Transportation Analytics Market by Type (Descriptive Analytics, Predictive Analytics, Prescriptive Analytics), Mode (Roadways, Railways, Airways, and Waterways), Region (North America, Europe, APAC, Latin America, MEA) - Global Forecast to 2024

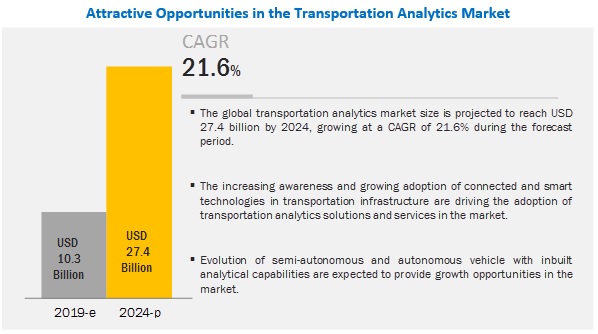

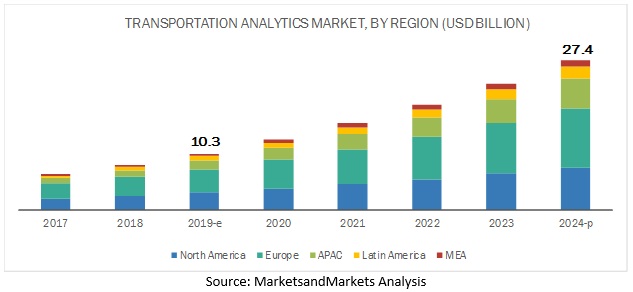

[169 Pages Report] The global transportation analytics market size is projected to reach USD 27.4 Billion by 2024, at a CAGR of 21.6% during the forecast period. The government initiatives for smart cities and growing population are major factors driving the growth of the market.

By type, predictive analytics segment to register most significant market and higher growth rate during the forecast period

Predictive analytics for managing transportation can be useful to make commercial as well as personal transport easier, particularly in terms of cost-efficiency. In transit, it can be used to improve productivity, fuel optimization, and people efficiency thus lowering the operational costs. Anticipating daily volumes, optimizing delivery routes, and allocation of resources to deliver the service efficiently, ultimately enhancing customer satisfaction. The advanced analytics instead of preventive maintenance enables companies to perform predictive maintenance. The predictive analytics solutions gather vehicle data from sensors, which is then examined to identify components that are most likely to break or underperform.

By mode, under roadways, road traffic management to register higher market size during the forecast period

In the modes segment under roadways, road traffic management to register higher market size during the forecast period in transportation analytics market. Data collected through the GPS and the satellite imaging is used to help in traffic management, by assisting the user in selecting their way to destination. This helps in developing better transportation as well as transport infrastructure. Analytics on a large scale is impacting Traffic management systems by making traveler information available on a global map that tell drivers about the jam-packed areas.

Europe to account for the highest market size during the forecast period

Europe is a significant revenue-generating region in the global transportation analytics market. The region experiences maximum developments in the transportation analytics space. Majority of the transportation analytics solution providers across the region are regularly involved in product innovations and deployment of these transportation analytics solutions and services. The vendors across the region are adopting various growth strategies, such as product enhancements and new launches, partnerships, and acquisitions, strengthening their position in the market.

Key Market Players

The major transportation analytics vendors include IBM (US), Siemens(Germany), Cubic (US), Cellint (Israel), Alteryx (US), Kapsch Trafficcom (Austria), INRIX (US), Indra Sistema (Spain), Trimble (US), TomTom (Netherland), Iteris (US), Conduent (US), Hitachi (France), Thales (France), OmniTracs (US), Techvantage (US), CARTO (US), Syntelic (US), SmartDrive Systems (US), Envista (US). These players have adopted various growth strategies, such as partnerships, agreements, and collaborations; new product launches and product enhancements; and acquisitions, to further expand their presence in the global transportation analytics market. New product launches and product enhancements have been the most dominating strategies adopted by the major players from 2017 to 2019, which has helped them to innovate on their offerings and broaden their customer base.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Type, Mode, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

IBM (US), Siemens(Germany), Cubic (US), Cellint (Israel), Alteryx (US), Kapsch Trafficcom (Austria), INRIX (US), Indra Sistema (Spain), Trimble (US), TomTom (Netherland), Iteris (US), Conduent (US), Hitachi (France), Thales (France), OmniTracs (US), Techvantage (US), CARTO (US), Syntelic (US), SmartDrive Systems (US), Envista (US) |

This research report categorizes the transportation analytics market based on type, mode, and region.

By Type, the market has the following segments:

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

By Mode, the transportation analytics market has the following segments:

- Railways

- Performance Management

- Rail Traffic Management

- Others (Planning & Maintenance and Customer Satisfaction)

- Roadways

- Road Safety Management

- Road Traffic Management

- Others (Planning & Maintenance and Customer Satisfaction)

- Airways

- Air Traffic Management

- Route Optimization

- Others (Planning & Maintenance and Customer Satisfaction)

- Waterways

- Ship Monitoring

- Route Optimization

- Others (Planning & Maintenance and Customer Satisfaction)

By Region, the transportation analytics market has the following segments:

- North America

- Europe

- APAC

- Latin America

- MEA

Recent Developments

- In May 2019, IBM partnered with Maersk, a Danish transport and logistics company, to create a blockchain-based shipping and supply chain company. The primary goal of the venture is to commercialize blockchain for all aspects of the global supply chain system, ranging from shipping to ports and banks to customs offices.

- In January 2018, IBM partnered with the Port of Rotterdam, Europes largest port, to build a long-term digitization strategy that would transform the operation of the port and lay the foundation for autonomous ships using cloud-based IoT, AI, and smart weather data.

- In January 2019, Cubic has acquired GRIDSMART Technologies a market-leading, technology-driven business with a differentiated video tracking offering for the Intelligent Traffic Systems for approximately USD 87 million in cash. This acquisition helps to expand intelligent traffic management offering.

Critical Questions the Report Answers

- What are the current trends driving the transportation analytics market?

- Where will all the developments take the industry in the mid- to long-term?

- Who are the top vendors in the market, and how is the competitive scenario among them?

- What are the drivers and challenges of the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

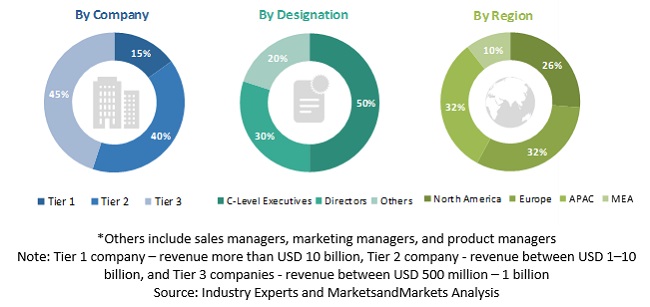

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities in the Transportation Analytics Market

4.2 Market: Top 3 Modes of Transportation

4.3 Market: By Region

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Adoption of Connected and Smart Technologies in Transportation Infrastructure

5.2.1.2 Rising Urban Population and High Demographic Rates

5.2.1.3 Government Initiatives for Smart Cities

5.2.2 Restraints

5.2.2.1 Recovering RoI From Legacy Systems

5.2.2.2 Compliance With Stringent Transportation Regulatory Policies

5.2.3 Opportunities

5.2.3.1 Designing and Developing Connected Vehicles Compatible With Its

5.2.3.2 Evolution of Semi-Autonomous and Autonomous Vehicles

5.2.4 Challenges

5.2.4.1 Moving Diversified Portfolio of Goods to the Growing Marketplace

5.2.4.2 Integration Complexities Over Legacy Systems and Network

5.3 Use Cases

5.3.1 Use Case: Scenario 1

5.3.2 Use Case: Scenario 2

5.3.3 Use Case: Scenario 3

5.4 Regulatory Implications

5.4.1 General Data Protection Regulation

5.4.2 Federal Trade Commission

6 Transportation Analytics Market, By Type (Page No. - 44)

6.1 Introduction

6.2 Descriptive Analytics

6.2.1 Descriptive Analytics Helps Extract Insightful Information From the Hist0ric Data

6.3 Predictive Analytics

6.3.1 Predictive Analytics Helps Make Travel Smoother By Optimizing Transportation Infrastructure

6.4 Prescriptive Analytics

6.4.1 Cost Saving and Performance Improvement to Boost the Demand for Prescriptive Analytics

7 Market, By Mode (Page No. - 49)

7.1 Introduction

7.2 Roadways

7.2.1 Road Safety Management

7.2.1.1 Government Investments for Better Road Safety Measures to Drive the Demand for Road Safety Management

7.2.2 Road Traffic Management

7.2.2.1 Need to Manage Both Vehicular and Non-Vehicular Traffic to Boost the Demand for Better Road Traffic Management

7.2.3 Other Applications in Roadways

7.3 Railways

7.3.1 Performance Management

7.3.1.1 Increasing Number of Passengers and Expanding Rail Network Worldwide to Boost the Demand for Performance Management in Railways

7.3.2 Rail Traffic Management

7.3.2.1 Increasing Focus on Public Safety to Drive the Demand for Advanced Rail Traffic Management

7.3.3 Other Applications in Railways

7.4 Airways

7.4.1 Air Traffic Management

7.4.1.1 Increasing Flight Frequency and Need to Avoid Air Accidents Driving the Demand for Air Traffic Management

7.4.2 Route Optimization

7.4.2.1 Unpredictable Weather Conditions and Increasing Air Traffic to Boost the Demand for Route Optimization in the Airways Segment

7.4.3 Other Applications in Airways

7.5 Waterways

7.5.1 Ship Monitoring

7.5.1.1 Cost Optimization to Drive the Demand for Ship Monitoring Systems

7.5.2 Route Optimization

7.5.2.1 Increasing Maritime Traffic to Fuel the Demand for Route Optimization in the Waterways Segment

7.5.3 Other Applications in Waterways

8 Market, By Region (Page No. - 62)

8.1 Introduction

8.2 North America

8.2.1 United States

8.2.1.1 Governments Specific Programs and Initiatives to Drive the Growth of Transportation Analytics Market in the US

8.2.2 Canada

8.2.2.1 Government Push in Smart Transportation Initiatives for the Development of Smart Cities to Boost the Adoption of Transportation Analytics Solutions in Canada

8.3 Europe

8.3.1 United Kingdom

8.3.1.1 Government Initiatives to Develop and Promote Safe and Efficient Transport Policies Driving the Adoption of Transportation Analytics Solutions in the UK

8.3.2 Germany

8.3.2.1 Government Collaboration and Initiatives With Transportation Analytics Vendors to Drive Increased Investments in the Market in Germany

8.3.3 France

8.3.3.1 Continuous Technological Developments in the Transport Industry to Boost the Adoption of Transportation Analytics Solutions in France

8.3.4 Spain

8.3.4.1 Smart City Initiatives Undertaken By the Government to Fuel the Growth of Transportation Analytics Market in Spain

8.3.5 Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.1.1 Government Initiatives and Investment in the Transportation Technologies to Boost the Growth of Market in China

8.4.2 Australia

8.4.2.1 Smart City Projects and Government Initiatives to Propel the Growth of Market in Australia

8.4.3 Singapore

8.4.3.1 Rising Implementation of Ai and Analytics to Boost the Adoption of Transportation Analytics Solutions in Singapore

8.4.4 Japan

8.4.4.1 Rising Implementation of Big Data and Analytics to Fuel the Adoption of Transportation Analytics in Japan

8.4.5 Rest of Asia Pacific

8.5 Middle East and Africa

8.5.1 Middle East

8.5.1.1 Major Investments to Develop Efficient Logistics and Transport Facilities Driving the Growth of Market in the Middle East

8.5.2 Africa

8.5.2.1 Growing Adoption of Digital Technologies to Boost the Growth of Transportation Analytics Market in Africa

8.6 Latin America

8.6.1 Brazil

8.6.1.1 Increasing Investments and the Support of Brazilian Government to Manage Public, Marine, and Air Transport Driving the Adoption of

Transportation Analytics in Brazil

8.6.2 Mexico

8.6.2.1 Competition Among Shipping Companies and Changing Regulations to Drive the Growth of Market in Mexico

9 Competitive Landscape (Page No. - 122)

9.1 Competitive Leadership Mapping, 2019

9.1.1 Visionary Leaders

9.1.2 Innovators

9.1.3 Dynamic Differentiators

9.1.4 Emerging Companies

9.2 Strength of Product Portfolio

9.3 Business Strategy Excellence

10 Company Profiles (Page No. - 126)

10.1 Introduction

(Business Overview, Solutions, Platforms, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

10.2 IBM

10.3 Siemens

10.4 Cubic

10.5 Cellint

10.6 Alteryx

10.7 Kapsch Trafficcom

10.8 INRIX

10.9 Indra Sistemas

10.10 Trimble

10.11 TomTom

10.12 Iteris

10.13 Conduent

10.14 Hitachi

10.15 Thales Group

10.16 OmniTracs

10.17 Techvantagee

10.18 CARTO

10.19 Syntelic

10.20 SmartDrive Systems

10.21 Envista

*Details on Business Overview, Solutions, Platforms, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 161)

11.1 Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (133 Tables)

Table 1 United States Dollar Exchange Rate, 20162018

Table 2 Factor Analysis

Table 3 Global Transportation Analytics Market Size and Growth Rate, 20172024 (USD Million, Y-O-Y %)

Table 4 Autonomous Vehicles: Future Landscape, 20102060

Table 5 Market Size, By Type, 20172024 (USD Million)

Table 6 Descriptive Analytics: Market Size, By Region, 20172024 (USD Million)

Table 7 Predictive Analytics: Market Size, By Region, 20172024 (USD Million)

Table 8 Prescriptive Analytics: Market Size, By Region, 20172024 (USD Million)

Table 9 Market Size, By Mode, 20172024 (USD Million)

Table 10 Roadways: Market Size, By Region, 20172024 (USD Million)

Table 11 Roadways: Market Size, By Application, 20172024 (USD Million)

Table 12 Railways: Market Size, By Region, 20172024 (USD Million)

Table 13 Railways: Market Size, By Application, 20172024 (USD Million)

Table 14 Airways: Market Size, By Region, 20172024 (USD Million)

Table 15 Airways: Transportation Analytics Market Size, By Application, 20172024 (USD Million)

Table 16 Waterways: Market Size, By Region, 20172024 (USD Million)

Table 17 Waterways: Market Size, By Application, 20172024 (USD Million)

Table 18 Market Size, By Region, 20172024 (USD Million)

Table 19 North America: Market Size, By Type, 20172024 (USD Million)

Table 20 North America: Market Size, By Mode, 20172024 (USD Million)

Table 21 North America: Market Size, By Roadway, 20172024 (USD Million)

Table 22 North America: Market Size, By Railway, 20172024 (USD Million)

Table 23 North America: Market Size, By Airway, 20172024 (USD Million)

Table 24 North America: Market Size, By Waterway, 20172024 (USD Million)

Table 25 North America: Transportation Analytics Market Size, By Country, 20172024 (USD Million)

Table 26 United States: Market Size, By Mode, 20172024 (USD Million)

Table 27 United States: Market Size, By Roadway, 20172024 (USD Million)

Table 28 United States: Market Size, By Railway, 20172024 (USD Million)

Table 29 United States: Market Size, By Airway, 20172024 (USD Million)

Table 30 United States: Transportation Analytics Market Size, By Waterway, 20172024 (USD Million)

Table 31 Canada: Market Size, By Mode, 20172024 (USD Million)

Table 32 Canada: Market Size, By Roadway, 20172024 (USD Million)

Table 33 Canada: Market Size, By Railway, 20172024 (USD Million)

Table 34 Canada: Market Size, By Airway, 20172024 (USD Million)

Table 35 Canada: Transportation Analytics Market Size, By Waterway, 20172024 (USD Million)

Table 36 Europe: Market Size, By Type, 20172024 (USD Million)

Table 37 Europe: Market Size, By Mode, 20172024 (USD Million)

Table 38 Europe: Market Size, By Roadway, 20172024 (USD Million)

Table 39 Europe: Market Size, By Railway, 20172024 (USD Million)

Table 40 Europe: Market Size, By Airway, 20172024 (USD Million)

Table 41 Europe: Market Size, By Waterway, 20172024 (USD Million)

Table 42 Europe: Transportation Analytics Market Size, By Country, 20172024 (USD Million)

Table 43 United Kingdom: Market Size, By Mode, 20172024 (USD Million)

Table 44 United Kingdom: Market Size, By Roadway, 20172024 (USD Million)

Table 45 United Kingdom: Market Size, By Railway, 20172024 (USD Million)

Table 46 United Kingdom: Market Size, By Airway, 20172024 (USD Million)

Table 47 United Kingdom: Transportation Analytics Market Size, By Waterway, 20172024 (USD Million)

Table 48 Germany: Market Size, By Mode, 20172024 (USD Million)

Table 49 Germany: Market Size, By Roadway, 20172024 (USD Million)

Table 50 Germany: Market Size, By Railway, 20172024 (USD Million)

Table 51 Germany: Market Size, By Airway, 20172024 (USD Million)

Table 52 Germany: Transportation Analytics Market Size, By Waterway, 20172024 (USD Million)

Table 53 France: Market Size, By Mode, 20172024 (USD Million)

Table 54 France: Market Size, By Roadway, 20172024 (USD Million)

Table 55 France: Market Size, By Railway, 20172024 (USD Million)

Table 56 France: Market Size, By Airway, 20172024 (USD Million)

Table 57 France: Market Size, By Waterway, 20172024 (USD Million)

Table 58 Spain: Transportation Analytics Market Size, By Mode, 20172024 (USD Million)

Table 59 Spain: Market Size, By Roadway, 20172024 (USD Million)

Table 60 Spain: Market Size, By Railway, 20172024 (USD Million)

Table 61 Spain: Market Size, By Airway, 20172024 (USD Million)

Table 62 Spain: Market Size, By Waterway, 20172024 (USD Million)

Table 63 Rest of Europe: Market Size, By Mode, 20172024 (USD Million)

Table 64 Rest of Europe: Market Size, By Roadway, 20172024 (USD Million)

Table 65 Rest of Europe: Market Size, By Railway, 20172024 (USD Million)

Table 66 Rest of Europe: Market Size, By Airway, 20172024 (USD Million)

Table 67 Rest of Europe: Transportation Analytics Market Size, By Waterway, 20172024 (USD Million)

Table 68 Asia Pacific: Market Size, By Type, 20172024 (USD Million)

Table 69 Asia Pacific: Market Size, By Mode, 20172024 (USD Million)

Table 70 Asia Pacific: Market Size, By Roadway, 20172024 (USD Million)

Table 71 Asia Pacific: Market Size, By Railway, 20172024 (USD Million)

Table 72 Asia Pacific: Market Size, By Airway, 20172024 (USD Million)

Table 73 Asia Pacific: Market Size, By Waterway, 20172024 (USD Million)

Table 74 Asia Pacific: Transportation Analytics Market Size, By Country, 20172024 (USD Million)

Table 75 China: Market Size, By Mode, 20172024 (USD Million)

Table 76 China: Market Size, By Roadway, 20172024 (USD Million)

Table 77 China: Market Size, By Railway, 20172024 (USD Million)

Table 78 China: Market Size, By Airway, 20172024 (USD Million)

Table 79 China: Transportation Analytics Market Size, By Waterway, 20172024 (USD Million)

Table 80 Australia: Market Size, By Mode, 20172024 (USD Million)

Table 81 Australia: Market Size, By Roadway, 20172024 (USD Million)

Table 82 Australia: Market Size, By Railway, 20172024 (USD Million)

Table 83 Australia: Market Size, By Airway, 20172024 (USD Million)

Table 84 Australia: Transportation Analytics Market Size, By Waterway, 20172024 (USD Million)

Table 85 Singapore: Market Size, By Mode, 20172024 (USD Million)

Table 86 Singapore: Market Size, By Roadway, 20172024 (USD Million)

Table 87 Singapore: Market Size, By Railway, 20172024 (USD Million)

Table 88 Singapore: Market Size, By Airway, 20172024 (USD Million)

Table 89 Singapore: Transportation Analytics Market Size, By Waterway, 20172024 (USD Million)

Table 90 Japan: Market Size, By Mode, 20172024 (USD Million)

Table 91 Japan: Market Size, By Roadway, 20172024 (USD Million)

Table 92 Japan: Market Size, By Railway, 20172024 (USD Million)

Table 93 Japan: Market Size, By Airway, 20172024 (USD Million)

Table 94 Japan: Market Size, By Waterway, 20172024 (USD Million)

Table 95 Rest of Asia Pacific: Transportation Analytics Market Size, By Mode, 20172024 (USD Million)

Table 96 Rest of Asia Pacific: Market Size, By Roadway, 20172024 (USD Million)

Table 97 Rest of Asia Pacific: Market Size, By Railway, 20172024 (USD Million)

Table 98 Rest of Asia Pacific: Market Size, By Airway, 20172024 (USD Million)

Table 99 Rest of Asia Pacific: Market Size, By Waterway, 20172024 (USD Million)

Table 100 Middle East and Africa: Market Size, By Type, 20172024 (USD Million)

Table 101 Middle East and Africa: Market Size, By Mode, 20172024 (USD Million)

Table 102 Middle East and Africa: Market Size, By Roadway, 20172024 (USD Million)

Table 103 Middle East and Africa: Market Size, By Railway 20172024 (USD Million)

Table 104 Middle East and Africa: Market Size, By Airway, 20172024 (USD Million)

Table 105 Middle East and Africa: Market Size, By Waterway, 20172024 (USD Million)

Table 106 Middle East and Africa: Transportation Analytics Market Size, By Sub-Region, 20172024 (USD Million)

Table 107 Middle East: Market Size, By Mode, 20172024 (USD Million)

Table 108 Middle East: Market Size, By Roadway, 20172024 (USD Million)

Table 109 Middle East: Market Size, By Railway, 20172024 (USD Million)

Table 110 Middle East: Market Size, By Airway, 20172024 (USD Million)

Table 111 Middle East: Transportation Analytics Market Size, By Waterway 20172024 (USD Million)

Table 112 Africa: Market Size, By Mode, 20172024 (USD Million)

Table 113 Africa: Market Size, By Roadway, 20172024 (USD Million)

Table 114 Africa: Market Size, By Railway, 20172024 (USD Million)

Table 115 Africa: Market Size, By Airway, 20172024 (USD Million)

Table 116 Africa: Market Size, By Waterway, 20172024 (USD Million)

Table 117 Latin America: Transportation Analytics Market Size, By Type, 20172024 (USD Million)

Table 118 Latin America: Market Size, By Mode, 20172024 (USD Million)

Table 119 Latin America: Market Size, By Roadway, 20172024 (USD Million)

Table 120 Latin America: Market Size, By Railway, 20172024 (USD Million)

Table 121 Latin America: Market Size, By Airway, 20172024 (USD Million)

Table 122 Latin America: Market Size, By Waterway, 20172024 (USD Million)

Table 123 Latin America: Market Size, By Country, 20172024 (USD Million)

Table 124 Brazil: Market Size, By Mode, 20172024 (USD Million)

Table 125 Brazil: Market Size, By Roadway, 20172024 (USD Million)

Table 126 Brazil: Market Size, By Railway, 20172024 (USD Million)

Table 127 Brazil: Market Size, By Airway, 20172024 (USD Million)

Table 128 Brazil: Market Size, By Waterway, 20172024 (USD Million)

Table 129 Mexico: Transportation Analytics Market Size, By Mode, 20172024 (USD Million)

Table 130 Mexico: Market Size, By Roadway, 20172024 (USD Million)

Table 131 Mexico: Market Size, By Railway, 20172024 (USD Million)

Table 132 Mexico: Market Size, By Airway, 20172024 (USD Million)

Table 133 Mexico: Market Size, By Waterway, 20172024 (USD Million)

List of Figures (37 Figures)

Figure 1 Transportation Analytics Market: Research Design

Figure 2 Market: Top-Down and Bottom-Up Approaches

Figure 3 Market, By Type

Figure 4 Market, By Mode (2019)

Figure 5 Market Snapshot, By Region

Figure 6 Major Factors Such as Increasing Awareness and Adoption of Connected and Smart Technologies in the Transportation Infrastructure and Rising Urban Population to Drive the Growth of Transportation Analytics Market

Figure 7 Roadways Segment to Hold the Largest Market Size During the Forecast Period

Figure 8 North America to Hold the Highest Market Share in 2019

Figure 9 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 10 Predictive Analytics Segment to Grow at the Highest CAGR During the Forecast Period

Figure 11 Waterways Segment to Grow at the Highest CAGR During the Forecast Period

Figure 12 Road Traffic Management Segment to Hold the Largest Market Size During the Forecast Period

Figure 13 Rail Traffic Management Segment to Hold the Largest Market Size During the Forecast Period

Figure 14 Air Traffic Management Segment to Hold the Largest Market Size During the Forecast Period

Figure 15 Ship Monitoring Segment to Hold the Largest Market Size During the Forecast Period

Figure 16 Europe to Hold the Largest Market Size During the Forecast Period

Figure 17 India Transportation Analytics Market to Register the Highest CAGR Among All Countries During the Forecast Period

Figure 18 Asia Pacific Market to Grow at the Highest CAGR During the Forecast Period

Figure 19 North America: Market Snapshot

Figure 20 Europe: Market Snapshot

Figure 21 Market (Global) Competitive Leadership Mapping, 2019

Figure 22 IBM: Company Snapshot

Figure 23 IBM: SWOT Analysis

Figure 24 Siemens: Company Snapshot

Figure 25 Cubic: Company Snapshot

Figure 26 Cubic: SWOT Analysis

Figure 27 Alteryx: Company Snapshot

Figure 28 Kapsch Trafficcom: Company Snapshot

Figure 29 Kapsch Trafficcom: SWOT Analysis

Figure 30 Indra Sistemas: Company Snapshot

Figure 31 Trimble: Company Snapshot

Figure 32 TomTom: Company Snapshot

Figure 33 Iteris: Company Snapshot

Figure 34 Conduent: Company Snapshot

Figure 35 Hitachi: Company Snapshot

Figure 36 Thales Group: Company Snapshot

Figure 37 Thales Group: SWOT Analysis

The study involved four major activities in estimating the current market size for transportation analytics. An exhaustive secondary research was done to collect information on the market, peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakup and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to, to identify and collect information for this study. The secondary sources included annual reports, best practices, international organization websites and resources (Transportation agencies, public transportation departments), press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the transportation analytics market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors of transportation analytics solutions, associated service providers, and system integrators operating in the targeted regions. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of the primary respondents profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

For making market estimates and forecasting the transportation analytics market and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market using the revenue of key companies and their offerings in the market. The research methodology used to estimate the market size included the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares split, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The global market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, segment, and project the global market size for transportation analytics

- To understand the structure of the transportation analytics market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micro-markets concerning individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, for the five regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify significant growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions and investments, new product launches, mergers and acquisitions, joint ventures, and agreements in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American transportation analytics market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Transportation Analytics Market

Which is fastest growing region and what are their predictions still 2024?