US Therapeutic Plasma Exchange Market by Product (Devices, Consumables), Technology (Centrifugation, Membrane Separation), Procedures & Patients (Guillain Syndrome, Multiple Sclerosis, Cryoglobulinemia), End Users & Region - Forecast to 2025

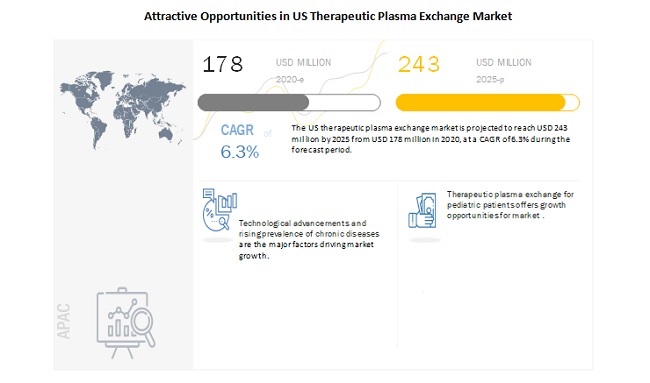

The US therapeutic plasma exchange (TPE) market, valued at $178 million in 2020, is projected to grow to $243 million by 2025, with a CAGR of 6.3%. Growth is fueled by increasing chronic disease prevalence and technological advancements, especially in continuous-flow centrifugation. However, high device costs and a shortage of skilled professionals may hinder growth. The consumables segment is expected to see the highest growth, with neurological disorders being a major driver. Key players include Terumo BCT, Fresenius, and Haemonetics.

To know about the assumptions considered for the study, Request for Free Sample Report

US Therapeutic Plasma Exchange Market Dynamics

Driver: Technological advancement

Continuous-flow centrifugation technology is a high-precision approach that has been refined over the past decade. It brings innovations in patient comfort and more efficient processing of blood and plasma products. This technique requires minimal blood flow compared with other technologies, such as membrane separation approaches. It is an improved technology that allows easy access to blood through the patient’s peripheral veins (antecubital or brachial), as compared with other membrane-based apheresis devices that mostly require invasive central venous catheterization. These technical innovations also result in better patient comfort and safety during the TPE procedure (than was previously possible) and more accurate fluid balance control for better hemodynamic stability during treatment.

Restraint: High cost of devices

The cost of apheresis devices is a critical factor in determining the adoption of plasma exchange by healthcare providers and, ultimately, by patients. Apheresis devices are used by blood banks for blood component collection, while hospitals use these devices for therapeutic plasma exchange procedures. The high cost of apheresis devices and disposables also increases the overall cost of apheresis procedures. For instance, in the US, the cost of an apheresis procedure is ~USD 2,500 per treatment. Patients might not opt for these procedures owing to their high cost.

Opportunity: Therapeutic plasma exchange for pediatric patients

The growing adoption of therapeutic plasma exchange for the treatment of various diseases is expected to offer potential growth opportunities to market players in the coming years. Therapeutic plasma exchange (TPE) is used in the treatment of neurological, hematological, renal, and autoimmune diseases with known or suspected immune pathogenesis. The use of therapeutic plasma exchange procedures in pediatric patients is very low. This therapeutic modality presents several technical challenges in children but is increasingly being used in pediatric nephrology. Owing to advances in technology, TPE procedures are carried out in pediatric patients for renal diseases.

Challenge: Dearth of skilled professionals

Therapeutic plasma exchange procedures require skilled professionals and apheresis nurse specialists, as most of these procedures are performed using apheresis systems. However, globally, there is a shortage of these physicians and surgeons. As the demand for TPA has increased, so has the need for apheresis nurses with their expertise in clinical patient care, transfusion medicine, and technology. Apheresis nurses provide care to a diversified population ranging from healthy donors to acute or chronically ill patients while adhering to strict, ever-changing regulatory issues. During an apheresis procedure, the nurse manages the donor/patient’s clinical status, the venous access, the infusion of blood components or specialized fluids, and the apheresis device. Additional responsibilities include donor/patient/family/public education.

Consumables segment to witness the highest growth during the forecast period

Based on products, the US therapeutic plasma exchange market has been segmented into devices and consumables. The consumables segment witness the highest growth during the forecast period. The fastest growth of this segment can be attributed to the recurrent use of these products, the increasing number of therapeutic plasma exchange procedures, and favorable reimbursement policies for TPE procedures.

The centrifugation segment is expected to account for the largest share of the US therapeutic plasma exchange market in 2019

On the basis of technology, the US therapeutic plasma exchange market has been segmented into centrifugation and membrane separation. In 2019, the centrifugation technology segment accounted for

the largest share of the US therapeutic plasma exchange market. The large share of this segment can be attributed to the advantages offered by centrifugation over membrane separation, such as high efficiency and its ability to separate all types of blood components.

Neurological segment to witness the highest growth during the forecast period

On the basis of indication, the US therapeutic plasma exchange market has been segmented into neurological disorders, renal disorders, hematologic disorders, metabolic disorders, and other indications.

In 2019, the neurological disorders segment accounted for the largest share of the US therapeutic plasma exchange market. Growth in this market is majorly driven by the rising prevalence and incidence of neurological diseases in the geriatric population, increasing awareness about the treatment of neurological diseases using plasma exchange, and rising investments by key players for R&D on the new application areas of therapeutic plasma exchange in the treatment of neurological disorders.

The blood collection centers and blood component providers segment is expected to account for the largest share of the US therapeutic plasma exchange market in 2019

On the basis of end users, the US therapeutic plasma exchange market has been segmented into blood

collection centers and blood component providers, hospitals and transfusion centers, and other end users. In 2019, the blood collection centers and blood component providers segment accounted for the largest share of the US therapeutic plasma exchange market. The large share of this end-user segment is mainly attributed to the rising number of blood component donations, the growing number of blood centers, and the increasing number of therapeutic plasma exchange procedures and plasma donations due to COVID-19.

Key players in the US therapeutic plasma exchange market

The prominent players in the US therapeutic plasma exchange market Terumo BCT, Inc. (US), Fresenius SE & Co. KGaA (Germany), Haemonetics Corporation (US), Asahi Kasei Medical Co. Ltd. (Japan), B. Braun Melsungen AG (Germany), Baxter International Inc. (US), Cerus Corporation (US), Kaneka Corporation (Japan), Kawasumi Laboratories, Inc. (Japan), Nikkiso Co., Ltd. (Japan), Miltenyi Biotec (Germany), Medica S.p.A. (Italy), Medicap Clinic GmbH (Germany), and Infomed (Switzerland).

The research report categorizes the market into the following segments and subsegments:

US Therapeutic Plasma Exchange Market, By Product & Technology

-

By Product

- Consumables

- Devices

-

By Technology

- Centrifugation

- Membrane Separation

US Therapeutic Plasma Exchange Market, By Indication

-

Neurological Disorders

- Guillain–Barré syndrome

- Chronic inflammatory demyelinating polyneuropathy

- Myasthenia gravis

- Multiple sclerosis

- PANDASa

-

Hematology Disorders

- Thrombotic thrombocytopenic purpura

- Atypical haemolytic uraemic syndrome

- Hyperviscosity syndromes

- Severe/symptomatic Cryoglobulinemia

-

Renal Disorders

- Goodpasture’s syndrome

- Wegener’s glomerulonephritis

- Antibody-mediated renal transplant rejection

-

Metabolic Disorders

- Familial hypercholesterolaemia (homozygous)

- Other Indications

US Therapeutic Plasma Exchange Market, By End User

- Blood Collection Centres & Blood Component Providers

- Hospitals & Transfusion Centres

- Other End Users

Recent Developments

- In April 2020, Terumo BCT and Marker Therapeutics received the first device FDA emergency use authorization (EUA) to treat acute respiratory failure in COVID-19 patients.

- In May 2020, cerus corporation received FDA regulatory approval for the manufacturing of INTERCEPT plasma with a new, alternative plastic disposable kit.

- In December 2019, Haemonetics corporation opened its new corporate headquarters in Downtown Boston.

- In February 2019, Fresenius Medical Care acquired NxStage Medical to widen its product portfolio in the areas of renal care and critical care.

- In April 2020, Fresenius collaborated with DaVita and other dialysis providers to support a broader kidney care community in the US.

Frequently Asked Questions (FAQ):

Which are the top industry players in the US Therapeutic Plasma Exchange Market?

The top market players in the US Therapeutic Plasma Exchange Market include Terumo BCT, Inc. (US), Fresenius SE & Co. KGaA (Germany), Haemonetics Corporation (US), Asahi Kasei Medical Co. Ltd. (Japan), B. Braun Melsungen AG (Germany), Baxter International Inc. (US), Cerus Corporation (US), Kaneka Corporation (Japan), Kawasumi Laboratories, Inc. (Japan), Nikkiso Co., Ltd. (Japan), Miltenyi Biotec (Germany), Medica S.p.A. (Italy), Medicap Clinic GmbH (Germany), and Infomed (Switzerland).

Which indications for patient and procedure data of US Therapeutic Plasma Exchange have been included in this report?

This report the following main segments:

-

Neurological Disorders

- Guillain–Barré syndrome

- Chronic inflammatory demyelinating polyneuropathy

- Myasthenia gravis

- Multiple sclerosis

- PANDASa

-

Hematology Disorders

- Thrombotic thrombocytopenic purpura

- Atypical haemolytic uraemic syndrome

- Hyperviscosity syndromes

- Severe/symptomatic cryoglobulinaemia

-

Renal Disorders

- Goodpasture’s syndrome

- Wegener’s glomerulonephritis

- Antibody-mediated renal transplant rejection

- Metabolic Disorders

- Familial hypercholesterolaemia (homozygous)

- Other Indications

Which technological segment is dominating in the US therapeutic plasma exchange market?

The centrifugation technology segment accounted for the largest share the US therapeutic plasma exchange market. The large share of this segment can be attributed to the advantages offered by centrifugation over membrane separation, such as high efficiency and its ability to separate all types of blood components.

Which is the leading US therapeutic plasma exchange end user?

In 2019, the blood collection centers and blood component providers segment accounted for the largest share of the US therapeutic plasma exchange market. The large share of this end-user segment is mainly attributed to the rising number of blood component donations, the growing number of blood centers, and the increasing number of therapeutic plasma exchange procedures and plasma donations due to COVID-19.

What is the current size of the US therapeutic plasma exchange market?

The US therapeutic plasma exchange market is projected to reach USD 243 million by 2025 from USD 178 million in 2020, at a CAGR of 6.3% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

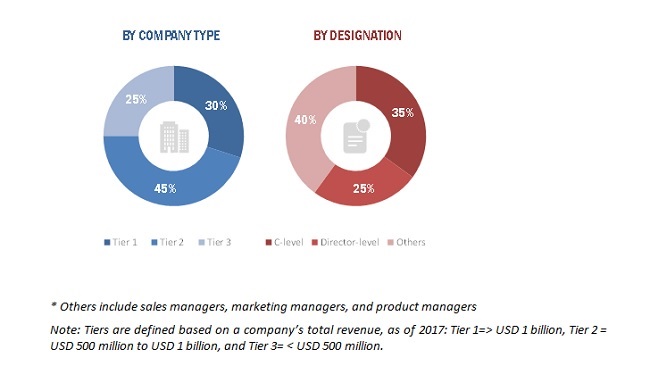

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE AND DESIGNATION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (ILLUSTRATIVE EXAMPLE)

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 8 US THERAPEUTIC PLASMA EXCHANGE MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 9 US THERAPEUTIC PLASMA EXCHANGE MARKET, BY TECHNOLOGY, 2020 VS. 2025 (USD MILLION)

FIGURE 10 US THERAPEUTIC PLASMA EXCHANGE MARKET, BY INDICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 11 US THERAPEUTIC PLASMA EXCHANGE MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

4 MARKET OVERVIEW (Page No. - 35)

4.1 INTRODUCTION

4.2 MARKET DYNAMICS

FIGURE 12 US THERAPEUTIC PLASMA EXCHANGE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

4.2.1 DRIVERS

4.2.1.1 Rising prevalence of chronic diseases

4.2.1.2 Technological advancements

4.2.2 RESTRAINTS

4.2.2.1 High cost of apheresis devices and therapeutic plasma exchange procedures and installation of apheresis devices through a rental model

4.2.3 OPPORTUNITIES

4.2.3.1 Therapeutic plasma exchange for pediatric patients

4.2.4 CHALLENGES

4.2.4.1 Dearth of skilled professionals

5 INDUSTRY INSIGHTS (Page No. - 39)

5.1 INDUSTRY TRENDS

5.1.1 IMPACT OF COVID-19 ON THE THERAPEUTIC PLASMA EXCHANGE MARKET

FIGURE 13 IMPACT OF COVID-19 (2020-2025)

5.1.2 NEW INDICATIONS FOR PLASMA PRODUCTS

5.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 14 PORTER'S FIVE FORCES ANALYSIS (2019): US THERAPEUTIC PLASMA EXCHANGE MARKET

5.2.1 THREAT OF NEW ENTRANTS

5.2.2 THREAT OF SUBSTITUTES

5.2.3 BARGAINING POWER OF SUPPLIERS

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 RIVALRY AMONG EXISTING COMPETITORS

5.3 VALUE CHAIN ANALYSIS

FIGURE 15 VALUE CHAIN: US THERAPEUTIC PLASMA EXCHANGE MARKET

5.4 REGULATORY ANALYSIS

5.4.1 US

6 US THERAPEUTIC PLASMA EXCHANGE MARKET, BY PRODUCT & TECHNOLOGY (Page No. - 46)

6.1 US THERAPEUTIC PLASMA EXCHANGE MARKET, BY PRODUCT

6.1.1 INTRODUCTION

TABLE 2 US THERAPEUTIC PLASMA EXCHANGE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

6.1.2 CONSUMABLES

6.1.2.1 Recurrent use of consumables to drive the growth of this segment

6.1.3 DEVICES

6.1.3.1 Increasing installation of devices in hospitals for therapeutic plasma exchange to drive market growth

6.2 US THERAPEUTIC PLASMA EXCHANGE MARKET, BY TECHNOLOGY

6.2.1 INTRODUCTION

TABLE 3 CENTRIFUGATION VS. MEMBRANE SEPARATION

FIGURE 16 CENTRIFUGATION SEGMENT TO DOMINATE THE US THERAPEUTIC PLASMA EXCHANGE MARKET DURING THE FORECAST PERIOD

TABLE 4 THERAPEUTIC PLASMA EXCHANGE MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

6.2.2 CENTRIFUGATION

6.2.2.1 Centrifugation technology to dominate the US therapeutic plasma exchange market

TABLE 5 KEY PRODUCTS OFFERED IN THE CENTRIFUGATION MARKET

6.2.3 MEMBRANE SEPARATION

6.2.3.1 Recent advances in developing highly permeable filters are supporting the growth of this market

TABLE 6 SIZE OF BLOOD COMPONENTS

TABLE 7 MEMBRANE SEPARATION PRODUCTS AVAILABLE IN THE MARKET

7 US THERAPEUTIC PLASMA EXCHANGE MARKET, BY INDICATION (Page No. - 53)

7.1 INTRODUCTION

7.2 NEUROLOGICAL DISORDERS

7.2.1 NEUROLOGICAL DISORDERS ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

TABLE 8 NEUROLOGICAL DISORDERS MARKET, BY TYPE, 2018-2025 (USD MILLION)

7.2.1.1 Guillain-Barré syndrome

7.2.1.1.1 Patient and procedure data for guillain-barré syndrome

TABLE 9 DISEASE STATISTICS: GUILLAIN-BARRÉ SYNDROME

TABLE 10 TREATMENT GUIDELINES AND PROTOCOLS FOR GUILLAIN-BARRÉ SYNDROME

TABLE 11 EPIDEMIOLOGY FOR GUILLAIN-BARRÉ SYNDROME

7.2.1.2 Chronic inflammatory demyelinating polyneuropathy

7.2.1.2.1 Patient and procedure data for chronic inflammatory demyelinating polyneuropathy

TABLE 12 DISEASE STATISTICS: CHRONIC INFLAMMATORY DEMYELINATING POLYNEUROPATHY

TABLE 13 TREATMENT GUIDELINES AND PROTOCOLS FOR CHRONIC INFLAMMATORY DEMYELINATING POLYNEUROPATHY

TABLE 14 EPIDEMIOLOGY FOR CHRONIC INFLAMMATORY DEMYELINATING POLYNEUROPATHY

7.2.1.3 Myasthenia gravis

7.2.1.3.1 Patient and procedure data for myasthenia gravis

TABLE 15 DISEASE STATISTICS: MYASTHENIA GRAVIS

TABLE 16 TREATMENT GUIDELINES AND PROTOCOLS FOR MYASTHENIA GRAVIS

TABLE 17 EPIDEMIOLOGY FOR MYASTHENIA GRAVIS

7.2.1.4 Multiple sclerosis

7.2.1.4.1 Patient and procedure data for multiple sclerosis

TABLE 18 DISEASE STATISTICS: MULTIPLE SCLEROSIS

TABLE 19 TREATMENT GUIDELINES AND PROTOCOLS FOR MULTIPLE SCLEROSIS

TABLE 20 TREATMENT GUIDELINES AND PROTOCOLS FOR CHRONIC PROGRESSIVE MULTIPLE SCLEROSIS

TABLE 21 EPIDEMIOLOGY FOR MULTIPLE SCLEROSIS

7.2.1.5 PANDAS

7.2.1.5.1 Patient and procedure data for PANDAS

TABLE 22 DISEASE STATISTICS: PANDAS

TABLE 23 TREATMENT GUIDELINES AND PROTOCOLS FOR PANDAS

TABLE 24 EPIDEMIOLOGY FOR PANDAS

7.3 HEMATOLOGIC DISORDERS

7.3.1 INCREASING PREVALENCE AND INCIDENCE OF HEMATOLOGIC DISORDERS WILL BOOST THE DEMAND FOR THERAPEUTIC PLASMA EXCHANGE

TABLE 25 HEMATOLOGIC DISORDERS MARKET, BY TYPE, 2018-2025 (USD MILLION)

7.3.1.1 Thrombotic thrombocytopenic purpura

7.3.1.1.1 Patient and procedure data for thrombotic thrombocytopenic purpura

TABLE 26 DISEASE STATISTICS: THROMBOTIC THROMBOCYTOPENIC PURPURA

TABLE 27 TREATMENT GUIDELINES AND PROTOCOLS FOR THROMBOTIC THROMBOCYTOPENIC PURPURA

TABLE 28 EPIDEMIOLOGY FOR THROMBOTIC THROMBOCYTOPENIC PURPURA

7.3.1.2 Atypical hemolytic uremic syndrome

7.3.1.2.1 Patient and procedure data for atypical hemolytic uremic syndrome

TABLE 29 DISEASE STATISTICS: ATYPICAL HEMOLYTIC UREMIC SYNDROME

TABLE 30 TREATMENT GUIDELINES AND PROTOCOL FOR ATYPICAL HEMOLYTIC UREMIC SYNDROME

TABLE 31 EPIDEMIOLOGY FOR ATYPICAL HEMOLYTIC UREMIC SYNDROME

7.3.1.3 Hyperviscosity syndrome

7.3.1.3.1 Patient and procedure data for hyperviscosity syndrome

TABLE 32 DISEASE STATISTICS: HYPERVISCOSITY SYNDROME

TABLE 33 TREATMENT GUIDELINES AND PROTOCOLS FOR HYPERVISCOSITY SYNDROME

TABLE 34 EPIDEMIOLOGY FOR HYPERVISCOSITY SYNDROME

7.3.1.4 Severe/symptomatic cryoglobulinemia

7.3.1.4.1 Patient and procedure data for cryoglobulinemia

TABLE 35 DISEASE STATISTICS: CRYOGLOBULINEMIA

TABLE 36 TREATMENT GUIDELINES AND PROTOCOLS FOR CRYOGLOBULINEMIA

TABLE 37 EPIDEMIOLOGY FOR CRYOGLOBULINEMIA

7.4 RENAL DISORDERS

7.4.1 THERAPEUTIC PLASMA EXCHANGE IS REGARDED AS ONE OF THE MOST USEFUL TREATMENT OPTIONS FOR SEVERAL RENAL DISORDERS

TABLE 38 RENAL DISORDERS MARKET, BY TYPE, 2018-2025 (USD MILLION)

7.4.1.1 Goodpasture syndrome

7.4.1.1.1 Patient and procedure data for goodpasture syndrome

TABLE 39 DISEASE STATISTICS: GOODPASTURE SYNDROME

TABLE 40 TREATMENT GUIDELINES AND PROTOCOLS FOR GOODPASTURE SYNDROME

TABLE 41 EPIDEMIOLOGY FOR GOODPASTURE SYNDROME

7.4.1.2 WEGENER'S GRANULOMATOSIS (ANCA)-associated rapidly progressive glomerulonephritis

7.4.1.2.1 Patient and procedure data for wegener's granulomatosis

TABLE 42 DISEASE STATISTICS: WEGENER'S GRANULOMATOSIS

TABLE 43 TREATMENT GUIDELINES AND PROTOCOLS FOR WEGENER'S GRANULOMATOSIS

TABLE 44 EPIDEMIOLOGY FOR WEGENER'S GRANULOMATOSIS

7.4.1.3 Antibody-mediated renal transplant rejection

7.4.1.3.1 Patient and procedure data for AMR

TABLE 45 DISEASE STATISTICS: ANTIBODY?MEDIATED REJECTION

TABLE 46 TREATMENT GUIDELINES AND PROTOCOLS FOR ANTIBODY?MEDIATED REJECTION

TABLE 47 EPIDEMIOLOGY FOR ANTIBODY?MEDIATED REJECTION

7.5 METABOLIC DISORDERS

7.5.1 INCREASING ADOPTION OF PLASMA EXCHANGE FOR DIABETES AND OTHER METABOLIC DISORDERS TO DRIVE MARKET GROWTH

7.5.1.1 Familial hypercholesterolemia (homozygous)

7.5.1.1.1 Patient and procedure data for homozygous familial hypercholesterolemia

TABLE 48 DISEASE STATISTICS: HOMOZYGOUS FAMILIAL HYPERCHOLESTEROLEMIA

TABLE 49 TREATMENT GUIDELINES AND PROTOCOLS FOR HOMOZYGOUS FAMILIAL HYPERCHOLESTEROLEMIA

TABLE 50 EPIDEMIOLOGY FOR HOMOZYGOUS FAMILIAL HYPERCHOLESTEROLEMIA

7.6 OTHER INDICATIONS

8 US THERAPEUTIC PLASMA EXCHANGE MARKET, BY END USER (Page No. - 75)

8.1 INTRODUCTION

FIGURE 17 BLOOD COLLECTION CENTERS & BLOOD COMPONENT PROVIDERS SEGMENT TO DOMINATE THE US THERAPEUTIC PLASMA EXCHANGE MARKET DURING THE FORECAST PERIOD

TABLE 51 US THERAPEUTIC PLASMA EXCHANGE MARKET, BY END USER, 2018-2025 (USD MILLION)

8.2 BLOOD COLLECTION CENTERS & BLOOD COMPONENT PROVIDERS

8.2.1 BLOOD COLLECTION CENTERS & BLOOD COMPONENT PROVIDERS ARE THE LARGEST END USERS OF THERAPEUTIC PLASMA EXCHANGE

FIGURE 18 NUMBER OF ANNUAL PLASMA DONATIONS IN THE US, 2003?2016 (MILLION)

8.3 HOSPITALS & TRANSFUSION CENTERS

8.3.1 HOSPITALS & TRANSFUSION CENTERS SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

8.4 OTHER END USERS

9 COMPETITIVE LANDSCAPE (Page No. - 79)

9.1 OVERVIEW

FIGURE 19 KEY DEVELOPMENTS IN THE US THERAPEUTIC PLASMA EXCHANGE MARKET, JANUARY 2017?JULY 2020

9.2 MARKET EVALUATION FRAMEWORK

FIGURE 20 MARKET EVALUATION FRAMEWORK: PRODUCT LAUNCHES & APPROVALS WERE THE MOST WIDELY ADOPTED STRATEGIES

9.3 COMPETITIVE SITUATIONS AND TRENDS

9.3.1 PRODUCT LAUNCHES & APPROVALS

9.3.2 EXPANSIONS

9.3.3 ACQUISITIONS

9.3.4 COLLABORATIONS

10 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 83)

10.1 COMPANY EVALUATION MATRIX DEFINITION & METHODOLOGY

10.2 COMPETITIVE LEADERSHIP MAPPING

10.2.1 STARS

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE

10.2.4 EMERGING COMPANIES

FIGURE 21 US THERAPEUTIC PLASMA EXCHANGE MARKET: COMPETITIVE LEADERSHIP MAPPING (2019)

10.3 MARKET SHARE ANALYSIS

FIGURE 22 US THERAPEUTIC PLASMA EXCHANGE MARKET SHARE, BY KEY PLAYER, 2019

10.4 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, Strategic overview, Competitive analysis, MnM View)*

10.4.1 TERUMO BCT, INC.

FIGURE 23 TERUMO BCT, INC.: COMPANY SNAPSHOT (2018)

10.4.2 FRESENIUS SE & CO. KGAA

FIGURE 24 FRESENIUS MEDICAL CARE: COMPANY SNAPSHOT (2019)

FIGURE 25 FRESENIUS KABI: COMPANY SNAPSHOT (2019)

10.4.3 HAEMONETICS CORPORATION

FIGURE 26 HAEMONETICS CORPORATION: COMPANY SNAPSHOT (2020)

10.4.4 BAXTER INTERNATIONAL INC.

FIGURE 27 BAXTER INTERNATIONAL: COMPANY SNAPSHOT (2019)

10.4.5 ASAHI KASEI MEDICAL CO. LTD.

FIGURE 28 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT (2019)

10.4.6 B. BRAUN MELSUNGEN AG

FIGURE 29 B. BRAUN MELSUNGEN: COMPANY SNAPSHOT (2019)

10.4.7 CERUS CORPORATION

FIGURE 30 CERUS CORPORATION: COMPANY SNAPSHOT (2019)

10.4.8 KANEKA CORPORATION

FIGURE 31 KANEKA CORPORATION: COMPANY SNAPSHOT (2019)

10.4.9 KAWASUMI LABORATORIES, INC.

FIGURE 32 KAWASUMI LABORATORIES: COMPANY SNAPSHOT (2019)

10.4.10 NIKKISO CO., LTD.

FIGURE 33 NIKKISO CO., LTD.: COMPANY SNAPSHOT (2019)

10.4.11 MILTENYI BIOTEC

10.4.12 MEDICA S.P.A.

10.4.13 MEDICAP CLINIC GMBH

10.4.14 INFOMED

*Business Overview, Products Offered, Recent Developments, Strategic overview, Competitive analysis, MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 116)

11.1 INSIGHTS OF INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the US therapeutic plasma exchange market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the US therapeutic plasma exchange market. The primary sources from the demand side included industry experts, such as doctors, nurses, and purchase managers in hospitals.

Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, end user, and region).

Data Triangulation

After arriving at the market size, the US therapeutic plasma exchange market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, and forecast the US therapeutic plasma exchange market by product, technology, indication, and end user

- To provide detailed information about the major factors influencing market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall US therapeutic plasma exchange market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile the key players and comprehensively analyze their market shares and core competencies in the US therapeutic plasma exchange market

- To track and analyze competitive developments such as partnerships, collaborations, acquisitions, product launches and approvals, and expansions in the US therapeutic plasma exchange market

- To benchmark players within the US therapeutic plasma exchange market using the "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of the top companies

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in US Therapeutic Plasma Exchange Market