Environmental Testing Equipment Market by Product (Spectrometers (GC-MS, LC-MS), Molecular Spectroscopy, Chromatography (GC, LC)), Platform (Benchtop, Mobile), Application (Water (PFAS), Air, Soil), End User (Labs, Govt. Agencies) & Region - Global Forecast to 2027

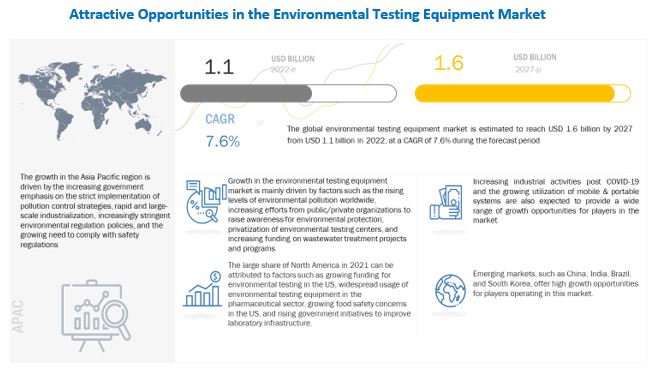

[268 Pages Report] The global environmental testing equipment market is estimated to reach USD 1.6 billion by 2027 from USD 1.1 billion in 2022, at a CAGR of 7.6% during the forecast period (2022-2027). Growth in the environmental testing market is mainly driven by the rising levels of environmental pollution worldwide, increasing efforts from public/private organizations to raise awareness about environment protection, privatization of environmental testing and treatment services, and increasing funding on wastewater treatment projects/programs. Increasing industrial activities post COVID-19, and the growing utilization of mobile & portable systems are also expected to provide a wide range of growth opportunities for players in the market. On the other hand, high capital investments for accurate and sensitive analytical testing and inadequate supporting infrastructure coupled with the shortage of skilled professionals are factors expected to limit market growth to a certain extent in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global environmental testing equipment market

Globally, the outbreak of COVID-19 has impacted every aspect of the industry, including the environmental testing market. From region to region, there is considerable variation in the demand for environmental testing equipment primarily due to the huge impact of the pandemic on the economy and purchasing power of buyers.

The global spread of COVID-19 has led to unprecedented restrictions on and disruptions in business and personal activities. For example, many governments issued “stay-at-home” orders for local business and personal activities. The direct impact of COVID-19 and the preventive and precautionary measures implemented as a result thereof have adversely affected, and are expected to continue to affect, certain industry elements, including operations, commercial organizations, supply chains, and distribution systems.

Specifically, COVID-19 had adversely impacted various value chain stages, primarily due to strict lockdown imposed by the government in most countries. Many companies had to halt their manufacturing for some time as well temporarily. Similarly, supply and distribution networks also got interrupted, majorly due to restrictions in traveling due to lockdown and decline in sales activity. The COVID-19 pandemic also impacted the buyer’s or customer’s buying capacity and behavior. As a result, the market, like other markets, saw a decline in 2020. However, with the ongoing vaccination drives and the government slowly uplifting lockdown restrictions, the economy has started to rise again. A similar trend can be observed in the global market. The annual revenue of the seven major players in the market saw a decline from FY 2019 to FY 2020. However, almost all players saw a peak in their revenue collection in FY 2021.

Environmental Testing Equipment Market Dynamics

Driver: Increasing efforts from public & private organizations to raise awareness on environmental protection

Environmental pollution is a major concern worldwide. According to a report by the Energy Policy Institute at the University of Chicago (US), particulate air pollution driven by fossil fuel cuts the global average life expectancy by 1.8 years per person. Many government and non-government organizations work to bring the attention of national and international societies to the effect of air pollution on the health of living beings and the environment. Prominent public organizations involved in driving public awareness on environmental impacts of air pollution include the EPA (The United States Environmental Protection Agency), Clean Air in London (London), Coalition for Clean Air (California, US), Sierra Club (US), Union of Concerned Scientists (US), Mom’s Clean Air Force (US), Global Action Plan (International), Little Ninja (UK), Earthjustice (US), and German VCD (German Sustainable Transport Association).

Restraint: High capital investments for accurate & sensitive analytical testing

Extensive sample preparation requires laboratory analysts to use advanced testing technologies. A wide range of existing testing methods and the introduction of advanced technologies for environmental samples have resulted in a major change in the dynamics of the environmental testing market. Advanced technologies such as liquid chromatography (LC), high-performance liquid chromatography (HPLC), and spectrometry are sensitive, accurate, and efficient. However, these technologies have cost, sample preparation, and calibration limitations.

Technological developments have increased the prices of these systems. Environmental agencies require many systems; this significantly increases the capital expenditure for these agencies. In addition, maintenance costs and other indirect expenses result in an overall increase in the total cost of ownership of these instruments. This may limit market adoption to a certain extent, which, in turn, may hamper the market growth in the coming years.

Opportunity: Increasing industrial activities post COVID-19

The COVID-19 pandemic has triggered the sharpest downturn in the world economy since the Great Depression. In 2020, the global average daily consumption of petroleum and other liquid fuels saw a major decline from the previous year's average consumption. However, this fall in global petrochemical production is expected to reverse in post covid years. The Energy Information Agency (EIA) estimated that fall in production would reverse in 2022. Given their high pollutant emissions, the growth of these industries in the coming years can be expected to provide strong growth opportunities for environmental testing equipment manufacturers.

Challenge: Inadequate supporting infrastructure and the shortage of skilled professionals

Testing & certification practices in several developing countries lack organization, sophistication, and technology. Lack of the basic supporting infrastructure for setting up testing laboratories is another major challenge to the growth of the environmental testing market. Testing service providers in some developing regions also face challenges obtaining samples from manufacturing companies as they are fragmented and dominated by small enterprises. Other key issues include lack of institutional coordination; shortage of equipment, technical skills, and expertise for legislating legislation at the grassroots; and lack of updated standards.

Environmental Testing Equipment Market Ecosystem:

To know about the assumptions considered for the study, download the pdf brochure

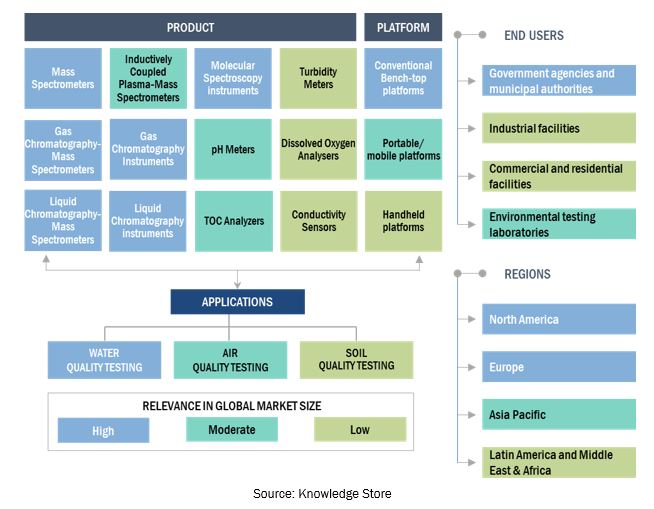

The environmental testing equipment market is segmented into five segments: by product, platform, application, end user and region

By product, the mass spectrometers segment is expected to grow at the highest rate during the forecast period

Based on the different products employed for environmental testing, the market is segmented into mass spectrometers, chromatography products, molecular spectroscopy products, TOC analyzers, pH meters, dissolved oxygen analyzers, conductivity sensors, turbidity meters, and other products. The mass spectrometers segment is further divided into gas chromatography-mass spectrometry (GC-MS) instruments, liquid chromatography-mass spectrometry (LC-MS) instruments, and inductively coupled plasma mass spectrometry (ICP-MS) instruments. The chromatography products segment comprises gas chromatography (GC) and liquid chromatography (LC) instruments. The mass spectrometers segment is expected to register the highest growth rate during the forecast period as MS is the most specific method for studying small and volatile molecules. Also, the various technological enhancements in GC-MS systems are supporting the adoption of MS in environmental testing.

By platform, the portable/mobile platforms segment is expected to grow at the highest rate during the forecast period

Based on platform, the environmental testing market is segmented into conventional/benchtop platforms, portable/mobile platforms, and handheld platforms. Based on type, the imaging market is segmented into two major types—dynamic imaging, and static imaging. The positive demand growth of portable/mobile platforms is mainly attributed to increasing adoption among lab professionals (owing to its miniaturized technique with less weight and low cost & power usage). Moreover, stringent regulations by the government for pollution monitoring and control across developed countries will also drive demand growth.

The government agencies and municipal authorities segment accounted for the largest market share in the global environmental testing equipment market

Based on end users, the environmental testing market is segmented into government agencies and municipal authorities, environmental testing laboratories, industrial facilities, commercial and residential facilities, and other end users. The government agencies and municipal authorities segment accounted for the largest market share in 2021. The large share of this segment can be attributed to active government participation in environmental testing and pollution monitoring, especially in emerging countries with alarming pollution levels

Asia Pacific is expected to grow at the highest CAGR in the environmental testing equipment market during the forecast period

The Asia Pacific region is expected to be the fastest-growing region during the study period. The demand for environmental testing equipment in the APAC is supported by the increasing government emphasis on the strict implementation of pollution control strategies, rapid and large-scale industrialization, increasingly stringent environmental regulation policies, and the growing need to comply with safety regulations. However, a shortage of skilled professionals to operate advanced instruments, the slow implementation of pollution control reforms due to budgetary constraints, and the pricing pressures faced by prominent product manufacturers in the region are expected to restrain the growth of the Asia Pacific environmental testing market during the forecast period.

Key Market Players

The vendors operating in the environmental testing equipment market include Agilent Technologies Inc. (US), Thermo Fisher Scientific Inc. (US), Shimadzu Corporation (Japan), Waters Corporation (US), Bruker Corporation (US), PerkinElmer Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), JEOL Ltd. (Japan), Endress+Hauser Group Services AG (Analytik Jena, Switzerland), JASCO Corporation (Japan), Teledyne Technologies Incorporated (US), AMETEK, Inc. (US), and INFICON (Switzerland), among others.

An analysis of the market developments between 2019 and 2022 revealed that several growth strategies such as launches and enhancements, agreements and partnerships, and acquisitions were adopted by market players to strengthen their product portfolios and maintain a competitive position in the analytical instrumentation market. Among these business strategies, product approval & launches were the most widely adopted growth strategies by market players.

Agilent Technologies (US) is the leading environmental testing market player. The leading position of Agilent Technologies can be attributed to the extensive product portfolio of analytical technologies, including chromatography and molecular spectroscopy. The company maintains its leading position by engaging in organic growth strategies such as product development and launches. The life sciences and applied markets channels (offering chromatography and spectrometry instruments) focus on the therapeutics and human disease research customer base (pharma, biopharma, CRO, CMO, and generics) and clinical customer base (high complexity clinical testing labs). The company’s growth directly impacted the revenue increase of its Applied Markets segment (responsible for the market).

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2020–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Product, Platform, Application, End user, and Region |

|

Geographies Covered |

North America (US & Canada), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), APAC (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and, Rest of Latin America), and Middle East & Africa |

|

Companies Covered |

Agilent Technologies Inc. (US), Thermo Fisher Scientific Inc. (US), Shimadzu Corporation (Japan), Waters Corporation (US), Bruker Corporation (US), PerkinElmer Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), JEOL Ltd. (Japan), Endress+Hauser Group Services AG (Analytik Jena, Switzerland), JASCO Corporation (Japan), Teledyne Technologies Incorporated (US), AMETEK, Inc. (US), and INFICON (Switzerland), among others |

This research report categorizes the environmental testing equipment market market based on technology and region.

By Product

- Mass Spectrometers

- GC-MS Instruments

- LC-MS Instruments

- ICP-MS Instruments

- Chromatography Products

- Gas Chromatography

- Liquid Chromatography

- Molecular Spectroscopy Instruments

- TOC Analyzers

- pH Meters

- Dissolved Oxygen Analyzers

- Conductivity Sensors

- Turbidity Meters

- Other Products*

Note: *Other products include colorimeters, spectrophotometers, refractometers, ion analyzers, temperature & pressure sensors, chlorine sensors, and radioactivity analyzers

By Platform

- Conventional/Benchtop Platforms

- Portable/Mobile Platforms

- Handheld Platforms

By Application

- Water Quality Testing

- Organic Pollutants

- PFAS (Poly- and Perfluoroalkyl Substances)

- Solid Pollutants

- Heavy Metals

- Microbial and Other Water Pollutants

- Air Quality Testing

- Volatile Organic Pollutants

- Other Air Pollutants

- Soil Quality Testing

- Pesticides

- Heavy Metals

- Other Soil Pollutants

By End-use Industry

- Government Agencies and Municipal Authorities

- Environmental Testing Laboratories

- Industrial Facilities

- Commercial & Residential Facilities

- Others*

Note:*Other end users include agriculture industries, forestry departments, and geology departments.

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest Of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest Of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments:

- In June 2021, SCIEX (US), which is a subsidiary of Danaher Corporation (US), introduced ZenoTOF 7600 system LC-MS/MS instrument.

- In June 2020, Agilent Technologies (US) launched two new mass spectrometry (MS) products: the Agilent 6470B Triple Quadrupole LC/MS (6470 LC/TQ) system, and the Agilent RapidFire 400 system at ASMS 2020 Reboot held in June 2020.

- In December 2019, Shimadzu Corporation (Japan) released six new UV-VIS spectrophotometer models under a new UV-i Selection brand (UV-1900i, UV-2600i, UV-2700i, UV-3600i Plus, SolidSpec-3700i, and SolidSpec-3700i DUV)

Frequently Asked Questions (FAQ):

What is the expected addressable market value of global environmental testing equipment market over a 5-year period?

The global environmental testing equipment market is estimated to reach USD 1.6 billion by 2027 from USD 1.1 billion in 2022, at a CAGR of 7.6% during the forecast period.

Which segment based on product is expected to garner the highest traction within the environmental testing equipment market?

Based on products, the market is segmented into mass spectrometers, chromatography products, molecular spectroscopy products, TOC analyzers, pH meters, dissolved oxygen analyzers, conductivity sensors, turbidity meters, and other products. The mass spectrometers segment is expected to register the highest growth rate during the forecast period.

What are the strategies adopted by the top market players to penetrate emerging regions?

The key growth strategies adopted by the top players in this market include product launches and approvals; agreements and partnerships; and acquisitions.

What are the major factors expected to limit the growth of the environmental testing equipment market?

The high capital investments for accurate and sensitive analytical testing and inadequate supporting infrastructure coupled with the shortage of skilled professionals are factors expected to limit market growth to a certain extent in the coming years.

What is the adoption pattern for environmental testing equipment market major regional markets?

North America accounted for the largest share of the global environmental testing equipment market in 2021. The large share of the market in North America is attributed to factors such as the growing funding for environmental testing in the US, widespread usage of environmental testing equipment in the pharmaceutical sector, growing food safety concerns in the US, and government initiatives to improve lab infrastructure and propel fundamental scientific research in Canada. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIES COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Secondary data sources

2.1.2 PRIMARY DATA SOURCES

2.1.2.1 Breakdown of primaries

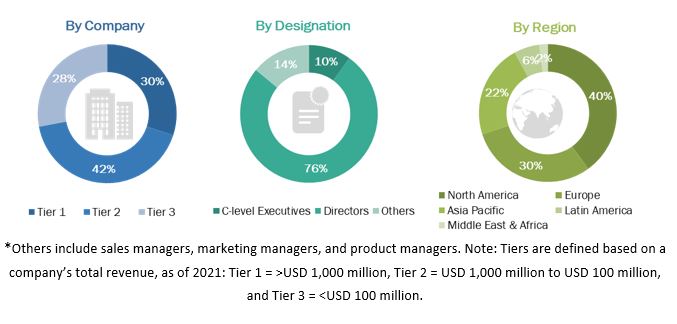

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

2.2.2 USAGE-BASED MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: GLOBAL ENVIRONMENTAL TESTING EQUIPMENT MARKET

2.2.3 PRIMARY RESEARCH VALIDATION

2.3 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

2.4 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 6 ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 7 ENVIRONMENTAL TESTING MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 8 ENVIRONMENTAL TESTING MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 9 ENVIRONMENTAL TESTING MARKET, BY PLATFORM (2022 VS. 2027)

FIGURE 10 ENVIRONMENTAL TESTING MARKET: GEOGRAPHIC SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ENVIRONMENTAL TESTING EQUIPMENT MARKET OVERVIEW

FIGURE 11 RISING LEVELS OF ENVIRONMENTAL POLLUTION WORLDWIDE DRIVES THE MARKET GROWTH FOR ENVIRONMENTAL TESTING EQUIPMENT

4.2 ENVIRONMENTAL TESTING MARKET FOR MASS SPECTROMETERS, BY TYPE

FIGURE 12 GC-MS SEGMENT TO DOMINATE THE MASS SPECTROMETER MARKET DURING THE FORECAST PERIOD

4.3 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR WATER QUALITY TESTING, BY POLLUTANT TYPE

FIGURE 13 ORGANIC POLLUTANTS ACCOUNTED FOR THE LARGEST SHARE OF THE WATER QUALITY TESTING MARKET IN 2021

4.4 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR AIR QUALITY TESTING, BY POLLUTANT TYPE

FIGURE 14 VOLATILE ORGANIC POLLUTANTS ACCOUNTED FOR THE LARGEST SHARE IN THE AIR QUALITY TESTING MARKET IN 2021

4.5 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR SOIL QUALITY TESTING, BY POLLUTANT TYPE

FIGURE 15 PESTICIDE TESTING ACCOUNTED FOR THE LARGEST SHARE IN THE SOIL QUALITY TESTING MARKET IN 2021

4.6 GEOGRAPHIC SNAPSHOT OF THE ENVIRONMENTAL TESTING EQUIPMENT MARKET

FIGURE 16 CHINA IS EXPECTED TO BE THE FASTEST-GROWING MARKET FOR ENVIRONMENTAL TESTING EQUIPMENT DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 ENVIRONMENTAL TESTING EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising levels of environmental pollution worldwide

5.2.1.2 Increasing efforts from public & private organizations to raise awareness on environmental protection

5.2.1.3 Privatization of environmental testing and treatment services

5.2.1.4 Increasing funding activities on wastewater treatment projects/programs

5.2.2 RESTRAINTS

5.2.2.1 High capital investments for accurate & sensitive analytical testing

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing industrial activities post COVID-19

5.2.3.2 Growing utilization of mobile & portable systems

TABLE 1 MAJOR PLAYERS OFFERING PORTABLE AND MOBILE MASS SPECTROMETERS

5.2.4 CHALLENGES

5.2.4.1 Inadequate supporting infrastructure and the shortage of skilled professionals

5.3 REGULATORY LANDSCAPE

TABLE 2 MAJOR REGULATORY AUTHORITIES GOVERNING THE ENVIRONMENTAL TESTING AND MONITORING MARKET

5.3.1 US

5.3.1.1 Air quality guidelines

5.3.1.2 Water quality guidelines

5.3.1.2.1 Clean Water Act

5.3.2 EUROPEAN UNION (EU)

5.3.2.1 Air quality guidelines

5.3.2.2 Drinking water legislations

5.3.2.3 EU Soil Policy

5.3.3 ASIA PACIFIC

5.3.3.1 India

5.3.3.2 China

5.4 ECOSYSTEM MAPPING

5.5 VALUE CHAIN ANALYSIS

5.5.1 RESEARCH & DEVELOPMENT

5.5.2 PROCUREMENT AND PRODUCT DEVELOPMENT

5.5.3 MARKETING, SALES AND DISTRIBUTION, AND POST-SALES SERVICES

FIGURE 18 VALUE CHAIN ANALYSIS

5.6 SUPPLY CHAIN ANALYSIS

5.6.1 PROMINENT COMPANIES

5.6.2 SMALL & MEDIUM-SIZED ENTERPRISES

5.6.3 END USERS

FIGURE 19 SUPPLY CHAIN ANALYSIS

5.6.4 ROLE IN SUPPLY CHAIN

5.7 IMPACT OF COVID 19 ON THE GLOBAL ENVIRONMENTAL TESTING MARKET

5.8 PORTER’S FIVE FORCES ANALYSIS

5.8.1 OVERVIEW

TABLE 3 ENVIRONMENTAL TESTING EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.2 THREAT OF NEW ENTRANTS

5.8.3 THREAT OF SUBSTITUTES

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 BARGAINING POWER OF BUYERS

5.8.6 DEGREE OF COMPETITION

5.9 PRICING ANALYSIS

5.10 PATENT ANALYSIS

5.10.1 ANALYSIS OF PATENTS RELATED TO CHROMATOGRAPHY PRODUCTS

FIGURE 20 TOP 10 PATENT APPLICANTS FOR CHROMATOGRAPHY PRODUCTS (JANUARY 2012 AND JANUARY 2022)

FIGURE 21 TOP 10 PATENT INVENTORS FOR CHROMATOGRAPHY PRODUCTS (JANUARY 2012 AND JANUARY 2022)

FIGURE 22 TOP 10 PATENT OWNERS FOR CHROMATOGRAPHY PRODUCTS (JANUARY 2012 AND JANUARY 2022)

5.10.2 ANALYSIS OF PATENTS RELATED TO MASS SPECTROMETERS

FIGURE 23 TOP 10 PATENT APPLICANTS FOR MASS SPECTROMETERS (JANUARY 2012 AND JANUARY 2022)

FIGURE 24 TOP 10 PATENT INVENTORS FOR MASS SPECTROMETERS (JANUARY 2012 AND JANUARY 2022)

FIGURE 25 TOP 10 PATENT OWNERS FOR MASS SPECTROMETER (JANUARY 2012 AND JANUARY 2022)

5.10.3 ANALYSIS OF PATENTS RELATED TO MOLECULAR SPECTROSCOPY PRODUCTS

FIGURE 26 TOP 10 PATENT APPLICANTS FOR MOLECULAR SPECTROSCOPY (JANUARY 2012 AND JANUARY 2022)

FIGURE 27 TOP 10 PATENT INVENTORS FOR MOLECULAR SPECTROSCOPY PRODUCTS (JANUARY 2012 AND JANUARY 2022)

FIGURE 28 TOP 10 PATENT OWNERS FOR MOLECULAR SPECTROSCOPY PRODUCTS (JANUARY 2012 AND JANUARY 2022)

5.11 TRADE ANALYSIS

5.11.1 TRADE DATA FOR CHROMATOGRAPHS AND ELECTROPHORESIS INSTRUMENTS, BY COUNTRY, 2021 (USD MILLION)

5.11.2 TRADE DATA FOR SPECTROMETERS, SPECTROPHOTOMETERS, AND SPECTROGRAPHS, BY COUNTRY, 2021 (USD MILLION)

6 ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT (Page No. - 86)

6.1 INTRODUCTION

TABLE 4 ENVIRONMENTAL TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 MASS SPECTROMETERS

TABLE 5 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 6 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY REGION, 2020–2027 (USD MILLION)

6.2.1 GAS CHROMATOGRAPHY-MASS SPECTROMETRY INSTRUMENTS (GC-MS)

6.2.1.1 GC-MS is the preferred technique for the analysis of volatile compounds

TABLE 7 ENVIRONMENTAL TESTING MARKET FOR GC-MS INSTRUMENTS, BY REGION, 2020–2027 (USD MILLION)

6.2.2 LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY INSTRUMENTS (LC-MS)

6.2.2.1 The high cost of LC-MS instruments restricts its widespread adoption among end users

TABLE 8 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR LC-MS INSTRUMENTS, BY REGION, 2020–2027 (USD MILLION)

6.2.3 INDUCTIVELY COUPLED MASS SPECTROMETERS (ICP-MS)

6.2.3.1 ICP-MS detects trace environmental elements in samples

TABLE 9 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR ICP-MS INSTRUMENTS, BY REGION, 2020–2027 (USD MILLION)

6.3 CHROMATOGRAPHY PRODUCTS

TABLE 10 ENVIRONMENTAL TESTING MARKET FOR CHROMATOGRAPHY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 11 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY, BY REGION, 2020–2027 (USD MILLION)

6.3.1 GAS CHROMATOGRAPHY (GC)

6.3.1.1 GC is used for the separation & analysis of volatile compounds in the gaseous phase

TABLE 12 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR GAS CHROMATOGRAPHY, BY REGION, 2020–2027 (USD MILLION)

6.3.2 LIQUID CHROMATOGRAPHY (LC)

6.3.2.1 Widespread applications of HPLC and UHPLC drives the adoption of liquid chromatography

TABLE 13 ENVIRONMENTAL TESTING MARKET FOR LIQUID CHROMATOGRAPHY, BY REGION, 2020–2027 (USD MILLION)

6.4 MOLECULAR SPECTROSCOPY PRODUCTS

6.4.1 MOLECULAR SPECTROSCOPY IS USED IN THE ANALYSIS OF VARIOUS SAMPLES FOR QUALITATIVE & QUANTITATIVE INFORMATION

TABLE 14 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MOLECULAR SPECTROSCOPY, BY REGION, 2020–2027 (USD MILLION)

6.5 TOC ANALYZERS

6.5.1 REGULATORY GUIDELINES FOR TOC CONTENT IN WATER QUALITY TESTING TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 15 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR TOC ANALYZERS, BY REGION, 2020–2027 (USD MILLION)

6.6 PH METERS

6.6.1 PH METERS ARE A CRUCIAL ASPECT IN ENVIRONMENTAL ASSESSMENT & THEIR WIDESPREAD ADOPTION AMONG END USERS SUPPORTS MARKET DEMAND

TABLE 16 ENVIRONMENTAL TESTING MARKET FOR PH METERS, BY REGION, 2020–2027 (USD MILLION)

6.7 DISSOLVED OXYGEN ANALYZERS

6.7.1 DISSOLVED OXYGEN IS AN IMPORTANT PARAMETER FOR WATER QUALITY

TABLE 17 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR DISSOLVED OXYGEN ANALYZERS, BY REGION, 2020–2027 (USD MILLION)

6.8 CONDUCTIVITY SENSORS

6.8.1 UTILIZATION OF CONDUCTIVITY SENSORS TO ENSURE WATER QUALITY SUPPORTS THE GROWTH OF THIS SEGMENT

TABLE 18 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CONDUCTIVITY SENSORS, BY REGION, 2020–2027 (USD MILLION)

6.9 TURBIDITY METERS

6.9.1 TURBIDITY IS AN IMPORTANT PARAMETER FOR CHANGE IN WATER QUALITY

TABLE 19 ENVIRONMENTAL TESTING MARKET FOR TURBIDITY METERS, BY REGION, 2020–2027 (USD MILLION)

6.10 OTHER PRODUCTS

TABLE 20 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR OTHER PRODUCTS, BY REGION, 2020–2027 (USD MILLION)

7 ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PLATFORM (Page No. - 100)

7.1 INTRODUCTION

TABLE 21 ENVIRONMENTAL TESTING MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

7.2 CONVENTIONAL/BENCHTOP PLATFORMS

7.2.1 PROCEDURAL BENEFITS SUCH AS HIGH ACCURACY AND MULTIPLE SAMPLE TESTING IN A SINGLE RUN DRIVES THE MARKET GROWTH

TABLE 22 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CONVENIENT/BENCHTOP PLATFORMS, BY REGION, 2020–2027 (USD MILLION)

7.3 PORTABLE/MOBILE PLATFORMS

7.3.1 COMPACT AND MINIATURIZED ARCHITECTURE FOR IN SITU SAMPLE ANALYSIS TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 23 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR PORTABLE/MOBILE PLATFORMS, BY REGION, 2020–2027 (USD MILLION)

7.4 HANDHELD PLATFORMS

7.4.1 INCREASING RESEARCH ACTIVITIES FOR DATA ACCURACY IN THIS SEGMENT SUPPORTS THE MARKET GROWTH

TABLE 24 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR HANDHELD PLATFORMS, BY REGION, 2020–2027 (USD MILLION)

8 ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY APPLICATION (Page No. - 104)

8.1 INTRODUCTION

TABLE 25 ENVIRONMENTAL TESTING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 WATER QUALITY TESTING

TABLE 26 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR WATER QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 27 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR WATER QUALITY TESTING, BY REGION, 2020–2027 (USD MILLION)

8.2.1 ORGANIC POLLUTANTS

8.2.1.1 Untreated effluent water is a major source of organic pollutants

TABLE 28 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR ORGANIC POLLUTANTS, BY REGION, 2020–2027 (USD MILLION)

8.2.2 PFAS (POLY- AND PERFLUOROALKYL SUBSTANCES)

8.2.2.1 Active efforts by regulatory agencies to control water pollution due to PFAs contamination to drive the market growth

TABLE 29 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR PFAS, BY REGION, 2020–2027 (USD MILLION)

8.2.3 SOLID POLLUTANTS

8.2.3.1 High concentrations of suspended solids in water bodies are grave threats to the environment

TABLE 30 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR SOLID POLLUTANTS, BY REGION, 2020–2027 (USD MILLION)

8.2.4 HEAVY METALS

8.2.4.1 Mining industries & metal processing refineries are the major contributors to heavy metal pollutants in water bodies

TABLE 31 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR HEAVY METALS, BY REGION, 2020–2027 (USD MILLION)

8.2.5 MICROBIAL AND OTHER WATER POLLUTANTS

8.2.5.1 Growing incidence of water-born diseases to drive the growth of this segment

TABLE 32 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MICROBIAL AND OTHER WATER POLLUTANTS, BY REGION, 2020–2027 (USD MILLION)

8.3 AIR QUALITY TESTING

TABLE 33 ENVIRONMENTAL TESTING MARKET FOR AIR QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 34 ENVIRONMENTAL TESTING MARKET FOR AIR QUALITY TESTING, BY REGION, 2020–2027 (USD MILLION)

8.3.1 VOLATILE ORGANIC POLLUTANTS

8.3.1.1 VOC pollution is a major concern in indoor air quality monitoring

TABLE 35 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR VOLATILE ORGANIC POLLUTANTS, BY REGION, 2020–2027 (USD MILLION)

8.3.2 OTHER AIR POLLUTANTS

TABLE 36 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR OTHER AIR POLLUTANTS, BY REGION, 2020–2027 (USD MILLION)

8.4 SOIL QUALITY TESTING

TABLE 37 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR SOIL QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 38 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR SOIL QUALITY TESTING, BY REGION, 2020–2027 (USD MILLION)

8.4.1 PESTICIDES

8.4.1.1 Pesticides are essential to modern farming and agriculture, thereby contributing to soil pollution

TABLE 39 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR PESTICIDES, BY REGION, 2020–2027 (USD MILLION)

8.4.2 HEAVY METALS

8.4.2.1 Heavy metal contamination depletes the quality of soil over time and also affects the overall ecosystem

TABLE 40 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR HEAVY METALS IN SOIL QULITY TESTING, BY REGION, 2020–2027 (USD MILLION)

8.4.3 OTHER SOIL POLLUTANTS

TABLE 41 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR OTHER SOIL POLLUTANTS, BY REGION, 2020–2027 (USD MILLION)

9 ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY END USER (Page No. - 117)

9.1 INTRODUCTION

TABLE 42 ENVIRONMENTAL TESTING MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 GOVERNMENT AGENCIES AND MUNICIPAL AUTHORITIES

9.2.1 STRINGENT GOVERNMENT REGULATIONS FOR POLLUTION MONITORING & CONTROL DRIVES THE MARKET GROWTH FOR THIS END-USER SEGMENT

TABLE 43 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR GOVERNMENT AGENCIES AND MUNICIPAL AUTHORITIES, BY REGION, 2020–2027 (USD MILLION)

9.3 ENVIRONMENTAL TESTING LABORATORIES

9.3.1 INCREASING NUMBER OF PRIVATE TESTING LABORATORIES TO SUPPORT GROWTH OF THIS SEGMENT

TABLE 44 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR ENVIRONMENTAL TESTING LABORATORIES, BY REGION, 2020–2027 (USD MILLION)

9.4 INDUSTRIAL FACILITIES

9.4.1 GOVERNMENT REGULATIONS AND MANDATORY COMPLIANCE REQUIREMENTS TO DRIVE THE GROWTH OF THIS END-USER SEGMENT

TABLE 45 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR INDUSTRIAL FACILITIES, BY REGION, 2020–2027 (USD MILLION)

9.5 COMMERCIAL & RESIDENTIAL FACILITIES

9.5.1 HIGHER ADOPTION OF ALTERNATE TECHNOLOGIES TO RESTRICT THE MARKET GROWTH IN THIS END-USER SEGMENT

TABLE 46 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR COMMERCIAL & RESIDENTIAL FACILITIES, BY REGION, 2020–2027 (USD MILLION)

9.6 OTHER END USERS

TABLE 47 ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

10 ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY REGION (Page No. - 123)

10.1 INTRODUCTION

TABLE 48 ENVIRONMENTAL TESTING MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET SNAPSHOT

TABLE 49 NORTH AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: ENVIRONMENTAL TESTING MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR WATER QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR AIR QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR SOIL QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Government initiatives and investment plans for environmental protection to drive the market growth in the US

TABLE 59 US: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 60 US: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 61 US: ENVIRONMENTAL TESTING MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Government funding programs are expected to be a key factor driving the market growth in Canada

TABLE 62 CANADA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 63 CANADA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 64 CANADA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.3 EUROPE

TABLE 65 EUROPE: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 EUROPE: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 67 EUROPE: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 EUROPE: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 EUROPE: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 70 EUROPE: ENVIRONMENTAL TESTING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 71 EUROPE: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR WATER QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 EUROPE: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR AIR QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 EUROPE: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR SOIL QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 EUROPE: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Stringent government regulations for environmental protection to drive the market growth in the UK

TABLE 75 UK: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 76 UK: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 UK: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Air pollution management and depleting air quality to drive the demand for environmental testing equipment in Germany

TABLE 78 GERMANY: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 79 GERMANY: ENVIRONMENTAL TESTING MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 GERMANY: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Pollution in drinking water bodies is a major concern in France, thus driving the adoption of water quality testing equipment

TABLE 81 FRANCE: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 82 FRANCE: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 FRANCE: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 High pollutant levels in Italy to ensure the demand for environmental testing equipment

TABLE 84 ITALY: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 85 ITALY: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 ITALY: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 The dry climatic conditions in Spain drives the demand for effective wastewater & drinking water testing equipment

TABLE 87 SPAIN: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 88 SPAIN: ENVIRONMENTAL TESTING MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 SPAIN: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE (ROE)

TABLE 90 REST OF EUROPE: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 91 REST OF EUROPE: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 REST OF EUROPE: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: ENVIRONMENTAL TESTING EQUIPMENT MARKET SNAPSHOT

TABLE 93 ASIA PACIFIC: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 94 ASIA PACIFIC: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR WATER QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR AIR QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR SOIL QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Public emphasis on water & air quality testing to aid the market growth

TABLE 103 CHINA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 104 CHINA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 CHINA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Availability of skilled workforce to support the utilization of environmental testing equipment in the country

TABLE 106 JAPAN: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 107 JAPAN: ENVIRONMENTAL TESTING MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 JAPAN: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Regulations implemented by the government to control environmental pollution drives the market growth

TABLE 109 INDIA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 110 INDIA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 111 INDIA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.4.4 SOUTH KOREA

10.4.4.1 Partnership with international agencies to support the market growth in South Korea

TABLE 112 SOUTH KOREA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 113 SOUTH KOREA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 SOUTH KOREA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.4.5 AUSTRALIA

10.4.5.1 Increasing air pollution due to rising bushfire incidents to drive the market growth for testing equipment in Australia

TABLE 115 AUSTRALIA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 116 AUSTRALIA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 AUSTRALIA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 118 REST OF ASIA PACIFIC: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 119 REST OF ASIA PACIFIC: ENVIRONMENTAL TESTING MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 REST OF ASIA PACIFIC: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

TABLE 121 LATIN AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 122 LATIN AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 123 LATIN AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 LATIN AMERICA: ENVIRONMENTAL TESTING MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 LATIN AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 126 LATIN AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 127 LATIN AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR WATER QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 128 LATIN AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR AIR QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 129 LATIN AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR SOIL QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 LATIN AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Lack of skilled technicians and the absence of stringent environmental pollution regulations restrict the market growth

TABLE 131 BRAZIL: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 132 BRAZIL: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 133 BRAZIL: ENVIRONMENTAL TESTING MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.5.2 MEXICO

10.5.2.1 Slow adoption of advanced technologies is expected to hinder the market growth for testing equipment in Mexico

TABLE 134 MEXICO: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 135 MEXICO: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 MEXICO: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.5.3 REST OF LATIN AMERICA

TABLE 137 REST OF LATIN AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 138 REST OF LATIN AMERICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 139 REST OF LATIN AMERICA: ENVIRONMENTAL TESTING MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 HIGH POLLUTION LEVELS IN THE REGION DUE TO GROWTH IN THE OIL & PETROCHEMICAL TO DRIVE MARKET GROWTH

TABLE 140 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR MASS SPECTROMETERS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR CHROMATOGRAPHY PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING MARKET FOR WATER QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR AIR QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET FOR SOIL QUALITY TESTING, BY TYPE, 2020–2027 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 184)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

FIGURE 31 KEY DEVELOPMENTS IN THE ENVIRONMENTAL TESTING EQUIPMENT MARKET (2019 TO 2022)

11.3 REVENUE SHARE ANALYSIS

FIGURE 32 REVENUE SHARE ANALYSIS OF THE TOP FIVE PLAYERS IN THE ENVIRONMENTAL TESTING EQUIPMENT MARKET (2017-2021)

11.4 MARKET SHARE ANALYSIS: ENVIRONMENTAL TESTING EQUIPMENT MARKET, BY KEY PLAYER (2021)

FIGURE 33 ENVIRONMENTAL TESTING EQUIPMENT MARKET SHARE, BY KEY PLAYER, 2021

11.5 COMPANY EVALUATION QUADRANT FOR MAJOR PLAYERS (AS OF 2021)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 34 ENVIRONMENTAL TESTING EQUIPMENT MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

11.6 START-UP/SME EVALUATION QUADRANT (AS OF 2021)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 35 ENVIRONMENTAL TESTING EQUIPMENT MARKET: COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS)

11.7 COMPETITIVE BENCHMARKING

11.7.1 COMPANY FOOTPRINT ANALYSIS OF THE TOP 10 PLAYERS IN THE ENVIRONMENTAL TESTING EQUIPMENT MARKET

TABLE 149 PRODUCT FOOTPRINT ANALYSIS OF THE TOP 10 COMPANIES IN THE ENVIRONMENTAL TESTING MARKET

11.7.2 PLATFORM FOOTPRINT ANALYSIS OF THE TOP 10 COMPANIES IN THE ENVIRONMENTAL TESTING EQUIPMENT MARKET

11.7.3 REGIONAL FOOTPRINT ANALYSIS OF THE TOP 10 COMPANIES IN THE ENVIRONMENTAL TESTING EQUIPMENT MARKET

11.8 COMPETITIVE SCENARIO (2019–2022)

11.8.1 PRODUCT LAUNCHES & APPROVALS

11.8.2 DEALS

12 COMPANY PROFILES (Page No. - 195)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 AGILENT TECHNOLOGIES INC.

TABLE 150 AGILENT TECHNOLOGIES INC.: BUSINESS OVERVIEW

FIGURE 36 AGILENT TECHNOLOGIES INC.: COMPANY SNAPSHOT (2021)

12.1.2 THERMO FISHER SCIENTIFIC INC.

TABLE 151 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

FIGURE 37 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2020)

12.1.3 SHIMADZU CORPORATION

TABLE 152 SHIMADZU CORPORATION: BUSINESS OVERVIEW

FIGURE 38 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2020)

12.1.4 WATERS CORPORATION

TABLE 153 WATERS CORPORATION: BUSINESS OVERVIEW

FIGURE 39 WATERS CORPORATION: COMPANY SNAPSHOT (2020)

12.1.5 BRUKER CORPORATION

TABLE 154 BRUKER CORPORATION: BUSINESS OVERVIEW

FIGURE 40 BRUKER CORPORATION: COMPANY SNAPSHOT (2020)

12.1.6 DANAHER CORPORATION

TABLE 155 DANAHER: BUSINESS OVERVIEW

FIGURE 41 DANAHER: COMPANY SNAPSHOT (2020)

12.1.7 PERKINELMER INC.

TABLE 156 PERKINELMER INC.: BUSINESS OVERVIEW

FIGURE 42 PERKINELMER: COMPANY SNAPSHOT (2020)

12.1.8 AMETEK PROCESS INSTRUMENTS

TABLE 157 AMETEK, INC.: BUSINESS OVERVIEW

FIGURE 43 AMETEK, INC.: COMPANY SNAPSHOT (2020)

12.1.9 ANALYTIK JENA (A SUBSIDIARY OF ENDRESS HAUSER)

TABLE 158 ENDRESS+HAUSER GROUP SERVICES AG: BUSINESS OVERVIEW

FIGURE 44 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY SNAPSHOT (2020)

12.1.10 BAYSPEC, INC.

TABLE 159 BAYSPEC, INC.: BUSINESS OVERVIEW

12.1.11 ESSCO LIMITED

TABLE 160 ESSCO LIMITED: BUSINESS OVERVIEW

12.1.12 HIDEN ANALYTICAL

TABLE 161 HIDEN ANALYTICAL: BUSINESS OVERVIEW

12.1.13 INFICON

TABLE 162 INFICON: BUSINESS OVERVIEW

FIGURE 45 INFICON: COMPANY SNAPSHOT (2020)

12.1.14 JASCO CORPORATION

TABLE 163 JASCO CORPORATION: BUSINESS OVERVIEW

12.1.15 JEOL LTD.

TABLE 164 JEOL LTD.: BUSINESS OVERVIEW

FIGURE 46 JEOL LTD.: COMPANY SNAPSHOT (2020)

12.1.16 KORE TECHNOLOGY

TABLE 165 KORE TECHNOLOGY: BUSINESS OVERVIEW

12.1.17 LECO

TABLE 166 LECO: BUSINESS OVERVIEW

12.1.18 MERCK KGAA

TABLE 167 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 47 MERCK KGAA: COMPANY SNAPSHOT (2020)

12.1.19 TELEDYNE TECHNOLOGIES INCORPORATED

TABLE 168 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 48 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT (2021)

12.1.20 908 DEVICES

TABLE 169 908 DEVICES: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 ADVION, INC.

12.2.2 EXTREMEL CMS LLC

12.2.3 RIGAKU

12.2.4 SCION INSTRUMENTS

12.2.5 1ST DETECT

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 258)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study on the global environmental testing equipment market involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the environmental testing equipment market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the environmental testing equipment market scenario through secondary research. A significant number of primary interviews were conducted from both the demand (Government agencies and municipal authorities, environmental testing laboratories, industrial product manufacturers, agriculture, forestry, and geology departments, commercial end users) and the supply sides (developers, manufacturers, and distributors of environmental testing equipment). The primaries interviewed for this study include experts from the environmental testing equipment industry, such as CEOs, VPs, directors, sales heads, and marketing managers of tier 1, 2, and 3 companies engaged in offering environmental testing equipment and consumables across the globe as well as administrators and purchase managers of demand-side end users. Around 80% and 20% of primary interviews were conducted with the supply and demand side, respectively. A robust primary research methodology has been adopted to validate the contents of the report and to fill gaps. Telephonic and e-mail communications were adopted to conduct interviews (questionnaires were designed and sent to primary participants as per their convenience.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the size of the global environmental testing equipment market, as mentioned below:

- The key players in the global environmental testing equipment market were identified through secondary research, and their market shares in respective regions were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of the top market players as well as interviews with industry experts for key insights on the global environmental testing equipment market.

- All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources.

- All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Both top-down and bottom-up approaches were used to estimate and validate the size of the global environmental testing equipment market and various other dependent submarkets.

Market Size Estimation For Environmental Testing Equipment Market

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and measure the global environmental testing equipment market by product, platform, application, end user, and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the global environmental testing equipment market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To estimate the market size and growth potential of the market segments and subsegments with respect to five key regions—North America (includes the US & Canada), Europe (includes Germany, France, UK, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, South Korea, Australia, and the Rest of Asia Pacific), Latin America (Brazil, Mexico, and the Rest of Latin America), and the Middle East & Africa

- To strategically analyze the market structure with key players and their core competencies in the global environmental testing equipment market

- To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To track and analyze competitive developments such as product launches & approvals; acquisitions; expansions; and partnerships, agreements, & collaborations in the environmental testing equipment market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global environmental testing equipment market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe environmental testing equipment market into Belgium, Portugal, Poland, and Russia, among others

- Further breakdown of the Rest of Asia Pacific environmental testing equipment market market into Singapore, New Zealand, Indonesia, Vietnam, Taiwan, Malaysia, and other APAC countries

- Further breakdown of the Latin American environmental testing equipment market into Argentina, Chile, Columbia, Peru, Puerto Rico, and Venezuela, among others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Environmental Testing Equipment Market