Tactical Data Link Market by Data Link Type (Link 11, LINK 16, Link 22, Others), (Application (Command & Control, ISR, EW, Radio Communication), Platform, Component, Frequency, Point of Sale, Military Standard, and Region - Global Forecast to 2027

Update: 11/08/2024

Tactical Data Links (TDLs) are secure, military communication networks designed to transmit real-time information among different assets, such as aircraft, ships, and ground vehicles, to enable coordinated operations. TDLs allow for the exchange of crucial data, including targeting information, surveillance, command, and control data, and situational awareness across various platforms and nations. Examples include Link 16, Link 11, and the Joint Tactical Information Distribution System (JTIDS). These links enhance interoperability between allied forces, improve response times, and support network-centric warfare by ensuring that decision-makers and operators have a synchronized and up-to-date picture of the battlefield, which is essential for effective joint and coalition missions.

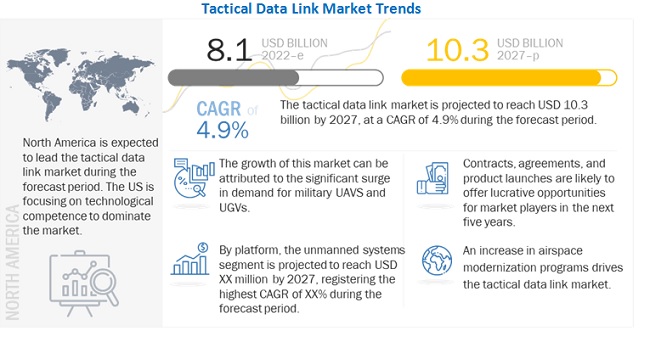

Tactical Data Link Market Size & Growth

The Global Tactical Data Link Market Size was valued at USD 8.1 billion in 2022 and is estimated to reach USD 10.3 billion by 2027, growing at a CAGR of 4.9% during the forecast period. The Tactical Data Link Industry is driven by factors such as rise in airspace modernization programs, emergence of modern warfare systems, etc.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid - 19 Impact on Tactical Data Link Market

The COVID-19 pandemic has caused a large-scale impact on economies across the world. The global manufacturing of tactical data links, components, and assembly lines have been impacted. COVID-19 has led to several challenges for many industries. The Aerospace & defense industry is no exception to that. The budget allotted to the defense sector has been reduced by several countries due to the COVID-19 pandemic. This puts most research projects on hold. The export of tactical data links to several countries in the Middle East, Africa, and Latin America has also been reduced. All these scenarios affect the development of tactical data links.

Tactical Data Link Market Dynamics

Driver : Rise in airspace modernization programs

Modernizing and overhauling the airspace is of prime focus areas in North American and European countries to enhance safety and minimize flight delays. Better routing decisions, improved pilot communications, and enhanced efficiency are some benefits of airspace modernization, which involves the installation of new technologies and components to communicate effectively with air traffic managers, perform multidimensional aircraft tracking, and improve navigation by generating an image of the forward external scene topography. These airspace modernization programs, when implemented successfully, help save fuel, enhance the quality of air, and reduce carbon emissions.

Airspace modernization programs include designing new communication antennas to increase the connectivity of aircraft. For instance, in March 2021, a new communication antenna was designed by ThinKom Solutions, which offers flexible installation options for special-purpose aircraft. The company has developed a new variant of its Variable Inclination Continuous Transverse Stub (VICTS) antenna for the government and military Beyond-Line-of-Sight (BLoS) applications. Initial units of the product are currently going through integration, with formal qualification scheduled to start soon.

Restraint : Rigorous military standards and stringent regulations

In the defense sector, the secure communication of data links is very important as it may alter an incorrect interpretation of communication. Therefore, the defense sector defines the standards to develop and test these data link solutions. The North Atlantic Treaty Organization (NATO) has described standards that all NATO members and other countries can follow. However, these stringent norms and regulations hamper the growth of the market. Moreover, defense equipment has to pass through different military standards to qualify for procurement by defense forces. Apart from the military standards, the defense products should meet the size, weight, and power (SWaP) requirements used in military aircraft.

Opportunity : Growing demand for enhanced interoperability

The Electromagnetic Compatibility (EMC) design is integral to electrical components and systems. The growing demand for improved interoperability among armed forces and coalition partners is accelerating the production of advanced system solutions. The interoperability allows the system or arm forces to work together in a particular situation and improve communication security. Therefore, there is an increase in the adoption of tactical data link solutions from end-users due to the increasing need for secure communication.

On March 27, 2020, North Macedonia became a member of NATO. NATO uses military data link 16 networks to communicate with its coalition partners. With more and more countries joining NATO, the demand for standardized tactical data links is expected to grow during the forecast period.

Challenges : Lack of skilled workforce

Countries such as Morocco, South Africa, Nigeria, Somalia, Kenya, Bangladesh, Nepal, and Bhutan lack a skilled technical workforce in the defense industry. Potential workforce issues affect the safety and effectiveness of operations, which further limits the number of missions that the systems can handle. Thus, the lack of a skilled workforce acts as a challenge to the growth of the tactical data link market.

Critical land, marine, airborne, and space operations increasingly rely on well-qualified personnel for various tasks such as R&D, patent development, and software development & application. Thus, the recruitment of a technical workforce forms a crucial part of ensuring innovation in business processes and products in the defense industry.

Tactical Data Link Market Segmental Analysis

Unmanned Systems segment of the Tactical Data Link Market by platform, to grow at highest CAGR during the forecast period

Based on platform, the Unmanned Systems segment is projected to grow from USD 792 million in 2022 to USD 1,082 million by 2027, at a CAGR of 6.4% during the forecast period. The growth can be attributed to the increasing use of UAVs across various industries, as well as increasing demand of UAVs for both military and commercial application.

Product segment to command the Tactical Data Link Market by component, during the forecast period

Based on component, the product segment is projected to grow from USD 5,326 million in 2022 to USD 6,862 million by 2027, at a CAGR of 5.2% during the forecast period. The growth can be attributed to the higher adoption of technologically advanced tactical data link products owing to the ease of operation and maintenance.

OEM segment to dominate the Tactical Data Link Market by point of sale, during the forecast period

Based on point of sale, the OEM segment is projected to grow from USD 5,292 million in 2022 to USD 6,825 million by 2027, at a CAGR of 5.2% during the forecast period..

The North America market is projected to contribute the largest share from 2022 to 2027

To know about the assumptions considered for the study, download the pdf brochure

Emerging Industry Trends

Development of cognitive radios

Efforts are underway to develop a smart and computer-controlled radio which can monitor the RF environment, identify available and interference-free frequencies, and establish communications links automatically in real-time. This has led to the development of cognitive radios, which are expected to be more computer-intensive than software-defined radios. Cognitive radios need to possess the intelligence to monitor the environment, determine if frequencies are jammed, and make use of other frequencies in such cases. This technology is still in the developmental phase and is expected to be used first in the commercial sector.

The deployment of radio systems in the defense sector generally entails extensive spectrum management, owing to the latter’s limited availability. However, cognitive radios are expected to be able to function in a congested spectrum in an optimized manner by monitoring the spectrum in real-time and identifying a channel that is not in use. Cognitive radios are expected to be used to improve the overall spectrum utilization and efficiency.

Tactical Data Link Companies: Top Key Market Players

The Tactical Data Link Companies is dominated by globally established players such as:

- Collins Aerospace (US)

- L3harris Technologies (US)

- ViaSat (US)

- Thales Group (France)

- General Dynamics Corporation (US)

The report covers various industry trends and new technological innovations in the Tactical Data Link Market for the period, 2018-2027.

Tactical Data Link Market Report Scope:

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 8.1 Billion |

|

Revenue Forecast in 2027 |

USD 10.3 Billion |

|

Growth Rate |

4.9 % |

|

Forecast period |

2022-2027 |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Platform, By Application, By Component, By Frequency, By Data link type, By Point of sale, By Military Standard |

|

Geographies covered |

|

|

Companies covered |

L3harris Technologies (US), Honeywell International Inc (US), General Dynamics Corporation (US), Lockheed Martin Corporation (US), ViaSat (US), Leonardo S.p.A. (Italy), BAE Systems (UK), among others. (24 Companies) |

The study categorizes the Tactical Data Link Market based on platform, application, component, technology, and region

By Platform

-

Ground

- Ground Control Stations/Command Centre

- Armored vehicles

- Soldiers

-

Airborne

- Fixed

- Rotary

-

Naval

- Ships

- Submarines

-

Unmanned Systems

- Unmanned Ground Vehicles (UGVs)

- Unmanned Aerial Vehicles (UAVs)

- Underwater Vehicles

- Weapons

By Application

- Command & Control

- Intelligence, Surveillance & Reconnissance

- Electronic Warfare

- Radio Communications

By Component

-

Product

- Terminals

- Radio Sets

- Modems

- Routers

- Controllers

- Transceivers

- Monitors

- Others

- Software Solution

By Frequency

- High Frequency

- Ultra High Frequency

By Data Link Type

- Link 11

- Link 16

- Link 22

- Others

By Point of Sale

- OEM

- Aftermarket

By Military Standard

- MIL STD 6011

- MIL STD 6016

- MIL STD 6017

- MIL STD 6020

- MIL STD 3011

By Region

- North America

- Asia Pacific

- Europe

- Rest of the World

Recent Developments

- In May 2022, Thales was one of two (2) vendors awarded an Indefinite Delivery, Indefinite Quantity (IDIQ) contract by the US Army to deliver advanced tactical radios under the US Army’s Combat Net Radio (CNR) modernization program. The competitive 10-year contract for the Combat Net Radio (CNR) program includes a five-year base ordering period and an additional five-year optional ordering period.

- In May 2022, L3Harris Technologies received an IDIQ contract increase for its Falcon IV AN/PRC-167 radio systems from the US Special Operations Command (USSOCOM). USSOCOM increased the initial IDIQ ceiling from USD 255 million to USD 552 million.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Tactical Data Link Market?

The Tactical Data Link Market is expected to grow substantially owing to the technological development in designing of the various tactical data links and related components for several military applications.

What are the key sustainability strategies adopted by leading players operating in the Tactical Data Link Market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Tactical Data Link Market. Major players, including Collins Aerospace (US), L3harris Technologies (US), ViaSat (US), Thales Group (France), and General Dynamics Corporation (US) have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the Tactical Data Link Market?

Some of the major emerging technologies and use cases disrupting the market include development of compact tactical data link products, development of cognitive radios, etc.

Who are the key players and innovators in the ecosystem of the Tactical Data Link Market?

Major players, including Collins Aerospace (US), L3harris Technologies (US), ViaSat (US), Thales Group (France), and General Dynamics Corporation (US).

Which region is expected to hold the highest market share in the Tactical Data Link Market?

Tactical Data Link Market in the North America region is estimated to account for the largest share of 49.5% of the market in 2022. The market in the Asia Pacific region is expected to grow at the highest CAGR of 4.18% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

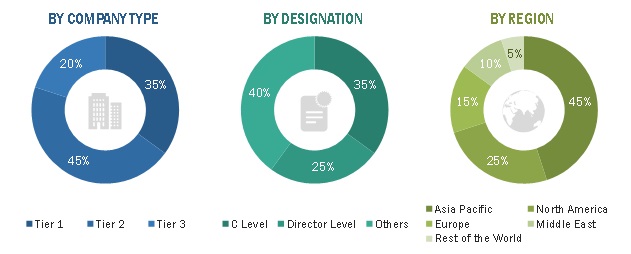

The study involved four major activities in estimating the current size of the tactical data link market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market share of companies offering tactical data links was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies and rating them based on their performance and quality.

In the secondary research process, sources such as government sources; SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles by recognized authors, directories, and databases were used to identify and collect information for this study.

Secondary research was mainly used to obtain key information about the industry’s value and supply chain and to identify the key players by various products, market classifications, and segmentation according to their offerings and industry trends related to tactical data link components, platforms, and regions, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included industry experts such as vice presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from marine vessel manufacturers; aircraft manufacturers; tactical data links manufacturers; integrators; and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

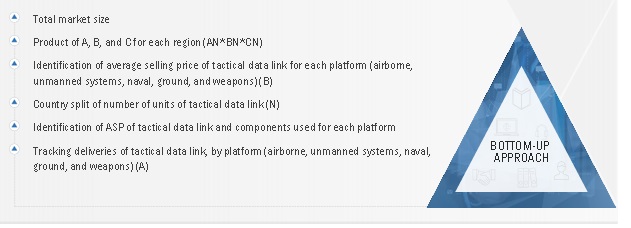

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the tactical data link market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Tactical Data Link Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for tactical data link segments and subsegments. The data was triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

Report Objectives

- To define, describe, segment, and forecast the size of the tactical data link market based on platform, application, component, frequency, data link type, point of sale, military standard, and region for the forecast period from 2022 to 2027

- To forecast the size of various segments of the tactical data link market with respect to 6 major regions namely, North America, Europe, Asia Pacific, Rest of the World which consists of the Middle East and Latin America & Africa

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the tactical data link market

- To identify the opportunities for stakeholders in the market by identifying key market and technology trends

- To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and Research & Development (R&D) activities in the tactical data link market.

- To anticipate the status of the tactical data link market procurements by different countries, technological advancements in tactical data links; and joint developments undertaken by leading players to analyze the degree of competition in the market

- To provide a comprehensive competitive landscape of the tactical data link market, along with an overview of the different strategies adopted by the key market players to strengthen their position in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Market sizing and forecast for additional countries

- By platform, by data link type breakdown at country level

- Additional five companies profiling

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the tactical data link market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Tactical Data Link Market

how much is the tactical data link package sir

I would like to further understand TDL offerings in the market, market share by dollar value, platform type, number of TDL systems, ... etc.