Terrestrial Trunked Radio (TETRA) Market by Component (Hardware, and Software), Device Type (Portable, and Vehicular (Mobile)), Application (Commercial, and Public Safety), and Geography - Global Forecast to 2022

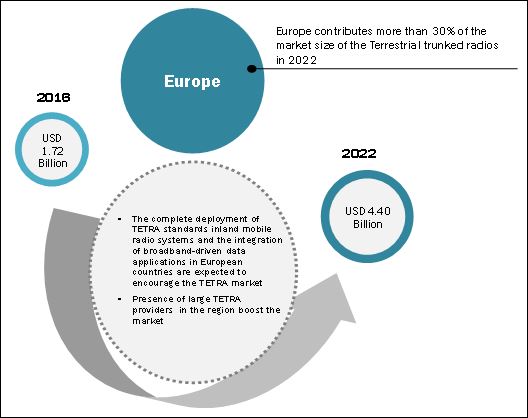

The terrestrial trunked radio (TETRA) market is expected to reach USD 4.40 Billion by 2022, at a CAGR of 17.08% between 2017 and 2022. The overall market is driven by factors such as the transition of radio communication devices from analog to digital and growing use of mobile radio communications in the transportation industry. For this study, the base year considered is 2016 and the market forecast is provided for 2017–2022.

Growing demand for mission critical communication to drive the global terrestrial trunked radio demand close to USD 4.40 billion by 2022

The global terrestrial trunked radio market size is projected to reach 4.40 billion by 2022 largely due to the increased requirement for efficient critical communication in public safety applications. terrestrial trunked radio technology offers outstanding features to mobile communication, by combining the features of mobile cellular phones with fast data communication and the workgroup capabilities of PMR. Several TETRA manufacturers offer installation and maintenance networks and services for end-user applications.

For instance, in March 2015, Motorola Solutions, Inc. (US) launched an entire MTP3000 series of TETRA with more durability, greater audio clarity, and improved coverage and connectivity features for mission-critical users. The companies present in the terrestrial trunked radio market focus on acquisitions and contracts to enhance their customer base pertaining to the TETRA business. For example, in January 2015, Airbus Defence and Space (France) received a contract from the Ministry of Interior of Lebanon for a Terrestrial Trunked Radio (Tetra) Communication System for the country’s General Directorate of General Security (GDGS).

The contract includes the delivery of terrestrial trunked radio switches, base stations, dispatcher workstations, and more than 2,000 radio terminals for Lebanese security forces.

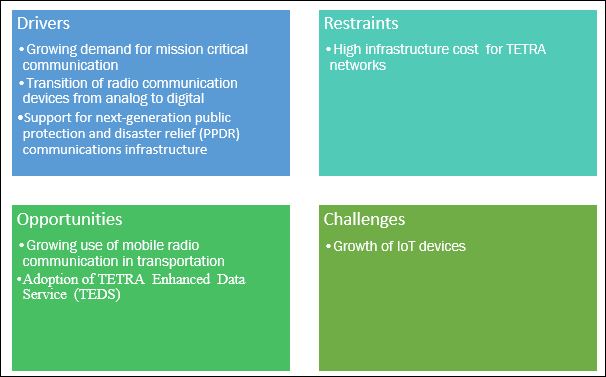

This report provides a detailed analysis of the terrestrial trunked radio (TETRA) market by component, device type, application, and geography North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). The terrestrial trunked radio market report provides detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges). The main driver for the terrestrial trunked radio market is the growing demand of critical communications operations in industries such as public safety and commercial. The report also profiles the key players and comprehensively analyzes their market ranking and core competencies, along with details of the competitive landscape of the market leaders.

To estimate the size of the terrestrial trunked radio market, top-down and bottom-up approaches have been used. This research study involves extensive reference to secondary sources, directories, and paid databases such as Factiva and OneSource to identify and collect information useful to study the technical, market-oriented, and commercial aspects of terrestrial trunked radio.

Research Methodology:

The terrestrial trunked radio (TETRA) market is expected to be worth USD 4.40 Billion by 2022, at a CAGR of 17.08% between 2017 and 2022. Factors such as growing demand for mission critical communications and growing use of mobile radio communications in the transportation industry could lead to significant opportunities for this market in the near future. TETRA is the largest land mobile radio standard, has good spectrum efficiency, and extraordinary critical communication features—such as security, short call set-up time, voice calls feature set, and high-speed data services on direct mode and site trunking. Its adoption is growing in existing and potential market segments, such as public safety and commercial applications.

The terrestrial trunked radio market has also been segmented by component into hardware and software. The implementation of software application for text messaging, automatic position messages, remoting radio monitor, accessing voice, and data information is leading to increased demand for software component in the terrestrial trunked radio market. Portable devices are expected to experience high growth between 2017 and 2002. As portable radios are handy and easy to use, demand for portable devices using terrestrial trunked radio technology will boost the market in the near future.

In 2016, public safety application accounted for the largest share of the terrestrial trunked radio market, followed by commercial application. The market for military and defense is expected to grow at a high rate between 2017 and 2022. The growing need for efficient critical communications in military and defense, home security, emergency and medical services, and fire department is expected to drive the growth of this market. Also, the growing use of mobile radios in transportation and utilities applications will likely lead to the growth of the TETRA market for commercial application.

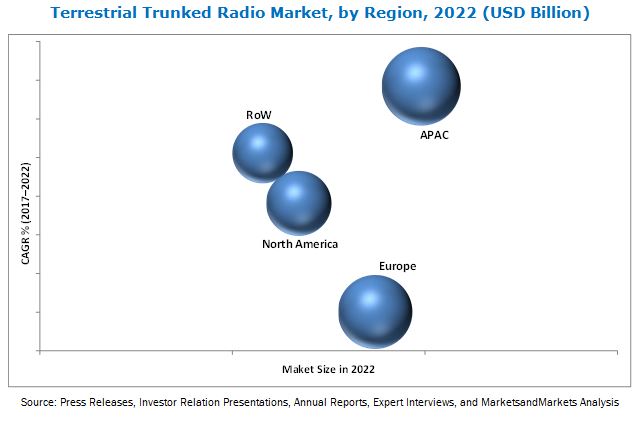

APAC is expected to hold the largest share of the terrestrial trunked radio market in 2022. The huge population base, increasing adoption of TETRA networks, research and development (R&D) activities, and increasing focus on critical communications operations are driving the growth of the market in APAC. The use of mobile radios in the commercial sector, mainly in transportation and utility applications, is the major factor driving the growth of the terrestrial trunked radio market in APAC.

High infrastructure cost for TETRA networks is the major restraint for the market

The key restraining factor in the terrestrial trunked radio market is the high infrastructure cost for TETRA networks in this market.

TETRA was designed to cover the PAMR market with every conceivable feature; as a result, complexity and development costs ended up being the highest contributors to the cost of the final product. Fast and dedicated switch nodes (which are expensive) are required for multiple subscriber interactions in a TETRA infrastructure. The number of sites required to perform the same coverage of an existing analog system may be two times or more. More sites require higher initial investment, with a fixed cost of maintenance, site rent, frequency license, and backbone links. Expensive hardware is required for liner modulation. Moreover, a new mobile radio and antenna package can cost up to USD 5,000, which is outside the budget of many. TETRA technology requires extensive testing, which increases the overall development cost of the product. Owing to this, the present demand for and supply of terrestrial trunked radio solutions are less.

Motorola Solutions, Inc. (US) is a leading global provider of mission critical communication infrastructure, devices, software, accessories, and services. The company is focusing on the development of advanced terrestrial trunked radios and technology to strengthen its position. The company has sales offices with additional representation via a network of distributors across the globe.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Terrestrial Trunked Radio Market, 2017–2022 (USD Billion)

4.2 Market, By Component

4.3 Market, By Device

4.4 Market, By Application

4.5 TETRA Market: Commercial and Public Safety Applications (2016)

4.6 TETRA Market in APAC to Witness A Rapid Growth Between 2017 and 2022

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Mission Critical Communication

5.2.1.2 Transition of Radio Communication Devices From Analog to Digital

5.2.1.3 Support for Next-Generation Public Protection and Disaster Relief (PPDR) Communications Infrastructure

5.2.2 Restraints

5.2.2.1 High Infrastructure Cost for Tetra Networks

5.2.3 Opportunities

5.2.3.1 Growing Use of Mobile Radio Communication in Transportation

5.2.3.2 Adoption of Tetra Enhanced Data Service (TEDS)

5.2.4 Challenges

5.2.4.1 Growth of Iot Devices

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Industry Trends and Insights

7 Modes of Operations (Page No. - 42)

7.1 Introduction

7.2 Trunked Mode Operation (TMO)

7.3 Direct Mode Operation (DMO)

8 Frequency Bands Used in Tetra Technology (Page No. - 43)

8.1 Introduction

8.2 150–350 MHz

8.3 350–700 MHz

8.4 700 MHz & Above

9 Market, By Component (Page No. - 44)

9.1 Introduction

9.2 Hardware

9.3 Software

10 Market, By Device (Page No. - 47)

10.1 Introduction

10.2 Portable

10.3 Vehicular (Mobile)

11 Market, By Application (Page No. - 53)

11.1 Introduction

11.2 Commercial

11.2.1 Industrial

11.2.2 Transportation

11.2.3 Utilities

11.2.4 Mining

11.2.5 Others

11.3 Public Safety

11.3.1 Military and Defense

11.3.2 Home Security

11.3.3 Fire Department

11.3.4 Emergency and Medical Services

11.3.5 Others

12 Geographic Analysis (Page No. - 65)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 UK

12.3.2 Germany

12.3.3 France

12.3.4 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.2 Japan

12.4.3 India

12.4.4 South Korea

12.4.5 Rest of APAC

12.5 Rest of the World

12.5.1 Middle East and Africa

12.5.2 South America

13 Competitive Landscape (Page No. - 94)

13.1 Introduction

13.2 Market Ranking Analysis: Terrestrial Trunked Radio Market

13.3 Competitive Scenario

13.4 Vendor Dive Overview

13.4.1 Vanguards

13.4.2 Dynamic

13.4.3 Innovator

13.4.4 Emerging

13.5 Analysis of the Product Portfolio of Major Players in the Tetra Market (25 Companies)

13.6 Business Strategies Adopted By Major Players in the Tetra Market (25 Companies)

*Top 25 Companies Analyzed for This Study are – Motorola Solutions, Inc.; Hytera Communications Corporation Ltd.; Sepura PLC; Airbus Defence and Space OY; Jvckenwood Corporation; Simoco Group; DAMM Cellular Systems A/S; Rohill Engineering B.V.; Rolta India Limited; BiTEA Limited; Selex Es S.P.A; Alcatel-Lucent (Nokia Networks); Teltronic Sau; Powertrunk, Inc.; Thales Group; Mentura Group OY; Procom A/S; Rohde & Schwarz GmbH & Co.; Ervocom International Ag; Artevea Digital India Pvt. Limited; Tianjin Communication & Broadcast Group Co., Ltd.; Danimex Communication; Consort Digital Pvt. Ltd.; American International Radio, Inc.; and NPO Angstrem, PAO.

14 Company Profiles (Page No. - 100)

14.1 Introduction

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

14.2 Motorola Solutions, Inc.

14.3 Hytera Communications Corporation Limited

14.4 Airbus Defence and Space OY

14.5 Sepura PLC

14.6 Jvckenwood Corporation

14.7 Simoco Group

14.8 DAMM Cellular Systems A/S

14.9 Rohill Engineering B.V.

14.10 BiTEA Limited

14.11 Rolta India Limited

14.12 Key Innovators

14.12.1 Artevea Digital Limited

14.12.2 Tianjin Communication & Broadcast Group Co., Ltd.

14.12.3 Consort Digital Pvt. Ltd.

14.12.4 Radlink Communications

14.12.5 NPO Angstrem, PAO

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 134)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (62 Tables)

Table 1 Key Industry Trends in the Tetra Market

Table 2 Terrestrial Trunked Radio Market, By Component, 2014–2022 (USD Million)

Table 3 Market Size, By Device, 2014–2022 (USD Million)

Table 4 Market for Portable, By Component, 2014–2022 (USD Million)

Table 5 TETRA Market for Portable, By Application, 2014–2022 (USD Million)

Table 6 Market for Portable, By Region, 2014–2022 (USD Million)

Table 7 TETRA Market for Vehicular, By Component, 2014–2022 (USD Million)

Table 8 Market for Vehicular, By Application, 2014–2022 (USD Million)

Table 9 TETRA Market for Vehicular, By Region, 2014–2022 (USD Million)

Table 10 Market, By Application, 2014–2022 (USD Million)

Table 11 Market, By Commercial Application, 2014–2022 (USD Million)

Table 12 TETRA Market for Commercial Applications, By Region, 2014–2022 (USD Million)

Table 13 Market for Commercial Applications in North America, By Country, 2014–2022 (USD Million)

Table 14 Market for Commercial Applications in Europe, By Country/Region, 2014–2022 (USD Million)

Table 15 TETRA Market for Commercial Applications in APAC, By Country/Region, 2014–2022 (USD Million)

Table 16 Market for Commercial Applications in RoW, By Region, 2014–2022 (USD Million)

Table 17 Market, By Public Safety Application, 2014–2022 (USD Million)

Table 18 TETRA Market for Public Safety Applications, By Region, 2014–2022 (USD Million)

Table 19 Market for Public Safety Applications in North America, By Country, 2014–2022 (USD Million)

Table 20 Market for Public Safety Applications in Europe, By Country/Region, 2014–2022 (USD Million)

Table 21 TETRA Market for Public Safety Applications in APAC, By Country/Region, 2014–2022 (USD Million)

Table 22 Market for Public Safety Applications in RoW, By Region, 2014–2022 (USD Million)

Table 23 Market Size, By Region, 2014–2022 (USD Million)

Table 24 Market in North America, By Component, 2014–2022 (USD Million)

Table 25 TETRA Market in North America, By Device, 2014–2022 (USD Million)

Table 26 Market in North America, By Application, 2014–2022 (USD Million)

Table 27 Market in North America, By Commercial Application, 2014–2022 (USD Million)

Table 28 Market in North America, By Public Safety Application, 2014–2022 (USD Million)

Table 29 Market in North America, By Country, 2014–2022 (USD Million)

Table 30 Market in US, By Application, 2014–2022 (USD Million)

Table 31 TETRA Market in Canada, By Application, 2014–2022 (USD Million)

Table 32 TETRA Market in Mexico, By Application, 2014–2022 (USD Million)

Table 33 Market in Europe, By Component, 2014–2022 (USD Million)

Table 34 Market in Europe, By Device, 2014–2022 (USD Million)

Table 35 Market in Europe, By Application, 2014–2022 (USD Million)

Table 36 Market in Europe, By Commercial Application, 2014–2022 (USD Million)

Table 37 Market in Europe, By Public Safety Application, 2014–2022 (USD Million)

Table 38 Market in Europe, By Country, 2014–2022 (USD Million)

Table 39 Market in UK, By Application, 2014–2022 (USD Million)

Table 40 TETRA Market in Germany, By Application, 2014–2022 (USD Million)

Table 41 Market in France, By Application, 2014–2022 (USD Million)

Table 42 Market in Rest of Europe, By Application, 2014–2022 (USD Million)

Table 43 Market in APAC, By Component, 2014–2022 (USD Million)

Table 44 Market in APAC, By Device, 2014–2022 (USD Million)

Table 45 TETRA Market in APAC, By Application, 2014–2022 (USD Million)

Table 46 Market in APAC, By Commercial Application, 2014–2022 (USD Million)

Table 47 Market in APAC, By Public Safety Application, 2014–2022 (USD Million)

Table 48 Market in APAC, By Country, 2014–2022 (USD Million)

Table 49 Market in China, By Application, 2014–2022 (USD Million)

Table 50 TETRA Market in Japan, By Application, 2014–2022 (USD Million)

Table 51 TETRA Market in India, By Application, 2014–2022 (USD Million)

Table 52 Market in South Korea, By Application, 2014–2022 (USD Million)

Table 53 Market in Rest of APAC, By Application, 2014–2022 (USD Million)

Table 54 Market in RoW, By Component, 2014–2022 (USD Million)

Table 55 Market in RoW, By Device, 2014–2022 (USD Million)

Table 56 Market in RoW, By Application, 2014–2022 (USD Million)

Table 57 Market in RoW, By Commercial Application, 2014–2022 (USD Million)

Table 58 Market in RoW, By Public Safety Application, 2014–2022 (USD Million)

Table 59 Market in RoW, By Region, 2014–2022 (USD Million)

Table 60 Market in Middle East and Africa, By Application, 2014–2022 (USD Million)

Table 61 Market in South America, By Application, 2014–2022 (USD Million)

Table 62 Market Ranking of the Top 5 Players in the Market

List of Figures (61 Figures)

Figure 1 Overview of the Terrestrial Trunked Radio Market

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Assumptions of the Research Study

Figure 6 Market, 2014–2022 (USD Million)

Figure 7 TETRA Market, By Device (2016 vs 2022)

Figure 8 Tetra Market for Public Safety Applications to Grow at A Higher Rate Between 2017 and 2022

Figure 9 Transportation Held the Largest Share of the Tetra Market for Commercial Applications in 2016

Figure 10 Europe Held the Largest Share of the Tetra Market in 2016

Figure 11 Attractive Opportunities for the Market During the Forecast Period

Figure 12 Market for Software Components to Grow at A Higher Rate Between 2017 and 2022

Figure 13 Portable Devices to Hold A Larger Share of the TETRA Market By 2022

Figure 14 APAC Held the Largest Market Share of the TETRA Market in 2016

Figure 15 Market for Commercial and Public Safety Applications in APAC to Grow at the Highest Rate During the Forecast Period

Figure 16 China to Emerge as the Fastest-Growing Market for Terrestrial Trunked Radio Between 2017 and 2022

Figure 17 Growing Demand for Mission Critical Communication to Drive the Growth of the Tetra Market During 2017–2022

Figure 18 Value Chain Analysis (2016): Maximum Value Added in the Testing & Verification and Regulation & Policy Phases

Figure 19 Tetra Market for Software Components to Grow at A Higher Rate Between 2017 and 2022

Figure 20 Market for Portable Device is Expected to Grow at the Highest Rate Between 2017 and 2022

Figure 21 RoW Tetra Market for Portable Device is Expected to Grow at the Highest Rate Between 2017 and 2022

Figure 22 APAC Tetra Market for Vehicular Device is Expected to Grow at the Highest Rate Between 2017 and 2022

Figure 23 Tetra Market for Public Safety Applications to Grow at A Higher Rate Between 2017 and 2022

Figure 24 Transportation to Dominate the Tetra Market for Commercial Applications During the Forecast Period

Figure 25 Military and Defense to Dominate the Tetra Market for Public Safety Applications During the Forecast Period

Figure 26 Tetra Market for Public Safety Applications in APAC to Grow at the Highest Rate Between 2017 and 2022

Figure 27 Geographic Snapshot: Asia Pacific to Witness the Highest Growth Rate for the Tetra Market Between 2017 and 2022

Figure 28 Tetra Market in China Estimated to Grow at the Highest Rate Between 2017 and 2022

Figure 29 Overview of TETRA Market in North America, 2016

Figure 30 Overview of Market in Europe, 2016

Figure 31 Overview of Market in Asia Pacific, 2016

Figure 32 Companies Adopted New Product Launches as the Key Growth Strategy Between 2014 and 2017

Figure 33 Battle for Market Share: New Product Launches Was the Key Strategy Adopted By Key Players in the Tetra Market

Figure 34 Dive Chart

Figure 35 Geographic Revenue Mix of Leading Players

Figure 36 Motorola Solutions, Inc.: Company Snapshot

Figure 37 Motorola Solutions, Inc.: Product Offerings

Figure 38 Motorola Solutions, Inc.: Business Strategy

Figure 39 Hytera Communications Corporation Limited: Company Snapshot

Figure 40 Hytera Communications Corporation Limited: Product Offerings

Figure 41 Scorecard: Business Strategy

Figure 42 Airbus Defence and Space OY: Company Snapshot

Figure 43 Airbus Defence and Space OY: Product Offerings

Figure 44 Airbus Defence and Space OY: Business Strategy

Figure 45 Sepura PLC: Company Snapshot

Figure 46 Sepura PLC: Product Offerings

Figure 47 Sepura PLC: Business Strategy

Figure 48 Jvckenwood Corporation: Company Snapshot

Figure 49 Jvckenwood Corporation: Product Offerings

Figure 50 Jvckenwood Corporation: Business Strategy

Figure 51 Simoco Group: Product Offerings

Figure 52 Simoco Group: Business Strategy

Figure 53 DAMM Cellular Systems A/S: Product Offerings

Figure 54 DAMM Cellular Systems A/S: Business Strategy

Figure 55 Rohill Engineering B.V.: Product Offerings

Figure 56 Rohill Engineering B.V.: Business Strategy

Figure 57 BiTEA Limited: Product Offerings

Figure 58 BiTEA Limited: Business Strategy

Figure 59 Rolta India Limited: Company Snapshot

Figure 60 Rolta India Limited: Product Offerings

Figure 61 Rolta India Limited: Business Strategy

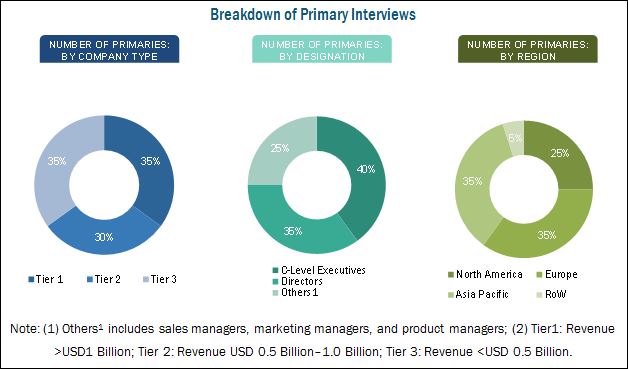

The research methodology is explained below.

- This entire research methodology includes the study of annual and financial reports of the top players, presentations, press releases, journals, paid databases, and interviews with industry experts.

- The high-growth segments have been identified to analyze opportunities in the overall terrestrial trunked radio market.

- Competitive developments, such as contracts, agreement and acquisitions, new product developments, and research and development (R&D), in the overall market have been analyzed.

- All the percentage splits and breakdowns of the terrestrial trunked radio market segments have been analyzed based on secondary and primary research.

The following figure depicts the breakdown of the primaries by company type, designation, and region during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

This report provides valuable insights regarding the ecosystem of the terrestrial trunked radio (TETRA) market. This includes component manufacturers (Motorola Solutions, Inc. (US), Airbus Defense and Space Corporation (France), Hytera Communications Corporation Limited (China), JVCKENWOOD Corporation (Japan), Sepura PLC (UK), and Simoco Group (UK)); software components (DAMM Cellular Systems A/S (Denmark), Rohill Engineering B.V. (Netherlands), Bitea Limited (UK)); and application areas. This study answers several questions of stakeholders with regard to the market segments to focus on during the next 2–5 years to prioritize efforts and investments.

Market Dynamics

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2016 |

|

Forecast period |

2017–2022 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Motorola Solutions, Inc. (US), Airbus Defense and Space Corporation (France), Hytera Communications Corporation Limited (China), JVCKENWOOD Corporation (Japan), Sepura PLC (UK), Simoco Group (UK), DAMM Cellular Systems A/S (Denmark), Rohill Engineering B.V. (Netherlands), Bitea Limited (UK), and Rolta India Limited (India) |

Target Audience:

- Raw material and manufacturing equipment suppliers

- Electronic design automation (EDA) and design tool vendors

- Component manufacturers

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODMs)

- Integrated device manufacturers (IDMs)

- ODM and OEM technology solution providers

- Assembly, testing, and packaging vendors

- Solution providers

- Intellectual property (IP) core and licensing providers

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- Governments, financial institutions, and regulatory bodies

“The study answers several questions of the target audience with regard to the market segments to focus in the next 2–5 years to prioritize efforts and investments.”

Scope of the Report:

This research report categorizes the overall terrestrial trunked radio market by component, device type, application, and geography.

Terrestrial Trunked Radio Market, By Component

- Hardware

- Software

Market, By Device Type

- Portable

- Vehicular

Market, By Application

-

Commercial

- Industrial

- Transportation

- Utilities

- Mining

- Others (Oil & gas , Construction, and Tourism)

-

Public Safety

- Military and Defense

- Home Security

- Fire Department

- Emergency Medical Services

- Others (Law Enforcement and Public Places)

Market, By Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Rest of Europe (Greece, Spain, Italy, Russia, Finland, Denmark, Netherlands, and Sweden)

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC (Australia, New Zealand, Singapore, Hong Kong, Indonesia, and Taiwan)

-

Rest of the World (RoW)

- Middle East and Africa

- South America

Key Reasons

The report would help leaders/new entrants in the TETRA market in the following ways:

- This report segments the terrestrial trunked radio market comprehensively and provides the closest market size estimations for segments across different regions.

- The report would help stakeholders understand the pulse of the market and provide them with the information on key drivers, restraints, challenges, and opportunities for the terrestrial trunked radio market growth.

- This report would help stakeholders understand their competitors better and gain insights to improve their position in the business. The competitive landscape section includes the competitor ecosystem, product launches, acquisitions, expansions, partnerships, contracts, and agreements.

Also there is a long list of product launches and advanced technologies implementation for a range of solutions for securing communications in different public safety and commercial applications in TETRA market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Growth opportunities and latent adjacency in Terrestrial Trunked Radio (TETRA) Market