Tire Cord Fabrics Market by Material (Nylon, Polyester, Rayon, Aramid, Polyethylene Napthalate), Tire Type (Radial Tire, Bias Tire), Application (OEM, Replacement), Vehicle Type (Passenger Cars, Commercial Vehicles) - Global Forecast to 2023

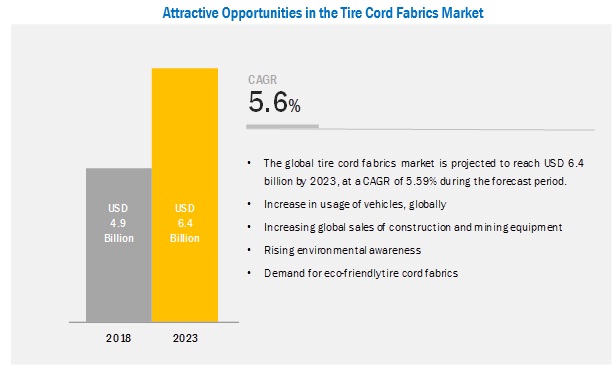

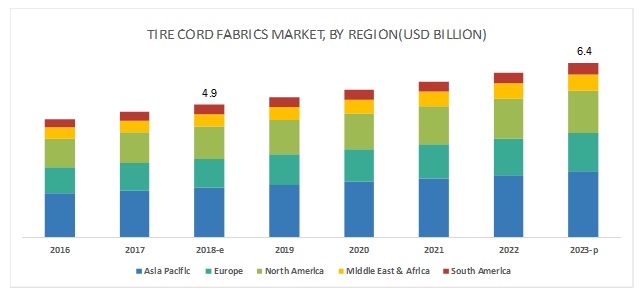

[129 Pages Report] The tire cord fabrics market size is estimated to be USD 4.9 billion in 2018 and is projected reach USD 6.4 billion by 2023, at a CAGR of 5.59% between 2018 and 2023. The increased vehicle demand, especially light-duty vehicles, around the globe has increased the global vehicle production in the past few years. Subsequently, with the growing vehicle sales, there is an increase in vehicle parc. These factors have indirectly fueled the global tire cord fabric market. APAC is the key market for tire cord fabrics, globally, followed by Europe and North America. The growing demand for eco-friendly tire cord fabrics is expected to provide opportunities for the market.

Nylon is expected to be the largest segment of the overall tire cord fabrics market during the forecast period.

On the basis of material, the tire cord fabric market has been segmented into nylon, polyester, rayon, and others. The nylon segment is estimated to register the highest CAGR, in terms of value, of the overall tire cord fabric market. The growth of the nylon segment is expected to continue during the forecast period due to the increasing demand for high-strength tire cord fabrics from different vehicle types, including passenger cars, lightweight vehicles, and heavyweight vehicles.

The radial tires segment is expected to be the largest tire type during the forecast period.

On the basis of tire type, the tire cord fabric market has been segmented into radial and bias. The radial segment accounted for the largest market share in 2017. The dominance of the segment is owing to the increasing production of passenger cars.

Replacement segment is projected to be the largest application of tire cord fabrics during the forecast period.

On the basis of application, the tire cord fabric market has been segmented into OEM and replacement. The replacement segment is projected to dominate the tire cord fabric market during the forecast period. The dominance of the replacement segment can be attributed to the increasing number of vehicles on road and age of vehicles.

APAC is expected to account for the largest share of the tire cord fabrics market during the forecast period.

APAC is estimated to be the fastest-growing market for tire cord fabrics during the forecast period, in terms of value. The growth is attributed to the increase in car production in developing countries such as China, India, and Indonesia.

Key Market Players

Key market players profiled in the report include Indorama Ventures Company Limited (Thailand), Kolon Industries Inc. (South Korea), Hyosung Corporation (South Korea), SRF Limited (India), Kordsa Teknik Tekstil A.S. (Turkey), Teijin Limited (Japan), and Toray Industries Inc. (Japan).

Indorama Ventures Public Company Limited, through its wide range of product portfolio, is able to cater to the specific needs of end customers. The company, through its innovative products & solutions, has been able to serve a wide range of end customers. The company has made a large number of acquisitions, which has enabled it to strengthen its position in the tire cord fabric market. For instance, Indorama Ventures Company Limited (IVL) acquired Kordarna Plus S.A. The acquisition will help the companies broaden their product portfolio and strengthen their position in the market.

Kordsa is into developing eco-friendly products, which has enabled it to stay competitive and cater to the specific needs of customers and adhere to the regulations. For instance, Kordsa developed eco-friendly tire cord with a technology, which enabled the use of more environment-friendly chemicals as compared to harmful chemicals such as resorcinol-formaldehyde which have always been used in the production of tire cord fabrics. The company is also continually expanding its geographic reach. For instance, Kordsa established its second tire cord fabric and polyester yarn facility in Indonesia. It is opening two new plants including an 18-kiloton tire cord fabric plant and a 14-kiloton 3rd and 4th generation polyester HMLS yarn plant. This would enable the company to expand its geographic reach in the APAC region.

Scope of the Report

|

Report Metric |

Details | |

|

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

This report categorizes the global tire cord fabrics market based on material, tire type, vehicle type, application, and region.

On the basis of type, the tire cord fabrics market has been segmented as follows:

- Nylon

- Polyester

- Rayon

- Others (Aramid fibers, hybrid, PEN)

On the basis of tire type, the tire cord fabrics market has been segmented as follows:

- Radial

- Bias

On the basis of vehicle type, the tire cord fabrics market has been segmented as follows:

- Passenger cars

- Commercial vehicles

On the basis of application, the tire cord fabrics market has been segmented as follows:

- OEM

- Replacement

On the basis of region, the tire cord fabrics market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In October 2018, Indorama Ventures Company Limited (IVL) acquired Kordarna Plus S.A. The acquisition will help the companies broaden their product portfolio and strengthen their position in the market.

- In June 2017, Indorama Ventures Company Limited (IVL) acquired Glanzstoff Group (Netherlands) tire cord and single-end cord businesses. The acquisition will enable the company to strengthen its position in the rayon, nylon 6.6, and polyester businesses within the auto segment.

- In January 2017, Indorama Ventures Company Limited (IVL) expanded its tire-cord manufacturing line at its Performance Fibers facility in Kaiping, Guangdong Province, China. The expansion will help the company strengthen its presence in the high value-added automotive safety market.

- In June 2018, Hyosung built a new factory in Quang Nam Province, Vietnam to strengthen its position in the global tire cord fabric market.

- In November 2016, Kolon Industries invested USD 260 billion to set up a new tire cord plant in Vietnam. The expansion enabled the company to expand its automotive material business.

Key Questions addressed by the report

- What are the major developments impacting the market?

- Where will all the developments take the industry in the mid to long term?

- What are the upcoming types of tire cord fabrics?

- What are the emerging applications of tire cord fabrics?

- What are the major factors impacting market growth during the forecast period?

Frequently Asked Questions (FAQ):

What are the different types of tire cord fabrics?

What are the different tire types? Does the material type of tire cord fabrics vary depending on the tire types?

What are the opportunities for the market?

Does the material type vary depending upon the vehicle type?

Which is the major contributor to the market among OEM and replacement?

What are the factors supporting the growth of tire cord fabrics market?

Who are the major manufacturers in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Tire Cord Fabrics Market Segmentation

1.3.1 Regions Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Tire Cord Fabrics Market

4.2 Market of Tire Cord Fabrics in APAC, By Application and Country

4.3 Market of Tire Cord Fabrics, By Region

4.4 Market of Tire Cord Fabrics, By Material

4.5 Market of Tire Cord Fabrics Attractiveness

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Vehicle Usage, Globally

5.2.1.2 Increasing Global Sales of Construction and Mining Equipment

5.2.2 Restraints

5.2.2.1 Fluctuating Raw Material Prices

5.2.3 Opportunities

5.2.3.1 Demand for Eco-Friendly Tire Cord Fabrics

5.2.4 Challenges

5.2.4.1 Cost-Sensitiveness of the Automotive Industry

5.3 Porters Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 GDP Trends and Forecast of Major Economies

5.4.2 Trends and Forecast of Automotive Industry and Its Impact on Tire Cord Fabrics Market

6 Tire Cord Fabrics Market, By Material (Page No. - 42)

6.1 Introduction

6.2 Nylon

6.2.1 Nylon is Extensively Used in Various Automotive Applications

6.3 Polyester

6.3.1 High Mechanical Strength and Heat Resistance Properties are Boosting the Growth of the Polyester Segment

6.4 Rayon

6.4.1 Environmental Sustainability of New Types of Rayon Fibers is Expected to Drive This Segment

6.5 Others

7 Tire Cord Fabrics Market, By Tire Type (Page No. - 46)

7.1 Introduction

7.2 Radial Tires

7.2.1 Growing Demand for Passenger Cars is Expected to Boost the Demand for Radial Tires

7.3 Bias Tires

7.3.1 Growth in Commercial Vehicles Demand is Likely to Drive the Market of Tire Cord Fabrics in This Segment

8 Tire Cord Fabrics Market, By Application (Page No. - 50)

8.1 Introduction

8.2 OEM

8.2.1 Rising Automobile Production is Expected to Drive the OEM Segment

8.3 Replacement

8.3.1 Replacement Segment is Likely to Dominate the Market

9 Tire Cord Fabrics Market, By Vehicle Type (Page No. - 54)

9.1 Introduction

9.2 Passenger Cars

9.2.1 Growing Per Capita Income in Emerging Economies is Driving the Market

9.3 Commercial Vehicles

9.3.1 Increasing Industrialization and Growing Infrastructure Activities are Expected to Propel the Market of Tire Cord Fabrics

10 Tire Cord Fabrics Market, By Region (Page No. - 59)

10.1 Introduction

10.2 APAC

10.2.1 China

10.2.1.1 as A Leading Producer of Vehicles, Globally, China is Influencing the Overall Market of Tire Cord Fabrics Positively

10.2.2 Japan

10.2.2.1 High Volume of Automobile Production is Expected to Boost the Demand for Tire Cord Fabrics in the Country

10.2.3 India

10.2.3.1 Rising Production Levels in the Automotive Industry are Expected to Propel the Market of Tire Cord Fabrics

10.2.4 South Korea

10.2.4.1 Growing Demand From Major Auto Players is Likely to Drive the Market for Tire Cord Fabrics

10.3 North America

10.3.1 US

10.3.1.1 Presence of A Large Automotive Industry is Driving the Market

10.3.2 Canada

10.3.2.1 Growth of the Countrys Manufacturing Sector is Boosting the Canadian Market of Tire Cord Fabrics

10.3.3 Mexico

10.3.3.1 Commissioning of Various Developmental Projects in the Countrys Automotive Industry has Propelled the Market

10.4 Europe

10.4.1 Germany

10.4.1.1 Increasing Production of Passenger Vehicles Act as an Opportunity for the Market Growth of Tire Cord Fabrics

10.4.2 Italy

10.4.2.1 Growth of the Automotive Industry, Along With Government Support is Expected to Drive the Market

10.4.3 France

10.4.3.1 Increasing Environmental Regulations for the Transportation Industry are Fueling the Market

10.4.4 Spain

10.4.4.1 as A Key Market for Foreign Car Manufacturers, Spain Offers Immense Prospects for Market Growth of Tire Cord Fabrics

10.4.5 UK

10.4.5.1 High Demand for High-Performance Tires in the Country is Expected to Drive the Market

10.5 Middle East & Africa

10.5.1 Turkey

10.5.1.1 Increasing Demand for Passenger Cars is Fueling the Market

10.5.2 Iran

10.5.2.1 Increasing Foreign Investments in the Automotive Industry are Expected to Impact the Market of Tire Cord Fabrics Significantly

10.5.3 South Africa

10.5.3.1 Low Production Costs and Trade Agreements are Likely to Generate A Positive Impact on the Market

10.6 South America

10.6.1 Brazil

10.6.1.1 Presence of Global Automotive Manufacturers in the Country is Supporting the Market Growth

10.6.2 Argentina

10.6.2.1 Increasing Car Sales in the Country is Aiding the Market Growth of Tire Cord Fabrics

11 Competitive Landscape (Page No. - 90)

11.1 Overview

11.2 Competitive Leadership Mapping, 2018

11.2.1 Visionary Leaders

11.2.2 Innovators

11.3 Strength of Product Portfolio

11.4 Business Strategy Excellence

11.5 Competitive Leadership Mapping (SMSE)

11.5.1 Progressive Companies

11.5.2 Responsive Companies

11.6 Strength of Product Portfolio

11.7 Business Strategy Excellence

11.8 Market Share Analysis

11.8.1 Indorama Ventures Company Limited

11.8.2 Kolon Industries Inc.

11.8.3 Hyosung Corporation

11.8.4 SRF Limited

11.8.5 Kordsa Teknik Tekstil A.S.

11.9 Competitive Scenario

11.9.1 Expansion

11.9.2 New Product Launch

11.9.3 Acquisition

12 Company Profiles (Page No. - 101)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Indorama Ventures Public Company Limited

12.2 Kolon Industries Inc.

12.3 Hyosung Corporation

12.4 SRF Ltd.

12.5 Kordsa Teknik Tekstil A.S.

12.6 Teijin Ltd.

12.7 Toray Industries Inc.

12.8 Century Enka Limited

12.9 Firestone Fibers & Textile Company

12.10 Cordenka GmbH & Co Kg

12.11 Shenma Industrial Co. Ltd.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12.12 Other Market Players

12.12.1 Saba Tire Cord Company

12.12.2 Madura Industrial Textiles Ltd.

12.12.3 Junma Group

12.12.4 Sohrab Group

12.12.5 Hanoi Industrial Textile Jsc (Haicatex)

12.12.6 Glanzstoff Industries

12.12.7 Kuibyshevazot Pjsc

12.12.8 Formosa Taffeta Co. Ltd.

12.12.9 Oriental Industries (Suzhou) Ltd.

12.12.10 Kian Cord Co.

12.12.11 Hangzhou Dikai Industrial Fabrics Co., Ltd.

12.12.12 Shandong Helon Polytex Chemical Fibre Co., Ltd.

12.12.13 Shenma Industrial Co., Ltd.

12.12.14 Dongping Jinma Tyre Cord Fabric Co., Ltd.

12.12.15 Zhejiang Hailide New Material Co., Ltd.

12.12.16 Colmant Coated Fabrics

12.12.17 Groz-Beckert

12.12.18 Milliken & Company

13 Appendix (Page No. - 122)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (100 Tables)

Table 1 Trends and Forecast of GDP, 20182023 (USD Billion)

Table 2 Market Size, By Material, 20162023 (USD Million)

Table 3 Market Size, By Material, 20162023 (Kiloton)

Table 4 Market Size, By Tire Type, 20162023 (USD Million)

Table 5 Market Size, By Tire Type, 20162023 (Kiloton)

Table 6 Market Size for Radial Tires, By Region, 2016-2023 (USD Million)

Table 7 Market Size for Radial Tires, By Region, 2016-2023 (Kiloton)

Table 8 Market Size for Bias Tires, By Region, 2016-2023 (USD Million)

Table 9 Market Size for Bias Tires , By Region, 2016-2023 (Kiloton)

Table 10 Market Size, By Application, 20162023 (USD Million)

Table 11 Market Size, By Application, 20162023 (Kiloton)

Table 12 Market Size in OEM Application, By Region, 2016-2023 (USD Million)

Table 13 Market Size in OEM Application, By Region, 20162023 (Kiloton)

Table 14 Market Size in Replacement Application, By Region, 2016-2023 (USD Million)

Table 15 Market Size in Replacement Application, By Region, 20162023 (Kiloton)

Table 16 Market Size, By Vehicle Type, 20162023 (USD Million)

Table 17 Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 18 Market Size for Passenger Cars, By Region, 2016-2023 (USD Million)

Table 19 Market Size for Passenger Cars, By Region, 2016-2023 (Kiloton)

Table 20 Market Size for Commercial Vehicles, By Region, 2016-2023 (USD Million)

Table 21 Market Size for Commercial Vehicles, By Region, 2016-2023 (Kiloton)

Table 22 Market Size, By Region, 20162023 (USD Million)

Table 23 Market Size, By Region, 20162023 (Kiloton)

Table 24 APAC: Market Size, By Country, 20162023 (USD Million)

Table 25 APAC: Market Size, By Country, 20162023 (Kiloton)

Table 26 APAC: Market Size, By Application, 20162023 (USD Million)

Table 27 APAC: Market Size, By Application, 20162023 (Kiloton)

Table 28 APAC: Market Size, By Tire Type, 20162023 (USD Million)

Table 29 APAC: Market Size, By Tire Type, 20162023 (Kiloton)

Table 30 APAC: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 31 APAC: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 32 China: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 33 China: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 34 Japan: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 35 Japan: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 36 India: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 37 India: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 38 South Korea: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 39 South Korea: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 40 North America: Market Size, By Country, 20162023 (USD Million)

Table 41 North America: Market Size, By Country, 20162023 (Kiloton)

Table 42 North America: Market Size, By Application, 20162023 (USD Million)

Table 43 North America: Market Size, By Application, 20162023 (Kiloton)

Table 44 North America: Market Size, By Tire Type, 20162023 (USD Million)

Table 45 North America: Market Size, By Tire Type, 20162023 (Kiloton)

Table 46 North America: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 47 North America: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 48 US: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 49 US: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 50 Canada: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 51 Canada: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 52 Mexico: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 53 Mexico: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 54 Europe: Market Size, By Country, 20162023 (USD Million)

Table 55 Europe: Market Size, By Country, 20162023 (Kiloton)

Table 56 Europe: Market Size, By Application, 20162023 (USD Million)

Table 57 Europe: Market Size, By Application, 20162023 (Kiloton)

Table 58 Europe: Market Size, By Tire Type, 20162023 (USD Million)

Table 59 Europe: Market Size, By Tire Type, 20162023 (Kiloton)

Table 60 Europe: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 61 Europe: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 62 Germany: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 63 Germany: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 64 Italy: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 65 Italy: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 66 France: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 67 France: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 68 Spain: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 69 Spain: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 70 UK: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 71 UK: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 72 Middle East & Africa: Market Size, By Country, 20162023 (USD Million)

Table 73 Middle East & Africa: Market Size, By Country, 20162023 (Kiloton)

Table 74 Middle East & Africa: Market Size, By Applicaton, 20162023 (USD Million)

Table 75 Middle East & Africa: Market Size, By Applicaton, 20162023 (Kiloton)

Table 76 Middle East & Africa: Market Size, By Tire Type, 20162023 (USD Million)

Table 77 Middle East & Africa: Market Size, By Tire Type, 20162023 (Kiloton)

Table 78 Middle East & Africa: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 79 Middle East & Africa: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 80 Turkey: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 81 Turkey: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 82 Iran: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 83 Iran: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 84 South Africa: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 85 South Africa: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 86 South America: Market Size, By Country, 20162023 (USD Million)

Table 87 South America: Market Size, By Country, 20162023 (Kiloton)

Table 88 South America: Market Size, By Application, 20162023 (USD Million)

Table 89 South America: Market Size, By Application, 20162023 (Kiloton)

Table 90 South America: Market Size, By Tire Type, 20162023 (USD Million)

Table 91 South America: Market Size, By Tire Type, 20162023 (Kiloton)

Table 92 South America: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 93 South America: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 94 Brazil: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 95 Brazil: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 96 Argentina: Market Size, By Vehicle Type, 20162023 (USD Million)

Table 97 Argentina: Market Size, By Vehicle Type, 20162023 (Kiloton)

Table 98 Expansion, 20142018

Table 99 New Product Launch, 20142018

Table 100 Acquisition, 20142018

List of Figures (46 Figures)

Figure 1 Tire Cord Fabrics: Market Segmentation

Figure 2 Tire Cord Fabrics: Market Research Design

Figure 3 Tire Cord Fabrics: Market Data Triangulation

Figure 4 Nylon Accounted for the Largest Market Share in the Tire Cord Fabrics in 2017

Figure 5 OEM to Be the Fastest-Growing Application of Tire Cord Fabrics

Figure 6 China to Be the Fastest-Growing Market of Tire Cord Fabrics

Figure 7 APAC Led the Market of Tire Cord Fabrics in 2017

Figure 8 Growth Opportunities in the Tire Cord Fabrics Market

Figure 9 China and Replacement Application Accounted for the Largest Market Share in APAC

Figure 10 APAC Accounted for the Largest Market Share in 2017

Figure 11 Nylon Segment Accounted for the Largest Market Share of the Overall Tire Cord Fabrics

Figure 12 China to Register the Highest Cagr

Figure 13 Drivers, Restraints, Opportunities, and Challenges: Tire Cord Fabrics Market

Figure 14 Market: Porters Five Forces Analysis

Figure 15 Global Motor Vehicle Sales in 2017

Figure 16 Automotive (Passenger Car) Sales Outlook in 2017

Figure 17 Nylon to Be the Leading Material for Tire Cord Fabrics

Figure 18 Radial to Be the Dominating Tire Type for Tire Cord Fabrics

Figure 19 Replacement Segment to Dominate the Market

Figure 20 Passenger Cars Segment to Dominate the Market of Tire Cord Fabrics

Figure 21 APAC Market to Register the Highest Cagr

Figure 22 APAC: Market Snapshot

Figure 23 North America: Market Snapshot

Figure 24 Europe: Tire Cord Fabrics Snapshot

Figure 25 Market: Competitive Leadership Mapping, 2018

Figure 26 Strength of Product Portfolio, 2018

Figure 27 Business Strategy Excellence, 2018

Figure 28 Small and Medium-Sized Enterprises (SMSE) Mapping, 2018

Figure 29 Strength of Product Portfolio, 2018

Figure 30 Business Strategy Excellence, 2018

Figure 31 Expansion Was the Key Growth Strategy Adopted By the Market Players Between 2014 and 2018

Figure 32 Market Share Analysis, 2017

Figure 33 Indorama Ventures Public Company Limited: Company Snapshot

Figure 34 Indorama Ventures Public Company Limited: SWOT Analysis

Figure 35 Kolon Industries: Company Snapshot

Figure 36 Kolon Industries: SWOT Analysis

Figure 37 Hyosung Corporation: Company Snapshot

Figure 38 Hyosung Corporation: SWOT Analysis

Figure 39 SRF Ltd.: Company Snapshot

Figure 40 SRF Ltd.: SWOT Analysis

Figure 41 Kordsa Teknik Tekstil: Company Snapshot

Figure 42 Kordsa Teknik Tekstil: SWOT Analysis

Figure 43 Teijin: Company Snapshot

Figure 44 Teijin: SWOT Analysis

Figure 45 Toray Industries: Company Snapshot

Figure 46 Century Enka Limited: Company Snapshot

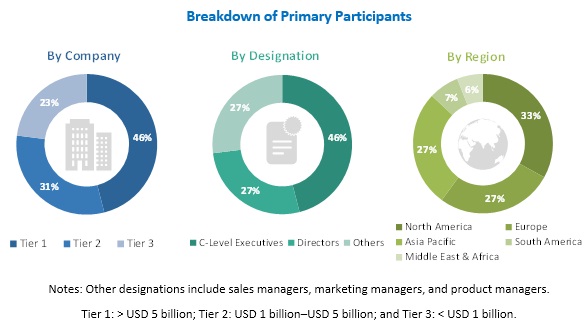

The study involved four major activities in estimating the market size for tire cord fabrics. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The tire cord fabrics market comprises several stakeholders such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the automotive industry. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the tire cord fabric market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the automotive industry.

Report Objectives

- To analyze and forecast the size of the tire cord fabric market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the tire cord fabric market on the basis of material, tire type, application, and vehicle type

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, new product launches, acquisitions in the tire cord fabric market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional end-use industry

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Tire Cord Fabrics Market