Veterinary PoC Diagnostics Market by Product (Imaging Systems, Analyzers, Reagents), Technology (Immuno & Molecular Diagnostics), Application (Pathology, Bacteriology, Gynecology), Animal (Cat, Dog, Horse, Cattle), End User & Region - Global Forecast to 2025

Market Growth Outlook Summary

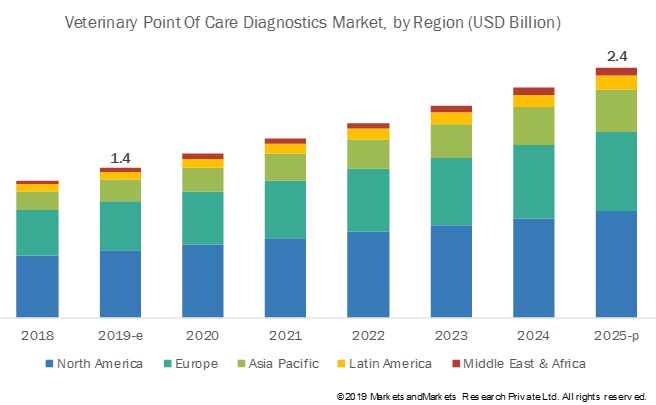

The global veterinary PoC diagnostics market growth forecasted to transform from $1.4 billion in 2019 to $2.4 billion by 2025, driven by a CAGR of 8.9%. Key drivers include the rising prevalence of zoonotic diseases in animals and the need for rapid diagnostics, though high costs of imaging equipment pose a challenge. The market is segmented by product (with consumables dominating), technology (clinical biochemistry leads), application (clinical pathology is prominent), animal type (companion animals account for the largest share), and end user (veterinary clinics dominate). North America holds the largest regional share. Major players include Zoetis, IDEXX Laboratories, and Thermo Fisher Scientific.

The consumables segment dominated the veterinary PoC diagnostics industry

Based on product, the global veterinary PoC diagnostics market is segmented into consumables and instruments. Consumables accounted for the largest market share in 2018. The large share of the consumables segment can be attributed to the increasing demand for the rapid detection of diseases, the growing prevalence of animal zoonotic diseases, and growth in the companion animal population worldwide. This segment is also expected to grow at the highest CAGR during the forecast period.

By technology, the clinical biochemistry segment accounted for the largest share of the global veterinary PoC diagnostics industry

Based on technology, the veterinary PoC market is segmented into immunodiagnostics, clinical biochemistry, molecular diagnostics, hematology, urinalysis, and other technologies. In 2018, the clinical biochemistry segment accounted for the largest share of the market. The higher preference for various advanced clinical diagnostic products by veterinarians and pet owners are contributing to the large share of this segment.

By application, the clinical pathology segment accounted for the largest share of the veterinary PoC diagnostics industry

Based on application, the veterinary PoC diagnostics market is segmented into clinical pathology, bacteriology, virology, parasitology, and other applications. The clinical pathology segment accounted for the largest market share in 2018. This segment is also projected to register the highest CAGR during the forecast period. The growth in this segment can be attributed to the increasing adoption of chemistry analyzers for the primary diagnosis of diseases in clinics.

By animal type, the companion animals segment accounted for the largest share of the veterinary PoC diagnostics industry

Based on animal type, the veterinary PoC diagnostics market is segmented into companion and livestock animals. In 2018, the companion animals segment accounted for the largest share of the veterinary point-of-care diagnostics industry. The increasing companion animal ownership, growing awareness about animal health among pet owners, and rising pet healthcare expenditure are the factors driving the growth of this segment.

By end user, the veterinary clinics segment accounted for the largest share of the veterinary PoC diagnostics industry

Based on end user, the veterinary PoC diagnostics market is segmented into veterinary hospitals & academic institutes, veterinary clinics, and home care settings. In 2018, the veterinary clinics segment accounted for the largest share of the veterinary point-of-care diagnostics market. The large share of this segment is attributed to the growing number of patients visiting vet clinics and the increasing number of private clinical practices.

North America will continue to dominate the veterinary PoC diagnostics industry during the forecast period

The veterinary PoC diagnostics market, by region, is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the veterinary point-of-care diagnostics market in 2018. The large share of North America in the global market can be attributed to the increasing adoption of companion animals, growing veterinary healthcare expenditure, and rising demand for animal-derived food products.

Key players operating in this market are Zoetis, Inc. (US), IDEXX Laboratories, Inc. (US), Heska Corporation (US), Virbac (France), Thermo Fisher Scientific, Inc. (US), Eurolyser Diagnostica GmbH (Austria), Woodley Equipment Company (UK), Randox Laboratories LTD. (UK), AniPOC, Ltd. (UK), Carestream Health, Inc. (a part of ONEX Corporation) (Canada), NeuroLogica Corporation (a part of Samsung Electronics Co. Ltd.) (South Korea), and FUJIFILM SonoSite (a part of FUJIFILM Holdings Corporation) (Japan).

Scope of the Veterinary PoC Diagnostics Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2019 |

$1.4 billion |

|

Projected Revenue Size by 2025 |

$2.4 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 8.9% |

|

Market Driver |

Growing demand for pet insurance & increasing pet care expenditure |

|

Market Opportunity |

Untapped emerging markets |

The research report categorizes the veterinary PoC diagnostics market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Consumables

- Instruments

By Technology (Kits and Analyzers)

- Immunodiagnostics

- Clinical Biochemistry

- Molecular Diagnostics

- Hematology

- Urinalysis

- Other Technologies

By Animal Type

- Companion Animals

- Livestock Animals

By Application

- Clinical Pathology

- Bacteriology

- Virology

- Parasitology

- Other Applications

By End User

- Veterinary Clinics

- Veterinary Hospitals and Academic Institutes

- Home Care Settings

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- The Middle East & Africa

Recent Developments of Veterinary PoC Diagnostics Industry

- In 2019, IDEXX Laboratories launched a Canine Progesterone Test for Catalyst Dx and Catalyst One Chemistry Analyzers.

- In 2019, Zoetis, Inc. launched Stablelab, a handheld point-of-care diagnostic blood test for equine.

- In 2019, FUJIFILM SonoSite partnered with Partners Healthcare (US) to enable clinicians to perform scans at point of care.

- In 2019, Eurolyser partnered with Sysmex Corporation (Japan) to sell Eurolyser’s point of care systems measuring CRP.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global veterinary PoC diagnostics market?

The global veterinary PoC diagnostics market boasts a total revenue value of $2.4 billion by 2025.

What is the estimated growth rate (CAGR) of the global veterinary PoC diagnostics market?

The global veterinary PoC diagnostics market has an estimated compound annual growth rate (CAGR) of 8.9% and a revenue size in the region of $1.4 billion in 2019.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary sources

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 38)

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 VETERINARY POC DIAGNOSTICS MARKET OVERVIEW

4.2 REGIONAL MIX: VETERINARY POC DIAGNOSTICS INDUSTRY (2017–2025)

4.3 VETERINARY POC DIAGNOSTICS INDUSTRY: DEVELOPED VS. DEVELOPING MARKETS, 2019 VS. 2025

4.4 VETERINARY POC DIAGNOSTICS INDUSTRY: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth in the companion animal population

5.2.1.2 Increasing prevalence of zoonotic diseases

5.2.1.3 Advantages of POCT

5.2.1.4 Increasing demand for animal-derived food products

5.2.1.5 Growing demand for pet insurance & increasing pet care expenditure

5.2.2 RESTRAINTS

5.2.2.1 High cost of veterinary imaging systems

5.2.3 OPPORTUNITIES

5.2.3.1 Untapped emerging markets

5.2.4 CHALLENGES

5.2.4.1 Low animal healthcare awareness and inadequate infrastructure

5.2.4.2 Shortage of veterinarians in emerging markets

6 VETERINARY POC MARKET, BY PRODUCT (Page No. - 54)

6.1 INTRODUCTION

6.2 CONSUMABLES

6.2.1 KITS & REAGENTS

6.2.1.1 Increasing demand for rapid disease diagnosis to support market growth

6.2.2 IMAGING SYSTEM REAGENTS

6.2.2.1 Increasing adoption of imaging technologies for disease diagnosis to drive the demand for imaging system reagents

6.3 INSTRUMENTS

6.3.1 IMAGING SYSTEMS

6.3.1.1 Radiography (X-ray) systems

6.3.1.1.1 X-ray systems enable the rapid acquisition of digital radiographs of small and large animals in both practice-based and field environments

6.3.1.2 Ultrasound systems

6.3.1.2.1 Ultrasound is an ideal noninvasive tool to get faster and more accurate diagnoses of the internal structures of an animal’s body

6.3.1.3 Computed tomography systems

6.3.1.3.1 Portable CT imaging provides information that cannot be obtained using portable radiography and ultrasound

6.3.1.4 Thermal imaging systems

6.3.1.4.1 Thermography is used to determine inflammation and access blood flow to tissues

6.3.2 ANALYZERS

6.3.2.1 Key companies are focusing on developing analyzers that integrate several technologies to obtain accurate results

7 VETERINARY POC DIAGNOSTICS MARKET, BY TECHNOLOGY (Page No. - 69)

7.1 INTRODUCTION

7.2 CLINICAL BIOCHEMISTRY

7.2.1 GROWING NUMBER OF HEALTH SCREENING TESTS TO SUPPORT MARKET GROWTH

7.3 IMMUNODIAGNOSTICS

7.3.1 IMMUNODIAGNOSTICS IS THE FASTEST-GROWING TECHNOLOGY SEGMENT IN THE POC DIAGNOSTICS MARKET

7.4 HEMATOLOGY

7.4.1 HEMATOLOGY ANALYZERS AID IN QUICK BLOOD ANALYSIS IN ANIMALS

7.5 URINALYSIS

7.5.1 NEED FOR EARLY DIAGNOSIS OF METABOLIC DISEASES TO SUPPORT THE GROWTH OF THIS TECHNOLOGY SEGMENT

7.6 MOLECULAR DIAGNOSTICS

7.6.1 GROWING DEMAND FOR FASTER DETECTION OF CHRONIC DISEASES & GENETIC DISORDERS TO SUPPORT MARKET GROWTH

7.7 OTHER TECHNOLOGIES

8 VETERINARY POC DIAGNOSTICS MARKET, BY APPLICATION (Page No. - 78)

8.1 VETERINARY KITS & ANALYZERS MARKET, BY APPLICATION

8.1.1 INTRODUCTION

8.1.2 CLINICAL PATHOLOGY

8.1.2.1 Clinical pathology is the largest application segment in the point-of-care diagnostic kits & analyzers market

8.1.3 BACTERIOLOGY

8.1.3.1 Point-of-care testing of bacterial diseases helps in early and effective patient management

8.1.4 VIROLOGY

8.1.4.1 Growing number of viral outbreaks to drive the demand for point-of-care testing

8.1.5 PARASITOLOGY

8.1.5.1 Increasing prevalence of parasitic diseases and rising demand for quality parasitology testing to support market growth

8.1.6 OTHER APPLICATIONS

8.2 VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION

8.2.1 INTRODUCTION

8.2.2 ORTHOPEDICS & TRAUMATOLOGY

8.2.2.1 Increasing prevalence of arthritis and joint disorders to drive market growth

8.2.3 GYNECOLOGY

8.2.3.1 Ultrasound technology enables the assessment of pregnancy status and fetal viability, thus improving reproductive efficiency

8.2.4 ONCOLOGY

8.2.4.1 High incidence of cancer in dogs and cats to increase the demand for imaging systems in veterinary oncology

8.2.5 CARDIOLOGY

8.2.5.1 Obesity, lack of exercise, and over-vaccination are the major factors contributing to the rising incidence of heart diseases in animals

8.2.6 NEUROLOGY

8.2.6.1 MRI is the primary imaging tool to visualize the nervous system of animals

8.2.7 OTHER APPLICATIONS

9 VETERINARY POC DIAGNOSTICS MARKET, BY ANIMAL TYPE (Page No. - 92)

9.1 INTRODUCTION

9.2 COMPANION ANIMALS

9.2.1 DOGS

9.2.1.1 Dogs dominate the global market for companion animals

9.2.2 CATS

9.2.2.1 Growing obesity rate in cats to support the demand for feline veterinary POC diagnostics

9.2.3 HORSES

9.2.3.1 Growing equine health awareness will drive market growth

9.2.4 OTHER COMPANION ANIMALS

9.3 LIVESTOCK ANIMALS

9.3.1 CATTLE

9.3.1.1 Early diagnosis is important as cattle are major sources of meat & milk

9.3.2 SWINE

9.3.2.1 Growing incidence of diseases will support market growth

9.3.3 POULTRY

9.3.3.1 Growing infectious disease prevalence and the need for timely diagnosis will support market growth

9.3.4 OTHER LIVESTOCK ANIMALS

10 VETERINARY POC DIAGNOSTICS MARKET, BY END USER (Page No. - 110)

10.1 INTRODUCTION

10.2 VETERINARY CLINICS

10.2.1 INCREASING RELIANCE ON CLINICS AND GROWING NUMBER OF PRIVATE CLINICS WILL SUPPORT MARKET GROWTH

10.3 VETERINARY HOSPITALS & ACADEMIC INSTITUTES

10.3.1 GROWING DEMAND FOR MODERN, STATE-OF-THE-ART LARGE VETERINARY FACILITIES HAS RESULTED IN HIGH ADOPTION IN HOSPITALS

10.4 HOME CARE SETTINGS

10.4.1 HIGH DEMAND FOR IMPROVED PATIENT CARE AND GREATER COST CONTROL ARE DRIVING GROWTH IN HOME CARE SETTINGS

11 VETERINARY POC DIAGNOSTICS MARKET, BY REGION (Page No. - 116)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 US

11.2.1.1 The US dominates the North American veterinary point-of-care diagnostics market

11.2.2 CANADA

11.2.2.1 Growing awareness about pet healthcare to support market growth

11.3 EUROPE

11.3.1 GERMANY

11.3.1.1 Germany is the largest market for veterinary point-of-care diagnostics in Europe

11.3.2 UK

11.3.2.1 Growing pet adoption in the UK—a major factor driving market growth

11.3.3 FRANCE

11.3.3.1 Large pet population in France is driving the market for veterinary POC diagnostics

11.3.4 ITALY

11.3.4.1 Increasing population of cats, sheep, goats, and swine in Italy to drive market growth

11.3.5 SPAIN

11.3.5.1 Increase in pork & beef consumption to drive market growth in Spain

11.3.6 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 CHINA

11.4.1.1 China dominates the APAC veterinary PoC diagnostics market

11.4.2 JAPAN

11.4.2.1 Rising awareness about zoonotic diseases and increasing pet expenditure are expected to drive the market in Japan

11.4.3 INDIA

11.4.3.1 India offers high-growth opportunities for players in the global market

11.4.4 REST OF ASIA PACIFIC

11.5 LATIN AMERICA

11.5.1 RISING AWARENESS ABOUT ANIMAL HEALTH TO SUPPORT MARKET GROWTH IN LATIN AMERICA

11.6 MIDDLE EAST & AFRICA

11.6.1 AVAILABILITY OF FUNDING TO PROMOTE ANIMAL HEALTHCARE IS SUPPORTING MARKET GROWTH IN THE REGION

12 COMPETITIVE LANDSCAPE (Page No. - 206)

12.1 OVERVIEW

12.2 GROWTH STRATEGY MATRIX (2016–2019)

12.3 MARKET SHARE ANALYSIS

12.3.1 MARKET SHARE ANALYSIS: VETERINARY POC DIAGNOSTICS INDUSTRY

12.4 COMPETITIVE LEADERSHIP MAPPING

12.4.1 VISIONARY LEADERS

12.4.2 INNOVATORS

12.4.3 DYNAMIC DIFFERENTIATORS

12.4.4 EMERGING COMPANIES

12.5 COMPETITIVE SITUATION AND TRENDS

12.5.1 PRODUCT LAUNCHES

12.5.2 EXPANSIONS

12.5.3 ACQUISITIONS

12.5.4 PARTNERSHIPS & COLLABORATIONS

13 COMPANY PROFILES (Page No. - 213)

(Business overview, Products offered, Recent developments, MNM view)*

13.1 IDEXX LABORATORIES, INC.

13.2 ZOETIS, INC.

13.3 VIRBAC

13.4 HESKA CORPORATION

13.5 THERMO FISHER SCIENTIFIC, INC.

13.6 EUROLYSER DIAGNOSTICA GMBH

13.7 WOODLEY EQUIPMENT COMPANY LTD.

13.8 RANDOX LABORATORIES, LTD.

13.9 ANIPOC, LTD.

13.10 CARESTREAM HEALTH, INC. (A PART OF ONEX CORPORATION)

13.11 NEUROLOGICA CORPORATION (A PART OF SAMSUNG ELECTRONICS CO. LTD.)

13.12 FUJIFILM SONOSITE, INC. (A PART OF FUJIFILM HOLDINGS CORPORATION)

13.13 DIAGNOSTIC IMAGING SYSTEMS, INC.

13.14 ESAOTE SPA

13.15 MINDRAY MEDICAL INTERNATIONAL LIMITED (A PART OF EXCELSIOR UNION LIMITED)

13.16 GE HEALTHCARE

13.17 MINXRAY, INC.

13.18 QR S.R.L.

13.19 SEDECAL

13.20 EXAMION GMBH

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 253)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

LIST OF TABLES (282 TABLES)

TABLE 1 PET POPULATION, BY COUNTRY, 2014–2018 (MILLION)

TABLE 2 GLOBAL PRODUCTION, CONSUMPTION, IMPORT, AND EXPORT OF ANIMAL-DERIVED FOOD PRODUCTS (2000 VS. 2030) (THOUSAND METRIC TONS)

TABLE 3 VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 4 VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 5 VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 6 KITS & REAGENTS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 7 IMAGING SYSTEM REAGENTS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 8 VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 9 VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 10 IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 11 IMAGING SYSTEMS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 12 MAJOR PORTABLE X-RAY SYSTEMS

TABLE 13 RADIOGRAPHY SYSTEMS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 14 MAJOR PORTABLE ULTRASOUND SYSTEMS

TABLE 15 ULTRASOUND SYSTEMS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 16 MAJOR PORTABLE CT SYSTEMS

TABLE 17 COMPUTED TOMOGRAPHY SYSTEMS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 18 THERMAL IMAGING SYSTEMS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 19 ANALYZERS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 20 VETERINARY POC DIAGNOSTICS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 21 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & REAGENTS MARKET FOR CLINICAL BIOCHEMISTRY, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 22 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & REAGENTS MARKET FOR IMMUNODIAGNOSTICS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 23 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & REAGENTS MARKET FOR HEMATOLOGY, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 24 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & REAGENTS MARKET FOR URINALYSIS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 25 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & REAGENTS MARKET FOR MOLECULAR DIAGNOSTICS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 26 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & REAGENTS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 27 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 28 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET FOR CLINICAL PATHOLOGY, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 29 VETERINARY POC DIAGNOSTICS MARKET FOR BACTERIOLOGY, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 30 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET FOR VIROLOGY, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 31 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET FOR PARASITOLOGY, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 32 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 33 VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 34 VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET FOR ORTHOPEDICS & TRAUMATOLOGY, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 35 VETERINARY POC DIAGNOSTICS MARKET FOR GYNECOLOGY, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 36 VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET FOR ONCOLOGY, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 37 VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET FOR CARDIOLOGY, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 38 VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET FOR NEUROLOGY, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 39 VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 40 VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 41 VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 42 VETERINARY POC DIAGNOSTICS INDUSTRY FOR COMPANION ANIMALS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 43 EUROPE: PET DOG POPULATION, BY COUNTRY, 2012–2018 (THOUSAND)

TABLE 44 VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR DOGS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 45 EUROPE: PET CAT POPULATION, BY COUNTRY, 2012–2018 (MILLION)

TABLE 46 VETERINARY POC DIAGNOSTICS INDUSTRY FOR CATS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 47 PET HORSE POPULATION, BY COUNTRY, 2014–2017 (THOUSAND)

TABLE 48 VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR HORSES, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 49 VETERINARY POINT-OF-CARE DIAGNOSTICS FOR OTHER COMPANION ANIMALS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 50 VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 51 VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 52 CATTLE POPULATION, BY COUNTRY, 2014–2018 (THOUSAND)

TABLE 53 VETERINARY POC DIAGNOSTICS MARKET FOR CATTLE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 54 VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR SWINE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 55 VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR POULTRY, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 56 VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR OTHER LIVESTOCK ANIMALS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 57 VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 58 NUMBER OF VETERINARIANS IN PRIVATE CLINICAL PRACTICES, BY COUNTRY (2012 VS. 2017)

TABLE 59 VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR VETERINARY CLINICS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 60 VETERINARY POC DIAGNOSTICS INDUSTRY FOR VETERINARY HOSPITALS & ACADEMIC INSTITUTES, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 61 VETERINARY POC DIAGNOSTICS INDUSTRY FOR HOME CARE SETTINGS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 62 VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: VETERINARY POC DIAGNOSTICS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 65 NORTH AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 66 NORTH AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 67 NORTH AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 69 NORTH AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 70 NORTH AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 71 NORTH AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 72 NORTH AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 73 NORTH AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 75 US: PET OWNERSHIP, 2017

TABLE 76 US: PRIVATE CLINICAL PRACTICES, BY ANIMAL TYPE, 2012 VS. 2017

TABLE 77 US: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 78 US: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 79 US: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 80 US: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 81 US: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 82 US: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 83 US: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 84 US: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 85 US: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 86 US: VETERINARY POC DIAGNOSTICS INDUSTRY FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 87 US: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 88 CANADA: POPULATION OF COMPANION ANIMALS, 2014 VS. 2018 (MILLION)

TABLE 89 CANADA: POPULATION OF FOOD-PRODUCING ANIMALS, 2010–2017 (MILLION)

TABLE 90 CANADA: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 91 CANADA: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 92 CANADA: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 93 CANADA: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 94 CANADA: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 95 CANADA: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 96 CANADA: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 97 CANADA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 98 CANADA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 99 CANADA: MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 100 CANADA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 101 EUROPE: LIVESTOCK POPULATION, 2017 (MILLION)

TABLE 102 EUROPE: VETERINARY POC DIAGNOSTICS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 103 EUROPE: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 104 EUROPE: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 105 EUROPE: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 106 EUROPE: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 107 EUROPE: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 108 EUROPE: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 109 EUROPE: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 110 EUROPE: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 111 EUROPE: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 112 EUROPE: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 114 GERMANY: POPULATION OF COMPANION ANIMALS, 2012–2017 (MILLION)

TABLE 115 GERMANY: NUMBER OF VETERINARIANS, BY TYPE OF PRACTICE, 2014 VS. 2016 VS. 2018

TABLE 116 GERMANY: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 117 GERMANY: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 118 GERMANY: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 119 GERMANY: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 120 GERMANY: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 121 GERMANY: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 122 GERMANY: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 123 GERMANY: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 124 GERMANY: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 125 GERMANY: VETERINARY POC DIAGNOSTICS INDUSTRY FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 126 GERMANY: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 127 UK: POPULATION OF COMPANION ANIMALS, 2012–2018 (MILLION)

TABLE 128 UK: NUMBER OF VETERINARIANS, BY TYPE OF PRACTICE, 2014 VS. 2016 VS. 2017

TABLE 129 UK: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 130 UK: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 131 UK: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 132 UK: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 133 UK: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 134 UK: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 135 UK: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 136 UK: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 137 UK: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 138 UK: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 139 UK: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 140 FRANCE: POPULATION OF COMPANION ANIMALS, 2010–2017 (MILLION)

TABLE 141 FRANCE: NUMBER OF VETERINARIANS, BY TYPE OF PRACTICE, 2014 VS. 2017

TABLE 142 FRANCE: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 143 FRANCE: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 144 FRANCE: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 145 FRANCE: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 146 FRANCE: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 147 FRANCE: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 148 FRANCE: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 149 FRANCE: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 150 FRANCE: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 151 FRANCE: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 152 FRANCE: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 153 ITALY: POPULATION OF FOOD-PRODUCING ANIMALS, 2010–2017 (MILLION)

TABLE 154 ITALY: NUMBER OF VETERINARIANS, BY TYPE OF PRACTICE, 2012 VS. 2017

TABLE 155 ITALY: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 156 ITALY: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 157 ITALY: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 158 ITALY: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 159 ITALY: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 160 ITALY: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 161 ITALY: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 162 ITALY: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 163 ITALY: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 164 ITALY: VETERINARY POC DIAGNOSTICS INDUSTRY FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 165 ITALY: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 166 SPAIN: POPULATION OF FOOD-PRODUCING ANIMALS, 2010–2017 (MILLION)

TABLE 167 SPAIN: NUMBER OF VETERINARIANS, BY TYPE OF PRACTICE, 2014

TABLE 168 SPAIN: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 169 SPAIN: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 170 SPAIN: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 171 SPAIN: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 172 SPAIN: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 173 SPAIN: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 174 SPAIN: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 175 SPAIN: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 176 SPAIN: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 177 SPAIN: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 178 SPAIN: VETERINARY POC DIAGNOSTICS INDUSTRY, BY END USER, 2017–2025 (USD MILLION)

TABLE 179 ROE: POPULATION OF COMPANION ANIMALS, 2017 (MILLION)

TABLE 180 ROE: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 181 ROE: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 182 ROE: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 183 ROE: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 184 ROE: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 185 ROE: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 186 ROE: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 187 ROE: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 188 ROE: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 189 ROE: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 190 ROE: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 191 APAC: POPULATION OF FOOD-PRODUCING ANIMALS, 2010–2017 (MILLION)

TABLE 192 APAC: VETERINARY POC DIAGNOSTICS MARKET, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 193 APAC: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 194 APAC: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 195 APAC: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 196 APAC: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 197 APAC: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 198 APAC: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 199 APAC: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 200 APAC: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 201 APAC: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 202 APAC: VETERINARY POC DIAGNOSTICS INDUSTRY FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 203 APAC: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 204 CHINA: POPULATION OF FOOD-PRODUCING ANIMALS, 2010–2017 (MILLION)

TABLE 205 CHINA: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 206 CHINA: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 207 CHINA: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 208 CHINA: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 209 CHINA: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 210 CHINA: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 211 CHINA: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 212 CHINA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 213 CHINA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 214 CHINA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 215 CHINA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 216 JAPAN: POPULATION OF FOOD-PRODUCING ANIMALS, 2010–2017 (MILLION)

TABLE 217 PRODUCTION, CONSUMPTION, IMPORT, AND EXPORT OF ANIMAL-DERIVED FOOD PRODUCTS IN JAPAN, 2000 VS. 2030 (THOUSAND METRIC TONS)

TABLE 218 JAPAN: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 219 JAPAN: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 220 JAPAN: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 221 JAPAN: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 222 JAPAN: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 223 JAPAN: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 224 JAPAN: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 225 JAPAN: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 226 JAPAN: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 227 JAPAN: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 228 JAPAN: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 229 INDIA: POPULATION OF FOOD-PRODUCING ANIMALS, 2010–2017 (MILLION)

TABLE 230 PRODUCTION, CONSUMPTION, IMPORT, AND EXPORT OF ANIMAL-DERIVED FOOD PRODUCTS IN INDIA, 2000 VS. 2030 (THOUSAND METRIC TONS)

TABLE 231 INDIA: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 232 INDIA: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 233 INDIA: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 234 INDIA: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 235 INDIA: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 236 INDIA: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 237 INDIA: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 238 INDIA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 239 INDIA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 240 INDIA: VETERINARY POC DIAGNOSTICS INDUSTRY FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 241 INDIA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 242 ROAPAC: POPULATION OF FOOD-PRODUCING ANIMALS, 2010–2017 (MILLION)

TABLE 243 ROAPAC: NUMBER OF VETERINARIANS, 2010–2016

TABLE 244 ROAPAC: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 245 ROAPAC: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 246 ROAPAC: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 247 ROAPAC: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 248 ROAPAC: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 249 ROAPAC: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 250 ROAPAC: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 251 ROAPAC: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 252 ROAPAC: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 253 ROAPAC: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 254 ROAPAC: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 255 NUMBER OF VETERINARIANS & PARAVETERINARIANS IN LATIN AMERICAN COUNTRIES, 2010 VS. 2016

TABLE 256 LATIN AMERICA: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 257 LATIN AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 258 LATIN AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 259 LATIN AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 260 LATIN AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 261 LATIN AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 262 LATIN AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 263 LATIN AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 264 LATIN AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 265 LATIN AMERICA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 266 LATIN AMERICA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 267 NUMBER OF VETERINARIANS & PARAVETERINARIANS IN THE MIDDLE EAST & AFRICA, 2010 VS. 2016

TABLE 268 MIDDLE EAST & AFRICA: VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 269 MIDDLE EAST & AFRICA: VETERINARY POINT-OF-CARE DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 270 MIDDLE EAST & AFRICA: VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 271 MIDDLE EAST & AFRICA: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 272 MIDDLE EAST & AFRICA: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 273 MIDDLE EAST & AFRICA: VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 274 MIDDLE EAST & AFRICA: VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 275 MIDDLE EAST & AFRICA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2017–2025 (USD MILLION)

TABLE 276 MIDDLE EAST & AFRICA: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 277 MIDDLE EAST & AFRICA: VETERINARY POC DIAGNOSTICS INDUSTRY FOR LIVESTOCK ANIMALS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 278 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2017–2025 (USD MILLION)

TABLE 279 PRODUCT LAUNCHES, 2016–2019

TABLE 280 EXPANSIONS, 2016–2019

TABLE 281 ACQUISITIONS, 2016–2019

TABLE 282 PARTNERSHIPS & COLLABORATIONS, 2016–2019

LIST OF FIGURES (40 FIGURES)

FIGURE 1 RESEARCH DESIGN

FIGURE 2 PRIMARY SOURCES

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 TOP-DOWN APPROACH

FIGURE 6 DATA TRIANGULATION METHODOLOGY

FIGURE 7 VETERINARY POC DIAGNOSTICS MARKET, BY PRODUCT, 2019 VS. 2025 (USD MILLION)

FIGURE 8 VETERINARY POINT-OF-CARE DIAGNOSTIC INSTRUMENTS MARKET, BY TYPE, 2019 VS. 2025 (USD MILLION)

FIGURE 9 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY TECHNOLOGY, 2019 VS. 2025 (USD MILLION)

FIGURE 10 VETERINARY POINT-OF-CARE DIAGNOSTIC KITS & ANALYZERS MARKET, BY APPLICATION, 2019 VS. 2025 (USD MILLION)

FIGURE 11 VETERINARY POINT-OF-CARE DIAGNOSTIC IMAGING SYSTEMS MARKET, BY APPLICATION, 2019 VS. 2025 (USD MILLION)

FIGURE 12 VETERINARY POC DIAGNOSTICS MARKET, BY ANIMAL TYPE, 2019 VS. 2025 (USD MILLION)

FIGURE 13 VETERINARY POC DIAGNOSTICS MARKET, BY END USER, 2019 VS. 2025 (USD MILLION)

FIGURE 14 GEOGRAPHICAL SNAPSHOT OF THE VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET

FIGURE 15 ADVANTAGES OF POCT OVER CLINICAL CHEMISTRY LABORATORY ANALYSIS TO DRIVE MARKET GROWTH

FIGURE 16 APAC TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD (2019–2025)

FIGURE 17 DEVELOPING MARKETS WILL REGISTER HIGHER GROWTH BETWEEN 2019 AND 2025

FIGURE 18 CHINA AND INDIA TO GROW AT THE HIGHEST RATES DURING THE FORECAST PERIOD

FIGURE 19 VETERINARY POC DIAGNOSTICS INDUSTRY: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 20 US: PET INDUSTRY EXPENDITURE, 2010–2018

FIGURE 21 COMPANION ANIMALS WILL DOMINATE THE VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET DURING THE FORECAST PERIOD

FIGURE 22 PER CAPITA PORK CONSUMPTION FROM 2006–2018 (POUNDS)

FIGURE 23 PER CAPITA POULTRY MEAT CONSUMPTION FROM 2006–2018 (POUNDS)

FIGURE 24 VETERINARY CLINICS WILL CONTINUE TO DOMINATE THE VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET DURING THE FORECAST PERIOD

FIGURE 25 VETERINARY POC DIAGNOSTICS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 26 NORTH AMERICA: VETERINARY POC DIAGNOSTICS INDUSTRY SNAPSHOT

FIGURE 27 EUROPE: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET SNAPSHOT

FIGURE 28 APAC: VETERINARY POINT-OF-CARE DIAGNOSTICS MARKET SNAPSHOT

FIGURE 29 PRODUCT LAUNCHES—A KEY GROWTH STRATEGY ADOPTED BY MARKET PLAYERS FROM JANUARY 2016 AND DECEMBER 2019

FIGURE 30 VETERINARY POC DIAGNOSTICS MARKET FOR KITS & ANALYZERS, BY KEY PLAYER, 2018

FIGURE 31 VETERINARY POC DIAGNOSTICS MARKET: COMPETITIVE LEADERSHIP MAPPING (2018)

FIGURE 32 IDEXX LABORATORIES, INC.: COMPANY SNAPSHOT (2018)

FIGURE 33 ZOETIS, INC.: COMPANY SNAPSHOT (2018)

FIGURE 34 VIRBAC: COMPANY SNAPSHOT (2018)

FIGURE 35 HESKA CORPORATION: COMPANY SNAPSHOT (2018)

FIGURE 36 THERMO FISHER SCIENTIFIC, INC: COMPANY SNAPSHOT (2018)

FIGURE 37 ONEX CORPORATION: COMPANY SNAPSHOT (2018)

FIGURE 38 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT (2018)

FIGURE 39 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2018)

FIGURE 40 GE HEALTHCARE: COMPANY SNAPSHOT (2018)

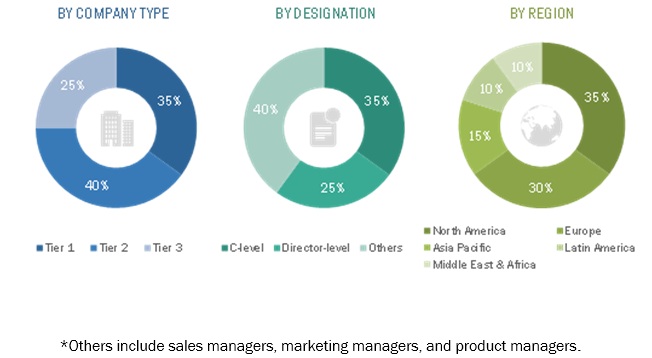

The study involved four major activities in estimating the size of the global veterinary point-of-care diagnostics market. Exhaustive secondary research was done to collect information on the adoption of different technologies and their regional adoption trends. Industry experts further validated the data obtained through secondary research through primary research. Furthermore, the market size estimates and forecast provided in this study are derived through a mix of the bottom-up approach (country-level incidence data for various diseases) and top-down approach (assessment of utilization/adoption/penetration trends, by product, technology, application, animal type, and end user). After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources such as the American Pet Products Association (APPA), American Veterinary Medical Association (AVMA), European Pet Food Industry Federation (FEDIAF), Food and Agriculture Organization of the United Nations (FAO), International Federation for Animal Health (IFAH), North American Pet Health Insurance Association (NAPHIA), National Office of Animal Health (NOAH), Canadian Animal Health Institute (CAHI), United States Department of Agriculture (USDA), World Health Organization (WHO), annual reports/SEC filings, investor presentations, and press releases of key players have been used to identify and collect information useful for the study of this market.

Primary Research

Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess the dynamics of this market. The primary participants mainly include product managers, business development directors, sales managers, and veterinarians across the industry. The breakdown of primaries is shown in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total market size for the veterinary point-of-care diagnostics market was arrived at after data triangulation from three different approaches, as mentioned below.

Approach to calculate revenue of different players in the veterinary point-of-care diagnostics market

In this report, the revenue of individual companies were gathered from public sources and databases. In certain cases, the share of veterinary point-of-care diagnostics business for kits & analyzers was ascertained after a detailed analysis of various parameters, including product portfolio, market positioning, selling price, and geographic reach & strength, among others. Individual shares or estimates were validated through expert interviews.

Approach to calculate parent markets of the veterinary point-of-care diagnostics market

In this report, the veterinary companion animal diagnostics market, veterinary radiography systems market, veterinary ultrasound imaging systems market, veterinary CT scanners market, and veterinary imaging market from MnM’s repository were referred to in order to obtain the market size of the veterinary point-of-care diagnostics market. A weighted average of numbers obtained from these reports was taken to derive the market size of the global veterinary point-of-care diagnostics market.

Approach to get the market size and estimate market growth

The market size and market growth was estimated through primary interviews on a regional and global level. All responses were collated and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall veterinary point-of-care diagnostics market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the veterinary point-of-care diagnostics market with respect to segments in product, animal type, application, technology, end user, and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall veterinary point-of-care diagnostics market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the veterinary point-of-care diagnostics market for five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the global veterinary point-of-care diagnostics market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as acquisitions, new tests/technology developments, geographical expansions, and research & development activities of the leading players in the global veterinary point-of-care diagnostics market

Target Audience:

- Veterinary point-of-care diagnostic manufacturers

- Veterinary point-of-care diagnostic distributors

- Animal health research and development (R&D) companies

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of European veterinary point-of-care diagnostics market into the Russia, Switzerland, the Netherlands, Sweden, Norway, Poland, and other countries

- Further breakdown of the Rest of Asia Pacific veterinary point-of-care diagnostics market into South Korea, Australia, and Singapore and other countries

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary PoC Diagnostics Market