainment

10.9 Others

11 Cloud Storage Gateway Market, By Region (Page No. - 87)

11.1 Introduction

11.2 North America (NA)

11.3 Europe

11.4 Asia-Pacific (APAC)

11.5 Middle-East and Africa (MEA)

11.6 Latin America (LA)

12 Competitive Landscape (Page No. - 98)

12.1 Overview

12.2 Competitive Situation and Trends

12.3 New Product Launches

12.4 Partnerships and Collaborations

12.5 Mergers and Acquisitions

12.6 Venture Funding

13 Company Profiles (Page No. - 108)

13.1 Agosto

13.1.1 Business Overview

13.1.2 Products and Services

13.1.3 Strategies and Insights

13.1.4 Recent Developments

13.2 Amazon Web Services

13.2.1 Business Overview

13.2.2 Products and Services

13.2.3 Strategies and Insights

13.2.4 Recent Developments

13.2.5 SWOT Analysis

13.3 Ctera Networks Corporation

13.3.1 Business Overview

13.3.2 Products and Services

13.3.3 Strategies and Insights

13.3.4 Recent Developments

13.4 EMC Corporation

13.4.1 Business Overview

13.4.2 Products and Services

13.4.3 Strategies and Insights

13.4.4 Recent Developments

13.4.5 SWOT Analysis

13.5 Emulex Corporation

13.5.1 Business Overview

13.5.2 Products and Services

13.5.3 Strategies and Insights

13.5.4 Recent Developments

13.6 Hewlett-Packard

13.6.1 Business Overview

13.6.2 Products and Services

13.6.3 Strategies and Insights

13.6.4 Recent Developments

13.6.5 SWOT Analysis

13.7 Maldivica Inc.

13.7.1 Business Overview

13.7.2 Products and Services

13.7.3 Strategies and Insights

13.7.4 Recent Developments

13.8 Microsoft Corporation

13.8.1 Business Overview

13.8.2 Products and Services

13.8.3 Strategies and Insights

13.8.4 Recent Developments

13.8.5 SWOT Analysis

13.9 Nasuni

13.9.1 Business Overview

13.9.2 Products and Services

13.9.3 Strategies and Insights

13.9.4 Recent Developments

13.10 Netapp

13.10.1 Business Overview

13.10.2 Products and Services

13.10.3 Strategies and Insights

13.10.4 Recent Developments

13.10.5 SWOT Analysis

14 Appendix (Page No. - 134)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Related Reports

List of Tables (66 Tables)

Table 1 Global Cloud Storage Gateway Market: Assumptions

Table 2 Cloud Storage Gateway Market Size, By Type, 2015-2020 ($Million)

Table 3 Market Size, By Services, 2015-2020 ($ Million)

Table 4 Virtual CSG Market Size, By Region, 2015-2020 ($ Million)

Table 5 Virtual CSG Market Size, By Vertical, 2015-2020 ($ Million)

Table 6 Virtual CSG Market Size, By Organization Size, 2015-2020 ($ Million)

Table 7 Virtual CSG Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 8 Physical CSG Market Size, By Region, 2015-2020 ($ Million)

Table 9 Physical CSG Market Size, By Vertical, 2015-2020 ($ Million)

Table 10 Physical CSG Market Size, By Organization Size, 2015-2020 ($ Million)

Table 11 Physical CSG Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 12 Cloud Storage Gateway Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 13 Market Size, By Organization Size, 2015-2020 ($ Million)

Table 14 Market Size, By Vertical, 2015-2020 ($ Million)

Table 15 BFSI Market Size, By Type, 2015-2020 ($ Million)

Table 16 BFSI Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 17 BFSI Market Size, By Organization Size, 2015-2020 ($ Million)

Table 18 BFSI Market Size, By Region, 2015-2020 ($ Million)

Table 19 Manufacturing Market Size, By Type, 2015-2020 ($ Million)

Table 20 Manufacturing Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 21 Manufacturing Market Size, By Organization Size, 2015-2020 ($ Million)

Table 22 Manufacturing Market Size, By Region, 2015-2020 ($ Million)

Table 23 Healthcare and Life Sciences Market Size, By Type, 2015-2020 ($ Million)

Table 24 Healthcare and Life Sciences Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 25 Healthcare and Life Sciences Market Size, By Organization Size, 2015-2020 ($ Million)

Table 26 Healthcare and Life Sciences Market Size, By Region, 2015-2020 ($ Million)

Table 27 Retail and Consumer Goods Market Size, By Type, 2015-2020 ($ Million)

Table 28 Retail and Consumer Goods Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 29 Retail and Consumer Goods Market Size, By Organization Size, 2015-2020 ($ Million)

Table 30 Retail and Consumer Goods Market Size, By Region, 2015-2020 ($ Million)

Table 31 Research and Education Market Size, By Type, 2015-2020 ($ Million)

Table 32 Research and Education Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 33 Research and Education Market Size, By Organization Size, 2015-2020 ($ Million)

Table 34 Research and Education Market Size, By Region, 2015-2020 ($ Million)

Table 35 High Tech and Electronics Market Size, By Type, 2015-2020 ($ Million)

Table 36 High Tech and Electronics Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 37 High Tech and Electronics Market Size, By Organization Size, 2015-2020 ($ Million)

Table 38 High Tech and Electronics Market Size, By Region, 2015-2020 ($ Million)

Table 39 Media and Entertainment Market Size, By Type, 2015-2020 ($ Million)

Table 40 Media and Entertainment Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 41 Media and Entertainment Market Size, By Organization Size, 2015-2020 ($ Million)

Table 42 Media and Entertainment Market Size, By Region, 2015-2020 ($ Million)

Table 43 Others Market Size, By Type, 2015-2020 ($ Million)

Table 44 Others Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 45 Others Market Size, By Organization Size, 2015-2020 ($ Million)

Table 46 Others Market Size, By Region, 2015-2020 ($ Million)

Table 47 Cloud Storage Gateway Market Size, By Region, 2015-2020 ($ Million)

Table 48 NA Market Size, By Type, 2015-2020 ($ Million)

Table 49 NA Market Size, By Organization Size, 2015-2020 ($ Million)

Table 50 NA Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 51 Europe Market Size, By Type, 2015-2020 ($ Million)

Table 52 Europe Market Size, By Organization Size, 2015-2020 ($ Million)

Table 53 Europe Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 54 APAC Market Size, By Type, 2015-2020 ($ Million)

Table 55 APAC Market Size, By Organization Size, 2015-2020 ($ Million)

Table 56 APAC Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 57 MEA Market Size, By Type, 2015-2020 ($ Million)

Table 58 MEA Market Size, By Organization Size, 2015-2020 ($ Million)

Table 59 MEA Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 60 LA Market Size, By Type, 2015-2020 ($ Million)

Table 61 LA Market Size, By Organization Size, 2015-2020 ($ Million)

Table 62 LA Market Size, By Deployment Model, 2015-2020 ($ Million)

Table 63 New Product Launches, 2012-2015

Table 64 Partnerships and Collaborations, 2012–2014

Table 65 Mergers and Acquisitions, 2012–2014

Table 66 Venture Funding, 2008–2015

List of Figures (42 Figures)

Figure 1 Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 The Evolution of Cloud Storage

Figure 5 NA Holds the Highest Market Share for the Year 2015

Figure 6 Top Three Segments for Cloud Storage Gateway Market 2015-2020

Figure 7 Growth Trend of Cloud Storage Gateway Market (2015–2020)

Figure 8 Geographic Lifecycle Analysis (2015): LA and MEA Are Expected to Enter the Exponential Growth Phase During the Forecast Period

Figure 9 Market Investment Scenario: MEA and APAC Rise as the Best Opportunity Markets for Investment in the Next Five Years

Figure 10 New Revenue Pocket for Market Players

Figure 11 NA Commands Over 39.2% of the Market Share in 2014

Figure 12 Market Segmentation: By Type

Figure 13 Market Segmentation: By Deployment Model

Figure 14 Market Segmentation: By Organization Size

Figure 15 Market Segmentation: By Verticals

Figure 16 Market Segmentation: By Region

Figure 17 Continuous Rise in the Enterprise Level Data is the Basic Driver in This Market

Figure 18 Cloud Storage Gateway: Value Chain Analysis

Figure 19 Cloud Storage Gateway Ecosystem

Figure 20 Cloud Storage Gateway: Porter’s Five Forces Analysis

Figure 21 Strategic Benchmarking: Cloud Storage Gateway

Figure 22 Physical CSG Leads the Cloud Storage Gateway Market By Type for the Year 2015

Figure 23 Cloud Storage Gateway Market, By Deployment Model

Figure 24 Companies Adopted Partnerships and Agreements as the Key Growth Strategy (2010-2014)

Figure 25 Revenue of Amazon Web Services Grew at the Highest Rate Between 2009 and 2013

Figure 26 Market Evaluation Framework

Figure 27 Battle for Market Share: New Product Developments Had Been the Key Strategy for the Year 2014

Figure 28 Agosto : Business Overview

Figure 29 Amazon Web Services : Business Overview

Figure 30 Amazon Web Services : SWOT Analysis

Figure 31 Ctera Networks: Business Overview

Figure 32 EMC: Business Overview

Figure 33 EMC Corporation : SWOT Analysis

Figure 34 Emulex: Business Overview

Figure 35 Hewlett-Packard : Business Overview

Figure 36 Hewlett-Packard : SWOT Analysis

Figure 37 Maldivica Inc. : Business Overview

Figure 38 Microsoft Corporation: Business Overview

Figure 39 Microsoft Corporation: SWOT Analysis

Figure 40 Nasuni: Business Overview

Figure 41 Netapp : Business Overview

Figure 42 Netapp : SWOT Analysis

Growth opportunities and latent adjacency in Cloud Storage Gateway Market