U.S. Electronic Medical Records (EMR - Physician Office & Hospital) Market - Emerging Trends (Smart Cards, Speech Enabled EMR), Market Share, Winning Strategies, Adoption & Forecasts till 2015

An Electronic Medical Record (EMR) is the digital version of paper-based medical record. It is owned by a single healthcare provider organization such as a hospital or physician and contains detailed information of the care provided at every encounter of the provider. EMR contains the data captured or transcribed in the electronic format from several other adjunctive departments such as laboratory, pharmacy, or radiology. In addition to this, modern EMR may contain digitized images of paper documents; along with images of diagnostic procedures such as X-rays and EKGs. In the U.S., EMR have evolved into EHR solutions having an ability to form an integrated network when interconnected. Many EMR vendors across the U.S. have modified their offerings into EHR solutions for the healthcare community.

An EMR is a structured and integrated method of gathering, storing and retrieving, and sharing of a particular patient’s healthcare record. Electronic Medical Record (EMR) is an evolving concept, starting from storing medical records on computers - moving to computerized patient records, and recently being developed as an Electronic Health Records (EHR) system. Effective implementation of EMR helps in reducing administrative overheads that may add up to the bottom line profits for healthcare providers. In addition to this, it may result in increased revenue through effective utilization of resources, resulting in greater number of patients being attended to. However, the lack of standards for development of EMR solutions has resulted in a number of EMR solutions in the market that lack integration and interoperability among themselves.

EMR solutions help to achieve paperless administration across the healthcare industry. This form of administration facilitates creation of a centralized patient repository. The records generated through successful implementation of EMRs in healthcare practices can be used for various purposes such as patient care, administration, research, healthcare quality improvement, and processing of reimbursements. EMR is a part of healthcare information technology that is used to make paperless computerized patient data in order to increase efficiency of hospital systems and reduce chances of errors in medical records. A substantial growth rate (more than 16%) of the U.S. healthcare IT spending and the government initiatives towards development of a nationwide healthcare information network are expected to push EMR implementation across the healthcare sector in the U.S. As per a study by Harvard Medical School in 2008, administrative automation may result in saving 5% of the total healthcare spending or $100 billion in the U.S. by reducing adverse events such as adverse drug events, medical errors, and complications of interventions including hospital acquired infections. Similarly, overuse of emergency departments and unnecessary ordering of clinical and radiology tests result in loss of $55 billion, which could be saved by implementation of EMR systems at healthcare practices.

EMR helps to improve clinical efficiency in the following ways:

- Providing improved accessibility to patient records

- Improved communication between provider and clinical departments such as pharmacy, laboratory, and radiology departments

- Improved communication among healthcare facilities

- Reduced transcription cost and lesser number of chart pulls

- Improved clinical decision making through CDSS functions

The rising demand for the healthcare cost containment and need to improve the quality of healthcare service are driving the growth of the EMR market in the U.S. The U.S. EMR market is expected to grow from $2,177 million in 2009 to $6,054 million in 2015 at an estimated CAGR of 18.1% during the forecast period 2010-2015.

Though large-sized healthcare practices prefer on-site/client-server based EMR systems, web-based EMR solutions or ASP models are gaining higher popularity within the small sized healthcare practices and private physician offices.

The U.S. EMR market space is highly fragmented with more than 1000 players in the market. In 2010, Allscripts emerged as a market leader with 15.7% market share in the physician office EMR market; whereas Meditech led the hospital EMR segment with an overall market share of 24.9%.

Scope of the report

The report evaluates the U.S. EMR market with respect to its sub-segments on the basis of end users, components, and applications.

Each section provides market data, market drivers, trends and opportunities, top-selling products, key players, and competitive outlook. This report also provides market tables for covering the sub-segments and micro-markets. In addition, the report also provides more than 20 company profiles covering all the sub-segments.

Customer Interested in this report also can view

-

Worldwide Electronic Medical Records (EMR - Physician Office & Hospital) Market - Emerging Trends (Smart Cards, Speech Enabled EMR), Market Share, Winning Strategies, Adoption & Forecasts till 2015

The rising demand for healthcare cost containment and need to improve quality of healthcare service are driving the growth of the U.S. EMR market. In addition to this, the federal incentives of $20 billion for healthcare providers to achieve “meaningful use” of EMR solutions by 2015 are expected to drive the EMR market during the forecasted period. The U.S. EMR market is expected to grow from $2,177 million in 2009 to $6,054 million in 2015, at a CAGR of 18.1% from 2010 to 2015.

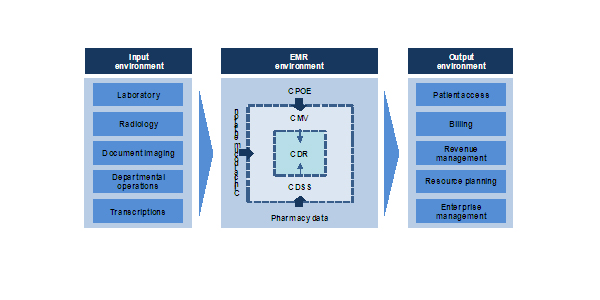

FRAMEWORK OF integrated EMR SYSTEM

At present, the market players are focusing on development of interoperable EMR solutions. Many companies have opted the route of agreements and partnerships to pull technical expertise and achieve their objective. Lowering the cost of EMR implementation is another burning issue within the industry that has driven growth of web-based EMR solutions within the industry. Though the client-server based EMRs formed approximately 76% of the EMR software market in 2009, web-based EMRs are gaining greater popularity within the smaller healthcare practices and expected to gain higher market share by 2015.

Industry players with the most significant developments include Allscripts, Cerner, McKesson, EMIS, and NextGen. They are undergoing consolidation to achieve marketing and distribution synergy and develop an interoperable EMR solution.

TABLE OF CONTENTS

EXECUTIVE SUMMARY

OBJECTIVE

MARKET SCENARIO

FUTURE TRENDS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

2 SUMMARY

3 MARKET OVERVIEW

3.1 INTRODUCTION

3.1.1 DEFINITION OF EMR

3.1.2 EMR ENVIRONMENT

3.1.3 NEED FOR AN EMR SOLUTION

3.1.4 EMR VERSUS EHR

3.1.5 SEGMENTATION OF EMR MARKET

3.2 KEY MARKET DYNAMICS

3.2.1 DRIVERS

3.2.1.1 Healthcare reforms & Federal incentives to contain healthcare costs

3.2.1.2 Growing need of integrated healthcare system

3.2.1.3 Increasing share of IT in healthcare expenditure

3.2.1.4 Improved quality of care through EMR implementation

3.2.1.5 Increased ROI through efficient utilization of EMR

3.2.2 RESTRAINTS

3.2.2.1 Interoperability & integration issues

3.2.2.2 Privacy & security issues

3.2.2.3 Reluctance for EMR use by doctors

3.2.3 OPPORTUNITIES

3.2.3.1 Manpower shortage in the healthcare industry

3.2.3.2 Increasing patient centric approach

3.3 KEY INDUSTRY INSIGHTS

3.3.1 WINNING IMPERATIVES

3.3.1.1 Development of interoperable solutions

3.3.1.2 Provide financing solutions

3.3.1.3 Intensive marketing strategies

3.3.2 GROWTH OF WEB-BASED EMR MARKET IN U.S.

3.3.3 ENTRY OF WAL-MART, DELL, IBM

3.3.3.1 Wal-Mart partnering with Dell & eClinicalWorks

3.3.3.2 Expected entry of Microsoft into EMR market

3.3.4 CONSOLIDATION OF EMR VENDORS

3.3.5 POTENTIAL ENTRY OF PHARMACEUTICAL COMPANIES

3.4 MARKET SHARE ANALYSIS

3.4.1 PHYSICIAN OFFICES: EMR MARKET SHARE

3.4.2 HOSPITALS: EMR MARKET SHARE

3.5 COST BENEFIT ANALYSIS

3.5.1 COST OF EMR ADOPTION

3.5.2 BENEFITS & ROI OF EMR ADOPTION

3.5.2.1 Time saving

3.5.2.2 Improved E&M coding

3.5.2.3 Reduced storage & maintenance cost

3.5.2.4 Reduction in transcription costs

3.5.2.5 Improved claims management

3.5.2.6 Improved charge capture

4 REGULATORY ENVIRONMENT

4.1 INTRODUCTION

4.2 REGULATORY BODIES

4.2.1 OFFICE OF NATIONAL COORDINATOR FOR HEALTH INFORMATION TECHNOLOGY (ONC)

4.2.1.1 Standards & certifications

4.2.1.1.1 Certification Commission for Healthcare Information Technology

4.2.1.1.2 Meaningful use

4.2.1.2 Privacy & security

4.2.2 HEALTHCARE INFORMATION TECHNOLOGY STANDARDS PANEL (HITSP)

4.3 AMERICAN RECOVERY AND REINVESTMENT ACT INCENTIVES

4.3.1 MEDICAID INCENTIVES

4.3.2 MEDICARE INCENTIVES

5 EMERGING TRENDS IN EMR

5.1 INTRODUCTION

5.2 EMERGING TECHNOLOGY TRENDS

5.2.1 SMART CARDS

5.2.2 SPEECH ENABLED EMR

5.2.3 INTEROPERABLE EMR SYSTEMS

5.3 EMERGING APPLICATION AREAS

5.3.1 CLINICAL TRIALS

5.3.2 PERSONAL HEALTH RECORD SYSTEM

6 EMR STANDARDS

6.1 INTRODUCTION

6.2 HL7

6.3 DICOM

6.4 ISO

6.4.1 ISO 18308

6.4.2 ISO/TC 215

6.5 ASTM

6.6 CEN 13606

7 EMR MARKET BY COMPONENTS

7.1 INTRODUCTION

7.2 EMR HARDWARE MARKET

7.3 EMR SOFTWARE MARKET

7.3.1 WEB-BASED EMR

7.3.2 CLIENT-SERVER-BASED EMR

7.4 EMR SERVICES MARKET

7.4.1 CONSULTING SERVICES

7.4.2 IMPLEMENTATION SERVICES

7.4.3 POST-SALES & MAINTENANCE SERVICES

7.4.4 TRAINING SERVICES

8 EMR MARKET BY END-USERS

8.1 INTRODUCTION

8.2 HOSPITALS

8.2.1 MARKET SIZE

8.3 PHYSICIAN OFFICES

8.3.1 MARKET SIZE

9 EMR MARKET BY APPLICATIONS

9.1 INTRODUCTION

9.2 GENERAL APPLICATION EMR

9.3 SPECIALTY SPECIFIC EMR

10 EMR BUYING CRITERIA (2010 VERSUS 2015)

10.1 INTRODUCTION

10.2 COST OF IMPLEMENTATION

10.3 INTEROPERABILITY

10.4 STANDARDIZATION

10.5 EASE OF OPERATION

10.6 VENDOR SUPPORT

10.7 SCALABILITY

11 STRATEGIC SOLUTIONS FOR MARKET PLAYERS

12 COMPETITIVE LANDSCAPE

12.1 KEY DEVELOPMENTS

12.1.1 MERGERS & ACQUISITIONS

12.1.2 AGREEMENTS & COLLABORATIONS

12.1.3 NEW PRODUCT LAUNCH

12.1.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

13.1 ALLSCRIPTS-MISYS HEALTHCARE SOLUTIONS INC

13.1.1 OVERVIEW

13.1.2 PRODUCTS & SERVICES

13.1.3 FINANCIALS

13.1.4 STRATEGY

13.1.5 DEVELOPMENTS

13.2 APRIMA MEDICAL SOFTWARE INC

13.2.1 OVERVIEW

13.2.2 PRODUCTS & SERVICES

13.2.3 FINACIALS

13.2.4 STRATEGY

13.2.5 DEVELOPMENTS

13.3 ATHENAHEALTH INC

13.3.1 OVERVIEW

13.3.2 PRODUCTS & SERVICES

13.3.3 FINANCIALS

13.3.4 STRATEGY

13.3.5 DEVELOPMENTS

13.4 BIZMATICS INC

13.4.1 OVERVIEW

13.4.2 PRODUCTS & SERVICES

13.4.3 FINANCIALS

13.4.4 STRATEGY

13.4.5 DEVELOPMENTS

13.5 CERNER CORP

13.5.1 OVERVIEW

13.5.2 PRODUCTS & SERVICES

13.5.3 FINANCIALS

13.5.4 STRATEGY

13.5.5 DEVELOPMENTS

13.6 COMPUTER PROGRAMS AND SYSTEMS INC

13.6.1 OVERVIEW

13.6.2 PRODUCTS & SERVICES

13.6.3 FINANCIALS

13.6.4 STRATEGY

13.6.5 DEVELOPMENTS

13.7 ECLINICALWORKS LLC

13.7.1 OVERVIEW

13.7.2 PRODUCTS & SERVICES

13.7.3 FINANCIALS

13.7.4 STRATEGY

13.7.5 DEVELOPMENTS

13.8 E-MDS INC

13.8.1 OVERVIEW

13.8.2 PRODUCTS & SERVICES

13.8.3 FINANCIALS

13.8.4 STRATEGY

13.8.5 DEVELOPMENTS

13.9 EPIC SYSTEMS

13.9.1 OVERVIEW

13.9.2 PRODUCTS & SERVICES

13.9.3 FINANCIALS

13.9.4 STRATEGY

13.9.5 DEVELOPMENTS

13.10 GE HEALTHCARE

13.10.1 OVERVIEW

13.10.2 PRODUCTS & SERVICES

13.10.3 FINACIALS

13.10.4 STRATEGY

13.10.5 DEVELOPMENTS

13.11 GREENWAY MEDICAL TECHNOLOGIES INC

13.11.1 OVERVIEW

13.11.2 PRODUCTS & SERVICES

13.11.3 FINANCIALS

13.11.4 STRATEGY

13.11.5 DEVELOPMENTS

13.12 HEALTHCARE MANAGEMENT SYSTEMS INC

13.12.1 OVERVIEW

13.12.2 PRODUCTS & SERVICES

13.12.3 FINANCIALS

13.12.4 STRATEGY

13.12.5 DEVELOPMENTS

13.13 HEALTHLAND

13.13.1 OVERVIEW

13.13.2 PRODUCTS & SERVICES

13.13.3 FINANCIALS

13.13.4 STRATEGY

13.13.5 DEVELOPMENTS

13.14 INFOR-MED MEDICAL INFORMATION SYSTEMS INC

13.14.1 OVERVIEW

13.14.2 PRODUCTS & SERVICES

13.14.3 FINANCIALS

13.14.4 STRATEGY

13.14.5 DEVELOPMENTS

13.15 INGENIX

13.15.1 OVERVIEW

13.15.2 PRODUCTS & SERVICES

13.15.3 FINANCIALS

13.15.4 STRATEGY

13.15.5 DEVELOPMENTS

13.16 MCKESSON CORP

13.16.1 OVERVIEW

13.16.2 PRODUCTS & SERVICES

13.16.3 FINANCIALS

13.16.4 STRATEGY

13.16.5 DEVELOPMENTS

13.17 MEDICAL INFORMATION TECHNOLOGY INC (MEDITECH)

13.17.1 OVERVIEW

13.17.2 PRODUCTS & SERVICES

13.17.3 FINANCIALS

13.17.4 STRATEGY

13.17.5 DEVELOPMENTS

13.18 NEXTGEN HEALTHCARE INFORMATION SYSTEMS INC

13.18.1 OVERVIEW

13.18.2 PRODUCTS & SERVICES

13.18.3 FINANCIALS

13.18.4 STRATEGY

13.18.5 DEVELOPMENTS

13.19 QHR TECHNOLOGIES INC

13.19.1 OVERVIEW

13.19.2 PRODUCTS & SERVICES

13.19.3 FINANCIALS

13.19.4 STRATEGY

13.19.5 DEVELOPMENTS

13.2 QUADRAMED

13.20.1 OVERVIEW

13.20.2 PRODUCTS & SERVICES

13.20.3 FINANCIALS

13.20.4 STRATEGY

13.20.5 DEVELOPMENTS

13.21 SAGE SOFTWARE HEALTHCARE INC

13.21.1 OVERVIEW

13.21.2 PRODUCTS & SERVICES

13.21.3 FINANCIALS

13.21.4 STRATEGY

13.21.5 DEVELOPMENTS

13.22 SIEMENS HEALTHCARE

13.22.1 OVERVIEW

13.22.2 PRODUCTS & SRVICES

13.22.3 FINANCIALS

13.22.4 STRATEGY

13.22.5 DEVELOPMENTS

13.23 WELLSOFT CORP

13.23.1 OVERVIEW

13.23.2 PRODUCTS & SERVICES

13.23.3 FINANCIALS

13.23.4 STRATEGY

13.23.5 DEVELOPMENTS

LIST OF TABLES

TABLE 1 U.S.: EMR MARKET REVENUE, BY END-USERS, 2008 – 2015 ($MILLION)

TABLE 2 EMR VERSUS EHR

TABLE 3 PHYSICIAN OFFICES: EMR INSTALLATIONS, 2010

TABLE 4 HOSPITAL EMR INSTALLATIONS, 2010

TABLE 5 MEDICAID INCENTIVES: BENEFICIARIES

TABLE 6 MEDICAID INCENTIVES: PAYMENT SCHEDULE

TABLE 7 MEDICARE INCENTIVES: BENEFICIARIES

TABLE 8 MEDICARE INCENTIVES: PAYMENT SCHEDULE

TABLE 9 EMR COMPONENTS MARKET REVENUE, BY PRODUCTS, 2008 – 2015 ($MILLION)

TABLE 10 EMR COMPONENTS MARKET Y-O-Y GROWTH RATE, BY PRODUCTS, 2009 – 2015

TABLE 11 EMR SOFTWARE MARKET REVENUE, BY PRODUCTS, 2008 – 2015 ($MILLION)

TABLE 12 EMR SOFTWARE MARKET Y-O-Y GROWTH RATE, BY PRODUCTS, 2009 - 2015

TABLE 13 U.S.: END-USERS MARKET REVENUE, 2008 - 2015 ($MILLION)

TABLE 14 U.S.: END-USERS EMR MARKET Y-O-Y GROWTH RATE, 2009 - 2015

TABLE 15 HOSPITAL EMR MARKET REVENUE, BY PRODUCTS, 2008 - 2015 ($MILLION)

TABLE 16 HOSPITAL EMR MARKET Y-O-Y GROWTH RATE, BY PRODUCTS, 2009 - 2015

TABLE 17 HOSPITAL EMR SOFTWARE MARKET REVENUE, BY PRODUCTS, 2008 - 2015 ($MILLION)

TABLE 18 HOSPITAL EMR SOFTWARE MARKET Y-O-Y GROWTH RATE, BY PRODUCTS, 2009 - 2015

TABLE 19 PHYSICIAN OFFICE EMR MARKET REVENUE, BY PRODUCTS, 2008 - 2015 ($MILLION)

TABLE 20 PHYSICIAN OFFICE EMR MARKET Y-O-Y GROWTH RATE, BY PRODUCTS, 2009 – 2015

TABLE 21 PHYSICIAN OFFICE EMR SOFTWARE MARKET REVENUE, BY PRODUCTS, 2008 - 2015 ($MILLION)

TABLE 22 PHYSICIAN OFFICE EMR SOFTWARE MARKET Y-O-Y GROWTH RATE, BY PRODUCTS, 2009 - 2015

TABLE 23 EMR MARKET REVENUE, BY APPLICATIONS, 2008 – 2015 ($MILLION)

TABLE 24 EMR MARKET Y-O-Y GROWTH RATE, BY APPLICATIONS, 2009 - 2015

TABLE 25 MERGERS & ACQUISITIONS

TABLE 26 AGREEMENTS & COLLABORATIONS, 2008 – 2010

TABLE 27 NEW PRODUCT LAUNCH, 2008 – 2010

TABLE 28 ALLSCRIPTS-MISYS HEALTHCARE SOLUTIONS: TOTAL REVENUE AND R&D EXPENSES ($MILLION)

TABLE 29 ALLSCRIPTS-MISYS HEALTHCARE SOLUTIONS: TOTAL REVENUE, BY SEGMENTS ($MILLION)

TABLE 30 ATHENAHEALTH INC: TOTAL REVENUE AND R&D EXPENSES ($MILLION)

TABLE 31 ATHENAHEALTH INC: TOTAL REVENUE, BY SEGMENTS ($MILLION)

TABLE 32 CERNER CORP: TOTAL REVENUE AND R&D EXPENSES ($MILLION)

TABLE 33 CERNER CORP: TOTAL REVENUE, BY GEOGRAPHY ($MILLION)

TABLE 34 CERNER CORP: TOTAL REVENUE, BY SEGMENTS ($MILLION)

TABLE 35 COMPUTER PROGRAMS AND SYSTEMS INC: TOTAL REVENUE, BY SEGMENTS ($MILLION)

TABLE 36 MCKESSON CORP: TOTAL REVENUE AND R&D EXPENSES ($MILLION)

TABLE 37 MCKESSON CORP: TOTAL REVENUE, BY SEGMENTS ($MILLION)

TABLE 38 MEDITECH: TOTAL REVENUE, BY COUNTRIES ($MILLION)

TABLE 39 MEDITECH: TOTAL REVENUE, BY SEGMENTS ($MILLION)

TABLE 40 QHR TECHNOLOGIES INC: TOTAL REVENUE, BY SEGMENTS ($MILLION)

TABLE 41 QHR TECHNOLOGIES INC: TOTAL REVENUE, BY COUNTRIES ($MILLION)

TABLE 42 SIEMENS HEALTHCARE: TOTAL REVENUE AND R&D EXPENSES ($MILLION)

TABLE 43 SIEMENS HEALTHCARE: TOTAL REVENUE, BY SEGMENTS ($MILLION)

TABLE 44 SIEMENS HEALTHCARE: TOTAL REVENUE, BY GEOGRAPHY ($MILLION)

LIST OF FIGURES

FIGURE 1 U.S.: EMR MARKET SIZE (2008 - 2015)

FIGURE 2 FRAMEWORK OF INTEGRATED EMR SYSTEM

FIGURE 3 EMR MARKET SEGMENTATION

FIGURE 4 KEY MARKET DYNAMICS

FIGURE 5 EMR MARKET ISSUES & WINNING STRATEGIES

FIGURE 6 INTENSIVE MARKETING STRATEGIES

FIGURE 7 EMR ADOPTION BY U.S. PHYSICIANS

FIGURE 8 PHYSICIAN OFFICES: EMR MARKET SHARE OF VENDORS (2010)

FIGURE 9 HOSPITAL EMR MARKET SHARE OF VENDORS (2010)

FIGURE 10 ROI ANALYSIS FOR EMR (PER PHYSICIAN BASIS)

FIGURE 11 OVERVIEW OF MEANINGFUL USE

FIGURE 12 BENEFICIARIES OF SMART CARD APPLICATIONS IN EMR

FIGURE 13 MODES OF DATA ENTRY FOR EMR SYSTEMS

FIGURE 14 INTEGRATION OF HEALTHCARE SERVICES & RESEARCH

FIGURE 15 EMR COMPONENTS MARKET SCENARIO (2010 VERSUS 2015)

FIGURE 16 EMR HARDWARE MARKET SIZE (2008 - 2015)

FIGURE 17 WEB-BASED EMR MARKET SIZE (2008 - 2015)

FIGURE 18 CLIENT-SERVER BASED EMR MARKET SIZE (2008 - 2015)

FIGURE 19 EMR SERVICES MARKET SIZE (2008 - 2015)

FIGURE 20 HOSPITAL EMR MARKET SIZE (2008 - 2015)

FIGURE 21 PHYSICIAN EMR MARKET SIZE (2008 - 2010)

FIGURE 22 GENERAL APPLICATION EMR MARKET SIZE (2008 - 2015)

FIGURE 23 SPECIALTY SPECIFIC EMR MARKET SIZE (2008 - 2015)

FIGURE 24 SPECIALTY SPECIFIC EMR MARKET SCENARIO

FIGURE 25 BUYING CRITERIA FOR EMR (2010 VERSUS 2015)

FIGURE 26 POSSIBLE STRATEGIES FOR EMR VENDORS

FIGURE 27 INTEGRATED APPROACH FOR EXCELLENCE IN SUPPORT SERVICE

FIGURE 28 INDUSTRY GROWTH STRATEGIES (2008 – 2010)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in U.S. Electronic Medical Records (EMR - Physician Office & Hospital) Market