Aerospace and Defense Telemetry Market by Platform (Ground, Airborne, Marine, Space, Weapons, UAVs), Technology (Wired and Wireless Telemetry), Component (Receiver, Transmitter, Antenna, Processors), Application, and Region - Global Forecast to 2027

Update: 11/05/2024

[217 Pages Report]

Aerospace and Defense Telemetry Market Size: Overview and Importance

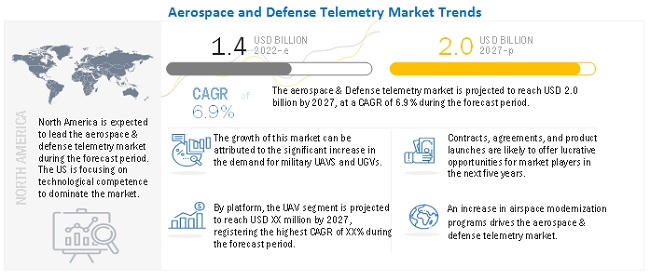

Aerospace and defense telemetry involves the collection and transmission of data from aerospace and defense systems, such as aircraft, missiles, satellites, and ground stations, to monitoring and control facilities. This critical data includes information on position, speed, altitude, and system performance, which is essential for mission planning, execution, and analysis. With the increasing complexity and sophistication of aerospace and defense operations, the demand for advanced telemetry solutions is growing rapidly. These systems ensure real-time data transmission and enhance the overall efficiency and safety of various missions. The Global Aerospace and Defense Telemetry Industry Size was valued at USD 1.4 Billion in 2022 and is estimated to reach USD 2.0 Billion by 2027, growing at a CAGR of 6.9% during the forecast period.

Aerospace and Defense Telemetry Market Growth Factors

The aerospace and defense telemetry market is experiencing significant growth due to several key factors. Technological advancements, such as miniaturization and enhanced data processing capabilities, are driving the adoption of advanced telemetry systems. Increasing defense budgets worldwide are leading to higher investments in sophisticated telemetry solutions. The rising use of unmanned aerial vehicles (UAVs) and satellites for surveillance and reconnaissance also boosts demand. Modernization of military equipment, expanding space exploration initiatives, regulatory mandates, and the need for secure data transmission contribute to the market's expansion. These factors collectively ensure that telemetry remains a vital component of modern aerospace and defense operations.

To know about the assumptions considered for the study, Request for Free Sample Report

The COVID-19 pandemic has caused a large-scale impact on economies across the world. The global manufacturing of telemetry systems, components, and assembly lines have been impacted. COVID-19 has led to several challenges for many industries. The Aerospace & defense industry is no exception to that. The budget allotted to the defense sector has been reduced by several countries due to the COVID-19 pandemic. This puts most research projects on hold. The export of aerospace and defense telemetry to several countries in the Middle East, Africa, and Latin America has also been reduced. All these scenarios affect the development of aerospace and defense telemetry.

Aerospace and Defense Telemetry Market Dynamics

Aerospace and Defense Telemetry Market: Growth Drivers

Aerospace and Defense Telemetry Market Opportunities:

Aerospace and Defense Telemetry Market Growing Segments

Platform Segments

Application Segments

Technology Segments

Component Segments

Aerospace and Defense Telemetry Market Regional Growth

The aerospace and defense telemetry market is expanding significantly across various regions, including North America, Europe, and Asia Pacific. Each region has unique factors contributing to this growth.

North America

Technological Leadership: North America, especially the United States, leads in aerospace and defense telemetry technology. The region's focus on innovation and advanced R&D drives the market.

High Defense Spending: The United States has one of the highest defense budgets globally, fueling investments in sophisticated telemetry systems for aircraft, UAVs, and missile systems.

Space Exploration Initiatives: Robust space exploration activities, led by NASA and private companies like SpaceX, significantly contribute to the growth of the space-based telemetry segment. Increasing satellite launches and space missions require advanced telemetry solutions.

Key Industry Players: North America hosts major aerospace and defense companies, including Lockheed Martin, Boeing, and Raytheon Technologies, driving demand for advanced telemetry systems.

Europe

Increasing Defense Budgets: European countries are enhancing their military capabilities with higher defense budgets, boosting the demand for advanced telemetry systems.

Collaborative Defense Projects: Europe has numerous collaborative defense initiatives, such as European Space Agency (ESA) projects and joint military programs like the Eurofighter Typhoon. These collaborations necessitate sophisticated telemetry systems for seamless integration and operation.

UAVs and Space Exploration: Europe is expanding its UAV capabilities and space exploration efforts. Investments in UAV technology and new space missions by countries like France, Germany, and the UK drive the need for reliable telemetry systems.

Stringent Regulatory Standards: Strict regulatory requirements in Europe mandate the use of advanced telemetry systems for safety, reliability, and performance monitoring, further propelling market growth.

Asia Pacific

Rising Defense Expenditure: Countries like China, India, and Japan are significantly increasing their defense spending. This modernization of military equipment and enhancement of surveillance capabilities drive the demand for telemetry systems.

Rapid Technological Advancements: The Asia Pacific region is witnessing rapid advancements in aerospace and defense technologies. Innovations in telemetry, supported by government R&D, boost market growth.

Expanding Space Programs: China and India are expanding their space programs with ambitious satellite launches and lunar missions. These initiatives require robust telemetry systems for successful missions.

Growing UAV Market: The UAV market in Asia Pacific is expanding due to increasing applications in defense, agriculture, and surveillance. The demand for real-time data transmission in UAV operations drives the growth of telemetry systems.

Regional Collaborations: Collaborative defense and aerospace projects in the region, such as joint military exercises and regional space collaborations, necessitate advanced telemetry systems for interoperability and mission success.

These growing regions highlight the diverse and dynamic nature of the aerospace and defense telemetry market, driven by increasing defense budgets, technological advancements, and expanding space and UAV programs.

To know about the assumptions considered for the study, download the pdf brochure

Emerging Industry Trends

Miniaturization of Antenna

Research & development on antennas to reduce the size and weight and increase power have led to the development of integrated antennas. Research to make antennas invisible to the naked eye is still underway; these small antennas will be integrated into various platforms such as ships, military vehicles, and manpacks.

Flexible hybrid electronics (FHE) technology is a result of R&D undertaken by the electronics and high precision printing industries. With the help of FHE technology, manufacturers can build integrated antennas that are lightweight and can be conformed to the curves of the human body while preserving full operational integrity. FHE technology can revolutionize the aerospace & defense telemetry market by integrating multiple ultra-thin silicon components with high precision, printing them with conductive and active inks, and pasting them on stretchable substrates.

Aerospace and Defense Telemetry Market Company Shares

The Aerospace and Defense Telemetry Companies are dominated by globally established players such as:

- L3harris Technologies (US)

- Honeywell International Inc (US)

- General Dynamics Corporation (US)

- Lockheed Martin (US)

- Maxar Technologies (US)

L3Harris Technologies (US)

L3Harris Technologies stands out as a premier provider of advanced telemetry solutions for aerospace and defense applications. Offering a diverse range of telemetry systems, L3Harris is pivotal in shaping the market landscape.

Honeywell International Inc (US)

Honeywell is a significant player in the aerospace and defense sector, delivering tailored telemetry solutions across various applications. With expertise in avionics and flight test instrumentation, Honeywell commands a substantial market share.

General Dynamics Corporation (US)

General Dynamics is a renowned provider of telemetry systems to government and commercial clients globally. Its broad portfolio, covering ground-based, airborne, and space-based platforms, solidifies its position in the telemetry market.

Lockheed Martin (US)

As one of the largest aerospace and defense companies, Lockheed Martin offers comprehensive telemetry solutions. With a focus on ground-based, airborne, and space-based systems, Lockheed Martin's reputation for quality contributes to its significant market share.

Maxar Technologies (US)

Maxar Technologies specializes in space-based telemetry solutions for defense and commercial purposes. Leveraging satellite-based systems and remote sensing capabilities, Maxar holds a notable presence in the aerospace and defense telemetry market.

These companies, renowned for their innovative technologies and broad product portfolios, collectively dominate the aerospace and defense telemetry market. Their continued investment in research, development, and strategic partnerships ensures their continued leadership in this dynamic industry.

Scope Of The Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.4 Billion in 2022 |

|

Projected Market Size |

USD 2.0 Billion by 2027 |

|

Growth Rate (CAGR) |

6.9% |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Platform, By Application, By Component, By technology |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Rest of the World. |

|

Companies covered |

L3harris Technologies (US), Honeywell International Inc (US), General Dynamics Corporation (US), Lockheed Martin Corporation (US), Maxar Technologies (US), Ruag International Holding Ltd (Switzerland), BAE Systems (UK), among others. (24 Companies) |

The study categorizes the aerospace and defense telemetry market based on platform, application, component, technology, and region

By Platform

-

Ground

-

Ground Stations

- Fixed

- Mobile

- Armored vehicles/Land Vehicle

-

Ground Stations

-

Airborne

-

Commercial

- Fixed

- Rotary

-

Military

- Fixed

- Rotary

-

Commercial

-

Marine

- Commercial

- Military

-

Space

- Satellite

- Launchers

- Weapons

- UAVs

By Application

- Avionics

- Air Vehicle Test

- Flight Test Instrumentation

- Distributed Data Acquisition System

- Flight Termination System

By Technology

-

Wired Telemetry

- Electrical Cables

- Fiber Optic Cables

-

Wireless Telemetry

- Short-range Radio Telemetry

- Microwave Telemetry

By Component

- Receivers

- Transmitters

- Antennas

- Processors

By Region

- North America

- Asia Pacific

- Europe

- Rest of the World

Recent Developments

- In February 2022, Lockheed Martin received a manufacturing contract from Smiths Interconnect to manufacture High Gain High Sensitivity (HGHS) Antenna systems to protect US Navy ships from threats during mission-critical operations.

- In January 2022, L3Harris Technologies was awarded an IDIQ contract by the US Marine for multi-channel handheld and vehicular radio systems.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Aerospace and Defense Telemetry Market?

The Aerospace and Defense Telemetry market is expected to grow substantially owing to the technological development in designing of the various telemetry systems, sub-system, and components for several military & commercial applications.

What are the key sustainability strategies adopted by leading players operating in the Aerospace and Defense Telemetry Market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Aerospace and Defense Telemetry Market. Major players, including L3harris Technologies (US), Honeywell International Inc (US), General Dynamics Corporation (US), Lockheed Martin (US), Maxar Technologies (US), have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the Aerospace and Defense Telemetry Market?

Some of the major emerging technologies and use cases disrupting the market include development of smart antenna, hybrid beamforming methods, ultra rugged inertial measurement systems, etc.

Who are the key players and innovators in the ecosystem of the Aerospace and Defense Telemetry Market?

Major players in the Aerospace and Defense Telemetry market include L3harris Technologies (US), Honeywell International Inc (US), General Dynamics Corporation (US), Lockheed Martin Corporation (US), Maxar Technologies (US).

Which region is expected to hold the highest market share in the Aerospace and Defense Telemetry Market?

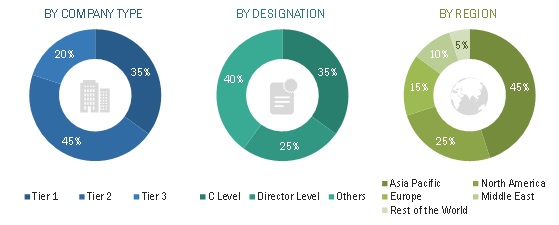

Aerospace and Defense Telemetry market in the North America region is estimated to account for the largest share of 46% of the market in 2022. The market in the Asia Pacific region is expected to grow at the highest CAGR of 7.6% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

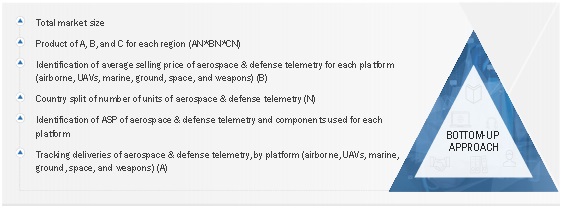

The study involved four major activities in estimating the current size of the Aerospace and defense telemetry market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market share of companies offering aerospace & defense telemetry systems was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies and rating them based on their performance and quality.

In the secondary research process, sources such as government sources; SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles by recognized authors, directories, and databases were used to identify and collect information for this study.

Secondary research was mainly used to obtain key information about the industry’s value and supply chain and to identify the key players by various products, market classifications, and segmentation according to their offerings and industry trends related to telemetry components, platforms, technologies, and regions, and key developments from both, market- and technology-oriented perspectives..

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included industry experts such as vice presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from marine vessel manufacturers; aircraft manufacturers; aerospace & defense telemetry manufacturers; integrators; and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aerospace and defense telemetry market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Aerospace and defense telemetry market Size: Bottom-Up Approach

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for aerospace & defense telemetry segments and subsegments. The data was triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

Report Objectives

- To define, describe, segment, and forecast the size of the aerospace and defense telemetry market based on platform, application, component, technology, and region for the forecast period from 2022 to 2027

- To forecast the size of various segments of the aerospace and defense telemetry market with respect to 6 major regions namely, North America, Europe, Asia Pacific, the Middle East, Rest of the World which consists of Latin America, and Africa

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aerospace and defense telemetry market

- To identify the opportunities for stakeholders in the market by identifying key market and technology trends

- To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and Research & Development (R&D) activities in the aerospace and defense telemetry market.

- To anticipate the status of the aerospace and defense telemetry procurements by different countries, technological advancements in telemetry; and joint developments undertaken by leading players to analyze the degree of competition in the market

- To provide a comprehensive competitive landscape of the aerospace and defense telemetry market, along with an overview of the different strategies adopted by the key market players to strengthen their position in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Market sizing and forecast for additional countries

- By platform, by sensor breakdown at country level

- Additional five companies profiling

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the aerospace and defense telemetry market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aerospace and Defense Telemetry Market