Thin client Market Size, Share & Industry Growth Analysis Report by Form Factor (Standalone, With Monitor, Mobile), Application (ITS, Education, Healthcare, Government, BFSI, Industrial, Retail, and Transportation) and Region (North America, Europe, APAC, RoW) - Global Growth Driver and Industry Forecast to 2028

Updated on : October 22, 2024

Thin client Market Size & Growth

The global thin client market size in terms of revenue was estimated to be worth USD 1.5 billion in 2023 and is poised to reach USD 1.7 billion by 2028, growing at a CAGR of 3.1% from 2023 to 2028. The new research study consists of an industry trend analysis of the market.

The thin client market trends is expected to experience steady growth in the coming years, driven by the increasing demand for cost-effective and secure computing solutions. Other factors contributing to market growth include the rise of cloud computing, the need for energy-efficient computing devices, and the growing trend towards remote work and virtualization.

Key features fueling the growth of thin clients are remote accessibility of data, centralized and easy manageability, cost-effectiveness, high security, and increased productivity. The cost reduction of thin clients is one of the major factors helping the manufacturers expand their customer reach. Additionally, consumers are looking for a system that would help them save on energy consumption, maintenance, and operational costs. Replacing traditional PCs with thin clients minimizes the cost and reduces energy consumption. Moreover, since the thin client is built with very few components, it is durable and needs nearly zero maintenance

Thin client Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of AI on Thin client Market

The integration of artificial intelligence (AI) is significantly reshaping the thin client market by enhancing performance, security, and manageability across enterprise environments. AI-driven thin clients leverage machine learning for predictive maintenance, dynamic workload distribution, and intelligent resource optimization, leading to improved system efficiency and user experience. These advancements are particularly impactful in sectors such as healthcare, finance, and education, where secure, lightweight computing solutions are essential. Moreover, AI enhances endpoint security by enabling real-time threat detection and adaptive defense mechanisms, further strengthening the appeal of thin clients in zero-trust architectures. As organizations increasingly adopt cloud-based and virtual desktop infrastructures (VDI), the synergy between AI and thin client technology is expected to drive innovation, reduce IT overhead, and support scalable, intelligent computing ecosystems.

Thin client Market Trends and Dynamics:

Driver: Rising adoption of cloud-based services

Earlier, with the onset of web-based applications, multiple apps could be hosted on a shared server. However, with the increase in the number of users and the complexity of apps, shared hosting has become ineffective, pushing businesses to opt for cloud-based solutions. Cloud migration simplifies setting up applications where users can access their browsers instead of downloading them on their devices. The cloud infrastructure is bridging the gap between IT and business by improving the agility and efficiency of IT resources and delivering cloud solutions to customers at a low cost.

Many companies in the thin client market are focusing on organic or inorganic strategies toward cloud computing. For instance, Dell Technologies has collaborated with VMware, which provides computing, cloud management, networking and security, storage and availability, and other computing offerings. The company’s growth strategies partly depend on its ability to access additional technologies and sales channels through selective acquisitions and strategic investments. Also, Dell Technologies acquired Wyse, the global leader in cloud client computing. Thus, with the rising adoption of cloud-based services globally, the virtual infrastructure market is also expanding, driving the demand for thin client solutions.

Restraint: System compatibility issues and dependency on a centralized network

Though virtual infrastructure-based thin client solutions offer various technological advantages, implementing them is difficult. For instance, setting up a virtual desktop requires a highly compatible infrastructure and software configuration, and addressing these requirements could be costly, complicated, and require extensive planning. Moreover, these systems require considerable network bandwidth, as all desktops and operating environments are virtually loaded and streamed across the network. Hence, these systems’ complexity and compatibility limit their adoption.

The single most significant limitation of a thin client is its dependency on the network. While the centralization of clients brings a lot of positives, it also implies a considerable potential risk: the server that the thin clients connect to is a single point of failure. If the server goes down, all clients that connect to it will be affected. While desktop computers use the network as and when required, thin clients always use it. With network fluctuations or traffic, the thin client performance reduces.

Opportunity: Rising investments in data centers by leading corporations

As many companies are investing in their IT infrastructures, the demand for data centers is rising globally. The virtual infrastructure market is growing rapidly with the rise in investments in data centers and cloud computing to upgrade digital infrastructure. For instance, with the advent of 4G, more and more people have started shopping online, and the data collected by e-commerce businesses is tremendous and requires more storage, fueling the demand for data centers.

Leading cloud services providers such as AWS, Microsoft, and Google are investing heavily in opening data centers across the globe to drive digital transformation. For instance, in April 2022, Google announced a USD 9.5 billion investment in data centers and offices in the US. In March 2022, AWS announced that it would spend more than USD 2.37 billion on building and operating data centers in the UK.

With the increasing investment trend in data centers and benefits over traditional desktop systems, the demand for virtual infrastructure will fuel the adoption of thin client solutions as they are secure, cost-effective, and easily manageable.

Challenge: Creation of network traffic while managing an enormous number of devices and data

Network monitoring has become a major concern as the number of IT infrastructure elements is increasing with the rise in topological complexities. There has been exponential growth in statistical data generation due to the increased network complexity. When this data is collected and used, it does not necessarily provide useful information to the management and operation teams because of its extensive volume. Thus, it is essential to break down this massive data into chunks and use it to further increase network efficiency. The rise in the number of users and devices on each network is making managing security more challenging.

Thin client Market Segmentation

Increasing focus on upgrading traditional PCs to boost adoption of standalone thin clients segment

A standalone thin client is a general thin client that requires users to plug in peripherals, including a monitor, keyboard, and mouse. Standalone is a computer that runs from resources stored on a central server instead of a localized hard drive. Standalone thin clients connect remotely to a server-based computing environment where most applications, sensitive data, and memory are stored. They enable local printing, audio and serial device support, web browsing, and terminal emulation and combine local processing with network computing.

The thin client market for the education segment held the largest share

In this digital era, educational institutions must provide their students with the latest computing facilities. IT knowledge is essential to a student’s employability; hence they should be familiar with the best software and solutions in the industry. This means that institutions must upgrade their PCs every two to three years, in keeping with the times. Updating computers with the latest software and programs is time-consuming and difficult for institutions to stay within budget. Hence, it is easy to consider affordable and collaborative technology, such as VDI, which allows IT to create simple, secure, and centrally manageable infrastructure.

Asia Pacific accounted for the largest share of the thin client market

Regional Analysis - Thin client Market

Asia Pacific is one of the strongest markets for thin client industry share with a major contribution from China and Japan. These nations have witnessed high digital transformation across manufacturing, retail, education, and logistics industries. Rapid industrialization in Asia and consistent growth in industrial activities in the pacific region are driving the development of the manufacturing sector in the Asia Pacific. High-tech medical device manufacturing companies are actively focusing on geographical expansion in Asia Pacific due to the growing demand for healthcare services and increasing investment in advanced healthcare infrastructure. Aerospace & Defense is a booming industry that uses commercial-grade PCs like thin clients. These solutions help consumers to operate from remote locations.

Thin client Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Thin client Companies - Key Market Players

The thin client market players have implemented various types of organic as well as inorganic growth strategies, such as new product launches and acquisitions, to strengthen their offerings in the market.

The major players in the thin client companies are

- HP (US), Dell Technologies (US),

- Centerm (China),

- IGEL (Germany),

- Fujitsu (Japan), among others.

The other thin client market companies profiled in the report are NComputing (US), Samsung (South Korea), LG Electronics (South Korea), Advantech Co., Ltd. (Taiwan), Lenovo (Hong Kong), Acer (Taiwan), Intel (US), 10ZiG (US), Siemens (Germany), Chip PC (Israel), Clearcube Technology (UK), VXL Technology (UK), Stratodesk Corp (US), OnLogic (US), Clientron Corp. (Taiwan), Arista Corporation (US), Thinvent (India), Seal Technologies (India), Atrust (Taiwan) and, Praim (Italy).

Thin Client Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.5 billion in 2023 |

|

Projected Market Size |

USD 1.7 billion by 2028 |

|

Growth Rate |

CAGR of 3.1% |

|

Years considered |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD million/billion) |

|

Segments covered |

Form Factor and Application |

|

Regions covered |

North America, Europe, APAC, and the Rest of the World |

|

Companies covered |

HP (US), Dell Technologies (US), Centerm (China), IGEL (Germany), Fujitsu (Japan), NComputing (US), Samsung (South Korea), LG Electronics (South Korea), Advantech Co., Ltd. (Taiwan), Lenovo (Hong Kong), Acer (Taiwan), Intel (US), 10ZiG (US), Siemens (Germany), Chip PC (Israel), Clearcube Technology (UK), VXL Technology (UK), Stratodesk Corp (US), OnLogic (US), Clientron Corp. (Taiwan), Arista Corporation (US), Thinvent (India), Seal Technologies (India), Atrust (Taiwan) and Praim (Italy). The study includes an in-depth competitive analysis of these key players in the thin client market with their company profiles, recent developments, and key market strategies. |

Thin client Market Highlights

In this report, the overall thin client market analysis has been segmented based on form factor, application, and region.

|

Aspect |

Details |

|

By Form Factor: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments in Thin Client Industry

- In November 2022, NComputing received validation from Citrix Systems for its LEAF OS and EX500 thin client.

- In October 2022, Centerm and Kaspersky signed an MoU to Cooperate for Cyber Immune Endpoints. As a part of the cooperation, Kaspersky will provide the KasperskyOS operating system and relative cyber immune products and solutions, while Centerm will provide hardware platforms (thin clients, tablets, other hardware end-user platforms) to corporate customers.

- In August 2022, 10ZiG launched the 7500q thin client series. It features an Intel Quad Core processor with 1.10 to 2.60 GHz (Burst); 15.6” display; FHD (1920 x 1080); 16:9 panel; 8GB DDR4 2,666 MHz RAM; 2 x USB Port 2.0; 1 x USB Port 3.0; 1 x USB Port C; 1 x HDMI; 1 x SD Card Reader; offers up to 10 hours of battery life.

- In May 2022, HP launched the HP Pro mt440 G3 Mobile Thin Client for the hybrid work environment for mobile virtualization with hybrid-ready management services.

Frequently Asked Questions (FAQ):

Who are the top 5 players in the thin client market?

The major vendors operating in the industry market are HP (US), Dell Technologies (US), Centerm (China), IGEL (Germany), and Fujitsu (Japan).

What are some of the technological advancements in the thin client market?

Thin client systems with cloud computing provide enterprises with many solutions to resolve concerns, such as cost reduction, data security, and efficient use of storage and technology. Cloud computing helps provide maximum storage with low computational costs. By enabling cloud computing technology, virtualization provides a realistic solution for resource consolidation, simplifying management. Companies can efficiently perform tasks with the help of virtual solutions and cloud productivity apps. No matter which device we use, a cloud virtual desktop (thin client) allows us to transfer work effectively and efficiently across several devices via the file system hosted in the cloud.

What are the factors driving the growth of the thin client thin client market?

Growing need for digitalization in the education sector and advancements in the healthcare sector.

What are their major strategies to strengthen their market presence?

The major strategies adopted by these players are product launches and contracts.

Which major countries are considered in the APAC region?

The report includes an analysis of China, Japan, India, South Korea, and the Rest of Asia Pacific.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of cloud-based services- Cost-effectiveness associated with deployment of thin clients- Growing need for digitalization in education sector- Shift from traditional to smart manufacturing in industrial sector- Advancements in healthcare infrastructureRESTRAINTS- System compatibility issues and dependency on centralized networkOPPORTUNITIES- Rising investments in data centers by leading corporations- Growing digitization of financial sectorCHALLENGES- Lack of skilled personnel for implementing virtualization systems- Creation of network traffic while managing enormous number of devices and data

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS IMPACTING CUSTOMERS’ BUSINESSES

- 5.6 PORTER’S FIVE FORCES ANALYSIS

-

5.7 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.8 PRICING ANALYSIS

- 5.9 CASE STUDY ANALYSIS

-

5.10 TECHNOLOGY ANALYSISCOMPLIMENTARY TECHNOLOGY- Artificial Intelligence (AI) and Machine Learning (ML)- Big dataADJACENT TECHNOLOGY- Cloud computing- PC-over-IP (PCoIP)

-

5.11 PATENT ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY LANDSCAPE- US regulations- EU regulationsSTANDARDS- CEN/ISO- ISO/IEC JTC 1- Payment Card Industry Data Security Standard- European Technical Standards Institute (ETSI)- Institute of Electrical and Electronics Engineers Standards Association (IEEE)TARIFF ANALYSIS

- 5.14 TRADE ANALYSIS

- 6.1 INTRODUCTION

-

6.2 STANDALONEINCREASING FOCUS ON UPGRADING TRADITIONAL PCS TO BOOST ADOPTION OF STANDALONE THIN CLIENTSCASE STUDY: AGRICULTURE BANK OF CHINA (ABC) REPLACED PCS WITH CENTERM’S THIN CLIENTS TO ACHIEVE HIGH EFFICIENCY

-

6.3 WITH MONITORLESS OPERATING COST TO FUEL ADOPTION OF THIN CLIENTS WITH MONITORSCASE STUDY: IGEL AND LG COLLABORATED TO IMPROVE DIGITAL EXPERIENCE FOR KALEIDA HEALTH

-

6.4 MOBILELOW LIFECYCLE AND OPERATIONAL COSTS TO FUEL DEMAND FOR MOBILE THIN CLIENTSCASE STUDY: ATRUST MOBILE THIN CLIENT HELPED VITAL-NET, INC. PROVIDE FLEXIBILITY AND MOBILITY

- 7.1 INTRODUCTION

-

7.2 INFORMATION AND TECHNOLOGY SERVICES (ITS)GROWING DATA SECURITY CONCERNS IN ENTERPRISESCASE STUDY: CALFORD SEADEN SWITCHED TO VIRTUAL DESKTOP ENVIRONMENT AS IT SAVES ENERGY COSTS

-

7.3 GOVERNMENTGROWING NEED FOR DATA SECURITYCASE STUDY: DEPLOYMENT OF BREEZE INNOVATIONS’ THIN CLIENTS AT PASSENGER RESERVATION SYSTEMS (PRSS) IN INDIA

-

7.4 EDUCATIONHIGH MAINTENANCE COSTS ASSOCIATED WITH COMPUTERSCASE STUDY: CLYDEBANK COLLEGE COLLABORATED WITH DEVON IT TO DEPLOY THIN CLIENTS TO OFFER STUDENTS VIRTUAL INFRASTRUCTURE

-

7.5 INDUSTRIALRISING ADOPTION OF SMART MANUFACTURING TO REDUCE COSTS AND INCREASE MANUFACTURING AND TRANSPORTATION EFFICIENCYCASE STUDY: ADVANTECH CO., LTD. HELPED BAT SET UP SMART FACTORY SOLUTIONS

-

7.6 HEALTHCAREDIGITAL ADVANCEMENTS IN HEALTHCARE INFRASTRUCTURECASE STUDY: VXL TECHNOLOGY HELPED PIEDMONT HEALTHCARE STREAMLINE DATABASE MANAGEMENT SYSTEM

-

7.7 RETAILGROWING USE OF THIN CLIENTS IN POINT-OF-SALE KIOSKSCASE STUDY: WAGELA HELPED RETAIL CHAIN UPGRADE EXISTING THIN CLIENTS ACROSS ALL LOCATIONS

-

7.8 BFSIGROWING USE OF THIN CLIENTS IN BFSI SECTOR TO ACHIEVE HIGH SECURITYCASE STUDY: CENTERM’S THIN CLIENTS IMPROVED OPERATIONAL EFFICIENCY AND SAVED COSTS FOR OCBC BANK

-

7.9 TRANSPORTATIONRISING USE OF THIN CLIENT-BASED INTELLIGENT TRANSPORTATION SYSTEMS

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Growing need for smart infrastructure and rising adoption of advanced technologies- Case Study: HP’s thin clients support Kindred in providing efficient, high-quality careCANADA- Rising shift toward automation of IT service operations- Case Study: JIG Technologies helped Terry Fox Foundation perform regular hardware and software upgrades and replace old PCs and serversMEXICO- Rising digital infrastructure development- Increasing investments in data centers with growing adoption of cloud computing

-

8.3 EUROPEEUROPE: RECESSION IMPACTUK- Increasing remote/hybrid initiatives by organizations- Case Study: Getech made strategic shift to AVD on IGEL OS-powered LG thin client desktopsGERMANY- Technological advancements in digital technologies- Government-led initiatives for digital transformationFRANCE- Increasing digital transformationREST OF EUROPE

-

8.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Increasing focus on cloud computing and smart infrastructure- Case Study: Agriculture Bank of China replaced PCs with Centerm’s thin clients for higher efficiencyJAPAN- Rising investments and adoption of cloud services- Case Study: Atrust Mobile’s thin client provides flexibility and mobility for Vital-Net, Inc.INDIA- Increasing public–private investments under Make in India initiative- Case Study: Deployment of Breeze thin clients at unreserved ticketing System (UTS) of India RailwaysSOUTH KOREA- Advancements in cellular technologiesREST OF ASIA PACIFIC

-

8.5 ROWROW: RECESSION IMPACTMIDDLE EAST & AFRICA- Increasing industrial automation- Growing adoption of advanced technologiesSOUTH AMERICA- Rising adoption of managed services

-

9.1 OVERVIEWOVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

- 9.2 THIN CLIENT MARKET: REVENUE ANALYSIS

- 9.3 MARKET SHARE ANALYSIS (2022)

-

9.4 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 9.5 COMPETITIVE BENCHMARKING

-

9.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

9.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

10.1 KEY PLAYERSHP INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDELL TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewIGEL- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCENTERM- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewFUJITSU- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNCOMPUTING- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSAMSUNG- Business overview- Products/Services/Solutions offeredADVANTECH CO., LTD.- Business overview- Products/Services/Solutions offeredLENOVO- Business overview- Products/Services/Solutions offered- Recent developmentsINTEL CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments10ZIG TECHNOLOGY- Business overview- Products/Services/Solutions offered- Recent developmentsLG ELECTRONICS- Business overview- Products/Services/Solutions offered- Recent developmentsACER- Business overview- Products/Services/Solutions offeredSIEMENS- Business overview- Products/Services/Solutions offeredCHIP PC- Business overview- Products/Services/Solutions offered

-

10.2 OTHER PLAYERSCLEARCUBE TECHNOLOGYONLOGICCLIENTRON CORP.THINVENTPRAIMATRUST COMPUTER CORPORATIONVXL TECHNOLOGYSTRATODESK CORPORATIONARISTA CORPORATIONSEAL TECHNOLOGIES

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 THIN CLIENT MARKET, 2019–2022 (USD MILLION)

- TABLE 2 MARKET, 2023–2028 (USD MILLION)

- TABLE 3 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 6 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 7 AVERAGE SELLING PRICE OF THIN CLIENTS, BY COMPANY

- TABLE 8 UNIVERSITY OF PENNSYLVANIA SCHOOL OF DENTAL MEDICINE TURNED TRADITIONAL PC ENVIRONMENT INTO VIRTUAL WORKSTATION FLEET

- TABLE 9 ADVANTECH CO., LTD. HELPED BAT SET UP SMART FACTORY SOLUTIONS

- TABLE 10 MINOOKA COMMUNITY CONSOLIDATED SCHOOL DISTRICT DEPLOYED HP’S THIN CLIENTS

- TABLE 11 10ZIG HELPED CONESTOGA TO ACHIEVE GOAL OF WORKSTATIONS OF REPORTING EACH STEP IN MANUFACTURING PROCESS

- TABLE 12 CENTERM HELPED CAIXA BANK IMPROVE EFFICIENCY AND SECURITY LEVEL

- TABLE 13 PATENTS RELATED TO MARKET

- TABLE 14 THIN CLIENT MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 TARIFF FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY US, 2021

- TABLE 20 TARIFF FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY CHINA, 2021

- TABLE 21 TARIFF FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY GERMANY, 2021

- TABLE 22 EXPORT DATA FOR HS CODE 847150, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 23 IMPORT DATA FOR HS CODE 847150, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 24 THIN CLIENT MARKET, BY FORM FACTOR, 2019–2022 (USD MILLION)

- TABLE 25 MARKET, BY FORM FACTOR, 2023–2028 (USD MILLION)

- TABLE 26 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 27 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 ITS: MARKET, BY FORM FACTOR, 2019–2022 (USD MILLION)

- TABLE 29 ITS: MARKET, BY FORM FACTOR, 2023–2028 (USD MILLION)

- TABLE 30 ITS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 ITS: THIN CLIENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 GOVERNMENT: THIN CLIENT MARKET, BY FORM FACTOR, 2019–2022 (USD MILLION)

- TABLE 33 GOVERNMENT: MARKET, BY FORM FACTOR, 2023–2028 (USD MILLION)

- TABLE 34 GOVERNMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 GOVERNMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 EDUCATION: MARKET, BY FORM FACTOR, 2019–2022 (USD MILLION)

- TABLE 37 EDUCATION: THIN CLIENT MARKET, BY FORM FACTOR, 2023–2028 (USD MILLION)

- TABLE 38 EDUCATION: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 EDUCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 INDUSTRIAL: MARKET, BY FORM FACTOR, 2019–2022 (USD MILLION)

- TABLE 41 INDUSTRIAL: MARKET, BY FORM FACTOR, 2023–2028 (USD MILLION)

- TABLE 42 INDUSTRIAL: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 43 INDUSTRIAL: THIN CLIENT MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 44 HEALTHCARE: MARKET, BY FORM FACTOR, 2019–2022 (USD MILLION)

- TABLE 45 HEALTHCARE: MARKET, BY FORM FACTOR, 2023–2028 (USD MILLION)

- TABLE 46 HEALTHCARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 RETAIL: THIN CLIENT MARKET, BY FORM FACTOR, 2019–2022 (USD THOUSAND)

- TABLE 49 RETAIL: MARKET, BY FORM FACTOR, 2023–2028 (USD THOUSAND)

- TABLE 50 RETAIL: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 51 RETAIL: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 52 BFSI: THIN CLIENT MARKET, BY FORM FACTOR, 2019–2022 (USD MILLION)

- TABLE 53 BFSI: MARKET, BY FORM FACTOR, 2023–2028 (USD MILLION)

- TABLE 54 BFSI: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 TRANSPORTATION: THIN CLIENT MARKET, BY FORM FACTOR, 2019–2022 (USD THOUSAND)

- TABLE 57 TRANSPORTATION: MARKET, BY FORM FACTOR, 2023–2028 (USD THOUSAND)

- TABLE 58 TRANSPORTATION: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 59 TRANSPORTATION: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 60 THIN CLIENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 65 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 66 ITS: NORTH AMERICA THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 67 ITS: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 68 EDUCATION: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 69 EDUCATION: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 70 BFSI: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 71 BFSI: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 72 INDUSTRIAL: NORTH AMERICA THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 73 INDUSTRIAL: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 74 GOVERNMENT: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 75 GOVERNMENT: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 76 HEALTHCARE: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 77 HEALTHCARE: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 78 RETAIL: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 79 RETAIL: NORTH AMERICA THIN CLIENT MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 80 TRANSPORTATION: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 81 TRANSPORTATION: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 82 EUROPE: THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 85 EUROPE: THIN CLIENT MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 86 ITS: EUROPE MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 87 ITS: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 88 EDUCATION: EUROPE MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 89 EDUCATION: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 90 BFSI: EUROPE THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 91 BFSI: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 92 INDUSTRIAL: EUROPE THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 93 INDUSTRIAL: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 94 GOVERNMENT: EUROPE ARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 95 GOVERNMENT: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 96 HEALTHCARE: EUROPE MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 97 HEALTHCARE: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 98 RETAIL: EUROPE THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 99 RETAIL: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 100 TRANSPORTATION: EUROPE THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 101 TRANSPORTATION: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 102 ASIA PACIFIC: THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: THIN CLIENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 ITS: ASIA PACIFIC THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 107 ITS: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 108 EDUCATION: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 109 EDUCATION: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 110 BFSI: ASIA PACIFIC THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 111 BFSI: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 112 INDUSTRIAL: ASIA PACIFIC THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 113 INDUSTRIAL: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 114 GOVERNMENT: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 115 GOVERNMENT: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 116 HEALTHCARE: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 117 HEALTHCARE: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 118 RETAIL: ASIA PACIFIC THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 119 RETAIL: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 120 TRANSPORTATION: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 121 TRANSPORTATION: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 122 ROW: THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 123 ROW: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 124 ROW: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 125 ROW: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 126 ITS: ROW MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 127 ITS: ROW MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 128 EDUCATION: ROW MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 129 EDUCATION: ROW MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 130 BFSI: ROW THIN CLIENT MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 131 BFSI: ROW THIN CLIENT MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 132 INDUSTRIAL: ROW MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 133 INDUSTRIAL: ROW MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 134 GOVERNMENT: ROW MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 135 GOVERNMENT: ROW MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 136 HEALTHCARE: ROW MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 137 HEALTHCARE: ROW THIN CLIENT MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 138 RETAIL: ROW MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 139 RETAIL: ROW MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 140 TRANSPORTATION: ROW MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 141 TRANSPORTATION: ROW MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 142 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

- TABLE 143 THIN CLIENT MARKET: MARKET SHARE ANALYSIS

- TABLE 144 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 145 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 146 MARKET: COMPANY FOOTPRINT

- TABLE 147 MARKET: FORM FACTOR FOOTPRINT

- TABLE 148 MARKET: APPLICATION FOOTPRINT

- TABLE 149 MARKET: REGIONAL FOOTPRINT

- TABLE 150 THIN CLIENT MARKET: PRODUCT LAUNCHES, APRIL 2018–AUGUST 2022

- TABLE 151 THIN CLIENT MARKET: DEALS, JUNE 2018–NOVEMBER 2022

- TABLE 152 HP INC.: COMPANY OVERVIEW

- TABLE 153 HP INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 154 HP INC.: PRODUCT LAUNCHES

- TABLE 155 HP INC.: DEALS

- TABLE 156 DELL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 157 DELL TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 158 DELL TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 159 IGEL: COMPANY OVERVIEW

- TABLE 160 IGEL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 161 IGEL: DEALS

- TABLE 162 CENTERM: COMPANY OVERVIEW

- TABLE 163 CENTERM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 164 CENTERM: DEALS

- TABLE 165 FUJITSU: COMPANY OVERVIEW

- TABLE 166 FUJITSU: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 167 FUJITSU.: PRODUCT LAUNCHES

- TABLE 168 NCOMPUTING: COMPANY OVERVIEW

- TABLE 169 NCOMPUTING: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 170 NCOMPUTING: PRODUCT LAUNCHES

- TABLE 171 NCOMPUTING: DEALS

- TABLE 172 SAMSUNG: COMPANY OVERVIEW

- TABLE 173 SAMSUNG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 174 ADVANTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 175 ADVANTECH CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 176 LENOVO: COMPANY OVERVIEW

- TABLE 177 LENOVO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 178 LENOVO: DEALS

- TABLE 179 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 180 INTEL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 181 INTEL: DEALS

- TABLE 182 10ZIG TECHNOLOGY: COMPANY OVERVIEW

- TABLE 183 10ZIG TECHNOLOGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 184 10ZIG TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 185 10ZIG TECHNOLOGY: DEALS

- TABLE 186 LG ELECTRONIC: COMPANY OVERVIEW

- TABLE 187 LG ELECTRONICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 188 LG ELECTRONICS: PRODUCT LAUNCHES

- TABLE 189 LG ELECTRONICS: DEALS

- TABLE 190 ACER: COMPANY OVERVIEW

- TABLE 191 ACER: PRODUCT LAUNCHES

- TABLE 192 SIEMENS: COMPANY OVERVIEW

- TABLE 193 SIEMENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 194 CHIP PC: COMPANY OVERVIEW

- TABLE 195 CHIP PC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 1 THIN CLIENT MARKET SEGMENTATION

- FIGURE 2 REGIONAL SCOPE

- FIGURE 3 THIN CLIENT MARKET: RESEARCH DESIGN

- FIGURE 4 RESEARCH APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION: RESEARCH METHODOLOGY

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 ASSUMPTIONS

- FIGURE 10 GDP GROWTH PROJECTIONS TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 11 PROJECTIONS FOR THIN CLIENT MARKET, 2019–2028

- FIGURE 12 PROJECTED YEARLY GROWTH TREND OF MARKET

- FIGURE 13 THIN CLIENT MARKET, 2019–2028 (MILLION UNITS)

- FIGURE 14 EDUCATION SEGMENT HELD LARGEST SHARE OF MARKET, BY APPLICATION, IN 2022

- FIGURE 15 STANDALONE SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY FORM FACTOR, DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2022

- FIGURE 17 GROWING ADOPTION OF THIN CLIENTS TO REMOTELY ACCESS CENTRALIZED DATA

- FIGURE 18 STANDALONE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 19 EDUCATION SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 21 EDUCATION SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC THIN CLIENT MARKET IN 2022

- FIGURE 22 CHINA TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 23 THIN CLIENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 MARKET: IMPACT OF DRIVERS

- FIGURE 25 GLOBAL SMART MANUFACTURING MARKET (USD BILLION)

- FIGURE 26 MARKET: IMPACT OF RESTRAINTS

- FIGURE 27 MARKET: IMPACT OF OPPORTUNITIES

- FIGURE 28 MARKET: IMPACT OF CHALLENGES

- FIGURE 29 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 THIN CLIENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 REVENUE SHIFT IN THIN CLIENT MARKET

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 33 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 34 AVERAGE SELLING PRICE OF THIN CLIENTS, BY FORM FACTOR

- FIGURE 35 MARKET: PATENT ANALYSIS

- FIGURE 36 EXPORT DATA FOR HS CODE 847150, BY COUNTRY, 2017–2021 (USD MILLION)

- FIGURE 37 IMPORT DATA FOR HS CODE 847150, BY COUNTRY, 2017–2021 (USD MILLION)

- FIGURE 38 MARKET, BY FORM FACTOR, 2023–2028

- FIGURE 39 THIN CLIENT MARKET, BY APPLICATION, 2023–2028

- FIGURE 40 ASIA PACIFIC MARKET TO GROW AT SIGNIFICANT RATE FROM 2023 TO 2028

- FIGURE 41 NORTH AMERICA: SNAPSHOT OF THIN CLIENT MARKET

- FIGURE 42 EUROPE: SNAPSHOT OF MARKET

- FIGURE 43 ASIA PACIFIC: SNAPSHOT OF MARKET

- FIGURE 44 THREE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN MARKET

- FIGURE 45 THIN CLIENT MARKET (GLOBAL): KEY COMPANY EVALUATION QUADRANT, 2022

- FIGURE 46 MARKET (GLOBAL): SME EVALUATION QUADRANT, 2022

- FIGURE 47 HP INC.: COMPANY SNAPSHOT

- FIGURE 48 DELL TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 49 FUJITSU: COMPANY SNAPSHOT

- FIGURE 50 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 51 ADVANTECH CO., LTD.: COMPANY SNAPSHOT

- FIGURE 52 LENOVO: COMPANY SNAPSHOT

- FIGURE 53 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 LG ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 55 ACER: COMPANY SNAPSHOT

- FIGURE 56 SIEMENS: COMPANY SNAPSHOT

The study involves four major activities for estimating the size of the thin client market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Bottom-up approaches have been used to estimate and validate the size of the thin client market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for key insights.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as The Organization for Economic Co-operation and Development (OECD), Center for Security and Emerging Technology, The Japan External Trade Organization (JETRO), Semiconductor Industry Association, and SEMI have been used to identify and collect information for an extensive technical and commercial study of the thin client market.

Primary Research

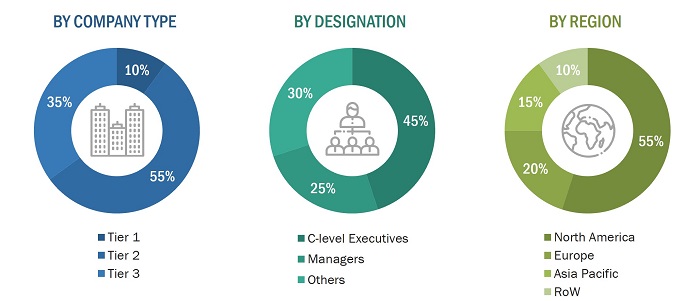

Extensive primary research was conducted after understanding and analyzing the thin client market through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across major regions—North America, Europe, APAC, and RoW. Approximately 30% of the primary interviews were conducted with the demand-side vendors and 70% with the supply-side vendors. This primary data was mainly collected through telephonic interviews/web conferences, which consist of 85% of total primary interviews, as well as questionnaires and e-mails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The thin client market consists of form factors: Standalone, With Monitor, and Mobile. Thin client is usually employed in the following application; ITS, Education, BFSI, Industrial, Government, Healthcare, Retail, and Transportation. Top-down and bottom-up approaches have been used to estimate and validate the size of the thin client market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for key insights.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the thin client market, in terms of value, by form factor and application.

- To describe and forecast the market, in terms of value, for four main regions – North America, Europe, APAC, and the Rest of the World.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain of the thin client market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the thin client ecosystem

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, and provide a detailed competitive landscape of the market

- To analyze the competitive developments, such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product developments, and research and development (R&D), in the thin client market

Growth Opportunities for Virtual Desktop Infrastructure and Thin client desktop Market in the Future

VDI technology is closely related to thin client technology because it relies on a centralized server to provide desktop environments to multiple users. With VDI, each user is given a virtual desktop that is hosted on a central server, which they can access from any device with an internet connection. This provides greater flexibility for businesses because employees can access their desktop environment from any device, regardless of its operating system.

The combination of thin client technology and VDI has transformed the IT industry by providing businesses with a cost-effective and secure way to manage their desktop environments. It has also made it easier for businesses to manage their IT infrastructure, as they can manage multiple workstations from a central location.

Thin client desktops are designed to be used with thin clients, providing a remote desktop environment that can be accessed from any device with an internet connection. Thin client desktops are managed centrally, allowing businesses to easily manage and maintain their desktop environments from a central location. They also offer greater security than traditional desktops because data is stored on a central server rather than on individual devices.

How Virtual Desktop Infrastructure or Thin client desktop is going to impact the Thin client Market?

Virtual Desktop Infrastructure (VDI) and Thin Client Desktops are expected to have a significant impact on the Thin Client Market in the coming years. Both of these technologies have been gaining popularity due to their many benefits, including cost savings, improved security, and easier management.

VDI is a virtualization technology that allows multiple users to access a centralized desktop environment from anywhere with an internet connection. Thin Client Desktops, on the other hand, are desktop environments that are specifically designed to work with thin clients, allowing users to access their desktops remotely from a central server.

The increasing adoption of VDI and Thin Client Desktops is expected to drive growth in the Thin Client Market. This is because these technologies offer several benefits over traditional desktop computing, including:

Cost savings: By using thin clients or virtual desktops, businesses can reduce hardware costs, as well as maintenance and support costs.

Improved security: Thin clients and virtual desktops can provide a more secure computing environment, as data is stored on a central server rather than on individual devices.

Easier management: With thin clients or virtual desktops, IT administrators can manage and maintain desktop environments from a central location, simplifying management tasks and reducing the need for on-site IT support.

Some futuristic growth use-cases of Virtual Desktop Infrastructure market?

The Virtual Desktop Infrastructure (VDI) market is expected to see significant growth in the coming years, driven by several futuristic use-cases. Some of these use-cases include:

Remote work: The COVID-19 pandemic has accelerated the shift towards remote work, and VDI technology has played a key role in enabling this transition. As remote work becomes more common, the demand for VDI solutions is expected to grow.

Cloud adoption: With the increasing adoption of cloud computing, more businesses are looking to move their desktop environments to the cloud. VDI technology can help businesses achieve this by providing a secure and scalable solution for desktop virtualization.

Disaster recovery: VDI technology can be used as part of a disaster recovery strategy, allowing businesses to quickly and easily recover desktop environments in the event of an outage or other disaster.

IoT integration: The Internet of Things (IoT) is expected to play an increasingly important role in business operations. VDI technology can be used to provide a secure and scalable solution for managing IoT devices and applications.

Artificial Intelligence (AI) and Machine Learning (ML): As AI and ML become more integrated into business operations, VDI technology can be used to provide a secure and scalable solution for managing AI and ML workloads.

Industries That Will Be Impacted in the Future by Virtual Desktop Infrastructure

Virtual Desktop Infrastructure (VDI) is expected to have a significant impact on various industries in the future. Some of the industries that are likely to be impacted by VDI include:

Healthcare: The healthcare industry is expected to benefit from VDI technology, as it can provide a secure and scalable solution for managing patient data and electronic medical records. VDI can also help healthcare providers deliver remote consultations and telemedicine services.

Education: VDI can be used in the education sector to provide students and teachers with access to a centralized desktop environment, enabling remote learning and collaboration.

Financial services: The financial services industry is highly regulated and requires strict security measures to protect sensitive data. VDI technology can provide a secure and compliant solution for managing desktop environments in this industry.

Manufacturing: VDI technology can be used in the manufacturing industry to provide employees with access to a centralized desktop environment, enabling collaboration and remote work.

Growth Opportunities and Key Challenges for Virtual Desktop Infrastructure in the Future

Growth Opportunities:

Increasing demand for remote work solutions: The COVID-19 pandemic has accelerated the shift towards remote work, and VDI technology has played a key role in enabling this transition. As remote work becomes more common, the demand for VDI solutions is expected to grow.

Adoption of cloud computing: With the increasing adoption of cloud computing, more businesses are looking to move their desktop environments to the cloud. VDI technology can help businesses achieve this by providing a secure and scalable solution for desktop virtualization.

Need for cost-effective solutions: VDI technology can help businesses reduce costs associated with managing and maintaining desktop environments, making it an attractive option for businesses looking to reduce their IT expenses.

Increasing demand for secure solutions: As cyber threats continue to evolve, businesses are looking for secure solutions to protect their desktop environments. VDI technology can provide a secure solution by centralizing desktop management and enabling secure remote access.

Key Challenges:

Complexity: VDI technology can be complex to set up and manage, requiring specialized skills and expertise.

Infrastructure requirements: VDI technology requires a robust infrastructure to support it, including servers, storage, and networking equipment. This can be a barrier to entry for smaller businesses.

User experience: VDI technology relies on network connectivity, which can impact the user experience if the network is slow or unreliable.

Cost: While VDI technology can help businesses reduce costs in the long run, the initial setup costs can be significant, making it less accessible for smaller businesses.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thin client Market