Security Policy Management Market by Component (Solution and Services), Product Type (Network Policy Management, Compliance and Auditing, Change Management, and Vulnerability Assessment), Organization Size, Vertical, and Region - Global Forecast to 2024

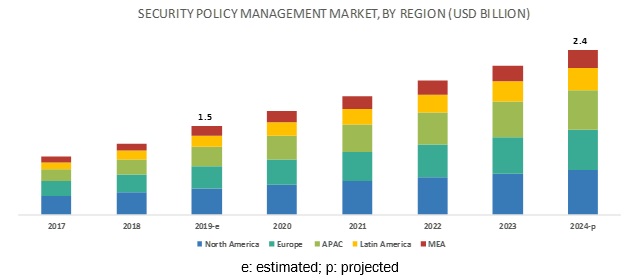

[134 Pages Report] The global security policy management market size expected to grow from USD 1.5 billion in 2019 to USD 2.4 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 9.6% during the forecast period. Need to increase the agility of business processes without sacrificing security and the need to reduce the reliance on the manual process are the major factors driving the growth of the market.

Solution segment to be the largest contributor to the market growth during the forecast period

The solution segment is expected to hold the largest market size in the security policy management market by component. Security policy management solutions help to protect data within networks. Organizations are adopting these solutions to ensure continuous compliance. Security policy management solutions are capable of securing vital information against evolving threats, such as spams, malware, Trojan, Business Email Compromise (BEC), and phishing. The solutions are gaining traction due to the increasing demand among enterprises to effectively secure their internal and external infrastructure in order to protect critical business information and infrastructure.

Banking, Financial Services, and Insurance (BFSI) industry vertical to hold the largest market size in the security policy management market in 2019

The BFSI industry vertical is estimated to hold the largest market size in the security policy management market in 2019. The BFSI is the most targeted industry vertical, as it deals with large volumes of sensitive and private financial data. The enterprises in BFSI are demanding for security policy management solutions to ensure irreversible security. Moreover, the industry vertical is the most regulated, as it has to comply with many security requirements.

North America to hold the largest market size during the forecast period

North America is estimated to account for the highest market share in the security policy management market in 2019. Early adoption of security policy management solution and the presence of several vendors that provide security policy management are expected to drive market growth in the region. Businesses in the region are increasingly implementing security policy management solutions to detect and prevent threats at the early stage.

Key Market Players

The major vendors in the market are Cisco (US), Micro Focus (UK), Palo Alto Networks (US), Check Point Software Technologies (US), McAfee (US), Juniper Networks (US), Firemon (US), HelpSystems (US), AlgoSec (US), Tufin (US), CoNetrix (US), iManage (US), Odyssey Consultants (Cyprus), OPAQ Networks (US), Enterprise Integration (US) and Skybox Security (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Components (solution and services), Product type (network policy management, compliance and auditing, change management and vulnerability assessment) Organization size (small and medium-sized enterprises and large enterprises), Verticals (banking, financial services, and insurance, government and public sector, it and telecom, healthcare, retail, manufacturing, energy and utilities and others), and Regions. |

|

Geographies covered |

North America, Europe, APAC, Latin America and MEA |

|

Companies covered |

Cisco (US), Micro Focus (UK), Palo Alto Networks (US), Check Point Software Technologies (US), McAfee (US), Juniper Networks (US), Firemon (US), HelpSystems (US), AlgoSec (US), Tufin (US), CoNetrix (US), iManage (US), Odyssey Consultants (Cyprus), OPAQ Networks (US), Enterprise Integration (US), and Skybox Security (US). |

This research report categorizes the security policy management market to forecast revenues and analyze trends in each of the following submarkets:

On the basis of Components, the market has been segmented as follows:

- Solution

- Services

- Professional services

- Managed services

On the basis of Product Type, the security policy management market has been segmented as follows:

- Network policy management

- Compliance and auditing

- Change management

- Vulnerability assessment

On the basis of Organization Size, the market has been segmented as follows:

- Small and Medium-sized Enterprises

- Large Enterprises

On the basis of Vertical, the market has been segmented as follows:

- BFSI

- Government and public utilities

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Energy and Utilities

- Others (Travel and Hospitality, Education, and Media and Entertainment)

On the basis of Regions, the security policy management market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- Middle East

- Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2019, HelpSystems acquired Core Security Solutions from SecureAuth. This would help HelpSystems expand its offering that can defend against internal and external threats and intrusion.

Key Questions Addressed by the Report:

- Where would all these developments take the industry in the mid to long term?

- What are the upcoming industry solutions for the security policy management market?

- Which are the major factors expected to drive the market?

- Which region would offer high growth for vendors in the market?

- Which solution would gain the largest market share in the market?

Frequently Asked Questions (FAQ):

What does security policy management mean?

Security policy management is defined as a set of tool to address security threats from internal and external entities in a digital ecosystem. It helps companies understand their electronic assets, comply with regulations; and enforce the security measurements to understand their electronic assets; comply with regulations; and enforce the security measurements to enhance change management, application and business continuity, data migration, and disaster recovery.What are the driving factors for security policy management market?

Some of the factors that are driving the security policy management market includes:

- Demand for Greater Business Agility Without Sacrificing Security

- Need to Reduce the Reliance on Manual Processes

Who are the prominent players in the security policy management market?

Some of the prominent players in the security policy management market include Cisco, Micro Focus, Palo Alto Networks, Check Point Software Technologies, McAfee, Juniper Networks, Firemon, HelpSystems, AlgoSec, Tufin, CoNetrix, iManage, Odyssey Consultants, OPAQ Networks, Enterprise Integration and Skybox Security.What is the security policy management market size?

The global security policy management market size is projected to grow from USD 1.5 billion in 2019 to USD 2.4 billion by 2024, at a CAGR of 9.6% during the forecast period. Compliances such as PCI, DSS, GDPR, and HIPAA are compelling enterprises to adopt security policy management solutions for enhancing data protection.Which are the major security policy management verticals?

Some of the major verticals that deploy security policy management are Government and public utilities, Banking, Financial Services and Insurance (BFSI), IT and Telecom, Retail, Energy and Utilities, Manufacturing, and Healthcare. Retail and manufacturing are fastest growing verticals during the forecast period. Due to increase in the number of financial crimes in the retail vertical helps the vertical growth at the highest rate.To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Participants’ Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down and Bottom-Up Approaches

2.4 Market Forecast

2.5 Microquadrant Research Methodology

2.5.1 Vendor Inclusion Criteria

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in the Security Policy Management Market

4.2 Market By Component, 2019

4.3 Market By Organization Size, 2019–2024

4.4 Market Market Share of Top 3 Industry Verticals and Regions, 2019

4.5 Market By Product Type, 2019

4.6 Market Investment Scenario

5 Security Policy Management Market Overview and Industry Trends (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Demand for Greater Business Agility Without Sacrificing Security

5.2.1.2 Need to Reduce the Reliance on Manual Processes

5.2.2 Restraints

5.2.2.1 Continuously Changing Business Requirements

5.2.3 Opportunities

5.2.3.1 Shift From Homogenous Model to Hybrid Network Model

5.2.3.2 Growing Pressure From Regulatory Bodies to Maintain Proper Security Policies

5.2.4 Challenges

5.2.4.1 Low Cybersecurity Budget

5.3 Industry Trends

5.3.1 Centralized Security Policy Management

5.4 Security Policy Management: use Cases

5.4.1 Cdw Attaining Sox Compliance With Ease

5.4.2 Tekjet Adopted Check Point for Security Management

5.5 Regulatory Implications

5.5.1 General Data Protection Regulation

5.5.2 Payment Card Industry Data Security Standard

5.5.3 Health Insurance Portability and Accountability Act

5.5.4 Federal Information Security Management Act

5.5.5 Gramm-Leach-Bliley Act

5.5.6 Sarbanes-Oxley Act

5.5.7 The International Organization for Standardization 27001

6 Security Policy Management Market By Component (Page No. - 42)

6.1 Introduction

6.2 Solution

6.2.1 Need to Secure Organizations From Cyberattacks to Drive the Adoption of Security Policy Management Solutions

6.3 Services

6.3.1 Professional Services

6.3.1.1 Increasing Need for Security Professionals to Drive the Demand for Professional Services

6.3.2 Managed Services

6.3.2.1 Increasing Need to Reduce Data Breaches and Protect Intellectual Property Driving the Demand for Managed Services

7 Market By Product Type (Page No. - 48)

7.1 Introduction

7.2 Network Policy Management

7.2.1 Growing Complexities in Networks to Boost the Demand for Network Policy Management

7.3 Compliance and Auditing

7.3.1 Growing Need for Dynamic Policy Auditing and Risk Analysis to Fuel the Demand for Compliance and Auditing

7.4 Change Management

7.4.1 Increasing Network Policy Changes to Drive the Demand for Change Management

7.5 Vulnerability Assessment

7.5.1 Surging Need to Identify Network Vulnerabilities Driving the Demand for Vulnerability Management

8 Security Policy Management Market By Organization Size (Page No. - 54)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.2.1 Rising Security Issues to Drive the Adoption of Security Policy Management Solutions Among Small and Medium-Sized Enterprises

8.3 Large Enterprises

8.3.1 Increasing Cyberattacks and Hefty Fines for Regulatory Non-Compliance to Boost the Adoption of Security Policy Management Solutions Among Large Enterprises

9 Market By Vertical (Page No. - 58)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.2.1 Growing Need to Adhere to Stringent Regulatory Compliances Driving the Adoption of Security Policy Management Solutions in Banking, Financial Services, and Insurance Vertical

9.3 Government and Public Sector

9.3.1 Increasing Need to Protect Sensitive Data of Citizens as Well as Organizations Driving the Adoption of Security Policy Management Solutions in Government and Public Sector

9.4 IT and Telecom

9.4.1 Increasing Need for Web, Mobile, and Cloud-Based Applications to Drive the Demand for Security Policy Management Solutions in IT and Telecom Vertical

9.5 Healthcare

9.5.1 Growing Need for Securing Patients’ Data to Boost the Adoption of Security Policy Management Solutions in Healthcare

9.6 Retail

9.6.1 Need to Reduce Operational Cost and Enhance Profit Margins Driving the Adoption of Security Policy Management Solutions in Retail

9.7 Manufacturing

9.7.1 Rising Need for Effective Risk Management to Drive the Adoption of Security Policy Management Solutions in Manufacturing

9.8 Energy and Utilities

9.8.1 Need for IIoT and Connected Devices to Spur the Demand for Security Policy Management Solutions in Energy and Utilities

9.9 Others

10 Security Policy Management Market By Region (Page No. - 68)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 Stringent Regulatory Standards and a Large Number of Vendors to Drive the Growth of Market in the US

10.2.2 Canada

10.2.2.1 Increasing Adoption of New Technology to Drive the Growth of Market in Canada

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 Existing Laws and Regulations and Adoption of New Technologies to Drive the Demand for Security Policy Management Solutions in the UK

10.3.2 Germany

10.3.2.1 Existing Ecosystem to Increase the Need for Security Policy Management Solutions in German Organizations

10.3.3 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Already Existing Economy to Boost the Growth of Security Policy Management Market in China

10.4.2 Japan

10.4.2.1 Government Initiatives and Increase in Need for Cybersecurity to Spur the Demand for Security Policy Management Solutions in Japan

10.4.3 India

10.4.3.1 Presence of Local and International Players to Contribute to the Growth of Market in India

10.4.4 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Government Initiatives and Digitalization of Core Business Functions to Drive the Growth of the Market in the Middle East

10.5.2 Africa

10.5.2.1 Communication Service Providers’ Continued Focus on Cloud Technologies to Boost the Growth of the Security Policy Management Market in Africa

10.6 Latin America

10.6.1 Brazil

10.6.1.1 Banking Sector to Drive the Growth of Security Policy Management in Brazil

10.6.2 Mexico

10.6.2.1 Focus of Mexican Government Toward Egovernance Using Cloud Technologies to Drive the Demand for Security Policy Management Solutions in Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 92)

11.1 Competitive Leadership Mapping

11.1.1 Visionary Leaders

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

11.2 Competitive Scenario

11.2.1 Partnerships, Agreements, and Collaborations

11.2.2 New Product Launches/Product Enhancements

11.2.3 Mergers and Acquisitions

12 Company Profiles (Page No. - 98)

12.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2 Cisco

12.3 Micro Focus

12.4 Palo Alto Networks

12.5 Check Point Software Technologies

12.6 McAfee

12.7 Juniper Networks

12.8 Firemon

12.9 HelpSystems

12.10 AlgoSec

12.11 Tufin

12.12 CoNetrix

12.13 iManage

12.14 Odyssey Consultants

12.15 OPAQ Networks

12.16 Enterprise Integration

12.17 Skybox Security

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 128)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (60 Tables)

Table 1 Factor Analysis

Table 2 Evaluation Criteria

Table 3 Security Policy Management Market Size and Growth, 2017–2024 (USD Million, Y-O-Y %)

Table 4 Market Size By Component, 2017–2024 (USD Million)

Table 5 Solution: Market Size By Region, 2017–2024 (USD Million)

Table 6 Services: Market Size By Region, 2017–2024 (USD Million)

Table 7 Services: Market Size By Type, 2017–2024 (USD Million)

Table 8 Professional Services Market Size, By Region, 2017–2024 (USD Million)

Table 9 Managed Services Market Size, By Region, 2017–2024 (USD Million)

Table 10 Security Policy Management Market Size, By Product Type, 2017–2024 (USD Million)

Table 11 Network Policy Management: Market Size By Region, 2017–2024 (USD Million)

Table 12 Compliance and Auditing: Market Size By Region, 2017–2024 (USD Million)

Table 13 Change Management: Market Size By Region, 2017–2024 (USD Million)

Table 14 Vulnerability Assessment: Market Size By Region, 2017–2024 (USD Million)

Table 15 Market Size, By Organization Size, 2017–2024 (USD Million)

Table 16 Small and Medium-Sized Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 17 Large Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 18 Security Policy Management Market Size, By Vertical, 2017–2024 (USD Million)

Table 19 Banking, Financial Services, and Insurance: Market Size By Region, 2017–2024 (USD Million)

Table 20 Government and Public Sector: Market Size By Region, 2017–2024 (USD Million)

Table 21 IT and Telecom: Market Size By Region, 2017–2024 (USD Million)

Table 22 Healthcare: Market Size By Region, 2017–2024 (USD Million)

Table 23 Retail: Market Size By Region, 2017–2024 (USD Million)

Table 24 Manufacturing: Market Size By Region, 2017–2024 (USD Million)

Table 25 Energy and Utilities: Market Size By Region, 2017–2024 (USD Million)

Table 26 Others: Market Size By Region, 2017–2024 (USD Million)

Table 27 Security Policy Management Market Size, By Region, 2017–2024 (USD Million)

Table 28 North America: Market Size, By Component, 2017–2024 (USD Million)

Table 29 North America: Market Size By Service, 2017–2024 (USD Million)

Table 30 North America: Market Size By Product Type, 2017–2024 (USD Million)

Table 31 North America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 32 North America: Market Size By Vertical, 2017–2024 (USD Million)

Table 33 North America: Market Size By Country, 2017–2024 (USD Million)

Table 34 Europe: Security Policy Management Market Size, By Component, 2017–2024 (USD Million)

Table 35 Europe: Market Size By Service, 2017–2024 (USD Million)

Table 36 Europe: Market Size By Product Type, 2017–2024 (USD Million)

Table 37 Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 38 Europe: Market Size By Vertical, 2017–2024 (USD Million)

Table 39 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 40 Asia Pacific: Market Size, By Component, 2017–2024 (USD Million)

Table 41 Asia Pacific: Market Size By Service, 2017–2024 (USD Million)

Table 42 Asia Pacific: Market Size By Product Type, 2017–2024 (USD Million)

Table 43 Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 44 Asia Pacific: Market Size By Vertical, 2017–2024 (USD Million)

Table 45 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 46 Middle East and Africa: Security Policy Management Market Size, By Component, 2017–2024 (USD Million)

Table 47 Middle East and Africa: Market Size By Service, 2017–2024 (USD Million)

Table 48 Middle East and Africa: Market Size By Product Type, 2017–2024 (USD Million)

Table 49 Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 50 Middle East and Africa: Market Size By Vertical, 2017–2024 (USD Million)

Table 51 Middle East and Africa: Market Size By Country, 2017–2024 (USD Million)

Table 52 Latin America: Security Policy Management Market Size, By Component, 2017–2024 (USD Million)

Table 53 Latin America: Market Size By Service, 2017–2024 (USD Million)

Table 54 Latin America: Market Size By Product Type, 2017–2024 (USD Million)

Table 55 Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 56 Latin America: Market Size By Vertical, 2017–2024 (USD Million)

Table 57 Latin America: Market Size By Country, 2017–2024 (USD Million)

Table 58 Partnerships, Agreements, and Collaborations, 2017–2019

Table 59 New Product Launches/Product Enhancements, 2017–2019

Table 60 Mergers and Acquisitions, 2017–2019

List of Figures (32 Figures)

Figure 1 Global Security Policy Management Market: Research Design

Figure 2 Research Methodology

Figure 3 Security Policy Management Market: Bottom-Up and Top-Down Approaches

Figure 4 Global Market to Witness Significant Growth During the Forecast Period

Figure 5 Services Segment to Grow at a Higher CAGR During the Forecast Period

Figure 6 North America to Hold the Highest Market Share in 2019

Figure 7 Fastest-Growing Segments of the Security Policy Management Market

Figure 8 Increasing Number of Cyberattacks Across Verticals Fueling the Growth of Market

Figure 9 Solution Segment to Have a Higher Market Share During the Forecast Period

Figure 10 Large Enterprises Segment to Have a Higher Market Share During the Forecast Period

Figure 11 BFSI Industry Vertical and North America to Have the Highest Market Shares in 2019

Figure 12 Network Policy Management Segment to Hold the Highest Market Share in 2019

Figure 13 Asia Pacific to Emerge as the Best Market for Investment in the Next 5 Years

Figure 14 Drivers, Restraints, Opportunities, and Challenges: Security Policy Management Market

Figure 15 Services Segment to Grow at a Higher CAGR During the Forecast Period

Figure 16 Managed Services Segment to Grow at the Highest CAGR During the Forecast Period

Figure 17 Change Management Product Type to Grow at the Highest CAGR During the Forecast Period

Figure 18 Small and Medium-Sized Enterprises Segment to Grow at the Highest CAGR During the Forecast Period

Figure 19 Retail Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 20 North America to Account for the Largest Market Size in 2018

Figure 21 North America: Market Snapshot

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Global Security Policy Management Market, Competitive Leadership Mapping, 2019

Figure 24 Key Developments By the Leading Players in the Market, 2017–2019

Figure 25 Cisco: Company Snapshot

Figure 26 Cisco: SWOT Analysis

Figure 27 Micro Focus: Company Snapshot

Figure 28 Micro Focus: SWOT Analysis

Figure 29 Palo Alto Networks: Company Snapshot

Figure 30 Check Point Software Technologies: Company Snapshot

Figure 31 Check Point Software Technologies: SWOT Analysis

Figure 32 Juniper Networks: Company Snapshot

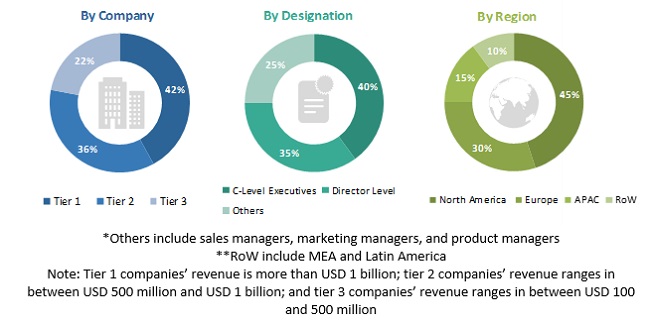

The study involved 4 major activities in estimating the current market size for the security policy management market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments of the security policy management market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The security policy management market comprises several stakeholders, such as security policy management vendors, regulatory bodies, system integrators, resellers and distributors, research organizations, government agencies, enterprise users, venture capitalists, private equity firms, and startup companies. The demand-side of the market consists of enterprises across different industries including retail, manufacturing and logistics, BFSI, telecom and IT, and healthcare and life science. The supply-side includes security policy management solution providers, offering security policy management solution and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Security Policy Management Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the security policy management market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the security policy management market by components (solution and services), product type (network policy management, compliance and auditing, change management and vulnerability assessment) organization size (small and medium-sized enterprises and large enterprises), verticals (banking, financial services, and insurance, government and public sector, it and telecom, healthcare, retail, manufacturing, energy and utilities and others), and regions. To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment

- To analyze the competitive developments, such as agreements, partnerships, acquisitions, and product/solution launches, in the security policy management market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market into the US and Canada

- Further breakup of the European market into the UK, Germany, and Rest of Europe

- Further breakup of the APAC market into ANZ, Japan, and Rest of APAC

- Further breakup of the MEA market into Africa and the Middle East

- Further breakup of the Latin American market into Brazil, Mexico, and Rest of Latin America

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Security Policy Management Market

Would like to understand the security investment landscape in Middle east region

What are the COVID-driven dynamics in Security Policy Management

Interested in Security Patch and Policy Management

What industries are affected majorly by lapse in Security Policy Management and how ?