U.S. Machine-to-Machine (M2M) Connections Market by Technology (Wired and Wireless), Industry Verticals (Healthcare, Utilities, Retail, Consumer Electronics, Automotive & Transportation, Security & Surveillance, and Others) - Forecast to 2020

A combination of wired and wireless technologies that enables two or more machines of the same type other than smartphones, tablets, and wearables among others to communicate with each other is known as M2M.

This report provides an in-depth analysis of the Machine-to-Machine market in the U.S. and segments the same based on technology and industry vertical. The different industry verticals covered in the report include automotive & transportation, utilities, healthcare, retail, security & surveillance, consumer electronics, and others.

The report also covers the major trends being followed in the M2M Communications market along with, market dynamics, Porterís analysis, and value chain analysis. The M2M market dynamics are categorized under four headers: drivers, restraints, opportunities, and challenges. The market related forecasts have been done using these market dynamics.

The report also includes the detailed profiles of various companies, currently active in the U.S. M2M market. In addition to the company profiles, the report also provides a competitive landscape (CL) of the key players in the market. The CL covers market ranking analysis, mergers and acquisitions, collaborations, partnerships, new product developments, and other key growth strategies of each player.

The report also provides detailed profiles of various companies currently active in this market. Some of the major players in the M2M market include AT&T (U.S.), Cisco (U.S.), Gemalto (The Netherlands), Intel (U.S), Jasper Technologies, Inc. (U.S), Sierra Wireless (Canada), Sprint (U.S.), Telit Communications (U.K), Texas Instruments (U.S.), T-Mobile (U.S), Verizon Communications, Inc. (U.S), and Vodafone (U.K.) among others.

KEY TAKE-AWAYS

- The U.S. Machine-to-Machine Communications market statistics with detailed classifications and splits based on the respective market size.

- Impact analysis of market dynamics along with, the factors currently driving and restraining the growth of the said market and their impact in the short, medium, and long-term

- Illustrative segmentation, analysis, and forecast of the major industry verticals to provide an overall view of the M2M connections market in the U.S.

- Detailed competitive landscape with identification of the key players in each type of product and application and an in-depth market share analysis with the respective revenue and market share rankings.

- Competitive intelligence based on the company profiles, key player strategies, and key developments such as product launches and acquisitions

- Complete value chain analysis of the M2M Communications market landscape along with the key stakeholders.

Please click here to get the relevant report of Machine-to-Machine (M2M) Connections Market by Technology (Wired, Wireless), Industry (Healthcare, Utilities, Retail, Consumer Electronics, Automotive & Transportation, Security & Surveillance, Others), and by Geography - Forecast to 2020

All forms of technologies that allow two or more machines of the same type except smartphones, tablets, and wearables among others, to communicate with each other through wired or wireless connectivity are known as Machine-to-Machine (M2M) connections.

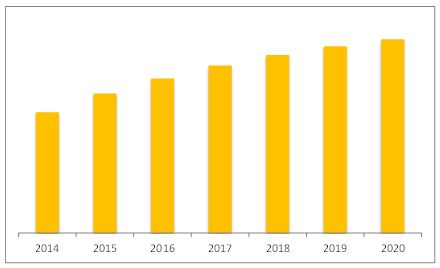

The market size of M2M Communications in the U.S. is expected to reach $7,262.76 Million by 2020, at a CAGR of 6.79% between 2015 and 2020.

Short-range technologies such as ZigBee, Wi-Fi, and Bluetooth are expected to dominate the M2M Communications market during the forecast period. The market share of wired and cellular technology 2G is projected to decline in the coming years. 3G and 4G/LTE technologies are anticipated to have high growth rates. Rising application of telematics in the automotive industry, demand for smart grids in the utilities sector, coupled with overall standardization of IPv6 are expected to propel the growth of U.S. Machine-to-Machine Communications market.

The market associated with the Machine-to-Machine Communications is poised to witness tremendous growth. Industries such as utilities and automotive & transportation are expected to be high growth areas for M2M connections.

This report covers the U.S. Machine-to-Machine Communications market on the basis of different types of technologies and industry verticals. The major technologies considered for this study are wired and wireless. The wireless technology has been further segmented into short range and cellular.

Some of the major industry players in the said market are Gemalto (The Netherlands), Sierra Wireless (Canada), Telit PLC (U.K.), AT&T (U.S.), Vodafone (U.K.), Jasper Wireless Inc. (U.S.), and Intel (U.S.) among others.

U.S. M2M Communications Market Size ($Million), 2014-2020

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Year

1.4 Currency

1.5 Package

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Market

4.2 Machine-to-Machine Communications Market, By Technology

4.3 Short Range: Machine-to-Machine Communications market, By Wireless Technology

4.4 Machine-to-Machine Communications Market, By Cellular Technology

4.5 Machine-to-Machine Communications Market, By Industry Vertical

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market, By Technology

5.2.2 Machine-to-Machine Communications market, By Industry Vertical

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Migration to 3G and 4G Networks

5.3.1.2 Adoption of M2M Technology in Telematics and Telemetry Related Applications

5.3.2 Restraints

5.3.2.1 Lack of Standardization

5.3.2.2 Inability to Leverage the Benefits of Mobility

5.3.3 Opportunities

5.3.3.1 Strategic Partnerships With System Integrators

5.3.3.2 Growth of the Connected Car Market

5.3.4 Challenge

5.3.4.1 Privacy & Security

5.3.5 Winning Imperative

5.3.5.1 Certifications for M2M Modules

5.3.6 Burning Issue

5.3.6.1 Establishment and Execution of Regulations, Standards, and Protocols

6 Industry Trends (Page No. - 42)

6.1 Strategic Benchmarking

6.1.1 Product Innovation and Development

6.2 Value Chain Analysis

6.3 Porterís Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Market, By Technology (Page No. - 50)

7.1 Introduction

7.2 Wired Technologies

7.2.1 Ethernet

7.2.1.1 Industrial Ethernet

7.3 Wireless Technologies

7.3.1 Short-Range

7.3.1.1 Wi-Fi

7.3.1.2 Zigbee

7.3.1.3 Bluetooth

7.3.2 Cellular Technologies

7.3.2.1 Second Generation (2G)

7.3.2.2 Third Generation (3G)

7.3.2.3 Fourth Generation (4G)/Long Term Evolution (Lte)

8 Market, By Industry Vertical (Page No. - 62)

8.1 Introduction

8.2 Healthcare

8.2.1 Patient Monitoring & Tracking

8.2.2 Telemedicine

8.3 Utilities

8.3.1 Smart Grids

8.3.2 Smart Meters

8.4 Automotive & Transportation

8.4.1 Telematics

8.4.2 Fleet Tracking/Monitoring

8.5 Retail

8.5.1 Digital Signage & Point-Of-Sales

8.5.2 Vending Machine & ATMs

8.6 Consumer Electronic

8.6.1 Smart TV and Smart TV Consoles

8.6.2 Smart Appliances

8.7 Security & Surveillance

8.7.1 Commercial & Residential Security

8.7.2 Remote Surveillance

8.8 Others

8.8.1 Oil & Gas

8.8.2 Agriculture

9 Competitive Landscape (Page No. - 82)

9.1 Introduction

9.2 Major Market Players

9.3 Competitive Situation and Trends

9.3.1 New Product Launches, Developments

9.3.2 Acquisitions, Collaborations, and Partnerships

9.3.3 Other Developments

10 Company Profiles (Page No. - 88)

(Overview, Products and Services, Financials, Strategy & Development)*

10.1 AT&T Inc.

10.2 Cisco Systems Inc.

10.3 Gemalto

10.4 Intel

10.5 Jasper Technologies Inc.

10.6 Sierra Wireless

10.7 Sprint Corporation

10.8 Telit Communications

10.9 Texas Instruments

10.10 T-Mobile Us, Inc.

10.11 Verizon Communication Inc.

10.12 Vodafone Group PLC.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 119)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Introducing RT: Real Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

List of Tables (52 Tables)

Table 1 Migration to 3G & 4G Connectivity is Expected to Propel the Growth of M2M Connections Market

Table 2 Lack of Standardization is Restraining the Market Growth

Table 3 Connected Car Market is A Key Growth Area for Machine-to-Machine Communications marketTable 4 Privacy & Security Issues are Constraining the Growth of the M2M Connections Market

Table 5 Market Size, By Technology, 2013-2020 ($Million)

Table 6 Machine-to-Machine Communications Market Size, By Technology, 2013-2020 (Million Connections)

Table 7 Wired Technology: U.S. Machine-to-Machine Communications market Size, By Industry Vertical, 2013-2020 ($Million)

Table 8 Wired Technology: Market Size, By Industry Vertical, 2013-2020 (Million Connections)

Table 9 Wireless Technology: U.S. Market Size, By Technology, 2013-2020 ($Million)

Table 10 Wireless Technology: Market Size, By Technology, 2013-2020 (Million Connections)

Table 11 Wireless Technology: Market Size, By Industry Vertical, 2013-2020 ($Million)

Table 12 Wireless Technology: Market Size, By Industry Vertical, 2013-2020 (Million Connections)

Table 13 Short-Range: market Size, By Wireless Technology, 2013-2020 ($Million)

Table 14 Short-Range: Market Size, By Wireless Technology, 2013-2020 (Million Connections)

Table 15 Short-Range: U.S. Machine-to-Machine Communications market Size, By Industry Vertical, 2013-2020 ($Million)

Table 16 Short-Range: Market Size, By Industry Vertical, 2013-2020 (Million Connections)

Table 17 Cellular: Market Size, By Wireless Technology, 2013-2020 ($Million)

Table 18 Cellular: U.S. Machine-to-Machine Communications market Size, By Wireless Technology, 2013-2020 (Million Connections)

Table 19 Cellular: Machine-to-Machine Communications Market Size, By Industry Vertical, 2013-2020 ($Million)

Table 20 Cellular: Machine-to-Machine Communications Market Size, By Industry Vertical, 2013-2020 (Million Connections)

Table 21 Machine-to-Machine Communications Market Size, By Industry Vertical, 2013-2020 ($Million)

Table 22 Market Size, By Industry Vertical, 2013-2020 (Million Connections)

Table 23 Healthcare: Market Size, By Technology, 2013-2020 ($Million)

Table 24 Healthcare: U.S. Machine-to-Machine Communications market Size, By Technology, 2013-2020 (Million Connections)

Table 25 Healthcare: Market Size, By Wireless Technology, 2013-2020 ($Million)

Table 26 Healthcare: Machine-to-Machine Communications Market Size, By Wireless Technology, 2013-2020 (Million Connections)

Table 27 Utilities: U.S. M2M Connections Market Size, By Technology, 2013-2020 ($Million)

Table 28 Utilities: Market Size, By Technology, 2013-2020 (Million Connections)

Table 29 Utilities: U.S. M2M Connections Market Size, By Wireless Technology, 2013-2020 ($Million)

Table 30 Utilities: U.S. M2M Connections Market Size, By Wireless Technology, 2013-2020 (Million Connections)

Table 31 Automotive & Transportation: market Size, By Technology, 2013-2020 ($Million)

Table 32 Automotive & Transportation: U.S. M2M Connections Market Size, By Technology, 2013-2020 (Million Connections)

Table 33 Automotive & Transportation: Market Size, By Wireless Technology, 2013-2020 ($Million)

Table 34 Automotive & Transportation: Market Size, By Wireless Technology, 2013-2020 (Million Connections)

Table 35 Retail: U.S. M2M Connections Market Size, By Technology, 2013-2020 ($Million)

Table 36 Retail: market Size, By Technology, 2013-2020 (Million Connections)

Table 37 Retail: U.S. M2M Connections Market Size, By Wireless Technology, 2013-2020 ($Million)

Table 38 Retail: M2M Connections Market Size, By Wireless Technology, 2013-2020 (Million Connections)

Table 39 Consumer Electronics: U.S. M2M Connections Market Size, By Technology, 2013-2020 ($Million)

Table 40 Consumer Electronics: M2M Connections Market Size, By Technology, 2013-2020 (Million Connections)

Table 41 Security & Surveillance: U.S. M2M Connections Market Size, By Technology, 2013-2020 ($Million)

Table 42 Security & Surveillance: U.S. M2M Connections Market Size, By Technology, 2013-2020 (Million Connections)

Table 43 Security & Surveillance: Market Size, By Wireless Technology, 2013-2020 ($Million)

Table 44 Security & Surveillance: U.S. M2M Connections Market Size, By Wireless Technology, 2013-2020 (Million Connections)

Table 45 Others: M2M Connections Market Size, By Technology, 2013-2020 ($Million)

Table 46 Others: M2M Connections Market Size, By Technology, 2013-2020 (Million Connections)

Table 47 Others: U.S. M2M Connections Market Size, By Wireless Technology, 2013-2020 ($Million)

Table 48 Others: Market Size, By Wireless Technology, 2013-2020 (Million Connections)

Table 49 U.S. M2M Connections Market Rankings, By Key Player, 2014

Table 50 New Product Launches, Developments, & Expansions in the Machine-To-Machine Market, 2015

Table 51 Acquisitions, Collaborations, Partnerships, and Agreements in the Smart Sensor Market, 2015

Table 52 Other Developments, 2015

List of Figures (53 Figures)

Figure 1 M2M Connections Market, By Technology

Figure 2 Research Design

Figure 3 Machine-to-Machine Communications Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown & Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 U.S. M2M Connections Market in Terms of Value & Volume, 2015Ė2020

Figure 8 U.S. M2M Connections Market, By Technology, 2015-2020

Figure 9 U.S. Machine-to-Machine Communications market, By Industry Vertical, 2014

Figure 10 M2M Connections Market, By Short-Range Technology: Wi-Fi Connectivity is Expected to Dominate the Market During the Forecast Period

Figure 11 M2M Connections Market, By Cellular Connectivity: 4G Technology is Expected to Witness the Highest Growth Rate

Figure 12 The U.S. M2M Connections Market Presents Lucrative Growth Opportunities

Figure 13 Wireless Technology Would Continue to Dominate the Market During the Forecast Period

Figure 14 Bluetooth Technology is Expected to Witness the Fastest Growth During the Forecast Period

Figure 15 4G Connectivity is Projected to Witness the Highest CAGR During the Forecast Period

Figure 16 The Automotive & Transportation Sector Would Continue to Dominate the Market During the Forecast Period

Figure 17 M2M Connections Market, By Technology

Figure 18 Machine-to-Machine Communications market, By Industry Vertical

Figure 19 Migration to 3G and 4G Networks: Key Driver for the M2M Connections Market

Figure 20 Growth of Global Lte (4G) Connections

Figure 21 Percentage of Population Covered By Lte Networks

Figure 22 Strategic Benchmarking: Companies Largely Adopted Organic Growth Strategies for Product Innovation & Enhancement

Figure 23 Value Chain Analysis: M2M Platform Providers are the Key Players

Figure 24 Porterís Five Forces Analysis, 2014

Figure 25 Graphical Representation of Porterís Five Forces Analysis

Figure 26 Threat of New Entrants

Figure 27 Threat of Substitutes

Figure 28 Bargaining Power of Suppliers

Figure 29 Bargaining Power of Buyers

Figure 30 Intensity of Competitive Rivalry

Figure 31 U.S. M2M Connections Market Size, By Technology, 2015-2020 (Million Connections)

Figure 32 Wireless Technology: U.S. M2M Connections Market Size, By Technology, 2015-2020 ($Million)

Figure 33 U.S. M2M Connections Market Size, By Industry Vertical, 2015-2020 (Million Connections)

Figure 34 Utilities: U.S. Machine-to-Machine Communications market Volume (Million Connections): By Technology, 2015-2020

Figure 35 Consumer Electronics: U.S. M2M Connections Market Value ($Million) & Volume (Million Connections), By Wireless Technology, 2013-2020

Figure 36 Companies That Adopted Product Innovation as the Key Growth Strategy

Figure 37 Battle for Market Share: New Product Launches Comprise the Key Strategy

Figure 38 AT&T: Company Snapshot

Figure 39 AT&T: SWOT Analysis

Figure 40 Cisco: Company Snapshot

Figure 41 Cisco: SWOT Analysis

Figure 42 Gemalto: Company Snapshot

Figure 43 Gemalto: SWOT Analysis

Figure 44 Intel: Company Snapshot

Figure 45 Intel: SWOT Analysis

Figure 46 Sierra Wireless: Company Snapshot

Figure 47 Sprint: Company Snapshot

Figure 48 Telit Communications: Business Overview

Figure 49 Texas Instruments: Company Snapshot

Figure 50 Texas Instruments: SWOT Analysis

Figure 51 T-Mobile Us, Inc.: Company Snapshot

Figure 52 Verizon: Company Snapshot

Figure 53 Vodafone Group PLC.: Company Snapshot

Growth opportunities and latent adjacency in U.S. Machine-to-Machine (M2M) Connections Market