TOC Analyzer Market by offering (Hardware, Software, and Services), Type (Online and Portable), Technology, Application (High-Purity Water, Wastewater treatment, Surface Water), Industry, and Geography - Global Forecast to 2023

The Total Organic Carbon (TOC) analyzer market was valued at USD 828.1 Million in 2016 and is expected to reach USD 1,286.4 Million by 2023 during the forecast period. The base year used for this study is 2016, and the forecast period considered is between 2017 and 2023.

The objectives of the study are as follows:

- To define, describe, and forecast the TOC analyzer market segmented on the basis of offering, type, technology, application, industry, and geography

- To define, describe, and forecast the overall market in terms of volume

- To forecast the size of the market, in terms of value, for various segments with respect to four main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To identify the major market trends and factors (drivers, restraints, opportunities, and challenges) that have an impact on the growth of the market and its submarkets

- To provide a detailed overview of the value chain in the market and regulatory standards

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players operating in the market and comprehensively analyze their ranking and core competencies in the said market

- To analyze the strategic developments such as product launches, partnerships, collaborations, acquisitions, and contracts in the market

The Total Organic Carbon (TOC) analyzer market was valued at USD 828.1 Million in 2016 and is expected to reach USD 1,286.4 Million, at a CAGR of 6.3% during the forecast period from 2017 to 2023. The growth of this market is being propelled by the increasing demand for water and wastewater treatment, growing adoption of preventive and predictive maintenance services, benefits of TOC analysis over COD and BOD analyses, and its growing applications across various industries.

The report covers the TOC analyzer market segmented on the basis of offering, type, technology, application, industry, and geography. The hardware segment is expected to hold the largest size of the market based on offering by 2023. The growth of this market is being propelled by the high demand for TOC analyzer hardware from various industries all over the world.

The “wastewater treatment” segment held a larger share of the overall market based on the application. Many countries across regions have stringent regulations and standards set by the legislative authorities pertaining to wastewater treatment and movement. The augmented standards of water quality in industrial applications and the stringent environmental laws on water treatment and wastewater management would drive the demand TOC analyzers for the wastewater treatment application. On the other hand, the market for the high-purity water application is expected to grow at a significant CAGR during the forecast period. The major factors encouraging the market for the high-purity water segment are its critical use in various industries such as pharmaceuticals, semiconductor, and energy and power.

The TOC analyzer market for the pharmaceuticals industry is expected to grow at the highest CAGR during the forecast period. TOC measurement is critical to the pharmaceuticals industry because various regulatory bodies have established limits for TOC levels in high-purity water, water for injection (WFI), and other uses of water in the pharmaceuticals industry.

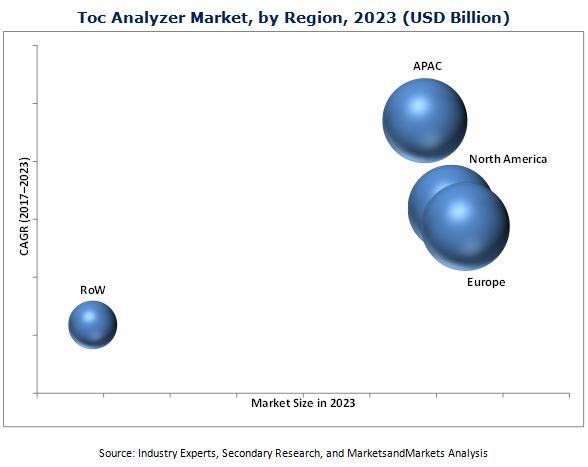

Europe held the largest size of the TOC analyzer market in 2016. The presence of prominent market players, along with the strengthening government regulations for environmental conservation in the European region in countries such in Germany and the UK, is driving the demand for TOC analyzer systems in Europe. The market in APAC is expected to grow the highest CAGR during the forecast period.

TOC analyzers are usually valued at a higher price than conventional analyzers, which is one of the major restraints for the market growth. The cost of ownership of TOC analyzer providing companies does not limit to initial purchase stage, but the end users also incur additional costs for additional accessories and spare parts, maintenance as well as calibration processes, among others. Thus, although TOC analysis has recently evolved as a standard test for water and wastewater analysis, many companies globally prefer using the conventional analyzers. Thus, investment huge capital requirement restraints small enterprises to enter into the market.

Some of the major companies operating in the TOC analyzer market are General Electric Company (US), Shimadzu Corporation (Japan), Mettler-Toledo International Inc. (Canada), Hach Company (US), LAR Process Analysers AG. (Germany), Teledyne Tekemar Company Inc. (US), Xylem, Inc. (US), Endress+Hauser Management AG (Germany), ELTRA GmbH (Germany), Metrohm AG (Switzerland), Elementar Analysensysteme GmbH (Germany), and Skalar Analytical B.V. (Netherlands).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.3 Scope of the Study

1.3.1 Geographic Scope

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary and Primary Research

2.2.1 Secondary Data

2.2.1.1 Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

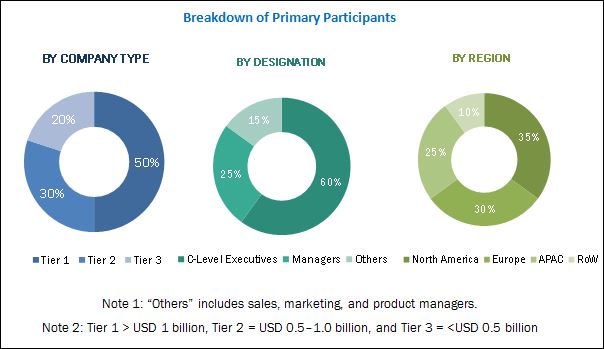

2.2.2.3 Breakdown of Primaries

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.1.1 Approach for Arriving at the Market Share By Bottom-Up Approach (Demand Side)

2.3.2 Top-Down Approach

2.3.2.1 Approach for Arriving at the Market Share By Top-Down Analysis (Supply Side)

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 36)

4.1 Market Expected to Have Huge Growth Opportunities in APAC

4.2 Market, By Offering

4.3 Market, By Region and Industry

4.4 Market, By Type

4.5 Market, By Country (2017)

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Benefits of TOC Analysis Over Bod and Cod Analyses

5.2.1.2 Increasing Adoption of Preventive and Predictive Maintenance Services

5.2.1.3 Rising Demand for Water and Wastewater Treatments

5.2.1.4 Growing Application Areas of TOC Analyzers Across Various Industries

5.2.2 Restraints

5.2.2.1 High Cost of Ownership

5.2.3 Opportunities

5.2.3.1 Growing Government Initiatives and Policies Related to Water and Wastewater Treatment

5.2.3.2 Technological Innovations With Improved Capabilities

5.2.4 Challenges

5.2.4.1 Technical Challenges Related to Reliability of Analyzers

5.2.4.2 Need for Expertise to Operate TOC Analyzers

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Regulatory Standards

6.3.1 Pharmacopoeia

6.3.2 Food and Drug Administration

6.3.3 American Society for Testing and Materials

6.3.4 International Organization for Standardization

6.3.5 Environmental Protection Agency (EPA)

6.3.6 Standard Methods

7 TOC Analyzer Market, By Offering (Page No. - 50)

7.1 Introduction

7.2 Hardware

7.3 Software

7.3.1 Data Integration

7.3.2 Diagnostic Reporting

7.3.3 Parameter Calculation

7.4 Services

8 TOC Analyzer Market, By Type (Page No. - 55)

8.1 Introduction

8.2 Online

8.3 Laboratory

9 TOC Analyzer Market, By Technology (Page No. - 63)

9.1 Introduction

9.2 Ultraviolet (UV) Oxidation

9.3 UV Persulfate Oxidation

9.4 High-Temperature Combustion

9.5 Others

10 TOC Analyzer Market, By Application (Page No. - 72)

10.1 Introduction

10.2 High Purity Water

10.3 Water for Injection

10.4 Source/Drinking Water

10.5 Industrial Process Water

10.6 Wastewater Treatment

10.7 Surface Water

11 TOC Analyzer Market, By Industry (Page No. - 85)

11.1 Introduction

11.2 Pharmaceutical

11.3 Environmental

11.4 Energy and Power

11.5 Semiconductor

11.6 Oil and Gas

11.7 Chemical

11.8 Food and Beverages

11.9 Others

12 Geographic Analysis (Page No. - 105)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.1.1 US Held the Largest Share of Market in 2016

12.2.2 Canada

12.2.2.1 Canadian Market Expected to Grow at the Highest CAGR During the Forecast Period

12.2.3 Mexico

12.2.3.1 Growing Need for Water and Wastewater Treatment Technologies Would Lead to the market Growth in the Near Future

12.3 Europe

12.3.1 Germany

12.3.1.1 Germany Held the Largest Share of the European TOC Analyzer Market in 2016

12.3.2 UK

12.3.2.1 Significant Market for TOC Analyzers in the Water Industry

12.3.3 France

12.3.3.1 Water and Wastewater Treatment Applications in France Drive the Growth of the market

12.3.4 Rest of Europe

12.3.4.1 Growing Opportunity From Metals and Mining Industry

12.4 Asia Pacific (APAC)

12.4.1 China

12.4.1.1 Increasing Adoption From Manufacturing Industries Fueling the Market in China

12.4.2 Japan

12.4.2.1 Significant Growth of Semiconductor and Pharmaceuticals Industries Drive the Market in Japan

12.4.3 India

12.4.3.1 Proactive Initiatives Taken By the Indian Government Encouraging the Growth of the market

12.4.4 Rest of APAC

12.4.4.1 Australia and South Korea are Emerging Markets With Significant Potential

12.5 Rest of the World (RoW)

12.5.1 Middle East

12.5.1.1 Infrastructure Development in Oil and Gas Sector in the Middle East to Drive the market

12.5.2 South America

12.5.2.1 South America to Hold A Significant Share of the Market in RoW

12.5.3 Africa

12.5.3.1 Water and Wastewater Treatment Opportunities and Rapid Growth of Mining and Oil and Gas Industries

13 Competitive Landscape (Page No. - 127)

13.1 Overview

13.2 Ranking Analysis: Market, 2016

13.3 Competitive Situation and Trends

13.3.1 Product Launches and Developments

13.3.2 Acquisition and Agreements

13.3.3 Contracts and Expansions

14 Company Profiles (Page No. - 133)

(Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments, Key Relationships)*

14.1 General Electric

14.2 Shimadzu

14.3 Hach

14.4 Mettler-Toledo

14.5 Lar Process Analysers

14.6 Endress+Hauser

14.7 Teledyne Tekemar

14.8 Xylem

14.9 Eltra

14.10 Metrohm

14.11 Key Innovators

14.11.1 Elementar Analysensysteme GmbH

14.11.2 Skalar

14.11.3 UIC Inc.

14.11.4 Comet Analytics, Inc.

14.11.5 TOC Systems Inc.

*Details on Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments, Key Relationships Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 161)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (64 Tables)

Table 1 Market Size in Terms of Value and Volume, 2014–2023

Table 2 Market, By Offering, 2014–2023 (USD Million)

Table 3 Market, By Type, 2014–2023 (USD Million)

Table 4 Online TOC Analyzer Market, By Application, 2014–2023 (USD Million)

Table 5 Online TOC Analyzer Market, By Industry, 2014–2023 (USD Million)

Table 6 Online TOC Analyzer Market, By Region, 2014–2023 (USD Million)

Table 7 Laboratory TOC Analyzer Market, By Application, 2014–2023 (USD Million)

Table 8 Laboratory TOC Analyzer Market, By Industry, 2014–2023 (USD Million)

Table 9 Laboratory TOC Analyzer Market, By Region, 2014–2023 (USD Million)

Table 10 Market, By Technology, 2014–2023 (USD Million)

Table 11 Market for Ultraviolet Oxidation Technology, By Application, 2014–2023 (USD Million)

Table 12 Market for UV Persulfate Oxidation Technology, By Application, 2014–2023 (USD Million)

Table 13 Market for High-Temperature Combustion Technology, By Application, 2014–2023 (USD Million)

Table 14 Market for Other Technologies, By Application, 2014–2023 (USD Million)

Table 15 Market, By Application, 2014–2023 (USD Million)

Table 16 Market for High Purity Water Application, By Type, 2014–2023 (USD Million)

Table 17 Market for High Purity Water Application, By Technology, 2014–2023 (USD Million)

Table 18 Market for Water for Injection Application, By Type, 2014–2023 (USD Million)

Table 19 Market for Water for Injection Application, By Technology, 2014–2023 (USD Million)

Table 20 Market for Source Water Application, By Type, 2014–2023 (USD Million)

Table 21 Market for Source Water Application, By Technology, 2014–2023 (USD Million)

Table 22 Market for Industrial Process Water Application, By Type, 2014–2023 (USD Million)

Table 23 Market for Industrial Process Water Application, By Technology, 2014–2023 (USD Million)

Table 24 Market for Wastewater Treatment Application, By Type, 2014–2023 (USD Million)

Table 25 Market for Wastewater Treatment Application, By Technology, 2014–2023 (USD Million)

Table 26 Market for Surface Water Application, By Type, 2014–2023 (USD Million)

Table 27 Market for Surface Water Application, By Technology, 2014–2023 (USD Million)

Table 28 Market, By Industry, 2014–2023 (USD Million)

Table 29 Market for Pharmaceuticals Industry, By Type, 2014–2023 (USD Million)

Table 30 Market for Pharmaceuticals Industry, By Region, 2014–2023 (USD Million)

Table 31 Market for Pharmaceuticals Industry in North America, By Country, 2014–2023 (USD Million)

Table 32 Market for Environmental Industry, By Type, 2014–2023 (USD Million)

Table 33 Market for Environmental Industry, By Region, 2014–2023 (USD Million)

Table 34 Market for Environmental Industry in North America, By Country, 2014–2023 (USD Million)

Table 35 Market for Energy and Power Industry, By Type, 2014–2023 (USD Million)

Table 36 Market for Energy and Power Industry, By Region, 2014–2023 (USD Million)

Table 37 Market for Semiconductor Industry, By Type, 2014–2023 (USD Million)

Table 38 Market for Semiconductor Industry, By Region, 2014–2023 (USD Million)

Table 39 Market for Oil and Gas Industry, By Type, 2014–2023 (USD Million)

Table 40 Market for Oil and Gas Industry, By Region, 2014–2023 (USD Million)

Table 41 Market for Chemicals Industry, By Type, 2014–2023 (USD Million)

Table 42 Market for Chemicals Industry, By Region, 2014–2023 (USD Million)

Table 43 Market for Food and Beverages Industry, By Type, 2014–2023 (USD Million)

Table 44 Market for Food and Beverages, By Region, 2014–2023 (USD Million)

Table 45 Market for Food and Beverages Industry in North America, By Country, 2014–2023 (USD Million)

Table 46 Market for Other Industries, By Type, 2014–2023 (USD Million)

Table 47 Market for Other Industries, By Region, 2014–2023 (USD Million)

Table 48 Market, By Region, 2014–2023 (USD Million)

Table 49 Market in North America, By Country, 2014–2023 (USD Million)

Table 50 Market in North America, By Type, 2014–2023 (USD Million)

Table 51 Market in North America, By Industry, 2014–2023 (USD Million)

Table 52 Market in Europe, By Country, 2014–2023 (USD Million)

Table 53 Market in Europe, By Type, 2014–2023 (USD Million)

Table 54 Market in Europe, By Industry, 2014–2023 (USD Million)

Table 55 Market in APAC, By Country, 2014–2023 (USD Million)

Table 56 Market in APAC, By Type, 2014–2023 (USD Million)

Table 57 Market in APAC, By Industry, 2014–2023 (USD Million)

Table 58 Market in RoW, By Region, 2014–2023 (USD Million)

Table 59 Market in RoW, By Type, 2014–2023 (USD Million)

Table 60 Market in RoW, By Industry, 2014–2023 (USD Million)

Table 61 Market: Ranking Analysis (2016)

Table 62 Most Significant Product Launches and Developments in the Market

Table 63 Most Significant Acquisitions and Agreements in the Market

Table 64 Most Significant Contracts and Expansions in the Market

List of Figures (62 Figures)

Figure 1 Markets Covered

Figure 2 Market: Research Design

Figure 3 Market: Bottom-Up Approach

Figure 4 Market: Top-Down Approach

Figure 5 Market Breakdown & Data Triangulation

Figure 6 Snapshot of Market (2017 vs 2023): Hardware to Hold the Largest Market Size in 2017

Figure 7 Laboratory TOC Analyzers to Hold A Larger Market Size By 2023

Figure 8 Market for High Purity Water Application to Grow at the Highest CAGR During the Forecast Period

Figure 9 Market for Pharmaceuticals Industry to Grow at Highest CAGR During the Forecast Period

Figure 10 Europe to Hold the Largest Share of the market in 2017

Figure 11 Attractive Growth Opportunities in the market

Figure 12 Market for Software to Grow at the Highest CAGR During the Forecast Period

Figure 13 Europe Expected to Hold the Largest Share of Market in 2017

Figure 14 Online TOC Analyzer Market to Grow at A Higher CAGR During the Forecast Period (2017–2023)

Figure 15 US to Hold the Largest Share of the TOC Analyzer Market in 2017

Figure 16 Rising Demand for Water and Wastewater Treatments to Drive the Market Growth

Figure 17 Market: A Major Value Added By Manufacturers and Component Providers

Figure 18 Market, By Offering

Figure 19 Market for Software to Grow at Highest CAGR Between 2017 and 2023

Figure 20 Market, By Type

Figure 21 Market for Online TOC Analyzers to Grow at Higher CAGR Between 2017 and 2023

Figure 22 Environmental to Hold the Largest Size of the Online market Between 2017 and 2023

Figure 23 Laboratory TOC Analyzer Market for Pharmaceuticals Industry to Grow at the Highest CAGR Between 2017 and 2023

Figure 24 Market, By Technology

Figure 25 Market for UV Oxidation Technology to Grow at the Highest CAGR Between 2017 and 2023

Figure 26 High Purity Water Application to Lead the Market for TOC Analyzers With UV Persulfate Oxidation Technology Between 2017 and 2023

Figure 27 Wastewater Treatment Application to Dominate the High-Temperature Combustion TOC Analyzer Market By 2023

Figure 28 Market, By Application

Figure 29 Market for High Purity Water Application to Grow at the Highest CAGR Between 2017 and 2023

Figure 30 UV Oxidation Technology to Dominate the Market for High Purity Water Application Between 2017 and 2023

Figure 31 Market for Online TOC Analyzers for Water for Injection Application to Grow at A Higher CAGR Between 2017 and 2023

Figure 32 High-Temperature Combustion Technology to Hold the Largest Size of the market for Source Water Application By 2023

Figure 33 Laboratory Analyzers to Hold A Larger Market Size for Industrial Process Water Application By 2023

Figure 34 High-Temperature Combustion Technology to Hold the Largest Size of the market for Wastewater Treatment Application By 2023

Figure 35 Laboratory Analyzers to Hold A Larger Market Size for Surface Water Application By 2023

Figure 36 Market, By Industry

Figure 37 Market for Pharmaceuticals Industry Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 38 Laboratory Analyzers to Hold A Larger Market Size for Pharmaceuticals Industry During the Forecast Period

Figure 39 Market in APAC for Environmental Industry to Grow at the Highest CAGR Between 2017 and 2023

Figure 40 Laboratory Analyzers to Dominate the Market for Energy and Power Industry During the Forecast Period

Figure 41 APAC to Lead the market for Semiconductor Industry During 2017–2023

Figure 42 Market for Online TOC Analyzers for Oil and Gas Industry to Grow at A Higher CAGR Between 2017 and 2023

Figure 43 North America to Hold the Largest Size of the Market for Chemicals Industry in 2017

Figure 44 Online TOC Analyzer Market for Food and Beverages Industry to Grow at A Higher CAGR Between 2017 and 2023

Figure 45 Market in APAC for Other Industries to Growth at the Highest CAGR During the Forecast Period

Figure 46 Geographic Snapshot: Chinese and Indian Markets Expected to Grow at A Significant CAGR During Forecast Period

Figure 47 Europe Held the Largest Share of the Market in 2016

Figure 48 North America: Market Snapshot

Figure 49 Market in Canada to Grow at Highest CAGR Between 2017 and 2023

Figure 50 Europe: TOC Analyzer Market Snapshot

Figure 51 Market in France to Grow at the Highest CAGR Between 2017 and 2023

Figure 52 Asia Pacific: Market Snapshot

Figure 53 China Expected to Hold the Largest Size of Market in APAC Between 2017 and 2023

Figure 54 Market in South America to Grow at the Highest CAGR Between 2017 and 2023

Figure 55 Companies Adopted Product Launches and Developments as Key Growth Strategies Between 2014 and August 2017

Figure 56 Market Evaluation Framework

Figure 57 Product Launches and Developments as Key Strategies

Figure 58 General Electric: Company Snapshot

Figure 59 Shimadzu: Company Snapshot

Figure 60 Mettler-Toledo: Company Snapshot

Figure 61 Endress+Hauser: Company Snapshot

Figure 62 Xylem: Company Snapshot

The research methodology used to estimate and forecast the TOC analyzer market begins with obtaining data on key vendor revenues through secondary research. Some of the secondary sources used in this research include information from various journals and databases such as IEEE journals, pharmacopeias, and environmental journals, Factiva, Hoovers, and OneSource. Moreover, the vendor offerings have been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the market from the revenue of the key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting extensive interviews with the officials holding key positions in the industry such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries has been depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

The TOC analyzer ecosystem comprises the vendors such as General Electric Company (US), Shimadzu Corporation (Japan), Mettler-Toledo International Inc. (Canada), Hach Company (US), LAR Process Analysers AG. (Germany), Teledyne Tekemar Company Inc. (US), Xylem, Inc. (US), Endress+Hauser Management AG (Germany), ELTRA GmbH (Germany), Metrohm AG (Switzerland), Elementar Analysensysteme GmbH (Germany), and Skalar Analytical B.V. (Netherlands) selling these products and solutions to end users according to their unique requirements. The end users industries such as pharmaceuticals, environmental, energy and power, semiconductor, oil and gas, chemicals, food and beverages, and others.

Target Audience:

- TOC analyzer manufacturers

- Original equipment manufacturers (OEMs)

- Research organizations and consulting companies

- TOC analyzer-related associations, organizations, forums, and alliances

- Distributors and traders

- Government bodies such as regulating authorities and policymakers

- Venture capitalists, private equity firms, and startup companies

“The study answers several questions for the target audience, primarily which market segments to focus on in the next 2 to 5 years for prioritizing their efforts and investments.”

Report Scope:

In this report, the market has been segmented into the following categories:

TOC Analyzer Market, by Offering:

- Hardware

- Software

- Services

TOC Analyzer Market, by Type:

- Online

- Laboratory

TOC Analyzer Market, by Technology:

- Ultraviolet (UV) Oxidation

- UV Persulfate Oxidation

- High-Temperature Combustion

- Others

TOC Analyzer Market, by Application:

- High Purity Water

- Water for Injection

- Source Water

- Industrial Process Water

- Wastewater Treatment

- Surface Water

TOC Analyzer Market, by Industry:

- Pharmaceuticals

- Environmental

- Energy and Power

- Semiconductor

- Oil and Gas

- Chemicals

- Food and Beverages

- Others (agriculture, pulp and paper, cement, and metals and mining)

TOC Analyzer Market, by Geography:

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, and Rest of Europe)

- Asia Pacific (China, Japan, India, and Rest of APAC)

- Rest of the World (South America, Middle East, and Africa)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of the company. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in TOC Analyzer Market