Automotive Power Distribution Block Market by Type (Hardwired and Configurable), Component, EV Type, Off-Highway Vehicle (Agricultural Tractors and Construction Equipment), Vehicle Type (PC, LCV, and HCV), and Region - Global Forecast to 2025

[135 Pages Report] The automotive power distribution block market was valued at USD 6.29 billion in 2017 and is projected to reach USD 8.60 billion by 2025, growing at a CAGR of 4.15% during the forecast period. The base year for the report is 2017 and the forecast period is 2018 to 2025.

Objectives of the Report

- To define, segment, and forecast the automotive power distribution block market (20182025), in terms of volume (thousand units) and value (USD million)

- To provide detailed analyses of the various forces acting in the market (drivers, restraints, opportunities, and challenges)

- To segment the market and forecast the market size based on type, component, vehicle type, electric vehicle, off-highway vehicle, and region (Asia Pacific, Europe, North America, and the Rest of the World)

- To segment the market and forecast the market size, by volume and value, based on type Hardwired and Configurable

- To segment the market and forecast the market size, by value, based on component fuses, relays, CAN, and others

- To segment the market and forecast the market size, by volume and value, based on vehicle type passenger cars, light commercial vehicles, and heavy commercial vehicles

- To segment the market and forecast the market size, by volume and value, based on electric vehicle type BEVs, HEVs, and PHEVs

- To segment the market and forecast the market size, by volume and value, based on off-highway vehicle agricultural tractors and construction equipment

- To track and analyze competitive developments, such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

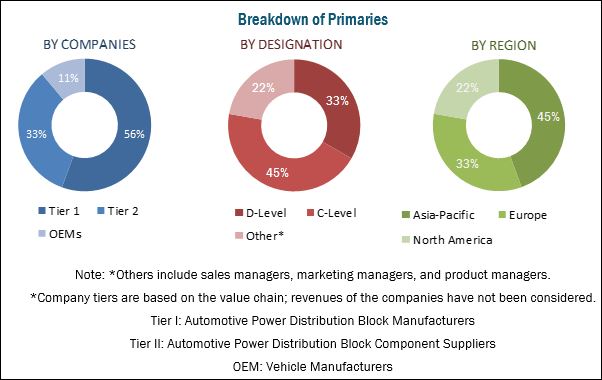

The research methodology used in the report involves primary and secondary sources and follows a bottom-up approach for the purpose of data triangulation. The study involves the country-level OEM and model-wise analysis of automotive power distribution block market. This analysis involves historical trends as well as existing penetrations by country as well as vehicle type. The analysis is projected based on various factors such as growth trends in vehicle production and adoption rate of automotive power distribution block by OEMs. The analysis has been discussed and validated by primary respondents, which include experts from the automotive industry, manufacturers, and suppliers. Secondary sources include associations such as China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), European Automobile Manufacturers Association (ACEA), Society of Indian Automobile Manufacturers (SIAM), SAE International, and paid databases and directories such as Factiva.

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive power distribution block market consists of automotive power distribution block manufacturers such as Eaton (Ireland), Lear (US), Sumitomo Electric (Japan), TE Connectivity (Switzerland), Yazaki (Japan), and Littelfuse (US).

Target Audience

- Automotive Power Distribution Block Manufacturers

- Automotive Fuse Manufacturers

- Automotive Relay Manufacturers

- Automotive Safety and Comfort System Manufacturers

- Industry Associations

- Raw Material Suppliers for Automotive Power Distribution Block

- The Automobile Industry as an End User

- Traders, Distributors, and Suppliers of Automotive Power Distribution Block

Scope of the Report

Automotive Power Distribution Block Market, By Type

- Hardwired

- Configurable

Automotive Power Distribution Block Market, By Vehicle Type

- Passenger Car

- LCVs

- HCVs

Automotive Power Distribution Block Market, By Electric Vehicle Type

- BEV

- HEV

- PHEV

Automotive Power Distribution Block Market, By Off- Highway Vehicle Type

- Agricultural Tractors

- Construction Equipment

Automotive Power Distribution Block Market, By Component

- Fuse

- Relay

- CAN

- Others

Automotive Power Distribution Block Market, By Region

- Asia Pacific (China, India, Japan, South Korea, Thailand, and Rest of Asia Pacific)

- Europe (Germany, France, Russia, Spain, Turkey, the UK, and Rest of Europe)

- North America (US, Mexico, and Canada)

- Rest of the World (Brazil, Iran, and Others)

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the companys specific needs.

The following customization options are available for the report:

Additional Company Profiles

- Business Overview

- SWOT analysis

- Recent developments

- MnM view

Detaled Analysis of Automotive Power Distribution Block Market By Vehicle Type

Drivers

Increasing adoption of electronic functions in a vehicle

The adoption of electronic content in vehicles has increased rapidly in the last two decades. The pace is poised to accelerate further. Further, the adoption of advanced electronics in smart vehicles would enable vehicle users to use features such as in-car payment services, on-road entertainment, connected services, etc. The increasing consumer preference for these features is a major driving force for the growth of the electronic cockpit systems. Moreover, stringent safety norms imposed by governments and legislative agencies have forced automobile manufacturers to make vehicles safer by providing features such as anti-lock braking systems (ABS), electronic brake-force distribution (EBD), telematics, adaptive lighting, and airbags. These safety features rely heavily on inputs from electronic control units.

Restraints

Lack of technological innovations in the power distribution box

A hardwired power distribution box uses traditional power transmission components such as fuses, relays, connectors, wires, etc. This type of power distribution box is widely used in the vehicle power distribution market, particularly in the Asia Pacific region. The passenger car market in developing economies such as China, Brazil, and India has a large market share of this type of power distribution box. Also, the hardwired power distribution box is widely used in heavy commercial and off-highway vehicles because of its cost-effectiveness, reliability, and load carrying capacity. However, the use of this type of power distribution box increases the number as well as the size of cables, which in turn increases the overall weight of the vehicle. The increase in vehicle weight is a major problem for the manufacturers of vehicle power distribution box.

Opportunities

Rapid technological changes in the commercial vehicle segment

The market for commercial vehicles is growing at a significant rate. The rapid development of infrastructure, especially in countries such as China and India, is supporting the growth of the commercial vehicle market. According to the Department of Statistics, Stanford University, spending on infrastructure development in China increased by almost 50% from 2015 to 2016. Increasing investments in infrastructure have propelled the demand for HCVs. Also, the growing demand for freight transportation is driving the market for HCVs.

New Product Developments

|

Company |

Date |

Description |

|

Leoni |

July 2017 |

Leoni presented the next generation of its modular system for high-voltage power distribution in electric and hybrid vehicles at the IAA International Motor Show in Frankfurt. The further-developed Y-splitter is more variable, lighter, and less expensive than comparable products. |

|

Littelfuse |

April 2016 |

Littelfuse added two new power distribution products to its commercial vehicle products offering. The new products, HWB6 and HWB12, complement the existing product family with the addition of two more compact options to their wide variety of rugged vehicle electrical modules. The HWB family is ideal for accessory circuits, overflow circuits, and can even be used as a main unit on smaller vehicles. |

Source: Press Releases, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis

Expansions

|

Company |

Date |

Description |

|

Eaton |

May 2018 |

Eaton announced its long-term commitment to be present and serve the Israel market through the establishment of Eaton Israel. The company will operate through two sitesa sales, marketing, and support center in Ra'anana and a logistics and distribution center in Ashdod. The products and services offered in Israel include power distribution, energy storage, industrial automation, and data center solutions, as well as life safety products for fire detection, emergency notification, and safe evacuation including adaptive emergency lighting systems. The company aims to double its sales in Israel over the next three years. |

|

Yazaki |

September 2018 |

Yazaki expanded its operations in Texas to include manufacturing of dealer parts and service components and established a manufacturing development center for engineering. |

Source: Company Website, Annual Reports, and MarketsandMarkets Analysis

The automotive power distribution block market is projected to grow at a CAGR of 4.15% from 2018 to 2025. The market is estimated to be USD 6.47 billion in 2018 and is projected to reach USD 8.60 billion by 2025. The market growth can be attributed to the increasing adoption of vehicle electronic functions that require a reliable, flexible, robust, and efficient power distribution system.

The configurable power distribution box is estimated to be the fastest growing segment of automotive power distribution block market. The configurable power distribution box combines fuses, relays, microcontrollers, and multiple (circuit board and fret) layers of interconnections into a single integrated assembly to distribute power for different applications. Also, this type of a power distribution box is more suitable for a complex electronic control system.

By vehicle type, the passenger car segment is estimated to hold the largest share of the automotive power distribution block market. The rise in the production of passenger cars globally, increasing demand for premium vehicles and SUVs, and increasing preference for high-performance personal vehicles are fueling the growth of the passenger car market. Also, the global demand for passenger cars is higher than that for commercial vehicles and is expected to grow further in the future. Additionally, factors such as the sizeable number of luxury light-duty vehicles in Europe and North America and the increasing demand for these vehicles in the Asia Pacific region are increasing the demand for automotive power distribution block in this vehicle segment.

The automotive power distribution block market for Battery Electric Vehicles (BEVs) segment is estimated to be the fastest growing market. Factors such as strict emission norms by the government, the rise in ecological imbalance due to excessive carbon emission, and less energy consumption are promoting the growth of BEVs.

By off-highway vehicle type, the construction equipment is estimated to be the fastest growing segment of automotive power distribution block market. Rapid development of infrastructure, especially in countries such as China and India, is supporting the growth of this market.

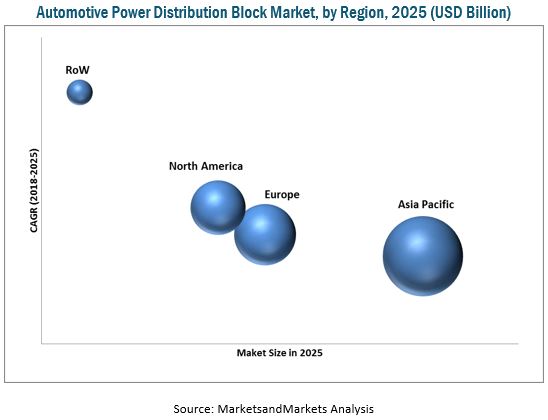

The Asia Pacific region is estimated to dominate the automotive power distribution block market for automotive, by volume as well as value. The growth of this market can be attributed to the increase in production and demand for passenger cars and electric vehicles. Also, the increasing adoption of advanced cockpit electronic functions in vehicles, growing purchasing power of the population, and increasing consumer awareness for safety features in developing countries are the key factors driving the market in the Asia Pacific region.

A key factor restraining the growth of the automotive power distribution block market is the lack of technological innovation in power distribution box. A hardwired power distribution box is cost-effective but requires more space and adds to the overall weight of the vehicle. On the other hand, a configurable power distribution box reduces the number of fuses and other components and thus helps in reducing the overall weight of the vehicle. However, the cost of this type of a power distribution box is higher than a hardwired power distribution box. Manufacturers should offer a solution that can meet both requirements i.e. weight reduction and cost-effective system.

Some of the key market players are Eaton (Ireland), Lear (US), Sumitomo Electric (Japan), TE Connectivity (Switzerland), Yazaki (Japan), and Littelfuse (US).

Challenges

Increasing complexity in the design of the vehicle power distribution box

In todays market, components are much cheaper, technology has improved considerably, and several mechanically-operated systems and components are being converted to electrical to reduce the weight of the vehicle. For instance, the use of an electric power steering over hydraulic power steering leads to a saving of 2 to 4% in the fuel consumption of a vehicle. Also, OEMs have started offering premium features in their mid-segment vehicles to differentiate themselves from the competitors. Some of these features are ambiance lighting, powered sunroof, powered tailgate, digital instrument clusters, and infotainment systems. With increasing demand, these features would become a standard offering for the mid-segment vehicles. Moreover, the advent of semi-autonomous and autonomous vehicles has fueled the use of ADAS features in all variants of vehicles. The use of ADAS features leads to an increase in vehicle electrification, which in turn requires more power supply. The increased need for power compels manufacturers to increase the number of components and size of the power distribution box, which in turn increases the complexity in the design of the power distribution box. The increased complexity in the design of the power distribution box is the major challenge for vehicle power distribution manufacturers.

Partnerships/Supply Contracts/Collaborations/Joint Ventures

|

Company |

Date |

Description |

|

Sumitomo Electric |

February 2018 |

Sumitomo and NEC Corporation collaborated for the development and planning of automotive components in the mobility business segment. With this development, the companies plan to develop and demonstrate software and hardware for transportation and in-vehicle infrastructure. The companies will exploit the provisions of artificial intelligence and internet of things (IoT) technologies in cascading effect. |

|

Sumitomo Electric |

November 2017 |

Sumitomo and GoMentum Station entered into a partnership to develop autonomous and connected vehicle technologies. This move would help introduce advanced automated vehicle technology by utilizing the resources of GoMentum Station. |

Source: Press Releases, Annual Reports, and MarketsandMarkets Analysis

Acquisitions/Agreements

|

Company |

Date |

Description |

|

Littelfuse |

March 2016 |

Littelfuse successfully acquired the circuit protection business of TE Connectivity for USD 350 million. After the acquisition, Littelfuse strengthened its core circuit protection business by adding new products and new markets from TE connectivity. |

|

Littelfuse |

July 2017 |

Littelfuse acquired the assets of JRS MFG. LTD., headquartered in Winnipeg, Manitoba, Canada. JRS MFG. LTD. provides custom engineered and manufactured products for the electrical industry with a primary focus on the mining and utility markets. |

Source: Press Releases, Annual Reports, and MarketsandMarkets Analysis

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Data Triangulation

2.5 Market Size Estimation

2.6 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Automotive Power Distribution Block Market for Automotive

4.2 Market, By Region

4.3 Market, By Country

4.4 Market, By Type

4.5 Market, By Vehicle Type

4.6 Market, By Electric Vehicle Type

4.7 Market, By Component

4.8 Market, By Off-Highway Vehicle Type

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of Electronic Functions in A Vehicle

5.2.2 Restraints

5.2.2.1 Lack of Technological Innovations in the Power Distribution Box

5.2.3 Opportunities

5.2.3.1 Rapid Technological Changes in the Commercial Vehicle Segment

5.2.4 Challenges

5.2.4.1 Increasing Complexity in the Design of the Automotive Power Distribution Block

6 Automotive Power Distribution Block Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Hardwired

6.3 Configurable

7 Automotive Power Distribution Block Market, By Component (Page No. - 44)

7.1 Introduction

7.2 Can

7.3 Fuse

7.4 Relay

7.5 Others

8 Automotive Power Distribution Block Market, By Vehicle Type (Page No. - 50)

8.1 Introduction

8.2 Passenger Cars

8.3 LCV

8.4 HCV

9 Automotive Power Distribution Block Market, By Electric Vehicle (Page No. - 57)

9.1 Introduction

9.2 Battery Electric Vehicle (BEV)

9.3 HEV

9.4 PHEV

10 Automotive Power Distribution Block Market, By Off-Highway Vehicle Type (Page No. - 64)

10.1 Introduction

10.2 Agricultural Tractors

10.3 Construction Equipment

11 Automotive Power Distribution Block Market, By Type & Region (Page No. - 70)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.2.5 Thailand

11.2.6 Rest of Asia Pacific

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Russia

11.3.4 Spain

11.3.5 Turkey

11.3.6 UK

11.3.7 Rest of Europe

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 RoW

11.5.1 Brazil

11.5.2 Iran

11.5.3 Others

12 Competitive Mapping (Page No. - 98)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Situation & Trends

12.3.1 New Product Developments

12.3.2 Expansions

12.3.3 Partnerships/Supply Contracts/Collaborations/Joint Ventures

12.3.4 Acquisitions/Agreements

13 Company Profiles (Page No. - 105)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Eaton

13.2 Lear

13.3 Sumitomo Electric

13.4 TE Connectivity

13.5 Yazaki

13.6 Littelfuse

13.7 Leoni

13.8 Furukawa

13.9 Horiba

13.10 Mersen

13.11 E-T-A

13.12 Schurter

13.13 PKC

13.14 Minda

13.15 Draxlmaier

13.16 MTA

13.17 Truck-Lite

13.18 Kissling Elektrotechnik

13.19 Curtiss-Wright

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 130)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Available Customizations

14.3.1 Additional Company Profiles

14.3.1.1 Business Overview

14.3.1.2 SWOT Analysis

14.3.1.3 Recent Developments

14.3.1.4 MnM View

14.3.2 Detaled Analysis of Automotive Power Distribution Block Market By Vehicle Type

14.4 Related Reports

14.5 Author Details

List of Tables (96 Tables)

Table 1 Currency Exchange Rates (WRT USD)

Table 2 Automotive Power Distribution Block Market Size, By Type, 20162025 (Thousand Units)

Table 3 Market Size, By Type, 20162025 (USD Million)

Table 4 Hardwired: Market, By Region, 20162025 (Thousand Units)

Table 5 Hardwired: Market, By Region, 20162025 (USD Million)

Table 6 Configurable: Market, By Region, 20162025 (Thousand Units)

Table 7 Configurable: Market, By Region, 20162025 (USD Million)

Table 8 Market, By Component, 20162025 (USD Million)

Table 9 Can: Market, By Region, 20162025 (USD Million)

Table 10 Fuse: Market, By Region, 20162025 (USD Million)

Table 11 Relay: Market, By Region, 20162025 (USD Million)

Table 12 Others: Market, By Region, 20162025 (USD Million)

Table 13 Automotive Power Distribution Block Market, By Vehicle Type, 20162025 (Thousand Units)

Table 14 Market, By Vehicle Type, 20162025 (USD Million)

Table 15 Passenger Car: Block Market, By Region, 20162025 (Thousand Units)

Table 16 Passenger Car: Market, By Region, 20162025 (USD Million)

Table 17 LCV: Market, By Region, 20162025 (Thousand Units)

Table 18 LCV: Market, By Region, 20162025 (USD Million)

Table 19 HCV: Market, By Region, 20162025 (Thousand Units)

Table 20 HCV: Market, By Region, 20162025 (USD Million)

Table 21 Automotive Power Distribution Block Market, By Electric Vehicle, 20162025 (Thousand Units)

Table 22 Market, By Electric Vehicle, 20162025 (USD Million)

Table 23 Battery Electric Vehicle (BEV): Market Size, By Region, 20162025 (Thousand Units)

Table 24 Battery Electric Vehicle (BEV): Market Size, By Region, 20162025 (USD Million)

Table 25 HEV: Market, By Region, 20162025 (Thousand Units)

Table 26 HEV: Market, By Region, 20162025 (USD Million)

Table 27 PHEV: Market, By Region, 20162025 (Thousand Units)

Table 28 PHEV: Market, By Region, 20162025 (USD Million)

Table 29 Market, By Off-Highway Vehicle Type, 20162025 (Thousand Units)

Table 30 Market, By Off-Highway Vehicle Type, 20162025 (USD Million)

Table 31 Off-Highway Vehicle: Market, By Type, 20162025 (Thousand Units)

Table 32 Off-Highway Vehicle: Market, By Type, 20162025 (USD Million)

Table 33 Agricultural Tractors: Market Size, By Region, 20162025 (Thousand Units)

Table 34 Agricultural Tractors: Automotive Power Distribution Block Market Size, By Region, 20162025 (USD Million)

Table 35 Construction Equipment: Market, By Region, 20162025 (Thousand Units)

Table 36 Construction Equipment: Market, By Region, 20162025 (USD Million)

Table 37 Market, By Region, 20162025 (Thousand Units)

Table 38 Market, By Region, 20162025 (USD Million)

Table 39 Asia Pacific: Market, By Country, 20162025 (Thousand Units)

Table 40 Asia Pacific: Market, By Country, 20162025 (USD Million)

Table 41 Asia Pacific: Market, By Type, 20162025 (Thousand Units)

Table 42 Asia Pacific: Market, By Type, 20162025 (USD Million)

Table 43 China: Market, By Type, 20162025 (Thousand Units)

Table 44 China: Market, By Type, 20162025 (USD Million)

Table 45 India: Market, By Type, 20162025 (Thousand Units)

Table 46 India: Market, By Type, 20162025 (USD Million)

Table 47 Japan: Market, By Type, 20162025 (Thousand Units)

Table 48 Japan: Market, By Type, 20162025 (USD Million)

Table 49 South Korea: Market, By Type, 20162025 (Thousand Units)

Table 50 South Korea: Market, By Type, 20162025 (USD Million)

Table 51 Thailand: Market, By Type, 20162025 (Thousand Units)

Table 52 Thailand: Market, By Type, 20162025 (USD Million)

Table 53 Rest of Asia Pacific: Market, By Type, 20162025 (Thousand Units)

Table 54 Rest of Asia Pacific: Market, By Type, 20162025 (USD Million)

Table 55 Europe: Market, By Type, 20162025 (Thousand Units)

Table 56 Europe: Market, By Type, 20162025 (USD Million)

Table 57 Europe: Market, By Country, 20162025 (Thousand Units)

Table 58 Europe: Market, By Country, 20162025 (USD Million)

Table 59 France: Market, By Type, 20162025 (Thousand Units)

Table 60 France: Market, By Type, 20162025 (USD Million)

Table 61 Germany: Market, By Type, 20162025 (Thousand Units)

Table 62 Germany: Market, By Type, 20162025 (USD Million)

Table 63 Russia: Market, By Type, 20162025 (Thousand Units)

Table 64 Russia: Market, By Type, 20162025 (USD Million)

Table 65 Spain: Market, By Type, 20162025 (Thousand Units)

Table 66 Spain: Market, By Type, 20162025 (USD Million)

Table 67 Turkey: Market, By Type, 20162025 (Thousand Units)

Table 68 Turkey: Market, By Type, 20162025 (USD Million)

Table 69 UK: Market, By Type, 20162025 (Thousand Units)

Table 70 UK: Market, By Type, 20162025 (USD Million)

Table 71 Rest of Europe: Market, By Type, 20162025 (Thousand Units)

Table 72 Rest of Europe: Market, By Type, 20162025 (USD Million)

Table 73 North America: Market, By Type, 20162025 (Thousand Units)

Table 74 North America: Market, By Type, 20162025 (USD Million)

Table 75 North America: Market, By Country, 20162025 (Thousand Units)

Table 76 North America: Market, By Country, 20162025 (USD Million)

Table 77 Canada: Market, By Type, 20162025 (Thousand Units)

Table 78 Canada: Market, By Type, 20162025 (USD Million)

Table 79 Mexico: Market, By Type, 20162025 (Thousand Units)

Table 80 Mexico: Market, By Type, 20162025 (USD Million)

Table 81 US: Market, By Type, 20162025 (Thousand Units)

Table 82 US: Market, By Type, 20162025 (USD Million)

Table 83 Rest of the World (RoW): Market, By Country, 20162025 (Thousand Units)

Table 84 Rest of the World (RoW): Market, By Country, 20162025 (USD Million)

Table 85 RoW: Market, By Type, 20162025 (Thousand Units)

Table 86 RoW: Market, By Type, 20162025 (USD Million)

Table 87 Brazil: Market, By Type, 20162025 (Thousand Units)

Table 88 Brazil: Market, By Type, 20162025 (USD Million)

Table 89 Iran: Market, By Type, 20162025 (Thousand Units)

Table 90 Iran: Market, By Type, 20162025 (USD Million)

Table 91 Others: Market, By Type, 20162025 (Thousand Units)

Table 92 Others: Market, By Type, 20162025 (USD Million)

Table 93 New Product Developments, 20142018

Table 94 Expansions, 20142018

Table 95 Partnerships/Supply Contracts/Collaborations/Joint Ventures, 20142018

Table 96 Acquisitions/Agreements, 20152018

List of Figures (43 Figures)

Figure 1 Automotive Power Distribution Block Market: Segmentations Covered

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market: Bottom-Up Approach

Figure 6 Market: Market Dynamics

Figure 7 Market: Market Size

Figure 8 Increasing Adoption of Cockpit Electronic Functions to Drive the Automotive Power Distribution Block Market in the Next 7 Years

Figure 9 Asia Pacific is Estimated to Be the Largest Market, By Value, 2018 vs 2025(USD Million)

Figure 10 Indian Market is Expected to Witness the Highest Growth During the Forecast Period (By Value)

Figure 11 Configurable Segment of Market to Grow at the Highest Rate From 2018 to 2025 (By Value)

Figure 12 Passenger Car Segment is Expected to Dominate the Market Between 2018 and 2025 (By Value)

Figure 13 BEV Segment is Projected to Have the Largest Market Share By 2025 (By Value)

Figure 14 Can Module Segment is Estimated to Have the Largest Market Share in 2018 (By Value)

Figure 15 Agricultural Tractors Segment is Expected to Dominate the Automotive Power Distribution Block Market for Off-Highway Vehicles Between 2018 and 2025 (By Value)

Figure 16 Growth Trend of Key Advanced Driver Assistance System Features, 20162022 (CAGR)

Figure 17 Market, By Type, 2018 vs 2025 (Thousand Units)

Figure 18 Market, By Component, 2018 vs 2025 (USD Million)

Figure 19 Market, By Vehicle Type, 2018 vs 2025 (Thousand Units)

Figure 20 Market, By Electric Vehicle, 2018 vs 2025 (Thousand Units)

Figure 21 Market, By Off-Highway Vehicle, 2018 vs 2025 (USD Million)

Figure 22 Market, By Region, 2018 vs 2025 (Thousand Units)

Figure 23 Asia Pacific: Market Snapshot

Figure 24 Europe: Market, By Country, 2018 vs 2025 (Thousand Units)

Figure 25 North America: Market Snapshot

Figure 26 RoW: Market, By Country, 2018 vs 2025 (Thousand Units)

Figure 27 Key Developments By Leading Players in the Market, 20142018

Figure 28 Automotive Power Distribution Block Market Ranking: 2017

Figure 29 Eaton: Company Snapshot

Figure 30 Eaton: SWOT Analysis

Figure 31 Lear: Company Snapshot

Figure 32 Lear: SWOT Analysis

Figure 33 Sumitomo Electric: Company Snapshot

Figure 34 Sumitomo Electric: SWOT Analysis

Figure 35 TE Connectivity: Company Snapshot

Figure 36 TE Connectivity: SWOT Analysis

Figure 37 Yazaki: Company Snapshot

Figure 38 Yazaki: SWOT Analysis

Figure 39 Littelfuse: Company Snapshot

Figure 40 Leoni: Company Snapshot

Figure 41 Furukawa: Company Snapshot

Figure 42 Horiba: Company Snapshot

Figure 43 Company Snapshot: Mersen

Growth opportunities and latent adjacency in Automotive Power Distribution Block Market