Polypropylene Market by Type (Homopolymer, Copolymer), Application (Injection Molding, Fiber & Raffia, Film & Sheet, and Blow Molding), End-Use Industry (Packaging, Automotive, Building & Construction, Medical), and Region - Global Forecast to 2022

To get the latest information, inquire now!

[154 Pages Report] Polypropylene is a thermoplastic polymer that is used in a variety of applications. Polypropylene is produced by combining propylene monomer with catalysts. The global polypropylene industry is witnessing growth because of the emergence of new applications, technological advancements, and growing demand in the APAC region. Polypropylene is one of the most versatile polymers and is used in almost every modern industry. Polypropylene provides resistance against chemicals and extreme temperatures and is increasingly used in packaging, automobiles, building & construction, healthcare , and electronics.

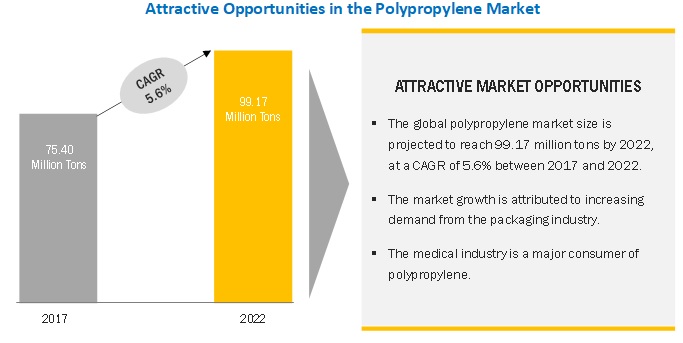

The polypropylene market size was USD 71.08 Billion in 2016 and is projected to reach USD 99.17 billion by 2022, at a CAGR of 5.6% between 2017 and 2022. The base year considered for the study is 2016, while the forecast period is from 2017 to 2022. Also, the global polypropylene market size is projected to reach 99.17 million tons by 2022, at a CAGR of 5.6% between 2017 and 2022. Major factor driving the growth of this market is the rising demand for polypropylene in emerging markets . The restraining factors in the market are identified as environmental concerns and rising raw material costs. The restraints related to the market mainly pertain to environmental concerns of polypropylene, especially regarding the disposal of plastic waste.

Homopolymer to dominate the polypropylene market between 2017 and 2022.

Homopolymer polypropylene is majorly used in a variety of applications as they provide high strength. They are also stiffer and stronger than copolymer. Also, due to its chemical resistance and elasticity, it can be used in a variety of applications. Copolymer polypropylene is softer, but, has a stronger impact strength and is more durable than homopolymer propylene. It is increasingly being used in the medical industry.

Homopolymer accounted to be the largest and the fastest-growing segment of the overall polypropylene market. The growth is attributed to the broad applicability of homopolymer in different end-use industries such as packaging, automotive, building & construction, electrical & electronics, and medical.

Fiber & raffia to lead the polypropylene market during the forecast period.

Polypropylene is one of the lowest density plastics. Due to its properties, such as chemical resistance, low density, outstanding property balance, and versatility, polypropylene is used in a broad range of applications, including fiber & raffia. They are used as flexible fibers for carpet, carpet backing, and tapes.

The injection molding segment is the second-largest application of polypropylene. Polypropylene is smooth to mold, and it flows well in the injection molding equipment due to its low melt viscosity. Injection molding is used for the production of molded plastic products.

Injection molding accounted for the second-largest application of polypropylene globally. The increasing demand for molded plastics in almost every end-use industry is driving the demand for polypropylene in injection molding. The market for polypropylene is projected to register the highest growth in the blow molding application segment. The increasing demand from the food & beverage sector is also a significant factor in the polypropylene market.

Packaging end-use industry to dominate the overall polypropylene market between 2017 and 2022.

The packaging industry led the polypropylene market, and the trend is estimated to remain the same during the forecast period. Polypropylene is the most-widely used plastic for packaging. It is majorly used in food packaging applications where there is direct contact with food or beverages. The reason for this is that polypropylene does not leak chemicals into the food. It is also used in water bottles, toys, steering wheels, and others.

The automotive sector is the second-largest end-use industry of polypropylene. The main driving factor for polypropylene in the automotive industry is the increasing demand for electric and hybrid electric vehicles (EV/HEV). Polypropylene can be used as an insulating material for high voltage carrying cables as well as in the interior of the vehicle. Polypropylene provides lightweight, thinner, and flexible insulation.

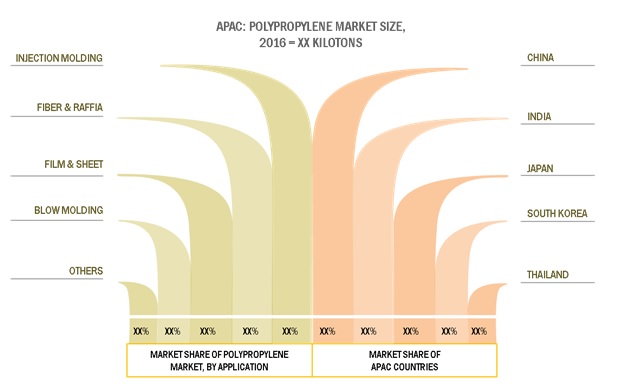

APAC market is expected to grow at the highest CAGR during the forecast period.

APAC led the global polypropylene market, both in terms of volume and value. The APAC market is also estimated to record the highest growth in terms of volume between 2017 and 2022. Increased demand for polypropylene from packaging, automotive, building & construction, electricals & electronics, and medical industries in countries such as China and India is driving the growth of the market in APAC.

Market Dynamics

Driver: Growth of key end-use industries

The growing demand from end-use industries such as packaging, automotive, building & construction, healthcare , and electricals & electronics is the primary growth driver for the polypropylene market. Polypropylene is a low-cost material with excellent mechanical properties and moldability. Due to this, more than half of the plastic used in the automotive sector is polypropylene. Polypropylene is used in different parts, such as bumpers, instrumental panels, and door trims.

The properties of polypropylene, such as low density, lightweight, high heat resistance, durability, and high clarity make it a suitable material for packaging. Polypropylene is also used in building & construction and electricals & electronics for insulating building wraps and insulation of electronics goods. The Ministry of Industry and Information Technology of China predicts the country’s electric car sales to double in the coming few years. All these factors act as critical growth drivers for polypropylene.

Restraints: Availability of other substitutes providing stiff competition to polypropylene

There are several plastic materials other than polypropylene, such as polystyrene (PS), polyethylene terephthalate (PET), polyurethane (PUR), polyvinyl chloride (PVC), and polyethylene (PE). These plastic materials give stiff competition to polypropylene. Amongst these plastics materials, polyethylene is the most commonly used and most produced. Polyethylene can be processed into soft and flexible as well as hard and robust products.

Polyethylene can be molded in all kinds of shapes, from the simplest to the most complex ones. All these properties make polyethylene a reliable substitute for polypropylene. Also, the availability of other similar polymers poses intense competition to polypropylene.

Opportunities:

Owing to the growing concern over climate change in recent times, the global automotive industry is focusing on developing materials to improve fuel efficiency in automotive. More than a quarter of all combined greenhouse gas emissions (GHG) are associated with road transport vehicles. Increased awareness about greenhouse gas emission and energy security issues have led to automotive light-weighting as a major trend worldwide.

Along with this, the significant growth of electric vehicles is opening up new opportunities for polypropylene. The increase of electric vehicles is associated with rising government regulations over the reduction of greenhouse gas emitted by conventional vehicles, high fuel efficiency provided, and soundless operation. The use of polypropylene helps in light-weighting the vehicle. Light weighting is significant for electric cars as it improves the range of these vehicles. Polypropylene is one most-widely used plastics in electric vehicles. Due to these factors, the growth in the electric vehicle market is expected to open up several opportunities for polypropylene.

Challenges: Increasing trend of plastic recycling

Plastics are some of the most commonly produced materials in the world on a large scale. However, plastics are non-biodegradable and affect the environment severely. This affects the growth of the plastics industry. The new trend of recycling plastics materials retrains the growth of plastics and, in turn, the growth of the polypropylene market. Recycling of the available plastic/polypropylene restricts or lessens the manufacturing of plastics/polypropylene.

Plastic recycling refers to the process of collecting waste or scrap plastic and reprocessing it into useful products. Earlier, polypropylene was rarely recycled. Now, it is becoming a highly recyclable item through organized efforts to build secondary markets. Brands such as Unilever and Procter & Gamble are driving the demand for post-consumer recycled polypropylene for packaging applications. Also, many companies are adopting this trend to enhance the brand image by committing to zero waste and environmental protection. All these factors affect the growth of the polypropylene market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2015 – 2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017 – 2022 |

|

Forecast units |

(USD) million/ billion, kiloton |

|

Segments covered |

Type, Application, End-User Industry, and Region |

|

Geographies covered |

North America, Europe, APAC, Middle East & Africa, and South America |

|

Companies covered |

Major industry players, also including, |

The research report categorizes the Polypropylene market to forecast the revenues and analyze the trends in each of the following sub-segments:

Polypropylene Market On the basis of Type:

- Homopolymer

- Copolymer

Polypropylene Market On the basis of Application:

- Injection Molding

- Fiber & Raffia

- Film & Sheet

- Blow Molding

Polypropylene Market On the basis of End-use Industry:

- Packaging

- Automotive

- Building & Construction

- Electrical & Electronics

- Medical

Polypropylene Market On the basis of Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Key Market Players

Exxon Mobil Corporation (US), LyondellBasell Industries Holdings B.V. (Netherlands), SABIC (Saudi Arabia), INEOS (Switzerland), China Petrochemical Corporation (China).

Recent Developments

- In September 2017, LyondellBasell started a new 20 kilotons per year polypropylene compounding plant in Dalian, China. Through this expansion, the company aimed to serve the growing demand for the domestic automotive industry.

- In September 2017, SABIC continued its global expansion with the setting up of a new polypropylene pilot plant in Geleen, Netherlands. Through this expansion, the company aims to serve the rising demand for polypropylene.

- In June 2017, INEOS announced plans to construct a world-scale PDH (propane dehydrogenation) unit in Europe. The plant will produce 750,000 tonnes per annum of propylene for INEOS. Through this expansion, the company benefits from self-sufficiency in all key olefin products and further supports the growth of its polymer business.

- In May 2017, Total revamped its Carling- Saint- Avlod petrochemical complex in eastern France. Through this expansion, the company commissioned its compound polypropylene and hydrocarbon resin production.

- In September 2016, Sumitomo Chemicals established its polypropylene production facility in Tamil Nadu, India. Through this expansion, the company aimed to serve the growing demand for polypropylene in the automotive industry of the country.

Critical questions the report answers:

- What are the upcoming trends for the Polypropylene market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Polypropylene Market

4.2 APAC Polypropylene Market, By Application and Country

4.3 Polypropylene Market, By Type

4.4 Polypropylene Market, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth of Key End-Use Industries

5.2.1.2 Preference for Polypropylene to Metal and Other Traditional Materials in Various Industries

5.2.2 Restraints

5.2.2.1 Availability of Other Substitutes Providing Stiff Competition to Polypropylene

5.2.2.2 Growing Concern Over Environmental Impact and Disposal of Plastics

5.2.3 Opportunities

5.2.3.1 Increasing Use of Polypropylene in Automotive Industry

5.2.4 Challenges

5.2.4.1 Increasing Trend of Plastic Recycling

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.4 Intensity of Competitive Rivalry

5.3.5 Threat of New Entrants

5.4 Macroeconomic Indicators

5.4.1 GDP Growth Rate Forecast of Major Economies

5.4.2 Automotive Industry Analysis

6 Polypropylene Market, By Type (Page No. - 44)

6.1 Introduction

6.2 Homopolymer

6.3 Copolymer

6.4 Others

7 Polypropylene Market, By Application (Page No. - 49)

7.1 Introduction

7.2 Injection Molding

7.3 Fiber & Raffia

7.4 Film & Sheet

7.5 Blow Molding

7.6 Others

8 Polypropylene Market, By End-Use Industry (Page No. - 54)

8.1 Introduction

8.2 Packaging

8.3 Automotive

8.4 Building & Construction

8.5 Medical

8.6 Electrical & Electronics

8.7 Others

9 Polypropylene Market, By Region (Page No. - 62)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 South Korea

9.2.5 Thailand

9.2.6 Taiwan

9.2.7 Rest of Asia Pacific

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 France

9.4.3 Italy

9.4.4 U.K.

9.4.5 Russia

9.4.6 Rest of Europe

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Middle East & Africa

9.6.1 South Africa

9.6.2 Turkey

9.6.3 Saudi Arabia

9.6.4 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 118)

10.1 Overview

10.2 Market Share Analysis

10.3 Competitive Scenario

10.3.1 Expansions

10.3.2 Joint Ventures

10.3.3 Acquisitions

10.3.4 New Product Launch

11 Company Profiles (Page No. - 122)

11.1 Lyondellbasell Industries Holdings B.V.

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Recent Developments

11.1.4 SWOT Analysis

11.1.5 MnM View

11.2 SABIC

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Exxon Mobil

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Dupont

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 SWOT Analysis

11.4.4 MnM View

11.5 INEOS

11.5.1 Business Overview

10.5.2 Products Offered

10.5.3 Recent Developments

10.5.4 SWOT Analysis

10.5.5 MnM View

11.6 Total S.A.

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 MnM View

11.7 Formosa Plastics Group (FPG)

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments

11.7.4 MnM View

11.8 China Petrochemical Corporation

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.8.4 MnM View

11.9 LG Chem

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 MnM View

11.10 Sumitomo Chemical

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Recent Developments

11.10.4 MnM View

11.11 Other Key Players

11.12 Eastman Chemical Company

11.13 BASF SE

11.14 Reliance Industries Limited

11.15 Westlake Chemical Corporation

11.16 Braskem

11.17 Haldia Petrochemicals Limited

11.18 Lotte Chemical UK Ltd.

11.19 Trinseo

11.20 HPCL- Mittal Energy Limited

11.21 Brahmaputra Cracker and Polymer Limited

11.22 Saco Aei Polymers

12 Appendix (Page No. - 146)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knoweldge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (119 Tables)

Table 1 Trends and Forecast of GDP Growth Rates, 2016–2022

Table 2 Automotive Production Statistics of Key Countries in 2016

Table 3 Polypropylene Market Size, By Type, 2015–2022 (Million Ton)

Table 4 Polypropylene Market Size, By Type, 2015–2022 (USD Billion)

Table 5 Polypropylene Market Size, By Application, 2015–2022 (Million Ton)

Table 6 Polypropylene Market Size, By Application, 2015–2022 (USD Billion)

Table 7 Polypropylene Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 8 Synthetic Rubber Market Size, By End Use Industry, 2015–2022 (USD Million)

Table 9 Polypropylene Market Size, By Region, 2015–2022 (Million Ton)

Table 10 Polypropylene Market Size, By Region, 2015–2022 (USD Billion)

Table 11 Asia-Pacific: Polypropylene Market Size, By Country, 2015–2022 (Million Ton)

Table 12 Asia-Pacific: Market Size, By Country, 2015–2022 (USD Billion)

Table 13 Asia-Pacific: Market Size, By Type, 2015–2022 (Million Ton)

Table 14 Asia-Pacific: Market Size, By Type, 2015–2022 (USD Billion)

Table 15 Asia-Pacific: Market Size, By Application, 2015–2022 (Million Ton)

Table 16 Asia-Pacific: Market Size, By Application, 2015–2022 (USD Billion)

Table 17 Asia-Pacific: Market Size, By End-Use Industry, 2015–2022 (Million Ton)

Table 18 Asia-Pacific: Market Size, By End-Use Industry, 2015–2022 (USD Billion)

Table 19 China: Polypropylene Market Size, By Type, 2015–2022 (Million Ton)

Table 20 China: Market Size, By Application, 2015–2022 (Million Ton)

Table 21 China: Market Size, By End-Use Industry, 2015–2022 (Million Ton)

Table 22 Japan: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 23 Japan: Market Size, By Application, 2015–2022 (Kiloton)

Table 24 Japan: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 25 India: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 26 India: Market Size, By Application, 2015–2022 (Kiloton)

Table 27 India: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 28 South Korea: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 29 South Korea: Market Size, By Application, 2015–2022 (Kiloton)

Table 30 South Korea: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 31 Thailand: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 32 Thailand: Market Size, By Application, 2015–2022 (Kiloton)

Table 33 Thailand: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 34 Taiwan: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 35 Taiwan: Market Size, By Application, 2015–2022 (Kiloton)

Table 36 Taiwan: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 37 Rest of Asia Pacific: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 38 Rest of Asia Pacific: Market Size, By Application, 2015–2022 (Kiloton)

Table 39 Rest of Asia Pacific: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 40 North America: Polypropylene Market Size, By Country, 2015–2022 (Million Ton)

Table 41 North America: Market Size, By Country, 2015–2022 (USD Billion)

Table 42 North America: Market Size, By Type, 2015–2022 (Million Ton)

Table 43 North America: Market Size, By Type, 2015–2022 (USD Billion)

Table 44 North America: Market Size, By Application, 2015–2022 (Million Ton)

Table 45 North America: Market Size, By Application, 2015–2022 (USD Billion)

Table 46 North America: Market Size, By End-Use Industry, 2015–2022 (Million Ton)

Table 47 North America: Market Size, By End-Use Industry, 2015–2022 (USD Billion)

Table 48 U.S.: Polypropylene Market Size, By Type, 2015–2022 (Million Ton)

Table 49 U.S.: Market Size, By Application, 2015–2022 (Kiloton)

Table 50 U.S.: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 51 Canada: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 52 Canada: Market Size, By Application, 2015–2022 (Kiloton)

Table 53 Canada: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 54 Mexico: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 55 Mexico: Market Size, By Application, 2015–2022 (Kiloton)

Table 56 Mexico: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 57 Europe: Polypropylene Market Size, By Country, 2015–2022 (Million Ton)

Table 58 Europe: Market Size, By Country, 2015–2022 (USD Billion)

Table 59 Europe: Market Size, By Type, 2015–2022 (Million Ton)

Table 60 Europe: Market Size, By Type, 2015–2022 (USD Billion)

Table 61 Europe: Market Size, By Application, 2015–2022 (Million Ton)

Table 62 Europe: Market Size, By Application, 2015–2022 (USD Billion)

Table 63 Europe: Market Size, By End-Use Industry, 2015–2022 (Million Ton)

Table 64 Europe: Market Size, By End-Use Industry, 2015–2022 (USD Billion)

Table 65 Germany: Polypropylene Market Size, By Type, 2015–2022 (Million Ton)

Table 66 Germany: Market Size, By Application, 2015–2022 (Kiloton)

Table 67 Germany: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 68 France: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 69 France: Market Size, By Application, 2015–2022 (Kiloton)

Table 70 France: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 71 Italy: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 72 Italy: Market Size, By Application, 2015–2022 (Kiloton)

Table 73 Italy: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 74 U.K.: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 75 U.K.: Market Size, By Application, 2015–2022 (Kiloton)

Table 76 U.K.: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 77 Russia: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 78 Russia.: Market Size, By Application, 2015–2022 (Kiloton)

Table 79 Russia: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 80 Rest of Europe: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 81 Rest of Europe: Market Size, By Application, 2015–2022 (Kiloton)

Table 82 Rest of Europe: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 83 South America: Polypropylene Market Size, By Country, 2015–2022 (Kiloton)

Table 84 South America: Market Size, By Country, 2015–2022 (USD Million)

Table 85 South America: Market Size, By Type, 2015–2022 (Kiloton)

Table 86 South America: Polypropylene Market Size, By Type, 2015–2022 (USD Million)

Table 87 South America: Market Size, By Application, 2015–2022 (Kiloton)

Table 88 South America: Market Size, By Application, 2015–2022 (USD Million)

Table 89 South America: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 90 South America: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 91 Brazil: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 92 Brazil: Market Size, By Application, 2015–2022 (Kiloton)

Table 93 Brazil: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 94 Argentina: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 95 Argentina: Market Size, By Application, 2015–2022 (Kiloton)

Table 96 Argentina: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 97 Rest of South America: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 98 Rest of South America: Market Size, By Application, 2015–2022 (Kiloton)

Table 99 Rest of South America: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 100 Middle East & Africa: Polypropylene Market Size, By Country, 2015—2022 (Kiloton)

Table 101 Middle East & Africa: Market Size, By Country, 2015—2022 (USD Billion)

Table 102 Middle East & Africa : Market Size, By Type, 2015—2022 (Million Ton)

Table 103 Middle East & Africa: Market Size, By Type, 2015—2022 (USD Billion)

Table 104 Middle East & Africa: Market Size, By Application, 2015—2022 (Million Ton)

Table 105 Middle East & Africa: Market Size, By Application, 2015—2022 (USD Billion)

Table 106 Middle East & Africa: Market Size, By End-Use Industry, 2015—2022 (Kiloton)

Table 107 Middle East & Africa: Market Size, By End-Use Industry, 2015—2022 (USD Million)

Table 108 South Africa: Polypropylene Market Size, By Type, 2015—2022 (Kiloton)

Table 109 South Africa: Market Size, By Application, 2015—2022 (Kiloton)

Table 110 South Africa : Market Size, By End-Use Industry, 2015—2022 (Kiloton)

Table 111 Turkey: Polypropylene Market Size, By Type, 2015–2022 (Kiloton)

Table 112 Turkey: Market Size, By Application, 2015—2022 (Kiloton)

Table 113 Turkey : Market Size, By End-Use Industry, 2015—2022 (Kiloton)

Table 114 Saudi Arabia: Polypropylene Market Size, By Type, 2015—2022 (Kiloton)

Table 115 Saudi Arabia: Market Size, By Application, 2015—2022 (Kiloton)

Table 116 Saudi Arabia : Market Size, By End-Use Industry, 2015—2022 (Kiloton)

Table 117 Rest of Middle East & Africa: Polypropylene Market Size, By Type, 2015—2022 (Kiloton)

Table 118 Rest of Middle East & Africa: Market Size, By Application, 2015—2022 (Kiloton)

Table 119 Rest of Middle East & Africa: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

List of Figures (50 Figures)

Figure 1 Polypropylene Market Segmentation

Figure 2 Research Methodology

Figure 3 Data Triangulation: Polypropylene Market

Figure 4 Homopolymer to Dominate Polypropylene Market Between 2017 and 2022

Figure 5 Fiber & Raffia to Lead Polypropylene Market Between 2017 and 2022

Figure 6 Packaging End-Use Industry to Dominate Overall Polypropylene Market Between 2017 and 2022

Figure 7 APAC Market to Witness Significant Growth During Forecast Period

Figure 8 Demand for Packaging Industry is Driving the Polypropylene Market

Figure 9 China Accounted for Largest Market in APAC

Figure 10 Homopolymer to Account Largest Share of Overall Polypropylene Market

Figure 11 APAC Dominates Polypropylene Market

Figure 12 Overview of Factors Governing the Polypropylene Market

Figure 13 Top 10 Vehicle Producing Countries in 2015

Figure 14 Us Electric Vehicle Market Size 2012 vs 2019

Figure 15 Electric Vehicles Sales and Growth

Figure 16 Homopolymer Accounted for Largest Market Share in 2016

Figure 17 APAC to Be Fastest-Growing Homopolymer Market Between 2017 and 2022

Figure 18 APAC to Be Largest Copolymer Market Between 2017 and 2022

Figure 19 Middle East & Africa to Be Fastest-Growing Market for Others Segment

Figure 20 Injection Molding Accounted for Largest Market Share in 2016

Figure 21 APAC to Be Fastest-Growing Polypropylene Market in Injection Molding Application Between 2017 and 2022

Figure 22 APAC to Be Fastest Growing Market in Fiber & Raffia Application During Forecast Period

Figure 23 APAC to Be Fastest-Growing Market in Fiber & Raffia Application During Forecast Period

Figure 24 South America to Be Second-Fastest Growing Market for Polypropylene Between 2017 and 2022

Figure 25 APAC to Be Largest Market for Polypropylene in Others End-Use Industries

Figure 26 Packaging Accounted for the Largest Market Share in 2016

Figure 27 APAC to Be the Fastest-Growing Polypropylene Market in Packaging Between 2017 and 2022

Figure 28 Middle East & Africa to Be the Second Fastest-Growing Polypropylene Market in Automotive End-Use Industry Between 2017 and 2022

Figure 29 APAC to Be the Largest Polypropylene Market in Building & Construction End-Use Industry Between 2017 and 2022

Figure 30 South America to Be the Fastest Growing Polypropylene Market in Medical End-Use Industry Between 2017 and 2022

Figure 31 Asia-Pacific Will Witness Highest Growth Rate for the Electronics End-Use Industry in the Polypropylene Market

Figure 32 Asia-Pacific to Be the Largest Market for the Others End-Use Industry in the Polypropylene Market

Figure 33 China to Emerge as New Hotspot for the Polypropylene Market

Figure 34 Asia-Pacific: Polypropylene Market Snapshot

Figure 35 Europe: Polypropylene Market Snapshot

Figure 36 Key Developments By Leading Players Between 2012 and 2017

Figure 37 Lyondellbasell Industries Holdings B.V.: Company Snapshot

Figure 38 Lyondellbasell Industries Holdings B.V. : SWOT Analysis

Figure 39 SABIC: Company Snapshot

Figure 40 SABIC: SWOT Analysis

Figure 41 Exxon Mobil: Company Snapshot

Figure 42 Exxon Mobil Corporation : SWOT Analysis

Figure 43 Du Pont: Company Snapshot

Figure 44 Du Pont: SWOT Analysis

Figure 45 INEOS: Company Snapshot

Figure 46 INEOS: SWOT Analysis

Figure 47 Total S.A.: Company Snapshot

Figure 48 China Petroleum Corporation: Company Snapshot

Figure 49 LG Chem: Company Snapshot

Figure 50 Company Snapshot: Sumitomo Chemical

Growth opportunities and latent adjacency in Polypropylene Market