U.S. Veterinary Infusion Pumps Market by Type (Large Volume Infusion Pumps, Syringe Infusion Pumps), End User (Private Hospitals, Private Clinics, Teaching Hospitals) - Global Forecast to 2021

[105 Pages Report] The U.S. veterinary infusion pumps market is estimated to grow at a CAGR of 5.8% from 2016 to 2021, to reach USD 35.4 Million by 2021. Factors such as the growing demand for pet insurance and increasing animal healthcare expenditure, rising demand for animal-derived food products, and growth in the number of veterinary practitioners and their income levels are the primary growth drivers for this market. Growing adoption of companion animals and increasing prevalence of animal diseases requiring surgeries are expected to offer significant growth opportunities to market players in the coming years. However, increasing pet care costs may hinder the growth of this market to a certain extent.

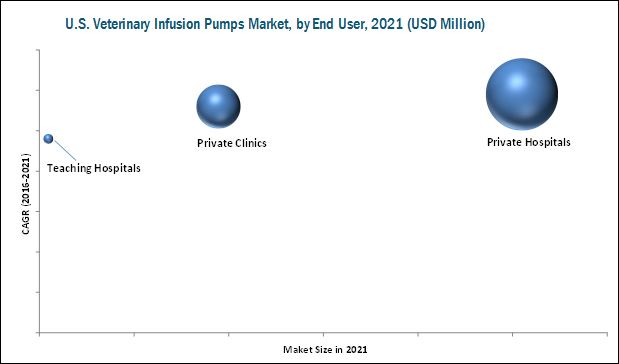

In this report, the market is segmented on the basis of type and end user. On the basis of type, the market is segmented into large-volume infusion pumps and syringe infusion pumps. In 2015, the large-volume infusion pumps segment accounted for the largest market share, primarily due to the increasing use of these pumps for delivering large volumes of fluids to animals during emergency conditions, providing blood transfusions, and administering total parenteral nutrition at continuous predetermined medium-to-high flow rates. Based on end user, the market is segmented into private hospitals, private clinics, and teaching hospitals. Private hospitals are expected to dominate this market in 2015.

Some of the prominent players operating in the U.S. veterinary infusion pumps market include DRE Veterinary (U.S.), Jorgensen Laboratories (U.S.), Heska Corporation (U.S.), Digicare Biomedical Technology Inc. (U.S.), B. Braun Melsungen AG (Germany), Q Core Medical Ltd. (Israel), Grady Medical System Inc. (U.S.), Mediaid Inc. (U.S.), Burtons Medical Equipment Ltd. (U.K.), Jørgen Kruuse A/S (Denmark), and Kent Scientific Corporation (U.S.).

Target Audience:

- Veterinary Equipment Manufacturers and Distributors

- Veterinary Institutions

- Contract Manufacturing Organizations (CMOs)

- Government Associations

- Market Research and Consulting Firms

- Venture Capitalists and Investors

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report:

This research report categorizes the U.S. veterinary infusion pumps market into the following segments:

U.S. Veterinary Infusion Pumps Market, by Type

- Large-volume Infusion Pumps

- Syringe Infusion Pumps

U.S. Veterinary Infusion Pumps Market, by End User

- Private Hospitals

- Private Clinics

- Teaching Hospitals

The U.S. veterinary infusion pumps market is expected to witness growth in the coming years as a result of the growing demand for pet insurance and increasing animal healthcare expenditure, rising demand for animal-derived food products, and growth in the number of veterinary practitioners and their income levels. This market is projected to reach USD 35.4 Million by 2021 from USD 26.6 Million in 2016, at a CAGR of 5.8% from 2016 to 2021. Growing adoption of companion animals and increasing prevalence of animal diseases requiring surgeries are the major factors that are expected to offer potential growth opportunities to market players. However, increasing pet care costs may hinder the growth of this market to a certain extent.

This report analyzes the market by type and end user. On the basis of type, the market is segmented into large-volume infusion pumps and syringe infusion pumps. In 2015, the large-volume infusion pumps segment accounted for the largest market share, primarily due to the increasing use of these pumps for delivering large volumes of fluids to animals during emergency conditions, providing blood transfusions, and administering total parenteral nutrition at continuous predetermined medium-to-high flow rates. Based on end user, the market is segmented into private hospitals, private clinics, and teaching hospitals. Private hospitals are expected to dominate this market in 2015.

The U.S. veterinary infusion pumps market is characterized by the presence of a large number of players. The market is dominated by DRE Veterinary (U.S.) and Jorgensen Laboratories (U.S.). Other players operating in this market are Heska Corporation (U.S.), Digicare Biomedical Technology Inc. (U.S.), B. Braun Melsungen AG (Germany), Q Core Medical Ltd. (Israel), Grady Medical System Inc. (U.S.), Mediaid Inc. (U.S.), Burtons Medical Equipment Ltd. (U.K.), Jørgen Kruuse A/S (Denmark), and Kent Scientific Corporation (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Research Approach

2.1.1 Secondary Sources

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Sources

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimations

2.2.1 Top-Dowm Approach

2.2.2 Bottom-Up Approach

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Assumption for the Study

3 Executive Summary

4 Market Overview

4.1 U.S. Veterinary Equipment Market

4.2 Veterinary Practices in the U.S.

4.3 Market Dynamics

4.3.1 Key Market Drivers

4.3.2 Key Market Restraints

4.3.3 Key Market Opportunities

4.3.4 Key Market Trends

5 U.S.Veterinary Infusion Pumps Market, By Type

5.1 Introduction

5.2 Large-Volume Infusion Pumps

5.3 Syringe Infusion Pumps

6 U.S.Veterinary Infusion Pumps Market, By End User

6.1 Introduction

6.2 Private Hospitals

6.3 Private Clinics

6.4 Teaching Hospitals

7 Key Players in the Market

7.1 B. Braun Melsungen AG

7.2 Heska Corporation

7.3 DRE Veterinary

7.4 Digicare Biomedical Technology, Inc.

7.5 Grady Medical Systems, Inc.

7.6 Jorgen Kruuse A/S

7.7 Jorgensen Laboratories

7.8 Leading Edge Veterinary Equipment

7.9 Q Core Medical Ltd.

7.10 Burtons Medical Equipment Ltd.

8 Key Distributors of Veterinary Infusion Pumps in the U.S.

9 Key Customers of Veterinary Infusion Pumps in the U.S.

10 Appendix

10.1 Insights of Industry Experts

10.2 Discussion Guide

10.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

10.4 Introducing RT: Real-Time Market Intelligence

10.5 Related Reports

List of Tables (17 Tables)

Table 1 North America Veterinary Equipment & Disposables Market Size, By Country, 2014–2021 (USD Million)

Table 2 U.S. Veterinary Equipment & Disposables Market Size, By Type, 2014–2021 (USD Million)

Table 3 U.S.: Number of Veterinarians in Private Clinical Practices, 2015

Table 4 U.S.: Number of Veterinarians in Public & Corporate Employment, 2015

Table 5 Veterinary Expenditure Per Animal, 2007 vs 2012 (USD)

Table 6 Meat Consumption in the U.S. (Kg/Capita), 2011–2015

Table 7 U.S.: Veterinary Graduates Per Year (2016–2021)

Table 8 Salary for Veterinarians in Public & Corporate Employment and Private Clinical Practice

Table 9 U.S. Veterinary Infusion Pumps Market Size, By Type, 2014–2021 (USD Million)

Table 10 Average Selling Price (ASP) of Veterinary Infusion Pumps in the U.S., 2014–2021 (USD)

Table 11 Market Size, By Type, 2014–2021 (Units)

Table 12 Major Large-Volume Infusion Pumps Available in the U.S

Table 13 Major Syringe Infusion Pumps Available in the U.S

Table 14 Market Size, By End User, 2014–2021 (USD Million)

Table 15 List of Key Distributors of Veterinary Infusion Pumps in the U.S.

Table 16 Major Veterinary Teaching Hospitals in the U.S

Table 17 List of Major Private Veterinary Hospitals in the U.S.

List of Figures (19 Figures)

Figure 1 U.S. Veterinary Infusion Pumps Market

Figure 2 Research Methodology

Figure 3 Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type and Designation

Figure 5 Top-Down Approach

Figure 6 Bottom-Up Approach

Figure 7 Data Triangulation Methodology

Figure 8 Market: Drivers, Restraints, Opportunities, and Trends

Figure 9 Market Size, 2014–2021 (USD Million)

Figure 10 U.S. Large-Volume Infusion Pumps Market Size, 2014–2021 (USD Million)

Figure 11 U.S. Large-Volume Infusion Pumps Market Share Analysis, 2015

Figure 12 U.S. Syringe Infusion Pumps Market Size, 2014–2021 (USD Million)

Figure 13 U.S. Syringe Infusion Pumps Market Share Analysis, 2015

Figure 14 U.S Veterinary Infusion Pumps Market Size for Private Hospitals, 2014–2021 (USD Million)

Figure 15 U.S Veterinary Infusion Pumps Market Size for Private Clinics, 2014–2021 (USD Million)

Figure 16 U.S Veterinary Infusion Pumps Market Size for Teaching Hospitals, 2014–2021 (USD Million)

Figure 17 Braun Melsungen AG: Company Snapshot

Figure 18 Heska Corporation: Company Snapshot

Figure 19 Key Customer Segments of Veterinary Infusion Pumps in the U.S.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in U.S. Veterinary Infusion Pumps Market