Corporate Wellness Solutions Market by Service Offering (HRA, Nutrition, Weight Loss, Fitness, Substance Abuse Management, Employee Assistance Programs, Health Benefits), End User (Organizations (Large, Mid-Sized, SME)) & Region - Global Forecast to 2026

The global corporate wellness solutions market in terms of revenue was estimated to be worth $61.2 billion in 2021 and is poised to reach $94.6 billion by 2026, growing at a CAGR of 9.1% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in the market is driven by the rising adoption of corporate wellness programs by employers, increased uptake of technology-powered corporate wellness solutions, and the substantial burden of chronic lifestyle diseases and mental health in organizations. However, factors posing a challenge to this market include low employee engagement and participation in corporate wellness programs and the adoption of internal-led corporate wellness programs through benefits packages and perks.

To know about the assumptions considered for the study, Request for Free Sample Report

Corporate Wellness Solutions Market Dynamics

Driver: Rising adoption of corporate wellness programs

Corporate wellness programs are being increasingly implemented by organizations to improve employee health and productivity, reduce health risks, and lower employee healthcare costs. Companies are becoming more aware of the need to maintain a mentally and physically healthy workforce. This has resulted in increased corporate investments in employee wellbeing programs, solutions, and services.

According to the 3rd annual UnitedHealthcare Wellness Checkup Survey, published in 2019, US employers were expected to invest an average of more than USD 3.6 million in their respective wellbeing programs. This high investment has resulted in a proven positive impact on employee health and wellbeing. These factors indicate a trend of rising adoption of corporate wellness programs in the forecast period.

Restraint: Dearth of qualified and licensed professionals to support corporate wellness programs

According to the Health Resources and Services Administration, by 2030, it is projected that there would be a 20% decrease in the number of adult psychiatrists in the US. This shortage can largely be attributed to the dwindling supply of new professionals entering these fields. This deficit in mental health professionals is even more pronounced in emerging countries. For example, in India, there are only 0.75 psychiatrists available per 100,000 people. This shortage in the number of suitably qualified professionals impedes the ability to initiate and drive efficient, holistic corporate wellness programs and could restrain the growth of this market.

Opportunity: Emerging countries with a large working population

According to the International Labour Organization (ILO), the Asia Pacific constitutes a workforce of 1.9 billion individuals. Globalization has resulted in rapid economic growth in the Asia Pacific, with a steady rise in the number of employees in most countries. Moreover, the workforce in the region is aging, as the population aged 60 and above in the region is expected to increase by 24% by 2050, according to the United Nations Department of Economic and Social Affairs. This would increase the burden of chronic diseases in the working population in this region in the coming years. These factors pose an opportunity for the growth of the market in the forecast period, in emerging countries.

Challenge: Low employee engagement and participation in corporate wellness programs

Corporate wellness solutions need to be customized as per the interest and dynamic requirements of the workforce, which may be dependent on several internal and external factors that cannot be controlled nor predicted. In this regard, a study conducted by UnitedHealthcare in 2017 showed that 63% of employees surveyed in the US are unwilling to spend more than an hour per day improving their health and wellbeing. Therefore, to encourage employee participation, many organizations offer financial incentives. This poses a challenge to the growth of this market in the forecast period.

The health risk assessment segment holds the highest market share, by service offering, in the corporate wellness solutions industry

On the basis of service offering, the corporate wellness solutions market is broadly segmented into health risk assessment, nutrition and weight management, smoking cessation, fitness services, biometric screening, alcohol/substance abuse services, mental/behavioral health management, health education services, virtual consultation/virtual care, employee assistance programs, and health benefits programs.

The health risk assessment segment holds the highest market share, by service offering, in the market. The large share of this segment can be attributed to the utility of this service for early identification and mitigation health risks in employees, to reduce absenteeism due to health conditions, and lower healthcare costs.

The small-sized organizations segment to grow at the highest CAGR in the corporate wellness solutions industry, in the forecast period.

Based on end user, the corporate wellness solutions market is broadly segmented into large, medium-sized, and small organizations. The small organizations segment is projected to grow at the highest CAGR during the forecast period. Growth in this segment is largely driven by the growing use of corporate wellness programs by these organizations due to the rising affordability and favorable payment models for small businesses.

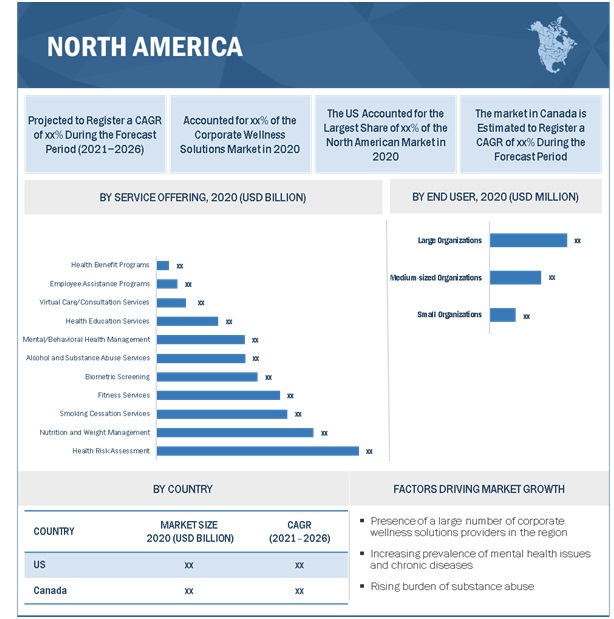

North America holds the largest share in the corporate wellness solutions industry, by region, in the forecast period.

The corporate wellness solutions market is segmented into North America, Europe, Asia Pacific, and Rest of the World. North America accounted for the largest share in the market in 2020. The large share of this regional segment can be attributed to the rising need for corporate wellness solutions for employees due to the rising prevalence of chronic conditions, mental health issues, and substance abuse especially related to the opioid crisis in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the corporate wellness solutions market include ComPsych Corporation (US), LifeWorks, Inc. (Canada), UnitedHealth Group (Optum) (US), Anthem, Inc. (US), Workplace Options (US), Cerner Corporation (US), Centene Corporation (US), TELUS (Canada), Cleveland Clinic (US), Wellright (US), Virgin Group Ltd. (US), CVS Health Corporation (US), Alphabet Inc. (Fitbit) (US), Discovery Limited (Vitality Group) (South Africa), EXOS (US), Laboratory Corporation of American Holdings (US), Sharecare (US), Gilsbar (US), Medcan Clinic (Canada), Limeade (US), Aduro, Inc. (US), TotalWellness (US), Wellsteps (US), Corporate Fitness Works (US), and WellWorks For You (US).

Scope of the Corporate Wellness Solutions Industry

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$61.2 billion |

|

Projected Revenue by 2026 |

$94.6 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 9.1% |

|

Market Driver |

Rising adoption of corporate wellness programs |

|

Market Opportunity |

Emerging countries with a large working population |

This research report categorizes the corporate wellness solutions market to forecast revenue and analyze trends in each of the following submarkets:

By Service Offering

- Health Risk Assessment

- Nutrition and Weight Management

- Smoking Cessation

- Fitness Services

- Biometric Screening

- Alcohol/Substance Abuse Services

- Mental/Behavioral Health Management

- Virtual consultation/Virtual care

- Employee Assistance Programs

- Health Benefit Programs

By End User

- Large organizations

- Medium-sized organizations

- Small organizations

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Rest of the World

Recent Developments of Corporate Wellness Solutions Industry

- In April 2021, Workplace Options (US) launched a specialized program, Revive, to assist employees experiencing or at risk of burnout through live counseling and coaching sessions.

- In February 2021, LifeWorks, Inc. completed the acquisition of SMG Health Pty. Ltd. (Australia) through its LifeWorks Business, expanding the company’s service offerings in Australia.

- In January 2021, UnitedHealth Group (US) launched virtual primary care for employees for wellness and routine and chronic condition management.

- In February 2020, Anthem, Inc. (US), acquired Beacon Health Options (US), an independently held behavioral health organization, to combine the company’s behavioral health capabilities with Beacon Health’s model and support services.

- In June 2020, Virgin Group Ltd. (US) launched VP Passport, a unified engagement platform with employer-configurable monitoring and screening tools, live support, and partner solutions to facilitate safe return to workplace.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global corporate wellness solutions market?

The global corporate wellness solutions market boasts a total revenue value of $94.6 billion by 2026.

What is the estimated growth rate (CAGR) of the global corporate wellness solutions market?

The global corporate wellness solutions market has an estimated compound annual growth rate (CAGR) of 9.1% and a revenue size in the region of $61.2 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 CORPORATE WELLNESS SOLUTIONS MARKET SEGMENTATION

FIGURE 2 MARKET, BY REGION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH APPROACH

2.2 RESEARCH METHODOLOGY DESIGN

FIGURE 3 CORPORATE WELLNESS SOLUTIONS MARKET: RESEARCH DESIGN

2.2.1 SECONDARY RESEARCH

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

FIGURE 4 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

2.2.2.2 Insights from primary experts

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 9 REVENUE ANALYSIS OF THE TOP 3 PUBLIC COMPANIES: CORPORATE WELLNESS SOLUTIONS MARKET (2020)

FIGURE 10 BOTTOM-UP APPROACH: END-USER ADOPTION/CONSUMPTION OF CORPORATE WELLNESS SERVICES (US)

FIGURE 11 BOTTOM-UP APPROACH: END-USER ADOPTION/CONSUMPTION OF CORPORATE WELLNESS SERVICES (EUROPE)

FIGURE 12 BOTTOM-UP APPROACH: END-USER ADOPTION/CONSUMPTION OF HEALTH RISK ASSESSMENT SOLUTIONS (US)

FIGURE 13 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE CORPORATE WELLNESS SOLUTIONS MARKET (2021–2026)

FIGURE 14 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 15 TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 16 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE ESTIMATION

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 17 CORPORATE WELLNESS SOLUTIONS MARKET, BY SERVICE OFFERING, 2021 VS. 2026 (USD BILLION)

FIGURE 18 MARKET, BY END USER, 2021 VS. 2026 (USD BILLION)

FIGURE 19 GEOGRAPHIC SNAPSHOT: CORPORATE WELLNESS SOLUTIONS INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 CORPORATE WELLNESS SOLUTIONS MARKET OVERVIEW

FIGURE 20 INCREASED UPTAKE OF TECHNOLOGY-POWERED CORPORATE WELLNESS SOLUTIONS RESPONSIBLE FOR MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY SERVICE OFFERING

FIGURE 21 IN NORTH AMERICA, LARGE ORGANIZATIONS COMMANDED THE LARGEST SHARE IN THE MARKET, BY END USER, IN 2020

4.3 MARKET: GEOGRAPHIC MIX

FIGURE 22 CHINA TO WITNESS THE HIGHEST GROWTH IN THE MARKET DURING THE FORECAST PERIOD

4.4 REGIONAL MIX: CORPORATE WELLNESS SOLUTIONS INDUSTRY

FIGURE 23 NORTH AMERICA DOMINATED THE MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 CORPORATE WELLNESS SOLUTIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 MARKET DRIVERS

5.2.1.1 Rising adoption of corporate wellness programs

FIGURE 25 US: PERCENTAGE OF FIRMS PROVIDING HEALTH RISK ASSESSMENT SOLUTIONS (AMONG FIRMS OFFERING HEALTH BENEFITS), 2015–2019

5.2.1.2 Technology-powered corporate wellness solutions

FIGURE 26 US: PERCENTAGE OF FIRMS PROVIDING EMPLOYEES WITH WEARABLE TECHNOLOGIES AS PART OF THEIR HEALTH IMPROVEMENT PROGRAM, BY FIRM SIZE, 2019

5.2.1.3 Substantial burden of chronic lifestyle diseases and mental health issues in organizations

FIGURE 27 TOTAL HEALTH EXPENDITURE ON DIABETES (USD MILLION), BY REGION, 2019

FIGURE 28 PERCENTAGE OF SMALL AND LARGE FIRMS OFFERING CORPORATE WELLNESS PROGRAMS IN THE US, 2019

5.2.2 MARKET RESTRAINTS

5.2.2.1 Dearth of qualified and licensed professionals to support corporate wellness programs

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Increased focus on employee health and wellbeing driven by the COVID-19 pandemic

5.2.3.2 Emerging countries with a large working population

5.2.4 MARKET CHALLENGES

5.2.4.1 Low employee engagement and participation in corporate wellness programs

5.2.4.2 Budgetary constraints

5.2.4.3 Adoption of internal employer-led wellness programs through benefits packages and perks

5.3 SCENARIOS: PESSIMISTIC, REALISTIC, AND OPTIMISTIC

5.3.1 MARKET

5.4 COVID-19 IMPACT ANALYSIS

5.4.1 COVID-19 HEALTH ASSESSMENT

5.5 COVID-19 ECONOMIC ASSESSMENT

5.6 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 29 CRITERIA IMPACTING THE GLOBAL ECONOMY

5.7 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO IN THE MARKET

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES (YC-YCC)

5.8.1 MARKET

5.8.1.1 Revenue sources are shifting towards more technology-based solutions due to the COVID-19 pandemic

FIGURE 30 REVENUE SHIFT IN THE CORPORATE WELLNESS SOLUTIONS MARKET

5.9 AVERAGE SELLING PRICE TREND

TABLE 3 AVERAGE PRICING OF CORPORATE WELLNESS SERVICE OFFERINGS, BY REGION (USD)

5.10 ECOSYSTEM/MARKET MAP

TABLE 4 MARKET: ECOSYSTEM

5.11 PATENT ANALYSIS: BIOMETRIC SCREENING

FIGURE 31 LIST OF MAJOR PATENTS FOR BIOMETRIC SCREENING

5.12 CASE STUDY ANALYSIS

5.12.1 CASE STUDY 1: CORPORATE WELLNESS PROGRAMS LOWERING THE RISK OF CHRONIC DISEASES IN EMPLOYEES

5.12.2 CASE STUDY 2: WORKPLACE MENTAL HEALTH STRATEGY

5.13 TECHNOLOGICAL ANALYSIS: WEARABLE TECHNOLOGY

5.13.1 KEY TECHNOLOGY

5.13.2 COMPLEMENTARY TECHNOLOGY

5.13.2.1 Medical wearable technology

5.13.3 ADJACENT TECHNOLOGY

5.13.3.1 IoT (Internet of Things) in healthcare

5.14 REGULATORY LANDSCAPE

5.14.1 NORTH AMERICA

5.14.2 EUROPE

5.15 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS (2020): CORPORATE WELLNESS SOLUTIONS MARKET

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.15.1 THREAT FROM NEW ENTRANTS

5.15.1.1 Growth in the overall corporate wellness solutions industry

5.15.1.2 High labor intensity of the market

5.15.2 THREAT FROM SUBSTITUTES

5.15.2.1 Internal wellness programs designed by HR departments

5.15.2.2 Gyms and health clubs offering corporate wellness programs

5.15.3 BARGAINING POWER OF SUPPLIERS

5.15.3.1 Price sensitivity of the market

5.15.3.2 Large number of market players

5.15.4 BARGAINING POWER OF BUYERS

5.15.4.1 Low differentiation between service offerings and low switching costs

5.15.5 INTENSITY OF COMPETITIVE RIVALRY

5.15.5.1 Similar services offered by market players

6 CORPORATE WELLNESS SOLUTIONS MARKET, BY SERVICE OFFERING (Page No. - 73)

6.1 INTRODUCTION

TABLE 6 CORPORATE WELLNESS SOLUTIONS INDUSTRY, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 7 MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.2 HEALTH RISK ASSESSMENT

6.2.1 RISING ADOPTION OF HEALTH RISK ASSESSMENT SERVICES DUE TO THE COVID-19 PANDEMIC TO BOOST THE GROWTH OF THIS SEGMENT

TABLE 8 MARKET FOR HEALTH RISK ASSESSMENT, BY COUNTRY, 2019–2026 (USD MILLION)

6.3 NUTRITION AND WEIGHT MANAGEMENT

6.3.1 GROWING FOCUS ON NUTRITION AND WEIGHT MANAGEMENT BY EMPLOYERS TO REDUCE HEALTH RISK IN EMPLOYEES TO PROMOTE GROWTH IN THIS SEGMENT

TABLE 9 US: PERCENTAGE OF FIRMS OFFERING PROGRAMS TO LOSE WEIGHT (2019)

TABLE 10 NUTRITION AND WEIGHT MANAGEMENT SERVICES PROVIDED FOR CORPORATE WELLNESS PROGRAMS

TABLE 11 MARKET FOR NUTRITION AND WEIGHT MANAGEMENT, BY COUNTRY, 2019–2026 (USD MILLION)

6.4 SMOKING CESSATION SERVICES

6.4.1 REDUCED HEALTHCARE COSTS WITH SMOKING CESSATION TO BOOST THE UPTAKE OF THESE SERVICES BY ORGANIZATIONS

TABLE 12 MARKET FOR SMOKING CESSATION SERVICES, BY COUNTRY, 2019–2026 (USD MILLION)

6.5 FITNESS SERVICES

6.5.1 RISING POPULARITY OF WEARABLE DEVICES IN CORPORATE FITNESS PROGRAMS DRIVING GROWTH IN THIS SEGMENT

TABLE 13 MARKET FOR FITNESS SERVICES, BY COUNTRY, 2019–2026 (USD MILLION)

6.6 BIOMETRIC SCREENING

6.6.1 INCENTIVIZED BIOMETRIC SCREENING PROGRAMS MAY BOOST THE GROWTH OF THIS SEGMENT

FIGURE 33 US: PERCENTAGE OF FIRMS OFFERING BIOMETRIC SCREENING (AMONG THOSE OFFERING HEALTH BENEFITS) IN THE US, BY FIRM SIZE (2019)

TABLE 14 MARKET FOR BIOMETRIC SCREENING, BY COUNTRY, 2019–2026 (USD MILLION)

6.7 ALCOHOL AND SUBSTANCE ABUSE SERVICES

6.7.1 RISING INCIDENCE OF ALCOHOL & SUBSTANCE ABUSE IN THE COVID-19 PANDEMIC TO PROMOTE THE GROWTH OF THIS SEGMENT

FIGURE 34 US: PERCENTAGE OF FIRMS TAKING VARIOUS ACTIONS IN RESPONSE TO THE OPIOID CRISIS IN THE US, BY FIRM SIZE (2019)

TABLE 15 MARKET FOR ALCOHOL AND SUBSTANCE ABUSE SERVICES, BY COUNTRY, 2019–2026 (USD MILLION)

6.8 MENTAL/BEHAVIORAL HEALTH MANAGEMENT

6.8.1 PHONE/VIDEO COUNSELING AND WELLNESS PLATFORMS ENCOURAGE THE ADOPTION OF CORPORATE WELLNESS PROGRAMS FOCUSING ON MENTAL HEALTH MANAGEMENT

TABLE 16 MARKET FOR MENTAL/BEHAVIORAL HEALTH MANAGEMENT, BY COUNTRY, 2019–2026 (USD MILLION)

6.9 HEALTH EDUCATION SERVICES

6.9.1 HEALTH EDUCATION IS THE CORE AND KEY TO THE SUCCESS OF ANY CORPORATE WELLNESS PROGRAM—A KEY FACTOR DRIVING MARKET GROWTH

TABLE 17 MARKET FOR HEALTH EDUCATION SERVICES, BY COUNTRY, 2019–2026 (USD MILLION)

6.10 VIRTUAL CARE/CONSULTATION SERVICES

6.10.1 RISING ADOPTION AND COVERAGE OF VIRTUAL CARE/CONSULTATION IN HEALTH BENEFIT PROGRAMS BY EMPLOYERS TO BOOST THE GROWTH OF THIS MARKET

TABLE 18 MARKET FOR VIRTUAL CARE/CONSULTATION SERVICES, BY COUNTRY, 2019–2026 (USD MILLION)

6.11 EMPLOYEE ASSISTANCE PROGRAMS

6.11.1 NEED TO ENSURE HOLISTIC WELLBEING OF EMPLOYEES DRIVES THE GROWTH OF THIS SEGMENT

TABLE 19 EXAMPLES OF EMPLOYEE ASSISTANCE PROGRAMS PROVIDED BY MARKET PLAYERS

TABLE 20 MARKET FOR EMPLOYEE ASSISTANCE PROGRAMS, BY COUNTRY, 2019–2026 (USD MILLION)

6.12 HEALTH BENEFIT PROGRAMS

6.12.1 NEED FOR SEAMLESS NAVIGATION OF HEALTH BENEFITS BY EMPLOYEES PROPELLING THE GROWTH OF THIS SEGMENT

TABLE 21 EXAMPLES OF HEALTH BENEFIT PROGRAMS PROVIDED BY MARKET PLAYERS

TABLE 22 CORPORATE WELLNESS SOLUTION MARKET FOR HEALTH BENEFIT PROGRAMS, BY COUNTRY, 2019–2026 (USD MILLION)

7 CORPORATE WELLNESS SOLUTIONS MARKET, BY END USER (Page No. - 90)

7.1 INTRODUCTION

TABLE 23 CORPORATE WELLNESS SOLUTIONS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

7.2 LARGE ORGANIZATIONS

7.2.1 HIGH UTILIZATION OF WORKPLACE WELLNESS PROGRAMS AND FAVORABLE INCENTIVIZATION TO PROMOTE THE GROWTH OF THIS SEGMENT

FIGURE 35 US: PERCENTAGE OF FIRMS IN THE US OFFERING INCENTIVES FOR PARTICIPATION IN CORPORATE WELLNESS PROGRAMS, BY FIRM SIZE (2019)

TABLE 24 CORPORATE WELLNESS SOLUTION MARKET FOR LARGE ORGANIZATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 MEDIUM-SIZED ORGANIZATIONS

7.3.1 RISING AWARENESS OF BENEFITS AND RETURNS ON INVESTMENT OF WELLNESS PROGRAMS TO BOOST THE GROWTH OF THIS END-USER SEGMENT

TABLE 25 CORPORATE WELLNESS SOLUTION MARKET FOR MEDIUM-SIZED ORGANIZATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 SMALL ORGANIZATIONS

7.4.1 RISING AFFORDABILITY AND FAVORABLE PAYMENT MODELS TO BOOST THE GROWTH OF THIS SEGMENT

TABLE 26 CORPORATE WELLNESS SOLUTION MARKET FOR SMALL ORGANIZATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

8 CORPORATE WELLNESS SOLUTIONS MARKET, BY REGION (Page No. - 95)

8.1 INTRODUCTION

FIGURE 36 GEOGRAPHIC SNAPSHOT OF THE CORPORATE WELLNESS SOLUTION MARKET

TABLE 27 CORPORATE WELLNESS SOLUTIONS INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

TABLE 28 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.2.1 US

8.2.1.1 Increasing prevalence of chronic disease and the rising opioid crisis to drive growth in the corporate wellness solutions market in the US

TABLE 31 US: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 32 US: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Increasing mental health issues and substance abuse fueled by the COVID-19 pandemic to drive the demand for corporate wellness solutions in Canada

TABLE 33 CANADA: CORPORATE WELLNESS SOLUTIONS INDUSTRY, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 34 CANADA: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

8.3 EUROPE

TABLE 35 EUROPE: CORPORATE WELLNESS SOLUTION MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 36 EUROPE: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 37 EUROPE: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 High prevalence of obesity and growing burden of substance abuse to increase the adoption of corporate wellness solutions in Germany

TABLE 38 GERMANY: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 39 GERMANY: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

8.3.2 FRANCE

8.3.2.1 Growing absenteeism due to poor physical and mental wellbeing of employees to drive market growth in France

TABLE 40 FRANCE: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 41 FRANCE: CORPORATE WELLNESS SOLUTIONS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

8.3.3 UK

8.3.3.1 Increasing work stress and the growing prevalence of obesity in the country to boost the demand for employee health and wellness solutions

TABLE 42 UK: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 43 UK: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Growing demand for virtual care/consultation services in the country to drive market growth

TABLE 44 ITALY: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 45 ITALY: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 High incidence of obesity and heart disease to drive the demand for nutrition and weight management and fitness services in Spain

TABLE 46 SPAIN: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 47 SPAIN: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 48 ROE: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 49 ROE: CORPORATE WELLNESS SOLUTIONS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: CORPORATE WELLNESS SOLUTION MARKET SNAPSHOT

TABLE 50 ASIA PACIFIC: CORPORATE WELLNESS SOLUTION MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 51 ASIA PACIFIC: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 52 ASIA PACIFIC: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

8.4.1 CHINA

8.4.1.1 Increasing number of lifestyle diseases, coupled with growing tobacco addiction, to drive the demand for corporate wellness solutions

TABLE 53 CHINA: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 54 CHINA: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

8.4.2 JAPAN

8.4.2.1 Favorable regulations and increasing focus on workplace wellness to boost market growth in Japan

TABLE 55 JAPAN: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 56 JAPAN: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

8.4.3 INDIA

8.4.3.1 Rising digitization of services and increasing penetration of smartphones and wearable devices to contribute to market growth

TABLE 57 INDIA: CORPORATE WELLNESS SOLUTIONS INDUSTRY, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 58 INDIA: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

8.4.4 ROAPAC

TABLE 59 ROAPAC: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 60 ROAPAC: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

8.5 REST OF THE WORLD

TABLE 61 ROW: CORPORATE WELLNESS SOLUTION MARKET, BY SERVICE OFFERING, 2019–2026 (USD MILLION)

TABLE 62 ROW: CORPORATE WELLNESS SOLUTION MARKET, BY END USER, 2019–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 123)

9.1 INTRODUCTION

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

9.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN THE CORPORATE WELLNESS SOLUTIONS INDUSTRY

9.3 REVENUE SHARE ANALYSIS

9.3.1 REVENUE ANALYSIS FOR KEY PLAYERS IN THE CORPORATE WELLNESS SOLUTION MARKET

FIGURE 39 REVENUE ANALYSIS FOR KEY PLAYERS IN THE CORPORATE WELLNESS SOLUTIONS MARKET IN THE PAST 5 YEARS

9.4 MARKET SHARE ANALYSIS

9.4.1 MARKET (2020)

FIGURE 40 SHARE OF LEADING COMPANIES IN THE GLOBAL CORPORATE WELLNESS SOLUTIONS INDUSTRY (2020)

TABLE 63 MARKET: DEGREE OF COMPETITION

9.5 COMPANY EVALUATION QUADRANT

9.5.1 COMPANY EVALUATION QUADRANT: CORPORATE WELLNESS SOLUTIONS MARKET

FIGURE 41 GLOBAL CORPORATE WELLNESS SOLUTIONS INDUSTRY COMPANY EVALUATION MATRIX, 2020

9.5.1.1 Stars

9.5.1.2 Pervasive players

9.5.1.3 Emerging leaders

9.5.1.4 Participants

9.5.1.5 Competitive benchmarking

9.5.1.5.1 Company product/service footprint (20 companies)

TABLE 64 COMPANY SERVICE OFFERING FOOTPRINT (20 COMPANIES)

TABLE 65 COMPANY END-USER FOOTPRINT (20 COMPANIES)

TABLE 66 COMPANY REGION FOOTPRINT (20 COMPANIES)

9.6 COMPETITIVE SITUATIONS AND TRENDS

9.6.1 PRODUCT/SERVICE LAUNCHES & APPROVALS

TABLE 67 PRODUCT/SERVICE LAUNCHES (2018–MAY 2021)

9.6.2 DEALS

TABLE 68 DEALS (2018–MAY 2021)

TABLE 69 OTHER DEVELOPMENTS (2018–MAY 2021)

10 COMPANY PROFILES (Page No. - 138)

10.1 KEY PLAYERS

10.1.1 COMPSYCH CORPORATION

10.1.1.1 Business overview

TABLE 70 COMPSYCH CORPORATION: BUSINESS OVERVIEW

10.1.1.2 Products & services offered

10.1.1.3 Recent developments

10.1.1.4 MnM view

10.1.1.4.1 Right to win

10.1.1.4.2 Strategic choices made

10.1.2 UNITEDHEALTH GROUP (OPTUM)

10.1.2.1 Business overview

TABLE 71 UNITEDHEALTH GROUP: BUSINESS OVERVIEW

FIGURE 42 UNITEDHEALTH GROUP: COMPANY SNAPSHOT (2020)

FIGURE 43 OPTUM: COMPANY SNAPSHOT (2020)

10.1.2.2 Products & services offered

10.1.2.3 Recent developments

10.1.2.4 MnM view

10.1.2.4.1 Right to win

10.1.2.4.2 Strategic choices made

10.1.3 ANTHEM, INC.

10.1.3.1 Business overview

TABLE 72 ANTHEM, INC.: BUSINESS OVERVIEW

FIGURE 44 ANTHEM, INC.: COMPANY SNAPSHOT (2020)

10.1.3.2 Products & services offered

10.1.3.3 Recent developments

10.1.3.4 MnM view

10.1.3.4.1 Right to win

10.1.3.4.2 Strategic choices made

10.1.4 WORKPLACE OPTIONS

10.1.4.1 Business overview

TABLE 73 WORKPLACE OPTIONS: BUSINESS OVERVIEW

10.1.4.2 Products & services offered

10.1.4.3 Recent developments

10.1.4.4 MnM view

10.1.4.4.1 Right to win

10.1.4.4.2 Strategic choices made

10.1.5 VIRGIN GROUP LTD. (VIRGIN PULSE)

10.1.5.1 Business overview

TABLE 74 VIRGIN GROUP LTD.: BUSINESS OVERVIEW

TABLE 75 VIRGIN PULSE: BUSINESS OVERVIEW

10.1.5.2 Products & services offered

10.1.5.3 Recent developments

10.1.6 CVS HEALTH CORPORATION

10.1.6.1 Business overview

TABLE 76 CVS HEALTH CORPORATION: BUSINESS OVERVIEW

FIGURE 45 CVS HEALTH CORPORATION: COMPANY SNAPSHOT (2020)

10.1.6.2 Products & services offered

10.1.6.3 Recent developments

10.1.7 CLEVELAND CLINIC

10.1.7.1 Business overview

TABLE 77 CLEVELAND CLINIC: BUSINESS OVERVIEW

FIGURE 46 CLEVELAND CLINIC: COMPANY SNAPSHOT (2020)

10.1.7.2 Products & services offered

10.1.7.3 Recent developments

10.1.8 EXOS

10.1.8.1 Business overview

TABLE 78 EXOS: BUSINESS OVERVIEW

10.1.8.2 Products & services offered

10.1.8.3 Recent developments

10.1.9 CERNER CORPORATION

10.1.9.1 Business overview

TABLE 79 CERNER CORPORATION: BUSINESS OVERVIEW

FIGURE 47 CERNER CORPORATION: COMPANY SNAPSHOT (2020)

10.1.9.2 Products & services offered

10.1.9.3 Recent developments

10.1.10 ALPHABET INC. (FITBIT)

10.1.10.1 Business overview

TABLE 80 GOOGLE LLC: BUSINESS OVERVIEW

FIGURE 48 ALPHABET, INC.: COMPANY SNAPSHOT (2020)

FIGURE 49 FITBIT, INC.: COMPANY SNAPSHOT (2019)

10.1.10.2 Products & services offered

10.1.10.3 Recent developments

10.1.11 LABORATORY CORPORATION OF AMERICA HOLDINGS

10.1.11.1 Business overview

TABLE 81 LABORATORY CORPORATION OF AMERICA HOLDINGS: BUSINESS OVERVIEW

FIGURE 50 LABORATORY CORPORATION OF AMERICA HOLDINGS: COMPANY SNAPSHOT (2020)

10.1.11.2 Products & services offered

10.1.11.3 Recent developments

10.1.12 LIFEWORKS, INC.

10.1.12.1 Business overview

TABLE 82 LIFEWORKS, INC.: BUSINESS OVERVIEW

FIGURE 51 LIFEWORKS, INC.: COMPANY SNAPSHOT (2020)

10.1.12.2 Products & services offered

10.1.12.3 Recent developments

10.1.12.4 MnM view

10.1.12.4.1 Right to win

10.1.12.4.2 Strategic choices made

10.1.13 CENTENE CORPORATION (MANAGED HEALTH NETWORK, INC.)

10.1.13.1 Business overview

TABLE 83 CENTENE CORPORATION: BUSINESS OVERVIEW

TABLE 84 MANAGED HEALTH NETWORK, INC.: BUSINESS OVERVIEW

FIGURE 52 CENTENE CORPORATION: COMPANY SNAPSHOT (2020)

10.1.13.2 Products & services offered

10.1.14 TELUS

10.1.14.1 Business overview

TABLE 85 TELUS: BUSINESS OVERVIEW

FIGURE 53 TELUS: COMPANY SNAPSHOT (2020)

10.1.14.2 Products & services offered

10.1.14.3 Recent developments

10.1.14.4 MnM view

10.1.14.4.1 Right to win

10.1.14.4.2 Strategic choices made

10.1.15 DISCOVERY LIMITED (VITALITY GROUP INTERNATIONAL, INC.)

10.1.15.1 Business overview

TABLE 86 DISCOVERY LIMITED: BUSINESS OVERVIEW

TABLE 87 VITALITY GROUP: BUSINESS OVERVIEW

FIGURE 54 DISCOVERY LIMITED: COMPANY SNAPSHOT (2020)

10.1.15.2 Products & services offered

10.1.15.3 Recent developments

10.2 OTHER EMERGING COMPANIES

10.2.1 WELLRIGHT

10.2.1.1 Business overview

TABLE 88 WELLRIGHT: BUSINESS OVERVIEW

10.2.1.2 Products & services offered

10.2.1.3 Recent developments

10.2.2 MEDCAN

10.2.2.1 Business overview

TABLE 89 MEDCAN: BUSINESS OVERVIEW

10.2.2.2 Products & services offered

10.2.2.3 Recent developments

10.2.3 SHARECARE

10.2.3.1 Business overview

TABLE 90 SHARECARE: BUSINESS OVERVIEW

10.2.3.2 Products & services offered

10.2.4 GILSBAR

10.2.4.1 Business overview

TABLE 91 GILSBAR: BUSINESS OVERVIEW

10.2.4.2 Products & services offered

10.2.5 LIMEADE

10.2.5.1 Business overview

TABLE 92 LIMEADE: BUSINESS OVERVIEW

FIGURE 55 LIMEADE: COMPANY SNAPSHOT (2020)

10.2.5.2 Products & services offered

10.2.5.3 Recent developments

10.2.6 TOTALWELLNESS

10.2.7 WELLSTEPS

10.2.8 ADURO, INC.

10.2.9 CORPORATE FITNESS WORKS

10.2.10 WELLWORKS FOR YOU

11 APPENDIX (Page No. - 221)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

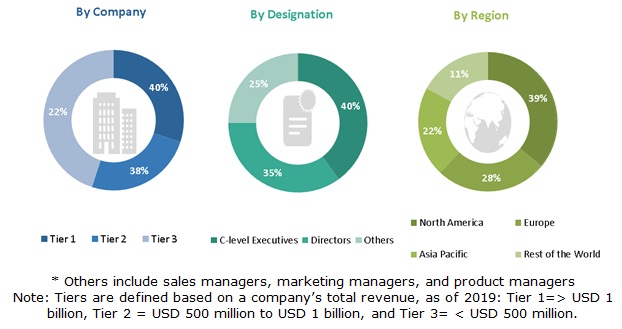

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

Secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the corporate wellness solutions market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The corporate wellness solutions market comprises several stakeholders such as corporate wellness solutions providers, wearable technology companies, government associations and agencies. The demand side of this market includes corporate businesses and organizations, executive workforce, HR/benefit specialists, employers, payers and providers.

Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents for corporate wellness solutions market is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product, by service offering, by end user and by region.

Data Triangulation

After arriving at the market size, the total corporate wellness solutions market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, analyze, and forecast the size of the corporate wellness solutions market on the basis of service offering, end user, and region.

- To provide detailed information on the major factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the market segments with respect to North America, Europe, Asia Pacific, and Rest of the World.

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as product launches, expansions, partnerships, agreements, collaborations, acquisitions and other developments in the market.

- To benchmark players within the corporate wellness solutions market using the Competitive Leadership Mapping framework which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific Corporate Wellness Solutions market into South Korea, New Zealand, and other countries

- Further breakdown of Rest of the World into Latin America and Middle East & Africa.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Corporate Wellness Solutions Market