Turboexpander Market by Loading Device (Compressor, Generator, and Oil Break), Application (Air Separation, and Hydrocarbon), End-User (Manufacturing, Oil & Gas, and Power Generation), and Region - Global Forecast to 2023

[121 Pages Report] The global turboexpander market was valued at USD 280.5 Million in 2017 and is projected to reach USD 390.8 Million by 2023, at a CAGR of 6.11% during the forecast period.

Years considered for the study are as follows:

- Base Year: 2017

- Estimated Year: 2018

- Projected Year: 2023

- Forecast Period: 2018 2023

The base year considered for company profiles is 2017. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define and classify the turboexpander market by loading device, application, end-user, and region

- To provide detailed information on major factors influencing the growth of the turboexpanders market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contributions to the market

- To analyze turboexpanders market opportunities and competitive landscape for stakeholders and market leaders

- To forecast the growth of the turboexpanders market with respect to major regions (Asia Pacific, Europe, North America, and rest of the world)

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as new product development, mergers & acquisitions, expansions & investments, partnerships & collaborations, and contracts & agreements in the turboexpanders market

Research Methodology

This research involved the use of extensive secondary sources, directories, journals on power generation technologies, and other related rental markets, newsletters and databases such as Hoovers, Bloomberg, Businessweek, and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the global turboexpanders market. Primary sources used include interviews with several industry experts from the core and related industries, vendors, preferred suppliers, technology developers, alliances, and organizations related to all the segments of this industrys value chain. The research methodology has been explained below.

- Study of annual revenues and market developments of key players in the market

- Analysis of major end uses and applications of turboexpanders

- Assessment of future trends and growth of the turboexpanders market based on investments in key end-user segments such as manufacturing, oil & gas, and power generation

- Study of contracts and developments pertaining to the market by key players across different regions

- Finalization of overall market size by triangulating supply-side data, which includes product developments, supply chains, and annual revenues of companies manufacturing turboexpanders across the globe

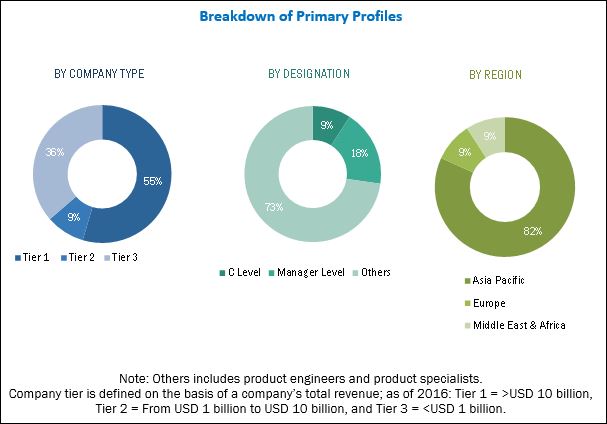

After arriving at the overall turboexpander market size, the total market was split into several segments and sub-segments. The figure given below illustrates the breakdown of primary interviews conducted for this study based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Major players operating in the turboexpander market are Atlas Copco (Sweden), BHGE (US), Cryostar (Switzerland), Air Products and Chemicals (UK), and L.A. Turbine (US).

Target Audience:

- Turboexpander manufacturing companies

- LNG transmission and distribution companies

- Power generation companies

- LNG refinery EPC contractors

- Governments and industry associations

Scope of the Report:

- Compressor

- Generator

- Oil Break

- Hydrocarbon Turboexpanders

- Air Separation Turboexpanders

- Others*

- Oil & Gas

- Manufacturing

- Power Generation

- Asia Pacific

- North America

- Europe

- Rest of the World

By Loading Device

By Application

By End-User

By Region

Others* include turboexpanders for pressure letdown, geothermal, and waste heat recovery applications

Rest of the World includes the Middle East, Africa, and South America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. Following customization options are available for this report:

Company Information

Detailed analyses and profiling of additional market players (up to five)

The global turboexpander market is expected to reach USD 390.8 Million by 2023 from ~FUSD 290.6 Million in 2018, at a CAGR of 6.61% during the forecast period. This market growth can be attributed to increasing share of natural gas in primary energy consumption and increasing focus of end users such as the manufacturing and oil & gas industries on energy efficiency. Turboexpanders are mainly used for the liquification of natural gases and in petrochemical applications such as hydrogen, nitrogen and ammonia purification and ethylene production. Increasing production of natural gas is expected to create the demand for turboexpander in hydrocarbon applications. So, rising natural gas production is expected to boost the demand for turboexpanders.

The report segments the turboexpander market by loading device into compressor, generator, and oil break. The compressor segment is expected to hold the largest market share (by value) by 2023. Increased production of natural gas by key oil & gas companies is one of the major factors driving the turboexpanders market in various countries such as China, US, and Russia.

The turboexpanders market by application is segmented into hydrocarbon turboexpanders, air separation turboexpanders, and others. Others includes turboexpanders used for pressure letdown, geothermal, and waste heat recovery applications. The hydrocarbon segment is expected to dominate the turboexpanders market (by value) by 2023. Hydrocarbon turboexpanders deliver shaft power output in the range of 1,600 kW to 20,000 kW for various applications such as liquefaction of natural gases, dew point control, and FPSO LNG. Increase in production of shale gas is one of the major factors driving the growth of the hydrocarbon turboexpanders market across various regions.

The oil & gas segment is expected to hold the largest turboexpander market share (by value) during the forecast period. According to the BP Statistical Review of World Energy 2017, natural gas production was 3,192.2 BCM in 2010 and reached 3,551.6 BCM in 2016, the CAGR being 1.8% during this period. Increased production of LNG and LPG are expected to be the major drivers boosting growth of the turboexpanders market in the oil & gas sector.

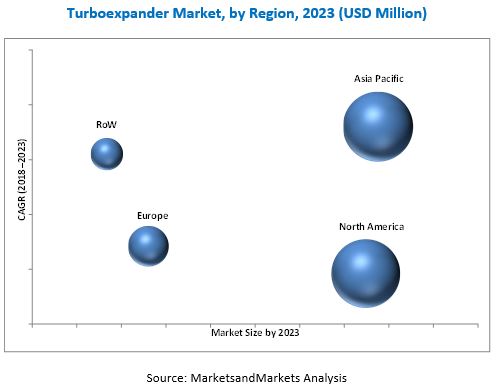

In this report, the turboexpanders market has been analyzed with respect to four regions, namely, North America, Europe, Asia Pacific, and rest of the world. Asia Pacific is estimated to be the largest turboexpander market between 2018 and 2023. As per the BP Statistical Review of World Energy 2017, natural gas production increased from 490.6 billion cubic meters in 2010 to 579.9 billion cubic meters in 2016 in Asia Pacific, indicating a positive growth curve of the turboexpanders market in this region. Factors, such as increasing investments in natural gas production plants are driving the Asia Pacific turboexpanders market during the forecasted period.

However, high initial costs of small-scale installations could act as a restraint for the market. Leading players in the turboexpander market are Atlas Copco (Sweden), BHGE (US), Cryostar (France), Air Products and Chemicals (US), and L.A. Turbine (US). Signing contracts and agreements was the most commonly adopted strategy by top players, followed by investments and expansions and mergers and acquisitions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Turboexpander Market

4.2 Turboexpanders Market, By Loading Device

4.3 Turboexpanders Market, By Application

4.4 Turboexpanders Market, By End-User

4.5 North American Turboexpanders Market, By Country and End-User

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Share of Natural Gas in Primary Energy Consumption

5.2.1.2 Increasing Focus on Energy Efficiency

5.2.2 Restraints

5.2.2.1 High Initial Cost for Smaller Installations

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Cryogenic Liquids

5.2.4 Challenges

5.2.4.1 Availability of Alternative Energy Recovery Devices and Pressure Letdown Systems

6 Turboexpander Market, By Loading Device (Page No. - 35)

6.1 Introduction

6.2 Compressor

6.3 Generator

6.4 Oil Break

7 Turboexpander Market, By Application (Page No. - 41)

7.1 Introduction

7.2 Hydrocarbon

7.3 Air Separation

7.4 Others

8 Turboexpander Market, By End-User (Page No. - 47)

8.1 Introduction

8.2 Oil & Gas

8.3 Manufacturing

8.4 Power Generation

9 Turboexpander Market, By Region (Page No. - 53)

9.1 Introduction

9.2 North America

9.2.1 By Application

9.2.2 By End-User

9.2.3 By Loading Device

9.2.4 By Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3 Asia Pacific

9.3.1 By Application

9.3.2 By End-User

9.3.3 By Loading Device

9.3.4 By Country

9.3.4.1 China

9.3.4.2 India

9.3.4.3 Japan

9.3.4.4 Rest of Asia Pacific

9.4 Europe

9.4.1 By Application

9.4.2 By End-User

9.4.3 By Loading Device

9.4.4 By Country

9.4.4.1 Germany

9.4.4.2 Russia

9.4.4.3 Rest of Europe

9.5 Rest of the World

9.5.1 By Application

9.5.2 By End-User

9.5.3 By Loading Device

9.5.4 By Country

9.5.4.1 Brazil

9.5.4.2 Saudi Arabia

9.5.4.3 Others

10 Competitive Landscape (Page No. - 83)

10.1 Overview

10.2 Ranking of Players and Market Concentration

10.3 Competitive Scenario

10.3.1 Contracts & Agreements

10.3.2 Investments and Expansions

10.3.3 Mergers & Acquisitions

10.3.4 New Product Launches

10.3.5 Partnerships & Collaborations

11 Company Profiles (Page No. - 89)

11.1 Benchmarking

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.2 Atlas Copco

11.3 Bhge

11.4 Cryostar

11.5 Air Products and Chemicals

11.6 L.A. Turbine

11.7 Honeywell

11.8 Man

11.9 Siemens

11.10 ACD

11.11 Elliott Group

11.12 R&D Dynamics Corporation

11.13 Turbogaz

*Details on Business Overview, Products Offered, Recent Developments, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 113)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customization

12.6 Related Report

12.7 Author Details

List of Tables (78 Tables)

Table 1 Turboexpanders Market Snapshot

Table 2 Market Size, By Loading Device, 20162023 (Units)

Table 3 Market Size, By Loading Device, 20162023 (USD Million)

Table 4 Compressor: Market Size, By Region, 20162023 (Units)

Table 5 Compressor: Market Size, By Region, 20162023 (USD Million)

Table 6 Generator: Turboexpander Market Size, By Region, 20162023 (Units)

Table 7 Generator: Market Size, By Region, 20162023 (USD Million)

Table 8 Oil Break: Market Size, By Region, 20162023 (Units)

Table 9 Oil Break: Market Size, By Region, 20162023 (USD Million)

Table 10 Turboexpander Market Size, By Application, 20162023 (Units)

Table 11 Market Size, By Application, 20162023 (USD Million)

Table 12 Hydrocarbon: Market Size, By Region, 20162023 (Units)

Table 13 Hydrocarbon: Market Size, By Region, 20162023 (USD Million)

Table 14 Air Separation: Market Size, By Region, 20162023 (Units)

Table 15 Air Separation: Market Size, By Region, 20162023 (USD Million)

Table 16 Others: Market Size, By Region, 20162023 (Units)

Table 17 Other: Market Size, By Region, 20162023 (USD Million)

Table 18 Turboexpander Market Size, By End-User, 20162023 (Units)

Table 19 Market Size, By End-User, 20162023 (USD Million)

Table 20 Oil & Gas: Market Size, By Region, 20162023 (Units)

Table 21 Oil & Gas: Market Size, By Region, 20162023 (USD Million)

Table 22 Manufacturing: Market Size, By Region, 20162023 (Units)

Table 23 Manufacturing: Market Size, By Region, 20162023 (USD Million)

Table 24 Power Generation: Turboexpanders Market Size, By Region, 20162023 (Units)

Table 25 Power Generation: Market Size, By Region, 20162023 (USD Million)

Table 26 Turboexpanders Market Size, By Region, 20162023 (Units)

Table 27 Market Size, By Region, 20162023 (USD Million)

Table 28 North America: Market Size, By Application, 20162023 (Units)

Table 29 North America: Market Size, By Application, 20162023 (USD Million)

Table 30 North America: Turboexpander Market Size, By End-User, 20162023 (Units)

Table 31 North America: Market Size, By End-User, 20162023 (USD Million)

Table 32 North America: Market Size, By Loading Device, 20162023 (Units)

Table 33 North America: Market Size, By Loading Device, 20162023 (USD Million)

Table 34 North America: Market Size, By Country, 20162023 (Units)

Table 35 North America: Market Size, By Country, 20162023 (USD Million)

Table 36 US: Turboexpanders Market Size, By End-User, 20162023 (Units)

Table 37 US: Market Size, By End-User, 20162023 (USD Million)

Table 38 Canada: Market Size, By End-User, 20162023 (Units)

Table 39 Canada: Market Size, By End-User, 20162023 (USD Million)

Table 40 Mexico: Market Size, By End-User, 20162023 (Units)

Table 41 Mexico: Market Size, By End-User, 20162023 (USD Million)

Table 42 Asia Pacific: Turboexpander Market Size, By Application, 20162023 (Units)

Table 43 Asia Pacific: Market Size, By Application, 20162023 (USD Million)

Table 44 Asia Pacific: Market Size, By End-User, 20162023 (Units)

Table 45 Asia Pacific: Market Size, By End-User, 20162023 (USD Million)

Table 46 Asia Pacific: Market Size, By Loading Device, 20162023 (Units)

Table 47 Asia Pacific: Market Size, By Loading Device, 20162023 (USD Million)

Table 48 Asia Pacific: Turboexpanders Market Size, By Country, 20162023 (Units)

Table 49 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 50 China: Market Size, By End-User, 20162023 (Units)

Table 51 China: Market Size, By End-User, 20162023 (USD Million)

Table 52 India: Market Size, By End-User, 20162023 (Units)

Table 53 India: Market Size, By End-User, 20162023 (USD Million)

Table 54 Japan: Turboexpanders Market Size, By End-User, 20162023 (Units)

Table 55 Japan: Market Size, By End-User, 20162023 (USD Million)

Table 56 Rest of Asia Pacific: Market Size, By End-User, 20162023 (Units)

Table 57 Rest of Asia Pacific: Market Size, By End-User, 20162023 (USD Million)

Table 58 Europe: Market Size, By Application, 20162023 (Units)

Table 59 Europe: Market Size, By Application, 20162023 (USD Million)

Table 60 Europe: Turboexpander Market Size, By End-User, 20162023 (Units)

Table 61 Europe: Market Size, By End-User, 20162023 (USD Million)

Table 62 Europe: Market Size, By Loading Device, 20162023 (Units)

Table 63 Europe: Market Size, By Loading Device, 20162023 (USD Million)

Table 64 Europe: Market Size, By Country, 20162023 (Units)

Table 65 Europe: Market Size, By Country, 20162023 (USD Million)

Table 66 Germany: Turboexpanders Market Size, By End-User, 20162023 (Units)

Table 67 Germany: Market Size, By End-User, 20162023 (USD Million)

Table 68 Russia: Market Size, By End-User, 20162023 (Units)

Table 69 Russia: Market Size, By End-User, 20162023 (USD Million)

Table 70 Rest of Europe: Market Size, By End-User, 20162023 (Units)

Table 71 Rest of Europe: Turboexpander Market Size, By End-User, 20162023 (USD Million)

Table 72 Rest of the World: Market Size, By Application, 20162023 (Units)

Table 73 Rest of the World: Market Size, By Application, 20162023 (USD Million)

Table 74 Rest of the World: Market Size, By End-User, 20162023 (Units)

Table 75 Rest of the World: Market Size, By End-User, 20162023 (USD Million)

Table 76 Rest of the World: Turboexpanders Market Size, By Loading Device, 20162023 (Units)

Table 77 Rest of the World: Market Size, By Loading Device, 20162023 (USD Million)

Table 78 L.A. Turbine has Undertaken the Most Number of Developments in the Turboexpanders Market

List of Figures (32 Figures)

Figure 1 Turboexpander Market Segmentation

Figure 2 Turboexpanders Market: Research Design

Figure 3 Breakdown of Primaries: By Company Type, Designation, and Region

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Turboexpander Market: Data Triangulation

Figure 7 Compressor Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 8 Oil & Gas is Expected to Have the Largest Market Share, By End-User, During the Forecast Period

Figure 9 Hydrocarbon Turboexpander is Expected to Lead the Turboexpanders Market in 2018

Figure 10 North America is Expected to Dominate the Turboexpander Market During the Forecast Period

Figure 11 Increasing Share of Natural Gas in Primary Energy Consumption is Expected to Drive the Turboexpander Market, 20182023

Figure 12 Compressor Segment Led the Turboexpanders Market (By Value) in 2017

Figure 13 Hydrocarbon Turboexpander is Expected to Lead the Turboexpander Market During the Forecast Period

Figure 14 Oil & Gas is Expected to Lead the Turboexpander Market (By Value) During the Forecast Period

Figure 15 US Dominated the North American Turboexpanders Market in 2017

Figure 16 Turboexapnder Market: Market Dynamcis

Figure 17 Increasing Natural Gas Production

Figure 18 Turboexpander Market Size, By Loading Device, 20162023 (USD Million)

Figure 19 Market Size, By Application, 20162023 (USD Million)

Figure 20 Turboexpander Market Size, By End-User, 20162023 (USD Million)

Figure 21 Market, By Region, 2017

Figure 22 Regional Snapshot: the Turboexpander Market in Asia Pacific is Expected to Grow at the Highest CAGR (By Value) During the Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Developments in the Turboexpanders Market, 2014May 2018

Figure 26 Ranking of Players, 2017

Figure 27 Atlas Copco: Company Snapshot

Figure 28 Bhge: Company Snapshot

Figure 29 Air Products and Chemicals: Company Snapshot

Figure 30 Honeywell: Company Snapshot

Figure 31 Man: Company Snapshot

Figure 32 Siemens: Company Snapshot

Growth opportunities and latent adjacency in Turboexpander Market