Desktop Virtualization Market by Type (Virtual Desktop Infrastructure, Desktop-as-a-Service, Remote Desktop Services), Organization Size, Vertical (Telecom, IT & ITeS, BFSI, Education, Healthcare & Lifesciences) and Region - Global Forecast to 2027

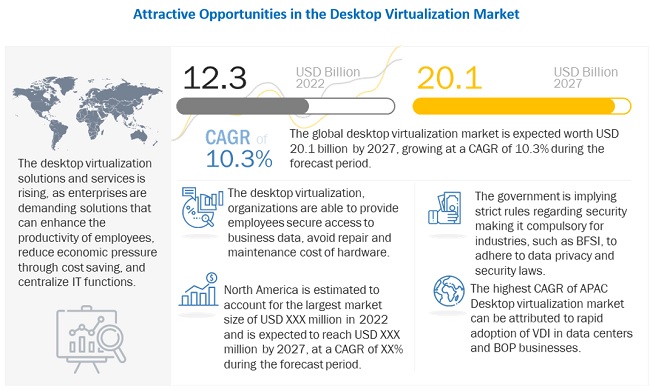

[201 Pages Report] The global Desktop Virtualization Market size is expected to grow from USD 12.3 billion in 2022 to USD 20.1 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 10.3% during the forecast period. Desktop virtualization makes it easier for employees to access enterprise computing resources. Employees can work anytime, anywhere, from any supported device with an Internet connection.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

Due to COVID-19, there was a sudden shift to remote working. Therefore, VDI solutions were adopted, as they help businesses run smoothly. Even after COVID-19, the market for VDI will continue to evolve, with more potential developments in virtualization as virtual desktop infrastructure solutions are matured. Also, the cost is low and more stable.

Desktop Virtualization Market Dynamics

Driver: Cost savings to reduce economic pressure on enterprises

The highly competitive market and economic pressure are driving businesses to implement enterprise solutions, which help to decrease the IT expenditure and focus on core business areas. After the recession of 2007, the trend has gained significant importance, which has pushed businesses across the globe to meet the aforementioned objectives. Apart from large businesses, several small and medium-sized businesses (SMBs), especially in North America, are migrating from traditional desktop systems to virtual desktop workplaces.

VDI provides a consistent and secure means for employees to work anywhere, thereby reducing the number of PCs and expensive hardware at workplaces, resulting in a decline in the cost for hardware maintenance. VDI deployment also cuts down expenses on several applications, as major applications and updates are deployed on the server or the cloud, and an authorized access is provided to the users. Therefore, desktop virtualization solutions are helping organizations save costs on hardware and its maintenance, and thus, the adoption of desktop virtualization solutions will be high in the coming years.

Restraint: System complexity and compatibility issues

Though desktop virtualization offers various technological advantages, implementing it is not an easy task. For generating several virtual desktop instances, a highly compatible infrastructure and software configuration is required, and addressing these requirements could be costly, complicated, and requires extensive planning. Moreover, virtual desktops require a considerable amount of network bandwidth, as all desktops, along with the operating environment are virtually loaded and streamed across the network. Hence, system complexity and compatibility issues are limiting the adoption of desktop virtualization solutions.

Opportunity: Shift toward remote working and rise in the adoption of cloud computing

Enterprises are focusing on remote working to make their workforce efficient and productive. Remote working and cloud computing reduce the IT infrastructure spending. Clouds have emerged as an infrastructure, enabling rapid delivery of computing resources as a utility in a dynamically scalable and virtual manner. Higher cloud adoption rate and enterprise inclination toward deploying desktops on cloud drive the usage of desktop virtualization.

Challenge: Lack of skilled personnel for implementation and reconfiguration of desktop virtualization

Configuration and implementation of desktop virtualization is not an easy process, as it involves numerous complexities and compatibility issues. It is necessary to analyze the infrastructure requirements, such as server size, network bandwidth, and workload, before implementing desktop virtualization solutions. Several times, a user compromises on the required infrastructure configuration and tries to implement desktop virtualization solution on the existing infrastructure, which may further hamper the performance of the implemented solution. To solve such problems related to the performance and configuration of these solutions, vendors need to critically analyze the existing IT infrastructure and reconfigure the desktop virtualization solution. Virtualization experts can handle these issues effectively and deliver quality service to end-users. Thus, it is important for vendors to develop virtualization experts who possess updated knowledge and satisfactory level of skills for the implementation and reconfiguration of desktop virtualization solutions. Currently, there is a dearth of skilled employees in the market.

Large enterprises are expected account for the largest market share during 2022

The adoption of desktop virtualization technologies in large enterprises is relatively high compared to SMEs. This is majorly due to the benefits provided by these technologies, which include a decline in energy consumption and security and replacement rates, which, in turn, result in a low cost of ownership and high returns on investments. These technologies also offer a centralization control of hardware, software, and applications, leading to increased utilization and low management costs.

Companies are spending significant amounts on new marketing techniques to sustain their positions in the highly competitive market. The desktop virtualization market is expected to witness strong growth in the coming years across large enterprises. Nowadays, enterprises realize the importance of desktop virtualization to manage the complex end-point environment.

Healthcare and lifesciences is expected to account for a higher CAGR during the forecast period

The Desktop virtualization has enhanced the overall healthcare sector by providing healthcare professionals with quick and secure access to patient information anywhere and anytime. This has helped them overcome all the traditional challenges faced by the industry in keeping patients’ written records and providing them with e-medical records. The BYOD concept allows healthcare providers to access information easily and simultaneously collaborate with clinicians and colleagues. This, in turn, helps them save the time of doctors and patients and provides security of data. This further assists staff members in having access to critical information, such as patient information, responses, and timetables.

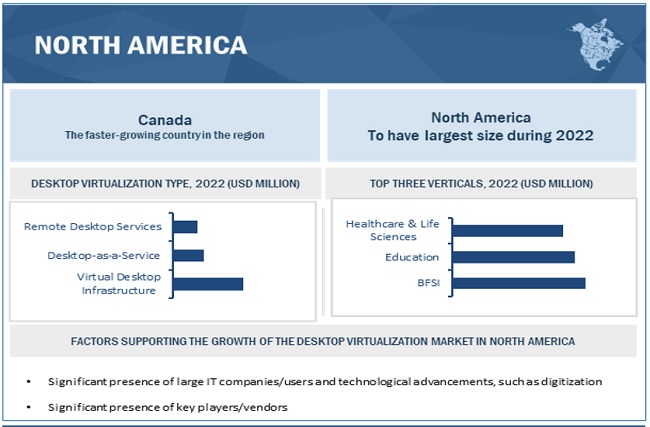

North America to account for the largest market share during the forecast period

North America is estimated to capture the largest share of the overall Desktop virtualization market. Organizations in the region are the early adopters of desktop virtualization solutions and services. The market growth in this region is primarily driven by the presence of large IT companies/users and rapid technological advancements, such as digitization in the US and Canada. The benefits offered by desktop virtualization (mobility, security, flexibility, and manageability) are driving the increasing implementation of desktop virtualization solutions in the region. The need to reduce excessive expenditures, such as hardware costs, and provide a flexible work environment to employees has significantly increased the adoption of desktop virtualization solutions across large, small, and medium-sized enterprises.

To know about the assumptions considered for the study, download the pdf brochure

Desktop Virtualization Companies

The desktop virtualization market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Desktop virtualization market Citrix systems (US), VMware (US), Microsoft (US), Cisco Systems (US), Oracle (US), IBM (US), Huawei (China), Kyndryl Holdings (US), DXC Technology (US), NTT DATA (Japan), Amazon Web Services (AWS) (US), Softchoice (Canada), Nutanix (US), Pure Storage (US), NetApp (California), Ivanti (US), Nasstar (UK), Datacom (New Zealand), NComputing (US), Evolve IP (US), Ericom Software (US), Parallels International (US), V2 Cloud (Canada), Kasm (Virginia), Itopia (US), ClearCube (US), Hewlett Packard Enterprise (US), Adar (US), Systancia (France), and HiveIO (US).

The study includes an in-depth competitive analysis of these key players in the desktop virtualization market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 12.3 billion |

|

Revenue forecast for 2027 |

USD 20.1 billion |

|

Growth Rate |

10.3% CAGR |

|

Forecast units |

Value (USD Billion) |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Segments covered |

By type, organization size, verticals, and region |

|

Regions covered |

North America, Europe, APAC, MEA, Latin America |

|

List of Companies in Desktop Virtualization |

Citrix systems (US), VMware (US), Microsoft (US), Cisco Systems (US), Oracle (US), IBM (US), Huawei (China), Kyndryl Holdings (US), DXC Technology (US), NTT DATA (Japan), Amazon Web Services (AWS) (US), Softchoice (Canada) |

This research report categorizes the desktop virtualization market to forecast revenues and analyze trends in each of the following subsegments:

By Type:

- Virtual desktop infrastructure (VDI)

- Desktop-as-a-service (DaaS)

- Remote Desktop Services (RDS)

By Organization size:

- Small and medium sized enterprises

- Large enterprises

By Verticals:

- Banking, Finance services, and Insurance (BFSI)

- Education

- Healthcare and Life Sciences

- IT and ITeS

- Government and Defense

- Telecom

- Retail

- Automotive, Transportation and Logistics

- Media and Entertainment

- Manufacturing

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- India

- China

- Japan

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2022 IBM acquired Neudesic, a leading Microsoft Azure Consultancy, to expand IBM's portfolio of hybrid multicloud services and influence the company's hybrid cloud and AI strategy.

- In November 2021 VMware and Vodafone partnered. The partnership aims to deploy the full VMware Telco Cloud Platform in all European markets. In addition to utilizing Telco Cloud Infrastructure for NFV, Vodafone will access VMware Tanzu for Telco and VMware Telco Cloud Automation.

- In July 2021 Cisco acquired Socio Labs. The acquisition would expand Webex offerings beyond meetings, webinars, and webcasts; would include conferences; and would add power to the future of hybrid events.

Frequently Asked Questions (FAQ):

How big is the Desktop virtualization market?

What is growth rate of the Desktop virtualization market?

Who are the key players in Desktop virtualization market?

Who will be the leading hub for Desktop virtualization market?

What is the Desktop virtualization market segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 DESKTOP VIRTUALIZATION MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 MARKET: GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 3 DESKTOP VIRTUALIZATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Primary sources

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE DESKTOP VIRTUALIZATION MARKET

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 8 RESEARCH ASSUMPTIONS

2.4.1 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 9 DESKTOP VIRTUALIZATION MARKET, 2022–2027 (USD MILLION)

FIGURE 10 LEADING SEGMENTS IN THE MARKET IN 2022

FIGURE 11 MARKET, REGIONAL-WISE SHARE, 2022

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE OPPORTUNITIES IN THE DESKTOP VIRTUALIZATION MARKET

FIGURE 12 EARLY ADOPTION OF NEW TECHNOLOGIES DRIVING MARKET GROWTH

4.2 MARKET, BY 0RGANIZATION SIZE

FIGURE 13 SMALL & MEDIUM-SIZED ENTERPRISES TO LEAD MARKET GROWTH IN 2022

4.3 MARKET, BY VERTICAL

FIGURE 14 BFSI VERTICAL EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2027

4.4 MARKET, BY TYPE

FIGURE 15 DESKTOP-AS-A-SERVICE (DAAS) SEGMENT TO LEAD MARKET GROWTH BY 2027

4.5 MARKET, BY REGION

FIGURE 16 ASIA PACIFIC TO GROW AT FASTEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DESKTOP VIRTUALIZATION MARKET

5.2.1 DRIVERS

5.2.1.1 Need to increase the productivity of employees

5.2.1.2 Cost savings to reduce economic pressure on enterprises

5.2.1.3 Simplified management and enhanced security (centralization of IT functions)

5.2.1.4 Disaster recovery and reduced downtime for enterprises

5.2.2 RESTRAINTS

5.2.2.1 System complexity and compatibility issues

5.2.2.2 Bottleneck issues related to botting, login, antivirus, and user workload actions of VDI

5.2.3 OPPORTUNITIES

5.2.3.1 Rising attractiveness of workspace-as-a-service (WaaS)

5.2.3.2 Shift toward remote working and rise in the adoption of cloud computing

5.2.4 CHALLENGES

5.2.4.1 Cultural and organizational challenges

5.2.4.2 Lack of skilled personnel for implementation and reconfiguration of desktop virtualization

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

5.4 INDUSTRY TRENDS

5.4.1 DESKTOP VIRTUALIZATION MARKET: VALUE CHAIN ANALYSIS

5.4.1.1 Value Chain Analysis

FIGURE 18 VALUE CHAIN ANALYSIS OF THE MARKET

5.4.2 ECOSYSTEM

TABLE 3 MARKET: ECOSYSTEM

5.4.3 PRICING MODEL OF MARKET PLAYERS

TABLE 4 PRICING MODELS AND INDICATIVE PRICE POINTS, 2021–2022

5.4.4 TECHNOLOGY ANALYSIS

5.4.4.1 Artificial Intelligence and Machine Learning

5.4.4.2 Blockchain

5.4.4.3 Cloud computing

5.4.4.4 Internet of Things

5.4.5 DESKTOP VIRTUALIZATION MARKET: REGULATIONS

5.4.5.1 The Gramm-Leach-Bliley Act (GLBA)

5.4.5.2 Health Insurance Portability and Accountability Act (HIPAA)

5.4.5.3 Family Educational Rights and Privacy Act (FERPA)

5.4.5.4 Payment Card Industry Data Security Standard

5.4.5.5 The FTC Fair Information Practice

5.4.5.6 General Data Protection Regulation

5.4.5.7 ISO/IEC 27001

5.4.6 CASE STUDY ANALYSIS

5.4.6.1 Case study 1: Citrix Cloud helping Autodesk’s further digitization

5.4.6.2 Case study 2: Queen’s University implementing VMware Horizon desktop virtualization to enable access to critical applications

5.4.6.3 Case study 3: ESSEC Business School applying desktop virtualization with pure storage

5.4.6.4 Case study 4: Midland’s partnership NHS foundation trust enabling virtual services during a healthcare crisis

5.4.6.5 Case study 5: Acuity facilitating remote work using Amazon WorkSpaces

5.4.7 DESKTOP VIRTUALIZATION MARKET: PATENT ANALYSIS

5.4.7.1 Methodology

5.4.7.2 Document Types of Patents

TABLE 5 PATENTS FILED, 2019–2022

5.4.7.3 Innovation and patent applications

FIGURE 19 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2019–2022

5.4.7.3.1 Top applicants

FIGURE 20 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2022

TABLE 6 LIST OF A FEW PATENTS IN THE MARKET, 2019–2021

5.4.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 DESKTOP VIRTUALIZATION MARKET: PORTER’S FIVE FORCES MODEL

5.4.8.1 Threat of new entrants

5.4.8.2 Threat of substitutes

5.4.8.3 Bargaining power of buyers

5.4.8.4 Bargaining power of suppliers

5.4.8.5 Degree of competition

5.4.9 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

FIGURE 21 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF THE MARKET

6 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY TYPE (Page No. - 61)

6.1 INTRODUCTION

6.1.1 TYPE: MARKET DRIVERS

6.1.2 TYPE: COVID-19 IMPACT

FIGURE 22 VIRTUAL DESKTOP INFRASTRUCTURE SEGMENT EXPECTED TO LEAD GLOBAL MARKET BY 2027

TABLE 8 GLOBAL MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 9 GLOBAL MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2 VIRTUAL DESKTOP INFRASTRUCTURE

6.2.1 NEED FOR CENTRALIZED MANAGEMENT IN DESKTOP VIRTUALIZATION

TABLE 10 VIRTUAL DESKTOP INFRASTRUCTURE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 11 VIRTUAL DESKTOP INFRASTRUCTURE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 DESKTOP-AS-A-SERVICE

6.3.1 ENTERPRISES ADOPTING DAAS SOLUTIONS FOR SECURE, SMOOTH REMOTE OPERATIONS

TABLE 12 DESKTOP-AS-A-SERVICE: DESKTOP VIRTUALIZATION MARKET BY REGION, 2016–2021 (USD MILLION)

TABLE 13 DESKTOP-AS-A-SERVICE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 REMOTE DESKTOP SERVICE

6.4.1 RDS COMPATIBILITY WITH MICROSOFT PRODUCTS

TABLE 14 REMOTE DESKTOP SERVICE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 15 REMOTE DESKTOP SERVICE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE (Page No. - 67)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 23 LARGE ENTERPRISES SEGMENT EXPECTED TO LEAD GLOBAL MARKET BY 2027

TABLE 16 GLOBAL MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 17 GLOBAL MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

7.2 SMALL & MEDIUM-SIZED ENTERPRISES

7.2.1 ADOPTION OF VDI BY SMES TO GAIN A COMPETITIVE EDGE

TABLE 18 SMALL & MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 19 SMALL & MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 LARGE ENTERPRISES

7.3.1 LARGE ENTERPRISES SWITCHING TO CENTRALIZED VIRTUAL DESKTOP INFRASTRUCTURE SOLUTIONS

TABLE 20 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY VERTICAL (Page No. - 72)

8.1 INTRODUCTION

8.1.1 VERTICAL: MARKET DRIVERS

8.1.2 VERTICAL: COVID-19 IMPACT

FIGURE 24 GLOBAL MARKET, BY VERTICAL, 2022 & 2027 (USD MILLION)

TABLE 22 GLOBAL MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 23 GLOBAL MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

8.2 BFSI

8.2.1 DESKTOP VIRTUALIZATION SOLUTIONS TO ATTAIN BUSINESS OBJECTIVES OF THE BFSI VERTICAL

TABLE 24 BFSI: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 EDUCATION

8.3.1 EDUCATION INDUSTRY PROVIDING REMOTE ACCESS WITH DESKTOP VIRTUALIZATION

TABLE 26 EDUCATION: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 27 EDUCATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 HEALTHCARE & LIFESCIENCES

8.4.1 HEALTHCARE & LIFESCIENCES INDUSTRY ADOPTING DESKTOP VIRTUALIZATION TO ENHANCE SECURITY

TABLE 28 HEALTHCARE & LIFESCIENCES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 HEALTHCARE & LIFESCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 IT & ITES

8.5.1 IT & ITES ADOPTING DAAS SOLUTIONS TO PROVIDE SECURE REMOTE WORKING

TABLE 30 IT & ITES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 IT & ITES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 GOVERNMENT & DEFENSE

8.6.1 GOVERNMENT TO CENTRALIZE MANAGEMENT WITH DESKTOP VIRTUALIZATION

TABLE 32 GOVERNMENT & DEFENSE: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 33 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 TELECOM

8.7.1 EMERGENCE OF DATA CENTERS TO ENABLE VIRTUALIZATION

TABLE 34 TELECOM: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 35 TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.8 RETAIL

8.8.1 RETAIL INDUSTRY ADOPTING DESKTOP VIRTUALIZATION SOLUTIONS TO ENHANCE CUSTOMER EXPERIENCE

TABLE 36 RETAIL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 RETAIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.9 AUTOMOTIVE, TRANSPORTATION, & LOGISTICS

8.9.1 USE OF DESKTOP VIRTUALIZATION SOLUTIONS FOR GAINING A COMPETITIVE EDGE

TABLE 38 AUTOMOTIVE, TRANSPORTATION & LOGISTICS: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 AUTOMOTIVE, TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.1 MEDIA & ENTERTAINMENT

8.10.1 ADOPTION OF VDI TECHNOLOGY REDUCING OPERATIONAL COSTS

TABLE 40 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2016–2021(USD MILLION)

TABLE 41 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.11 MANUFACTURING

8.11.1 MANUFACTURING INDUSTRY TO ADOPT VDI TECHNOLOGY TO ENHANCE DATA SECURITY

TABLE 42 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.12 OTHER VERTICALS

8.12.1 DESKTOP VIRTUALIZATION ENHANCING SECURITY IN VARIOUS SECTORS

TABLE 44 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 DESKTOP VIRTUALIZATION MARKET, BY REGION (Page No. - 87)

9.1 INTRODUCTION

FIGURE 25 NORTH AMERICA EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE BY 2027

TABLE 46 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 47 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: MARKET DRIVERS

9.2.2 NORTH AMERICA: COVID-19 IMPACT

9.2.3 NORTH AMERICA: REGULATORY NORMS

FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.4 UNITED STATES

9.2.4.1 Growing healthcare industry and adoption of advanced technology

9.2.5 CANADA

9.2.5.1 Cost-effectiveness, flexibility, and simplified management provided by desktop virtualization

9.3 EUROPE

9.3.1 EUROPE: DESKTOP VIRTUALIZATION MARKET DRIVERS

9.3.2 EUROPE: COVID-19 IMPACT

9.3.3 EUROPE: REGULATORY NORMS

TABLE 56 EUROPE: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 57 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 58 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021(USD MILLION)

TABLE 59 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 60 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 61 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 62 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 63 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.4 UNITED KINGDOM

9.3.4.1 Cloud-based service and solution providers driving the desktop virtualization market growth

9.3.5 GERMANY

9.3.5.1 Efficient work and high performance while working from remote locations

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: DESKTOP VIRTUALIZATION MARKET DRIVERS

9.4.2 ASIA PACIFIC: COVID-19 IMPACT

9.4.3 ASIA PACIFIC: REGULATORY NORMS

FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 64 ASIA PACIFIC: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 71 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.4 CHINA

9.4.4.1 Vast and skilled workforce driving the growth of the desktop virtualization market

9.4.5 JAPAN

9.4.5.1 Growth of emerging technologies

9.4.6 INDIA

9.4.6.1 Financial services, IT-enabled services, and retail sectors driving the growth of the market

9.4.7 REST OF ASIA PACIFIC

9.5 MIDDLE EAST & AFRICA

9.5.1 MIDDLE EAST & AFRICA: DESKTOP VIRTUALIZATION MARKET DRIVERS

9.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

9.5.3 MIDDLE EAST & AFRICA: REGULATORY NORMS

TABLE 72 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 74 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 75 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 79 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.5.4 KINGDOM OF SAUDI ARABIA

9.5.4.1 Rising adoption of public cloud offerings and high technology startups driving the growth

9.5.5 SOUTH AFRICA

9.5.5.1 Rising advancements in the field of IT and communications driving the demand for desktop virtualization

9.5.6 REST OF MIDDLE EAST AND AFRICA

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: DESKTOP VIRTUALIZATION MARKET DRIVERS

9.6.2 LATIN AMERICA: COVID-19 IMPACT

9.6.3 LATIN AMERICA: REGULATORY NORMS

TABLE 80 LATIN AMERICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 81 LATIN AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 82 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 83 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 84 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 85 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 86 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 87 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.6.4 BRAZIL

9.6.4.1 Affordable skilled crowd and growth of IT driving the desktop virtualization market growth

9.6.5 MEXICO

9.6.5.1 Growth of the tech industry increasing skilled workers and job opportunities

9.6.6 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 113)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES

TABLE 88 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE MARKET

10.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 89 DESKTOP VIRTUALIZATION MARKET: DEGREE OF COMPETITION

10.4 HISTORICAL REVENUE ANALYSIS

FIGURE 28 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD MILLION)

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 29 KEY MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

10.6 COMPETITIVE BENCHMARKING

TABLE 90 COMPANY FOOTPRINT

TABLE 91 COMPANY TYPE FOOTPRINT

TABLE 92 COMPANY TOP 3 VERTICAL FOOTPRINT

TABLE 93 COMPANY REGION FOOTPRINT

10.7 STARTUP/SME EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 30 STARTUP/SME DESKTOP VIRTUALIZATION MARKET EVALUATION MATRIX, 2021

10.8 COMPETITIVE SCENARIO

10.8.1 PRODUCT LAUNCHES

TABLE 94 PRODUCT LAUNCHES, 2019–2022

10.8.2 DEALS

TABLE 95 DEALS, 2020–2022

11 COMPANY PROFILES (Page No. - 125)

(Business overview, Products offered, Recent developments & MnM View)*

11.1 MAJOR PLAYERS

11.1.1 CITRIX SYSTEMS

TABLE 96 CITRIX SYSTEMS: BUSINESS OVERVIEW

FIGURE 31 CITRIX SYSTEMS: FINANCIAL OVERVIEW

TABLE 97 CITRIX SYSTEMS: PRODUCTS OFFERED

TABLE 98 CITRIX SYSTEMS: PRODUCT LAUNCHES

TABLE 99 CITRIX SYSTEMS: DEALS

11.1.2 VMWARE

TABLE 100 VMWARE: BUSINESS OVERVIEW

FIGURE 32 VMWARE: FINANCIAL OVERVIEW

TABLE 101 VMWARE: PRODUCTS OFFERED

TABLE 102 VMWARE: PRODUCT LAUNCHES

TABLE 103 VMWARE: DEALS

11.1.3 MICROSOFT

TABLE 104 MICROSOFT: BUSINESS OVERVIEW

FIGURE 33 MICROSOFT: FINANCIAL OVERVIEW

TABLE 105 MICROSOFT: PRODUCTS OFFERED

TABLE 106 MICROSOFT: PRODUCT LAUNCHES

TABLE 107 MICROSOFT: DEALS

11.1.4 ORACLE

TABLE 108 ORACLE: BUSINESS OVERVIEW

FIGURE 34 ORACLE: FINANCIAL OVERVIEW

TABLE 109 ORACLE: PRODUCTS OFFERED

TABLE 110 ORACLE: PRODUCT LAUNCHES

TABLE 111 ORACLE: DEALS

11.1.5 IBM

TABLE 112 IBM: BUSINESS OVERVIEW

FIGURE 35 IBM: FINANCIAL OVERVIEW

TABLE 113 IBM: PRODUCTS OFFERED

TABLE 114 IBM: DEALS

11.1.6 CISCO SYSTEMS

TABLE 115 CISCO SYSTEMS: BUSINESS OVERVIEW

FIGURE 36 CISCO SYSTEMS: FINANCIAL OVERVIEW

TABLE 116 CISCO SYSTEMS: PRODUCTS OFFERED

TABLE 117 CISCO SYSTEMS: PRODUCT LAUNCHES

TABLE 118 CISCO SYSTEM: DEALS

11.1.7 HUAWEI

TABLE 119 HUAWEI: BUSINESS OVERVIEW

FIGURE 37 HUAWEI: FINANCIAL OVERVIEW

TABLE 120 HUAWEI: PRODUCTS OFFERED

TABLE 121 HUAWEI: PRODUCT LAUNCHES

TABLE 122 HUAWEI: DEALS

11.1.8 KYNDRYL HOLDINGS

TABLE 123 KYNDRYL HOLDINGS: BUSINESS OVERVIEW

FIGURE 38 KYNDRYL HOLDINGS: FINANCIAL OVERVIEW

TABLE 124 KYNDRYL HOLDINGS: PRODUCTS OFFERED

TABLE 125 KYNDRYL HOLDINGS: DEALS

11.1.9 DXC TECHNOLOGY

TABLE 126 DXC TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 39 DXC TECHNOLOGY: FINANCIAL OVERVIEW

TABLE 127 DXC TECHNOLOGY: PRODUCTS OFFERED

TABLE 128 DXC TECHNOLOGY: PRODUCT LAUNCHES

TABLE 129 DXC TECHNOLOGY: DEALS

11.1.10 NTT DATA

TABLE 130 NTT DATA: BUSINESS OVERVIEW

FIGURE 40 NTT DATA: FINANCIAL OVERVIEW

TABLE 131 NTT DATA: PRODUCTS OFFERED

TABLE 132 NTT DATA: PRODUCT LAUNCHES

TABLE 133 NTT DATA: DEALS

11.1.11 AWS

TABLE 134 AWS: BUSINESS OVERVIEW

FIGURE 41 AWS: FINANCIAL OVERVIEW

TABLE 135 AWS: PRODUCTS OFFERED

TABLE 136 AWS: PRODUCT LAUNCHES

TABLE 137 AWS: DEALS

11.1.12 SOFTCHOICE

TABLE 138 SOFTCHOICE: BUSINESS OVERVIEW

FIGURE 42 SOFTCHOICE: FINANCIAL OVERVIEW

TABLE 139 SOFTCHOICE: PRODUCTS OFFERED

TABLE 140 SOFTCHOICE: DEALS

11.1.13 NUTANIX

11.1.14 PURE STORAGE

11.1.15 NETAPP

11.1.16 IVANTI

11.1.17 NASSTAR

11.1.18 DATACOM

11.1.19 HEWLETT PACKARD ENTERPRISE (HPE)

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

11.2 STARTUP/SMES PLAYERS

11.2.1 NCOMPUTING

11.2.2 EVOLVE IP

11.2.3 ERICOM SOFTWARE

11.2.4 PARALLELS

11.2.5 V2 CLOUD

11.2.6 KASM

11.2.7 ITOPIA

11.2.8 CLEARCUBE

11.2.9 ADAR

11.2.10 SYSTANCIA

11.2.11 HIVEIO

12 ADJACENT/RELATED MARKETS (Page No. - 184)

12.1 APPLICATION VIRTUALIZATION MARKET

12.1.1 MARKET DEFINITION

12.1.2 MARKET OVERVIEW

12.1.3 APPLICATION VIRTUALIZATION MARKET, BY COMPONENT

TABLE 141 APPLICATION VIRTUALIZATION MARKET, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 142 APPLICATION VIRTUALIZATION MARKET, BY SOLUTION TYPE, 2016–2023 (USD MILLION)

TABLE 143 APPLICATION VIRTUALIZATION MARKET, BY SERVICE TYPE, 2016–2023 (USD MILLION)

12.1.4 APPLICATION VIRTUALIZATION MARKET, BY DEPLOYMENT TYPE

12.1.5 APPLICATION VIRTUALIZATION MARKET, BY ORGANIZATION SIZE

TABLE 144 APPLICATION VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

12.1.6 APPLICATION VIRTUALIZATION MARKET, BY VERTICAL

TABLE 145 APPLICATION VIRTUALIZATION MARKET, BY VERTICAL, 2016–2023 (USD MILLION)

12.1.7 APPLICATION VIRTUALIZATION MARKET, BY REGION

TABLE 146 APPLICATION VIRTUALIZATION MARKET, BY REGION, 2016–2023 (USD MILLION)

12.2 DATA VIRTUALIZATION MARKET

12.2.1 MARKET DEFINITION

12.2.2 MARKET OVERVIEW

12.2.3 DATA VIRTUALIZATION MARKET, BY COMPONENT

TABLE 147 DATA VIRTUALIZATION MARKET, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 148 STANDALONE SOFTWARE: DATA VIRTUALIZATION MARKET, BY DEPLOYMENT MODE, 2015–2022 (USD MILLION)

TABLE 149 DATA INTEGRATION SOLUTION: DATA VIRTUALIZATION MARKET, BY DEPLOYMENT MODE, 2015–2022 (USD MILLION)

TABLE 150 APPLICATION TOOL SOLUTION: DATA VIRTUALIZATION MARKET, BY DEPLOYMENT MODE, 2015–2022 (USD MILLION)

12.2.4 DATA VIRTUALIZATION MARKET, BY DEPLOYMENT MODE

TABLE 151 DATA VIRTUALIZATION MARKET, BY DEPLOYMENT MODE, 2015–2022 (USD MILLION)

12.2.5 DATA VIRTUALIZATION MARKET, BY ORGANIZATION SIZE

TABLE 152 DATA VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

12.2.6 DATA VIRTUALIZATION MARKET, BY DATA CONSUMER

TABLE 153 DATA VIRTUALIZATION MARKET, BY DATA CONSUMER, 2015–2022 (USD MILLION)

12.2.7 DATA VIRTUALIZATION MARKET, BY VERTICAL

TABLE 154 DATA VIRTUALIZATION MARKET, BY VERTICAL, 2015–2022 (USD MILLION)

12.2.8 DATA VIRTUALIZATION MARKET, BY REGION

TABLE 155 DATA VIRTUALIZATION MARKET, BY REGION, 2015–2022 (USD MILLION)

12.3 DATA CENTER VIRTUALIZATIONS MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 DATA CENTER VIRTUALIZATIONS MARKET, BY TYPE

TABLE 156 DATA CENTER VIRTUALIZATIONS MARKET, BY TYPE, 2015–2022 (USD MILLION)

12.3.4 DATA CENTER VIRTUALIZATIONS MARKET, BY ORGANIZATION SIZE

TABLE 157 DATA CENTER VIRTUALIZATIONS MARKET, BY ORGANIZATION SIZE, 2015–2022 (USD MILLION)

12.3.5 DATA CENTER VIRTUALIZATIONS MARKET, BY VERTICAL

TABLE 158 DATA CENTER VIRTUALIZATIONS MARKET, BY VERTICAL, 2015–2022 (USD MILLION)

12.3.6 DATA CENTER VIRTUALIZATIONS MARKET, BY REGION

TABLE 159 DATA CENTER VIRTUALIZATIONS MARKET, BY REGION, 2015–2022 (USD MILLION)

13 APPENDIX (Page No. - 194)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

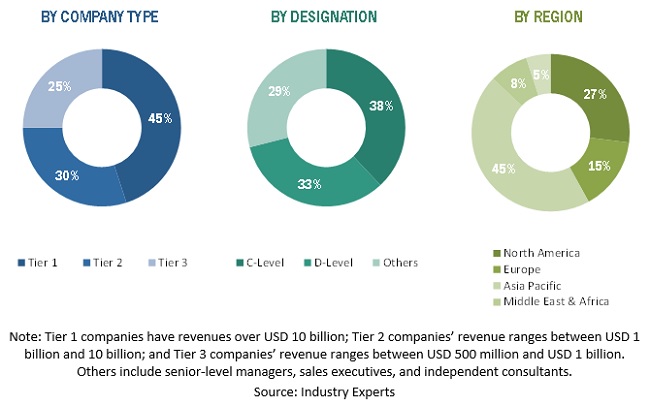

The study involved four major activities in estimating the current size of the desktop virtualization market. Exhaustive secondary research was done to collect information on the lending industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the desktop virtualization market.

Secondary Research

In the secondary research process, various secondary sources were referred to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation, and key developments in the market. The secondary sources included annual reports, press releases of various companies Citrix systems, VMware, Microsoft, Cisco Systems, among others, white papers, journals, and certified publications and articles from recognized authors, directories, and databases, such as Trusted Magazine (by Trusted Advisors Group), Customer Experience Magazine, and The European Magazine, investor presentations of companies, associations, and government publishing sources.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the desktop virtualization market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand side and supply side players across five major regions, namely North America, Europe, Asia Pacific, Middle East and Africa and Latin America. Approximately 70% and 30% of primary interviews have been conducted from demand and supply side, respectively. Primary data has been collected through questionnaires email, and telephonic interviews. In the canvassing of primaries, various organizations, such as sales. Operations, and administration, were covered to provide holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has lead us to the findings as described in the remainder of this report

Breakdown of Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Desktop Virtualization Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global desktop virtualization market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the desktop virtualization market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (solutions and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

Desktop virtualization market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global Desktop virtualization market based on type, organization size, verticals, and regions from 2022 to 2027, and analyze various macro and microeconomic factors that affect the market growth

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA).

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

- To analyze the impact of COVID-19 on the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the desktop virtualization market.

- To profile key market players (top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments, such as mergers and acquisitions, a new product launched and product developments, partnerships, agreements, and collaborations, business expansions, and Research & Development (R&D) activities, in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Desktop Virtualization Market