Variable Speed Generator Market by Type (Permanent Magnet, Doubly Fed Induction, Self-Excitation Induction, Wound Rotor Induction), Prime Mover (Wind, Hydro, Steam & Gas Turbine, Ic Engine), Technology, Power, End-User, Region Global Forecast to 2022

[154 Pages Report] The global variable speed generator market was valued at USD 5.24 Billion in 2016 and is projected to reach USD 8.36 Billion by 2022, at a CAGR of 7.63% during the forecast period. The years considered for the study are as follows:

- Base Year: 2016

- Estimated Year: 2017

- Projected Year: 2022

- Forecast Period: 2017 - 2022

The base year considered for company profiles is 2016. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define and segment the variable speed generator market with respect to generator type, technology type, prime mover, power rating, end user, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contributions to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

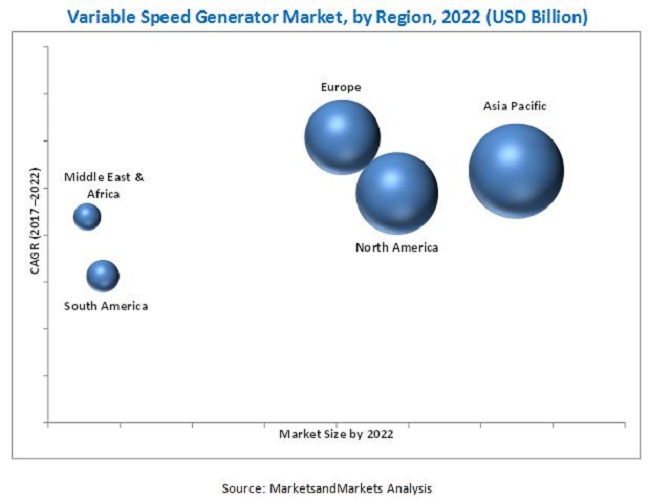

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as new product launches, mergers & acquisitions, expansions and investments, and contracts & agreements in the market

Research Methodology

This research study involved the use of extensive secondary sources, directories, journals on power generation technologies, and other related rental markets; newsletters and databases such as D&B, Bloomberg, Businessweek, and Factiva, among others, to identify and collect information useful for a technical, market-oriented, and commercial study of the global market. The primary sources include several industry experts from the core and related industries, vendors, preferred suppliers, technology developers, alliances, and organizations related to all the segments of this industrys value chain. The research methodology has been explained below.

- Study of annual revenues and market developments of the major players providing variable speed generators

- Assessment of future trends and growth of end users

- Assessment of the market with respect to the prime mover and power rating based on various end users

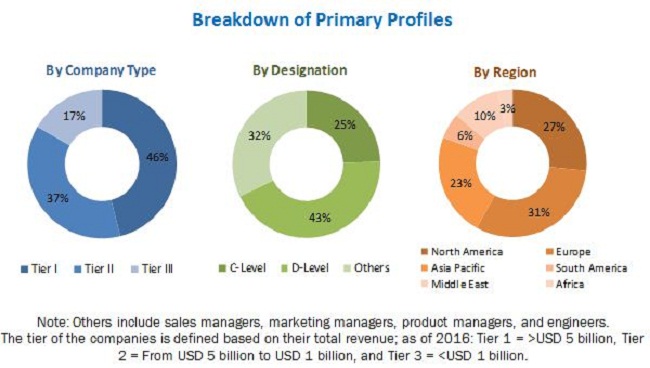

After arriving at the overall market size, the total market was split into several segments and subsegments. The figure given below illustrates the breakdown of primary interviews conducted during the research study based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Major players operating in the variable speed generator market include ABB (Switzerland), GE (US), Siemens (Germany), Wartsila (Finland), Cummins (US), and Rolls Royce (UK).

Target Audience:

- Banks, venture capitalists, financial institutions, and other investors

- Companies related to electric power generation

- Energy associations

- Environment associations

- Energy efficiency consultants

- Government and industry associations

- Government and research organizations

- Manufacturing industry

- Power plant project developers

- State and national regulatory authorities

Scope of the Report:

- By Generator Type

- Variable Speed-Self Excited Induction Generator (SEIG)

- Doubly Fed Induction Generator (DFIG)

- Wound Rotor Induction Generator (WRIG)

- Permanent Magnet Synchronous Generator (PMSG)

- By Technology Type

- Power Electronics Based Variable Speed Generator

- Mechanical Variable Speed Generator

- By Power Rating

- Up To 100 kVA

- 100 kVA1 MVA

- 125 MVA

- Above 25 MVA

- By Prime Mover

- Wind Turbine

- Hydro Turbine

- Steam and Gas Turbine

- Internal Combustion Engine

- By End User

- Renewable Power Generation

- Hydroelectric Power Generation

- Marine and Shipbuilding

- Oil & Gas and Mining

- Commercial and Residential

- Others (Defense, Aerospace, Co-Generation, Telecommunications, and Industrial Standby Generators)

- By Region

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

- More companies can be profiled along with their competitive situation in each region

- Additional country markets for regions such as the Asia Pacific and Europe

- Cross segmentation of markets

The global variable speed generator market is projected to reach USD 8.36 Billion by 2022, growing at a CAGR of 7.63%, from an estimated USD 5.79 Billion in 2017. This growth can be attributed to the increasing emphasis on alternative energy production across the globe, increasing government mandates over energy efficiency, and growing industrialization and urbanization.

On the basis of end user, the market is segmented into renewable power generation, hydroelectric power generation, marine and shipbuilding, oil & gas and mining, commercial and residential, defense, aerospace, co-generation, telecommunications, and industrial standby power. The commercial and residential segment is expected to grow at the highest CAGR during the forecast period. This segment is primarily driven by the growing demand for efficient variable speed standby gensets for commercial and residential applications in Europe, Asia Pacific, and North America.

The global variable speed generator market, by prime mover, is segmented into wind turbine, hydro turbine, gas and steam turbine, and internal combustion (IC) engine. The IC engine segment is expected to grow at the highest CAGR during the forecast period. The increasing implementation of variable speed generators for aerospace and marine applications is expected to drive the market.

The global market, by power rating, is segmented 100 kVA, 100 kVA1 MVA, 1 MVA25 MVA, and above 25 MVA. The 1 MVA25 MVA segment is expected to grow at the highest CAGR from 2017 to 2022. The increasing capacity addition in offshore wind projects and commercialization of high power rated permanent magnet synchronous generators will create new revenue pockets for this segment.

In this report, the global variable speed generator market has been analyzed with respect to five regions, namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific is estimated to grow at the highest CAGR during the forecast period. Factors such as increased power consumption; government mandates on energy efficiency; rising influx of renewable sources in the energy mix; and renovation, modernization, and upgradation of aging hydropower plants are to drive the global market in the region.

High capital investment and limited re-investment could act as restraints for the market. The leading players in the variable speed generator market include ABB (Switzerland), GE (US), Siemens (Germany), Wartsila (Finland), Cummins (US), and Rolls Royce (UK). Contracts & agreements was the most commonly adopted strategy by the top players. This was followed by new product launches, expansions and investments, and mergers & acquisitions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Limitations

2.5 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the global Variable Speed Generator Market

4.2 Asia Pacific Market Size, By Plant Type & By Country

4.3 Market, By Country

4.4 Market, By Power Rating

4.5 Market, By Generator

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Share of Renewable Power Generation and Increasing Government Mandates

5.2.1.2 Rising Need for Energy Efficiency

5.2.1.3 Increasing Urbanization and Industrialization

5.2.2 Restraints

5.2.2.1 Reluctance to Spend on Distributed Generation

5.2.3 Opportunities

5.2.3.1 Robust Growth in Hvac Systems

5.2.3.2 Renovation, Modernization and Uprating of Outdated Power Infrastructure

5.2.3.3 Applications in Hybrid Energy Systems

5.2.4 Challenges

5.2.4.1 Decreasing Greenfield Investments in Mining and Oil & Gas Industry

6 Market, By Generator Type (Page No. - 43)

6.1 Introduction

6.2 Variable Speed Self Excited Induction Generator (Seig)

6.3 Doubly Fed Induction Generator (Dfig)

6.4 Wound Rotor Induction Generator (Wrig)

6.5 Permanent Magnet Synchronous Generator (Pmsg)

7 Market, By Technology Type (Page No. - 48)

7.1 Introduction

7.2 Power Electronics-Based Variable Speed Generators

7.3 Mechanical Variable Speed Generators

8 Market, By Power Rating (Page No. - 52)

8.1 Introduction

8.2 Up to 100 Kva

8.3 100 Kva1 Mva

8.4 125 Mva

8.5 Above 25 Mva

9 Market, By Prime Mover (Page No. - 57)

9.1 Introduction

9.2 Hydro Turbines

9.3 Wind Turbines

9.4 Steam & Gas Turbines

9.5 Internal Combustion Engines

10 Market, By End-User (Page No. - 63)

10.1 Introduction

10.2 Renewable Power Generation

10.3 Hydroelectric Power Generation

10.4 Marine & Shipbuilding

10.5 Oil, Gas, & Mining

10.6 Commercial & Residential

10.7 Others

11 Market, By Region (Page No. - 71)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.2.3 Mexico

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 South Korea

11.3.5 Australia

11.3.6 Rest of Asia Pacific

11.4 Europe

11.4.1 Germany

11.4.2 UK

11.4.3 France

11.4.4 Spain

11.4.5 Sweden

11.4.6 Norway

11.4.7 Russia

11.4.8 Rest of Europe

11.5 South America

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Chile

11.5.4 Rest of South America

11.6 Middle East & Africa

11.6.1 Saudi Arabia

11.6.2 UAE

11.6.3 South Africa

11.6.4 Rest of the Middle East & Africa

12 Competitive Landscape (Page No. - 107)

12.1 Overview

12.2 Ranking of Players & Industry Concentration, 2016

12.3 Competitive Scenario

12.3.1 Contracts & Agreements

12.3.2 New Product Launches

12.3.3 Mergers & Acquisitions

12.3.4 Partnerships

13 Company Profiles (Page No. - 113)

13.1 Benchmarking

13.2 ABB

13.3 Siemens

13.4 Yanmar

13.5 GE

13.6 Whisperpower

13.7 Rolls Royce

13.8 Wartsila

13.9 Innovus Power

13.10 Cummins

13.11 Ausonia

13.12 Generac

13.13 Atlas Copco

13.14 Fischer Panda

14 Appendix (Page No. - 146)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (69 Tables)

Table 1 Variable Speed Generator Market Snapshot

Table 2 Comparison Between Constant Speed Generators & Variable Speed Generators

Table 3 Global Weighted Average Renewable Investment Costs, 2015 & 2025

Table 4 Urban Population, Proportion Urban, & Average Annual Rate of Change of the Proportion Urban, By Region, 1990, 2014, 2050

Table 5 Global Variable Speed Generator Market Size, By Generator Type, 20152022 (USD Million)

Table 6 Seig: Variable Speed Generator Market Size, By Region, 20152022 (USD Million)

Table 7 Dfig: Market Size, By Region, 20152022 (USD Million)

Table 8 Wrig: Market Size, By Region, 20152022 (USD Million)

Table 9 Pmsg: Market Size, By Region, 20152022 (USD Million)

Table 10 Market Size, By Generator Type, 20152022 (USD Billion)

Table 11 Power Electronics-Based Variable Speed Generators Market Size, By Region, 20152022 (USD Million)

Table 12 Mechanical Variable Speed Generators Market Size, By Region, 20152022 (USD Million)

Table 13 Variable Speed Generator Market Size, By Power Rating, 20152022 (USD Billion)

Table 14 Up to 100 Kva: Market Size, By Region, 20152022 (USD Million)

Table 15 100 Kva1 Mva: Market Size, By Region, 20152022 (USD Million)

Table 16 125 Mva: Market Size, By Region, 20152022 (USD Million)

Table 17 Above 25 Mva: Market Size, By Region, 20152022 (USD Million)

Table 18 Market Size, By Prime Mover, 20152022 (USD Million)

Table 19 Hydro Turbines: Market Size, By Region, 20152022 (USD Million)

Table 20 Wind Turbines: Market Size, By Region, 20152022 (USD Million)

Table 21 Steam & Gas Turbines: Variable Speed Generator Market Size, By Region, 20152022 (USD Million)

Table 22 Internal Combustion Engines: Variable Speed Generator Market Size, By Region, 20152022 (USD Million)

Table 23 Internal Combustion Engines: Variable Speed Generator Market Size, By Power Rating, 20152022 (USD Million)

Table 24 Internal Combustion Engines: Market Size, By End-User, 20152022 (USD Million)

Table 25 Market Size, By End-User, 20152022 (USD Million)

Table 26 Renewable Power Generation: Market Size, By Region, 20152022 (USD Million)

Table 27 Hydroelectric Power Generation: Variable Speed Generator Market Size, By Region, 20152022 (USD Million)

Table 28 Marine & Shipbuilding: Market Size, By Region, 20152022 (USD Million)

Table 29 Oil, Gas, & Mining: Market Size, By Region, 20152022 (USD Million)

Table 30 Commercial & Residential: Variable Speed Generator Market Size, By Region, 20152022 (USD Million)

Table 31 Others: Market Size, By Region, 20152022 (USD Million)

Table 32 Market Size, By Region, 20152022 (USD Million)

Table 33 North America: Market Size, By Country, 20152022 (USD Million)

Table 34 North America: Internal Combustion Engine-Based Market Size, By Country, 20152022 (USD Million)

Table 35 North America: Internal Combustion Engine-Based Market Size, By End-User, 20152022 (USD Million)

Table 36 US: Market Size, By End-User, 20152022 (USD Million)

Table 37 Canada: Variable Speed Generator Market Size, By End-User, 20152022 (USD Million)

Table 38 Mexico: Market Size, By End User, 20152022 (USD Million)

Table 39 Asia Pacific: Variable Speed Generator Market Size, By Country, 20152022 (USD Million)

Table 40 Asia Pacific: Internal Combustion Engine-Based Market Size, By Country, 20152022 (USD Million)

Table 41 Asia Pacific: Internal Combustion Engine-Based Market Size, By End-User, 20152022 (USD Million)

Table 42 China: Market Size, By End-User, 20152022 (USD Million)

Table 43 Japan: Market Size, By End-User, 20152022 (USD Million)

Table 44 India: Market Size, By End-User, 20152022 (USD Million)

Table 45 South Korea: Variable Speed Generator Market Size, By End-User, 20152022 (USD Million)

Table 46 Australia: Market Size, By End-User, 20152022 (USD Million)

Table 47 Rest of Asia Pacific: Market Size, By End-User, 20152022 (USD Million)

Table 48 Europe: Market Size, By Country, 20152022 (USD Million)

Table 49 Europe: Internal Combustion Engine-Based Variable Speed Generator Market Size, By Country, 20152022 (USD Million)

Table 50 Europe: Internal Combustion Engine-Based Market Size, By End-User, 20152022 (USD Million)

Table 51 Germany: Variable Speed Generator Market Size, By End-User, 20152022 (USD Million)

Table 52 UK: Market Size, By End-User, 20152022 (USD Million)

Table 53 France: Market Size, By End-User, 20152022 (USD Million)

Table 54 Spain: Market Size, By End-User, 20152022 (USD Million)

Table 55 Sweden: Market Size, By End-User, 20152022 (USD Million)

Table 56 Norway: Market Size, By End-User, 20152022 (USD Million)

Table 57 Russia: Market Size, By End-User, 20152022 (USD Million)

Table 58 Rest of Europe: Variable Speed Generator Market Size, By End-User, 20152022 (USD Million)

Table 59 South America: Market Size, By Country, 20152022 (USD Million)

Table 60 Brazil: Market Size, By End-User, 20152022 (USD Million)

Table 61 Argentina: Market Size, By End-User, 20152022 (USD Million)

Table 62 Chile: Market Size, By End-User, 20152022 (USD Million)

Table 63 Rest of South America: Variable Speed Generator Market Size, By End-User, 20152022 (USD Million)

Table 64 Middle East & Africa: Market Size, By Country, 20152022 (USD Million)

Table 65 Saudi Arabia: Market Size, By End-User, 20152022 (USD Million)

Table 66 UAE: Market Size, By End-User, 20152022 (USD Million)

Table 67 South Africa: Market Size, By End-User, 20152022 (USD Million)

Table 68 Rest of the Middle East & Africa: Market Size, By End-User, 20152022 (USD Million)

Table 69 Variable Speed Generator Market Developments Between 2014 & 2017

List of Figures (36 Figures)

Figure 1 Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Asia Pacific is Estimated to Hold the Largest Share of the Market in 2017

Figure 5 THE Renewable Power Generation Segment is Expected to Dominate the Market During the Forecast Period

Figure 6 THE Internal Combustion Engine Segment is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 7 THE 100 Kva1mva Segment is Expected to Dominate the Variable Speed Generator Market During the Forecast Period

Figure 8 THE Permanent Magnet Synchronous Generator is Expected to Dominate the Market During the Forecast Period

Figure 9 THE Power Electronics-Based Variable Speed Generator is Expected to Dominate the Market During the Forecast Period

Figure 10 Rise in Alternative Energy Programs is Expected to Drive the Market During the Forecast Period

Figure 11 THE Renewable Power Generation Segment & the Chinese Variable Speed Generator Market Held the Maximum Share of the Market in Asia 32

Figure 12 THE US Held the Largest Share in 2016

Figure 13 THE 100 Kva1 Mva Segment is Expected to Have the Largest Market Share By 2022

Figure 14 THE Permanent Magnet Synchronous Generator is Expected to Lead the Market During THE Forecast Period

Figure 15 Variable Speed Generators: Drivers, Restraints, Opportunities, & Challenges

Figure 16 Residential & Commercial Buildings Total Energy End-Use (2015)

Figure 17 The Permanent Magnet Synchronous Generators Segment is Expected to Hold the Largest Market Share By 2022

Figure 18 THE Power Electronics-Based Variable Speed Generators Segment is Expected to Hold the Largest Market Share By 2022

Figure 19 THE 100 Kva1 Mva Variable Speed Generator Segment is Expected to Hold the Largest Market Share By 2022

Figure 20 THE Wind Turbines Segment is Expected to Hold the Largest Market Share By 2022

Figure 21 Renewable Power Generation is Expected to Hold the Largest Market Share By 2022

Figure 22 Regional Snapshot: the Market in Europe is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 23 Market Share, By Region, 2016

Figure 24 Asia Pacific: Variable Speed Generator Market Snapshot

Figure 25 Europe: Market Snapshot

Figure 26 Key Developments in the Market, 20142017

Figure 27 General Electric Led the Market in 2016

Figure 28 ABB: Company Snapshot

Figure 29 Siemens: Company Snapshot

Figure 30 Yanmar: Company Snapshot

Figure 31 GE: Company Snapshot

Figure 32 Rolls Royce: Company Snapshot

Figure 33 Wartsila: Company Snapshot

Figure 34 Cummins: Company Snapshot

Figure 35 Generac: Company Snapshot

Figure 36 Atlas Copco: Company Snapshot

Growth opportunities and latent adjacency in Variable Speed Generator Market