Power Distribution Unit Market by Type (Basic, Metered, Switched, Monitored, ATS, Hot Swap, Dual Circuit), Phase (Single & Three), Power Rating (Up to 120 V, 120240 V, 240400 V, above 400 V), End User and Region - Global Forecast to 2027

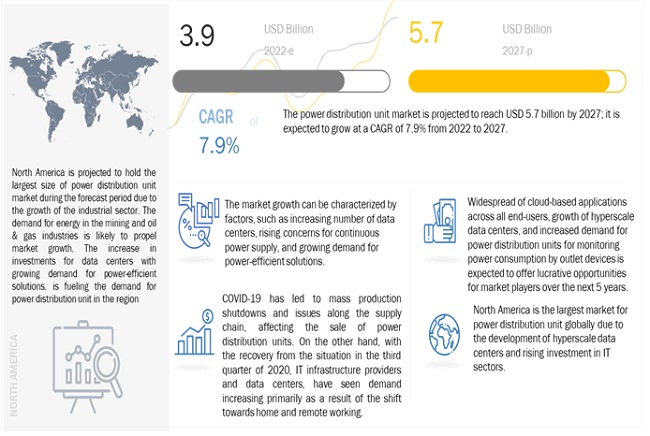

[197 Pages Report] The global power distribution unit market in terms of revenue was estimated to be worth $3.9 billion in 2022 and is poised to reach $5.7 billion by 2027, growing at a CAGR of 7.9% from 2022 to 2027. Due to the technological advancements and rising digitalization worldwide a considerable growth in data centers is witnessed. Secondly, growing industries are shifting their focus from conventionally investing in additional power infrastructure to optimizing the energy consumption, which is likely to propel the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Power Distribution Unit Market Dynamics

Driver: Increasing number of data centers

The power distribution unit market considers data centers as its major application segment. Data centers would continue to grow owing to trends such as a billion more people coming online across developing countries, the Internet of Things (IoT), automation in the automotive industry, robotics, and artificial intelligence (AI). The data production is expected to reach 175 zettabytes by 2025. To cope with the growing demand, companies such as Google, Amazon, and Microsoft, are all expanding their data centers in regions such as North America and Asia Pacific.

Restraint: Space constraints in old data center leading to heating up of spaces

In traditional systems, power distribution was dependent on the AC power source or batteries. With the rising and inevitable trend of processing additional data, the power distribution management in these facilities has become complex. Moreover, the colocation of data centers is another trend that requires space for servers and other computing hardware.

The conventional data centers are being modernized and thus require more applications and servers. The growth of such applications leads to physical space constraints, with limited room infrastructure. To meet the growing power demand, the data centers are installing power distribution units on a large scale. This leads to heating of space in data centers, which is harmful as the hot air produced by the continuously working server equipment can damage the assets as well as may lead to fire conditions in the facilities.

Opportunity: Strong growth from enterprises shift towards cloud applications

Cloud-based computing, networking and storage infrastructure, and cloud-native applications are trending in all business verticals. With the growing need for a truly connected world through cloud computing systems, the demand for cloud-based applications is rising. The construction of data centers and deployment of data warehousing are still vital for data storage, computation, and information management.

However, the transfer of data to-and-fro from a centralized data center system is costly and delayed. Thus, the industrial end-users are moving toward cloud platforms such as Microsoft Azure, Google Cloud, Amazon Web Services, IBM Bluemix, and SaaS. The growth trends show the fast deployment of cloud-based applications across end-users. This, in turn, creates opportunities for smart and compact power distribution units that can meet the rising power demand for operating such platforms.

Challenge: Integration of old power distribution units with data management software platform

The heavy work industries demand next-generation applications and new IT infrastructure in business facilities to reduce operational expenditures. According to a survey by International Data Group’s subsidiary IDC, 55% of the enterprises were forced to modernize their data centers through modernization of the existing infrastructure or deployment of new infrastructure in 2020. This would require the integration of the existing conventional power distribution units with the Data Center Infrastructure Management (DCIM) software platforms.

Retrofitting an operating data center with DCIM is not simple and may lead to revenue losses. Moreover, developing countries have a low acceptance level of such platforms. The major concerns are high payback period for the installation of smart power distribution units in the existing infrastructure. Moreover, in some cases, the information is limited to very specific applications. Thus, the investments in the complete modernization of smart power distribution units are comparatively high, which poses a challenge to the growth of the market.

Power Distribution Unit Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The switched segment by type holds the second largest segment in 2021

Switched PDUs include features such as remote monitoring and management, commands for rebooting connected servers and network equipment, and providing complete lights-out management of a data center or remote branch office. Also, switched PDUs are capable of receiving SNMP alerts and can assign specific access rights to designated outlets or groups. These can provide power requirements for high-amperage and high-voltage branch circuit protection. The globalization of cloud technology and the spread of IT infrastructure worldwide have increased the demand for server management in an efficient and intelligent way. These factors have led to a rise in the adoption of switched PDUs.

Single phase segment by phase is estimated to be the largest segment for power distribution unit market

The single-phase power distribution units can deliver low voltages of up to 4 single branch circuits. These consist of 4 wires, including 2 live wires, a neutral wire, and a ground wire. The major challenge for the single-phase power distribution units is that they cannot deliver continuous power at 60 Hz. The single-phase power supply is limited to residential and small businesses create more demand for single-phase power distribution units.

Power distribution units are expected to be used widely in telecom & IT segment

The telecom & IT segment, by end user, is projected to hold the highest market share during the forecast period. The telecom & IT industry consists of companies that deal with internet services, telecommunication lines, cloud computation, and data centers. The telecom industry has been rapidly evolving, with changes in technology and light-speed innovation. Intense competition, demanding customers, evolving technologies, regulatory hurdles, and shrinking margins are putting tremendous pressure on the telecom industry. The driving force for the growth of the global telecommunication industry is the growth in the mobile devices market due to the number of people connecting through smartphones is increasing every year, which creates opportunities for the telecom & IT sector.

Above 400 V segment by power rating is the fastest segment for power distribution unit market

These PDUs provide reliable three-phase power distribution. They save time and money during installation by using various standard connections. They also offer a quick recovery from overload events with resettable circuit breakers. For example, the Eaton 400–500 V three-phase power distribution units are designed for use with all three-phase uninterruptible power systems (UPS) and three-phase power sources. The PDU provides power distribution, voltage transformation, metering, status monitoring, and load profiling with easy adaptation and expansion without costly electrical rework. The PDU has the basic features that provide cost-effective and consistently reliable power distribution in hyperscale data centers, creating demand for PDUs.

North America is expected to account for the largest market size during the forecast period.

North America accounted for a 42.3% share of the power distribution unit market in 2021. North America region has been segmented, by country, into US, Canada and Mexico. The pdu market in this region is expected to grow due to the rise in investments in the end-user industries such as telecom & IT, healthcare, and BFSI. The telecom & IT sector is witnessing a rise in the demand for PDUs due to the rise in developments in IT infrastructure. Similarly, the healthcare sector provides an opportunity for the market because of the increased demand for lifesaving equipment, which requires an uninterrupted power supply for critical operations. Simultaneously, the continuous increase in data transfer through the Internet and the growing IT infrastructure are driving the demand for PDUs in the BFSI sector.

Key Players

Key Players include Schneider Electric (France), Legrand (France), Eaton (Ireland), Cisco Systems (US), ABB (Switzerland), Vertiv (US), nVent (UK), Panduit (US), Aten (Taiwan), Delta Electronics (Taiwan), Hewlett Packard Enterprise (US), Socomec (France)

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Type, By Phase, By Power Rating, By End User |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Schneider Electric (France), Legrand (France), Eaton (Ireland), Cisco Systems (US), ABB (Switzerland), Vertiv (US), nVent (UK), Panduit (US), Aten (Taiwan), Delta Electronics (Taiwan), Hewlett Packard Enterprise (US), Socomec (France) |

This research report categorizes the power distribution unit market based on type, phase, power rating, end user, and region.

By Type

- Basic

- Metered

- Switched

- Monitored

- Automatic Transfer Switch

- Hot swap

- Dual circuit

By Phase

- Single phase

- Three phase

By Power Rating

- Up to 120 V

- 120-240 V

- 240-400 V

- Above 400 V

By End user

- Telecom & IT

- BFSI

- Healthcare

- Manufacturing & Processing Industries

- Automotive

- Government & Defense

- Energy

By Region

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In April 2022, Cisco International Limited (US) and Telenor ASA (Norway) enhanced their relationship by signing the fourth iteration of their Joint Purpose Agreement (JPA) to empower societies through a better and more secure internet. The companies affirmed their shared values that focus on sustainability and commitment to building the internet for the future to address the digital divide and empower youth with digital skills and safe connectivity.

- In January 2022, Eaton and Samsung formed a new partnership to extend the home energy management and monitoring capabilities of Samsung’s SmartThings Energy platform. Eaton will integrate its smart circuit breaker technology into the SmartThings ecosystem, enabling homeowners to use data from connected devices throughout the home to better use energy. As part of the collaboration, users of the Samsung SmartThings Energy platform can leverage Eaton smart circuit breakers to expand their ability to monitor and gain insights into energy use from connected technology beyond Samsung devices throughout their homes. Additionally, Samsung SmartThings users can enroll in utility demand response programs where available to allow for more effective and efficient control of energy loads to help reduce the overall reliance on grid power.

- In September 2021, Schneider Electric (France) and the University of Birmingham Dubai have built a green, energy-efficient data center at its new campus for the benefit of students and academics. The University of Birmingham Dubai’s new facilities have been designed as a ‘Smart Campus,’ with technologies that enable innovative, multidisciplinary teaching and learning. Students and academics will benefit from WiFi6, the next generation of wireless connectivity, to support learning and research across the campus and between the UAE and the UK. The technology provided by Schneider Electric covers both, hardware and software and includes Easy Metered Rack Power Distribution Units (Rack PDU) for real-time remote monitoring of power usage, as well as power management for connected loads. Uninterruptible Power Supply devices provide battery backup power in case of a sudden loss of electricity, and Easy Rack mounts simplify the data center’s design and maintenance. In joint memoranda of understanding, ports worldwide are undertaking the construction of onshore power systems. Germany's federal government has entered a collaboration contract with Siemens to set up onshore power systems in its maritime and inland port facilities by 2023 with a total of USD 207.68 million in financial assistance

Frequently Asked Questions (FAQ):

What is the current size of the power distribution unit market?

The current market size of global power distribution unit market is estimated to be USD 3.9 billion in 2022.

What is the major drivers for power distribution unit market?

The power distribution unit market considers data centers as its major application segment. Data centers would continue to grow owing to trends such as a billion more people coming online across developing countries, the Internet of Things (IoT), automation in the automotive industry, robotics, and artificial intelligence (AI). The data production is expected to reach 175 zettabytes by 2025. To cope with the growing demand, companies such as Google, Amazon, and Microsoft, are all expanding their data centers in regions such as North America and Asia Pacific. Moreover, the growth in data centers is leading to increasing power consumption. According to research studies, about 5% of the global power is consumed by electronics, and more automation requires more power. Traditional data centers had higher operating expenses because of the lack of electricity efficient devices. In recent years, intelligent power distribution units and data center management software have come up as power management solutions for data centers. This is another factor leading the demand scenario of the power distribution market. According to the IEA, global internet traffic surged by over 40% in 2020, driven by increased video streaming, video conferencing, online gaming, and social networking. This growth is in addition to the past decade’s already high demand for digital services; since 2010, the number of internet users worldwide has doubled, while global internet traffic has increased ~30% per year.

Which is the largest-growing region during the forecasted period in power distribution unit market?

North America is expected to account for the largest market size during the forecast period. North America accounted for a 42.3% share of the power distribution unit market in 2021. The countries covered in the region are US, Canada and Mexico. North America is projected to hold the largest size of the power distribution unit market during the forecast period due to the growth of the telecom & IT sector. The major driving factors for the market includes the rise in investments in the end-user industries such as healthcare. The healthcare sector provides an opportunity for the power distribution unit market because of the increase in demand for lifesaving equipment, which requires an uninterrupted power supply for critical operations likely to propel the growth of power distribution unit market.

Which is the fastest-growing segment, by type during the forecasted period in power distribution unit market?

The metered segment, by type, is projected to hold the highest market share during the forecast period. Metered PDUs deliver local visual monitoring capability through an in-built LED screen that displays real-time power consumption data. These enable the optimum management of power used for powering specific business units of customers and increasing the efficiency of data centers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 POWER DISTRIBUTION UNIT MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

1.3.2 MARKET, BY PHASE: INCLUSIONS AND EXCLUSIONS

1.3.3 MARKET, BY POWER RATING: INCLUSIONS AND EXCLUSIONS

1.3.4 MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

1.3.5 MARKET, BY REGION: INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 1 POWER DISTRIBUTION UNIT MARKET: RESEARCH DESIGN

2.2 DATA TRIANGULATION

2.2.1 MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.2 SECONDARY DATA

2.2.2.1 Key data from secondary sources

2.2.3 PRIMARY DATA

2.2.3.1 Key data from primary sources

2.2.3.2 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE METRICS

FIGURE 6 METRICS CONSIDERED IN ANALYSIS AND DEMAND ASSESSMENT

2.3.4 CALCULATION FOR DEMAND-SIDE METRICS

2.3.5 RESEARCH ASSUMPTIONS FOR DEMAND-SIDE METRICS

2.3.6 SUPPLY-SIDE ANALYSIS

FIGURE 7 KEY STEPS IN SUPPLY ASSESSMENT OF POWER DISTRIBUTION UNIT SYSTEMS

FIGURE 8 MARKET: SUPPLY-SIDE ANALYSIS

2.3.6.1 Supply side calculation

2.3.6.2 Assumptions for supply side

2.3.7 FORECAST

2.4 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 36)

TABLE 1 POWER DISTRIBUTION UNIT MARKET SHARE, BY SEGMENT

FIGURE 9 GLOBAL MARKET, BY TYPE, 2022–2027

FIGURE 10 GLOBAL MARKET, BY PHASE, 2022–2027

FIGURE 11 GLOBAL MARKET, BY POWER RATING, 2022–2027

FIGURE 12 GLOBAL MARKET, BY END USER, 2022–2027

FIGURE 13 GLOBAL MARKET, BY REGION, 2022–2027

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN POWER DISTRIBUTION UNIT MARKET

FIGURE 14 INVESTMENTS MADE BY DATA CENTER OPERATORS TO INSTALL POWER-EFFICIENT DISTRIBUTION INFRASTRUCTURE ARE EXPECTED TO DRIVE MARKET FROM 2022 TO 2027

4.2 MARKET IN NORTH AMERICA, BY TYPE AND COUNTRY

FIGURE 15 METERED TYPE AND US HELD LARGEST SHARES OF MARKET IN NORTH AMERICA IN 2021

4.3 MARKET, BY TYPE

FIGURE 16 METERED TYPE CAPTURED MAJOR MARKET SHARE IN 2021

4.4 MARKET, BY PHASE

FIGURE 17 SINGLE PHASE HELD LARGEST SHARE OF GLOBAL MARKET IN 2021

4.5 MARKET, BY POWER RATING

FIGURE 18 120–240 V SEGMENT HELD LARGEST SHARE OF GLOBAL MARKET IN 2021

4.6 MARKET, BY END USER

FIGURE 19 TELECOM & IT ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2021

4.7 MARKET, BY REGION

FIGURE 20 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 21 GLOBAL PROPAGATION OF COVID-19

FIGURE 22 PROPAGATION OF COVID-19 CASES IN SELECTED COUNTRIES

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 COMPARISON OF GDP FOR SELECTED G20 COUNTRIES IN 2020

5.4 MARKET DYNAMICS

FIGURE 24 POWER DISTRIBUTION UNIT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.4.1 DRIVERS

5.4.1.1 Rising concerns over power stability for uninterrupted business operations

5.4.1.2 Increasing number of data centers

FIGURE 25 INCREASE IN NUMBER OF GLOBAL INTERNET USERS, 2005-2021

5.4.1.3 Rising power distribution unit installations for reducing energy losses

5.4.2 RESTRAINTS

5.4.2.1 Space constraints in old data centers leading to heating up of spaces

TABLE 2 THERMAL GUIDELINES FOR DATA CENTERS

5.4.2.2 Complex wiring systems with increasing number of power distribution units

5.4.3 OPPORTUNITIES

5.4.3.1 Containerized power solutions for edge data centers

TABLE 3 CONVENTIONAL DATA CENTERS VS. EDGE DATA CENTERS

5.4.3.2 Strong growth from enterprises’ shift toward cloud applications

FIGURE 26 ENTERPRISE SPENDING ON CLOUD AND DATA CENTERS FROM 2009 TO 2020

5.4.4 CHALLENGES

5.4.4.1 Integration of old power distribution units with data management software platform

5.5 COVID-19 IMPACT

5.6 MARKET MAP

FIGURE 27 MARKET MAP: POWER DISTRIBUTION UNIT MARKET

TABLE 4 MARKET: ROLE IN ECOSYSTEM

5.7 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS: PDU MARKET

5.7.1 COMPONENT MANUFACTURERS

5.7.2 POWER DISTRIBUTION UNIT MANUFACTURERS/ASSEMBLERS

5.7.3 DISTRIBUTORS (BUYERS)

5.7.4 END USERS

6 POWER DISTRIBUTION UNIT MARKET, BY TYPE (Page No. - 59)

6.1 INTRODUCTION

FIGURE 29 MARKET, BY TYPE, 2021 (%)

TABLE 5 MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2 BASIC

6.2.1 COST-EFFECTIVE POWER DISTRIBUTION SOLUTIONS FROM SMALL BUSINESS SECTORS INFLUENCE GROWTH OF BASIC PDUS

TABLE 6 BASIC PDU: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 METERED

6.3.1 REAL-TIME POWER CONSUMPTION DATA AT COMPARATIVELY LOW COST DRIVE METERED MARKET

TABLE 7 METERED PDU: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 SWITCHED

6.4.1 INCREASED CLOUD-BASED OPERATIONS CREATE DEMAND FOR SWITCHED POWER DISTRIBUTION UNITS

TABLE 8 SWITCHED PDU: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.5 MONITORED

6.5.1 INTELLIGENT POWER MANAGEMENT CAPABILITIES OF MONITORED PDUS ARE BOOSTING DEMAND FOR THESE PDUS

TABLE 9 MONITORED PDU: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.6 AUTOMATIC TRANSFER SWITCH

6.6.1 GROWING DEMAND FOR UPS FOR SMOOTH BUSINESS OPERATIONS DRIVES AUTOMATIC TRANSFER SWITCH MARKET

TABLE 10 AUTOMATIC TRANSFER SWITCH PDU: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.7 HOT SWAP

6.7.1 LIVE UPS MAINTENANCE FEATURE AND HIGH EFFICIENCY OF HOT SWAP POWER DISTRIBUTION UNITS ARE LIKELY TO DRIVE MARKET

TABLE 11 HOT SWAP PDU: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.8 DUAL CIRCUIT

6.8.1 EFFICIENT AND MANAGEABLE POWER DISTRIBUTION SOLUTIONS FOR MULTIPLE SERVERS THROUGH DUAL CIRCUIT PDUS

TABLE 12 DUAL CIRCUIT PDU: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 POWER DISTRIBUTION UNIT MARKET, BY PHASE (Page No. - 68)

7.1 INTRODUCTION

FIGURE 30 MARKET, BY PHASE, 2021

TABLE 13 MARKET SIZE, BY PHASE, 2020–2027 (USD MILLION)

7.2 SINGLE PHASE

7.2.1 RESIDENTIAL SECTOR TO DRIVE MARKET FOR SINGLE-PHASE POWER DISTRIBUTION UNITS

TABLE 14 SINGLE PHASE: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 THREE PHASE

7.3.1 RAPID INCREASE IN ELECTRICAL LOADS IS DRIVING GROWTH OF THREE-PHASE POWER DISTRIBUTION UNITS

TABLE 15 THREE PHASE: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 POWER DISTRIBUTION UNIT MARKET, BY POWER RATING (Page No. - 72)

8.1 INTRODUCTION

FIGURE 31 MARKET, BY POWER RATING, 2021 (%)

TABLE 16 MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

8.2 UP TO 120 V

8.2.1 HIGH DEMAND FOR SINGLE-PHASE 120 V POWER DISTRIBUTION UNITS WOULD FOSTER MARKET GROWTH

TABLE 17 UP TO 120 V: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 120–240 V

8.3.1 RISING FOCUS ON PREVENTING ACCIDENTAL OVERLOADS IS DRIVING DEMAND FOR 120–240 V POWER DISTRIBUTION UNITS

TABLE 18 120–240 V: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.4 240–400 V

8.4.1 WIDE USE IN HIGH-DENSITY NETWORK CLOSETS TO PROPEL GROWTH OF 240–400 V POWER DISTRIBUTION UNITS

TABLE 19 240–400 V: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.5 ABOVE 400 V

8.5.1 DEVELOPMENT OF HYPERSCALE DATA CENTERS CREATES OPPORTUNITIES FOR 400 V POWER DISTRIBUTION UNITS

TABLE 20 ABOVE 400 V: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 POWER DISTRIBUTION UNIT MARKET, BY END USER (Page No. - 78)

9.1 INTRODUCTION

FIGURE 32 MARKET, BY END USER, 2021 (%)

TABLE 21 MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 TELECOM & IT

9.2.1 INCREASING NUMBER OF DATA CENTERS ARE DRIVING TELECOM & IT SECTOR

TABLE 22 TELECOM & IT: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 BFSI

9.3.1 TECHNOLOGICAL DEVELOPMENTS AND ADOPTION OF DIGITAL TECHNOLOGY ARE DRIVING MARKET IN BFSI SECTOR

TABLE 23 BFSI: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.4 HEALTHCARE

9.4.1 REQUIREMENT FOR CONTINUOUS POWER SUPPLY IN HEALTHCARE INDUSTRY IS DRIVING MARKET

TABLE 24 HEALTHCARE: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.5 MANUFACTURING & PROCESSING INDUSTRIES

9.5.1 DATA CENTER CONSOLIDATION WITH INDUSTRIAL OPERATIONS IS LIKELY TO DRIVE MARKET IN MANUFACTURING & PROCESSING INDUSTRIES

TABLE 25 MANUFACTURING & PROCESSING INDUSTRIES: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.6 AUTOMOTIVE

9.6.1 ADOPTION OF CLOUD PLATFORMS IN AUTOMOTIVE SECTOR DRIVES MARKET

TABLE 26 AUTOMOTIVE: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.7 GOVERNMENT & DEFENSE

9.7.1 NEED FOR POWER DISTRIBUTION UNITS IN HARSH AND CRITICAL OPERATIONAL ENVIRONMENTS IS DRIVING MARKET

TABLE 27 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.8 ENERGY

9.8.1 DEMAND FOR CLOUD-BASED APPLICATIONS FROM ENERGY INDUSTRY IS BOOSTING MARKET

TABLE 28 ENERGY: MARKET, BY REGION, 2020–2027 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 88)

10.1 INTRODUCTION

FIGURE 33 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

FIGURE 34 MARKET SHARE FOR EACH REGION, 2021 (%)

TABLE 29 MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 ASIA PACIFIC

10.2.1 COVID-19 IMPACT

FIGURE 35 SNAPSHOT: POWER DISTRIBUTION UNIT MARKET IN ASIA PACIFIC, 2021

10.2.2 BY TYPE

TABLE 30 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.2.3 BY PHASE

TABLE 31 ASIA PACIFIC: MARKET, BY PHASE, 2020–2027 (USD MILLION)

10.2.4 BY POWER RATING

TABLE 32 ASIA PACIFIC: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

10.2.5 BY END USER

TABLE 33 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.6 BY COUNTRY

TABLE 34 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.2.7 CHINA

10.2.7.1 Investments in Big Data centers to drive the China-based pdu market

TABLE 35 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.8 INDIA

10.2.8.1 Increasing investments in data centers by IT companies fueling growth of market

TABLE 36 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.9 AUSTRALIA

10.2.9.1 Automation in automotive industries driving demand for power distribution units in Australia

TABLE 37 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.10 JAPAN

10.2.10.1 Significant impact of iot across end-user industries likely to bring opportunities

TABLE 38 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.11 REST OF ASIA PACIFIC

TABLE 39 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 NORTH AMERICA

10.3.1 COVID 19 IMPACT

FIGURE 36 SNAPSHOT: POWER DISTRIBUTION UNIT MARKET IN NORTH AMERICA, 2021

10.3.2 BY TYPE

TABLE 40 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.3 BY PHASE

TABLE 41 NORTH AMERICA: MARKET, BY PHASE, 2020–2027 (USD MILLION)

10.3.4 BY POWER RATING

TABLE 42 NORTH AMERICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

10.3.5 BY END USER

TABLE 43 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.6 BY COUNTRY

TABLE 44 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.3.6.1 US

10.3.6.1.1 Increasing applications of power distribution units in various industries for power solutions

TABLE 45 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.6.2 Canada

10.3.6.2.1 Optimum utilization of power components in industries likely to boost canadian market

TABLE 46 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.6.3 Mexico

10.3.6.3.1 Emerging automotive sector to attract opportunities in Mexico

TABLE 47 MEXICO: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 EUROPE

10.4.1 COVID 19 IMPACT

10.4.2 BY TYPE

TABLE 48 EUROPE: POWER DISTRIBUTION UNIT MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4.3 BY PHASE

TABLE 49 EUROPE: MARKET, BY PHASE, 2020–2027 (USD MILLION)

10.4.4 BY POWER RATING

TABLE 50 EUROPE: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

10.4.5 BY END USER

TABLE 51 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.6 BY COUNTRY

TABLE 52 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.4.6.1 UK

10.4.6.1.1 Expansion of data center networks by major players to bring opportunities

TABLE 53 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.6.2 France

10.4.6.2.1 Expansion of cloud based services likely to boost french market

TABLE 54 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.6.3 Germany

10.4.6.3.1 Rising concerns about reducing energy consumption from German data centers are driving market

TABLE 55 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.6.4 Rest of Europe

TABLE 56 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 SOUTH AMERICA

10.5.1 COVID 19 IMPACT

10.5.2 BY TYPE

TABLE 57 SOUTH AMERICA: POWER DISTRIBUTION UNIT MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.5.3 BY PHASE

TABLE 58 SOUTH AMERICA: MARKET, BY PHASE, 2020–2027 (USD MILLION)

10.5.4 BY POWER RATING

TABLE 59 SOUTH AMERICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

10.5.5 BY END USER

TABLE 60 SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.6 BY COUNTRY

TABLE 61 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.5.6.1 Brazil

10.5.6.1.1 Large investment in power grid infrastructure to boost market growth

TABLE 62 BRAZIL: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.6.2 Rest of South America

TABLE 63 REST OF SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 COVID 19 IMPACT

10.6.2 BY TYPE

TABLE 64 MIDDLE EAST & AFRICA: POWER DISTRIBUTION UNIT MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.6.3 BY PHASE

TABLE 65 MIDDLE EAST & AFRICA: MARKET, BY PHASE, 2020–2027 (USD MILLION)

10.6.4 BY POWER RATING

TABLE 66 MIDDLE EAST & AFRICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

10.6.5 BY END USER

TABLE 67 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6.6 BY COUNTRY

TABLE 68 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.6.6.1 Saudi Arabia

10.6.6.1.1 Rising demand for adopting cloud-based technologies is driving demand for power distribution units

TABLE 69 SAUDI ARABIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6.6.2 Turkey

10.6.6.2.1 Increasing number of colocation data centers is driving Turkish market

TABLE 70 TURKEY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6.6.3 South Africa

10.6.6.3.1 Need for storage facility for electronic data generated from various end users to drive demand

TABLE 71 SOUTH AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6.6.4 Rest of Middle East & Africa

TABLE 72 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 122)

11.1 KEY PLAYERS STRATEGIES

TABLE 73 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, AUGUST 2017– SEPTEMBER 2022

11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 74 MARKET: DEGREE OF COMPETITION

FIGURE 37 MARKET SHARE ANALYSIS, 2021

11.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 38 TOP PLAYERS IN POWER DISTRIBUTION MARKET FROM 2017 TO 2021

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 PERVASIVE

11.4.3 EMERGING LEADER

11.4.4 PARTICIPANT

FIGURE 39 COMPETITIVE LEADERSHIP MAPPING: PDU MARKET, 2021

11.5 POWER DISTRIBUTION UNIT MARKET: COMPANY FOOTPRINT

TABLE 75 COMPANY FOOTPRINT: BY TYPE

TABLE 76 COMPANY FOOTPRINT: BY PHASE

TABLE 77 COMPANY FOOTPRINT: BY END USER

TABLE 78 COMPANY FOOTPRINT: BY POWER RATING

TABLE 79 BY REGION: COMPANY FOOTPRINT

TABLE 80 OVERALL COMPANY FOOTPRINT

11.6 COMPETITIVE SCENARIO

TABLE 81 POWER DISTRIBUTION MARKET: PRODUCT LAUNCHES, AUGUST 2017– MARCH 2022

TABLE 82 POWER DISTRIBUTION MARKET: DEALS, JANUARY 2020– APRIL 2022

TABLE 83 POWER DISTRIBUTION MARKET: OTHERS, SEPTEMBER 2021– APRIL 2022

12 COMPANY PROFILES (Page No. - 141)

12.1 KEY PLAYERS

(Business Overview, Products, Recent Developments, MnM View)*

12.1.1 SCHNEIDER ELECTRIC

TABLE 84 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 40 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT (2021)

TABLE 85 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

TABLE 86 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

TABLE 87 SCHNEIDER ELECTRIC: EXPANSIONS

12.1.2 LEGRAND

TABLE 88 LEGRAND: BUSINESS OVERVIEW

FIGURE 41 LEGRAND: COMPANY SNAPSHOT (2021)

TABLE 89 LEGRAND: PRODUCTS OFFERED

12.1.3 EATON

TABLE 90 EATON: BUSINESS OVERVIEW

FIGURE 42 EATON: COMPANY SNAPSHOT (2021)

TABLE 91 EATON: PRODUCTS OFFERED

TABLE 92 EATON: PRODUCT LAUNCHES

TABLE 93 EATON: DEALS

12.1.4 CISCO SYSTEMS

TABLE 94 CISCO SYSTEMS: BUSINESS OVERVIEW

FIGURE 43 CISCO SYSTEMS: COMPANY SNAPSHOT (2021)

TABLE 95 CISCO SYSTEMS: PRODUCTS OFFERED

TABLE 96 CISCO SYSTEMS: PRODUCT LAUNCHES

TABLE 97 CISCO SYSTEMS: DEALS

12.1.5 ABB

TABLE 98 ABB: BUSINESS OVERVIEW

FIGURE 44 ABB: COMPANY SNAPSHOT (2021)

TABLE 99 ABB: PRODUCTS OFFERED

12.1.6 VERTIV

TABLE 100 VERTIV: BUSINESS OVERVIEW

TABLE 101 VERTIV: PRODUCTS OFFERED

12.1.7 NVENT

TABLE 102 NVENT: BUSINESS OVERVIEW

FIGURE 45 NVENT: COMPANY SNAPSHOT (2021)

TABLE 103 NVENT: PRODUCTS OFFERED

TABLE 104 NVENT: PRODUCT LAUNCHES

TABLE 105 NVENT: DEALS

TABLE 106 NVENT: EXPANSIONS

12.1.8 PANDUIT

TABLE 107 PANDUIT: BUSINESS OVERVIEW

TABLE 108 PANDUIT: PRODUCTS OFFERED

TABLE 109 PANDUIT: PRODUCT LAUNCHES

TABLE 110 PANDUIT: DEALS

12.1.9 ATEN

TABLE 111 ATEN: BUSINESS OVERVIEW

FIGURE 46 ATEN: COMPANY SNAPSHOT (2020)

TABLE 112 ATEN: PRODUCTS OFFERED

TABLE 113 ATEN: PRODUCT LAUNCHES

TABLE 114 ATEN: DEALS

12.1.10 DELTA ELECTRONICS

TABLE 115 DELTA ELECTRONICS: COMPANY OVERVIEW

FIGURE 47 DELTA ELECTRONICS: COMPANY SNAPSHOT (2020)

TABLE 116 DELTA ELECTRONICS: PRODUCTS OFFERED

TABLE 117 DELTA ELECTRONICS: DEALS

12.1.11 HEWLETT PACKARD ENTERPRISE

TABLE 118 HEWLETT PACKARD ENTERPRISE: COMPANY OVERVIEW

FIGURE 48 HEWLETT PACKARD ENTERPRISE: COMPANY SNAPSHOT (2021)

TABLE 119 HEWLETT PACKARD ENTERPRISE: PRODUCTS OFFERED

TABLE 120 HEWLETT PACKARD ENTERPRISE: PRODUCT LAUNCHES

TABLE 121 HEWLETT PACKARD ENTERPRISE: DEALS

TABLE 122 HEWLETT PACKARD ENTERPRISE: EXPANSIONS

12.1.12 SOCOMEC

TABLE 123 SOCOMEC: COMPANY OVERVIEW

TABLE 124 SOCOMEC: PRODUCTS OFFERED

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 189)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

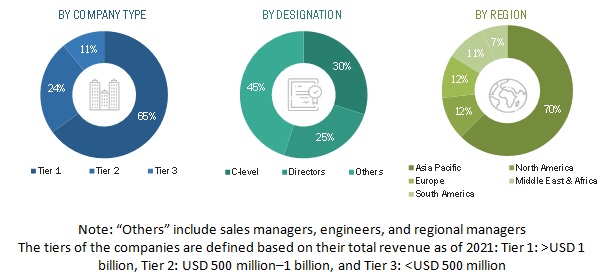

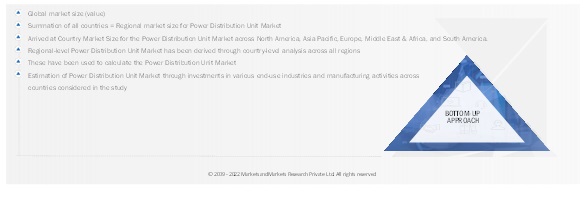

This study involved major activities in estimating the current size of the power distribution unit market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved was validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global power distribution unit market. The other secondary sources comprised press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

Primary Research

The power distribution unit market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by industrial end-users. Moreover, the demand is also fueled by the growing demand of Telecom & IT sector. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the power distribution unit market.

- In this approach, the power distribution unit production statistics for each product type have been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of power distribution units.

- Several primary interviews have been conducted with key opinion leaders related to power distribution unit system development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Power Distribution Market Size: Bottom-Up Approach

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the market ecosystem.

Report Objectives

- To define, describe, and forecast the size of the power distribution unit market by type, by phase, by power rating, by end user, and region, in terms of value for power output segment

- To estimate and forecast the global pdu market for various segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), South America, Middle East & Africa, in terms of value

- To provide comprehensive information about the drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

- To provide a detailed overview of the power distribution unit value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the market size in terms of value.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Power Distribution Unit Market

Who are the top vendors in the Power Distribution Unit Market? What is the competitive scenario among them?