Cognitive Radio Market by Component (Software Tools, Hardware, and Services), Application (Spectrum Sensing, Spectrum Analysis, Spectrum Allocation, Location Tracking, and Cognitive Routing), End-User, and Region - Global Forecast to 2022

[136 Pages Report] The cognitive radio technology is being significantly adopted by organizations worldwide to enhance the customer experience, improve the Return on Investment (RoI), and gain a competitive edge in the wireless communication industry. Moreover, in the coming years, the application of the cognitive radio is expected to rise exponentially across various industry verticals. Technological advancements, optimized spectrum utilization, and the increasing adoption of the 5G technology are some of the major driving factors for the market growth. The cognitive radio market size accounted for USD 3.16 Billion in 2016 and is projected to reach USD 7.44 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 16.6% during the forecast period.

The objective of the study is to define, describe, and forecast the global cognitive radio market on the basis of components (software tools, hardware, and services), software tools (radio control and reconfiguration tools, spectrum analyzer, and policy and configuration database manager), hardware (transmitter and reciver), services (proffesional services and managed services), applications (spectrum sensing, spectrum analysis, spectrum allocation, location tracking, and cognitive routing), end-users (government and defense, telecommunication, transportation, and others), and regions [North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America]. The report also aims at providing detailed information about the major factors influencing the growth of the cognitive radio market (drivers, restraints, opportunities, and challenges).

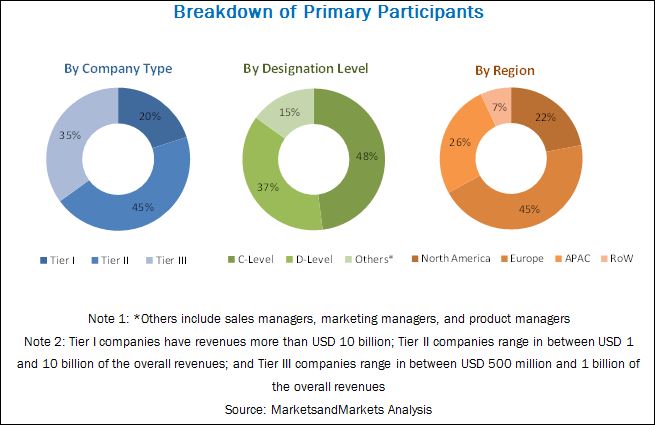

The research methodology used to estimate and forecast the global cognitive radio market size began with the capturing of data on the key vendor revenues through secondary research, annual reports, Institute of Electrical and Electronic Engineers (IEEE), Factiva, Bloomberg, and press releases. The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size from the revenues of the key market players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of the primary participants is depicted in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

The major cognitive radio vendors are BAE Systems (London, UK), Raytheon Company (Massachusetts, US), Thales Group (Paris, France), Rhode & Schwarz (Munich, Germany), Spectrum Signal Processing (Burnaby, Canada), xG Technology (Florida, US), Nutaq (Quebec, Canada), Ettus Research (California, US), Shared Spectrum Company (Virginia, US), DataSoft (Arizona, US), EpiSys Science (California, US), and Kyynel (Oulu, Finland).

Target Audience

- Original Equipment Manufacturers (OEMs)

- Military and defense organizations

- Software service providers

- Subcomponent manufacturers

- Communication equipment manufacturers

- Technology support providers

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Software Tools, Hardware, Services, Application, End-User, Region |

|

Regions covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

BAE Systems (London, UK), Raytheon Company (Massachusetts, US), Thales Group (Paris, France), Rhode & Schwarz (Munich, Germany), Spectrum Signal Processing (Burnaby, Canada), xG Technology (Florida, US), Nutaq (Quebec, Canada), Ettus Research (California, US), Shared Spectrum Company (Virginia, US), DataSoft (Arizona, US), EpiSys Science (California, US), and Kyynel (Oulu, Finland) |

The research report segments the cognitive radio market into the following segments:

By Component:

- Software Tools

- Radio Control and Reconfiguration Tools

- Spectrum Analyzer

- Policy and Configuration Database Manager

- Hardware

- Transmitter

- Receiver

- Services

- Professional Services

- Managed Services

By Application

- Spectrum Sensing

- Spectrum Analysis

- Spectrum Allocation

- Location Tracking

- Cognitive Routing

By End-User

- Government and Defense

- Telecommunication

- Transportation

- Others (Energy and Utilities, and Healthcare)

By Region:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- Rest of APAC

- MEA

- Middle East

- Africa

- Latin America

- Brazil

- Rest of Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the APAC cognitive radio market

- Further breakdown of the North American market

- Further breakdown of the MEA market

- Further breakdown of the European market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global cognitive radio market is expected to grow from USD 3.45 Billion in 2017 to USD 7.44 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 16.6% during the forecast period. The main driving factors for the market growth are the increasing adoption of the 5G technology and technological advancements in the wireless communication field.

The cognitive radio market is segmented on the basis of components into software tools, hardware, and services. The software tools segment is expected to hold the largest market size during the forecast period. Software tools play an important role in the cognitive radio market. Components that are integrated with the hardware of the radio communication systems, such as amplifiers, detectors, and modulators/demodulators, are embedded using the related software tools. Therefore, software tools are an important component of the cognitive radio ecosystem.

On the basis of software tools, the cognitive radio market is segmented into radio control and reconfiguration tools, spectrum analyzer, and policy and configuration database manager. The radio control and reconfiguration tools segment is expected to hold the largest market size during the forecast period. Radio control and reconfiguration tools enable the reconfiguration of the wireless equipment through the software. They help the users replace or reparametrize the original hardwired components with the software components in the cognitive radio system. Therefore, the increasing adoption of the radio control and reconfiguration tools is expected to fuel the overall growth of the cognitive radio market.

On the basis of hardware, the cognitive radio market is segmented into transmitter and receiver. The transmitter segment is expected to hold the larger market size during the forecast period. Transmitters used in cognitive radios incorporate various functionalities that are software-defined. They help replace the hardware components, thereby making the operations software-driven.

In the services segment, the professional services segment is expected to be the larger contributor during the forecast period. The growth of the professional services segment is mainly governed by the complexity of operations and increasing deployment of the cognitive radio technology in the wireless communication ecosystem.

In the applications segment, the spectrum sensing application is expected to hold the largest market size during the forecast period. The spectrum sensing application of the cognitive radio involves observing and updating the status of the spectrum and the movement of the licensed or primary users, by periodically sensing the frequency band. Spectrum sensing enables the cognitive radio transceiver to sense any spectrum hole or idle spectrum at a particular time, location, or band. It also identifies the way of accessing the spectrum hole without interfering the communication of the primary users.

In the end-users segment, the government and defense segment is expected to have the largest market size during the forecast period. The governments of various countries are focused on developing and implementing advanced communication technologies, such as cognitive radios and Software-Defined Radio (SDR), for serving the requirements of the modern nature of warfare as well as ensuring public safety and security.

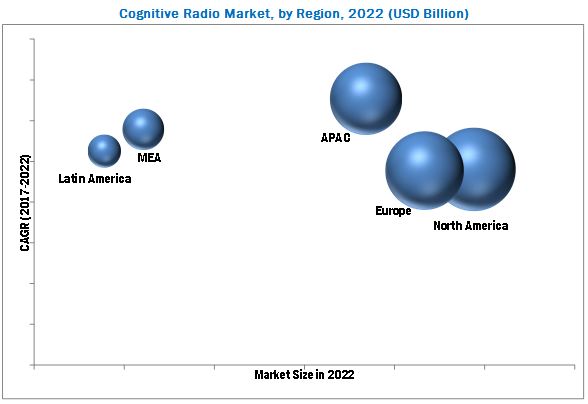

The global cognitive radio market is segmented on the basis of regions into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. North America is estimated to be the largest revenue-generating region during the forecast period. This is mainly because in the developed economies of the US and Canada, there is a high focus on innovations obtained from Research and Development (R&D). These regions have the most competitive and rapidly changing cognitive radio market in the world. The APAC region is expected to be the fastest-growing region in the cognitive radio market. Increased awareness about effective spectrum utilization, and business productivity supplemented by the competently designed cognitive radios offered by the vendors present in the APAC region have led APAC to become a highly potential market.

The major issues faced by most of the organizations while incorporating the cognitive radio technology in the wireless communication ecosystem are security concerns, dynamic communication standards, and issues related to interoperability.

The leading cognitive radio vendors are BAE Systems (London, UK), Raytheon Company (Massachusetts, US), Thales Group (Paris, France), Rhode & Schwarz (Munich, Germany), Spectrum Signal Processing (Burnaby, Canada), xG Technology (Florida, US), Nutaq (Quebec, Canada), Ettus Research (California, US), Shared Spectrum Company (Virginia, US), DataSoft (Arizona, US), EpiSys Science (California, US), and Kyynel (Oulu, Finland).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in the Cognitive Radio Market

4.2 Cognitive Radio Market: Top 3 Applications

4.3 Life Cycle Analysis, By Region, 20172022

5 Market Overview and Industry Trends (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Technological Advancements

5.2.1.2 Optimized Spectrum Utilization

5.2.1.3 Increasing Adoption of the 5g Technology

5.2.2 Restraints

5.2.2.1 Security Concerns

5.2.3 Opportunities

5.2.3.1 Rising Adoption of the Cognitive Radio Technology in Government and Defense Organizations

5.2.3.2 Increasing Demand for the Cognitive Radio Technology in Commercial Applications

5.2.4 Challenges

5.2.4.1 Dynamic Communication Standards

5.2.4.2 Overcoming Issues Related to Interoperability

5.3 Industry Trends

5.3.1 Cognitive Radio Architecture

5.3.2 Regulatory Implications and Regulatory Bodies

5.3.2.1 Introduction

5.3.2.2 Spectrum Management and Telecommunications

5.3.2.3 Radio Regulations of the International Telecommunication Union (ITU)

5.3.2.4 Federal Communications Commission (FCC)

5.3.2.5 The Office of Communications (OFCOM)

5.3.3 Innovation and Patent Registration

6 Cognitive Radio Market, By Component (Page No. - 44)

6.1 Introduction

6.2 Software Tools

6.2.1 Radio Control and Reconfiguration Tools

6.2.2 Spectrum Analyzer

6.2.3 Policy and Configuration Database Manager

6.3 Hardware

6.3.1 Transmitter

6.3.2 Receiver

6.4 Services

6.4.1 Professional Services

6.4.2 Managed Services

7 Cognitive Radio Market, By Application (Page No. - 56)

7.1 Introduction

7.2 Spectrum Sensing

7.3 Spectrum Analysis

7.4 Spectrum Allocation

7.5 Location Tracking

7.6 Cognitive Routing

8 Cognitive Radio Market, By End-User (Page No. - 62)

8.1 Introduction

8.2 Government and Defense

8.3 Telecommunication

8.4 Transportation

8.5 Others

9 Geographic Analysis (Page No. - 69)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.2 Canada

9.3 Europe

9.3.1 United Kingdom

9.3.2 Germany

9.3.3 France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 Rest of APAC

9.5 Middle East and Africa

9.5.1 Middle East

9.5.2 Africa

9.6 Latin America

9.6.1 Brazil

9.6.2 Rest of Latin America

10 Competitive Landscape (Page No. - 92)

10.1 Overview

10.2 Top Players Operating in the Cognitive Radio Market

10.3 Competitive Scenario

10.3.1 New Product Launches and Product Enhancements

10.3.2 Partnerships and Collaborations

10.3.3 Mergers and Acquisitions

10.3.4 Contracts

11 Company Profiles (Page No. - 97)

(Business Overview, Services Offered, Recent Developments, MnM View, Key Strategies, SWOT Analysis)*

11.1 Introduction

11.2 BAE Systems

11.3 Raytheon Company

11.4 Thales Group

11.5 Rohde & Schwarz

11.6 Spectrum Signal Processing

11.7 XG Technology

11.8 Nutaq

11.9 Ettus Research

11.10 Shared Spectrum Company

11.11 Datasoft Corporation

11.12 Key Innovators

11.12.1 Episys Science

11.12.2 Kyynel

*Details on Business Overview, Services Offered, Recent Developments, MnM View, Key Strategies, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 127)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (69 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Global Cognitive Radio Market Size and Growth Rate, 20152022 (USD Million, Y-O-Y %)

Table 3 Innovation and Patent Registration, 20162017

Table 4 Cognitive Radio Market Size, By Component, 20152022 (USD Million)

Table 5 Software Tools: Market Size By Type, 20152022 (USD Million)

Table 6 Software Tools: Market Size By Region, 20152022 (USD Million)

Table 7 Radio Control and Reconfiguration Tools Market Size, By Region, 20152022 (USD Million)

Table 8 Spectrum Analyzer Market Size, By Region, 20152022 (USD Million)

Table 9 Policy and Configuration Database Manager Market Size, By Region, 20152022 (USD Million)

Table 10 Hardware: Market Size By Type, 20152022 (USD Million)

Table 11 Hardware: Market Size By Region, 20152022 (USD Million)

Table 12 Transmitter Market Size, By Region, 20152022 (USD Million)

Table 13 Receiver Market Size, By Region, 20152022 (USD Million)

Table 14 Services: Market Size, By Type, 20152022 (USD Million)

Table 15 Services: Market Size By Region, 20152022 (USD Million)

Table 16 Professional Services Market Size, By Region, 20152022 (USD Million)

Table 17 Managed Services Market Size, By Region, 20152022 (USD Million)

Table 18 Cognitive Radio Market Size, By Application, 20152022 (USD Million)

Table 19 Spectrum Sensing: Market Size By Region, 20152022 (USD Million)

Table 20 Spectrum Analysis: Market Size By Region, 20152022 (USD Million)

Table 21 Spectrum Allocation: Market Size By Region, 20152022 (USD Million)

Table 22 Location Tracking: Market Size By Region, 20152022 (USD Million)

Table 23 Cognitive Routing: Market Size By Region, 20152022 (USD Million)

Table 24 Cognitive Radio Market Size, By End-User, 20152022 (USD Million)

Table 25 Government and Defense: Market Size By Region, 20152022 (USD Million)

Table 26 Telecommunication: Market Size By Region, 20152022 (USD Million)

Table 27 Transportation: Market Size By Region, 20152022 (USD Million)

Table 28 Others: Market Size By Region, 20152022 (USD Million)

Table 29 Cognitive Radio Market Size, By Region, 20152022 (USD Million)

Table 30 North America: Market Size By Country, 20152022 (USD Million)

Table 31 North America: Market Size By Component, 20152022 (USD Million)

Table 32 North America: Market Size By Software Tool, 20152022 (USD Million)

Table 33 North America: Market Size By Hardware, 20152022 (USD Million)

Table 34 North America: Market Size By Service, 20152022 (USD Million)

Table 35 North America: Market Size By Application, 20152022 (USD Million)

Table 36 North America: Market Size By End-User, 20152022 (USD Million)

Table 37 Europe: Cognitive Radio Market Size, By Country, 20152022 (USD Million)

Table 38 Europe: Market Size By Component, 20152022 (USD Million)

Table 39 Europe: Market Size By Software Tool, 20152022 (USD Million)

Table 40 Europe: Market Size By Hardware, 20152022 (USD Million)

Table 41 Europe: Market Size By Service, 20152022 (USD Million)

Table 42 Europe: Market Size By Application, 20152022 (USD Million)

Table 43 Europe: Market Size By End-User, 20152022 (USD Million)

Table 44 Asia Pacific: Cognitive Radio Market Size, By Country, 20152022 (USD Million)

Table 45 Asia Pacific: Market Size By Component, 20152022 (USD Million)

Table 46 Asia Pacific: Market Size By Software Tool, 20152022 (USD Million)

Table 47 Asia Pacific: Market Size By Hardware, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size By Service, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size By Application, 20152022 (USD Million)

Table 50 Asia Pacific: Market Size By End-User, 20152022 (USD Million)

Table 51 Middle East and Africa: Cognitive Radio Market Size, By Subregion, 20152022 (USD Million)

Table 52 Middle East and Africa: Market Size By Component, 20152022 (USD Million)

Table 53 Middle East and Africa: Market Size By Software Tool, 20152022 (USD Million)

Table 54 Middle East and Africa: Market Size By Hardware, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size By Service, 20152022 (USD Million)

Table 56 Middle East and Africa: Market Size By Application, 20152022 (USD Million)

Table 57 Middle East and Africa: Market Size By End-User, 20152022 (USD Million)

Table 58 Latin America: Cognitive Radio Market Size, By Country, 20152022 (USD Million)

Table 59 Latin America: Market Size By Component, 20152022 (USD Million)

Table 60 Latin America: Market Size By Software Tool, 20152022 (USD Million)

Table 61 Latin America: Market Size By Hardware, 20152022 (USD Million)

Table 62 Latin America: Market Size By Service, 20152022 (USD Million)

Table 63 Latin America: Market Size By Application, 20152022 (USD Million)

Table 64 Latin America: Market Size By End-User, 20152022 (USD Million)

Table 65 Cognitive Radio Market: Ranking

Table 66 New Product Launches and Product Enhancements, 20162017

Table 67 Partnerships and Collaborations, 20162017

Table 68 Mergers and Acquisitions, 20152017

Table 69 Contracts, 20152017

List of Figures (41 Figures)

Figure 1 Cognitive Radio Market Segmentation

Figure 2 Regional Scope

Figure 3 Cognitive Radio Market: Research Design

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Cognitive Radio Market Snapshot, By Component

Figure 8 Market Snapshot By Software Tool

Figure 9 Market Snapshot By Hardware

Figure 10 Market Snapshot By Service

Figure 11 Market Snapshot By Application

Figure 12 Market Snapshot By End-User

Figure 13 Market Snapshot By Region

Figure 14 Increasing Adoption of the 5g Technology is One of the Major Factors That is Expected to Drive the Overall Growth of the Cognitive Radio Market During the Forecast Period

Figure 15 Spectrum Analysis Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Asia Pacific is Expected to Exhibit the Highest Growth Potential During the Forecast Period

Figure 17 Market Investment Scenario: Asia Pacific is Expected to Become the Best Opportunity Market for Investments in the Next 5 Years

Figure 18 Cognitive Radio Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Cognitive Radio Framework

Figure 20 Services Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 21 Spectrum Analyzer Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 22 Transmitter Segment is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 23 Managed Services Segment is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 24 Spectrum Analysis Application is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 25 Telecommunication Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 26 North America is Expected to Have the Largest Market Size in the Cognitive Radio Market During the Forecast Period

Figure 27 Asia Pacific is Expected to Have the Highest Growth Rate in the Cognitive Radio Market During the Forecast Period

Figure 28 North America: Market Snapshot

Figure 29 Asia Pacific: Market Snapshot

Figure 30 Key Developments By Leading Players in the Cognitive Radio Market, 20152017

Figure 31 Geographic Revenue Mix of Top 3 Market Players

Figure 32 BAE Systems: Company Snapshot

Figure 33 BAE Systems: SWOT Analysis

Figure 34 Raytheon Company: Company Snapshot

Figure 35 Raytheon Company: SWOT Analysis

Figure 36 Thales Group: Company Snapshot

Figure 37 Thales Group: SWOT Analysis

Figure 38 Rohde & Schwarz: SWOT Analysis

Figure 39 Spectrum Signal Processing: SWOT Analysis

Figure 40 XG Technology: Company Snapshot

Figure 41 XG Technology: SWOT Analysis

Growth opportunities and latent adjacency in Cognitive Radio Market