Medical Imaging Workstations Market by Component (CPU, Hardware, Image Software), Modality (CT, MRI, Mammography), Application (Clinical Review, Diagnostic Imaging, 3D Imaging), Specialty, and Region - Global Forecasts to 2023

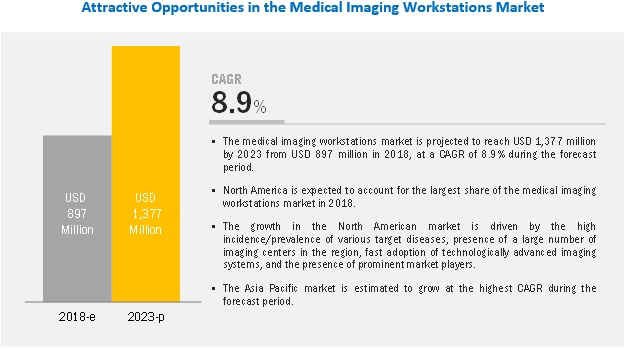

The medical imaging workstations market is projected to reach USD 1,377 million by 2023, growing at a CAGR of 8.9%. Factors such as the rising global burden of target diseases, increased product commercialization, rising public-private investments to support product development, evolving user preference for digital platforms, and the establishment of new medical facilities are driving the growth of the global market.

By usage mode, thin client workstations to account for the largest share of the medical imaging workstations market in 2018

On the basis of usage mode, the market is segmented into thick client workstations and Thin Client workstations. The thin client workstations segment is expected to account for a larger share of the market in 2018. Factors such as the increasing need for early and effective patient diagnosis (coupled with provider emphasis on greater workflow efficiency) and the growing preference for remote and multimodal patient monitoring are the major factors driving the demand for thin client workstations.

Diagnostic imaging workstations to dominate the market, by application, in 2018

On the basis of application, the medical imaging workstations industry is segmented into diagnostic imaging, clinical review, and advanced imaging workstations. The diagnostic imaging workstations segment is expected to account for the largest share of the market in 2018 due to the ongoing market transition from 2D to 3D clinical diagnostics and the greater integration of healthcare infrastructure with PACS, cloud-based solutions, and thin-client platforms across mature countries.

Oncology segment to account for the largest share of the medical imaging workstations market, by clinical specialty, in 2018

Based on clinical specialty, the market is segmented into general imaging/radiology, oncology, cardiology, obstetrics and gynecology, mammography, orthopedics, urology, and other clinical specialties. The oncology segment is expected to account for the largest share of the market in 2018 due to the growing need for the early and effective cancer diagnosis & treatment, coupled with the greater usage of multimodal diagnosis for the accurate clinical assessment of cancer. The rising burden of cancer across major healthcare markets, ongoing commercialization of oncology-specific medical imaging workstations, and the robust research ecosystem aimed at the development of novel cancer diagnosis & treatment strategies are some of the factors supporting the growth of this market segment.

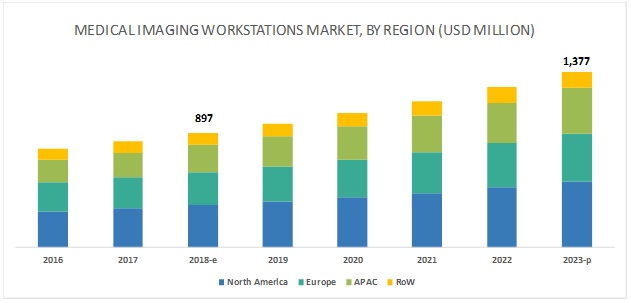

North America to account for the largest share of the medical imaging workstations market in 2018

This report covers the market across four major geographies, namely, North America, Europe, the Asia Pacific, and the Rest of the World (RoW). North America is expected to command the largest share of the market in 2018. This can be attributed to factors such as the high incidence/prevalence of various target diseases, presence of a large number of imaging centers, fast adoption of technologically advanced imaging systems, and the presence of prominent market players in this region.

General Electric Company (US), Koninklijke Philips N.V. (Netherlands), Siemens AG (Germany), Fujifilm Holdings Corporation (Japan), Canon Medical Systems Corporation (Japan), Carestream Health (US), Hologic (US), Carl Zeiss Meditec AG (Germany), Accuray Incorporated (US), Capsa Healthcare (US), Ampronix (US), Medicor Imaging (US), NGI Group (France), Alma IT Systems (Spain), and Pie Medical Imaging (Netherlands) are the major players operating in the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD million) |

|

Segments covered |

Modality, Component, Usage Mode, Clinical Specialty, Application, and Region |

|

Geographies covered |

North America, Europe, the Asia Pacific, and the Rest of the World |

|

Companies covered |

15 major players have been covered, including General Electric Company (US), Philips (Netherlands), Siemens AG (Germany), FUJIFILM Holdings Corporation (Japan), and Canon Medical Systems (Japan) |

This report has segmented the global market based on modality, component, usage mode, clinical specialty, application, and region.

Global Medical Imaging Workstations Market, by Modality

- Magnetic Resonance Imaging

- Computed Tomography

- Ultrasound

- Mammography

- Other Modalities (X-ray, angiography, radiotherapy, and nuclear imaging systems, among others)

Global Market, by Component

- Visualization Software

- Display Units

- Display Controller Cards

- Central Processing Units

Global Market, by Usage Mode

- Thin Client Workstations

- Thick Client Workstations

Global Medical Imaging Workstations Market, by Application

- Diagnostic Imaging

- Clinical Review

- Advanced Imaging

Global Market, by Clinical Specialty

- Oncology

- Cardiology

- General Imaging/Radiology

- Obstetrics and Gynecology

- Orthopedics

- Mammography

- Urology

- Other Clinical Specialties (hepatology, neurology, dentistry, bariatric surgery, respiratory care, and emergency care, among others)

Global Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific (RoAPAC)

- Rest of the World (RoW)

Medical Imaging Workstations Market : Recent Developments

- In March 2018, Fujifilm (Japan) launched ASPIRE Bellus II and version 6.4. Synapse VNA (which is an enterprise-wide medical information and image management solution for the support of DICOM web services).

- In May 2017, Siemens (Germany) and Heart Imaging Technologies, LLC (HeartIT, US) entered into a sales contract to sell HeartIT’s Precession cardiovascular magnetic resonance (CMR) workflow solution in the US and in European countries.

- In August 2017, Carl Zeiss Meditec (Germany) acquired Veracity Innovations, LLC (US) to focus on advancing digitalization in medical technology and expanding its digital solutions for eye care.

Medical Imaging Workstations Market : Key Questions Addressed in This Report

- What are the strategies adopted by the top market players to penetrate across emerging regions with their single-modal and multi-modal workstation products?

- Who are the major players offering multi-modal medical imaging workstations across major geographies?

- What revenue impact will visualization software have in the market during the forecast period?

- What are the emerging clinical specialties extensively using medical imaging workstation platforms; who are the major/emerging players in this space?

- In the next 5 years, what will be the market position for thin client workstations?

- What is the adoption pattern for advanced imaging workstations across the globe?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency Used for the Study

1.5 Market Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Research

2.1.2 Primary Research

2.2 Market Estimation Methodology

2.2.1 Revenue-Based Market Estimation

2.2.2 Usage Pattern-Based Market Estimation

2.2.3 Primary Research Validation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Medical Imaging Workstations: Market Overview

4.2 Medical Imaging Workstations Market, By Modality, 2018 (USD Million)

4.3 Medical Imaging Workstations Market, By Component, 2018 vs 2023, (USD Million)

4.4 Medical Imaging Workstations Market, By Usage Mode, 2018 vs 2023 (USD Million)

4.5 Medical Imaging Workstations Market, By Application, 2018 vs 2023 (USD Million)

4.6 Medical Imaging Workstations Market, By Clinical Specialties, 2018 vs 2023 (USD Million)

4.7 Medical Imaging Workstations Market: Geographical Snapshot

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Global Burden of Target Diseases

5.2.1.2 Increased Product Commercialization

5.2.1.3 Rising Investments to Support Product Development

5.2.1.4 Growing Adoption of Medical Imaging Workstations

5.2.1.5 Evolving User Preference for Digital Platforms

5.2.1.6 Establishment of New Medical Facilities

5.2.2 Restraints

5.2.2.1 Premium Product Pricing

5.2.3 Opportunities

5.2.3.1 Integration of AI and Cloud-Based Technologies in the Medical Imaging Workflow

5.2.3.2 Untapped Emerging Markets

5.2.4 Challenges

5.2.4.1 Dearth of Trained Personnel and Lack of Awareness

6 Medical Imaging Workstations Market, By Modality (Page No. - 47)

6.1 Introduction

6.2 Magnetic Resonance Imaging

6.2.1 Increasing Interdepartmental Diagnostic Workflows for Effective Resource Management to Drive the Market Growth

6.3 Computed Tomography

6.3.1 Greater Integration of CT Workflows With Advanced Imaging Software & Pacs to Drive Market Growth

6.4 Ultrasound

6.4.1 Development of Contrast-Enhanced Ultrasound Imaging for Specific Applications to Drive Market Growth

6.5 Mammography

6.5.1 Increasing Number of Breast Imaging Procedures to Drive the Demand for Mammography Equipments

6.6 Other Medical Imaging Modalities

7 Medical Imaging Workstations Market, By Component (Page No. - 61)

7.1 Introduction

7.2 Visualization Software

7.2.1 Increasing Focus on Commercialization of Advanced Image Visualization & Analysis Software to Support Market Growth

7.3 Display Units

7.3.1 Increased Availability of Innovative Display Systems to Drive the Adoption of Medical Display Units

7.4 Display Controller Cards

7.4.1 Display Controllers Offer Remote Monitoring and Video Controlling Capabilities in the Field of Diagnostic Imaging

7.5 Central Processing Units

7.5.1 Enhanced Data Processing Capabilities and Device Miniaturization to Impact Usage of Novel CPU Platforms in Diagnostic Imaging

8 Medical Imaging Workstations Market, By Usage Mode (Page No. - 67)

8.1 Introduction

8.2 Thin Client Workstations

8.2.1 Increasing Preference for Remote-Access and Multimodal Patient Monitoring to Drive the Adoption of Thin Client Workstations

8.3 Thick Client Workstations

8.3.1 Localized Data Storage, Fast Data Retrieval, and Real-Time Data Validation Capabilities to Drive the Overall Market Demand

9 Medical Imaging Workstations Market, By Application (Page No. - 71)

9.1 Introduction

9.2 Diagnostic Imaging

9.2.1 Integration of 3D Imaging & Thin-Client Platforms With Diagnostic Workflow to Replicate Into Higher Market Demand

9.3 Clinical Review

9.3.1 Increasingly Patient-Centric Regulations to Drive Greater Workstation Usage Among Researchers and Academia

9.4 Advanced Imaging

9.4.1 Growing Adoption of 3D and Multimodal Patient Diagnostics to Result in Effective and Early Clinical Diagnosis

10 Medical Imaging Workstations Market for Clinical Specialties, By Type (Page No. - 76)

10.1 Introduction

10.2 Oncology

10.2.1 Growing Market Need for Early & Effective Cancer Diagnosis Will Drive the Growth of This Segment

10.3 Cardiology

10.3.1 Growing Adoption of Remote-Access & Multimodal Diagnostic Imaging to Drive the Cardiology Market

10.4 General Imaging/Radiology

10.4.1 Increased Installation Base of 3D/4D Imaging Platforms for Radiology Procedures to Drive the Market Growth

10.5 Obstetrics & Gynecology

10.5.1 Greater Workflow Optimization & Growing Adoption of Enterprise-Wide Platforms to Drive the Market Growth

10.6 Orthopedics

10.6.1 Installation of Pacs-Integrated & Remote-Access Diagnostic Workstations is Growing Across Target End Users

10.7 Breast Health

10.7.1 Rising Adoption of Digital Mammography Across Major Countries to Drive the Growth of This Segment

10.8 Urology

10.8.1 Ongoing Commercialization of Urology Workstations Across Major Countries: A Key Market Driver

10.9 Other Clinical Specialties

11 Medical Imaging Workstations Market, By Region (Page No. - 87)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Rising Market Demand for Early and Effective Disease Diagnosis to Impact the Market Demand for Novel Diagnostic Methodologies

11.2.2 Canada

11.2.2.1 Increased Installation of Advanced Imaging Platforms to Boost the Usage of Image Analysis Software in the Country

11.3 Europe

11.3.1 Germany

11.3.1.1 Strong End User Base and Increased Integration of Diagnostic Platforms With Pacs to Drive the Overall Market Demand

11.3.2 UK

11.3.2.1 Increasing Penetration of Major Market Players in the UK to Drive Market Growth

11.3.3 France

11.3.3.1 France has the Second-Highest Cancer Rate Globally—A Major Driving Factor for the Oncology Workstations Market

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 Japan

11.4.1.1 Highest Per Capita Installed Base for MRI and CT Coupled With Technology Advancements to Drive Overall Market Demand

11.4.2 China

11.4.2.1 Increased Government Initiatives to Modernize & Expand Healthcare Infra to Drive the Demand for Imaging Workstations

11.4.3 India

11.4.3.1 Rising Number of Diagnostic Centers Coupled With Greater Availability of Novel Imaging Platforms to Drive the Market Demand

11.4.4 Rest of Asia Pacific

11.5 Rest of the World

12 Competitive Landscape (Page No. - 115)

12.1 Introduction

12.2 Global Medical Imaging Workstations Market Share Analysis (2017)

12.3 Competitive Scenario

12.4 Vendor Dive Overview

12.4.1 Vendor Inclusion Criteria

12.4.2 Vendor Dive Matrix

12.4.2.1 Vanguards

12.4.2.2 Innovators

12.4.2.3 Dynamic Players

12.4.2.4 Emerging Companies

13 Company Profiles (Page No. - 121)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

13.1 Accuray Incorporated

13.2 Alma Medical Imaging (Part of Alma It Systems)

13.3 Ampronix

13.4 Canon

13.5 Capsa Solutions LLC

13.6 Carestream Health (A Part of ONEX Corporation)

13.7 Carl-Zeiss Meditec AG

13.8 Fujifilm Holdings Corporation

13.9 General Electric Company

13.10 Hologic

13.11 Koninklijke Philips N.V.

13.12 Medicor Imaging (A Part of Lead Technologies)

13.13 NGI Group

13.14 PIE Medical Imaging B.V. (Part of PIE Medical N.V)

13.15 Siemens AG

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 149)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (84 Tables)

Table 1 Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 2 Medical Imaging Workstations Market for Magnetic Resonance Imaging, By Region, 2016–2023 (USD Million)

Table 3 Medical Imaging Workstations Market for Magnetic Resonance Imaging, By Component, 2016–2023 (USD Million)

Table 4 Medical Imaging Workstations Market for Magnetic Resonance Imaging, By Usage Mode, 2016–2023 (USD Million)

Table 5 Medical Imaging Workstations Market for Magnetic Resonance Imaging, By Application, 2016–2023 (USD Million)

Table 6 Medical Imaging Workstations Market for Magnetic Resonance Imaging, By Clinical Specialties, 2016–2023 (USD Million)

Table 7 Medical Imaging Workstations Market for Computed Tomography, By Region, 2016–2023 (USD Million)

Table 8 Medical Imaging Workstations Market for Computed Tomography, By Component, 2016–2023 (USD Million)

Table 9 Medical Imaging Workstations Market for Computed Tomography, By Usage Mode, 2016–2023 (USD Million)

Table 10 Medical Imaging Workstations Market for Computed Tomography, By Application, 2016–2023 (USD Million)

Table 11 Medical Imaging Workstations Market for Computed Tomography, By Clinical Specialties, 2016–2023 (USD Million)

Table 12 Medical Imaging Workstations Market for Ultrasound Market, By Region, 2016–2023 (USD Million)

Table 13 Medical Imaging Workstations Market for Ultrasound, By Component, 2016–2023 (USD Million)

Table 14 Medical Imaging Workstations Market for Ultrasound, By Usage Mode, 2016–2023 (USD Million)

Table 15 Medical Imaging Workstations Market for Ultrasound, By Application, 2016–2023 (USD Million)

Table 16 Medical Imaging Workstations Market for Ultrasound, By Clinical Specialties, 2016–2023 (USD Million)

Table 17 Medical Imaging Workstations Market for Mammography, By Region, 2016–2023 (USD Million)

Table 18 Medical Imaging Workstations Market for Mammography, By Component, 2016–2023 (USD Million)

Table 19 Medical Imaging Workstations Market for Mammography, By Usage Mode, 2016–2023 (USD Million)

Table 20 Medical Imaging Workstations Market for Mammography, By Application, 2016–2023 (USD Million)

Table 21 Medical Imaging Workstations Market for Mammography, By Clinical Specialty, 2016–2023 (USD Million)

Table 22 Medical Imaging Workstations Market for Other Medical Imaging Modalities, By Region, 2016–2023 (USD Million)

Table 23 Medical Imaging Workstations Market for Other Medical Imaging Modalities, By Component, 2016–2023 (USD Million)

Table 24 Medical Imaging Workstations Market for Other Medical Imaging Modalities, By Usage Mode, 2016–2023 (USD Million)

Table 25 Medical Imaging Workstations Market for Other Medical Imaging Modalities, By Application, 2016–2023 (USD Million)

Table 26 Medical Imaging Workstations Market for Other Medical Imaging Modalities, By Clinical Specialties, 2016–2023 (USD Million)

Table 27 Medical Imaging Workstations Market, By Component, 2016–2023 (USD Million)

Table 28 Medical Imaging Workstations Market for Visualization Software, By Region, 2016–2023 (USD Million)

Table 29 Medical Imaging Workstations Market for Display Units, By Region, 2016–2023 (USD Million)

Table 30 Medical Imaging Workstations Market for Display Controller Cards, By Region, 2016–2023 (USD Million)

Table 31 Medical Imaging Workstations Market for Central Processing Units, By Region, 2016–2023 (USD Million)

Table 32 Medical Imaging Workstations Market, By Usage Mode, 2016–2023 (USD Million)

Table 33 Thin Client Medical Imaging Workstations Market, By Region, 2016–2023 (USD Million)

Table 34 Thick Client Medical Imaging Workstations Market, By Region, 2016–2023 (USD Million)

Table 35 Medical Imaging Workstations Market, By Application, 2016–2023 (USD Million)

Table 36 Diagnostic Imaging Workstations Market, By Region, 2016–2023 (USD Million)

Table 37 Clinical Review Workstations Market, By Region, 2016–2023 (USD Million)

Table 38 Advanced Imaging Workstations Market, By Region, 2016–2023 (USD Million)

Table 39 Medical Imaging Workstations Market, By Clinical Specialties, 2016–2023 (USD Million)

Table 40 Medical Imaging Workstations Market for Oncology, By Region, 2016–2023 (USD Million)

Table 41 Medical Imaging Workstations Market for Cardiology, By Region, 2016–2023 (USD Million)

Table 42 Medical Imaging Workstations Market for General Imaging/Radiology, By Region, 2016–2023 (USD Million)

Table 43 Medical Imaging Workstations Market for Obstetrics & Gynecology, By Region, 2016–2023 (USD Million)

Table 44 Medical Imaging Workstations Market for Orthopedics, By Region, 2016–2023 (USD Million)

Table 45 Medical Imaging Workstations Market for Breast Health, By Region, 2016–2023 (USD Million)

Table 46 Medical Imaging Workstations Market for Urology, By Region, 2016–2023 (USD Million)

Table 47 Medical Imaging Workstations Market for Other Clinical Specialties, By Region, 2016–2023 (USD Million)

Table 48 Medical Imaging Workstations Market, By Region, 2016–2023 (USD Million)

Table 49 North America: Medical Imaging Workstations Market, By Country, 2016–2023 (USD Million)

Table 50 North America: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 51 North America: Medical Imaging Workstations Market, By Component, 2016–2023 (USD Million)

Table 52 North America: Medical Imaging Workstations Market, By Usage Mode, 2016–2023 (USD Million)

Table 53 North America: Medical Imaging Workstations Market, By Application, 2016–2023 (USD Million)

Table 54 North America: Medical Imaging Workstations Market, By Clinical Specialties, 2016–2023 (USD Million)

Table 55 US: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 56 Canada: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 57 Europe: Medical Imaging Workstations Market, By Country, 2016–2023 (USD Million)

Table 58 Europe: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 59 Europe: Medical Imaging Workstations Market, By Component, 2016–2023 (USD Million)

Table 60 Europe: Medical Imaging Workstations Market, By Usage Mode, 2016–2023 (USD Million)

Table 61 Europe: Medical Imaging Workstations Market, By Application, 2016–2023 (USD Million)

Table 62 Europe: Medical Imaging Workstations Market, By Clinical Specialties, 2016–2023 (USD Million)

Table 63 Germany: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 64 UK: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 65 France: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 66 RoE: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 67 Asia Pacific: Medical Imaging Workstations Market, By Country, 2016–2023 (USD Million)

Table 68 Asia Pacific: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 69 Asia Pacific: Medical Imaging Workstations Market, By Component, 2016–2023 (USD Million)

Table 70 Asia Pacific: Medical Imaging Workstations Market, By Usage Mode, 2016–2023 (USD Million)

Table 71 Asia Pacific: Medical Imaging Workstations Market, By Application, 2016–2023 (USD Million)

Table 72 Asia Pacific: Medical Imaging Workstations Market, By Clinical Specialties, 2016–2023 (USD Million)

Table 73 Japan: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 74 China: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 75 India: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 76 RoAPAC: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 77 RoW: Medical Imaging Workstations Market, By Modality, 2016–2023 (USD Million)

Table 78 RoW: Medical Imaging Workstations Market, By Component, 2016–2023 (USD Million)

Table 79 RoW: Medical Imaging Workstations Market, By Usage Mode, 2016–2023 (USD Million)

Table 80 RoW: Medical Imaging Workstations Market, By Application, 2016–2023 (USD Million)

Table 81 RoW: Medical Imaging Workstations Market, By Clinical Specialties, 2016–2023 (USD Million)

Table 82 Major Product Launches, Approvals, and Enhancements (2015-2018)

Table 83 Major Agreements, Partnerships, and Collaborations (2015-2018)

Table 84 Major Acquisitions (2015-2018)

List of Figures (44 Figures)

Figure 1 Research Design

Figure 2 Key Data From Secondary Sources

Figure 3 Key Data From Primary Sources

Figure 4 Breakdown of Primaries

Figure 5 Research Methodology: Hypothesis Building

Figure 6 Medical Imaging Workstations Market Estimation: Overall Methodology

Figure 7 Data Triangulation

Figure 8 Assumptions of the Research Study

Figure 9 Medical Imaging Workstations Market, By Modality, 2018 vs 2023 (USD Million)

Figure 10 Medical Imaging Workstations Market, By Component, 2018 vs 2023 (USD Million)

Figure 11 Medical Imaging Workstations Market, By Usage Mode, 2018 vs 2023 (USD Million)

Figure 12 Medical Imaging Workstations Market, By Application, 2018 vs 2023 (USD Million)

Figure 13 Medical Imaging Workstations Market, By Clinical Specialties, 2018 vs 2023 (USD Million)

Figure 14 Medical Imaging Workstations Market: Geographical Snapshot

Figure 15 Evolving User Preference for Digital Platforms to Drive Market Growth

Figure 16 MRI Segment to Hold the Largest Share of the Medical Imaging Workstations Market in 2018

Figure 17 Visualization Software Segment is Estimated to Hold the Largest Share of the Medical Imaging Workstations Market During the Forecast Period

Figure 18 Thin Client Workstations Segment to Hold A Larger Market Share in Medical Imaging Workstations Industry as 0f 2018

Figure 19 Diagnostic Imaging Segment Will Hold the Largest Market Share During 2018–2023

Figure 20 Oncology to Dominate the Medical Imaging Workstations Market During the Forecast Period

Figure 21 China is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Medical Imaging Workstations Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Mangetic Resonance Imaging is Expected to Account for the Largest Share of the Medical Imaging Workstations Market During the Forecast Period

Figure 24 Visualization Software Segment is Expected to Account for the Largest Share of the Medical Imaging Workstations Market Till 2023

Figure 25 Thin Client Platforms to Cover Larger Market Share as Compared to Thick Client Imaging Workstations During the Study Period

Figure 26 Advanced Imaging to Offer Significant Growth Opportunity Among All Workstation Applications During the Forecast Period

Figure 27 Cardiology Segment Poised to Be the Fastest Growing Application Segment in Medical Imaging Workstation Industry Till 2023

Figure 28 Medical Imaging Workstations Market, By Region (2018–2023)

Figure 29 North America: Medical Imaging Workstations Market Snapshot (2018–2023)

Figure 30 Europe: Medical Imaging Workstations Market Snapshot (2018–2023)

Figure 31 Asia Pacific: Medical Imaging Workstations Market Snapshot (2018–2023)

Figure 32 RoW: Medical Imaging Workstations Market Snapshot (2018–2023)

Figure 33 Key Developments in the Medical Imaging Workstations Market, 2015–2018

Figure 34 Global Market Share Analysis, By Major Players (2017)

Figure 35 Competitive Leadership Mapping (Overall Market)

Figure 36 Accuray Incorporated: Company Snapshot (2018)

Figure 37 Canon Medical Systems Corporation: Company Snapshot (2017)

Figure 38 ONEX : Company Snapshot (2017)

Figure 39 Carl-Zeiss Meditec AG : Company Snapshot (2017)

Figure 40 Fujifilm Holdings Corporation: Company Snapshot (2017)

Figure 41 General Electric Company: Company Snapshot (2017)

Figure 42 Hologic: Company Snapshot (2017)

Figure 43 Koninklijke Philips N.V.: Company Snapshot (2017)

Figure 44 Siemens AG : Company Snapshot (2018)

This study involved four major activities to estimate the current size of the global medical imaging workstations market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was conducted to obtain key information about market classification and segmentation, geographical scenario, key developments undertaken by major market players, and the identification of key industry trends. The secondary sources used for this study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles from recognized websites, databases, and directories.

Primary Research

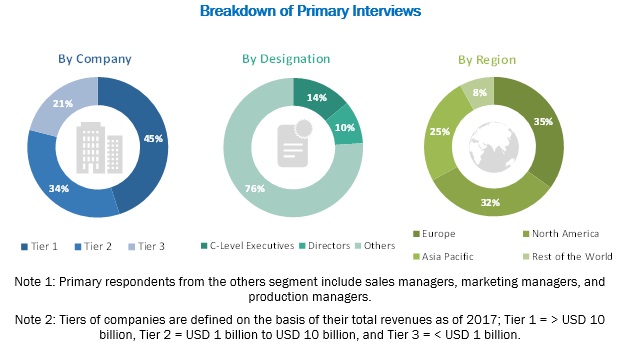

Extensive primary research was conducted after acquiring a preliminary understanding of the global medical imaging workstations market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as diagnostic centers, doctors, radiologists, medical diagnostic technicians, professors, and hospitals) and supply-side respondents (such as product manufacturers, software providers, suppliers, channel partners, and distributors) across four major geographies, namely, North America, Europe, the Asia Pacific, and the Rest of the World (Latin America, the Middle East, and Africa). Approximately 30% and 70% of primary interviews were conducted with both the demand- and supply-side respondents, respectively. The primary data was collected through questionnaires, e-mails, online surveys, and telephonic interviews. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

A detailed market estimation approach was followed to estimate and validate the size of the global medical imaging workstations market and other dependent submarkets.

- The key players in the global market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of the top market players as well as interviews with industry experts to gather key insights on various market segments and subsegments.

- All segmental shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources.

- The major macroindicators that affect market segments and subsegments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the quantitative and qualitative data.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation:

After deriving the overall market value data from the market size estimation process explained above, the total market value data was split into several segments and subsegments. Data triangulation and market breakdown were undertaken to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data was triangulated by studying various qualitative & quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macroindicators.

Report Objectives:

- To define, describe, and forecast the global market on the basis of modality, component, usage mode, clinical specialty, application, and region.

- To provide detailed information regarding the major factors influencing the global market (drivers, restraints, opportunities, and challenges).

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the global market.

- To analyze key growth opportunities in the global market for key stakeholders and provide details of the competitive landscape for key market players.

- To forecast the market value of various segments and/or subsegments with respect to four major regional segments North America (US, Canada), Europe (Germany, France, the UK, and the Rest of Europe), Asia Pacific (Japan, China, India, and the Rest of Asia Pacific), and the Rest of the World.

- To profile the key players in the global market and comprehensively analyze their market shares and core competencies.

- To track and analyze competitive developments undertaken by major players in the global market, such as product launches; agreements, partnerships, and collaborations; expansions; and mergers & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies in the market

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Imaging Workstations Market