Commodity Plastics Market by Type (PE, PP, PVC, PS, ABS, PET, PMMA), End-use Industry (Packaging, Construction, Consumer Goods, Automotive, Electronics, Textiles, Medical & Pharmaceutical), and Region - Global Forecast to 2025

Updated on : August 25, 2025

Commodity Plastics Market

The commodity plastics market was valued at USD 468.3 billion in 2020 and is projected to reach USD 596.1 billion by 2025, growing at 6.0% cagr from 2020 to 2025. The major driving factors of the market include growing packaging industry, increased disposable income generating high demand for consumer goods, growing production of lightweight electric vehicles and increasing metal prices.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Global Commodity Plastics Market

The global commodity plastics market is expected to witness a moderate decrease in its growth rate in 2020-2021, as the commodity plastics used in automotive, construction, textiles, and electronics will witness a significant decline in its demand. However, there will be an increase in the demand for commodity plastics used in the packaging, consumer goods, and medical & pharmaceutical industries during COVID-19.

- A resoundingly positive thing to observe in this crisis has been the swift response by the packaging industry. Many companies are continuing their operations as they supply packaging for essential products. Fundamental redesign and innovation are required to make types of packaging viable amid the pandemic to provide healthy packaging of products for customers. Single-use, disposable food packaging appears to have made a comeback due to the COVID-19 pandemic, as many consumers believe this to be safer and/or more hygienic.

- Automobile companies are seeing a decrease in sales because of fewer customers visiting their physical storefronts and travel restrictions. Automakers in China, the US, and European countries have suspended plant operations, which has disrupted production, and consumer demand has waned. Due to the negative impact of COVID-19 on sales, many companies are scrapping their outlook plans for the second quarter in 2020 and through the rest of the year.

- The electronics industry consists of various sectors, such as the semiconductor sector, which has annual sales of over USD 481 billion as of 2017-18. The largest sector is e-commerce, which generated over USD 29 trillion in 2017, and consumer electronics, mobile technology, and handset manufacturing are the major sectors in the electronics industry. With a huge size of the global electrical & electronics industry, China is the major manufacturer and supplier of raw materials and parts required for global players. The industry is thus largely dependent on China, and hence the occurrence of COVID-19 has caused disruption in the electrical & electronics industry. The main disruption is in the supply chain. As the coronavirus/COVID-19 transforms from a China-centric challenge to a global pandemic, the impact on the global electronics supply chains and markets has shifted.

- Advent of global pandemic, COVID-19 has resulted in creating a global crisis in the FMCG industry. Impacting over 195 countries across the global, the pandemic has already created economic backdrop across the globe, thereby hinting for the next global recession. Strong initiatives are undertaken by different governments for containing the outbreak. However, social distancing has made a drastic negative impact on the FMCG industry. Logistic issues, lack of adequate labor force, and operations limiting to production of only essential items are some of the few examples most FMCG companies are facing across the globe.

- The impact of COVID-19 on the global construction business is detrimental. Contractors are at the forefront as they are service and product providers at the same time. The virus affects both material and labor, key cost components of construction projects, which is a challenge for on-going project delivery, companies’ liquidity, and whole business models.

- The demand for textile products abroad and domestic sales have come down to a grinding halt due to the panic situation created by the COVID-19 outbreak. Due to the lockdown, all sorts of textile-related factories are closed, and it is tough to hazard a guess when those will be allowed to open. The business community is scared on account of cash crunch, supply chain disturbance, and manpower-related issues.

- The coronavirus pandemic could catalyze a new wave of management and investor interest in improving the transparency of medical supply chains. The healthcare industry has so far held up relatively well in the recent market sell-off, although there is no guarantee it will continue to do so in the future. Also, Product Governance scores can help investors select companies that are relatively well-positioned to manage regulatory pressures in the race to develop vaccines and treatments for COVID-19. Moreover, we think that the outbreak will begin to shine a light on medical supply chains

Commodity Plastics Market Dynamics

Driver: Growing packaging industry

The packaging industry is growing at a rapid pace. The emergence of e-commerce has further boosted the growth of the packaging industry. Packaging became an important necessity for marketing to attract customers. Value-added packaging has emerged in the FMCG (fast moving consumer goods) sector to prompt customers to buy products.

The global packaging industry, especially the flexible packaging industry, experienced significant growth in 2019, registering a higher growth rate than the US GDP. Value-added flexible packaging registered a higher growth compared to other segments of the packaging industry in 2019. Plastic packaging dominates the overall packaging industry, and this trend is expected to continue during the forecast period, thereby driving the market for commodity plastics.

Restraint: Increased environmental concerns over plastic waste

The major restraining factor for the growth of the commodity plastics market is concerns over plastic waste. Plastic waste is a major environmental concern due to its low degradation rate. It is either recycled or dumped in landfills or in the ocean. Dumping plastics in landfills lowers the quality of the soil by releasing harmful chemicals into the soil. These harmful chemicals released can come into contact with groundwater and can pose severe health hazards. Plastics dumped into the ocean are very harmful to marine life. Birds, fish, and other marine species can get tangled in it or may die from the consumption of these plastics.

Due to these environmental concerns, many organizations are promoting the use of paper or cloth bags which are easy to degrade. In view of these concerns, many retail stores are restricted from selling plastic bags or are charging extra for the same. This is a major restraining factor for the growth of the commodity plastics market.

Opportunity: Developing countries offering significant growth opportunities

The market for commodity plastics is dominated by the US, China, India, and Germany, among others. Brazil, China, South Africa, and Argentina, among other developing countries, present significant growth opportunities for the commodity plastics market. Growing economic activities, such as rapid industrialization and urbanization, are driving the demand for these plastics in these developing countries. For instance, the construction industry contributes 10.0% to India’s GDP. The end-use industries, including automobile, construction, packaging, consumer goods, and medical & pharmaceutical, are rapidly growing in these countries.

Challenge: Government regulations on the use of plastics for packaging

Governments of various countries are adopting various regulations regarding the use of plastics in various end-use industries. There are numerous restrictions on the use of PVC in various applications. Some of them are listed in the following:

- In 2005, a number of cities in the US passed a number of procurement policies to restrict the purchase of PVC products. New York, in 2005, passed legislation that reduced the city purchase limit of PVC.

- In 2009, legislation was introduced in California to ban PVC packaging.

- In 2016, the government of India banned the use of plastics bags with a thickness of 40 microns.

- In 2009, the government of India restricted the manufacturing of plastics, which do not comply with the specifications for compostable plastics stated by the Bureau of Indian Standards.

These regulations and guidelines put forth by the respective governments are becoming more stringent, which challenges the growth of the commodity plastics market.

The PET segment is projected to be the fastest-growing type in the market during the forecast period.

PET is a plastic resin and the most commonly used plastic material. A large number of consumer products, beverages, and food items are packaged and delivered and with this material. PET is manufactured from polyester and has good water and moisture resistance, due to which, it is used in the manufacturing of soft drinks bottles. It has a wide range of textile applications. PET plastic is approved as safe for food and beverage contact by the FDA and similar regulatory agencies throughout the world.

Packaging to be a promising industry of the commodity plastics market.

Packaging protects products during processing, storage, and distribution. The aim of any packaging system is to prevent or delay undesirable changes in appearance, flavor, odor, and texture. Consumers’ rejection of the product is possible if the mentioned quality is not met. Thus, a new technical tool is introduced in the market called ‘Active and Intelligent packaging,’ which better controls the food from contamination and maintains its quality. Packaging is an indispensable process for preserving and transporting goods. It caters to various sectors such as retail, institutional, and industrial. Changing consumer lifestyle with increasing disposable income has resulted in an increase in the importance of plastics as packaging products.

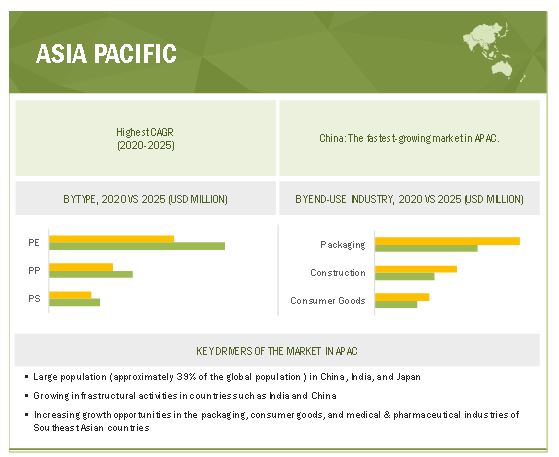

APAC is expected to account for the largest commodity plastics market share during the forecast period, in terms of value

The APAC commodity plastics market is segmented as China, Japan, India, South Korea, and the Rest of APAC. Moreover, APAC is projected to continue its dominance over the market until 2025. Increasing population, industrialization, and urbanization are augmenting the commodity plastics market growth. China’s emergence as a global manufacturing hub has increased the demand for commodity plastics. Cheap labor and easy availability of raw materials boost the production of these products in the region.

Commodity Plastics Market Players

Exxon Mobil (US) LG Chem (South Korea)Sumitomo Chemical (Japan)The Dow Chemical Company (US)SABIC (Saudi Arabia), BASF SE (Germany), LyondellBasell (Netherlands), Sinopec (China), Ineos (Switzerland), Formosa Plastics (Taiwan), Mitsubishi Chemical (Japan), Borealis AG (Austria), Chevron Phillips Chemical (US), ENI SpA (Italy), Reliance Industries (India), Braskem (Brazil), Hanwha Chemical (South Korea), Lotte Chemical (South Korea), Indian Oil (India), Haldia Petrochemicals (India), Nova Chemicals (Canada), Qenos Pty (Australia), Qatar Petroleum (Qatar), Westlake Chemical (US), and PTT Global Chemical (Thailand) are some of the players operating in the global commodity plastics market.

Commodity Plastics Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year |

2018 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Type and End-use Industry |

|

Regions |

North America, Europe, APAC, the Middle East & Africa, and South America |

|

Companies |

Exxon Mobil (US), LG Chem (South Korea), Sumitomo Chemical (Japan), The Dow Chemical Company (US), SABIC (Saudi Arabia), BASF SE (Germany), LyondellBasell (Netherlands), Sinopec (China), Ineos (Switzerland), Formosa Plastics (Taiwan), Mitsubishi Chemical (Japan), Borealis AG (Austria), Chevron Phillips Chemical (US), ENI SpA (Italy), Reliance Industries (India), Braskem (Brazil), Hanwha Chemical (South Korea), Lotte Chemical (South Korea), Indian Oil (India), Haldia Petrochemicals (India), Nova Chemicals (Canada), Qenos Pty (Australia), Qatar Petroleum (Qatar), Westlake Chemical (US), and PTT Global Chemical (Thailand) |

This research report categorizes the commodity plastics market based on type, end-use industry, and region.

Based on the type:

- PE

- PP

- PVC

- PS

- ABS

- PET

- PMMA

Based on the end-use industry:

- Packaging

- Construction

- Consumer Goods

- Automotive

- Electronics

- Textiles

- Medical & Pharmaceutical

- Others (agricultural films, sports equipment, educational stationery, and bike spare parts)

Based on the region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In May 2020, Sumitomo announced to invest in NanoScent, an Israel-based startup company, to develop a rapid diagnostic sensor for COVID-19.

- In May 2020, LyondellBasell announced that Advanced Global Investment Company (Saudi Arabia) selected its polypropylene technology for a new facility.

- In December 2020, LyondellBasell's Polypropylene Technology was selected by Blue Sky Energy (US) to build a new facility in Wenzhou, Zhejiang Province, China.

- In March 2020, INEOS signed an agreement with Spirit Energy (UK) to acquire two noncore Danish assets from the latter.

Frequently Asked Questions (FAQ):

What is the market for commodity plastics?

The global commodity plastics market size was valued at USD 468.3 billion in 2020. The market is projected to grow US$ 596.1 billion by 2025, exhibiting a CAGR of 6.0% during the forecast period

What are the factors influencing the growth of commodity plastics?

Growing packaging industry, increased disposable income generating high demand for consumer goods, growing production of lightweight electric vehicles and increasing metal prices are drivers of growth for the commodity plastics market.

Which are the key sectors driving the commodity plastics market?

Packaging, consumer goods, and medical & pharmaceutical are the key end-use sectors driving the commodity plastics market.

Who are the major manufacturers?

Major manufactures include Exxon Mobil (US), LG Chem (South Korea), Sumitomo Chemical (Japan), The Dow Chemical Company (US), SABIC (Saudi Arabia), among others.

What is the biggest restraint for commodity plastics?

The increased environmental concerns over plastic waste is the only factor that is currently restraining the growth of the market.

How is COVID-19 affecting the overall packaging industry?

The COVID-19 pandemic is causing widespread concern and economic hardship for consumers, businesses, and communities across the globe. Manufacturers are facing sudden challenges caused by the crisis. Moreover, the outbreak has got people into panic and bulk buying situations. This has triggered the growth of the packaging industry, thereby further driving the demand for commodity plastics.

What will be the growth prospects of the commodity plastics market?

Developing countries is expected to offer significant growth opportunities to manufacturers of commodity plastics. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 COMMODITY PLASTICS: MARKET DEFINITION AND INCLUSIONS, BY TYPE

1.2.2 COMMODITY PLASTICS: MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

1.3 MARKET SCOPE

FIGURE 1 COMMODITY PLASTICS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 COMMODITY PLASTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.2 BASE NUMBER CALCULATION

2.2.1 DEMAND SIDE APPROACH FOR MARKET SIZE (IN TERMS OF VOLUME) CALCULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION: COMMODITY PLASTICS MARKET

2.5 MARKET SHARE ESTIMATION

2.6 ASSUMPTIONS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 6 PE TO DOMINATE THE OVERALL COMMODITY PLASTICS MARKET

FIGURE 7 PACKAGING TO BE PREFERRED INDUSTRY TO INVEST IN NEXT FIVE YEARS

FIGURE 8 APAC ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN COMMODITY PLASTICS MARKET

FIGURE 9 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES BETWEEN 2020 AND 2025

4.2 COMMODITY PLASTICS MARKET, BY TYPE

FIGURE 10 PE TO REGISTER THE HIGHEST CAGR

4.3 COMMODITY PLASTICS MARKET, BY END-USE INDUSTRY

FIGURE 11 PACKAGING TO BE THE LARGEST END USER

4.4 COMMODITY PLASTICS MARKET, BY COUNTRY

FIGURE 12 MARKET IN DEVELOPING COUNTRIES TO GROW FASTER THAN IN DEVELOPED COUNTRIES

4.5 APAC: COMMODITY PLASTICS MARKET

FIGURE 13 CHINA TO LEAD THE COMMODITY PLASTICS MARKET IN APAC

4.6 COMMODITY PLASTICS MARKET, REGIONAL GROWTH RATES

FIGURE 14 INDIA TO REGISTER HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET EVOLUTION

5.3 VALUE CHAIN ANALYSIS

FIGURE 15 COMMODITY PLASTICS VALUE CHAIN

5.4 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN COMMODITY PLASTICS MARKET

5.4.1 DRIVERS

5.4.1.1 Growing packaging industry

5.4.1.2 Increasing disposable income generating high demand for consumer goods

5.4.1.3 Growing production of lightweight electric vehicles and increasing metal prices

5.4.2 RESTRAINTS

5.4.2.1 Increased environmental concerns over plastic waste

5.4.3 OPPORTUNITIES

5.4.3.1 Developing countries offering significant growth opportunities

5.4.4 CHALLENGES

5.4.4.1 Government regulations on the use of plastics for packaging

5.5 PORTER’S FIVE FORCES ANALYSIS OF COMMODITY PLASTICS MARKET

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 PATENT ANALYSIS: COMMODITY PLASTICS MARKET

5.6.1 METHODOLOGY

5.6.2 DOCUMENT TYPE

FIGURE 17 TOTAL PATENT COUNT IN COMMODITY PLASTICS MARKET

5.6.3 PUBLICATION TRENDS - LAST 5 YEARS

FIGURE 18 PATENT PUBLICATION TRENDS – LAST 5 YEARS

5.6.4 INSIGHTS

5.6.5 JURISDICTION ANALYSIS

FIGURE 19 JURISDICTION ANALYSIS IN COMMODITY PLASTICS MARKET

5.6.6 TOP APPLICANTS

FIGURE 20 TOP PATENT APPLICANTS IN COMMODITY PLASTICS MARKET

TABLE 1 LIST OF PATENTS BY GORE & ASSOCIATES

TABLE 2 LIST OF PATENTS BY HONDA MOTOR CO LTD.

TABLE 3 LIST OF PATENTS BY TOYOTA MOTOR CO LTD.

TABLE 4 LIST OF PATENTS BY UNIVERSITY FLORIDA

TABLE 5 LIST OF PATENTS BY RESINATE MAT GROUP INC.

5.7 IMPACT OF COVID-19 ON COMMODITY PLASTICS MARKET

5.7.1 SHIFT IN PACKAGING INDUSTRY

5.7.1.1 Impact on customers’ output and strategies to resume/ improve production

5.7.2 SHIFT IN AUTOMOTIVE INDUSTRY

5.7.2.1 Impact on customers’ output and strategies to resume/ improve production

5.7.3 SHIFT IN ELECTRONICS INDUSTRY

5.7.3.1 Impact on customers’ output and strategies to resume/ improve production

5.7.4 SHIFT IN CONSUMER GOODS INDUSTRY

5.7.4.1 Impact on customers’ output and strategies to resume/ improve production

5.7.5 SHIFT IN CONSTRUCTION INDUSTRY

5.7.5.1 Impact on customers’ output and strategies to resume/ improve production

5.7.6 SHIFT IN TEXTILES INDUSTRY

5.7.6.1 Impact on customers’ output and strategies to resume/ improve production

5.7.7 SHIFT IN MEDICAL & PHARMACEUTICAL INDUSTRY

5.7.7.1 Impact on customers’ output and strategies to resume/improve production

5.8 BIGGEST GAINERS, BY TOP END-USE INDUSTRIES

5.8.1 PACKAGING

5.8.2 MEDICAL & PHARMACEUTICAL

5.8.3 CONSUMER GOODS

5.9 BIGGEST LOSERS, BY TOP END-USE INDUSTRIES

5.9.1 CONSTRUCTION

5.9.2 AUTOMOTIVE

5.9.3 ELECTRONICS

5.1 PRICING ANALYSIS

5.11 PET VS. PP

TABLE 6 COMPARISON BETWEEN PET AND PP

6 COMMODITY PLASTICS MARKET, BY TYPE (Page No. - 60)

6.1 INTRODUCTION

FIGURE 21 PE TO DOMINATE COMMODITY PLASTICS MARKET DURING THE FORECAST PERIOD

TABLE 7 COMMODITY PLASTICS MARKET SIZE, BY TYPE, 2018—2025 (USD MILLION)

TABLE 8 COMMODITY PLASTICS MARKET SIZE, BY TYPE, 2018—2025 (KILOTON)

6.2 POLYETHYLENE (PE)

6.2.1 HDPE

6.2.2 LDPE

6.2.3 LLDPE

6.3 POLYPROPYLENE (PP)

6.3.1 POLYPROPYLENE HOMO-POLYMERS (PPH)

6.3.2 POLYPROPYLENE CO-POLYMERS (PPC)

6.4 POLYVINYL CHLORIDE (PVC)

6.4.1 RIGID PVC

6.4.2 FLEXIBLE PVC

6.5 POLYSTYRENE (PS)

6.6 ACRYLONITRILE BUTADIENE STYRENE (ABS)

6.7 POLYETHYLENE TEREPHTHALATE (PET)

6.8 POLY (METHYL METHACRYLATE) (PMMA)

7 COMMODITY PLASTICS MARKET, BY END-USE INDUSTRY (Page No. - 66)

7.1 INTRODUCTION

FIGURE 22 PACKAGING TO BE LARGEST END-USE INDUSTRY OF COMMODITY PLASTICS

TABLE 9 COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 10 COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

7.2 PACKAGING

7.2.1 FILM WRAPS

7.2.2 PLASTIC BAGS

7.2.3 INDUSTRIAL & HOUSEHOLD CHEMICAL CONTAINERS

7.2.4 MILK JUGS

7.2.5 CEREAL BOX LINERS

7.2.6 OTHERS

7.3 AUTOMOTIVE

7.3.1 AIR DAMS

7.3.2 CAR BUMPERS

7.3.3 ROCKER PANELS

7.3.4 CONSOLES

7.3.5 GRILLES

7.3.6 OTHERS

7.4 ELECTRONICS

7.4.1 TELECOMMUNICATIONS

7.4.2 SEMICONDUCTORS

7.4.3 ELECTRONIC COMPONENTS

7.4.4 DISPLAYS

7.4.5 OTHERS

7.5 CONSUMER GOODS

7.5.1 FOOD STORAGE CONTAINERS

7.5.2 WEATHER-RESISTANT CLOTHING

7.5.3 INDOOR-OUTDOOR CARPETING

7.5.4 UTENSILS

7.5.5 OTHERS

7.6 CONSTRUCTION

7.6.1 DOORS

7.6.2 ROOFING

7.6.3 FLOORING

7.6.4 WALL COVERING

7.6.5 PIPING

7.6.6 WINDOW COVERING

7.6.7 INSULATION

7.6.8 OTHERS

7.7 TEXTILES

7.7.1 FIBERS AND FABRICS

7.7.2 OTHERS

7.8 MEDICAL & PHARMACEUTICAL

7.8.1 MEDICAL OR LABORATORY TOOLS

7.8.2 PHARMACY PRESCRIPTION BOTTLES

7.8.3 THERAPEUTIC SYSTEMS

7.8.4 SURGICAL EQUIPMENT

7.8.5 OTHERS

7.9 OTHERS

8 COMMODITY PLASTICS MARKET, BY REGION (Page No. - 75)

8.1 INTRODUCTION

FIGURE 23 INDIA, CHINA, AND BRAZIL TO BE EMERGING HOTSPOTS IN THE COMMODITY PLASTICS MARKET DURING FORECAST PERIOD

TABLE 11 COMMODITY PLASTICS MARKET SIZE, BY REGION, 2018—2025 (USD MILLION)

TABLE 12 COMMODITY PLASTICS MARKET SIZE, BY REGION, 2018—2025 (KILOTON)

8.2 APAC

FIGURE 24 APAC: COMMODITY PLASTICS MARKET SNAPSHOT

TABLE 13 APAC: MARKET SIZE, BY COUNTRY, 2018—2025 (USD MILLION)

TABLE 14 APAC: MARKET SIZE, BY COUNTRY, 2018—2025 (KILOTON)

TABLE 15 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 16 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.2.1 CHINA

8.2.1.1 Purchasing power and growing concern over hygiene increasing the demand for commodity plastics in packaging industry

TABLE 17 CHINA: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 18 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.2.2 INDIA

8.2.2.1 Emergence of e-commerce is a major driver for the market

TABLE 19 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 20 INDIA: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.2.3 SOUTH KOREA

8.2.3.1 The Winter Olympics in 2018 largely helped in boosting the packaging industry, thereby driving the commodity plastics market

TABLE 21 SOUTH KOREA: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 22 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.2.4 JAPAN

8.2.4.1 Holds high growth potential for commodity plastics market

TABLE 23 JAPAN: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 24 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.2.5 REST OF APAC

TABLE 25 REST OF APAC: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 26 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.3 NORTH AMERICA

FIGURE 25 NORTH AMERICA: COMMODITY PLASTICS MARKET SNAPSHOT

TABLE 27 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018—2025 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018—2025 (KILOTON)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.3.1 US

8.3.1.1 Rising demand from packaging, automotive, and construction industries driving the market

TABLE 31 US: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 32 US: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.3.2 MEXICO

8.3.2.1 Rising demand for value-added packaging boosting the market

TABLE 33 MEXICO: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 34 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.3.3 CANADA

8.3.3.1 Demand from food and non-food packaging sectors for superior-quality polymers to drive the market

TABLE 35 CANADA: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 36 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.4 EUROPE

FIGURE 26 EUROPE: COMMODITY PLASTICS MARKET SNAPSHOT

TABLE 37 EUROPE: MARKET SIZE, BY COUNTRY, 2018—2025 (USD MILLION)

TABLE 38 EUROPE: MARKET SIZE, BY COUNTRY, 2018—2025 (KILOTON)

TABLE 39 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 40 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.4.1 GERMANY

8.4.1.1 Presence of a large number of plastic processing/production companies to boost the market

TABLE 41 GERMANY: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 42 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.4.2 FRANCE

8.4.2.1 Increased consumption of packaged food and aerated drinks creating demand for packaging

TABLE 43 FRANCE: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 44 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.4.3 ITALY

8.4.3.1 Growing usage of commodity plastics in the food & beverage industry driving the market

TABLE 45 ITALY: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 46 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.4.4 UK

8.4.4.1 Rise in household expenditure to increase the demand for commodity plastics market

TABLE 47 UK: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 48 UK: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.4.5 SPAIN

8.4.5.1 Regulations related to food handling, rising environmental concerns, and growing population to propel the market

TABLE 49 SPAIN: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 50 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.4.6 RUSSIA

8.4.6.1 Food & beverage industry mainly responsible for driving the commodity plastics market

TABLE 51 RUSSIA: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 52 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.4.7 REST OF EUROPE

TABLE 53 REST OF EUROPE: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 54 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.5 MIDDLE EAST & AFRICA

FIGURE 27 MIDDLE EAST & AFRICA: COMMODITY PLASTICS MARKET SNAPSHOT

TABLE 55 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018—2025 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018—2025 (KILOTON)

TABLE 57 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.5.1 SAUDI ARABIA

8.5.1.1 Per capita plastic consumption of 40kg per person drives the market for commodity plastics

TABLE 59 SAUDI ARABIA: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 60 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.5.2 SOUTH AFRICA

8.5.2.1 Growing demand for premium packaging, majorly from cosmetics and household sectors, driving the market

TABLE 61 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 62 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 63 REST OF MIDDLE EAST & AFRICA: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 64 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.6 SOUTH AMERICA

FIGURE 28 SOUTH AMERICA: COMMODITY PLASTICS MARKET SNAPSHOT

TABLE 65 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018—2025 (USD MILLION)

TABLE 66 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018—2025 (KILOTON)

TABLE 67 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 68 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.6.1 BRAZIL

8.6.1.1 High growth in the plastics industry driven by growing cosmetics and food industries

TABLE 69 BRAZIL: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 70 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

8.6.2 REST OF SOUTH AMERICA

TABLE 71 REST OF SOUTH AMERICA: COMMODITY PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (USD MILLION)

TABLE 72 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018—2025 (KILOTON)

9 COMPETITIVE LANDSCAPE (Page No. - 114)

9.1 INTRODUCTION

FIGURE 29 COMPANIES ADOPTED CONTRACT, EXPANSION, AGREEMENT, AND INVESTMENT AS THEIR KEY STRATEGIES BETWEEN 2015 AND 2020

9.2 COMPETITIVE LEADERSHIP MAPPING

9.2.1 STAR

9.2.2 EMERGING LEADERS

9.2.3 PERVASIVE

9.2.4 EMERGING COMPANIES

FIGURE 30 COMMODITY PLASTICS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

9.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 31 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN COMMODITY PLASTICS MARKET

9.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 32 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN COMMODITY PLASTICS MARKET

9.5 MARKET RANKING

FIGURE 33 MARKET RANKING OF KEY PLAYERS

9.6 COMPETITIVE SCENARIO

9.6.1 INVESTMENT & EXPANSION

TABLE 73 INVESTMENT & EXPANSION, 2015—2020

9.6.2 MERGERS & ACQUISITION

TABLE 74 MERGER & ACQUISITION, 2015—2020

9.6.3 CONTRACT, AGREEMENT, JOINT VENTURE, COLLABORATION, AND PARTNERSHIP

TABLE 75 CONTRACT, AGREEMENT, JOINT VENTURE, COLLABORATION, AND PARTNERSHIP, 2015—2020

9.6.4 NEW PRODUCT LAUNCH/DEVELOPMENT

TABLE 76 NEW PRODUCT LAUNCH/DEVELOPMENT, 2015—2020

10 COMPANY PROFILES (Page No. - 124)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, winning imperatives, Threat from Competition, Right to Win, MnM View)*

10.1 EXXON MOBIL

FIGURE 34 EXXON MOBIL: COMPANY SNAPSHOT

FIGURE 35 EXXON MOBIL: SWOT ANALYSIS

10.2 LG CHEM

FIGURE 36 LG CHEM: COMPANY SNAPSHOT

FIGURE 37 LG CHEM: SWOT ANALYSIS

10.3 SUMITOMO CHEMICAL

FIGURE 38 SUMITOMO CHEMICAL: COMPANY SNAPSHOT

FIGURE 39 SUMITOMO CHEMICAL: SWOT ANALYSIS

10.4 THE DOW CHEMICAL COMPANY

FIGURE 40 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 41 THE DOW CHEMICAL COMPANY: SWOT ANALYSIS

10.5 SABIC

FIGURE 42 SABIC: COMPANY SNAPSHOT

FIGURE 43 SABIC: SWOT ANALYSIS

10.6 BASF SE

FIGURE 44 BASF SE: COMPANY SNAPSHOT

10.7 LYONDELLBASELL

FIGURE 45 LYONDELLBASELL: COMPANY SNAPSHOT

10.8 SINOPEC

FIGURE 46 SINOPEC: COMPANY SNAPSHOT

10.9 INEOS

FIGURE 47 INEOS: COMPANY SNAPSHOT

10.10 FORMOSA PLASTICS

FIGURE 48 FORMOSA PLASTICS: COMPANY SNAPSHOT

10.11 MITSUBISHI CHEMICAL

FIGURE 49 MITSUBISHI CHEMICAL: COMPANY SNAPSHOT

10.12 OTHER COMPANIES

10.12.1 BOREALIS

10.12.2 CHEVRON PHILLIPS CHEMICAL

10.12.3 ENI SPA

10.12.4 RELIANCE INDUSTRIES

10.12.5 BRASKEM

10.12.6 HANWHA CHEMICAL

10.12.7 LOTTE CHEMICAL

10.12.8 INDIAN OIL

10.12.9 HALDIA PETROCHEMICALS

10.12.10 NOVA CHEMICALS

10.12.11 QENOS PTY

10.12.12 QATAR PETROLEUM

10.12.13 WESTLAKE CHEMICAL

10.12.14 PTT GLOBAL CHEMICAL

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, winning imperatives, Threat from Competition, Right to Win, might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 158)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 RELATED REPORTS

11.4 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the commodity plastics market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource, to identify and collect information useful for the technical, market-oriented, and commercial study of the commodity plastics market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

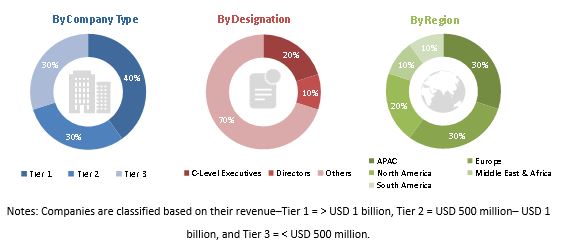

Primary Research

The commodity plastics market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. The demand side of this market is characterized by developing the end-use industry, such as packaging, construction, consumer goods, automotive, electronics, textile, medical & pharmaceutical, and others. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the commodity plastics market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the estimation processes explained above-the commodity plastics market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the commodity plastics market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the commodity plastics market

- To analyze and forecast the size of the market based on type, and end-use industry

- To estimate and forecast the market size based on five regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as merger & acquisition, investment & expansion, new product launch/development, and partnerships, contracts & agreements in the commodity plastics market

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the commodity plastics market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the commodity plastics market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Commodity Plastics Market