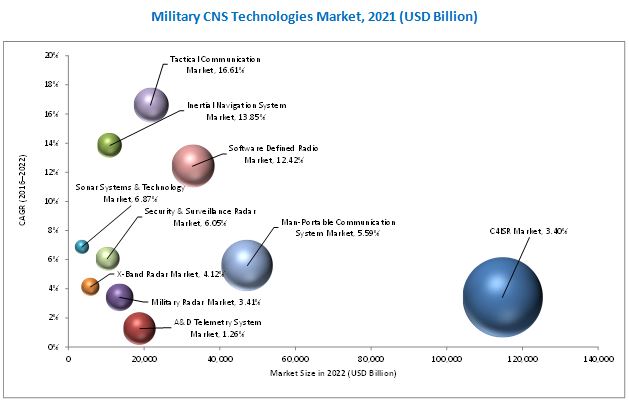

Top 10 Military CNS Technologies Market by Technology (C4ISR, Telemetry, INS, Military Radar, SONAR, X-Band Radar, Man Portable Communication, SDR, Security & Surveillance Radar, Tactical Communication) & Geography - Global Forecast to 2022

[211 Pages Report] The military CNS technologies market report covers the forecast of the military communication, navigation, and surveillance technologies and its dynamics over the next six years, in addition to recognizing market application gaps, recent developments in the market, and high potential regions. The military CNS technologies market has been analyzed primarily on the basis of varied CNS technologies used by defense forces worldwide during the forecast period, considering 2015 as the base year.

Communication, navigation, and surveillance (CNS) technologies are widely utilized in military CNS equipment for battlefield operations. There have been huge R&D investments made in this field by prominent players operating in the defense sector, owing to the replacement of legacy systems in developed countries, technological innovations in defense communication equipment, and modernization of battlefield operations.

A Software Defined Radio (SDR) is a radio communication system that attempts to place most of the complex signal handling involved in receivers and transmitters into the digital (DSP) style. These radios are increasingly used by defense forces to communicate through various frequencies, as well as to implement different protocols. In addition, the propagation of military CNS technologies from conventional tools to advanced products will help enhance the combat capabilities of defense forces. One of most immediate benefits that software defined radio can provide is spectrum flexibility. As the defense spectrum is off-limits for civilian use, the efficient use of spectrum is expected to be the key focus area in the near future, which will eventually push the growth for military CNS technologies market.

The demand for advanced communication systems to replace legacy equipment, the need for compatibility of devices with future standards, and the need to reduce the cost of end products and services are some of the major factors driving the growth of the SDR segment. However, high development costs and integration issues are factors restraining the demand for SDR.

Navigation systems have evolved since their inception in World War II. Earlier, most navigation systems were stable platform systems, wherein navigation sensors were mounted on a platform, independent of the rotation of the object. Presently, most navigation systems are strapdown systems. Over the course of time, navigation systems have evolved in terms of the technology used. The use of advanced technologies replaced mechanical components with electronic components, thereby increasing the accuracy and reducing the overall weight of navigation systems.

An Inertial Navigation System (INS) is a type of navigation system that tracks the position and orientation of an object relative to a known starting point, orientation, or velocity. The increasing demand for new aircraft delivery will directly impact the growth of the inertial navigation system segment, as INS is one of the primary systems installed in every aircraft, eventually the integral part of military CNS technologies market.

INS is primarily used for stabilization, guidance, and control in a variety of application platforms, including airplanes, unmanned aerial vehicles, missiles, drones, ships & submarines, and military vehicles. Growth in the commercial aerospace industry, increase in air passenger traffic, advancements in MEMS technology, increase in offshore oil & gas exploration activities, and rise in demand for unmanned underwater vehicles are factors anticipated to drive the demand for inertial navigation systems, subsequently the military CNS technologies market.

Military radar, a type of surveillance system, is utilized for air & ballistic missile defense, air-to-air combat, and strategic long-range surveillance, among other military applications. It plays a very important role in the military CNS technologies market The increase in demand for military radar systems and technologies is spurred by the need felt by several nations to upgrade their radar technologies, so as to safeguard their borders from terrorist threats. Military radar also offers countries with insurgent situations the access to perform surveillance and weapons control as well as other monitoring functions. Increased demand for defense surveillance over porous and attack prone borders, increased spending on defense equipment by emerging countries, and increased terrorism and ongoing inter-country conflicts are factors contributing to the rising demand for military radar. Unlike earlier times, defense surveillance has become an integral task for defense forces worldwide, considering the aforementioned causes.

Key players operating in the military CNS technologies market are Lockheed Martin (U.S.), Raytheon Company (U.S.), Northrop Grumman Corporation (U.S.), Saab Group (Sweden), Thales Group (France), BAE Systems plc (U.K.), Elbit Systems Ltd. (Israel), L3 Technologies (U.S.), General Dynamics Corporation (U.S.), and Honeywell International Inc. (U.S.). Contracts and acquisitions are major growth strategies adopted by top players to strengthen their position in the military CNS technologies market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

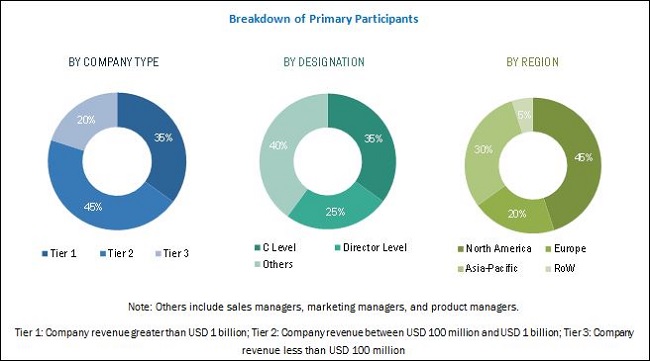

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Airspace Violation Incidents

2.2.2.2 Increasing Demand for Advanced Communication Systems

2.2.2.3 High Availability of Small and Robust Components

2.2.3 Supply-Side Analysis

2.2.3.1 Advancements in Efficient Materials

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 37)

4 Market Overview (Page No. - 44)

4.1 Introduction

4.2 Market Dynamics

4.2.1 Communication Technologies

4.2.1.1 Drivers

4.2.1.1.1 Huge R&D Investments for Technological Advancements in Defense Operations

4.2.1.1.2 Demand for Advanced Communication Systems to Replace Legacy Equipment

4.2.1.2 Restraints

4.2.1.2.1 Defense Budget Cuts

4.2.1.3 Opportunities

4.2.1.3.1 Use of Commercial Off-The-Shelf (COTS) Technology in Communication Systems

4.2.1.3.2 New Opportunities in the Form of Derived Technologies Such as Cognitive Radio

4.2.1.4 Challenges

4.2.1.4.1 Ensuring Interoperability of Disparate Communication Technologies

4.2.1.4.2 Ensuring Seamless Connectivity in A Limited Bandwidth

4.2.2 Navigation Technologies

4.2.2.1 Drivers

4.2.2.1.1 Technological Advancements in Navigation Systems

4.2.2.1.2 Increasing Demand for Accuracy in Navigation

4.2.2.1.3 Availability of Small Components at Low Cost

4.2.2.2 Restraints

4.2.2.2.1 Operational Complexity in Navigation Systems

4.2.2.3 Opportunities

4.2.2.3.1 Integration With Other Systems

4.2.2.4 Challenges

4.2.2.4.1 Error Propagation

4.2.2.4.2 System Initialization

4.2.3 Surveillance Technologies

4.2.3.1 Drivers

4.2.3.1.1 Replacement of Traditional Surveillance Systems

4.2.3.1.2 Increase in Situational Awareness to Drive Operations

4.2.3.1.3 Uav Revolution From Reconnaissance

4.2.3.2 Restraints

4.2.3.2.1 Interoperability

4.2.3.3 Opportunities

4.2.3.3.1 Increasing Role of Unmanned Combat Systems for Battlefield Surveillance and Counterattack

4.2.3.3.2 Increased Demand for Ballistic Missile and Air & Missile Defense Systems

4.2.3.4 Challenges

4.2.3.4.1 Electromagnetic Jamming and Noise Interruptions

4.2.3.4.2 Environmental Issues

5 Industry Trends (Page No. - 55)

5.1 Introduction

5.2 Technology Trends

5.2.1 Communication Technologies

5.2.1.1 Mobile Ad-Hoc Networking

5.2.1.2 Next-Generation IP

5.2.1.3 Data Acquisition for Unmanned Aerial Vehicles

5.2.1.4 Near Field Communication

5.2.1.5 Satellite Telemetry

5.2.1.6 Multiband Tactical Communication Amplifiers

5.2.2 Navigation Technologies

5.2.2.1 Remote Sensing

5.2.2.2 Navigation-Grade Gyroscopes

5.2.2.3 Next-Generation Flight Management System (NG-FMS)

5.2.2.4 Performance-Based Navigation (PBN)

5.2.2.5 Wide Area Augmentation System/Localizer Performance With Vertical Guidance (WAAS/LPV)

5.2.2.6 Adaptive 4D Trajectory Concept

5.2.3 Surveillance Technologies

5.2.3.1 Active Electronically Scanned Array (AESA)

5.2.3.2 Kestrel

5.2.3.3 Imaging System for Immersive Surveillance (ISIS)

5.2.3.4 Single-Object and Multiple-Object Tacker

5.2.3.5 High Resolution Radar

5.2.3.6 Constant Wave Radar

6 Aerospace & Defense Telemetry Technologies Market (Page No. - 64)

6.1 Introduction

6.2 By Component

6.2.1 Hardware

6.2.2 Software

6.3 By Platform

6.4 By Region

6.4.1 North America

6.4.2 Europe

6.4.3 Asia-Pacific

6.4.4 The Middle East

6.4.5 Latin America

6.4.6 Africa

6.4.7 Rest of the World

6.5 Competitive Landscape

6.5.1 Market Share Analysis

7 Man-Portable Communication Systems Market (Page No. - 73)

7.1 Introduction

7.2 By Application

7.2.1 Satcom

7.2.2 Telephonic Encryption

7.2.3 Smartphones

7.2.4 Homeland Security

7.2.5 Man-Portable Commercial Systems

7.3 By Platform

7.4 By Region

7.4.1 North America: A Matured Communication Technologies Market

7.4.2 Europe: A Stable Defense Market

7.4.3 Asia-Pacific: the Fastest Growing Region

7.4.4 The Middle East: an Emerging Defense Market

7.4.5 Rest of the World: an Untapped Potential Market

8 Software Defined Radio Technologies Market (Page No. - 81)

8.1 Introduction

8.2 By Component

8.2.1 Transmitter

8.2.2 Receiver

8.2.3 Software

8.3 By Application

8.3.1 Defense

8.3.2 Commercial

8.3.3 Homeland Security

8.4 By Type

8.4.1 Joint Tactical Radio Systems (JTRS)

8.4.2 Cognitive/Intelligent Radio

8.4.3 Terrestrial Trunked Radio (TETRA)

8.5 By Region

8.5.1 G7 Nations

8.5.2 BRICS

8.5.3 Rest of the World

8.6 Competitive Landscape

8.6.1 Market Share Analysis

9 Tactical Communication Technologies Market (Page No. - 93)

9.1 Introduction

9.2 By Type

9.2.1 Soldier Radio

9.2.2 Manpack

9.2.3 Vehicle Intercommunications Radio (VICR)

9.2.4 High Capacity Data Radio (HCDR)

9.2.5 Others

9.3 By Platform

9.3.1 Airborne

9.3.2 Shipborne

9.3.3 Land

9.3.4 Underwater

9.4 By Application

9.4.1 Isr (Intelligence, Surveillance, Reconnaissance)

9.4.2 Communications

9.4.3 Combat

9.4.4 Command & Control

9.4.5 Others

9.5 By Region

9.5.1 North America

9.5.2 Europe

9.5.3 Asia-Pacific

9.5.4 The Middle East

9.5.5 Rest of the World

9.6 Competitive Landscape

9.6.1 Brand Analysis

10 Inertial Navigation Systems Market (Page No. - 106)

10.1 Introduction

10.2 By Technology

10.2.1 Ring Laser Gyro

10.2.2 Fibre Optic Gyro

10.2.3 Micro Electric Mechanical Systems

10.2.4 Mechanical

10.2.5 Vibrating Gyro

10.2.6 Hemispherical Resonator Gyro

10.2.7 By Product

10.2.8 Marine

10.2.9 Navigation

10.2.10 Tactical

10.2.11 Commercial Grade

10.3 By Application

10.3.1 Commercial

10.3.2 Airborne

10.3.3 Land

10.3.4 Naval

10.4 By Region

10.4.1 North America: Reduction in Size and Weight of Ins Components Boosts the Use of Ins Technology in Commercial Sector

10.4.2 Europe: Increase in Demand for Aircraft Military and Commercial Sector

10.4.3 Asia-Pacific: Independent Reliable Navigation Systems for Defense and Military Applications

10.4.4 The Middle East: Heavy Investments Towards Naval Platforms

10.4.5 Rest of the World

10.5 Competitive Landscape

10.5.1 Market Share Analysis

11 C4isr Technologies Market (Page No. - 114)

11.1 Introduction

11.2 By Platform

11.2.1 Airborne

11.2.2 Naval

11.2.3 Land

11.3 By Application

11.3.1 Command & Control

11.3.2 Communications

11.3.3 Computers

11.3.4 Intelligence

11.3.5 Surveillance & Reconnaissance

11.3.6 Electronic Warfare

11.4 By Region

11.4.1 North America: Investment in Modernizing Its Weapons is Driving the Market in This Region

11.4.2 Europe: Deployment of Forces Will Influence the Demand for C4isr

11.4.3 Asia-Pacific: Countries Upgrading Their Surveillance and Resource Allocation

11.4.4 Middle East: Rising Tensions Among the Countries has Led to Procurement of Defense System for Homeland Security

11.4.5 Rest of the World: Increasing Expenditure for Procuring Defense Equipment

12 Sonar Systems Market (Page No. - 121)

12.1 Introduction

12.2 By System Type

12.2.1 Single Beam Sonar

12.2.2 Multi-Beam Sonar

12.2.3 Side-Scan Sonar

12.2.4 Synthetic Aperture Sonar (SAS)

12.2.5 Diver Detection Sonar (DDS)

12.3 By Application

12.3.1 Military

12.3.2 Commercial

12.3.3 Scientific

12.4 By Product

12.4.1 Hull-Mounted Sonar

12.4.2 Sonobuoys

12.4.3 Towed Array Sonar

12.4.4 Variable Depth Sonar

12.4.5 Portable Sonar

12.5 By Region

12.5.1 North America: Rise in the Use of Sonar Systems for Seabed Mapping and Marine Life Study By the Scientists

12.5.2 Europe: Increase in Underwater Threats Such as Enemy Submarines and Torpedoes Attacks

12.5.3 Asia-Pacific: Enhancement of the Defensive System of the Naval Forces

12.5.4 The Middle East

12.5.5 Rest of the World

12.6 Competitive Landscape

12.6.1 Market Share Analysis

13 Military Radar Technologies Market (Page No. - 132)

13.1 Introduction

13.2 By Platform

13.2.1 Ground Based Military Radars

13.2.2 Naval Military Radars

13.2.3 Airborne Military Radars

13.2.4 Space-Based Military Radar

13.3 By Band Type

13.3.1 X & Ku Band Radar

13.3.2 S & L Band Radar

13.3.3 Other Radar Bands

13.4 By Application

13.4.1 Weapon Guidance System Military Radars

13.4.2 Surveillance Military Radar

13.5 By Region

13.5.1 North America: Rise in Demand of Surveillance and Radar Systems for Replacing the Legacy Systems By the U.S. Military

13.5.2 Asia-Pacific: Increased Investment for Strengthening the Surveillance and Weapon Guidance Capabilities By China and India

13.5.3 Europe: Increased Investment in Maritime Situational Awareness

13.5.4 Middle East & Africa: Increasing Intercountry Conflicts, Terrorism, and Geopolitical Instability

13.5.5 Rest of the World: Increased Investment in the Surveillance and Security Sector By the Brazilian Military

14 Security and Surveillance Radar Technologies Market (Page No. - 140)

14.1 Introduction

14.2 By Platform

14.2.1 Maritime Surveillance

14.2.2 Land-Based Surveillance

14.2.3 Airborne Surveillance

14.3 By Region

14.3.1 North America

14.3.2 Europe

14.3.3 Asia-Pacific

14.3.4 The Middle East

14.3.5 Latin America

14.3.6 Rest of the World

14.4 Competitive Landscape

14.4.1 Market Share Analysis

15 X-Band Radars Technologies Market (Page No. - 145)

15.1 Introduction

15.2 By Array

15.2.1 Active Electronically Scanned Array (AESA)

15.2.2 Passive Electronically Scanned Array (PESA)

15.3 By Type

15.3.1 Mobile X-Band Radar

15.3.2 Sea-Based X-Band Radar(SBX)

15.4 By Application

15.4.1 Defense

15.4.2 Government

15.4.3 Commercial

15.5 By Region

15.5.1 North America

15.5.2 Europe

15.5.3 Asia-Pacific

15.5.4 The Middle East

15.5.5 Rest of the World

15.6 Competitive Landscape

15.6.1 Brand Analysis

15.6.2 Rank Analysis

16 Company Profiles (Page No. - 156)

(Overview, Products and Services, Financials, Strategy & Development)*

16.1 Introduction

16.2 Lockheed Martin Corporation

16.3 Northrop Grumman Corporation

16.4 Raytheon Company

16.5 Saab Group

16.6 Thales Group

16.7 BAE Systems PLC

16.8 Elbit Systems Ltd.

16.9 L-3 Communications Holdings, Inc.

16.10 General Dynamics Corporation

16.11 Honeywell International Inc.

16.12 Rockwell Collins, Inc.

16.13 Trimble Inc.

16.14 Harris Corporation

16.15 Leonardo S.P.A

16.16 Curtiss-Wright Corporation

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

17 Appendix (Page No. - 206)

17.1 Discussion Guide

17.2 Knowledge Store: Marketsandmarkets Subscription Portal

17.3 Introducing RT: Real Time Market Intelligence

17.4 Available Customizations

17.5 Author Details

List of Tables (39 Tables)

Table 1 High Risk Incidents Involving Russia and Nato in 2014

Table 2 R&D Investment Budget for Technological Developments in the U.S. (USD Million)

Table 3 Military Expenditure of Developed Economies, 2011-2015 (USD Billion)

Table 4 Military Expenditure of BRICS Economies, 2010-2014

Table 5 Aerospace & Defense Telemetry Market Size, By Component, 2014-2022 (USD Billion)

Table 6 Aerospace & Defense Telemetry Market Size, By Platform, 2014-2022 (USD Billion)

Table 7 Telemetry Market Size, By Region, 2014-2022 (USD Million)

Table 8 Man-Portable Communication Systems Market Size, By Application, 2014-2022 (USD Million)

Table 9 Man-Portable Communication Systems Market Size, By Platform, 2014-2022 (USD Million)

Table 10 Man-Portable Communication Systems Market Size, By Region, 2014-2022 (USD Million)

Table 11 Software Defined Radio Technologies Market Size, By Component, 2014-2022 (USD Billion)

Table 12 Software Defined Radio Technologies Market Size, By Application, 2014-2022 (USD Million)

Table 13 Software Defined Radio Market Size, By Type, 2014-2022 (USD Million)

Table 14 Software Defined Radio Technologies Market Size, By Region, 2014-2022 (USD Million)

Table 15 Tactical Communications Technologies Market Size, By Type, 2014-2022 (USD Billion)

Table 16 Tactical Communications Technologies Market Size, By Platform, 2014-2022 (USD Million)

Table 17 Tactical Communications Technologies Market Size, By Appliation, 2014-2022 (USD Billion)

Table 18 Tactical Communications Technologies Market Size, By Region, 2014-2022 (USD Million)

Table 19 Market Size of Inertial Navigation System, By Technology, 2014-2022 (USD Billion)

Table 20 Market Size of Inertial Navigation System, By Product, 2014-2022 (USD Billion)

Table 21 Market Size of Inertial Navigation System, By Application, 2014-2022 (USD Billion)

Table 22 Market Size of Inertial Navigation System, By Region, 2014-2022 (USD Million)

Table 23 Market Size of C4isr Technologies, By Platform, 2014-2022 (USD Billion)

Table 24 Market Size of C4isr Technologies, By Application, 2014-2022 (USD Billion)

Table 25 Market Size of C4isr Technologies, By Region, 2014-2022 (USD Million)

Table 26 Market Size of Sonar Systems, By System Type, 2014-2022 (USD Billion)

Table 27 Market Size of Sonar Systems, By Application, 2014-2022 (USD Billion)

Table 28 Market Size of Sonar Systems, By Product, 2014-2022 (USD Billion)

Table 29 Market Size of Sonar Technologies, By Region, 2014-2022 (USD Million)

Table 30 Market Size of Military Radar Technology, By Platform, 2014-2022 (USD Billion)

Table 31 Market Size of Military Radar Technology, By Band Type, 2014-2022 (USD Billion)

Table 32 Market Size of Military Radar Technology, By Application, 2014-2022 (USD Billion)

Table 33 Market Size of Military Radar Technology, By Region, 2014-2022 (USD Million)

Table 34 Surveillance and Security Radars Market Size, By Platform, 2014-2022 (USD Billion)

Table 35 Surveillance and Security Radars Market Size, By Region, 2014-2022 (USD Million)

Table 36 X-Band Radar Market Size, By Array, 2014-2022 (USD Million)

Table 37 X-Band Radar Market Size, By Type, 2014-2022 (USD Million)

Table 38 X-Band Radar Market Size, By Application, 2014-2022 (USD Million)

Table 39 X-Band Radar Market Size, By Region, 2014-2022 (USD Million)

List of Figures (88 Figures)

Figure 1 Markets Covered: Military CNS Technologies Market

Figure 2 Military CNS Technologies Market Stakeholders

Figure 3 Research Process Flow

Figure 4 Military CNS Technologies Market: Research Design

Figure 5 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 The Land Subsegment Projected to Lead the C4isr Technologies Segment During the Forecast Period

Figure 10 The Multibeam Sonar Subsegment Projected to Lead the Sonar Technologies Segment During the Forecast Period

Figure 11 The Ground-Based Subsegment Projected to Lead the Military Radar Technologies Segment During the Forecast Period

Figure 12 The RLG Subsegment Projected to Lead the Inertial Navigation Technologies Segment During the Forecast Period

Figure 13 The Land Subsegment Projected to Lead the Tactical Communication Technologies Segment During the Forecast Period

Figure 14 Regional Analysis: Software Defined Radio Technologies

Figure 15 Contracts Was the Key Growth Strategy Adopted By Market Players From March 2014 to January 2017

Figure 16 Market Dynamics of Military Communication Technologies

Figure 17 Market Dynamics of Military Navigation Technologies

Figure 18 Market Dynamics of Military Surveillance Technologies

Figure 19 Technological Advancement is A Growing Trend in the Military CNS Technologies Market

Figure 20 Hardware Segment of the Telemetry Systems Market Projected to Lead the Market During the Forecast Period

Figure 21 Defense Segment of the Telemetry Systems Market Projected to Lead the Market During the Forecast Period

Figure 22 Europe and Middle East Projected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Market Share Analysis, By Key Players (2013)

Figure 24 Commercial Segment of the Man-Portable Communication Systems Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Airborne Segment of the Man-Portable Communication Systems Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Software Segment of the Software Defined Radio Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 27 The Defense Segment Projected to Lead the Software Defined Radio Technologies Market During the Forecast Period

Figure 28 Joint Tactical Radio Systems (JRTS) Estimated to Lead Software Defined Radio Technologies Market in 2016

Figure 29 BRICS Nations Projected to Grow at Higihest CAGR During the Forecast Period

Figure 30 Market Share Analysis, By Key Players (2015)

Figure 31 Manpack Subsegment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Underwater Segment of the Tactical Communications Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 33 Combat Subsegment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 34 Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 35 Brand Analysis of Top Five Players in the X-Band Radar Market

Figure 36 Vibrating Gyro Segment of the Inertial Navigation System Projected to Grow at the Highest CAGR Owing to High Demand From Defense Organizations

Figure 37 Commercial Grade Segment of the Inertial Navigation System Projected to Grow at the Highest CAGR During the Forecast Period

Figure 38 Naval Segment of the Inertial Navigation System Projected to Grow at the Highest CAGR During the Forecast Period

Figure 39 Asia-Pacific Region of the Inertial Navigation System Projected to Grow at the Highest CAGR During the Forecast Period

Figure 40 Airborne Segment of the C4isr Technologies Projected to Grow at the Highest CAGR Due to High Demand From the Defense Organizations

Figure 41 Electronic Warfare Segment of the C4isr Technologies Projected to Grow at the Highest CAGR During the Forecast Period

Figure 42 Asia-Pacific Region of the C4isr Technologies Projected to Grow at the Highest CAGR During the Forecast Period

Figure 43 Synthetic Aperture Sonar Segment of the Sonar Systems Projected to Grow at the Highest CAGR Due to High Demand From the Naval Forces

Figure 44 Military Segment of the Sonar Systems Projected to Grow at the Highest CAGR During the Forecast Period

Figure 45 Portable Sonar Segment of the Sonar Systems Projected to Grow at the Highest CAGR During the Forecast Period

Figure 46 Asia-Pacific Region of the Sonar Systems Projected to Grow at the Highest CAGR During the Forecast Period

Figure 47 Market Share Analysis, By Key Player (2014)

Figure 48 Airborne Segment of the Military Radar Technology Projected to Grow at the Highest CAGR Due to High Investments Made By Departments of Defense (DoD)

Figure 49 X & Ku Band Segment of the Military Radar Technology Projected to Grow at the Highest CAGR During Forecast Period

Figure 50 Weapon Guidance System Segment of the Military Radar Technology Projected to Grow at the Highest CAGR During Forecast Period

Figure 51 RoW Region of the Military Radar Technology Projected to Grow at the Highest CAGR During Forecast Period

Figure 52 Land Based Segment of the Surveillance and Security Radars is Projected to Grow at the Highest CAGR Due to High Demand From Armed Services

Figure 53 Asia-Pacific Region of the Surveillance and Security Radars is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 54 Market Share Analysis, By Players (2014)

Figure 55 AESA Segment of the X Band Radar Market Projected to Grow at the Highest CAGR Due to High Demand From and Defense Industry

Figure 56 The Mobile X-Band Radar Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 57 The Defense Application Segment of the X-Band Radar Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 58 The Defense Application Segment of the X-Band Radar Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 59 Brand Analysis of Top Five Players in the X-Band Radar Market

Figure 60 Rank Analysis of Top Five Players in X-Band Radar Market (2015)

Figure 61 Regional Revenue Mix of Top Five Market Players

Figure 62 Lockheed Martin Corporation: Company Snapshot

Figure 63 Lockheed Martin Corporation: SWOT Analysis

Figure 64 Northrop Grumman Corporation: Company Snapshot

Figure 65 Northrop Grumman Corporation: SWOT Analysis

Figure 66 Raytheon Company: Company Snapshot

Figure 67 Raytheon Company: SWOT Analysis

Figure 68 Saab Group: Company Snapshot

Figure 69 Saab Group: SWOT Analysis

Figure 70 Thales Group: Company Snapshot

Figure 71 Thales Group: SWOT Analysis

Figure 72 BAE Systems PLC: Company Snapshot

Figure 73 BAE Systems PLC: SWOT Analysis

Figure 74 Elbit Systems Ltd.: Company Snapshot

Figure 75 Elbit Systems Ltd: SWOT Analysis

Figure 76 L-3 Communications Holdings, Inc.: Company Snapshot

Figure 77 L-3 Communications Holdings Inc.: SWOT Analysis

Figure 78 General Dynamics Corporation: Company Snapshot

Figure 79 General Dynamics Corporation: SWOT Analysis

Figure 80 Honeywell International Inc.: Company Snapshot

Figure 81 Honeywell International Inc.: SWOT Analysis

Figure 82 Rockwell Collins, Inc.: Company Snapshot

Figure 83 Rockwell Collins, Inc.: SWOT Analysis

Figure 84 Trimble Inc.: Company Snapshot

Figure 85 Trimble Inc.: SWOT Analysis

Figure 86 Harris Corporation: Company Snapshot

Figure 87 Leonardo S.P.A: Company Snapshot

Figure 88 Curtiss-Wright Corporation: Company Snapshot

Market size estimations for various segments and subsegments of this market were obtained through extensive secondary research and government sources, such as the U.S. Department of Defense, the U.S. Air Force, company website, corporate filings such as annual reports, investor presentations, and financial statements, and trade, business, and professional associations, among others. Furthermore, corroboration with primaries and market triangulation with the help of statistical techniques using econometric tools were carried out. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to acquire the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the military CNS technologies market comprises manufacturers, distributors, and end users. Key manufacturers of military CNS technologies are Lockheed Martin (U.S.), Raytheon Company (U.S.), Northrop Grumman Corporation (U.S.), Saab Group (Sweden), Thales Group (France), BAE Systems plc (U.K.), Elbit Systems Ltd. (Israel), L3 Technologies (U.S.), General Dynamics Corporation (U.S.), and Honeywell International Inc. (U.S.), among others.

“Study answers several questions for stakeholders, primarily, which segments to focus on over the next five years for prioritizing efforts and investments.”

Target Audience

- Original Equipment Manufacturers (OEMs)

- Regulatory Bodies

- Component Providers

- Defense Sector

- Technology Support Providers

- Distributors

Scope of the report

This research report categorizes the military CNS technologies market into the following segments and subsegments:

-

Military CNS Technologies Market, By Communication

- Tactical Communication

- Software Defined Radio

- Man-Portable Communication System

- Aerospace & Defense Telemetry System

-

Military CNS Technologies Market, By Navigation

- Inertial Navigation System

-

Military CNS Technologies Market, By Surveillance

- Security & Surveillance Radar

- Sonar Systems & Technology

- X-Band Radar

- C4ISR

- Military Radar

-

Military CNS Technologies Market, By Region

- North America

- Europe

- Asia-Pacific

- Middle East

- Rest of the World

Customizations available for the report

With the given market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for the report:

-

Country-level Analysis

- Comprehensive market projections for countries in North America, Europe, Asia-Pacific, the Middle East, and Rest of the World (RoW)

-

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Top 10 Military CNS Technologies Market