Voice Recognition System Market for Automotive by Technology (Embedded and Hybrid), Application (AI and Non-AI), End-User (Eco, Mid, and Luxury), Fuel Type (ICE and BEV), Level of Autonomous Driving, and Region - Global Forecast to 2025

The voice recognition system market for automotive was valued at USD 876.1 Million in 2016 and is projected to reach USD 3,890.3 Million by 2025, at a CAGR of 19.41% during the forecast period. The base year for the study is 2016 and the forecast period is 2017–2025. The market for automotive is primarily driven by the factors such as extended use of smartphones environment in cars, integration of technology to support centralized function, and rise in the level of autonomous driving and the trend of connected vehicles.

Objectives of the Report

- To define, describe, and project the voice recognition system market for automotive (2017–2025), in terms of volume (‘000 units) and value (USD million)

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market for automotive

- To analyze and forecast the market for automotive and estimate the market size, by volume and value, on the basis of application (by Value), technology (by volume), fuel type, end-user, level of autonomous driving, and region

- To forecast the market size, by volume and value, of the market for automotive with respect to four regions, namely, Asia Pacific, Europe, North America, and the Rest of the World (RoW)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and expansions in the market

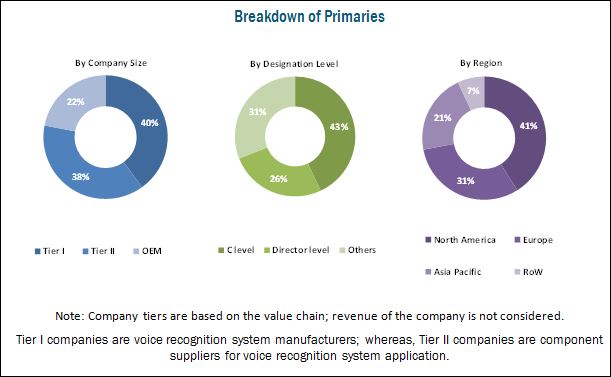

The research methodology used in the report involves primary and secondary sources and follows bottom-up and top-down approaches for the purpose of data triangulation. The study involves country-level OEMs and model-wise analysis of automotive voice recognition system. This analysis involves historical trends as well as existing reach of the voice recognition systems for automotive by country as well as by level of autonomous driving. The analysis is based on various factors such as growth trends in vehicle production and regulations or mandates on the implementation of automotive electronics, which drive the voice recognition system market for automotive. The analysis has been discussed with and validated by primary respondents, including experts from the market for automotive, automotive experts, manufacturers, and suppliers. Secondary sources include associations such as International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), and paid databases and directories such as Factiva and Bloomberg.

The figure below illustrates the break-up of the profile of industry experts who participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the voice recognition system market for automotive consists of voice recognition system manufacturers such as Nuance (US), Microsoft (US), Alphabet (US), Harman (US), and Apple (US). The voice recognition systems are supplied to automotive OEMs such as BMW (Germany), Daimler (Germany), and Ford (US).

Target Audience

- Automotive voice recognition system manufacturers and component suppliers

- Automotive voice recognition system manufacturers and software suppliers

- Automotive OEMs

- Industry associations and other driver assistance systems manufacturers

- Automobile industry and related end-user industries

Scope of the Report

Market, by Technology (Volume only)

- Embedded

- Hybrid

Market, by Application (Value only)

- AI

- Non-AI

Market, by Fuel Type

- BEV

- ICE

- Others (Hybrid)

Market, by End User

- Economy Vehicles

- Mid-Priced Vehicles

- Luxury Vehicles

Market, by Region

- Asia Pacific (China, Japan, India, South Korea, and Rest of Asia Pacific)

- Europe (France, Germany, Italy, Spain, the UK, and Rest of Europe)

- North America (Canada, Mexico, and the US)

- Rest of the World (Brazil, Russia, and South Africa)

Market, by Level of Autonomous Driving

- Autonomous

- Conventional

- Semi-Autonomous

Available Customizations

- Country-level analysis of market for automotive, by End-User

- Company Information

- Detailed analysis and profiling of additional market players (up to 3)

The voice recognition system market for automotive is estimated to be USD 941.0 Million in 2017 and is projected to reach USD 3,890.3 Million by 2025, at a CAGR of 19.41% from 2017 to 2025. The key growth drivers for the market are the rising trend of autonomous vehicles, integration of several electronics functions in central console of the car by OEMs, and growing demand for connected vehicles.

The non-AI-based segment is estimated to hold the largest market share in 2017. However, the AI-based voice recognition system is estimated to be the fastest growing market during the forecast period and is anticipated to grow at a rapid pace due to technological advancements. In addition, the technology-driven companies are using the AI-based voice recognition system as a tool for developing advanced infotainment features for autonomous and semi-autonomous vehicles.

The luxury vehicle segment is estimated to hold the largest market share, by volume and value, for market during the forecast period. However, the economy vehicle segment is estimated to be the fastest growing market because of the rise in demand for comfort and convenience features and integration of technology to support centralized functions in the vehicles.

By the level of autonomous driving, semi-autonomous vehicle segment is estimated to be the fastest growing segment of the market during the forecast period. The consistent advancement in the infotainment features and growing automation in driving functions are the major factors driving the growth of semi-autonomous vehicle segment. However, the conventional segment is estimated to be the largest segment of the market during the forecast period.

The market for battery electric vehicles (BEV) is estimated to be the fastest growing market in the fuel type segment. This growth is due to the increased production of electric vehicles. The largest market in the segment is the internal combustion engine (ICE) vehicles, and it is expected to remain an attractive market in the near future due to its production and sales.

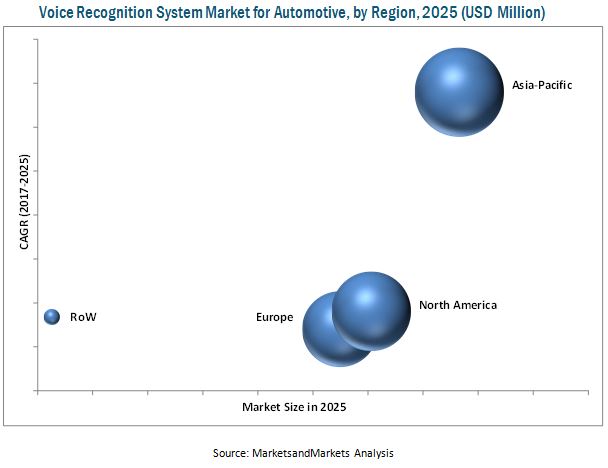

The Asia Pacific region is projected to be largest market for voice recognition system for automotive in 2025. Rise in the production rate of automobiles and significant adoption of advances technologies in automotive electronics are the market drivers in this region. Being the largest market of passenger vehicles, North American voice recognition market is estimated to be the largest in 2017. The rapid growth of semi-autonomous and autonomous vehicles coupled with rise in consumer demand for convenience features in mid-variant cars are the factors putting North America region at leading position in 2017.

The key factor restraining the growth of voice recognition system market for automotive is the high cost of high-end voice recognition system. However, the cost of the voice recognition system is likely to decrease in the coming years because of higher adoption rate by vehicle manufacturers to equip passenger cars with voice recognition system. Also, the number of suppliers for automakers has risen in the recent past. Cost is not the parameter considered in premium segment cars, but it may substantially affect the economy and mid-segment vehicles. The market is dominated by a few global players and comprises several regional players. Some of the key manufacturers operating in the market are Nuance (US), Microsoft (US), Alphabet (US), Apple (US), and Harman (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Voice Recognition System Market for Automotive Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Data Triangulation

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand-Side Analysis

2.5.2.1 Growth in Luxury Vehicle Sales

2.5.2.2 Increase in Demand for HEV & PHEV Vehicles

2.5.3 Supply-Side Analysis

2.5.3.1 OEMS Focus on Safety, Convenience, and Comfort Systems in Vehicles

2.5.3.2 Technological Advancements in Vehicle Safety and Security

2.6 Voice Recognition System Market for Automotive Size Estimation

2.7 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in the Market

4.2 Voice Recognition System Market for Automotive Share, By Country

4.3 Market, By Application

4.4 Market, By Fuel Type

4.5 Market, By End-User

4.6 Market, By Technology

4.7 Market, By Level of Autonomous Driving

4.8 Market, By Region

5 Voice Recognition System Market for Automotive Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Extended Use of Smartphone Environment in Cars

5.2.1.2 Rise in Trend of Connected Vehicles and Level of Autonomous Driving

5.2.1.3 Integration of Technology to Support Centralized Function

5.2.2 Restraints

5.2.2.1 High Cost of High-End Voice Recognition System

5.2.2.2 Oligopoly in the Development of Voice Recognition Technology Using Neural Network Restricting Its Usage for Cloud-Based Services

5.2.3 Opportunities

5.2.3.1 Voice Recognition System Can Extend to Integrated Personal Assistant System

5.2.3.2 Advent of Concept Cars and Electric Vehicles in the Auto Industry

5.2.3.3 High Growth Potential in Emerging Markets

5.2.3.4 New Prospect for Data-Driven Services

5.2.4 Challenges

5.2.4.1 Data Security Concerns

5.2.4.2 Designing A User-Friendly System to Mitigate the Driver Distraction Factor

5.2.4.3 Language and Vernacular Translation Issues

5.3 Macro Indicator Analysis

5.3.1 Introduction

5.3.1.1 Premium Segment Luxury Passenger Cars

5.3.1.2 GDP (USD Billion)

5.3.1.3 GNP Per Capita, Atlas Method (USD)

5.3.1.4 GDP Per Capita PPP (USD)

5.3.2 Macro Indicators Influencing the Market for Top 3 Countries

5.3.2.1 US

5.3.2.2 Germany

5.3.2.3 Japan

6 Technological Overview (Page No. - 53)

6.1 Introduction

6.2 Timeline: Automotive Voice Recognition System

6.3 Architecture: Voice Recognition System

6.4 Technology Outlook

7 Voice Recognition System Market for Automotive, By Application (Page No. - 58)

7.1 Introduction

7.2 Artificial Intelligence

7.3 Non-Artificial Intelligence

8 Voice Recognition System Market for Automotive, By Technology (Page No. - 63)

8.1 Introduction

8.2 Embedded

8.3 Hybrid

9 Voice Recognition System Market for Automotive, By End-User (Page No. - 68)

9.1 Introduction

9.2 Economy Vehicles

9.3 Mid-Price Vehicles

9.4 Luxury Vehicles

10 Voice Recognition System Market for Automotive, By Fuel Type (Page No. - 74)

10.1 Introduction

10.2 Battery Electric Vehicle (BEV)

10.3 Internal Combustion Engine (ICE)

10.4 Others (Hybrid Vehicles)

11 Voice Recognition System Market for Automotive, By Region (Page No. - 81)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.2.5 Rest of Asia Pacific

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Italy

11.3.4 UK

11.3.5 Spain

11.3.6 Rest of Europe

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 Rest of the World

11.5.1 Brazil

11.5.2 Russia

11.5.3 South Africa

12 Competitive Landscape (Page No. - 114)

12.1 Overview

12.2 Voice Recognition System Market for Automotive Ranking Analysis

12.3 Competitive Scenario

12.3.1 New Product Developments

12.3.2 Mergers & Acquisitions

12.3.3 Partnerships/Supply Contracts/Collaborations/Joint Ventures/License Agreements

13 Company Profiles (Page No. - 119)

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

13.1 Nuance

13.2 Microsoft

13.3 Alphabet

13.4 Harman

13.5 Apple

13.6 Sensory

13.7 Voicebox

13.8 Inago

13.9 Lumenvox

13.10 Vocalzoom

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 140)

14.1 Key Insights By Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.5.1 Country Level Analysis of Voice Recognition System Market for Automotive, By End-User

14.5.2 Company Information

14.5.2.1 Profiling of Additional Market Players (Up to 3)

14.6 Related Reports

14.7 Author Details

List of Tables (86 Tables)

Table 1 Currency Exchange Rates (Per USD)

Table 2 Automotive Application Features Related to Safety, Comfort, & Assistance

Table 3 Advantages and Limitations of Smartphone Environment in the Vehicle

Table 4 Autonomous Driving Attempts Among Vehicle Manufacturers

Table 5 User and Vehicle Data

Table 6 Factors Overcome By Voice Recognition System

Table 7 Interference Sources in Voice Recognition System

Table 8 Voice Recognition System Market for Automotive Size, By Application, 2016–2025 (USD Million)

Table 9 AI: Market Size, By Region, 2016–2025 (USD Million)

Table 10 Non-AI: Market Size, By Region, 2016–2025 (USD Million)

Table 11 Market Size, By Technology, 2016–2025 (’000 Units)

Table 12 Embedded: Market, By Region, 2016–2025 (’000 Units)

Table 13 Hybrid: Market, By Region, 2016–2025 (’000 Units)

Table 14 Market Size, By End-User, 2016–2025 (’000 Units)

Table 15 Market Size, By End-User, 2016–2025 (USD Million)

Table 16 Economy Vehicles: Market Size, By Region, 2016–2025 (’000 Units)

Table 17 Economy Vehicles: Market Size, By Region, 2016–2025 (USD Million)

Table 18 Mid-Priced Vehicles: Market Size, By Region, 2016–2025 (’000 Units)

Table 19 Mid-Priced Vehicles: Market Size, By Region, 2016–2025 (USD Million)

Table 20 Luxury Vehicles: Market Size, By Region, 2016–2025 (’000 Units)

Table 21 Luxury Vehicles: Market Size, By Region, 2016–2025 (USD Million)

Table 22 Market, By Fuel Type, 2016–2025 (‘000 Units)

Table 23 Market, By Fuel Type, 2016–2025 (USD Million)

Table 24 BEV: Market, By Region, 2016–2025 (‘000 Units)

Table 25 BEV: Market, By Region, 2016–2025 (USD Million)

Table 26 ICE: Market, By Region, 2016–2025 (‘000 Units)

Table 27 ICE: Market, By Region, 2016–2025 (USD Million)

Table 28 Others: Market, By Region, 2016–2025 (‘000 Units)

Table 29 Others: Market, By Region, 2016–2025 (USD Million)

Table 30 Voice Recognition System Market for Automotive, By Region, 2016–2025 (’000 Units)

Table 31 Market, By Region, 2016–2025 (USD Million)

Table 32 Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 33 Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 34 Asia Pacific: Market, By Country, 2016–2025 (’000 Units)

Table 35 Asia Pacific: Market, By Country, 2016–2025 (USD Million)

Table 36 Asia Pacific: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 37 Asia Pacific: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 38 China: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 39 China: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 40 India: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 41 India: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 42 Japan: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 43 Japan: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 44 South Korea: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 45 South Korea: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 46 Rest of Asia Pacific: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 47 Rest of Asia Pacific: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 48 Europe: Market , By Country, 2016–2025 (’000 Units)

Table 49 Europe: , Market By Country, 2016–2025 (USD Million)

Table 50 Europe: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 51 Europe: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 52 France: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 53 France: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 54 Germany: Market , By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 55 Germany: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 56 Italy: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 57 Italy: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 58 UK: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 59 UK: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 60 Spain: Market for Automotive Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 61 Spain: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 62 Rest of Europe: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 63 Rest of Europe: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 64 North America: Market, By Country, 2016–2025 (’000 Units)

Table 65 North America: Market, By Country, 2016–2025 (USD Million)

Table 66 North America: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 67 North America: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 68 Canada: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 69 Canada: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 70 Mexico: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 71 Mexico: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 72 US: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 73 US: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 74 Rest of the World: Market, By Country, 2016–2025 (’000 Units)

Table 75 Rest of the World: Market, By Country, 2016–2025 (USD Million)

Table 76 Rest of the World: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 77 Rest of the World: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 78 Brazil: Market for Automotive, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 79 Brazil: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 80 Russia: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 81 Russia: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 82 South Africa: Market, By Level of Autonomous Driving, 2016–2025 (’000 Units)

Table 83 South Africa: Market, By Level of Autonomous Driving, 2016–2025 (USD Million)

Table 84 New Product Development, 2016–2017

Table 85 Mergers & Acquisitions, 2016–2017

Table 86 Partnerships/Supply Contracts/Collaborations/Joint Ventures/Agreements, 2016–2017

List of Figures (44 Figures)

Figure 1 Voice Recognition System Market for Automotive: Segmentations Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Global Luxury Vehicle Y-O-Y Sales Growth (2011–2015)

Figure 6 HEV & PHEV Sales Data (2016 vs 2021)

Figure 7 Market, By End-User: Bottom-Up Approach

Figure 8 Market, By Level of Autonomous Driving: Top-Down Approach

Figure 9 Market, By Technology, 2017 vs 2025

Figure 10 Market, By Application, 2017 vs 2025

Figure 11 Market, By End-User, 2017 vs 2025

Figure 12 Market, By Level of Autonomous Driving, 2017 vs 2025

Figure 13 Market, By Fuel Type, 2017 vs 2025

Figure 14 Market, By Region, 2017 vs 2025

Figure 15 Growing Trend of Connected Vehicles and Increasing Level of Automation to Boost the Growth of the Market From 2017 to 2025

Figure 16 China to Be the Fastest Growing Market for Voice Recognition Systems, By Value, From 2017 to 2025

Figure 17 Artificial Intelligence (AI)-Based Voice Recognition System to Have the Largest Market Size By 2025

Figure 18 ICE Vehicle Segment to Have the Largest Market Size for Voice Recognition Systems, 2017 vs 2025

Figure 19 Luxury Passenger Car Segment to Have the Largest Market Size for Voice Recognition Systems, 2017 vs 2025

Figure 20 Hybrid Voice Recognition System to Hold the Largest Market Share of Voice Recognition Systems, 2017 vs 2025

Figure 21 Conventional Vehicle Segment to Have the Largest Market Share for Voice Recognition Systems, 2017 vs 2025

Figure 22 Asia Pacific to Be the Largest Market for Voice Recognition Systems, 2017 vs 2025

Figure 23 Market: Market Dynamics

Figure 24 US: Rising GNI Per Capita Expected to Drive the Sales of Luxury Vehicles During the Forecast Period

Figure 25 Germany: Rising GDP is Likely to Have High Impact on Premium Car Sales

Figure 26 Japan: Gross National Income is Expected to Play A Crucial Role in Boosting the Automotive Market

Figure 27 Automotive Voice Recognition Market for Automotive: Technology Outlook

Figure 28 Market for Automotive, By Application, 2017 vs 2025 (USD Million)

Figure 29 Market for Automotive, By Technology, 2017 vs 2025 (’000 Units)

Figure 30 Market, By End-User, 2017 vs 2025 (USD Million)

Figure 31 Market for Automotive, By Fuel Type, 2017 vs 2025 ('000 Units)

Figure 32 Market for Automotive, By Region, 2017 vs 2025 (USD Million)

Figure 33 Market for Automotive, By Level of Autonomous Driving, 2017 vs 2025 ('000 Units)

Figure 34 Asia Pacific: Market for Automotive Snapshot

Figure 35 Europe: Market, By Country, 2017 vs 2025 (‘000 Units)

Figure 36 North America: Market for Automotive Snapshot

Figure 37 Rest of the World: Market for Automotive Snapshot

Figure 38 Key Developments By Leading Players in the Automotive Market, 2012–2017

Figure 39 Voice Recognition System Market for Automotive Ranking: 2017

Figure 40 Company Snapshot: Nuance

Figure 41 Company Snapshot: Microsoft

Figure 42 Company Snapshot: Alphabet

Figure 43 Company Snapshot: Harman

Figure 44 Company Snapshot: Apple

Growth opportunities and latent adjacency in Voice Recognition System Market