Connected Truck Market by Range (DSRC and Cellular), Service (Fleet Management and Cybersecurity & Updates), Component (Hardware and Software), Communication (V2V, V2I, and V2C), Vehicle (LCV and HCV), and Region - Global Forecast to 2022

The Connected Truck Market is estimated to be $16.78 Billion in 2016 and is projected to grow at a CAGR of 15.14% from 2017 to 2022, to reach $37.64 Billion by 2022. In this study, 2016 has been considered the base year, and 2017 to 2022 the forecast period, for estimating the size of the market.

The report analyzes and forecasts the market size (USD million) of the connected truck market. The report segments the market by region, vehicle type, range type, communication type, component type, and services type. The report also provides a detailed analysis of various forces acting in the market including drivers, restraints, opportunities, and challenges. It strategically profiles key players and comprehensively analyzes their market shares and core competencies. It also tracks and analyzes competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants.

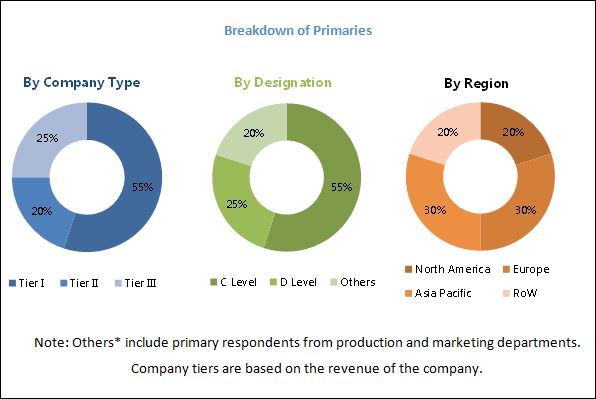

The research methodology used in the report involves various secondary sources such as National Highway Traffic Safety Administration (NHTSA), GENIVI Alliance, Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (ACEA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA). Experts from related industries and connected devices vendors have been interviewed to understand the future trends of the connected truck market. The market size of the individual segments has been determined through various secondary sources such as industry associations, white papers, and journals. The vendor offerings were also taken into consideration to determine the market segmentation. The top-down and bottom-up approaches have been used to estimate and validate the size of the global market. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments.

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the connected truck market consists of manufacturers such as Continental (Germany), Delphi (UK), Bosch (Germany), and Denso Corporation (Japan), and research institutes such as Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (ACEA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA).

Target Audience

- Automobile manufacturers

- Connected car devices manufacturers

- Automobile organizations/associations

- Cloud service providers

- Compliance regulatory authorities

- Government agencies

- Information Technology (IT) companies & system integrators

- Investors and Venture Capitalists (VCs)

Scope of the Report

By Region

By Range Type

By Services Type

By Vehicle Type

By Components Type

By Communication Type

-

- North America

- Europe

- Asia Pacific

- Rest of The World (RoW)

- Dedicated Short Range

- Long Range/Cellular Network

- Fleet Management

- Maintenance (Cybersecurity & Updates)

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Hardware

- Software

- Vehicle-To-Vehicle (V2V)

- Vehicle-To-Infrastructure (V2I)

- Vehicle-To-Cloud (V2C)

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis of connected truck services market

- Detailed analysis of connected truck market range market

The commercial vehicle manufacturers are taking several initiatives to expand the advanced innovation in their trucks. With the electrification and digitization of various components, infotainment, telematics systems, and autonomous driving are becoming an integral part of high-end automobiles. Most of these technologies use real-time data for live traffic, road conditions, and roadside help during a breakdown. The commercial vehicle is increasingly equipped with advanced driver assistance systems (ADAS) such as adaptive cruise control (ACC), lane departure warning (LDW), blind spot detection, and park assist system to enhance the safety of drivers as well as pedestrians. Also, automakers are looking forward to enhance customer satisfaction with the help of cybersecurity & over-the-air (OTA) updates to rectify the bugs generated in the software of various applications. The advancement in connected features will increase the overall operational efficiency and vehicle performance of fleet operators.

The global connected truck market is estimated to be USD 18.60 Billion in 2017 and is projected to grow at a CAGR of 15.14% during the forecast period, to reach USD 37.64 Billion by 2022. Some of the key market drivers are increasing industry compliance norms and government mandates supporting connected technology in commercial vehicles. Also, the vehicle data updates, which are generated by the telematics control unit (TCU), will help to reduce the overall recalling cost of OEMs and increase customer satisfaction.

The global connected truck market is segmented by range type, service type, vehicle type, component type, communication, and region. The report segments the market by range type into dedicated short-range communication (DSRC) and long-range communication. The DSRC segment accounts for the largest share of the global market and is estimated to grow at the highest CAGR during the forecast period. The growth of automotive DSRC segment is expected to be driven by increasing radar and LiDAR-based safety systems such as adaptive cruise control, lane departure warning, blind spot detection, and park assist system. Also, the report segments the market into three distinct types of communications, namely, vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-cloud (V2C). Further, to estimate the market size for different vehicle segments, the market is segmented into the light commercial vehicle (LCV) and heavy commercial vehicle (HCV). By component type, the market is segmented into hardware and software. The hardware segment is further divided into radar & LiDAR sensor and microcontroller. The study also segments the global market by service type into fleet management and maintenance. The extensive study has been done in four key regions, namely, Asia Pacific, Europe, North America, and the Rest of the World (RoW).

The vehicle-to-cloud (V2C) communication is estimated to account for the largest share of the global connected truck market for automotive, by communication, in 2017. Vehicle-to-vehicle (V2V) communication is estimated to be the second largest segment of the market, followed by vehicle-to-infrastructure (V2I). The others segment includes user interface programs and applications. The market for V2V segment is projected to grow at the highest CAGR during the forecast period due to increasing number of connected devices in trucks. Various automotive OEMs, especially in North America and Europe, are offering connected devices for short-range communication in their vehicles. OEMs such as General Motors (US), Daimler (Germany), Volvo (Sweden), and Volkswagen AG (Germany) provide connected devices in their commercial vehicle models.

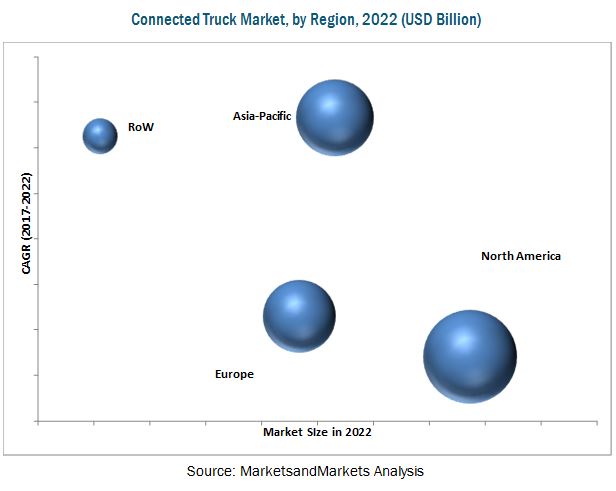

North America is estimated to account for the largest market share, followed by Asia Pacific, Europe, and Rest of the World (RoW), respectively. North America is estimated to be the largest market during the forecast period due to various factors such as increasing connected car devices in commercial vehicles, increasing digitization of various services in fleet management, and cyber security & updates. In terms of growth, the Asia Pacific connected truck market is estimated to grow at the highest CAGR during the forecast period. The market growth in Asia Pacific is driven by the increasing number of connected car devices in vehicles and growing communication and information technology infrastructure such as 4G LTE or 5G.

Some of the major restraints identified in the global connected truck market are lack of supporting infrastructure in developing countries and threats to cybersecurity. These factors may hinder the growth of the market to some extent.

Some of the major players in the global connected truck market are Bosch (Germany), Continental (Germany), Verizon Communications (US), Harman International (US), Denso Corporation (Japan), ZF Friedrichshafen AG (Germany), Magna (Canada), and Delphi (UK). The last chapter of this report covers a comprehensive study of the key vendors operating in the market. The competitive landscape matrix is divided into four distinct categories, namely, dynamic differentiators, visionary leaders, emerging companies, and innovators. The evaluation of market players is done by taking various factors into account such as new product development, R&D expenditure, business strategies, product revenue, and organic and inorganic growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Connected Truck Market Segmentation

1.3.2 Years Considered in the Report

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Demand-Side Analysis

2.4.1.1 Growing Information and Telecommunication Infrastructure is Fueling the Demand for Connected Trucks

2.4.1.2 Rising Need for Vehicle Connectivity in Logistics and Transportation Business

2.4.2 Supply-Side Analysis

2.4.2.1 Alternative Fuel Technology for Commercial Vehicles

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach

2.5.2 Top-Down Approach

2.6 Market Breakdown and Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Connected Truck Market, 2017 vs 2022 (USD Billion)

4.2 Market, By Region

4.3 Market, By Range

4.4 Market, By Service

4.5 Market, By Vehicle Type

4.6 Market, By Component Type

4.7 Market, By Communication Type

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Industry Compliance Norms and Government Mandates Supporting Connected Technologies in Automobiles

5.2.1.2 Vehicle Data Updates Will Help Reduce Vehicle Recalls

5.2.2 Restraints

5.2.2.1 Lack of Information Technology Communication Infrastructure in Emerging Regions

5.2.2.2 Threats to Cybersecurity of Vehicles

5.2.3 Opportunities

5.2.3.1 Introduction of 5G Technology in the Near Future

5.2.3.2 Unprecedented Advancements Toward Making Autonomous Trucks A Reality

5.2.4 Challenges

5.2.4.1 Forward Looking to Emerging Market

5.2.4.2 Unorganized Third-Party Logistics (3PL)

5.2.5 Macro Indicators Influencing the Connected Truck Market for the Automotive Industry for Top 3 Leading Nations

5.2.5.1 Us

5.2.5.2 China

5.2.5.3 Japan

6 Industry Trends and Technology Overview (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Connectivity (4G, 4G LTE & 5G)

6.4 Semiconductor Components: ICS and Microcontrollers

6.5 Autonomous Driving

6.6 Impact of Big Data, IoT, and Data Analytics

6.7 Technology Roadmap

7 By Range (Page No. - 55)

7.1 Introduction

7.2 Dedicated Short Range Communication (DSRC)

7.2.1 Adaptive Cruise Control (ACC)

7.2.2 Blind Spot Warning (BSW)

7.2.3 Forward Collision Warning (FCW)

7.2.4 Lane Departure Warning (LDW)

7.2.5 Park Assist System (PAS)

7.2.6 Emergency Brake Assist (EBA)

7.3 Long Range (Telematics Control Unit)

8 Connected Trucks Market, By Components Type (Page No. - 67)

8.1 Introduction

8.2 Hardware

8.2.1 Radar & Lidar Sensors

8.2.2 Microcontrollers

8.3 Software

9 By Communication Type (Page No. - 74)

9.1 Introduction

9.1.1 Vehicle to Vehicle (V2V)

9.1.2 Vehicle to Infrastructure (V2I)

9.1.3 Vehicle to Cloud (V2C)

10 By Service (Page No. - 80)

10.1 Introduction

10.2 Fleet Management Service

10.2.1 Tracking & Monitoring

10.2.2 Fleet Analytics

10.2.3 Driver Information System

10.2.4 Remote Diagnostics

10.2.5 Fuel Management System

10.3 Maintenance Service (Cybersecurity & Ota Updates)

11 By Vehicle Type (Page No. - 86)

11.1 Introduction

11.1.1 Light Commercial Vehicle (LCV)

11.1.2 Heavy Commercial Vehicle (HCV)

12 By Region (Page No. - 90)

12.1 Introduction

12.1.1 Asia Pacific

12.1.2 Europe

12.1.3 North America

12.1.4 Rest of the World

13 Company Profile (Page No. - 100)

(Overview, Strength of Product Portfolio, Business Strategy Excellence & Recent Developments)*

13.1 Robert Bosch

13.2 Continental

13.3 Denso

13.4 Delphi

13.5 Harman

13.6 ZF

13.7 NXP

13.8 Magna

13.9 Sierra Wireless

13.10 Tomtom

13.11 Trimble

13.12 Verizon

*Details on (Overview, Strength of Product Portfolio, Business Strategy Excellence & Recent Developments)* Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 137)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.4.1 Additional Company Profiles

14.4.1.1 Business Overview

14.4.1.2 SWOT Analysis

14.4.1.3 Recent Developments

14.4.1.4 MnM View

14.4.2 Detaled Analysis of Ota Applications

14.4.3 Detaled Analysis of Electric Vehicle

14.4.4 Detaled Analysis of Commercial Vehicle Segment

14.5 Related Reports

14.6 Author Details

List of Tables (54 Tables)

Table 1 Currency Exchange Rates (W.R.T USD)

Table 2 US: Increasing Sales of Commercial Vehicles Expected to Drive Connected Truck Market

Table 3 China: Rising Gva Percentage Contribution in GDP is Expected to Drive the Domestic Demand During the Forecast Period

Table 4 Japan: Rising Debt-GDP Ratio to Be the Most Crucial Indicator Given Its Excessively Weak Performance in the Recent Past

Table 5 Market Size, By Range, 2015–2022 (‘000 Units)

Table 6 Market, By Range, 2015–2022 (USD Million)

Table 7 Dedicated Short-Range Communication Market Size, By Product, 2015–2022 (‘000 Units)

Table 8 Dedicated Short-Range Communication Market Size, By Product, 2015–2022 (USD Million)

Table 9 Dedicated Short-Range Communication Market Size, By Region, 2015–2022 (‘000 Units)

Table 10 Dedicated Short-Range Communication Market Size, By Region, 2015–2022 (USD Million)

Table 11 Adaptive Cruise Control Market Size, By Region, 2015–2022 (‘000 Units)

Table 12 Adaptive Cruise Control Market Size, By Region, 2015–2022 (USD Million)

Table 13 Blind Spot Warning Market Size, By Region, 2015–2022 (‘000 Units)

Table 14 Blind Spot Warning Market Size, By Region, 2015–2022 (USD Million)

Table 15 Forward Collision Warning Market Size, By Region, 2015–2022 (‘000 Units)

Table 16 Forward Collision Warning Market Size, By Region, 2015–2022 (USD Million)

Table 17 Lane Departure Warning Market Size, By Region, 2015–2022 (‘000 Units)

Table 18 Lane Departure Warning Market Size, By Region, 2015–2022 (USD Million)

Table 19 Park Assist System Market Size, By Region, 2015–2022 (‘000 Units)

Table 20 Park Assist System Market Size, By Region, 2015–2022 (USD Million)

Table 21 Emergency Brake Assist Market Size, By Region, 2015–2022 (‘000 Units)

Table 22 Emergency Brake Assist Market Size, By Region, 2015–2022 (USD Million)

Table 23 Long Range (Telematics Control Unit) Market Size, 2015–2022 (‘000 Units)

Table 24 Long Range (Telematics Control Unit) Market Size, 2015–2022 (USD Million)

Table 25 Market, By Component, 2015–2022 (Million Units)

Table 26 Market, By Component, 2015–2022 (USD Million)

Table 27 Hardware Market Size, By Region, 2015–2022 (Million Units)

Table 28 Hardware Market Size, By Region, 2015–2022 (USD Million)

Table 29 Radar & Lidar Sensors Market Size, By Region, 2015–2022 (Million Units)

Table 30 Radar & Lidar Sensors Market Size, By Region, 2015–2022 (USD Million)

Table 31 Microcontroller Market Size, By Region, 2015–2022 (Million Units)

Table 32 Microcontroller Market Size, By Region, 2015–2022 (USD Million)

Table 33 Software Market Size, By Region, 2015–2022 (Million Units)

Table 34 Software Market Size, By Region, 2015–2022 (USD Million)

Table 35 Market Size, By Communication Type, 2015–2022 (USD Million)

Table 36 Market for V2V Communication, By Region, 2015–2022 (USD Million)

Table 37 Market for V2I Communication, By Region, 2015–2022 (USD Million)

Table 38 Market for V2C Communication, By Region, 2015–2022 (USD Million)

Table 39 Market Size, By Service, 2015–2022 (USD Million)

Table 40 Fleet Management Service Market Size, By Region, 2015–2022 (USD Million)

Table 41 Tracking & Monitoring Market Size, By Region, 2015–2022 (USD Million)

Table 42 Fleet Analytics Market Size, By Region, 2015–2022 (USD Million)

Table 43 Driver Information System Market Size, By Region, 2015–2022 (USD Million)

Table 44 Remote Diagnostic Market Size, By Region, 2015–2022 (USD Million)

Table 45 Fuel Management System Market Size, By Region, 2015–2022 (USD Million)

Table 46 Maintenance Service (Cybersecurity & Ota Updates) Market Size, By Region, 2015–2022 (USD Million)

Table 47 Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 48 Light Commercial Vehicle Market Size, By Region, 2015–2022 (USD Million)

Table 49 Heavy Commercial Vehicle Market Size, By Region, 2015–2022 (USD Million)

Table 50 Market Size, By Region, 2015–2022 (USD Million)

Table 51 Asia Pacific: Market Size, By Country, 2015–2022 (USD Million)

Table 52 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 53 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 54 Rest of the World: Market Size, By Country, 2015–2022 (USD Million)

List of Figures (50 Figures)

Figure 1 Connected Truck Market: Research Design

Figure 2 Research Design Model

Figure 3 Breakdown of Primary Interviews

Figure 4 Alternate Fuel Technologies and Related Vehicles

Figure 5 Market: Bottom-Up Approach

Figure 6 Market: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 North America to Hold the Largest Share of the Market, 2017

Figure 9 Light Commercial Vehicles is Estimated to Remain the Largest Segment in the Market, 2017 vs 2022 (USD Billion)

Figure 10 Vehicle to Cloud (V2C) to Hold the Largest Share in the Market, 2017 vs 2022 (USD Billion)

Figure 11 Attractive Opportunities in the Market

Figure 12 North America is Estimated to Lead the Market, 2017 vs 2022 (USD Billion)

Figure 13 DSRC Segment is Estimated to Lead the Market, 2017 vs 2022 (USD Billion)

Figure 14 Fleet Management is Estimated to Lead the Market, 2017 vs 2022 (USD Billion)

Figure 15 Light Commercial Vehicle Segment Estimated to Lead the Market, 2017 vs 2022 (USD Billion)

Figure 16 Hardware Segment Estimated to Lead the Market, 2017 vs 2022 (USD Billion)

Figure 17 V2C Communication Segment Estimated to Lead the Market, 2015–2022 (USD Billion)

Figure 18 Market: Market Dynamics

Figure 19 Path for Development of Truck Platooning and Level of Automation

Figure 20 Region-Wise Logistics Value as A Percentage of GDP, 2016

Figure 21 Commercial Vehicles Sales of Top Three Economies & Global Commercial Vehicle Sales

Figure 22 Evolution of Connected Services By OEMS (1995–2017)

Figure 23 Connected Truck Value Chain

Figure 24 Role of Connectivity in Advanced Vehicle Applications

Figure 25 Microcontrollers Used in Connected Trucks

Figure 26 Platooning for Autonomous Trucks

Figure 27 Software Development By Using Big Data and Cloud Services

Figure 28 Advantage of Big Data to Insurance Companies

Figure 29 Market, By Communication, 2017 vs 2022 (USD Million)

Figure 30 Vehicle to Vehicle (V2V): Market, By Region, 2017 vs 2022 (USD Million)

Figure 31 Vehicle to Infrastructure (V2I): Market, By Region, 2017 vs 2022 (USD Million)

Figure 32 Vehicle to Cloud (V2C): Market, By Region, 2017 vs 2022 (USD Million)

Figure 33 Light Commercial Vehicle Segment is Expected to Account for the Largest Market Share During the Forecast Period

Figure 34 Market Size (USD Million): China is Estimated to Grow at the Highest CAGR (2017–2022)

Figure 35 Asia Pacific: Market Snapshot

Figure 36 Europe: Market Snapshot

Figure 37 North America: Market Snapshot

Figure 38 European Market Size, 2017 vs 2022

Figure 39 Robert Bosch: Company Snapshot

Figure 40 Continental: Company Snapshot

Figure 41 Denso: Company Snapshot

Figure 42 Delphi: Company Snapshot

Figure 43 Harman: Company Snapshot

Figure 44 ZF: Company Snapshot

Figure 45 NXP: Company Snapshot

Figure 46 Magna: Company Snapshot

Figure 47 Sierra Wireless: Company Snapshot

Figure 48 Tomtom: Company Snapshot

Figure 49 Trimble: Company Snapshot

Figure 50 Verizon: Company Snapshot

Growth opportunities and latent adjacency in Connected Truck Market

We require telematics oriented data for this market.