Timing Belt Market by Drive Type (Dry Belts, Chain, Belt in Oil), Component (Idler Pulley, Sprocket, Tensioner, Timing Shield/Cover), ICE & Hybrid (Passenger Car, Commercial Vehicle, HEV, PHEV), Aftermarket, and Region - Global Forecast to 2025

The timing belt market is estimated to be $5.90 Billion in 2016 and is projected to grow at a CAGR of 5.21% from 2017 to 2025. Increase in vehicle production and rising adoption of direct injection is driving the growth of this market. In this study, 2016 has been considered the base year, and 2017 to 2025 the forecast period, for estimating the size of the global market.

Objectives of the Study

- To define, segment, and analyze the global timing belt market, in terms of volume (’000 units) and value (USD million), from 2017 to 2025

- To analyze and forecast the volume and value of the global market, by timing drive type (dry belt, chain, and belt-in-oil) from 2017 to 2025

- To analyze and forecast the global market, in terms of volume and value, by ICE vehicle type (passenger vehicles and commercial vehicles)

- To analyze and forecast the aftermarket for timing belt, in terms of volume and value, by component (tensioners, idler pulleys, timing belt/chain covers, and sprockets) from 2017 to 2025

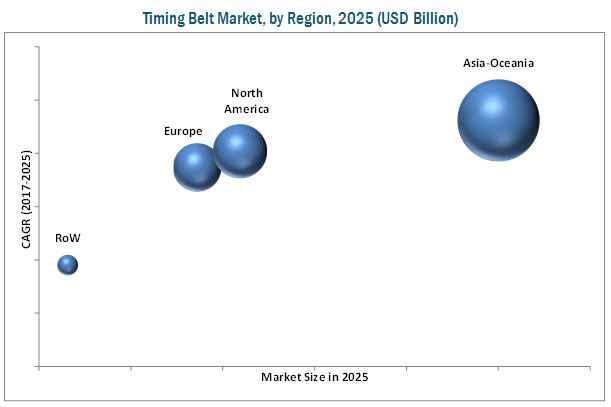

- To analyze and forecast the global market, in terms of volume and value, by region (Asia Oceania, Europe, North America, and the Rest of the World) from 2017 to 2025

- To analyze and forecast the aftermarket for timing belt , in terms of volume and value, by region (Asia Oceania, Europe, North America, and Rest of the World) from 2017 to 2025

- To analyze and forecast the global market, in terms of volume and value, by hybrid vehicle type (Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle) from 2017 to 2025

This research study involved the extensive use of secondary sources such as European Automobile Manufacturers Association (ACEA), Organisation for Economic Co-operation and Development (OECD), and the International Organization of Motor Vehicle Manufacturers (OICA), directories, and databases to gather and classify facts and figures useful for a technical, timing belt market-oriented, and commercial study of the global market. Primary sources include experts from the core and related industries, suppliers, manufacturers, distributors, service providers, and organizations related to various segments of this industry’s value chain. The size of the global market has been estimated by using the bottom-up approach. In this approach, the country-level vehicle production of passenger cars and commercial vehicles is derived from various secondary sources and paid databases. The installation rate of timing systems in different vehicle types is used to estimate the market of timing drive systems at a country level. The average price of different timing belt systems has been analyzed for different countries, vehicle types, and drive types and is then multiplied with the country-wise volume of timing drive systems. The summation of all regional markets including Asia Oceania, Europe, North America, and RoW helps to provide the size of the global market, in terms of value (USD million).

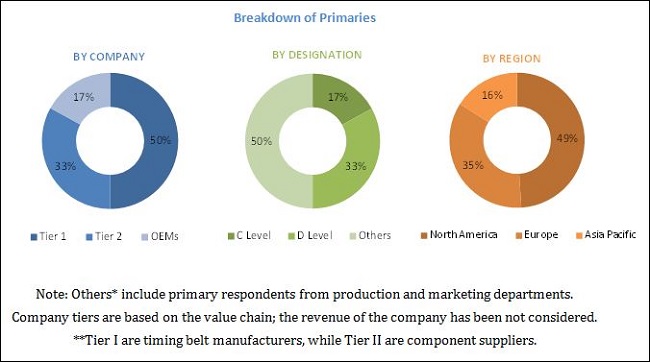

The below figure illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the timing belt market consists of manufacturers such as Continental (Germany), SKF (Sweden), BorgWarner (US), Tsubakimoto Chain (Japan), and others, and research institutes such as Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (ACEA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA).

Target Audience

- Automotive organizations/associations

- Automotive Original Equipment Manufacturers (OEMs)

- Raw material suppliers for timing belt kits

- Tensioner pulley and idler pulley manufacturers

- Timing belt and timing chain manufacturers

- Timing belt kit distributors

- Aftermarket suppliers of timing drive kit (OES & independent aftermarket suppliers)

Scope of the Report

Market, By Drive Type

Market, By ICE Vehicle

Market, By Hybrid Vehicle Type

Market, By Component

Market, By Region

Aftermarket, By Region

-

- Belt-in-Oil

- Chains

- Dry belts

- Passenger Vehicle

- Commercial Vehicle

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Tensioner

- Idler Pulleys

- Timing Shield/Cover

- Sprocket

- Asia Oceania

- Europe

- North America

- Rest of the World (RoW)

- AsiaOceania

- Europe

- North America

- Rest of the World (RoW)

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Market, by hybrid vehicle type & belt type

(Countries to be studied are Asia Oceania: China, India, Japan, and South Korea; Europe: Germany, France, UK, and Spain; North America: US, Canada, and Mexico; RoW: Brazil and Russia)

OE Market by Component type, by country

(Countries to be studied are Asia Oceania: China, India, Japan, and South Korea; Europe: Germany, France, and UK; North America: US, Canada, and Mexico; RoW: Brazil and Russia)

Aftermarket by ICE vehicle type, by country

(Countries to be studied are Asia Oceania: China, India, Japan, and South Korea; Europe: Germany, France, and UK; North America: US, Canada, and Mexico; RoW: Brazil and Russia)

-

- HEV

- PHEV

- Tensioners

- Idler Pulley

- Timing Shield /Cover

- Sprocket

- Passenger Vehicle

- Commercial Vehicle

The timing belt market is projected to grow at a CAGR of 5.21% during the forecast period, to reach a market size of USD 9.22 Billion by 2025 from USD 6.14 Billion in 2017. The global OE market for timing belt is driven by the increasing adoption of direct injection engines and rising vehicle production globally. The growing vehicle parc as well as increase in average miles driven per year are identified as the key factors influencing the aftermarket for timing belt.

The passenger car segment is estimated to be the largest timing belt market, by volume as well as value, for the OE market for timing belt, by ICE vehicle type. According to OICA publication, the passenger car production has increased from 59.89 million units in 2011 to 72.10 million units in 2016. This trend is projected to continue for the next five to seven years, owing to reasons such as rising consumer disposable income and vehicle ownership. Alternatively, the Hybrid Electric Vehicle (HEV) segment is expected to dominate this market, by hybrid vehicle type. The higher production and adoption of HEVs, as compared to PHEVs (Plug-in Hybrid Electric Vehicle), is leading to the growth of timing belt systems in HEV segment.

Tensioners are expected to lead the timing belt market, by component, in terms of value. The types of tensioners may vary depending upon their application in a timing belt and timing chain. On the basis of damping structure, auto tensioners can also be segmented into hydraulically operated and frictional systems. The usage of tensioners in timing belts and chains and relatively higher pricing have led to the growth of the global market.

North America is estimated to lead the aftermarket for timing belt by region. The high vehicle parc and average miles driven per vehicle have led to the growth of the aftermarket for timing belt in North America. The vehicle parc for North America has grown from 302,513 thousand units in 2011 to 324,763 thousand units in 2015. As per OICA, the US contributed around 63.9% of the total vehicle parc of North America in 2015. Mexico and Canada contributed 9% and 5.6%, respectively of the total vehicle parc of North America in the same year. Thus, the high vehicle parc shall positively impact the global aftermarket for timing belt in the region.

Asia Oceania is estimated to be the largest and fastest growing timing belt market during the forecast period. Countries such as China, Japan, and India are the leading markets in the region in terms of vehicle production. The production of passenger cars is the highest in the Asia Oceania region and has grown from 40.57 million units in 2011 to 43.85 million units in 2016 as per OICA. Asia Oceania contributed around 60.66% of the global passenger car production in 2016 as per OICA. The availability of cheap labor is one of the primary reasons for the high vehicle production in the region. China contributed 55.69% of the total passenger car production in Asia Oceania in 2016. Japan and India contributed 17.95% and 8.39% of the passenger car production, respectively in 2016. These factors have helped Asia Oceania to become the largest market.

The increasing adoption of direct injection engines by automotive OEMs and rise in global vehicle production shall lead to the growth of the OE timing belt market. Also, rising vehicle population and increase in average miles driven per vehicle would lead to higher replacement and growth of the aftermarket. The market is dominated by key players such as Continental (Germany), iwis motorsysteme (Germany), SKF (Sweden), BorgWarner (US), Tsubakimoto Chain (Japan), and others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Timing Belt Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Increased Demand for Commercial Vehicles

2.4.2.2 Rise in Household Disposable Income

2.4.3 Supply-Side Analysis

2.4.3.1 Engine Downsizing Due to Vehicle Light-Weighting to Support the Timing Chain Demand

2.4.3.2 Technological Advances and Increase in R&D Expenditure

2.5 Timing Belt Market Size Estimation

2.5.1 Bottom-Up Approach

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Timing Belt Market

4.2 Market, By Region

4.3 Market, By ICE Vehicle

4.4 Market, By Hybrid Vehicle Type

4.5 Market, By Component

4.6 Aftermarket, By Vehicle Type

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Timing Belt Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth of Direct Injection Engines to Fuel the Demand for Timing Chains

5.2.1.2 Increased Vehicle Parc & Average Miles Traveled

5.2.2 Restraints

5.2.2.1 Increase in Demand for Battery Electric Vehicles (BEVs)

5.2.3 Opportunities

5.2.3.1 Data Mining and Artificial Intelligence in the Timing Belt System

5.2.3.2 Shift From Dry Belt to Belt-In-Oil Timing System

5.2.4 Challenges

5.2.4.1 Large Unorganized Aftermarket for Timing Belts

5.2.4.2 Lack of Predictive Maintenance Can Cause Expensive Damage to Engine Components

6 Global Market, By ICE Vehicle (Page No. - 42)

Note: the Chapter is Further Segmented at Regional Level - Asia-Oceania, Europe, North America and RoW

6.1 Introduction

6.2 Passenger Vehicle

6.3 Commercial Vehicle

7 Global Market, By Hybrid Vehicle Type (Page No. - 47)

Note: the Chapter is Further Segmented at Regional Level - Asia-Oceania, Europe, North America and RoW

7.1 Introduction

7.2 Hybrid Electric Vehicle (HEV)

7.3 Plug-In Hybrid Electric Vehicle (PHEV)

8 Global Market, By Component (Page No. - 52)

Note: the Chapter is Further Segmented at Regional Level - Asia-Oceania, Europe, North America and RoW

8.1 Introduction

8.2 Tensioner

8.3 Idler Pulley

8.4 Timing Shield/Cover

8.5 Sprocket

9 Global Market, By Region (Page No. - 59)

The Chapter is Further Segmented at Country Level By Belt Drive Type (Timing Belt, Timing Chain, & Belt-In-Oil)

9.1 Introduction

9.2 Asia Oceania

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 South Korea

9.3 Europe

9.3.1 France

9.3.2 UK

9.3.3 Germany

9.3.4 Spain

9.3.5 Rest of Europe

9.4 North America

9.4.1 Canada

9.4.2 Mexico

9.4.3 US

9.5 Rest of the World (RoW)

9.5.1 Brazil

9.5.2 Russia

9.5.3 RoW Others

10 Global Timing Belt Aftermarket, By Region (Page No. - 80)

The Chapter is Further Segmented By Vehicle Type (Passenger Car & Commercial Vehicle)

10.1 Introduction

10.2 Asia Oceania

10.3 Europe

10.4 North America

10.5 Rest of the World (RoW)

11 Competitive Landscape (Page No. - 87)

11.1 Introduction

11.2 Global Timing Belt Market Ranking Analysis, 2016

11.3 Competitive Situation & Trends

11.3.1 New Product Launch/New Product Development/New Technology

11.3.2 Supply Contracts & Partnerships

11.3.3 Expansions/Investments

11.3.4 Mergers & Acquisitions/Joint Ventures/Collaborations

12 Company Profiles (Page No. - 91)

(Overview, Product Offerings, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments)*

12.1 Continental

12.2 Borgwarner

12.3 Schaffler

12.4 SKF

12.5 Toyoda

12.6 NTN

12.7 Aisin

12.8 Tsubakimoto

12.9 Fenner

12.10 Goodyear

*Details on Overview, Product Offerings, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 116)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.5.1 Global Timing Belt Market By Hybrid Vehicle Type & Belt Type

13.5.1.1 HEV

13.5.1.2 PHEV

13.5.2 Global OE Market By Component Type, By Country

13.5.2.1 Tensioners

13.5.2.2 Idler Pulleys

13.5.2.3 Timing Shield/Cover

13.5.2.4 Sprocket

13.5.3 Global Aftermarket By ICE Vehicle Type, By Country

13.5.3.1 Passenger Vehicle

13.5.3.2 Commercial Vehicle

13.6 Related Reports

13.7 Author Details

List of Tables (78 Tables)

Table 1 Currency Exchange Rates (Per USD)

Table 2 Timeline of Euro Regulations for Heavy-Duty Engines & Passenger Vehicles, 2000–2015

Table 3 Timing Belt Market Size, By ICE Vehicle Type, 2015–2025 (‘000 Units)

Table 4 Market Size, By ICE Vehicle Type, 2015–2025 (USD Million)

Table 5 Market for Passenger Vehicles, By Region, 2015–2025 (‘000 Units)

Table 6 Market for Passenger Vehicles, By Region, 2015–2025 (USD Million)

Table 7 Market for Commercial Vehicles, By Region, 2015–2025 (‘000 Units)

Table 8 Market for Commercial Vehicles, By Region, 2015–2025 (USD Million)

Table 9 Market Size, By Hybrid Vehicle Type, 2015–2025 (‘000 Units)

Table 10 Market Size, By Hybrid Vehicle Type, 2015–2025 (USD Million)

Table 11 Market for Hybrid Electric Vehicles, By Region, 2015–2025 (‘000 Units)

Table 12 Market for Hybrid Electric Vehicles, By Region, 2015–2025 (USD Million)

Table 13 Timing Belt Market for Plug-In Hybrid Electric Vehicle, By Region, 2015–2025 (‘000 Units)

Table 14 Market for Plug-In Hybrid Electric Vehicle, By Region, 2015–2025 (USD Million)

Table 15 Global Market Size, By Component, 2015–2025 (‘000 Units)

Table 16 Global Market Size, By Component, 2015–2025 (USD Million)

Table 17 Tensioner Market Size, By Region, 2015–2025 (‘000 Units)

Table 18 Tensioner Market Size, By Region, 2015–2025 (USD Million)

Table 19 Idler Pulley Market Size, By Region, 2015–2025 (‘000 Units)

Table 20 Idler Pulley Market Size, By Region, 2015–2025 (USD Million)

Table 21 Shield Market Size, By Region, 2015–2025 (‘000 Units)

Table 22 Shield Market Size, By Region, 2015–2025 (USD Million)

Table 23 Sprocket Market Size, By Region, 2015–2025 (‘000 Units)

Table 24 Sprocket Market Size, By Region, 2015–2025 (USD Million)

Table 25 Global Timing Belt Market Size, By Region, 2015–2025 (‘000 Units)

Table 26 Global Market Size, By Region, 2015–2025 (USD Million)

Table 27 Asia Oceania: Market Size, By Country, 2015–2025 (‘000 Units)

Table 28 Asia Oceana: Market Size, By Country, 2015–2025 (USD Million)

Table 29 China: Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 30 China: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 31 Japan: Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 32 Japan: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 33 India: Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 34 India: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 35 South Korea: Timing Belt Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 36 South Korea: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 37 Europe: Market Size, By Country, 2015–2025 ('000 Units)

Table 38 Europe: Market Size, By Country, 2015–2025 (USD Million)

Table 39 France: Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 40 France: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 41 UK: Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 42 UK: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 43 Germany: Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 44 Germany: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 45 Spain: Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 46 Spain: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 47 Rest of Europe: Timing Belt Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 48 Rest of Europe: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 49 North America: Market Size, By Country, 2015–2025 (‘000 Units)

Table 50 North America: Market Size, By Country, 2015–2025 (USD Million)

Table 51 Canada: Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 52 Canada: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 53 Mexico: Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 54 Mexico: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 55 US: Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 56 US: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 57 RoW: Market Size, By Country, 2015–2025 (‘000 Units)

Table 58 RoW: Market Size, By Country, 2015–2025 (USD Million)

Table 59 Brazil: Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 60 Brazil: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 61 Russia: Timing Belt Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 62 Russia: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 63 RoW Others: Market Size, By Drive Type, 2015–2025 (‘000 Units)

Table 64 RoW Others: Market Size, By Drive Type, 2015–2025 (USD Million)

Table 65 Global Aftermarket Size, By Region, 2015–2025 (‘000 Units)

Table 66 Global Aftermarket Size, By Region, 2015–2025 (USD Million)

Table 67 Asia Oceania: Global Aftermarket Size, By Vehicle Type, 2015–2025 (‘000 Units)

Table 68 Asia Oceania: Global Aftermarket Size, By Vehicle Type, 2015–2025 (USD Million)

Table 69 Europe: Aftermarket Size, By Vehicle Type, 2015–2025 (‘000 Units)

Table 70 Europe: Aftermarket Size, By Vehicle Type, 2015–2025 (USD Million)

Table 71 North America: Aftermarket Size, By Vehicle Type, 2015–2025 (‘000 Units)

Table 72 North America: Aftermarket Size, By ICE Vehicle Type, 2015–2025 (USD Million)

Table 73 RoW: Aftermarket Size, By Vehicle Type, 2015–2025 (‘000 Units)

Table 74 RoW: Aftermarket Size, By Vehicle Type, 2015–2025 (USD Million)

Table 75 New Product Launch/New Product Development/New Technology, 2014–2017

Table 76 Supply Contracts & Partnerships, 2014–2017

Table 77 Expansions, 2014–2016

Table 78 Mergers & Acquisitions/Joint Ventures/Collaborations, 2014

List of Figures (40 Figures)

Figure 1 Timing Belt Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Average Annual Household Disposable Income, (USD)

Figure 6 Market: Bottom-Up Approach

Figure 7 Market, By Region, 2017 vs 2025 (USD Million)

Figure 8 Market, By ICE Vehicle, 2017 vs 2025 (USD Million)

Figure 9 Market, By Component, 2017 vs 2025 (USD Million)

Figure 10 Market, By Hybrid Vehicle Type, 2017 vs 2025 (USD Million)

Figure 11 Aftermarket, By Vehicle Type, 2017 vs 2025 (USD Million)

Figure 12 Rising Vehicle Production & Increasing Adoption of Direct Injection Engines Shall Lead to the Growth of the Global Timing Belt Market From 2017 to 2025

Figure 13 Asia Oceania is Estimated to Be the Largest & Fastest Growing Market During the Forecast Period (‘000 Units)

Figure 14 Passenger Vehicle Segment Holds the Largest Share of the Market, 2017 vs 2025 (USD Million)

Figure 15 HEV are Estimated to Have the Largest Market Size for Timing Belts, 2017 vs 2025 (‘000 Units)

Figure 16 Tensioners are Expected to Lead the Market, By Component, 2017 vs 2025 (USD Million)

Figure 17 Passenger Car is Estimated to Have the Largest Aftermarket Size, 2017 vs 2025 (USD Million)

Figure 18 Global Timing Belt Market Dynamics

Figure 19 Global Passenger Car Vehicle Parc, 2005–2015 (Thousand Units)

Figure 20 Annual Miles Travelled Per Year in the US (Thousand Miles)

Figure 21 Europe: Sales of Battery Electric Vehicles, 2011–2015 (‘000 Units)

Figure 22 Passenger Vehicles is Expected to Be the Largest Oe Market By ICE Vehicle Type for Timing Belts During the Forecast Period (USD Million)

Figure 23 North America is Expected to Be the Fastest Growing Region for the Hybrid Vehicle Timing Belt, 2017 vs 2025 (USD Million)

Figure 24 Timing Belt Market, By Component, 2017 vs 2025 (USD Million)

Figure 25 Market, By Region, 2017 vs 2025 (USD Million)

Figure 26 Asia Oceania: Snapshot

Figure 27 Europe: Market Size, By Country, 2017 vs 2025 (USD Million)

Figure 28 North America: Market Snapshot

Figure 29 Passenger Vehicle Segment is Expected to Lead the Aftermarket for Timing Belt During the Forecast Period (USD Million)

Figure 30 Market Ranking, 2016

Figure 31 Continental: Company Snapshot (2016)

Figure 32 Borgwarner: Company Snapshot (2016)

Figure 33 Schaeffler: Company Snapshot (2016)

Figure 34 SKF: Company Snapshot (2016)

Figure 35 Toyoda: Company Snapshot (2015)

Figure 36 NTN: Company Snapshot (2016)

Figure 37 Aisin: Company Snapshot (2016)

Figure 38 Tsubakimoto: Company Snapshot (2016)

Figure 39 Fenner: Company Snapshot (2016)

Figure 40 Goodyear: Company Snapshot (2016)

Growth opportunities and latent adjacency in Timing Belt Market