Flat Steel Market by Process (Basic Oxygen Furnace, Electric Arc Furnace), Type (Sheets & Strips, Plates), End-Use Sector (Building & Infrastructure, Mechanical Equipment, Automotive & Other Transport), Region - Global Forecast to 2024

Updated on : June 18, 2024

Flat Steel Market

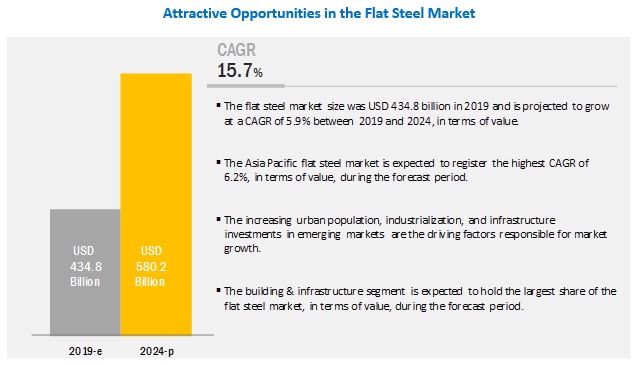

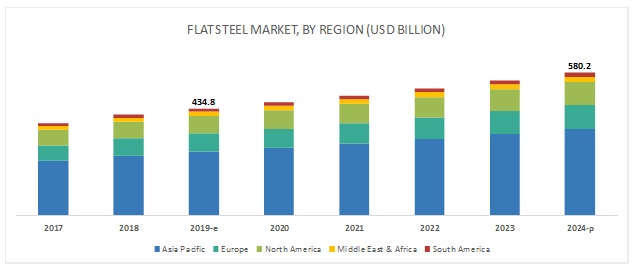

The global flat steel market was valued at USD 434.8 billion in 2019 and is projected to reach USD 580.2 billion by 2024, growing at 5.9% cagr from 2019 to 2024. The key factors driving the growth of this market are the increasing demand for flat steel products from building & infrastructure, mechanical equipment, automotive, and other end-use sectors.

The basic oxygen furnace segment is projected to be the largest segment during the forecast period

On the basis of process, the basic oxygen furnace segment accounted for the largest share in 2018. This is a traditional process that is widely accepted by steel manufacturers. The basic oxygen furnace process is costlier than the electric arc furnace process. The high production rate, low nitrogen content, and low labor requirements make basic oxygen furnace the most preferred process of manufacturing flat steel.

By type, sheets & strips is expected to be the largest segment of the flat steel market during the forecast period

By type, the sheets & strips segment accounted for the largest share of the flat steel market in 2018. This large share is mainly attributed to its increasing applications in the packaging, home appliances, and electronics industries. They are extensively used in the manufacturing of door & window hoods, wall ornaments, refrigerators, steel drums, steel furniture, dry batteries, automobiles, washing machines, gutters, downspouts, and roof ornaments, among others.

Building & infrastructure is projected to be the fastest-growing and the largest end-use sector of the flat steel market during the forecast period

The growth of the building & infrastructure end-use sector is attributed to the extensive use of flat steel in the construction of buildings, railway tracks, roads, bridges, factories, and other engineering structures. It not only lowers construction costs but also reduces the long-term maintenance costs of buildings. Flat steel is used in the development of infrastructure in the energy sector. It is used in the building & infrastructure sector as it offers design flexibility, strength, and durability. It is used in oil, gas, nuclear, solar, wind, and hydro energy plants.

Asia Pacific projected to grow at highest CAGR during the forecast period

Asia Pacific accounted for the largest share of the global flat steel market in 2018, followed by Europe and North America. China is one of the major consumers of flat steel in the Asia Pacific region. The market here is witnessing growth due to the increasing demand for flat steel and a rise in the number of end-use sectors in emerging economies such as India. The Indian flat steel market is projected to grow at the highest CAGR in the Asia Pacific region during the forecast period due to the growth of the economy, the rise in urban population, and the development of varied industries such as construction and automotive, among others, in the country.

Flat Steel Market Players

ArcelorMittal (Luxembourg), Nippon Steel & Sumitomo Metal Corporation (Japan), Tata Steel (India), POSCO (South Korea), China Baowu Steel Group Corporation Limited (China), Shougang Group Co., Ltd., (China), SSAB AB (Sweden), JFE Steel Corporation (Japan), HBIS Group (China), ThyssenKrupp AG (Germany), and Voestalpine Group (Austria) are some of the major players in the flat steel market. These players have been focusing on strategies such as expansions, acquisitions, new product launches, contracts, and collaborations that help them expand their businesses in untapped and potential markets. They have been adopting various organic and inorganic growth strategies to enhance their position in the flat steel market.

Flat Steel Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2019 |

USD 434.8 billion |

|

Revenue Forecast in 2024 |

USD 580.2 billion |

|

CAGR |

5.9% |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) & Volume (Kilotons) |

|

Segments covered |

Process, Type, End-use Sector, and Region |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa and South America |

|

Companies covered |

ArcelorMittal (Luxembourg), Nippon Steel & Sumitomo Metal Corporation (Japan), Tata Steel (India), POSCO (South Korea), China Baowu Steel Group Corporation Limited (China), Shougang Group Co., Ltd., (China), SSAB AB (Sweden), JFE Steel Corporation (Japan), HBIS Group (China), ThyssenKrupp AG (Germany), and Voestalpine Group (Austria). |

This report categorizes the flat steel market based on process, type, end-use sector, and region.

By process, the flat steel market is segmented as follows:

- Basic Oxygen Furnace

- Electric Arc Furnace

By type, the flat steel market is segmented as follows:

- Sheets & Strips

- Plates

By end-use sector, the flat steel market is segmented as follows:

- Building & Infrastructure

- Mechanical Equipment

- Automotive & Other Transport

- Others (Domestic Appliances, Electrical Appliances, Food Processing, Packaging, and Defense)

By region, the flat steel market is segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In December 2019, ArcelorMittal announced the acquisition of Essar Steel India Limited, (ESIL), a fully integrated flat carbon steel manufacturer located in Gujarat, India. The company simultaneously formed a joint venture with Nippon Steel Corporation, called ArcelorMittal Nippon Steel India Limited, which will own and operate ESIL. This acquisition will help the company strengthen its market presence in India.

- HBIS signed an MoU to set up a joint venture in China to develop, produce, and sell high-end steel products for the automobile industry. This joint venture, which produces high-quality and high-strength steel products as part of the Laoting cold rolling steel project, aims to create better opportunities in the Chinese automobile market.

- In November 2019, POSCO launched INNOVILT, a premium brand of steel products for the construction industry, to enhance the standard of steel products for construction.

- In November 2019, a strategic cooperation framework agreement was signed in Jinan between China Baowu Iron and Steel Group Co., Ltd., Taiyuan Iron and Steel Group Co., Ltd. and Shandong Xinhai Technology Co., Ltd. This cooperation agreement was formed to implement new development concepts, fulfill national reform requirements on the supply side, make full use of their respective advantages, and expand and strengthen the company through joint efforts by the cooperation of capital, technology, and management at different levels.

- In November 2019, JFE Steel Corporation and Guangdong Shaoguan Iron and Steel Songshan Co., Ltd. (SGIS), an affiliate of China BaoWu Steel Group Corporation Limited, signed an agreement under which JFE Steel will obtain a 50% share of Baosteel Special Steel Shaoguan Co., Ltd. (BSSS), a 100% subsidiary of SGIS, to launch a joint venture company with SGIS for the production and sale of specialty bar steel.

Key questions addressed by the report

- What are the future revenue pockets in the flat steel market?

- Which key developments are expected to have a long-term impact on the flat steel industry?

- Which materials are expected to cannibalize existing markets?

- How is the current regulatory framework expected to impact the market?

- What will the future product mix be of the flat steel industry?

- What are the prime strategies of leaders in the flat steel market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 22)

2.1 Market Definition and Scope

2.2 Base Number Calculation

2.3 Forecast Number Calculation

2.4 Market Engineering Process

2.4.1 Top-Down Approach

2.4.2 Bottom-Up Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

2.7 Research Data

2.7.1 Secondary Data

2.7.1.1 Key Data From Secondary Sources

2.7.2 Primary Data

2.7.2.1 Key Data From Primary Sources

2.7.2.2 Breakdown of Primary Interviews

2.7.2.3 Key Industry Insights

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Flat Steel Market

4.2 Flat Steel Market, By Type

4.3 Flat Steel Market, By Process

4.4 Flat Steel Market, By End-Use Sector

4.5 Flat Steel Market By End-Use Sector and Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Urban Population

5.2.1.2 Increasing Industrialization and Infrastructure Investment in Emerging Markets

5.2.2 Restraints

5.2.2.1 Volatile Price of Raw Materials

5.2.3 Opportunities

5.2.3.1 High Recyclability of Steel Scrap

5.2.3.2 Relaxed Credit Policy in Emerging Economies

5.2.4 Challenges

5.2.4.1 Eliminating Excess Capacity

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Flat Steel Market, By Process (Page No. - 40)

6.1 Introduction

6.2 Basic Oxygen Furnace

6.2.1 High Production Rate, Low Nitrogen Content, and Low Labor Requirement Expected to Drive Demand for Basic Oxygen Furnace

6.3 Electric Arc Furnace

6.3.1 Lower Capital Requirement Compared to Basic Oxygen Furnace Will Fuel the Market for Electric ARC Furnace

7 Flat Steel Market, By Type (Page No. - 44)

7.1 Introduction

7.2 Sheets & Strips

7.2.1 Increasing Demand From Home Appliance and Electrical Appliance Sectors Will Drive the Market for Flat Steel Sheets & Strips

7.3 Plates

7.3.1 Increasing Infrastructure Projects in Emerging Economies Projected to Trigger Market Growth for Flat Steel Plates

8 Flat Steel Market, By End-Use Sector (Page No. - 48)

8.1 Introduction

8.2 Building & Infrastructure

8.2.1 Increase in Demand for Flat Steel From Real Estate Sector Expected to Drive the Market

8.3 Mechanical Equipment

8.3.1 Rapid Industrialization has Led to an Increase in the Consumption of Flat Steel for Manufacturing Mechanical Equipment

8.4 Automotive & Other Transport

8.4.1 Increase in Demand for High-Strength and Lightweight Steel in Automobiles is Projected to Drive the Market

8.5 Others

8.5.1 Increasing Consumption of Flat Steel in Other End Uses is Expected to Drive the Market

9 Regional Analysis (Page No. - 55)

9.1 Introduction

9.2 Asia Pacific

9.2.1 China

9.2.1.1 China is Expected to Be the Largest Flat Steel Market in Asia Pacific

9.2.2 Japan

9.2.2.1 Increase in Automotive Demand is Expected to Drive the Market in Japan

9.2.3 India

9.2.3.1 Increase in Construction Projects and Government Initiatives Projected to Propel the Market in India

9.2.4 South Korea

9.2.4.1 Auto Manufacturing, Construction, and Shipbuilding Sectors Will Drive Market Growth in South Korea

9.2.5 Taiwan

9.2.5.1 Adoption of Strategies to Improve Bilateral Collaboration in Vertical Integration of Steel Industry is Projected to Drive the Market

9.2.6 Australia

9.2.6.1 Increase in Residential Construction is Anticipated to Propel the Flat Steel Market in Australia

9.2.7 Rest of Asia Pacific

9.2.7.1 Government Initiatives in Construction Anticipated to Propel the Market in Rest of Asia Pacific

9.3 Europe

9.3.1 Germany

9.3.1.1 Presence of Major Automobile Manufacturers in Germany is Expected to Fuel the Market

9.3.2 Russia

9.3.2.1 Growth of the Automotive Sector is Projected to Drive the Market in Russia

9.3.3 France

9.3.3.1 Increasing Foreign Investments in Automotive and Construction Expected to Drive the Demand for Flat Steel in France

9.3.4 UK

9.3.4.1 Demand for Flat Steel From Building & Construction, Transportation, and Other Industries has Increased in the UK

9.3.5 Spain

9.3.5.1 Rise in Residential Construction is Projected to Drive the Market in Spain

9.3.6 Italy

9.3.6.1 Growth of Industrial Engineering Sector is Expected to Fuel the Market for Flat Steel in Italy

9.3.7 UKraine

9.3.7.1 Advancements in Technology and Increasing Investments in Construction, Machinery, and Plant Production Drive Market Growth in UKraine

9.3.8 Belgium

9.3.8.1 Legislative and Infrastructural Barriers May Hamper Flat Steel Market Growth in Belgium

9.3.9 The Netherlands

9.3.9.1 Presence of Major Consumers of Flat Steel in the Netherlands is Expected to Propel the Market

9.3.10 Rest of Europe

9.3.10.1 Increasing Use of Flat Steel By Construction Industry Projected Drive the Market in the Rest of Europe

9.4 North America

9.4.1 US

9.4.1.1 US is Expected to Lead North America Flat Steel Market

9.4.2 Canada

9.4.2.1 Rise in Government Initiatives to Promote Construction Sector Projected to Trigger Market in Canada

9.4.3 Mexico

9.4.3.1 Increase in Infrastructural Activities in Mexico is Expected to Fuel the Market

9.5 Middle East & Africa

9.5.1 Iran

9.5.1.1 Increase in Demand for Housing Units is Projected to Drive the Flat Steel Market in Iran

9.5.2 Saudi Arabia

9.5.2.1 Government Approval for Large-Scale Infrastructure Projects is Expected to Drive the Market in Saudi Arabia

9.5.3 UAE

9.5.3.1 Increase in Construction Activities Will Fuel the Flat Steel Market in the UAE

9.5.4 South Africa

9.5.4.1 Imposition of Tariffs By the US has Led to A Decline in the Growth of the South African Market

9.5.5 Egypt

9.5.5.1 Increasing Investment in the Real Estate Sector is Projected to Drive the Market in Egypt

9.5.6 Israel

9.5.6.1 Increasing Number of Contracts in the Construction Sector is Expected to Drive the Market in Israel

9.5.7 Rest of Middle East & Africa

9.5.7.1 Increasing Consumption of Steel in the Construction Sector is Expected to Drive the Market in the Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.1.1 Brazil is Expected to Lead the South America Flat Steel Market

9.6.2 Argentina

9.6.2.1 Government Investment to Improve Infrastructure is Expected to Fuel the Market in Argentina

9.6.3 Venezuela

9.6.3.1 Venezuela is Projected to Witness Slow Growth in the Flat Steel Market

9.6.4 Rest of South America

9.6.4.1 Increasing Investment to Develop Infrastructure Projected to Fuel the Market in the Rest of South America

10 Competitive Landscape (Page No. - 103)

10.1 Introduction

10.1.1 Visionary Leaders

10.1.2 Innovators

10.1.3 Dynamic Differentiators

10.1.4 Emerging Companies

10.2 Strength of Product Portfolio

10.3 Business Strategy Excellence

10.4 Share of Key Players in the Flat Steel Market

11 Company Profiles (Page No. - 108)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win)*

11.1 Arcelormittal

11.2 United States Steel Corporation

11.3 Nippon Steel & Sumitomo Metal Corporation

11.4 Tata Steel

11.5 POSCO

11.6 China Baowu Steel Group Corporation Limited

11.7 Shagang Group

11.8 Shougang Group Co. Ltd.

11.9 Ansteel Group Corporation Limited

11.10 SSAB AB

11.11 JFE Steel Corporation

11.12 Bluescope Steel Limited

11.13 HBIS Group

11.14 Thyssenkrupp AG

11.15 Voestalpine Group

11.16 Steel Authority of India Limited

11.17 Other Key Market Players

11.17.1 Hebei Puyong Steel Group

11.17.2 Nucor Corporation

11.17.3 China Steel Corporation

11.17.4 Metinvest Holding LLC

11.17.5 Severstal JSC

11.17.6 Jsw Steel

11.17.7 Novolipetsk Steel (NLMK)

11.17.8 Gerdau S.A.

11.17.9 Citic

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 157)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (127 Tables)

Table 1 Urban Population, By Country, 2014–2018

Table 2 Flat Steel Market, By Process, 2017–2024 (USD Billion)

Table 3 Flat Steel Market, By Process, 2017–2024 (Kilotons)

Table 4 Basic Oxygen Furnace Market, By Region, 2017–2024 (USD Billion)

Table 5 Basic Oxygen Furnace Market, By Region, 2017–2024 (Kilotons)

Table 6 Electric Arc Furnace Market, By Region, 2017–2024 (USD Billion)

Table 7 Electric Arc Furnace Market, By Region, 2017–2024 (Kilotons)

Table 8 Flat Steel Market, By Type, 2017–2024 (USD Billion)

Table 9 Flat Steel Market, By Type, 2017–2024 (Kilotons)

Table 10 Flat Steel Sheets & Strips Market, By Region, 2017–2024 (USD Billion)

Table 11 Flat Steel Sheets & Strips Market, By Region, 2017–2024 (Kilotons)

Table 12 Flat Steel Plates Market, By Region, 2017–2024 (USD Billion)

Table 13 Flat Steel Plates Market, By Region, 2017–2024 (Kilotons)

Table 14 Flat Steel Market, By End-Use Sector, 2017–2024 (USD Billion)

Table 15 Flat Steel Market, By End-Use Sector, 2017–2024 (Kilotons)

Table 16 Flat Steel Market for Building & Infrastructure, By Region, 2017–2024 (USD Billion)

Table 17 Flat Steel Market for Building & Infrastructure, By Region, 2017–2024 (Kilotons)

Table 18 Flat Steel Market for Mechanical Equipment, By Region, 2017–2024 (USD Billion)

Table 19 Flat Steel Market for Mechanical Equipment, By Region, 2017–2024 (Kilotons)

Table 20 Flat Steel Market for Automotive & Other Transport, By Region, 2017–2024 (USD Billion)

Table 21 Flat Steel Market for Automotive & Other Transport, By Region, 2017–2024 (Kilotons)

Table 22 Flat Steel Market for Other End-Use Sectors, By Region, 2017–2024 (USD Billion)

Table 23 Flat Steel Market for Other End-Use Sectors, By Region, 2017–2024 (Kilotons)

Table 24 Flat Steel Market, By Region, 2017—2024 (USD Billion)

Table 25 Flat Steel Market, By Region, 2017—2024 (Kilotons)

Table 26 Asia Pacific: Flat Steel Market, By Country, 2017—2024 (USD Billion)

Table 27 Asia Pacific: Flat Steel Market, By Country, 2017—2024 (Kilotons)

Table 28 Asia Pacific: Flat Steel Market, By Type, 2017—2024 (USD Billion)

Table 29 Asia Pacific: Flat Steel Market, By Type, 2017—2024 (Kilotons)

Table 30 Asia Pacific: Flat Steel Market, By Process, 2017—2024 (USD Billion)

Table 31 Asia Pacific: Flat Steel Market, By Process, 2017—2024 (Kilotons)

Table 32 Asia Pacific: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 33 Asia Pacific: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 34 China: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 35 China: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 36 Japan: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 37 Japan: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 38 India: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 39 India: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 40 South Korea: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 41 South Korea: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 42 Taiwan: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 43 Taiwan: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 44 Australia: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 45 Australia: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 46 Rest of Asia Pacific: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 47 Rest of Asia Pacific: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 48 Europe: Flat Steel Market, By Country, 2017—2024 (USD Billion)

Table 49 Europe: Flat Steel Market, By Country, 2017—2024 (Kilotons)

Table 50 Europe: Flat Steel Market, By Type, 2017—2024 (USD Billion)

Table 51 Europe: Flat Steel Market, By Type, 2017—2024 (Kilotons)

Table 52 Europe: Flat Steel Market, By Process, 2017—2024 (USD Billion)

Table 53 Europe: Flat Steel Market, By Process, 2017—2024 (Kilotons)

Table 54 Europe: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 55 Europe: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 56 Germany: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 57 Germany: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 58 Russia: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 59 Russia: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 60 France: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 61 France: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 62 UK: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 63 UK: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 64 Spain: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 65 Spain: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 66 Italy: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 67 Italy: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 68 Ukraine: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 69 Ukraine: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 70 Belgium: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 71 Belgium: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 72 The Netherlands: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 73 The Netherlands: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 74 Rest of Europe: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 75 Rest of Europe: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 76 North America: Flat Steel Market, By Country, 2017—2024 (USD Billion)

Table 77 North America: Flat Steel Market, By Country, 2017—2024 (Kilotons)

Table 78 North America: Flat Steel Market, By Type, 2017—2024 (USD Billion)

Table 79 North America: Flat Steel Market, By Type, 2017—2024 (Kilotons)

Table 80 North America: Flat Steel Market, By Process, 2017—2024 (USD Billion)

Table 81 North America: Flat Steel Market, By Process, 2017—2024 (Kilotons)

Table 82 North America: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 83 North America: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 84 US: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 85 US: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 86 Canada: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 87 Canada: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 88 Mexico: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 89 Mexico: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 90 Middle East & Africa: Flat Steel Market, By Country, 2017—2024 (USD Billion)

Table 91 Middle East & Africa: Flat Steel Market, By Country, 2017—2024 (Kilotons)

Table 92 Middle East & Africa: Flat Steel Market, By Type, 2017—2024 (USD Billion)

Table 93 Middle East & Africa: Flat Steel Market, By Type, 2017—2024 (Kilotons)

Table 94 Middle East & Africa: Flat Steel Market, By Process, 2017—2024 (USD Billion)

Table 95 Middle East & Africa: Flat Steel Market, By Process, 2017—2024 (Kilotons)

Table 96 Middle East & Africa: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 97 Middle East & Africa: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 98 Iran: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 99 Iran: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 100 Saudi Arabia: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 101 Saudi Arabia: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 102 UAE: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 103 UAE: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 104 South Africa: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 105 South Africa: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 106 Egypt: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 107 Egypt: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 108 Israel: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 109 Israel: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 110 Rest of Middle East & Africa: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 111 Rest of Middle East & Africa: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 112 South America: Flat Steel Market, By Country, 2017—2024 (USD Billion)

Table 113 South America: Flat Steel Market, By Country, 2017—2024 (Kilotons)

Table 114 South America: Flat Steel Market, By Type, 2017—2024 (USD Billion)

Table 115 South America: Flat Steel Market, By Type, 2017—2024 (Kilotons)

Table 116 South America: Flat Steel Market, By Process, 2017—2024 (USD Billion)

Table 117 South America: Flat Steel Market, By Process, 2017—2024 (Kilotons)

Table 118 South America: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Billion)

Table 119 South America: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 120 Brazil: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 121 Brazil: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 122 Argentina: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 123 Argentina: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 124 Venezuela: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 125 Venezuela: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

Table 126 Rest of South America: Flat Steel Market, By End-Use Sector, 2017—2024 (USD Million)

Table 127 Rest of South America: Flat Steel Market, By End-Use Sector, 2017—2024 (Kilotons)

List of Figures (47 Figures)

Figure 1 Base Number Calculation: Approach 1

Figure 2 Base Number Calculation: Approach 2

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Building & Infrastructure Segment is Expected to Lead the Flat Steel Market From 2019 to 2024 (USD Billion)

Figure 6 Plates Segment to Grow at the Highest Cagr From 2019 to 2024 (USD Billion)

Figure 7 Asia Pacific is Projected to Dominate the Flat Steel Market From 2019 to 2024 (USD Billion)

Figure 8 Asia Pacific is Expected to Drive the Demand for Flat Steel

Figure 9 Sheets & Strips Segment to Dominate the Flat Steel Market (Kilotons)

Figure 10 Basic Oxygen Furnace Expected to Lead the Process Segment in the Flat Steel Market (Kilotons)

Figure 11 Building & Infrastructure Expected to Be the Largest End-Use Sector of Flat Steel Market (Kilotons)

Figure 12 Asia Pacific Accounted for the Largest Share of the Flat Steel Market

Figure 13 Flat Steel Market Dynamics

Figure 14 Porter’s Five Forces Analysis

Figure 15 Flat Steel Market, By Process, 2019 & 2024 (USD Billion)

Figure 16 Flat Steel Market, By Type, 2019 & 2024 (USD Billion)

Figure 17 Flat Steel Market, By End-Use Sector, 2019 & 2024 (USD Billion)

Figure 18 Flat Steel Market, By Region, 2019 & 2024 (USD Billion)

Figure 19 Asia Pacific Market Snapshot

Figure 20 Europe Market Snapshot

Figure 21 North America Market Snapshot

Figure 22 Middle East & Africa Market Snapshot

Figure 23 South America Flat Steel Market Snapshot

Figure 24 Flat Steel Competitive Leadership Mapping, 2018

Figure 25 Flat Steel Market Share of Key Players, 2018

Figure 26 Arcelormittal: Company Snapshot

Figure 27 Arcelormittal: Steel Products Production and Shipments

Figure 28 Arcelormittal: SWOT Analysis

Figure 29 United States Steel Corporation: Company Snapshot

Figure 30 United States Steel Corporation: SWOT Analysis

Figure 31 Nippon Steel & Sumitomo Metal Corporation: Company Snapshot

Figure 32 Nippon Steel & Sumitomo Metal Corporation: SWOT Analysis

Figure 33 Tata Steel: Company Snapshot

Figure 34 Tata Steel: SWOT Analysis

Figure 35 POSCO: Company Snapshot

Figure 36 POSCO: SWOT Analysis

Figure 37 SSAB AB: Company Snapshot

Figure 38 SSAB AB: SWOT Analysis

Figure 39 JFE Holdings Inc: Company Snapshot

Figure 40 JFE Steel Corporation: SWOT Analysis

Figure 41 Bluescope Steel Limited: Company Snapshot

Figure 42 Bluescope Steel Limited: SWOT Analysis

Figure 43 HBIS Group: SWOT Analysis

Figure 44 Thyssenkrup AG: Company Snapshot

Figure 45 Voestalpine Group: Company Snapshot

Figure 46 SWOT Analysis: Voestalpine Group

Figure 47 Steel Authority of India Limited: Company Snapshot

This study involved four major activities in estimating the current market size for flat steel. Exhaustive secondary research was carried out to collect information on the market, peer markets, and the parent market. The next step was to validate the findings from secondary sources, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as Forbes, Bloomberg Businessweek, and Factiva, were referred to identify and collect information for this study. Other secondary sources included annual reports, press releases, and investor presentations; white papers; and articles by recognized authors, associations, regulatory bodies, trade directories, and databases.

Primary Research

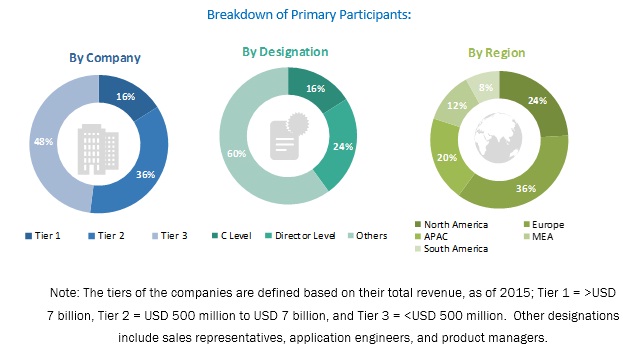

The flat steel market comprises stakeholders such as manufacturers, suppliers, distributors, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of flat steel products to be used in building & infrastructure, mechanical equipment, and automotive & other transport end-use sectors. The supply side is characterized by market consolidation activities undertaken by the manufacturers of flat steel. Several primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the flat steel market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives:

- To define and segment the flat steel market by type, process, end-use sector, and region

- To estimate and forecast the flat steel market size in terms of value and volume

- To identify and analyze the key drivers, restraints, opportunities, and challenges that influence the growth of the flat steel market

- To analyze significant region-specific trends in Asia Pacific, Europe, North America, the Middle East & Africa, and South America

- To strategically identify and profile key players and analyze their core competencies1 in the flat steel market

- To analyze recent developments and competitive strategies such as new product development, agreements, collaborations, expansions & investments, acquisitions, and partnerships, and draw a competitive landscape of the flat steel market

- To estimate the share of key players in the flat steel market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Type Analysis

- A further breakdown of the type segments of the flat steel market with respect to a particular end-user

End Use Sector Analysis

- A further breakdown of the end-use sector segments of the flat steel market with respect to a particular country

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Flat Steel Market