High Speed Steels Market by Product Type (Metal Cutting Tools, Cold Working Tools, Others), End-Use Industry (Automotive Industry, Plastic Industry, Aerospace Industry, Energy Sector, Others), Region - Global Forecasts to 2021

[164 Pages Report] The High Speed Steels Market is projected to grow from USD 2.13 Billion in 2016 to USD 2.77 Billion by 2021, at a CAGR of 5.3% between 2016 and 2021.

The objectives of this study are:

- To analyze and forecast the size of the high speed steels market, in terms of value and volume

- To define, describe, and forecast the high speed steels market on the basis of product type, end-use industry, and region

- To forecast the market size of different segments in five major regions, namely, North America, Europe, Asia-Pacific, Middle East & Africa, and South America

- To provide detailed information regarding major factors drivers, restraints, opportunities, and challenges influencing the growth of the high speed steels market

- To strategically analyze the segments of the high speed steels market on the basis of individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the high speed steels market for stakeholders and provide detailed competitive landscape for the market leaders

- To strategically profile key players and comprehensively analyze their core competencies

- To analyze competitive developments, such as new product launches, expansions, joint ventures, and mergers & acquisitions in the high speed steels market

Years considered for the study are:

- Base Year – 2015

- Estimated Year – 2016

- Projected Year –2021

- Forecast Period – 2016 to 2021

For company profiles, 2016 has been considered as the base year. In the cases, wherein information was unavailable for the base year, the years prior to it have been considered.

Research Methodology

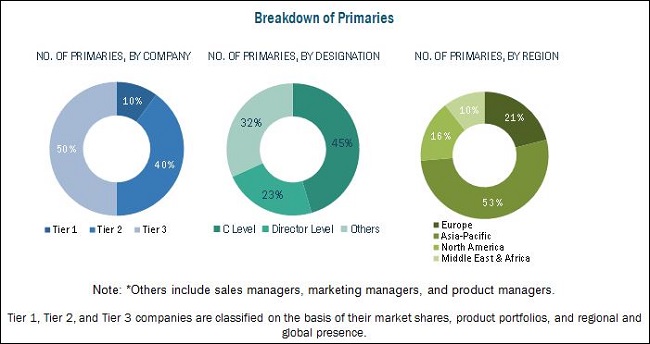

This study estimates the size of the high speed steels market for 2016 and projects its demand till 2021. It also provides a detailed qualitative and quantitative analysis of the high speed steels market. Various secondary sources, including directories, industry journals, and databases (such as Hoovers, Bloomberg, Chemical Weekly, Factiva, government and private websites, and associations), have been used to identify and collect information useful for this extensive commercial study of the high speed steels market. Primary sources, such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as assess future prospects of the high speed steels market. The breakdown of the profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the high speed steels includes raw material suppliers and manufacturers of high speed steels. Hudson Tool Steel Corporation (U.S.), Sandvik Materials Technology AB (Sweden), Erasteel (France), Nachi-Fujikoshi Corporation (Japan), Daido Steel Co., Ltd. (Japan), Friedr. Lohmann GmbH (Germany), Kennametal Inc. (U.S.), Voestalpine AG (Austria), ArcelorMittal S.A. (Luxembourg), and ThyssenKrupp AG (Germany), among others, are the key players operating in the high speed steels market. The products manufactured by these companies are used in the automotive, plastics, aerospace, and energy sectors.

Key Target Audience

- Manufacturers of High Speed Steels

- Traders, Distributors, and Suppliers of High Speed Steels

- End-Use Industries Operating in the High speed steels Supply Chain

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Scope of the Report: This research report categorizes the high speed steels market on the basis of product type, end-use industry, and region. The report forecasts revenues as well as analyzes the trends in each of these submarkets.

High speed steels Market, by Product Type:

- Metal Cutting Tools

- Cold Working Tools

- Others

High speed steels Market, by End-Use Industry:

- Automotive Industry

- Plastic Industry

- Aerospace Industry

- Energy Sector

- Others

High speed steels Market, by Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to specific needs of the companies. The following customization options are available for the report:

- New Product Analysis

Product matrix, which gives a detailed comparison of new products and market trends in each industry

- Regional Analysis

Further breakdown of a region on the basis of country and end-use industry

- Company Information

Detailed analysis and profiling of additional market players (up to five)

The high speed steels market is projected to grow from USD 2.13 Billion in 2016 to USD 2.77 Billion by 2021, at a CAGR of 5.3% between 2016 and 2021. Increasing demand for machinery made of high speed steels from various end-use industries, such as automotive, aerospace, and plastic, among others, is expected to drive the demand for high speed steels, thereby fueling the growth of the high speed steels market during the forecast period.

Among product types, the metal cutting tools segment of the high speed steels market is projected to grow at the highest CAGR during the forecast period, 2016 to 2021. The growth of this segment can be attributed to the fact that metal cutting tools made from high speed steels ensure effective manufacturing of critical and complex components with ease and utmost accuracy.

Among end-use industries, the automotive industry segment is projected to lead the high speed steels market during the forecast period. The growth of the automotive industry segment of the high speed steels market can be attributed to increasing demand for high-end industrial machinery and equipment from the automotive industry. High speed steels are widely used in the manufacturing of spare parts and components of railways and of passenger and commercial vehicles, owing to various properties offered by them, which include high strength, increased hardness, and high resistance to wearing and abrasion.

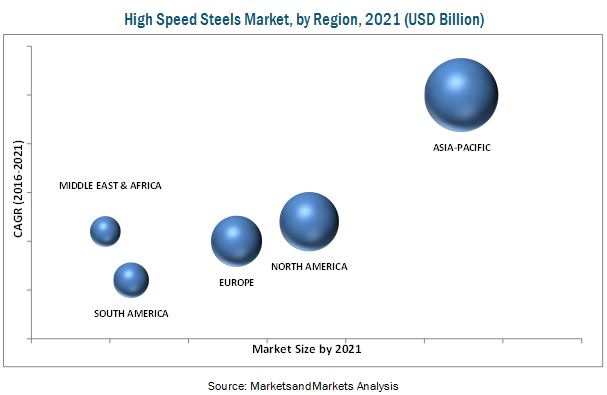

The Asia-Pacific high speed steels market is projected to grow at the highest CAGR during the forecast period, 2016 to 2021. The region is a major consumer of high speed steels, which are used in varied end-use industries, such as automotive, plastic, and aerospace, among others. The demand for high speed steels is increasing in various countries, such as Japan, China, India, and South Korea, among others of the Asia-Pacific region. In order to meet this growing demand for high speed steels, top manufacturers of high speed steels from the U.S. and Europe are focusing on the Asia-Pacific region to expand their businesses.

Lack of investments for carrying out R&D activities in the field of high speed steels and increasing use of carbide-based cutting tools in various end-use industries are expected to act as restraints for the growth of the high speed steels market during the forecast period.

Hudson Tool Steel Corporation (U.S.), Sandvik Materials Technology AB (Sweden), Erasteel (France), Nachi-Fujikoshi Corporation (Japan), Daido Steel Co., Ltd. (Japan), Friedr. Lohmann GmbH (Germany), Kennametal Inc. (U.S.), Voestalpine AG (Austria), ArcelorMittal S.A. (Luxembourg), and ThyssenKrupp AG (Germany), among others, are the key companies operating in the high speed steels market. These players, with a wide market reach and established distribution networks, are investing increasingly in research & development activities for development of new grades of high speed steels. They also have strong technical and market development capabilities, which enable them to upgrade their existing products for new applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Key Data From Secondary Sources

2.1.3 Primary Data

2.1.4 Key Data From Primary Sources

2.1.4.1 Key Industry Insights

2.1.4.2 Breakdown of Primary Interviews: By Company, Designation, and Region

2.2 Market Size Estimation

2.3 Data Triangulation

2.3.1 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the High Speed Steels Market

4.2 High Speed Steels Market, By Region

4.3 High Speed Steels Market, By Product Type

4.4 Asia-Pacific High Speed Steels Market

4.5 High Speed Steels Market: Emerging vs Developed Countries

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for High Speed Steels for Manufacturing Cutting Tools

5.2.2 Restraints

5.2.2.1 Increasing Use of Carbide-Based Cutting Tools in Various End-Use Industries

5.2.3 Opportunities

5.2.3.1 Increasing Applications of High Speed Steels in the Shipbuilding and Energy Sectors

5.3 Challenges

5.3.1 Economic Slowdown in the Manufacturing Sector of China

5.4 Impact Analysis of Drivers and Restraints

5.5 Technological Trends

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Economic Indicators

6.2.1 Trends and Forecast of Gdp

6.3 Industry Outlook

6.3.1 Automotive Market Trends

6.4 Porter’s Five Forces Analysis

6.4.1 Bargaining Power of Suppliers

6.4.2 Threat of New Entrants

6.4.3 Threat of Substitutes

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Rivalry

7 High Speed Steels Market, By Product Type (Page No. - 47)

7.1 Introduction

7.2 Metal Cutting Tools

7.2.1 Drill Bits

7.2.2 Broaches & Reamers

7.2.3 Taps

7.2.4 End Mills

7.2.5 Saws

7.3 Cold Working Tools

7.3.1 Blanking & Fine Blanking Tools

7.3.2 Extrusion Tools

7.3.3 Drawing & Deep Drawing Tools

7.3.4 Others

7.4 Others

7.4.1 Screws & Barrels

7.4.2 Molds

7.4.3 Pumps

8 High Speed Steels Market, By End-Use Industry (Page No. - 56)

8.1 Introduction

8.2 Automotive Industry

8.3 Plastic Industry

8.4 Aerospace Industry

8.5 Energy Sector

8.6 Others

9 Regional Analysis (Page No. - 66)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 South Korea

9.2.5 Taiwan

9.2.6 Rest of Asia-Pacific

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 U.K.

9.4.3 France

9.4.4 Belgium

9.4.5 Russia

9.4.6 Italy

9.4.7 Rest of Europe

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Middle East & Africa

9.6.1 South Africa

9.6.2 Saudi Arabia

9.6.3 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 119)

10.1 Overview

10.1.1 Mergers & Acquisitions: the Most Popular Growth Strategy

10.2 Growth Strategies Adopted By Companies in the High Speed Steels Market Between 2011 and 2017(February)

10.3 High Speed Steels Market Share, By Company, 2016

10.4 Recent Developments

10.4.1 New Product Launches, 2011–2017

10.4.2 Expansions, 2011–2017

10.4.3 Mergers & Acquisitions, 2011–2017

10.4.4 Agreements, 2011–2017

10.4.5 Joint Ventures, 2011–2017

11 Company Profiles (Page No. - 127)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Nachi-Fujikoshi Corporation

11.2 Daido Steel Co., Ltd.

11.3 Voestalpine AG

11.4 Sandvik Materials Technology AB

11.5 Kennametal Inc.

11.6 Hudson Tool Steel Corporation

11.7 Erasteel

11.8 Friedr. Lohmann GmbH

11.9 Arcelormittal S.A.

11.10 Thyssenkrupp AG

11.11 Tiangong International Co., Ltd.

11.12 Guhring Inc.

11.13 Heye Special Steel Co., Ltd.

11.14 Nippon Koshuha Steel Co., Ltd.

11.15 OSG Corporation

11.16 Carpenter

11.17 Graphite India Limited

11.18 Tivoly SA

11.19 Crucible Industries LLC

11.20 Dneprospetsstal

11.21 Jiangsu Fuda Special Steel Co., Ltd

11.22 Feida Group

11.23 West Yorkshire Steel Co. Ltd.

11.24 Big Kaiser Precision Tooling Inc.

11.25 Onsurd

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 155)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (147 Tables)

Table 1 High Speed Steels Market Snapshot

Table 2 Trends and Forecast of Gdp, USD Billion (2016–2021)

Table 3 International Car Sales Outlook, 1990-2016 (Million Units)

Table 4 High Speed Steels Market, By Product Type, 2014–2021 (Kilotons)

Table 5 High Speed Steels Market, By Product Type, 2014–2021 (USD Million)

Table 6 Metal Cutting Tools Segment, By Region, 2014–2021 (Kilotons)

Table 7 Metal Cutting Tools Segment, By Region, 2014–2021 (USD Million)

Table 8 Cold Working Tools Segment, By Region, 2014–2021 (Kilotons)

Table 9 Cold Working Tools Segment, By Region, 2014–2021 (USD Million)

Table 10 Other Product Types Segment, By Region, 2014–2021 (Kilotons)

Table 11 Other Product Types Segment, By Region, 2014–2021 (USD Million)

Table 12 High Speed Steels Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 13 High Speed Steels Market, By End-Use Industry, 2014–2021 (USD Million)

Table 14 Automotive Industry Segment, By Region, 2014–2021 (Kilotons)

Table 15 Automotive Industry Segment, By Region, 2014–2021 (USD Million)

Table 16 Plastic Industry Segment, By Region, 2014–2021 (Kilotons)

Table 17 Plastic Industry Segment, By Region, 2014–2021 (USD Million)

Table 18 Aerospace Industry Segment, By Region, 2014–2021 (Kilotons)

Table 19 Aerospace Industry Segment, By Region, 2014–2021 (USD Million)

Table 20 Energy Sector Segment, By Region, 2014–2021 (Kilotons)

Table 21 Energy Sector Segment, By Region, 2014–2021 (USD Million)

Table 22 Other End-Use Industries Segment, By Region, 2014–2021 (Kilotons)

Table 23 Others End-Use Industries Segment, By Region, 2014–2021 (USD Million)

Table 24 High Speed Steels Market, By Region, 2014–2021 (Kilotons)

Table 25 By Market, By Region, 2014–2021 (USD Million)

Table 26 By Market, By Product Type, 2014–2021 (Kilotons)

Table 27 By Market, By Product Type, 2014–2021 (USD Million)

Table 28 By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 29 By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 30 Asia-Pacific High Speed Steels Market, By Country, 2014-2021 (Kilotons)

Table 31 Asia-Pacific By Market, By Country, 2014-2021 (USD Million)

Table 32 Asia-Pacific By Market, By Product Type, 2014-2021 (Kilotons)

Table 33 Asia-Pacific By Market, By Type, 2014-2021 (USD Million)

Table 34 Asia-Pacific By Market, By End-Use Industry, 2014-2021 (Kilotons)

Table 35 Asia-Pacific By Market, By End-Use Industry, 2014-2021 (USD Million)

Table 36 China By Market, By Product Type, 2014–2021 (Kilotons)

Table 37 China By Market, By Product Type, 2014–2021 (USD Million)

Table 38 China By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 39 China By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 40 India By Market, By Product Type, 2014–2021 (Kilotons)

Table 41 India By Market, By Product Type, 2014–2021 (USD Million)

Table 42 India By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 43 India By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 44 Japan By Market, By Product Type, 2014–2021 (Kilotons)

Table 45 Japan By Market, By Product Type, 2014–2021 (USD Million)

Table 46 Japan By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 47 Japan By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 48 South Korea By Market, By Product Type, 2014–2021 (Kilotons)

Table 49 South Korea By Market, By Product Type, 2014–2021 (USD Million)

Table 50 South Korea By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 51 South Korea By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 52 Taiwan By Market, By Product Type, 2014–2021 (Kilotons)

Table 53 Taiwan By Market, By Product Type, 2014–2021 (USD Million)

Table 54 Taiwan By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 55 South Korea By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 56 Rest of Asia-Pacific By Market, By Product Type, 2014–2021 (Kilotons)

Table 57 Rest of Asia-Pacific By Market, By Product Type, 2014–2021 (USD Million)

Table 58 Rest of Asia-Pacific By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 59 Rest of Asia-Pacific By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 60 North America By Market, By Country, 2014-2021 (Kilotons)

Table 61 North America By Market, By Country, 2014-2021 (USD Million)

Table 62 North America By Market, By Product Type, 2014-2021 (Kilotons)

Table 63 North America By Market, By Type, 2014-2021 (USD Million)

Table 64 North America By Market, By End-Use Industry, 2014-2021 (Kilotons)

Table 65 North America By Market, By End-Use Industry, 2014-2021 (USD Million)

Table 66 U.S. By Market, By Product Type, 2014–2021 (Kilotons)

Table 67 U.S. By Market, By Product Type, 2014–2021 (USD Million)

Table 68 U.S. By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 69 U.S. By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 70 Canada By Market, By Product Type, 2014–2021 (Kilotons)

Table 71 Canada By Market, By Product Type, 2014–2021 (USD Million)

Table 72 Canada By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 73 Canada By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 74 Mexico By Market, By Product Type, 2014–2021 (Kilotons)

Table 75 Mexico By Market, By Product Type, 2014–2021 (USD Million)

Table 76 Mexico By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 77 Mexico By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 78 Europe By Market, By Country, 2014-2021 (Kilotons)

Table 79 Europe By Market, By Country, 2014-2021 (USD Million)

Table 80 Europe By Market, By Product Type, 2014-2021 (Kilotons)

Table 81 Europe By Market, By Type, 2014-2021 (USD Million)

Table 82 Europe By Market, By End-Use Industry, 2014-2021 (Kilotons)

Table 83 Europe By Market, By End-Use Industry, 2014-2021 (USD Million)

Table 84 Germany By Market, By Product Type, 2014–2021 (Kilotons)

Table 85 Germany By Market, By Product Type, 2014–2021 (USD Million)

Table 86 Germany By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 87 Germany By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 88 U.K. By Market, By Product Type, 2014–2021 (Kilotons)

Table 89 U.K. By Market, By Product Type, 2014–2021 (USD Million)

Table 90 U.K. By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 91 U.K. By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 92 France By Market, By Product Type, 2014–2021 (Kilotons)

Table 93 France By Market, By Product Type, 2014–2021 (USD Million)

Table 94 France By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 95 France By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 96 Belgium By Market, By Product Type, 2014–2021 (Kilotons)

Table 97 Belgium By Market, By Product Type, 2014–2021 (USD Million)

Table 98 Belgium By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 99 Belgium By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 100 Russia By Market, By Product Type, 2014–2021 (Kilotons)

Table 101 Russia By Market, By Product Type, 2014–2021 (USD Million)

Table 102 Russia By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 103 Russia By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 104 Italy By Market, By Product Type, 2014–2021 (Kilotons)

Table 105 Italy By Market, By Product Type, 2014–2021 (USD Million)

Table 106 Italy By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 107 Italy By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 108 Rest of Europe By Market, By Product Type, 2014–2021 (Kilotons)

Table 109 Rest of Europe By Market, By Product Type, 2014–2021 (USD Million)

Table 110 Rest of Europe By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 111 Rest of Europe By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 112 South America By Market, By Country, 2014-2021 (Kilotons)

Table 113 South America By Market, By Country, 2014-2021 (USD Million)

Table 114 South America By Market, By Product Type, 2014-2021 (Kilotons)

Table 115 South America By Market, By Type, 2014-2021 (USD Million)

Table 116 South America By Market, By End-Use Industry, 2014-2021 (Kilotons)

Table 117 South America By Market, By End-Use Industry, 2014-2021 (USD Million)

Table 118 Brazil By Market, By Product Type, 2014–2021 (Kilotons)

Table 119 Brazil By Market, By Product Type, 2014–2021 (USD Million)

Table 120 Brazil By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 121 Brazil By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 122 Argentina By Market, By Product Type, 2014–2021 (Kilotons)

Table 123 Argentina By Market, By Product Type, 2014–2021 (USD Million)

Table 124 Argentina By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 125 Argentina By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 126 Rest of South America By Market, By Product Type, 2014–2021 (Kilotons)

Table 127 Rest of South America By Market, By Product Type, 2014–2021 (USD Million)

Table 128 Rest of South America By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 129 Rest of South America By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 130 Middle East & Africa By Market, By Country, 2014-2021 (Kilotons)

Table 131 Middle East & Africa By Market, By Country, 2014-2021 (USD Million)

Table 132 Middle East & Africa By Market, By Product Type, 2014-2021 (Kilotons)

Table 133 Middle East & Africa By Market, By Type, 2014-2021 (USD Million)

Table 134 Middle East & Africa By Market, By End-Use Industry, 2014-2021 (Kilotons)

Table 135 Middle East & Africa By Market, By End-Use Industry, 2014-2021 (USD Million)

Table 136 South Africa By Market, By Product Type, 2014–2021 (Kilotons)

Table 137 South Africa By Market, By Product Type, 2014–2021 (USD Million)

Table 138 South Africa By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 139 South Africa By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 140 Saudi Arabia By Market, By Product Type, 2014–2021 (Kilotons)

Table 141 Saudi Arabia By Market, By Product Type, 2014–2021 (USD Million)

Table 142 Saudi Arabia By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 143 Saudi Arabia By Market, By End-Use Industry, 2014–2021 (USD Million)

Table 144 Rest of Middle East & Africa High Speed Steels Market, By Product Type, 2014–2021 (Kilotons)

Table 145 Rest of Middle East & Africa By Market, By Product Type, 2014–2021 (USD Million)

Table 146 Rest of Middle East & Africa By Market, By End-Use Industry, 2014–2021 (Kilotons)

Table 147 Rest of Middle East & Africa By Market, By End-Use Industry, 2014–2021 (USD Million)

List of Figures (48 Figures)

Figure 1 High Speed Steels Market Segmentation

Figure 2 High Speed Steels Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 High Speed Steels Market: Data Triangulation

Figure 6 The Metal Cutting Tools Product Type Segment Led the High Speed Steels Market in 2016

Figure 7 The Automotive Industry Segment Led the High Speed Steels Market in 2016

Figure 8 The Asia-Pacific Region Led the High Speed Steels Market in 2016

Figure 9 Increasing Demand for High Speed Steels for Various Applications to Fuel the Growth of Market During the Forecast Period

Figure 10 The Asia-Pacific High Speed Steels Market is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 11 The Metal Cutting Tools Segment Led the High Speed Steels Market in 2016

Figure 12 The Automotive Industry Segment Contributed the Largest Share to the Asia-Pacific High Speed Steels Market in 2016

Figure 13 China is Expected to Held the Largest Market Share From 2016 to 2021

Figure 14 Drivers, Restraints, Opportunities, and Challenges for the High Speed Steels Market

Figure 15 High Speed Steels: Porter’s Five Forces Analysis

Figure 16 The Metal Cutting Tools Segment is Expected to Drive the Growth of the High Speed Steels Market Between 2016 and 2021

Figure 17 The Metal Cutting Tools Segment of the Asia-Pacific High Speed Steels Market is Projected to Grow at the Highest CAGR Between 2016 and 2021

Figure 18 The Asia-Pacific to Lead the Cold Working Tools Segment of the High Speed Steels Market Between 2016 and 2021

Figure 19 The Asia-Pacific Region to Lead the Other Product Types Segment of the High Speed Steels Market From 2016 to 2021

Figure 20 The Automotive Industry Segment is Expected to Drive the Growth of the High Speed Steels Market Between 2016 and 2021

Figure 21 The Automotive Industry Segment of the Asia-Pacific High Speed Steels Market is Projected to Grow at the Highest CAGR Between 2016 and 2021

Figure 22 The Asia-Pacific is Projected to Lead the Plastic Industry Segment of the High Speed Steels Market Between 2016 and 2021

Figure 23 The Asia-Pacific Region is Projected to Lead the Aerospace Industry Segment of the High Speed Steels From 2016 to 2021

Figure 24 The Asia-Pacific is Projected to Lead the Energy Sector Segment of the High Speed Steels Between 2016 and 2021

Figure 25 The Asia-Pacific is Projected to Lead the Other End-Use Industries Segment of the High Speed Steels Market From 2016 to 2021

Figure 26 High Speed Steels Market, By Region, 2015

Figure 27 Asia-Pacific High Speed Steels Market Snapshot

Figure 28 North America High Speed Steels Market Snapshot

Figure 29 Europe High Speed Steels Market Snapshot

Figure 30 South America High Speed Steels Market Snapshot

Figure 31 Middle East & Africa High Speed Steels Market Snapshot

Figure 32 The Strategy of Mergers & Acquisitions has Been Widely Adopted By the Key Players to Strengthen Their Position in the High Speed Steels Market Between 2011 to 2017( Feburary)

Figure 33 Key Growth Strategies in the High Speed Steels Market Between 2011 and 2017 (February)

Figure 34 Nachi-Fujikoshi Corporation and Kennametal Inc. Accounted for the Largest Share of the Total Developments in the High Speed Steels Market Between 2011 and 2017(February)

Figure 35 Erasteel Accounted for the Largest Share of the Total Developments That Took Place in the High Speed Steels Market in 2016

Figure 36 Nachi-Fujikoshi Corporation: Company Snapshot

Figure 37 Nachi-Fujikoshi Corporation: SWOT Analysis

Figure 38 Daido Steel Co., Ltd.: Company Snapshot

Figure 39 Daido Steel Co., Ltd.: SWOT Analysis

Figure 40 Voestalpine AG: Company Snapshot

Figure 41 Voestalpine AG: SWOT Analysis

Figure 42 Sandvik Materials Technology AB: Company Snapshot

Figure 43 Sandvik Materials Technology AB: SWOT Analysis

Figure 44 Kennametal Inc.: Company Snapshot

Figure 45 Kennametal Inc.: SWOT Analysis

Figure 46 Arcelormittal S.A.: Company Snapshot

Figure 47 Arcelormittal S.A. : SWOT Analysis

Figure 48 Thyssenkrupp AG: Company Snapshot

Growth opportunities and latent adjacency in High Speed Steels Market