Text-to-Video AI Market by Component (Software, Services), Deployment Mode, Organization Size, End User (Corporate Professionals, Content Creators), Vertical (Education, Media & Entertainment, Retail & eCommerce) and Region - Global Forecast to 2027

Text to Video AI Market Summary

The global text to video AI market size was valued at USD 0.1 billion in 2022 and is projected to reach USD 0.9 billion by 2027, growing at a CAGR of 37.1% during the forecast period. This growth is driven by rapid advancements in AI technologies, including deep learning and natural language processing (NLP), which are enabling broader adoption of text-to-video AI solutions.

Key Market Trends & Insights

- Industry Adoption: Food & Beverages segment is projected to grow at the fastest rate, leveraging text-to-video AI for visually appealing product advertisements and menu showcases to enhance customer engagement and reduce order times.

- Segment Leadership: Software segment is set to hold the largest market share, driven by AI-powered solutions that convert text or audio into character-centric videos with advanced editing options and multilingual support.

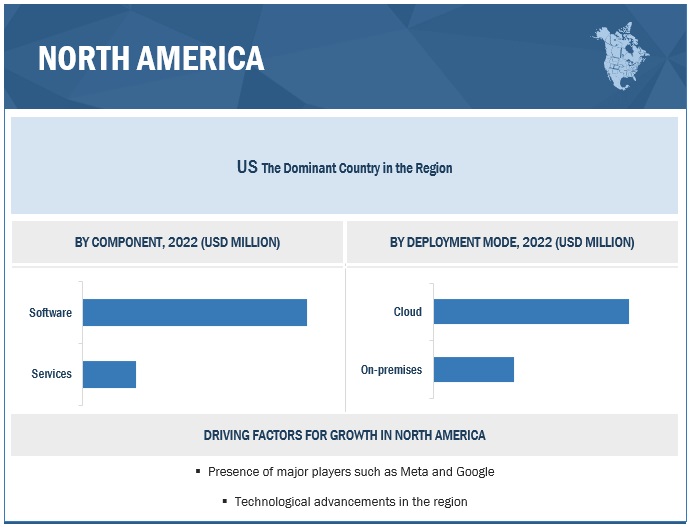

- Regional Dominance: North America is expected to account for the largest market share, supported by strong technology infrastructure, established copyright protections, and presence of major players such as Meta and Google.

Market Size & Forecast

- 2022 Market Size: USD 0.1 Billion

- 2027 Projected Market Size: USD 0.9 Billion

- CAGR (2022–2027): 37.1%

- Largest Market in 2022: North America

To know about the assumptions considered for the study, Request for Free Sample Report

Text to Video AI Market Dynamics

Driver: Realistic AI avatars to add social components to videos and make them dynamic

Video has become an important tool for increasing customer engagement and retention. Text-to-video AI solution providers such as Synthesia and Movio provide options to choose among multiple AI avatars. These avatars can speak the provided text in more than 120 languages and accents. These avatars are broad and diverse and cover different ages, ethnicities, races, and styles. The latest features, such as micro gestures, allow users to add various gestures to the avatars and make them wink, nod, frown, or raise an eyebrow. These videos are used for various purposes, such as learning and training videos, product walkthrough videos, corporate communications, and marketing. An AI-powered talking avatar draws customer attention and engages them.

Restraint: Ethical implications

ML approaches such as deepfakes are used to generate synthetic media such as images, videos, and audio. It becomes difficult or almost impossible to differentiate such AI-generated content from real media. Hence, posing serious ethical implications. Such media may be used to spread misinformation, manipulate public opinion, or even harass or defame individuals. A deepfake video pretending to show a political candidate saying or doing something that did not happen could manipulate public opinion and interfere with the democratic process.

Opportunity: Availability of applications in multiple languages to save on voiceover budgets

AI video generators help users create videos by applying minimum effort and cost, making it the best choice for businesses with tight budgets. The generation of text-to-video is a synthetic video generation form that utilizes NLP to convert written input into digital animation. Text-to-video AI software helps to convert plain text into videos in a fraction of a minute. This software helps create videos with high-quality content in multiple languages and saves up to 80% of time and budget without compromising on quality. The software provides AI voices that are digital clones of the voices of real people. So, it helps users convert text into professional voiceovers with consistent audio quality and language.

Challenge: High computing costs and lack of good datasets

Text-to-video AI software requires a vast amount of computing power and has high computation costs making training from scratch nearly unaffordable. They need an even bigger computational lift compared to large AI models. These models use a large amount of data to train, as they need to put the data together for just one short video. Only large enterprises can afford to build these types of systems for the predictable future. It becomes trickier to train those models due to the lack of large-scale data sets of high-quality videos paired with text.

Food & Beverages segment is projected to grow at the fastest rate during the forecast period.

Food & beverages form one of the fastest-growing industries in video content, so this industry can benefit from text-to-video AI. Using text-to-video AI, many companies can use advertise their products as videos are attractive. The videos bring out actual colors, consistency and visuals of the food and dishes. The text-to-video AI helps showcase the list of products available on the menu, which helps customers decide on the order, thus reducing order time per customer. Videos help food and beverage brands connect directly with their customers, thus making a positive image in the market to increase sales and compete.

Software segment is set to account for the largest market share during the forecast period

The text-to-video AI software tools are AI-powered solutions designed to convert raw input texts or even audio into animated character-centric video content. These solutions provide many features with options to select from various AI avatars, multiple languages, different voices, intended music, built-in video templates, transition effects and up-to-date editing options to generate high-quality videos.

North America to account for the largest market share during the forecast period

North America includes developed countries such as US and Canada with well-established infrastructures. It is expected to hold the largest global text-to-video AI market share. There are Copyright Acts in the US and Canada to protect the original work of the creators. No amendments are proposed for the upcoming creative work using technologies such as generative AI, ML and big data. These technology tools carry risks, and there can be action from the government in the form of regulations for the protection of the content generated with these technologies. North America consists of major players such as Meta and Google, which have released products related to AI video generation.

To know about the assumptions considered for the study, download the pdf brochure

Top Companies in Text to Video AI Market

The text to video AI market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global text-to-video AI market are

- GliaCloud (Taiwan)

- Designs.ai (Singapore)

- Pictory (US)

- Raw Shorts (US)

- Wochit (US)

- Vimeo (US)

- Vedia (US)

- Lumen5 (Canada)

- Synthesia (UK)

- Steve AI (US)

- InVideo (US)

- Meta (US)

- Hour One (Israel)

- Google (US)

- Elai.io (US)

The study includes an in-depth competitive analysis of these key players in the text-to-video AI market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By component, deployment mode, organization size, end user, vertical and region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

GliaCloud (Taiwan), Designs.ai (Singapore), Pictory (US), Raw Shorts (US), Wochit (US), Vimeo (US), Vedia (US), Lumen5 (Canada), Synthesia (UK), Steve AI (US), InVideo (US), Meta (US), Hour One (Israel), Google (US), Elai.io (US), Peech (Israel), Wave.video (US), DeepBrain AI (South Korea), D-ID (Israel), Yepic AI (UK), Movio (US), KLleon (South Korea), Synthesys (UK), VEED (UK), and Ezoic (US) |

This research report categorizes the text to video AI market to forecast revenues and analyze trends in each of the following subsegments:

By Component

- Software

-

Services

- Consulting Services

- Integration Services

- Support and Maintenance Services

By Deployment Mode

- On-premises

- Cloud

By Organization Size

- Large Enterprises

- Small- & Medium-Sized Enterprises

By End User

- Marketers

- Social Media Managers

- Educators & Course Creators

- Content Creators

- Corporate Professionals

- Other End Users

By Vertical

- Education

- Food & Beverages

- Media & Entertainment

- Fashion & Beauty

- Retail & Ecommerce

- Health & Wellness

- Travel & Hospitality

- Real Estate

- Other Verticals

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Nordic Region

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

- Middle East and Africa

-

Middle East

- UAE

- KSA

- Rest of Middle East

-

Africa

- South Africa

- Egypt

- Nigeria

- Rest of Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments in Text to Video AI Market:

- In March 2022, Vimeo acquired the interactive video platform Wirewax. With this acquisition, Wirewax would offer more interactive video functionality to Vimeo, particularly with a drag-and-drop interface and the addition of “shoppable” videos, which Wirewax frequently promoted.

- In March 2022, InVideo acquired the website KIZOA. InVideo bought the website KIZOA, a 13-year-old video editing software platform with 18 million registered accounts to the web service worldwide. InVideo’s purchase of Kizoa increased its market share in the online video editor sector.

- In January 2020, Wochit partnered with Kaltura to offer Wochit video creation capabilities to Kaltura customers.

Frequently Asked Questions (FAQ):

How big is the global text to video AI market?

What is growth rate of the text to video AI market?

What are the key trends affecting the global text to video AI market?

Who are the key players in text to video AI market?

What is the text to video AI market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Inclusion of data-driven videos on websites to boost conversion rates- Realistic AI avatars to add social components to videos and make them dynamic- Rise in demand for engaging videos in businessesRESTRAINTS- Ethical implications- Truthfulness and accuracyOPPORTUNITIES- Availability of applications in multiple languages to save on voiceover budgets- Higher adoption of AI video generation to increase revenue on OTT, DOOH, and CTV platformsCHALLENGES- High computing costs and lack of good datasets

-

5.3 INDUSTRY TRENDSVALUE CHAIN ANALYSISECOSYSTEMDISRUPTIONS IMPACTING BUYERS/CLIENTS IN TEXT-TO- VIDEO AI MARKETCASE STUDY ANALYSIS- Synthesia helped international consultancies create financial educational webinars in multiple languages- Cisco boosted engagement on digital channels using Lumen5- ALICE Receptionist offers AI-driven customer experience through expanded relationship with Hour One- PetroShore used Elai to make content reach wider audience- Youtuber used Pictory to create videos consistently in shorter timePRICING ANALYSIS- Average selling price of key players- Average selling price trendPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryTECHNOLOGY ANALYSIS- Natural language processing- Artificial intelligence- Big dataPATENT ANALYSIS- Methodology- Document types- Innovation and patent applicationsKEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaKEY CONFERENCES AND EVENTS

-

5.4 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Middle East & Africa- Latin America

-

6.1 INTRODUCTIONCOMPONENT: TEXT-TO-VIDEO AI MARKET DRIVERS

-

6.2 SOFTWAREAUTOMATION TO ASSIST VIDEO MAKING PROCESS THROUGH AI

-

6.3 SERVICESCONSULTING SERVICES- Consulting to help deploy right solutions in competitive marketINTEGRATION SERVICES- Integration to provide specialized services with tools, services, and knowledgeSUPPORT & MAINTENANCE SERVICES- Services to fulfill pre- and post-deployment needs

-

7.1 INTRODUCTIONDEPLOYMENT MODE: TEXT-TO-VIDEO AI MARKET DRIVERS

-

7.2 ON-PREMISESADVANCEMENTS IN IT INFRASTRUCTURE TO DRIVE ON-PREMISE SOLUTIONS

-

7.3 CLOUDSCALABILITY AND FLEXIBILITY OFFERED TO MONITOR NETWORK PERFORMANCE REMOTELY

-

8.1 INTRODUCTIONORGANIZATION SIZE: TEXT-TO-VIDEO AI MARKET DRIVERS

-

8.2 LARGE ENTERPRISESNEED TO UPSCALE EMPLOYEE TRAINING PROCESS TO DRIVE ADOPTION

-

8.3 SMALL- & MEDIUM-SIZED ENTERPRISESNEED TO CAPTURE CUSTOMER ATTENTION USING HIGH-PERFORMANCE VIDEO TOOLS

-

9.1 INTRODUCTIONEND USER: TEXT-TO-VIDEO AI MARKET DRIVERS

-

9.2 MARKETERSDEMAND FOR PROFESSIONAL-LOOKING VIDEOS CREATED INSTANTLY

-

9.3 SOCIAL MEDIA MANAGERSUSE OF AI VIDEO GENERATOR SOFTWARE TO BOOST ENGAGEMENT ON SOCIAL MEDIA

-

9.4 EDUCATORS & COURSE CREATORSINCREASED ONLINE EDUCATION THROUGH VIDEOS TO BOOST MARKET

-

9.5 CONTENT CREATORSDEMAND FOR CONTENT GENERATION WITH AI VIDEO CREATION TOOLS WITHOUT COMPROMISING ON QUALITY

-

9.6 CORPORATE PROFESSIONALSAI TO HELP INCREASE ENTERPRISE REVENUE AND BUILD CUSTOMER BASE

- 9.7 OTHER END USERS

-

10.1 INTRODUCTIONVERTICAL: TEXT-TO-VIDEO AI MARKET DRIVERS

-

10.2 EDUCATIONLEARNING TO BE MORE THROUGH VIDEOS THAN TEXTS

-

10.3 FOOD & BEVERAGESAI VIDEO GENERATORS TO ALLOW VISUALIZING MENU CARDS

-

10.4 MEDIA & ENTERTAINMENTAI TO ASSIST IN AUTOMATING VIDEO CONTENT GENERATION PROCESS

-

10.5 FASHION & BEAUTYSHORT VIDEOS TO REVIEW USER EXPERIENCE

-

10.6 RETAIL & ECOMMERCETEXT-TO-VIDEO AI TO PROVIDE PERSONALIZED USER EXPERIENCE

-

10.7 HEALTH & WELLNESSTEXT-TO-VIDEO AI TO PROVIDE HEALTH TIPS

-

10.8 TRAVEL & HOSPITALITYAI TO HELP VISUALIZE TEXT BLOGS OF TRAVELERS

-

10.9 REAL ESTATEAI TO HELP CONSUMERS VISUALIZE FEATURES OF PROPERTIES

- 10.10 OTHER VERTICALS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: PESTLE ANALYSISNORTH AMERICA: RECESSION IMPACTUS- Increase in use of generative AI to can encourage involvement of US governmentCANADA- Consultations to understand modern copyright framework for AI and IoT to pave way for market

-

11.3 EUROPEEUROPE: PESTLE ANALYSISEUROPE: RECESSION IMPACTUK- First generative AI skills training launched in UKGERMANY- Increase in AI startup companies in Germany to drive marketFRANCE- Technology advancements leading to increase in adoption of AI by FranceITALY- Growth in support from Italian government for AI adoption to bolster marketSPAIN- Increase in digital transformations in Spain to drive AI adoptionNORDIC REGION- Higher adoption of AI-enabled solutions by companies in Nordic region to fuel marketREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: PESTLE ANALYSISASIA PACIFIC: RECESSION IMPACTCHINA- Entrepreneurs and investors to look forward to entering generative AI space detectionINDIA- Evolving generative AI technologies to augment market in IndiaJAPAN- AI center in Japan to surpass limitations of current AI technologyAUSTRALIA & NEW ZEALAND- Government initiatives required to tackle privacy concerns regarding AISOUTHEAST ASIA- Rise in number of investments in AI startups in Southeast AsiaREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: PESTLE ANALYSISMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST- Generative AI to be gamechanger across Middle EastAFRICA- South Africa positioned as most technologically advanced African nation

-

11.6 LATIN AMERICALATIN AMERICA: PESTLE ANALYSISLATIN AMERICA: RECESSION IMPACTBRAZIL- Brazil to lead in adoption of advanced technologiesMEXICO- Rise in support for development of AI in MexicoREST OF LATIN AMERICA

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

- 12.4 HISTORICAL REVENUE ANALYSIS

- 12.5 COMPETITIVE BENCHMARKING

-

12.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 MAJOR PLAYERSVIMEO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINVIDEO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSYNTHESIA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHOUR ONE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWOCHIT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDESIGNS.AI- Business overview- Products/Solutions/Services offered- Recent developmentsSTEVE AI- Business overview- Products/Solutions/Services offered- Recent developmentsMETA- Business overview- Products/Solutions/Services offered- Recent developmentsGOOGLE- Business overview- Products/Solutions/Services offered- Recent developmentsDEEPBRAIN AI- Business overview- Products/Solutions/Services offered- Recent developmentsVEED- Business overview- Products/Solutions/Services offered- Recent developmentsEZOIC- Business overview- Products/Solutions/Services offered- Recent developmentsGLIACLOUDPICTORYRAW SHORTSLUMEN5ELAI.IOPEECHD-IDMOVIOYEPIC AIKLLEONSYNTHESYSWAVE.VIDEOVEDIA

- 14.1 INTRODUCTION

-

14.2 VIDEO ANALYTICS MARKETMARKET DEFINITIONMARKET OVERVIEWVIDEO ANALYTICS MARKET, BY COMPONENTVIDEO ANALYTICS MARKET, BY APPLICATIONVIDEO ANALYTICS MARKET, BY DEPLOYMENT MODELVIDEO ANALYTICS MARKET, BY TYPEVIDEO ANALYTICS MARKET, BY END USERVIDEO ANALYTICS MARKET, BY VERTICALVIDEO ANALYTICS MARKET, BY REGION

-

14.3 VIDEO MANAGEMENT SOFTWARE MARKETMARKET DEFINITIONMARKET OVERVIEWVIDEO MANAGEMENT SOFTWARE MARKET, BY COMPONENTVIDEO MANAGEMENT SOFTWARE MARKET, BY TECHNOLOGYVIDEO MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODEVIDEO MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZEVIDEO MANAGEMENT SOFTWARE MARKET, BY APPLICATIONVIDEO MANAGEMENT SOFTWARE MARKET, BY VERTICALVIDEO MANAGEMENT SOFTWARE MARKET, BY REGION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 FACTOR ANALYSIS

- TABLE 2 TEXT-TO-VIDEO AI MARKET AND GROWTH RATE, 2018–2021 (USD MILLION, Y-O-Y GROWTH)

- TABLE 3 TEXT-TO-VIDEO AI MARKET AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y GROWTH)

- TABLE 4 TEXT-TO-VIDEO AI MARKET: ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE OF KEY PLAYERS

- TABLE 6 TEXT-TO-VIDEO AI MARKET: PORTER’S FIVE FORCES MODEL ANALYSIS

- TABLE 7 PATENTS FILED, 2020–2023

- TABLE 8 LIST OF PATENTS IN TEXT-TO-VIDEO AI MARKET, 2020–2023

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 11 TEXT-TO-VIDEO AI MARKET: CONFERENCES AND EVENTS, 2022–2023

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 17 TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 18 TEXT-TO-VIDEO AI SOFTWARE MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 19 TEXT-TO-VIDEO AI SOFTWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 20 TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 21 TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 22 TEXT-TO-VIDEO AI SERVICE MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 23 TEXT-TO-VIDEO AI SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 24 TEXT-TO-VIDEO AI CONSULTING SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 25 TEXT-TO-VIDEO AI CONSULTING SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 26 TEXT-TO-VIDEO AI INTEGRATION SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 27 TEXT-TO-VIDEO AI INTEGRATION SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 28 TEXT-TO-VIDEO AI SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 29 TEXT-TO-VIDEO AI SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 30 TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 31 TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 32 ON-PREMISE TEXT-TO-VIDEO AI MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 33 ON-PREMISE TEXT-TO-VIDEO AI MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 34 CLOUD-BASED TEXT-TO-VIDEO AI MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 35 CLOUD-BASED TEXT-TO-VIDEO AI MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 36 TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 37 TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 38 LARGE ENTERPRISES MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 39 LARGE ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 40 SMALL- & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 41 SMALL- & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 42 TEXT-TO-VIDEO AI MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 43 TEXT-TO-VIDEO AI MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 44 MARKETER END USERS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 45 MARKETER END USERS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 46 SOCIAL MEDIA MANAGER END USERS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 47 SOCIAL MEDIA MANAGER END USERS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 48 EDUCATOR & COURSE CREATOR END USERS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 49 EDUCATOR & COURSE CREATOR END USERS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 50 CONTENT CREATOR END USERS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 51 CONTENT CREATOR END USERS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 52 CORPORATE PROFESSIONAL END USERS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 53 CORPORATE PROFESSIONAL END USERS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 54 OTHER END USERS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 55 OTHER END USERS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 56 TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 57 TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 58 EDUCATION VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 59 EDUCATION VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 60 FOOD & BEVERAGE VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 61 FOOD & BEVERAGE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 62 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 63 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 64 FASHION & BEAUTY VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 65 FASHION & BEAUTY VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 66 RETAIL & ECOMMERCE VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 67 RETAIL & ECOMMERCE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 68 HEALTH & WELLNESS VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 69 HEALTH & WELLNESS VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 70 TRAVEL & HOSPITALITY VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 71 TRAVEL & HOSPITALITY VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 72 REAL ESTATE VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 73 REAL ESTATE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 74 OTHER VERTICALS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 75 OTHER VERTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 76 TEXT-TO-VIDEO AI MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 77 TEXT-TO-VIDEO AI MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 79 NORTH AMERICA: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 80 NORTH AMERICA: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 81 NORTH AMERICA: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 82 NORTH AMERICA: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 83 NORTH AMERICA: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 84 NORTH AMERICA: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 85 NORTH AMERICA: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 87 NORTH AMERICA: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: TEXT-TO-VIDEO AI MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 89 NORTH AMERICA: TEXT-TO-VIDEO AI MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 90 NORTH AMERICA: TEXT-TO-VIDEO AI MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 91 NORTH AMERICA: TEXT-TO-VIDEO AI MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 92 US: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 93 US: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 94 US: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 95 US: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 96 US: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 97 US: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 98 US: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 99 US: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 100 US: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 101 US: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 102 US: TEXT-TO-VIDEO AI MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 103 US: TEXT-TO-VIDEO AI MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 104 CANADA: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 105 CANADA: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 106 CANADA: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 107 CANADA: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 108 CANADA: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 109 CANADA: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 110 CANADA: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 111 CANADA: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 112 CANADA: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 113 CANADA: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 114 CANADA: TEXT-TO-VIDEO AI MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 115 CANADA: TEXT-TO-VIDEO AI MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 116 EUROPE: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 117 EUROPE: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 118 EUROPE: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 119 EUROPE: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 120 EUROPE: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 121 EUROPE: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 122 EUROPE: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 123 EUROPE: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 124 EUROPE: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 125 EUROPE: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 126 EUROPE: TEXT-TO-VIDEO AI MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 127 EUROPE: TEXT-TO-VIDEO AI MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 128 EUROPE: TEXT-TO-VIDEO AI MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 129 EUROPE: TEXT-TO-VIDEO AI MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 130 UK: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 131 UK: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 132 UK: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 133 UK: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 134 UK: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 135 UK: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 136 UK: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 137 UK: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 138 UK: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 139 UK: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 140 UK: TEXT-TO-VIDEO AI MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 141 UK: TEXT-TO-VIDEO AI MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 142 ASIA PACIFIC: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 143 ASIA PACIFIC: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 144 ASIA PACIFIC: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 145 ASIA PACIFIC: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 146 ASIA PACIFIC: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 147 ASIA PACIFIC: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 148 ASIA PACIFIC: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 149 ASIA PACIFIC: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 150 ASIA PACIFIC: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 151 ASIA PACIFIC: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 152 ASIA PACIFIC: TEXT-TO-VIDEO AI MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 153 ASIA PACIFIC: TEXT-TO-VIDEO AI MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 154 ASIA PACIFIC: TEXT-TO-VIDEO AI MARKET, BY COUNTRY/REGION, 2018–2021 (USD MILLION)

- TABLE 155 ASIA PACIFIC: TEXT-TO-VIDEO AI MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

- TABLE 156 CHINA: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 157 CHINA: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 158 CHINA: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 159 CHINA: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 160 CHINA: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 161 CHINA: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 162 CHINA: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 163 CHINA: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 164 CHINA: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 165 CHINA: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 166 CHINA: TEXT-TO-VIDEO AI MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 167 CHINA: TEXT-TO-VIDEO AI MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: TEXT-TO-VIDEO AI MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 182 MIDDLE EAST: TEXT-TO-VIDEO AI MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 183 MIDDLE EAST: TEXT-TO-VIDEO AI MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 184 KSA: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 185 KSA: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 186 KSA: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 187 KSA: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 188 KSA: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 189 KSA: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 190 KSA: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 191 KSA: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 192 KSA: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 193 KSA: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 194 KSA: TEXT-TO-VIDEO AI MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 195 KSA: TEXT-TO-VIDEO AI MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 196 AFRICA: TEXT-TO-VIDEO AI MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 197 AFRICA: TEXT-TO-VIDEO AI MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 198 LATIN AMERICA: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 199 LATIN AMERICA: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 200 LATIN AMERICA: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 201 LATIN AMERICA: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 202 LATIN AMERICA: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 203 LATIN AMERICA: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 204 LATIN AMERICA: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 205 LATIN AMERICA: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 206 LATIN AMERICA: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 207 LATIN AMERICA: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 208 LATIN AMERICA: TEXT-TO-VIDEO AI MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 209 LATIN AMERICA: TEXT-TO-VIDEO AI MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 210 LATIN AMERICA: TEXT-TO-VIDEO AI MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 211 LATIN AMERICA: TEXT-TO-VIDEO AI MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 212 BRAZIL: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 213 BRAZIL: TEXT-TO-VIDEO AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 214 BRAZIL: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 215 BRAZIL: TEXT-TO-VIDEO AI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 216 BRAZIL: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 217 BRAZIL: TEXT-TO-VIDEO AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 218 BRAZIL: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 219 BRAZIL: TEXT-TO-VIDEO AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 220 BRAZIL: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 221 BRAZIL: TEXT-TO-VIDEO AI MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 222 BRAZIL: TEXT-TO-VIDEO AI MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 223 BRAZIL: TEXT-TO-VIDEO AI MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 224 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN TEXT-TO-VIDEO AI MARKET

- TABLE 225 TEXT-TO-VIDEO AI MARKET: DEGREE OF COMPETITION

- TABLE 226 TEXT-TO-VIDEO AI MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 227 TEXT-TO-VIDEO AI MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY VERTICAL AND REGION

- TABLE 228 TEXT-TO-VIDEO AI MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY END USER

- TABLE 229 PRODUCT LAUNCHES, 2020–2022

- TABLE 230 DEALS, 2020–2023

- TABLE 231 OTHERS, 2021–2022

- TABLE 232 VIMEO: BUSINESS OVERVIEW

- TABLE 233 VIMEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 VIMEO: DEALS

- TABLE 235 INVIDEO: BUSINESS OVERVIEW

- TABLE 236 INVIDEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 INVIDEO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 238 INVIDEO: DEALS

- TABLE 239 SYNTHESIA: BUSINESS OVERVIEW

- TABLE 240 SYNTHESIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 SYNTHESIA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 242 SYNTHESIA: OTHERS

- TABLE 243 HOUR ONE: BUSINESS OVERVIEW

- TABLE 244 HOUR ONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 HOUR ONE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 246 HOUR ONE: OTHERS

- TABLE 247 WOCHIT: BUSINESS OVERVIEW

- TABLE 248 WOCHIT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 WOCHIT: DEALS

- TABLE 250 DESIGNS.AI: BUSINESS OVERVIEW

- TABLE 251 DESIGNS.AI: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 252 STEVE AI: BUSINESS OVERVIEW

- TABLE 253 STEVE AI: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 254 META: BUSINESS OVERVIEW

- TABLE 255 META: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 META: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 257 META: DEALS

- TABLE 258 GOOGLE: BUSINESS OVERVIEW

- TABLE 259 GOOGLE: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 260 GOOGLE: PRODUCT LAUNCHES

- TABLE 261 GOOGLE: DEALS

- TABLE 262 DEEPBRAIN AI: BUSINESS OVERVIEW

- TABLE 263 DEEPBRAIN AI: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 264 DEEPBRAIN AI: PRODUCT LAUNCHES

- TABLE 265 DEEPBRAIN AI: DEALS

- TABLE 266 VEED: BUSINESS OVERVIEW

- TABLE 267 VEED: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 268 VEED: OTHERS

- TABLE 269 EZOIC: BUSINESS OVERVIEW

- TABLE 270 EZOIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 EZOIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 272 VIDEO ANALYTICS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 273 VIDEO ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 274 VIDEO ANALYTICS SOFTWARE MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 275 VIDEO ANALYTICS SOFTWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 276 VIDEO ANALYTICS SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 277 VIDEO ANALYTICS SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 278 VIDEO ANALYTICS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 279 VIDEO ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 280 VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2018–2021 (USD MILLION)

- TABLE 281 VIDEO ANALYTICS MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD MILLION)

- TABLE 282 VIDEO ANALYTICS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 283 VIDEO ANALYTICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 284 VIDEO ANALYTICS MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 285 VIDEO ANALYTICS MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 286 VIDEO ANALYTICS MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 287 VIDEO ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 288 VIDEO ANALYTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 289 VIDEO ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 290 VIDEO MANAGEMENT SOFTWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 291 VIDEO MANAGEMENT SOFTWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 292 VIDEO MANAGEMENT SOFTWARE SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 293 VIDEO MANAGEMENT SOFTWARE SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 294 VIDEO MANAGEMENT SOFTWARE SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 295 VIDEO MANAGEMENT SOFTWARE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 296 VIDEO MANAGEMENT SOFTWARE SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 297 VIDEO MANAGEMENT SOFTWARE SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 298 VIDEO MANAGEMENT SOFTWARE MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

- TABLE 299 VIDEO MANAGEMENT SOFTWARE MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 300 VIDEO MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 301 VIDEO MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 302 VIDEO MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 303 VIDEO MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 304 VIDEO MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 305 VIDEO MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 306 VIDEO MANAGEMENT SOFTWARE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 307 VIDEO MANAGEMENT SOFTWARE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 308 VIDEO MANAGEMENT SOFTWARE MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 309 VIDEO MANAGEMENT SOFTWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 TEXT-TO-VIDEO AI MARKET SEGMENTATION

- FIGURE 2 TEXT-TO-VIDEO AI MARKET: GEOGRAPHIC SCOPE

- FIGURE 3 TEXT-TO-VIDEO AI MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY USING APPROACH 1 (SUPPLY SIDE): REVENUE OF SOFTWARE/SERVICES

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOFTWARE/SERVICES

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY USING DEMAND-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 TEXT-TO-VIDEO AI MARKET WITNESSED MEAGER DIP IN Y-O-Y GROWTH IN 2022

- FIGURE 11 SUBSEGMENTS WITH LARGEST MARKET SIZE IN GLOBAL TEXT-TO-VIDEO AI MARKET FROM 2022 TO 2027

- FIGURE 12 TEXT-TO-VIDEO AI MARKET SHARE, BY REGION, 2022

- FIGURE 13 PROGRESS IN GENERATIVE AI TECHNOLOGY TO DRIVE TEXT-TO-VIDEO AI MARKET DURING FORECAST PERIOD

- FIGURE 14 SOFTWARE SEGMENT TO DOMINATE MARKET THROUGH 2027

- FIGURE 15 CLOUD SEGMENT TO LEAD MARKET THROUGH 2027

- FIGURE 16 LARGE ENTERPRISES SEGMENT TO WITNESS HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 17 EDUCATION VERTICAL TO LEAD MARKET THROUGH 2027

- FIGURE 18 CONTENT CREATOR END USER TO EXPERIENCE HIGH GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 EDUCATION AND EDUCATORS & COURSE CREATORS SEGMENT TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2022

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: TEXT-TO-VIDEO AI MARKET

- FIGURE 21 VIDEO USAGE, 2016–2022

- FIGURE 22 TEXT-TO-VIDEO AI MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 TEXT-TO-VIDEO AI MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 24 NUMBER OF PATENTS GRANTED ANNUALLY, 2020–2023

- FIGURE 25 TOP 10 PATENT APPLICANTS, 2020–2023

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 28 TEXT-TO-VIDEO AI SOFTWARE TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 SUPPORT & MAINTENANCE SERVICES TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 CLOUD DEPLOYMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 LARGE ENTERPRISES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 CONTENT CREATORS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 MEDIA & ENTERTAINMENT TO GROW AT HIGHEST CAGR AMONG VERTICALS

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 HISTORICAL REVENUE ANALYSIS OF PLAYERS, 2019–2021 (USD MILLION)

- FIGURE 37 KEY TEXT-TO-VIDEO AI MARKET PLAYERS: COMPANY EVALUATION MATRIX, 2022

- FIGURE 38 VIMEO: COMPANY SNAPSHOT

- FIGURE 39 META: COMPANY SNAPSHOT

- FIGURE 40 GOOGLE: COMPANY SNAPSHOT

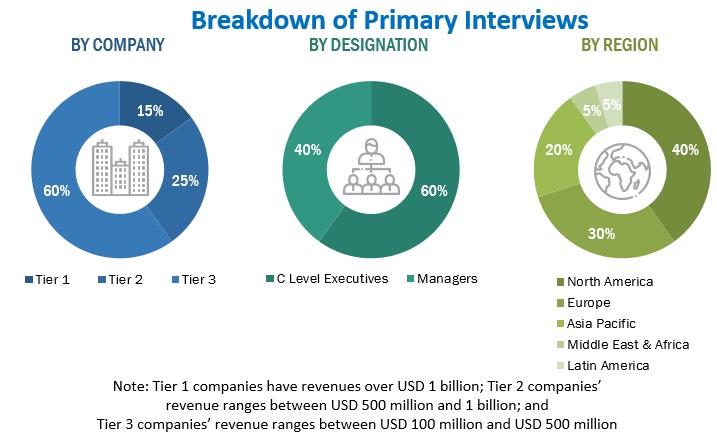

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the text-to-video AI market. Primary sources were industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information, as well as to assess the market’s prospects. These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations were also referred to, such as the Analytics India Magazine and Diggit Magazine. Secondary research was used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides of the text-to-video AI market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, related key executives from various vendors providing text-to-video AI solutions, associated service providers, and system integrators operating in the targeted regions. All parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both top-down and bottom-up approaches and several data triangulation methods were used to perform the market estimation and forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Text to video AI Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the text-to-video AI market. The first approach involves the estimation of the market size by summing up the revenues of the companies generated through the sale of software and services.

Text to video AI Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The bottom-up approach was employed to arrive at the overall size of the text-to-video AI market from the revenue of the key players and their share in this market. The revenue of the key players was analyzed to determine the overall size of the text-to-video AI market.

Report Objectives

- To determine, segment, and forecast the global text to video AI market by component, deployment mode, organization size, end user, vertical and region in terms of value.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the text to video AI market.

- To study the complete value chain and related industry segments and perform a value chain analysis of the text to video AI market landscape.

- To strategically analyze macro and micromarkets with respect to individual growth trends, prospects, and contributions to the total text to video AI market.

- To analyze industry trends, pricing data, and patents and innovations related to the text to video AI market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the text to video AI market.

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, collaborations, business expansions, and Research and Development (R&D) activities.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Further breakdown of South Korean text to video AI market

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Text-to-Video AI Market