Transparent Caching Market by Content Type, Software (Policy Management, Security, and Analytics), Hardware (Converged Servers and Switches), Service (Professional and Managed), End-user, and Region - Global Forecast to 2022

[139 Pages Report] The growth of the global transparent caching market is driven by various factors, such as need of reduction in cost of network infrastructure and need for improved network bandwidth. The increased problems of the network congestion can be tackled with the help of transparent caching solutions Installation of caches across the network can help service providers to offer popular content on the network, thereby reducing the amount of traffic across the network. Bandwidth plays an important role in business profitability while working on improving the user experience. Service providers are getting advantage from transparent caching technology by saving the bandwidth cost. The global transparent caching market is expected to grow from USD 876.6 Million in 2017 to USD 4,274.2 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 37.28%. The base year considered for the study is 2016, while the forecast period is 2017–2022.

The objective of the report is to define, describe, and forecast the size of the transparent caching market on the basis of content type (live streaming video, static videos, and others), software (policy management, security, and analytics), hardware (converged server and switches), services (professional and managed), end-user (ISPs, telecom operators, direct-to-home (DTH) Cable service Providers, enterprises, governments, and others), and regions. The report also aims to provide detailed information about the major factors influencing the growth of the transparent caching market (drivers, restraints, opportunities, and challenges).

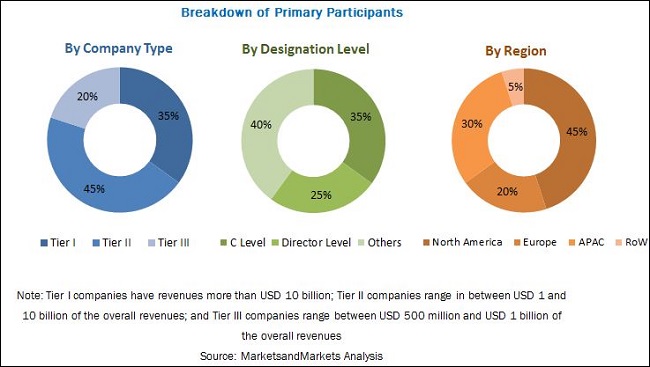

The research methodology used to estimate and forecast the global transparent caching market size begins with the capturing of data on the key vendor revenues through secondary research, annual reports, IEEE, Factiva, Bloomberg, and press releases. The vendor offerings are also taken into consideration to determine the market segmentations. The bottom-up procedure is employed to arrive at the overall market size from the revenues of the key market players. After arriving at the overall market size, the total market is split into several segments and subsegments, which are then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures are employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of the primary participants is depicted in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

Major vendors in the transparent caching market are Cisco Systems, Inc. (California, US), Ericsson AB (Stockholm, Sweden), Google (California, US), Qwilt (California, US), Symantec Corporation (California, US), Nokia Corporation (UuSimaa, Finland), ARA Networks (Seoul, Korea), SuperLumin (Dayton, Ohio), Kollective Technology, Inc. (California, US), Fortinet, Inc. (California, US), Akamai Technologies, Inc. (Massachusetts, US), Brocade Communications System, Inc. (California, US), Level 3 Communications, LLC (Colorado, US), Citrix Systems, Inc. (Florida, US), and Huawei Technologies Co., Ltd (Shenzhen, China).

The target audience of the transparent caching market report is given below:

- Government agencies

- Transparent caching solutions/services vendors

- Internet service providers

- Information Technology (IT) managers

- Telecom operators

- DTH service providers

- Managed networking solution providers

- Application end-users

“The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments”

Scope of the Report

The transparent caching market is segmented on the basis of content types, software, hardware, services, end-user, and regions:

By Content Type

- Live streaming videos

- Static videos

- Others (online games, software updates, and large file downloads)

By Software

- Policy management

- Security

- Analytics

By Hardware

- Converged server

- Switches

By Service

- Professional services

- Managed services

By End-User

- ISPs

- Telecom operators

- Direct-to-Home (DTH) Cable service Providers

- Enterprises

- Governments

- Other (retail and education) Managed services

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American transparent caching market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American transparent caching market

Company Information

- Detailed analysis and profiling of additional market players

The global transparent caching market is expected to grow from USD 876.6 Million in 2017 to USD 4,274.2 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 37.28%. The major growth drivers of the transparent caching market include the rising subscribers’ demand for superior Quality of Experience (QoE), the need for reduction in cost of the network infrastructure, and the need for a bandwidth.

In the content type segment, the static videos segment is expected to have the largest market share during the forecast period. The online video traffic occupies much of the internet bandwidth, due to which, the carriers feel more pressure. The transparent caching solutions caches the content, based on its popularity over the network. The cached content can then be delivered locally to the subscriber from the operator’s network rather than retrieving it each time from a distant content source, thus improving the QoE for users while watching online videos.

Under the hardware segment, the converged server segment is expected to grow at a higher CAGR and projected to have the largest market than that of the switches segment during forecasted period. Lots of cached file can be stored on the disk due to frequent Hypertext Transfer Protocol (HTTP) and Peer-to-Peer (P2P) cache. Users may not access the cached files on the disks regularly. With the advanced transparent caching solutions and disk recycling technology, the cache system utilizes and controls a huge disk space.

In the software segment, the security segment is expected to grow at a higher CAGR during forecast period. Transparent caching offers advanced security solutions to attain security goals. Caching software takes advantage of advanced features, including safe search enforcement and keyword filtering, and provides the web filtering solution, which simplifies the management of controlling the access to websites.

The professional services segment is expected to grow with the highest CAGR and have the largest market share during the forecast year. The professional service providers analyze the network traffic and service types, hit rates, deployment locations, redundancy and service availabilities, and business constraints and regulatory requirements. The professional service providers also provide major insights into professional services, which helps Internet Service Providers (ISPs) to deploy transparent caching solutions securely and accelerate business operations.

The telecom operators segment is expected to grow at the highest CAGR during the forecast year. Transparent caching allows telecom operators to handle the Over-the-Top (OTT) content consumption and offer enhanced QoE to the subscribers.

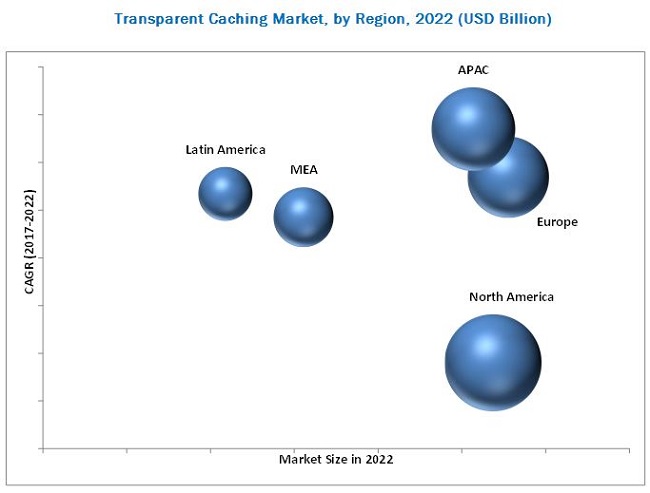

The global transparent caching market has been segmented on the basis of regions into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. North America is estimated to be the largest revenue-generating region. This is mainly because, in the developed economies of the US and Canada, there is a high focus on innovations obtained from R&D. These regions have the most competitive and rapidly changing market in the world. The APAC region is expected to be the fastest-growing region in the transparent caching market. The increased awareness for business productivity, supplemented with competently designed transparent caching solutions offered by vendors present in the APAC region has led APAC to become a highly potential market.

The transparent caching market faces many challenges, such as security concerns and insufficient investment in the transportation infrastructure.

The major vendors that offer transparent caching solutions across the globe are Cisco Systems, Inc. (California, US), Ericsson AB (Stockholm, Sweden), Google (California, US), Qwilt (California, US), Symantec Corporation (California, US), Nokia Corporation (Uusimaa, Finland), Ara Networks (Seoul, Korea), Superlumin (Dayton, Ohio), Kollective Technology, Inc. (California, US), Fortinet, Inc. (California, US), Akamai Technologies, Inc. (Massachusetts, US), Brocade Communications System, Inc. (California, US), Level 3 Communications, LLC (Colorado, US), Citrix Systems, Inc. (Florida, US), and Huawei Technologies Co., Ltd (Shenzhen, China). These vendors have adopted various types of organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their presence in the transparent caching market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Transparent Caching Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Transparent Caching Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 23)

3.1 Partnerships, Agreements, and Collaborations Strategy is Expected to Be the Differentiating Trend for the Top Companies

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Market

4.2 Transparent Caching Market, By Component

4.3 Market, By End-User and Region

4.4 Lifecycle Analysis, By Region, 2017

5 Transparent Caching Market Overview and Industry Trends (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Need for Improved Network Bandwidth

5.2.1.2 Rising Subscriber’s Demand for Superior Qoe

5.2.1.3 Need for Reduction in Cost of the Network Infrastructure

5.2.2 Opportunities

5.2.2.1 Isps are Partnering With Cdn Providers

5.2.2.2 Untapped Business Opportunities in the Transparent Caching Market

5.2.3 Challenges

5.2.3.1 Technical Complexity Involved in Deploying Solutions

5.2.4 Restraints

5.2.4.1 Security and Privacy Issues Among Content Delivery Providers

5.3 Ecosystem Analysis

5.4 System Architecture

6 Transparent Caching Market Analysis, By Content Type (Page No. - 40)

6.1 Introduction

6.2 Live Streaming Videos

6.3 Static Videos

6.4 Others

7 Transparent Caching Market Analysis, By Hardware (Page No. - 45)

7.1 Introduction

7.2 Converged Server

7.3 Switches

8 Transparent Caching Market Analysis, By Software (Page No. - 49)

8.1 Introduction

8.2 Policy Management

8.3 Security

8.4 Analytics

9 Transparent Caching Market Analysis, By Service (Page No. - 54)

9.1 Introduction

9.2 Managed Services

9.3 Professional Services

10 Transparent Caching Market Analysis, By End-User (Page No. - 58)

10.1 Introduction

10.2 Internet Service Providers

10.3 Telecom Operators

10.4 Enterprises

10.5 Direct-To-Home Cable Service Providers

10.6 Governments

10.7 Others

11 Geographic Analysis (Page No. - 65)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 84)

12.1 Microquadrant Overview

12.1.1 Vanguards

12.1.2 Innovators

12.1.3 Dynamic

12.1.4 Emerging

12.2 Competitive Benchmarking

12.2.1 Business Strategies Adopted By Major Players in the Transparent Caching Market

12.2.2 Analysis of Product Portfolio of Major Players in the Market

*Top Companies Analyzed for This Study are – Cisco Systems, Inc.; IBM Corporation; Juniper Networks; Google; Symantec Corporation; Alcatel-Lucent S.A.; Qwilt; Ericsson AB; Nokia Corporation; ARA Networks; Superlumin; Kollective Technology, Inc.; Fortinet, Inc.; Akamai Technologies; Brocade Communication Systems, Inc.; Level 3 Communications , Lcc; Citrix Systems Inc.; Huawei Technologies Co., Ltd.; Peerapp; Conversant Solutions Pte Ltd.; Vidscale, Inc.; Allot Communications Ltd.; Mara Systems GmbH; Appliansys; Ntt Communications Corporation

13 Company Profiles (Page No. - 88)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

13.1 Cisco Systems, Inc.

13.2 Ericsson AB

13.3 Google

13.4 Qwilt

13.5 Symantec Corporation

13.6 Nokia Corporation

13.7 ARA Networks

13.8 Superlumin

13.9 Kollective Technology, Inc.

13.10 Fortinet, Inc.

13.11 Akamai Technologies, Inc.

13.12 Brocade Communications Systems, Inc.

13.13 Level 3 Communications, LLC

13.14 Citrix Systems, Inc.

13.15 Huawei Technologies Co., Ltd.

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 130)

14.1 Industry Excerpts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Related Reports

14.6 Author Details

List of Tables (50 Tables)

Table 1 Transparent Caching Market Size, By Component, 2015–2022 (USD Million)

Table 2 Market Size, By Content Type, 2015–2022 (USD Million)

Table 3 Market Size, By End-User, 2015–2022 (USD Million)

Table 4 Market Size, By Content Type, 2015-2022 (USD Million)

Table 5 Live Streaming Videos: Market Size, By Region, 2015–2022 (USD Million)

Table 6 Static Videos: Market Size, By Region, 2015-2022 (USD Million)

Table 7 Others: Market Size, By Region, 2015-2022 (USD Million)

Table 8 Transparent Caching Market Size, By Hardware, 2015-2022 (USD Million)

Table 9 Converged Server: Market Size, By Region, 2015–2022 (USD Million)

Table 10 Switches: Market Size, By Region, 2015–2022 (USD Million)

Table 11 Transparent Caching Market Size, By Software, 2015-2022 (USD Million)

Table 12 Policy Management: Market Size, By Region, 2015–2022 (USD Million)

Table 13 Security: Market Size, By Region, 2015–2022 (USD Million

Table 14 Analytics: Market Size, By Region, 2015–2022 (USD Million)

Table 15 Transparent Caching Market Size, By Service, 2015-2022 (USD Million)

Table 16 Managed Services: Market Size, By Region, 2015–2022 (USD Million)

Table 17 Professional Services: Market Size, By Region, 2015–2022 (USD Million)

Table 18 Transparent Caching Market Size, By End-User, 2015-2022 (USD Million)

Table 19 Internet Service Providers: Market Size, By Region, 2015–2022 (USD Million)

Table 20 Telecom Operators: Market Size, By Region, 2015–2022 (USD Million)

Table 21 Enterprises: Market Size, By Region, 2015–2022 (USD Million)

Table 22 Direct-To-Home Cable Service Providers: Market Size, By Region, 2015–2022 (USD Million)

Table 23 Governments: Market Size, By Region, 2015–2022 (USD Million)

Table 24 Others: Market Size, By Region, 2015–2022 (USD Million)

Table 25 Transparent Caching Market Size, By Region, 2015–2022 (USD Million)

Table 26 North America: Market Size, By Content Type, 2015–2022 (USD Million)

Table 27 North America: Market Size, By Software, 2015–2022 (USD Million)

Table 28 North America: Market Size, By Hardware, 2015–2022 (USD Million)

Table 29 North America: Market Size, By Service, 2015–2022 (USD Million)

Table 30 North America: Market Size, By End-User, 2015–2022 (USD Million)

Table 31 Europe: Transparent Caching Market Size, By Content Type, 2015–2022 (USD Million)

Table 32 Europe: Market Size, By Software, 2015–2022 (USD Million)

Table 33 Europe: Market Size, By Hardware, 2015–2022 (USD Million)

Table 34 Europe: Market Size, By Service, 2015–2022 (USD Million)

Table 35 Europe: Market Size, By End-User, 2015–2022 (USD Million)

Table 36 Asia Pacific: Transparent Caching Market Size, By Content Type, 2015–2022 (USD Million)

Table 37 Asia Pacific: Market Size, By Software, 2015–2022 (USD Million)

Table 38 Asia Pacific: Market Size, By Hardware, 2015–2022 (USD Million)

Table 39 Asia Pacific: Market Size, By Service, 2015–2022 (USD Million)

Table 40 Asia Pacific: Market Size, By End-User, 2015–2022 (USD Million)

Table 41 Middle East and Africa: Transparent Caching Market Size, By Content Type, 2015–2022 (USD Million)

Table 42 Middle East and Africa: Market Size, By Software, 2015–2022 (USD Million)

Table 43 Middle East and Africa: Market Size, By Hardware, 2015–2022 (USD Million)

Table 44 Middle East and Africa: Market Size, By Service, 2015–2022 (USD Million)

Table 45 Middle East and Africa: Market Size, By End-User, 2015–2022 (USD Million)

Table 46 Latin America: Transparent Caching Market Size, By Content Type, 2015–2022 (USD Million)

Table 47 Latin America: Market Size, By Software, 2015–2022 (USD Million)

Table 48 Latin America: Market Size, By Hardware, 2015–2022 (USD Million)

Table 49 Latin America: Market Size, By Service, 2015–2022 (USD Million)

Table 50 Latin America: Market Size, By End-User, 2015–2022 (USD Million)

List of Figures (73 Figures)

Figure 1 Global Transparent Caching Market Segmentation

Figure 2 Transparent Caching Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Transparent Caching Market: Assumptions

Figure 8 Market Snapshot, By Component (2017 vs 2022)

Figure 9 Market Snapshot, By Content Type (2017 vs 2022)

Figure 10 Market Snapshot, By End-User (2017 vs 2022)

Figure 11 North America is Expected to Have the Largest Market Share in the Global Transparent Caching Market, 2017

Figure 12 Improved Network Bandwidth and Demand for Superior Quality of Experience are Pushing the Market

Figure 13 Hardware Segment is Expected to Contribute to the Largest Market Share in the Transparent Caching Market

Figure 14 Internet Service Providers and North America are Expected to Account for the Largest Market Shares in the Market

Figure 15 North America is the Leading Region in the Market Due to the High Adoption of Transparent Caching Solutions Across Network Service Providers

Figure 16 Market By Content Type

Figure 17 Market By Software

Figure 18 Market By Hardware

Figure 19 Market By Service

Figure 20 Market By End-User

Figure 21 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 22 Ecosystem: Transparent Caching Market

Figure 23 Static Videos Segment is Expected to Lead the Transparent Caching Market, By Content Type, During the Forecast Period

Figure 24 The Market is Expected to Be Dominated By Converged Server During the Forecast Period

Figure 25 Analytics Software is Expected to Have the Highest CAGR During the Forecast Period

Figure 26 Professional Services Segment is Expected to Dominate A Large Part of the Market During the Forecast Period

Figure 27 Telecom Operators Segment is Expected to Lead the End-Users Market During the Forecast Period

Figure 28 Asia Pacific is Expected to Lead the Transparent Caching Market During the Forecast Period

Figure 29 Asia Pacific—An Attractive Region for Investments in the Market

Figure 30 North America: Market Snapshot

Figure 31 Asia Pacific: Market Snapshot

Figure 32 Microquadrant

Figure 33 Cisco Systems, Inc.: Company Snapshot

Figure 34 Cisco Systems, Inc.: Product Offering Scorecard

Figure 35 Cisco Systems, Inc.: Business Strategy Scorecard

Figure 36 Ericsson AB: Company Snapshot

Figure 37 Ericsson AB: Product Offering Scorecard

Figure 38 Ericsson AB: Business Strategy Scorecard

Figure 39 Google: Company Snapshot

Figure 40 Google: Product Offering Scorecard

Figure 41 Google: Business Strategy Scorecard

Figure 42 Qwilt: Product Offering Scorecard

Figure 43 Qwilt: Business Strategy Scorecard

Figure 44 Symantec Corporation: Company Snapshot

Figure 45 Symantec Corporation: Product Offering Scorecard

Figure 46 Symantec Corporation: Business Strategy Scorecard

Figure 47 Nokia Corporation: Company Snapshot

Figure 48 Nokia Corporation: Product Offering Scorecard

Figure 49 Nokia Corporation: Business Strategy Scorecard

Figure 50 ARA Networks: Product Offering Scorecard

Figure 51 ARA Networks: Business Strategy Scorecard

Figure 52 Superlumin: Product Offering Scorecard

Figure 53 Superlumin: Business Strategy Scorecard

Figure 54 Kollective Technology, Inc.: Product Offering Scorecard

Figure 55 Kollective Technology, Inc.: Business Strategy Scorecard

Figure 56 Fortinet, Inc.: Company Snapshot

Figure 57 Fortinet, Inc.: Product Offering Scorecard

Figure 58 Fortinet, Inc.: Business Strategy Scorecard

Figure 59 Akamai Technologies, Inc.: Company Snapshot

Figure 60 Akamai Technologies, Inc.: Product Offering Scorecard

Figure 61 Akamai Technologies, Inc.: Business Strategy Scorecard

Figure 62 Brocade Communications Systems, Inc.: Company Snapshot

Figure 63 Brocade Communications Systems, Inc.: Product Offering Scorecard

Figure 64 Brocade Communications Systems, Inc.: Business Strategy Scorecard

Figure 65 Level 3 Communications, LLC: Company Snapshot

Figure 66 Level 3 Communications, LLC: Product Offering Scorecard

Figure 67 Level 3 Communications, LLC: Business Strategy Scorecard

Figure 68 Citrix Systems, Inc.: Company Snapshot

Figure 69 Citrix Systems, Inc.: Product Offering Scorecard

Figure 70 Citrix Systems, Inc.: Business Strategy Scorecard

Figure 71 Huawei Technologies Co., Ltd.: Company Snapshot

Figure 72 Huawei Technologies Co., Ltd.: Product Offering Scorecard

Figure 73 Huawei Technologies Co., Ltd.: Business Strategy Scorecard

Growth opportunities and latent adjacency in Transparent Caching Market