Point of Care Molecular Diagnostics Market: Growth, Size, Share, and Trends

Point-of-Care Molecular Diagnostics Market by Product & Service (Assays, Instruments, Software), Technology (RT-PCR, INAAT), Sample Type (Blood, Urine), Application (STD, HAI, Hepatitis, Cancer), and End User (Hospitals, Clinics) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

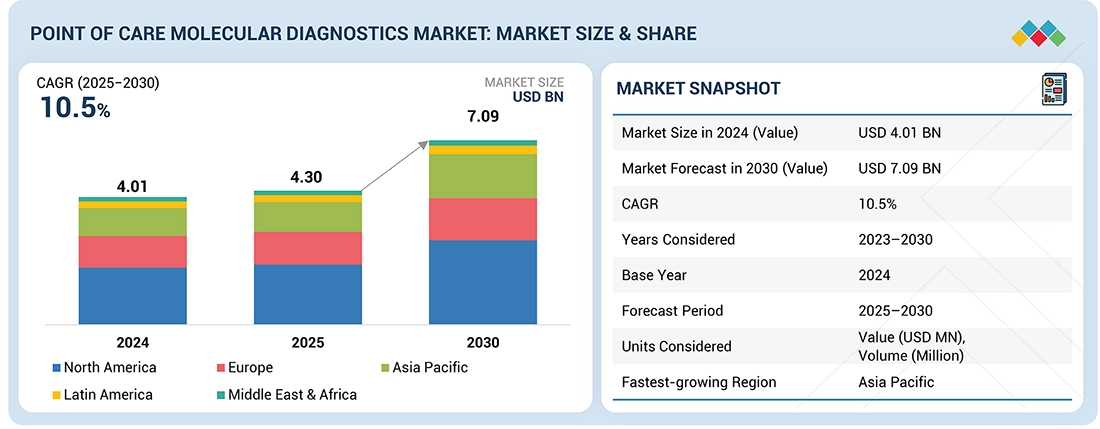

The point of care molecular diagnostics market is estimated at USD 4.30 billion in 2025 and is projected to reach USD 7.09 billion by 2030, growing at a CAGR of 10.5% during the forecast period. The demand for point of care molecular diagnostics is being shaped by the growing need for rapid and accurate testing across healthcare systems. Rising cases of infectious diseases and cancer have intensified the importance of timely diagnosis, while the shift toward decentralized healthcare has driven greater investment in R&D for advanced, portable solutions. At the same time, increasing awareness of the value of early disease detection is encouraging adoption, and the expanding use of POC diagnostic tests across hospitals, clinics, and remote care settings is further propelling market growth.

KEY TAKEAWAYS

-

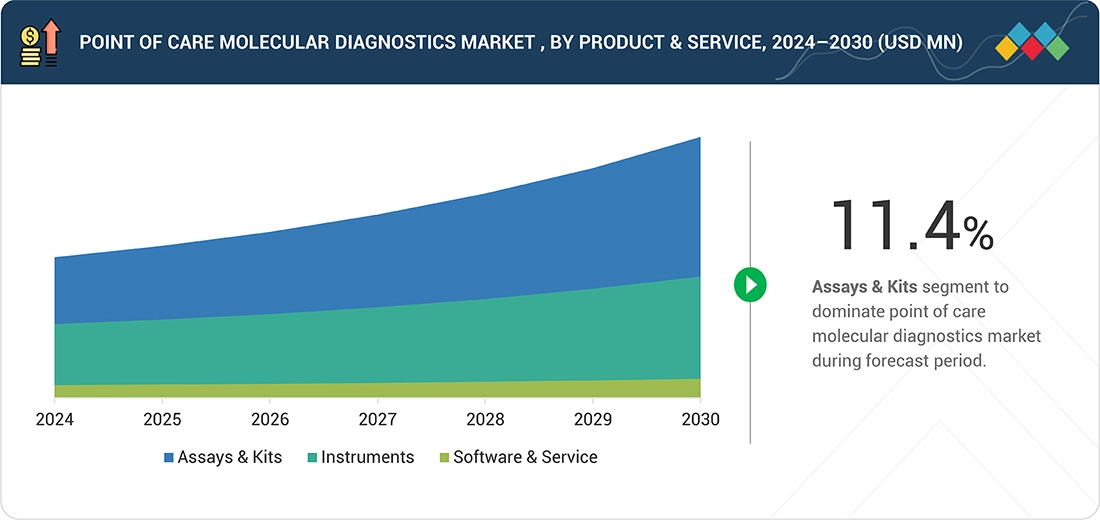

BY PRODUCT & SERVICEBased on product and service, the point of care molecular diagnostics market is segmented into assay kits, instruments & analyzers, and software & services. Assay kits hold a dominant share of the market, supported by their consistent and recurring demand across diverse point of care settings. Their frequent use in rapid disease detection, along with expanding applications across a wide range of clinical conditions, underpins their strong position. Additionally, the rising need for accurate, easy-to-use, and reliable molecular testing solutions at the point of care is expected to further strengthen the growth of this segment in the years ahead.

-

BY TECHNOLOGYBased on technology, the point of care molecular diagnostics market is divided into RT-PCR, INAAT, and other technologies. RT-PCR is widely adopted due to its broad clinical utility, high sensitivity, and rapid turnaround time, making it suitable for use across diverse healthcare settings. The availability of compact and easy-to-use RT-PCR systems designed for decentralized locations such as hospitals and emergency care units has further accelerated adoption. In addition, the rising need for timely detection of infectious diseases, coupled with continuous product development to enhance workflow efficiency and accuracy, is expected to strengthen the use of this technology in the coming years.

-

BY SAMPLE TYPEBy sample type, the point of care molecular diagnostics market is segmented into blood samples, urine, and other sample types. The other sample types category includes nasal and nasopharyngeal specimens, cerebrospinal fluid (CSF), genital swabs, tissue samples, and more. Its widespread use is largely attributed to the high reliance on nasal and nasopharyngeal swabs for diagnosing respiratory infections such as influenza and RSV. In addition, CSF and genital swabs play a vital role in detecting neurological and sexually transmitted infections, respectively. The ease of collection and wide diagnostic applicability of these samples further support their growing adoption in near-patient testing environments.

-

BY APPLICATIONThe point of care molecular diagnostics market is segmented into applications such as respiratory diseases, sexually transmitted diseases, hospital-acquired infections, cancer, hepatitis, gastrointestinal disorders, and other applications. Respiratory diseases are a key focus due to the high global prevalence of conditions like influenza and RSV, which has fueled the demand for rapid and reliable testing solutions. The ongoing risk of outbreaks and seasonal surges in respiratory infections further underscores the need for timely, decentralized testing. Healthcare providers increasingly rely on molecular diagnostic tools for respiratory infections because of their accuracy and speed. In addition, advancements in multiplex molecular assays allow simultaneous detection of multiple respiratory pathogens, enhancing diagnostic efficiency. Consequently, these solutions are extensively adopted across hospitals, clinics, and emergency care settings.

-

BY END USERBased on end user, the point of care molecular diagnostics market is segmented into physicians’ offices/clinics, hospitals, research institutes, and other end users. Hospitals are a major adopter due to their high patient volumes and the critical need for rapid and accurate diagnostic solutions. The increasing prevalence of infectious diseases, along with the demand for timely clinical decisions in emergency and critical care settings, has driven wider use of point of care molecular diagnostics in hospital environments. These platforms enable faster diagnosis and treatment initiation, helping to reduce hospital stays and improve patient outcomes. Furthermore, hospitals are increasingly investing in decentralized testing capabilities to streamline workflows and alleviate pressure on centralized laboratories, supporting continued adoption of point of care molecular diagnostic solutions.

The point of care molecular diagnostics market is poised for significant growth in the coming years, driven by the rising need for rapid and accurate testing, increasing prevalence of infectious diseases and cancer, and continuous innovations in molecular diagnostic technologies. Portable molecular platforms, isothermal amplification methods, and integrated cartridge-based systems are being increasingly adopted to deliver fast results at or near the patient, enabling timely clinical decisions and improving outcomes. Growing awareness of early disease detection, coupled with the shift toward decentralized healthcare delivery, is further accelerating market uptake. In addition, the expanding adoption of PoC diagnostics across hospitals, clinics, and resource-limited settings, along with ongoing R&D investments and advancements in automation, is enhancing the accessibility, efficiency, and reliability of PoC molecular testing.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The point of care molecular diagnostics market is evolving rapidly, driven by rising awareness of early disease detection, increasing prevalence of infectious diseases and cancer, and continuous advancements in molecular diagnostic technologies. Hospitals, clinics, and other decentralized healthcare settings represent the primary end users for point of care molecular testing solutions. Key trends, including the growing demand for rapid and accurate testing, expanding adoption of portable molecular platforms, and ongoing innovations in integrated and multiplex assays, are transforming diagnostic workflows and patient management strategies. These developments directly influence the procurement of assay kits, instruments, and testing services, thereby shaping the growth trajectory and adoption of point of care molecular diagnostic solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing prevalence of infectious diseases and cancer

-

Increasing focus on decentralized diagnostics and subsequent rise in R&D funding

Level

-

Unfavorable reimbursements

-

High capital investments and low cost-benefit ratio

Level

-

Growth opportunities in emerging economies

Level

-

Stringent regulatory guidelines that affect product commercialization

-

Introduction of alternative technologies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising incidence and prevalence of infectious diseases and cancer

The growing prevalence of infectious diseases and cancer is driving the adoption of point of care molecular diagnostics. Rapid and accurate testing near the patient is essential for early detection, improving outcomes, and limiting disease transmission, particularly for highly contagious infections. Point of care molecular diagnostics provide timely results, enabling faster clinical decisions and treatment initiation, especially in emergency care settings, clinics, and regions with limited access to centralized laboratories. Consequently, healthcare providers are increasingly turning to these solutions to meet rising diagnostic demands.

Restraint: High capital investments and low cost-benefit ratio

Market growth is restrained by the significant capital required to set up and maintain these technologies. Advanced molecular systems often involve high upfront costs for instruments, along with recurring expenses for consumables and maintenance, posing challenges for small- to mid-sized healthcare facilities and resource-limited settings. The perceived unfavourable cost-benefit ratio, particularly in budget-constrained regions, can hinder widespread adoption. Despite the benefits of faster diagnosis and improved patient care, these financial barriers limit market penetration, especially in emerging economies and rural healthcare infrastructures. Addressing this challenge will require cost-effective innovations and greater funding support.

Opportunity: Introduction of alternative technologies

Emerging markets such as India, Brazil, and Mexico offer significant growth opportunities for the point of care molecular diagnostics market. Rising healthcare investments, improving diagnostic infrastructure, and increasing awareness of early disease detection are driving demand for rapid and accurate testing. Companies providing affordable, portable, and user-friendly solutions can effectively capitalize on this potential. Collaborating with local stakeholders and supporting healthcare capacity-building initiatives can further strengthen their presence in these high-growth regions.

Challenge: Introduction of alternative technologies

The growth of point of care molecular diagnostics faces competition from alternative diagnostic methods such as immunoassays, biosensors, and next-generation sequencing. These technologies are gaining popularity due to their cost-effectiveness, ease of use, and expanding range of applications. In some settings, they can deliver faster results or require less complex infrastructure, appealing to healthcare providers with limited resources. Continuous advancements in these alternatives are narrowing the performance gap with molecular diagnostics, making it essential for point of care solutions to consistently demonstrate clinical value, accuracy, and cost-efficiency to remain competitive.

Point of Care Molecular Diagnostics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers point of care molecular diagnostic platforms and assay kits for infectious disease detection in hospitals and clinics | Rapid and accurate results, supports decentralized testing, high sensitivity and specificity, streamlined workflow, enables timely clinical decision-making, scalable for high patient volumes |

|

Provides POC molecular testing solutions for infectious diseases, including respiratory, gastrointestinal, and sepsis diagnostics | Broad pathogen coverage, fast turnaround time, easy-to-use systems for near-patient testing, reliable results, supports outbreak management and infection control |

|

Supplies compact and integrated POC molecular diagnostic platforms for infectious disease detection | High accuracy and reproducibility, supports multiplex testing, automated sample-to-result workflow, reduces turnaround time, improves early detection and patient management |

|

Offers portable POC molecular testing instruments and assay kits for infectious diseases, including respiratory and sexually transmitted infections | Quick results at or near the patient, user-friendly interface, high sensitivity, supports decentralized care, improves treatment initiation and clinical workflow |

|

Provides integrated POC molecular diagnostic solutions including real-time PCR and cartridge-based platforms | Reliable and reproducible results, supports rapid pathogen detection, compact and easy-to-use design, enables decentralized testing, enhances diagnostic efficiency and patient outcomes |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The point of care molecular diagnostics market caters to a wide range of end users, including physicians’ offices and clinics, hospitals, research institutes, and other healthcare settings. Testing focuses on rapid and accurate detection of infectious diseases, cancer, and other critical conditions near the patient. Adoption is being driven by advancements in portable molecular platforms, integrated sample-to-result systems, and automated workflows, which enhance accuracy, turnaround time, and operational efficiency. Increasing awareness of early disease detection, supportive regulatory approvals, and initiatives to expand decentralized healthcare services are further boosting the use of point of care molecular diagnostics across these diverse end-user segments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Point of Care Molecular Diagnostics Market, By Product & Service

Based on product and service, the point of care molecular diagnostics market is segmented into assay kits, instruments & analyzers, and software & services. Assay kits hold a dominant share of the market, supported by their consistent and recurring demand across diverse point of care settings. Their frequent use in rapid disease detection, along with expanding applications across a wide range of clinical conditions, underpins their strong position. Additionally, the rising need for accurate, easy-to-use, and reliable molecular testing solutions at the point of care is expected to further strengthen the growth of this segment in the years ahead.

Point of Care Molecular Diagnostics Market, By Technology

Based on technology, the point of care molecular diagnostics market is divided into RT-PCR, INAAT, and other technologies. RT-PCR is widely adopted due to its broad clinical utility, high sensitivity, and rapid turnaround time, making it suitable for use across diverse healthcare settings. The availability of compact and easy-to-use RT-PCR systems designed for decentralized locations such as hospitals and emergency care units has further accelerated adoption. In addition, the rising need for timely detection of infectious diseases, coupled with continuous product development to enhance workflow efficiency and accuracy, is expected to strengthen the use of this technology in the coming years.

Point of Care Molecular Diagnostics Market, By Sample Type

By sample type, the point of care molecular diagnostics market is segmented into blood samples, urine, and other sample types. The other sample types category includes nasal and nasopharyngeal specimens, cerebrospinal fluid (CSF), genital swabs, tissue samples, and more. Its widespread use is largely attributed to the high reliance on nasal and nasopharyngeal swabs for diagnosing respiratory infections such as influenza and RSV. In addition, CSF and genital swabs play a vital role in detecting neurological and sexually transmitted infections, respectively. The ease of collection and wide diagnostic applicability of these samples further support their growing adoption in near-patient testing environments.

Point of Care Molecular Diagnostics Market, By Application

The point of care molecular diagnostics market is segmented into applications such as respiratory diseases, sexually transmitted diseases, hospital-acquired infections, cancer, hepatitis, gastrointestinal disorders, and other applications. Respiratory diseases are a key focus due to the high global prevalence of conditions like influenza and RSV, which has fueled the demand for rapid and reliable testing solutions. The ongoing risk of outbreaks and seasonal surges in respiratory infections further underscores the need for timely, decentralized testing. Healthcare providers increasingly rely on molecular diagnostic tools for respiratory infections because of their accuracy and speed. In addition, advancements in multiplex molecular assays allow simultaneous detection of multiple respiratory pathogens, enhancing diagnostic efficiency. Consequently, these solutions are extensively adopted across hospitals, clinics, and emergency care settings.

Point of Care Molecular Diagnostics Market, By End User

Based on end user, the point of care molecular diagnostics market is segmented into physicians’ offices/clinics, hospitals, research institutes, and other end users. Hospitals are a major adopter due to their high patient volumes and the critical need for rapid and accurate diagnostic solutions. The increasing prevalence of infectious diseases, along with the demand for timely clinical decisions in emergency and critical care settings, has driven wider use of point of care molecular diagnostics in hospital environments. These platforms enable faster diagnosis and treatment initiation, helping to reduce hospital stays and improve patient outcomes. Furthermore, hospitals are increasingly investing in decentralized testing capabilities to streamline workflows and alleviate pressure on centralized laboratories, supporting continued adoption of point of care molecular diagnostic solutions.

REGION

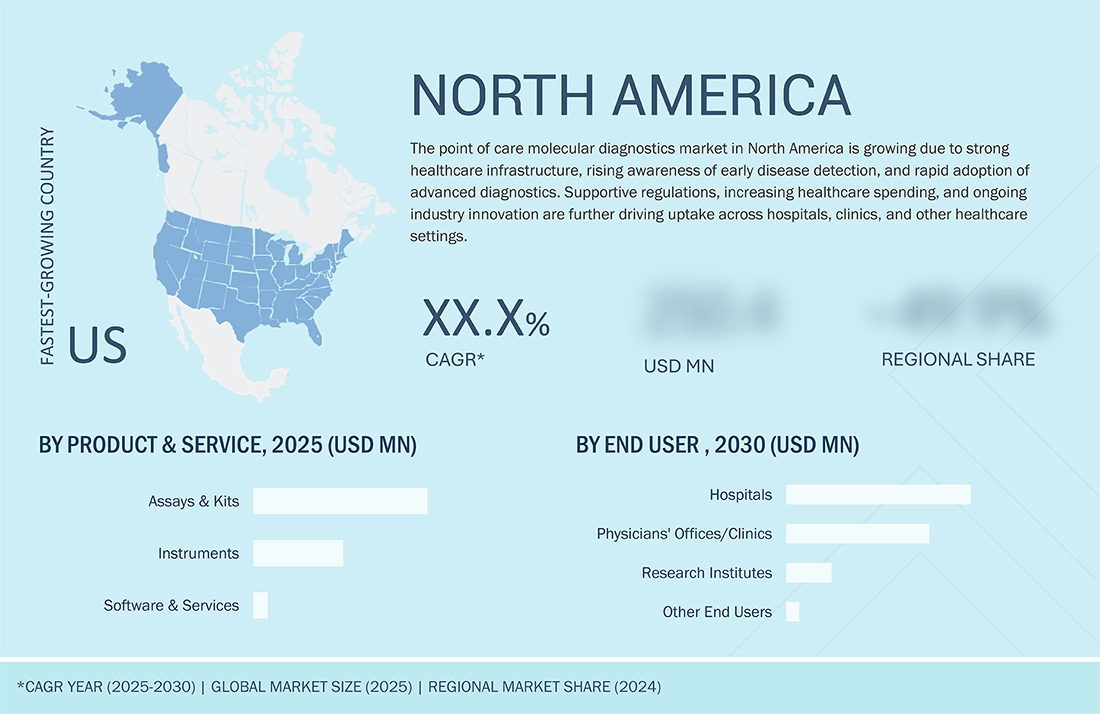

North America accounted for the largest share of the global point of care molecular diagnostics market during the forecast period.

The point of care molecular diagnostics market in North America is growing due to a strong healthcare infrastructure, increasing awareness of early disease detection, and the rapid adoption of advanced diagnostic technologies. Supportive regulatory policies, rising healthcare expenditure, and continuous innovation by key industry players are further driving the uptake of POC molecular testing across hospitals, clinics, and other healthcare settings.

Point of Care Molecular Diagnostics Market: COMPANY EVALUATION MATRIX

Danaher is a leading player in the point of care molecular diagnostics market, offering a broad portfolio of POC molecular testing platforms and assay kits for infectious diseases and other critical conditions. With a strong presence in North America and expanding operations globally, Danaher addresses diverse diagnostic needs across hospitals, clinics, and decentralized healthcare settings. Its collaborations with healthcare providers, laboratories, and public health organizations enhance its ability to support rapid, accurate testing and strengthen adoption of point of care molecular diagnostics in both developed and emerging regions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 4.01 Billion |

| Revenue Forecast in 2030 | USD 7.09 Billion |

| Growth Rate | CAGR of 10.5% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By product & service (assay & kits, instruments & analyzers, and software & services), by technology (RT-PCR, INAAT, other technologies), by sample type (blood samples, urine, and other sample types), by application (respiratory diseases, sexually transmitted diseases, hospital-acquired infections, cancer, hepatitis, gastrointestinal disorders, and other applications), by end user (physicians’ offices/clinics, hospitals, research institutes, and other end users) |

| Regional Scope | North America, Europe, Asia Pacific, Latin America and the Middle East & Africa |

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Product matrix, which provides a detailed comparison of the product portfolio of each company in the point of care molecular diagnostics market | Enables easy comparison of competitors’ offerings, helping identify gaps, overlaps, and differentiation opportunities. |

| Company Information | ? Additional five company profiles of players operating in the point of care molecular diagnostics market. | Provides insights into competitors’ strategies, innovation focus, and partnerships, supporting strategic planning. |

| Geographic Analysis | ? Additional country-level analysis of the point of care molecular diagnostics market | Guides market entry, localization, and targeted launch strategies by highlighting regional demand and opportunities. |

RECENT DEVELOPMENTS

- June 2025 : Cepheid (a subsidiary of Danaher) (US) announced that Health Canada has issued Cepheid a medical device licence for Xpert HIV-1 Viral Load XC, a next-generation extended-coverage (XC) test intended to aid in assessing HIV viral load levels, which are used to monitor effectiveness of antiretroviral treatment.

- January 2025 : F. Hoffmann-La Roche Ltd. (Switzerland) announced that the US Food and Drug Administration (FDA) has granted 510(k) clearance and Clinical Laboratory Improvement Amendments of 1988 (CLIA) waiver for its cobas liat sexually transmitted infection (STI) multiplex assay panels that diagnose sexually transmitted infections at the infectious disease.

- September 2024 : QIAGEN (Netherlands) announced an expanded partnership with Bio-Manguinhos/Fiocruz to provide advanced PCR-based molecular screening for malaria, HIV, hepatitis B, and hepatitis C in Brazil’s blood donation program.

- June 2024 : bioMérieux (France) received US FDA Special 510(k) clearance and CLIA-waiver for its BIOFIRE SPOTFIRE Respiratory/Sore Throat (R/ST) Panel Mini.

Table of Contents

Methodology

The study involved estimating activities to determine the current size of the point-of-care molecular diagnostics market. Exhaustive secondary research was done to collect information on the point-of-care molecular diagnostics industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the point-of-care molecular diagnostics market.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; gold-standard & silver-standard websites; regulatory bodies; and databases like D&B Hoovers, Bloomberg Business, and Factiva, were referred to identify and collect information for this study.

Primary Research

In the primary research process, primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess prospects.

Breakdown of Primaries

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both bottom-up and top-down approaches were used to estimate and validate the point-of-care molecular diagnostics market’s total size. These methods were also used extensively to estimate the size of various subsegments in tkehe mart. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The revenues generated by leading players operating in the point-of-care molecular diagnostics market have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size by applying the abovementioned process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Point-of-care molecular diagnostics includes various portable point-of-care devices and assays used by healthcare professionals to detect and diagnose diseases in humans using different techniques to identify and analyze nucleic acids or proteins at the molecular level.

Stakeholders

- Manufacturers and distributors of point-of-care molecular diagnostics products

- Physicians’ offices

- Hospitals and clinics

- Research institutes

- Point-of-care molecular diagnostics service providers

- Government associations

- Venture capitalists and investors

Report Objectives

- To define, describe, segment, and forecast the point-of-care molecular diagnostics market by product & service, technology, sample type, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as acquisitions, expansions, product launches & approvals, and other developments in the point-of-care molecular diagnostics market

- To benchmark players within the point-of-care molecular diagnostics market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

- To study the impact of AI/Gen AI on the market, along with the macroeconomic outlook for each region

Frequently Asked Questions (FAQ)

What are the recent trends affecting the point-of-care molecular diagnostics market?

Recent trends shaping the market include the increasing shift toward decentralized testing and the rising demand for multiplex assays that can identify multiple pathogens in a single test. There is also a trend toward miniaturized and portable systems that provide faster results and are easy to operate, especially suited for outpatient settings, rural areas, and emergency care environments.

What are the major products and services offered in the point-of-care molecular diagnostics market?

The market is broadly categorized into assays and kits, instruments and analyzers, and software and services. Among these, the assays and kits segment held the leading position in 2024 and is also the fastest-growing segment, driven by the consistent demand for test kits across various applications. The ease of use, shorter turnaround times, and frequent repurchasing of kits contribute to its sustained dominance.

Who are the key players in the point-of-care molecular diagnostics market?

Leading companies include Danaher Corporation (US), bioMérieux (France), F. Hoffmann-La Roche Ltd. (Switzerland), Abbott Laboratories (US), QIAGEN N.V. (Netherlands), QuidelOrtho Corporation (US), Co-Diagnostics, Inc. (US), Biocartis Group NV (Belgium), SD Biosensor, INC. (South Korea), and genedrive plc (UK).

Who are the key end users of the point-of-care molecular diagnostics?

The market is segmented by end users into physicians’ offices or clinics, hospitals, research institutes, and others. In 2024, hospitals emerged as the largest segment due to high patient volumes and the need for rapid, accurate results in critical care settings.

Which region is lucrative for the point-of-care molecular diagnostics market?

The Asia Pacific region is emerging as a lucrative market due to the rising incidence of infectious diseases, expanding healthcare access in rural areas, and increasing government initiatives to strengthen diagnostic infrastructure. Growing adoption of rapid and portable testing solutions, along with rising healthcare expenditure and awareness, further supports the region’s strong market potential.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Point-of-Care Molecular Diagnostics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Point-of-Care Molecular Diagnostics Market