Synthetic Paper Market by Raw Material (BOPP, HDPE, PET, and PVC), Application (Printing, Labels & Tags, Packaging), End-use Industry (Industrial, Institutional, and Commercial/Retail) and Geography - Global Forecast to 2027

Updated on : September 02, 2025

Synthetic Paper Market

The global synthetic paper market was valued at USD 766 million in 2021 and is projected to reach USD 1,286 million by 2027, growing at 9.2% cagr from 2022 to 2027. Synthetic paper is manufactured with synthetic resins derived from petroleum (primary material). Resin selection plays a major role in the attributes exhibited by different synthetic papers. It is preferred over conventional paper due to its excellent chemical, tear, oil, and moisture resistance, printability, heat sealability, durability, and high strength. Synthetic paper is usually made up of BOPP, HDPE, and others (polystyrene, polyamide, polyethylene, and polyvinyl chloride) and are used by various end-use industries, such as food & beverages, cosmetics, transportation, pharmaceuticals, chemical, and advertising.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Synthetic Paper Market

COVID-19 is an infectious disease caused by a newly discovered strain of the coronavirus. This disease is impacting the growth of economies across the globe. The virus was first identified in Wuhan (China) in December 2019. The COVID-19 pandemic has wreaked havoc on the world. COVID-19 significantly impacted the global GDP in 2020, and estimates, so far, indicate the virus had impacted the global economic growth by at least 0.5%- 1.5% in FY 2020-2021, but the economies are recovering with reduction in restrictions imposed by major countries. Owing to the swift spread of the disease, both lives and livelihoods are at risk. It is a global problem that calls for a global response. There cannot be estimates on how quickly this disease is going to retreat. This situation is somewhat unusual, as it affects both supply and demand, thus, also affecting the supply of synthetic paper, globally.

Various rigid plastic packaging suppliers are finding solutions and ways to communicate with their end users to help assure them by providing information on their websites and social media on how they are tackling the global challenges.

Synthetic Paper Market Dynamics

Driver: Synthetic papers are eco-friendly and possess ideal physical properties

Synthetic papers are inorganic and do not utilize trees or woods in their manufacturing process. They are made from different types of plastics, such as polyolefin resin or polypropylene. These plastics are melted and used through the extrusion process—a system-controlled process that minimizes waste and other hazards. Synthetic papers can also be recycled and used as plastic resins in different applications. These eco-friendly characteristics are amplifying the growth of synthetic paper market across the globe. Major operating players in the synthetic paper market promote the use of 100% recycled synthetic paper. Polyart follows a 4 Rs policy to maintain and promote eco-friendly characteristics—Recycle, Reuse, Respect, and Reduce. Through its patented product, PEPA, Nan Ya Plastics follows the manufacturing process of environment-friendly biaxial-oriented polypropylene synthetic paper. The 3 Rs of Yupo Corporation (Reuse, Recycle, and Repurpose) aid in manufacturing eco-friendly synthetic paper. Since synthetic paper can withstand a lot of tension without tearing, it has a long lifespan. It lacks wood fibers; therefore, it is waterproof and does not disintegrate in water. Furthermore, synthetic paper folds easily and does not crack.

Restraint: Fluctuation in the price of raw material and crude oil

The price fluctuations in basic raw materials such as polybutylene, polypropylene, and polyethylene may limit the synthetic paper market. The volatility in the price of raw material will further impact the already high production and product costs and can act as an industry's constraints. There is a limited supply of plastic material for synthetic paper, which is impeding market. Synthetic paper prices are also influenced by crude oil, which is a major restraint. Crude oil price fluctuations are expected to raise the prices of PP and PE. Polymer prices are expected to rise in the coming years, which will have an impact on the market. Price fluctuations are likely to continue to be driven by application growth and raw material availability. growth.

Opportunity: Stringent government regulations and increasing concerns of pulp paper for environment pollution

global paper industry is around 400 million tons, largely dominated by pulp or wood-based paper. These pulp or wood-based papers use wood as the primary material and are cheaper than synthetic paper, resulting in deforestation and rising environmental problems. On the other hand, producing synthetic papers is an eco-friendly process and helps preserve the environment by reducing the consumption of natural resources. Various research and developments executed by manufacturers towards the cost reduction of synthetic paper would help strengthen synthetic paper market share in the paper industry and increase the usage of synthetic paper.

To eliminate waste, governments worldwide are starting to focus on using recyclable and reusable papers. In 2019, the Indian government's environmental ministry issued a draught document titled "National Resource Efficiency Policy 2019," which proposed several measures for better waste management, reduced landfill use, and better management of construction waste, electronic waste, and waste from other rapidly growing sectors.

Challenges: Exorbitant prices of synthetic papers

The primary problem with synthetic paper is the cost, which is higher than the cost of paper and generic plastics such as PVC vinyl and polystyrene. As the synthetic paper is made of plastic, it can be twice as expensive as fine offset paper. Therefore, it is only recommended for long-term applications such as menus, seasonal P-O-P displays, banners, and manuals that may be exposed to harsh environments. Synthetic paper is used in applications where its properties allow it to last much longer than paper. Thus, the high cost of synthetic paper limits its use to the long term rather than the short term.

BOPP is the largest raw material segment of the synthetic paper market

Based on raw materials, the synthetic paper market includes BOPP, HDPE, PET, and PVC. The BOPP raw material segment led the application segment of the market in terms of both value and volume. BOPP is extensively used in applications that require heat stabilities, water and fatigue resistance, high tensile strength, and ease of printing. Due to the ability to be manufactured into a thin transparent substrate, BOPP can be used for labels and printing applications. BOPP can be environmentally friendly and low in toxicity, making this synthetic paper used to pack food items and beverages.

Printing is the largest applications segment of the synthetic paper market

Based on applications, the synthetic paper market is divides into printing, labels & tags, packaging, and others. Printing is the largest application of synthetic paper. It has micropores on the surface, enabling better affinity for ink holding and providing a high-quality finish. Its properties such as durability, tear resistance, water resistance, scratch resistance, and abrasion resistance make it an important substrate against conventional papers. The synthetic paper has a lower static surface, which prevents double feeding and eases the printing process, making synthetic papers suitable with various printers for several printing applications. These printing applications include menus, personalized marketing materials, point of purchase displays, wrist bands, cards/envelopes, tickets/passes, and labels for various end-use industries.

Industrial is the largest end-use industry segment of the synthetic paper market

Based on end-use industry, the synthetic paper market is divides into industrial, institutional, and commercial/retail. The industrial end-use industry segment is the largest end-user of synthetic paper. Synthetic paper is used in industrial product identification tags, Industrial labels. Outdoor applications for synthetic paper include billboards, horticulture ID tags, and bus shelter displays. It is resistant to moisture and chemicals and maintains print color consistency in the face of UV exposure and various weather conditions. Furthermore, the non-tearable paper has superior strength and excellent printability with various printing techniques.

Asia Pacific is the largest market for synthetic paper market

The Asia Pacific region is projected to be the largest market, in terms of value. Asia Pacific is expected to grow at a CAGR of 9.4% during the forecast period. The growth of Asia-Pacific region can be attributed to the high economic growth rate and various eating habits, packaging & printing preferences of people across different countries of the region. Also, the multiplying population of the region presents a huge customer base for fast-moving consumer goods (FMCG) products and packaged food & beverages, which is expected to lead to the growth of the synthetic paper market during the forecast period. Asia Pacific is the largest and the most promising synthetic paper market and is expected to continue during the forecast period. Rising population, growth in disposable income, rapid industrialization, and increased urbanization are driving the synthetic paper market in Asia Pacific. The market in the region is mainly driven by various end-use industries, such as foods & beverages, cosmetics, pharmaceuticals, chemicals, and manufacturings.

PPG Industries, Inc. (US), Seiko Epson Corporation (Japan), Agfa-Gevaert Group (Belgium), Yupo Corporation (Japan), and Arjobex SAS (France) are key players in synthetic paper market.

To know about the assumptions considered for the study, download the pdf brochure

Synthetic Paper Market Players

PPG Industries, Inc. (US), Seiko Epson Corporation (Japan), Agfa-Gevaert Group (Belgium), Yupo Corporation (Japan), and Arjobex SAS (France) are the key players operating in the synthetic paper market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for to synthetic paper from emerging economies.

Synthetic Paper Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 766 million |

|

Revenue Forecast in 2027 |

USD 1,286 million |

|

CAGR |

9.2% |

|

Market size available for years |

2020-2027 |

|

Base year |

2021 |

|

Forecast period |

2022-2027 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Raw Material, Application, End-use Industry and Region |

|

Regions |

Asia Pacific, Europe, North America, South America, and Middle East & Africa |

|

Companies |

PPG Industries, Inc. (US), Seiko Epson Corporation (Japan), Agfa-Gevaert Group (Belgium), Yupo Corporation (Japan), and Arjobex SAS (France) |

This research report categorizes the synthetic paper market based on application, end-use industry and region.

Synthetic Paper Market, By Application:

- BOPP

- HDPE

- PET

- PVC

Synthetic Paper Market, By Application:

- Printing

- Labels & Tags

- Packaging

- Others

Synthetic Paper Market, By End-use Industry:

- Industrial

- Institutional

- Commercial/Retail

Synthetic Paper Market, By Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In 2020, Arjobex SAS acquired 100% shares of the MDV Group—a niche manufacturer and coater of specialty papers and films for the print, packaging, medical, sign/display and building industries. MDV is the European market leader of fluorescent papers under the brand Fluolux and a major player in the films and synthetic paper market with brands like Robuskin and Satinex. This acquisition has greatly expanded Arjobex's footprint in Europe, making it the leading European specialty coatings solutions provider for paper and films.

- In January 2019, this agreement was signed between the Agfa-Gevaert Group and Fujitex Co., Ltd., a global trading company in Japan, to distribute synthetic paper under the trade name of SYNAPS. The agreement includes distributing SYNAPS XM products as Fujitex has a stronghold on the printer market.

- In September 2020, Yupo Corporation launched "SUPERYUPO Double" (grade: FRBW) grade for oil-based offset printing suitable for double-sided printing using oil-based ink for paper. "SUPERYUPO Double" is an innovative synthetic paper that retains YUPO's core characteristics, such as outstanding durability, water resistance, and suitability for printing, while allowing double-sided printing using oil-based ink for paper without having to use special synthetic paper ink. The product is part of the YUPO GREEN Series that is blended partially with plant-derived biomass resin, which helps reduce CO2 emissions..

- In June 2019, Yupo Corporation has developed its new synthetic paper, manufactured from biodegradable plastic resin, used for label applications. These YUPO Green Synthetic papers are made from sugarcane bagasse, which substitutes conventional crude oil-based paper. This development was an initiative by Yupo corporation has taken regarding the sustainable development goal of the organization and to produce environmentally friendly products.

- In September 2017, Transilwrap Teslin Synthetic Paper launched a rigid, opaque, glossy finished synthetic paper available in rolls and sheets with different thicknesses.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the synthetic paper market?

The growth of the global synthetic paper market is directly related to the strict government regulation against deforestation which results in high demand for conventional resources.

What are the market dynamics for the different raw materials of synthetic paper?

Based on raw materials, the synthetic paper market includes BOPP, HDPE, PET, and PVC. The BOPP raw material segment led the application segment of the market in terms of both value and volume. BOPP is extensively used in applications that require heat stabilities, water and fatigue resistance, high tensile strength, and ease of printing. Due to the ability to be manufactured into a thin transparent substrate, BOPP can be used for labels and printing applications. BOPP can be environmentally friendly and low in toxicity, making this synthetic paper used to pack food items and beverages.

What are the market dynamics for the different application of synthetic paper?

Based on applications, the synthetic paper market is divides into printing, labels & tags, packaging, and others. Printing is the largest application of synthetic paper. It has micropores on the surface, enabling better affinity for ink holding and providing a high-quality finish. Its properties such as durability, tear resistance, water resistance, scratch resistance, and abrasion resistance make it an important substrate against conventional papers. The synthetic paper has a lower static surface, which prevents double feeding and eases the printing process, making synthetic papers suitable with various printers for several printing applications. These printing applications include menus, personalized marketing materials, point of purchase displays, wrist bands, cards/envelopes, tickets/passes, and labels for various end-use industries.

What are the market dynamics for the different end-use industries of synthetic paper?

Based on end-use industry, the synthetic paper market is divides into industrial, institutional, and commercial/retail. The industrial end-use industry segment is the largest end-user of synthetic paper. Synthetic paper is used in industrial product identification tags, Industrial labels. Outdoor applications for synthetic paper include billboards, horticulture ID tags, and bus shelter displays. It is resistant to moisture and chemicals and maintains print color consistency in the face of UV exposure and various weather conditions. Furthermore, the non-tearable paper has superior strength and excellent printability with various printing techniques.

Who are the major manufacturers of the synthetic paper market?

PPG Industries, Inc. (US), Seiko Epson Corporation (Japan), Agfa-Gevaert Group (Belgium), Yupo Corporation (Japan), and Arjobex SAS (France) are the key players operating in the synthetic paper market.

What are the major factors which will impact market growth during the forecast period?

The price fluctuations in basic raw materials such as polybutylene, polypropylene, and polyethylene may limit the synthetic paper market. Synthetic paper prices are also influenced by crude oil, which is a major restraint. Crude oil price fluctuations are expected to raise the prices of PP and PE.

What are the effects of COVID-19 on the synthetic paper market?

The COVID-19 pandemic has significantly impacted the pigments industry worldwide, and it is difficult to ascertain the extent and severity of the impact in the long term. COVID-19 has had three major effects on the global economy: direct effects on production and demand, supply chain and market disruption, and financial impact on enterprises and financial markets. The market's expansion was hampered by disruptions in supply chain management and products and service transportation. The demand for essential services, such as personal and healthcare products is witnessing a spike, which can impact packaging, printing, and other applications. Prices of raw material like BOPP, HDPE, PP, PE has also risen. However, the demand from packaging of non-essential industries is increasing gradually with many countries easing the restricted movement across countries. The market is expected to expand at a rapid pace in the next years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 SYNTHETIC PAPER MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

FIGURE 2 MARKET, BY REGION

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 3 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

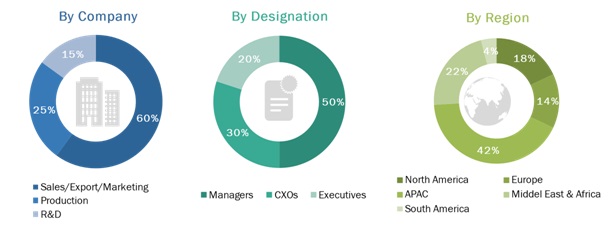

FIGURE 4 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: SUPPLY-SIDE

2.3 DATA TRIANGULATION

FIGURE 8 MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 9 BOPP SEGMENT TO LEAD RAW MATERIAL SEGMENT

FIGURE 10 PRINTING SEGMENT TO LEAD APPLICATION SEGMENT

FIGURE 11 INDUSTRIAL SEGMENT TO LEAD END-USE INDUSTRY SEGMENT

FIGURE 12 ASIA PACIFIC LED SYNTHETIC PAPER MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN SYNTHETIC PAPER MARKET

FIGURE 13 MARKET IN ASIA PACIFIC REGION TO OFFER ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD

4.2 SYNTHETIC PAPER MARKET, BY REGION

FIGURE 14 NORTH AMERICA TO BE FASTEST-GROWING REGION

4.3 MARKET IN ASIA PACIFIC, 2020

FIGURE 15 CHINA AND PRINTING ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC SYNTHETIC PAPER MARKET

4.4 MARKET: GLOBAL SNAPSHOT

FIGURE 16 CANADIAN MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 52)

5.1 OVERVIEW

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SYNTHETIC PAPER MARKET

5.2.1 DRIVERS

5.2.1.1 Synthetic papers are eco-friendly and possess ideal physical properties

5.2.1.2 Synthetic papers have wide areas of application

5.2.2 RESTRAINTS

5.2.2.1 Fluctuation in the price of raw materials and crude oil

5.2.3 OPPORTUNITIES

5.2.3.1 Stringent government regulations and increasing concerns about pulp paper for environmental pollution

5.2.4 CHALLENGES

5.2.4.1 Exorbitant prices of synthetic papers

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 18 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.4 COVID-19 IMPACT ON SYNTHETIC PAPER MARKET

5.4.1 INTRODUCTION

5.4.2 IMPACT ON PAPER AND PACKAGING INDUSTRY

5.4.3 IMPACT OF COVID-19 ON VARIOUS COUNTRIES

FIGURE 19 PRE- AND POST-COVID-19 SCENARIO OF MARKET

6 INDUSTRY TRENDS (Page No. - 57)

6.1 VALUE CHAIN

6.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 20 PORTER'S FIVE FORCES ANALYSIS

TABLE 2 SYNTHETIC PAPER MARKET: PORTER'S FIVE FORCE ANALYSIS

6.2.1 THREAT OF NEW ENTRANTS

6.2.2 THREAT OF SUBSTITUTES

6.2.3 BARGAINING POWER OF SUPPLIERS

6.2.4 BARGAINING POWER OF BUYERS

6.2.5 INTENSITY OF COMPETITIVE RIVALRY

6.3 V4 MANDATES

6.3.1 YC & YCC SHIFT

6.3.1.1 Revenue shift & new revenue pockets for synthetic paper manufacturers

FIGURE 21 REVENUE SHIFT FOR SYNTHETIC PAPER SERVICE, SOLUTION, AND PRODUCT PROVIDERS

6.3.2 TRADE ANALYSIS

TABLE 3 PAPER, PAPERBOARD, CELLULOSE WADDING, AND WEBS OF CELLULOSE FIBER IMPORT TRADE DATA, 2020 (USD THOUSAND)

TABLE 4 PAPER, PAPERBOARD, CELLULOSE WADDING, AND WEBS OF CELLULOSE FIBER EXPORT TRADE DATA, 2020 (USD THOUSAND)

6.3.3 ECOSYSTEM

FIGURE 22 SYNTHETIC PAPER MARKET ECOSYSTEM

6.3.4 PRICING ANALYSIS

6.3.5 TECHNOLOGY ANALYSIS

6.3.5.1 Cosmo Films upgraded synthetic paper to revolutionize industry

6.3.6 CASE STUDY ANALYSIS

6.3.6.1 In-Depth Optical Analysis

6.3.7 REGULATORY ANALYSIS

6.4 KEY CONFERENCES & EVENTS IN 2022

TABLE 5 SYNTHETIC PAPER MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.5 REGULATORY LANDSCAPE

6.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.6 SYNTHETIC PAPER PATENT ANALYSIS

6.6.1 INTRODUCTION

6.6.2 METHODOLOGY

6.6.3 DOCUMENT TYPE

FIGURE 23 PATENT ANALYSIS

FIGURE 24 PUBLICATION TRENDS - LAST 10 YEARS

6.6.4 INSIGHT

6.6.5 LEGAL STATUS OF PATENTS

FIGURE 25 STATUS OF PATENTS

FIGURE 26 JURISDICTION ANALYSIS

6.6.6 TOP COMPANIES/APPLICANTS

FIGURE 27 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NO OF PATENTS

TABLE 9 LIST OF PATENTS BY EAST CHINA UNIVERSITY OF SCIENCE AND TECHNOLOGY

TABLE 10 LIST OF PATENTS BY NAN YA PLASTICS CORPORATION

TABLE 11 LIST OF PATENTS BY EASTMAN CHEM CO:

TABLE 12 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

7 SYNTHETIC PAPER MARKET, BY RAW MATERIAL (Page No. - 74)

7.1 INTRODUCTION

FIGURE 28 BOPP TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

TABLE 13 SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 14 MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD MILLION)

TABLE 15 MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 16 MARKET SIZE, BY RAW MATERIAL, 2020–2027 (KILOTON)

7.2 BOPP

7.2.1 DEMAND FROM PACKAGING AND LABELING TO BOOST BOPP SEGMENT

TABLE 17 BOPP MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 18 BOPP MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.3 HDPE

7.3.1 ABILITY TO BOND WITH SUBSTRATES AND TAMPER-EVIDENT PROPERTIES IS DRIVING DEMAND FOR HDPE SEGMENT

TABLE 19 HDPE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 20 HDPE MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.4 PET

TABLE 21 PET MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 22 PET MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.5 PVC

TABLE 23 PVC MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 24 PVC MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8 SYNTHETIC PAPER MARKET, BY APPLICATION (Page No. - 80)

8.1 INTRODUCTION

FIGURE 29 PRINTING APPLICATION SEGMENT TO LEAD SYNTHETIC PAPER MARKET

TABLE 25 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 26 MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 27 MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 28 MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.2 PRINTING

8.2.1 EXCELLENT PHYSICAL PROPERTIES OF SYNTHETIC PAPERS TO BOOST PRINTING SEGMENT OF SYNTHETIC PAPER MARKET

TABLE 29 PRINTING SEGMENT MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 30 PRINTING SEGMENT MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8.3 PACKAGING

8.3.1 SYNTHETIC PAPER BEING AN ECO-FRIENDLY SUBSTITUTE OF CELLULOSE-BASED PAPER TO BOOST MARKET

TABLE 31 PACKAGING SEGMENT MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 32 PACKAGING SEGMENT MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8.4 LABELS & TAGS

8.4.1 EXTENSIVE USAGE OF LABELS IN VARIOUS INDUSTRIES TO BOOST LABELS & TAGS SEGMENT

TABLE 33 LABELS & TAGS SEGMENT MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 34 LABELS & TAGS SEGMENT MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8.5 OTHERS

TABLE 35 OTHER SEGMENT MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 36 OTHER SEGMENT MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

9 SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY (Page No. - 87)

9.1 INTRODUCTION

FIGURE 30 INDUSTRIAL END-USE INDUSTRY SEGMENT TO SYNTHETIC PAPER MARKET

TABLE 37 MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 38 MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 39 MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 40 MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.2 INDUSTRIAL

9.2.1 OPTIMUM CHEMICAL AND PHYSICAL PROPERTIES TO BOOST INDUSTRIAL SEGMENT

TABLE 41 INDUSTRIAL SEGMENT MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 42 INDUSTRIAL SEGMENT MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

9.3 INSTITUTIONAL

9.3.1 IDEAL PROPERTIES OF SYNTHETIC PAPER TO BOOST INSTITUTIONAL SEGMENT OF SYNTHETIC MARKET

TABLE 43 INSTITUTIONAL SEGMENT MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 44 INSTITUTIONAL SEGMENT MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

9.4 COMMERCIAL/RETAIL

9.4.1 EASE IN PRINTABILITY TO BOOST COMMERICIAL/RETAIL SEGMENT IN SYNTHETIC PAPER MARKET

TABLE 45 COMMERCIAL/RETAIL SEGMENT MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 46 COMMERCIAL/RETAIL SEGMENT MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

10 SYNTHETIC PAPER MARKET: REGIONAL ANALYSIS (Page No. - 92)

10.1 INTRODUCTION

TABLE 47 INTERIM ECONOMIC OUTLOOK FORECAST, 2019–2021

FIGURE 31 NORTH AMERICA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

10.1.1 GLOBAL: SYNTHETIC PAPER MARKET, BY REGION

TABLE 48 GLOBAL: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 GLOBAL: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 50 GLOBAL: MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 51 GLOBAL: MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

10.1.2 GLOBAL: SYNTHETIC PAPER MARKET, BY RAW MATERIAL

TABLE 52 GLOBAL: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 53 GLOBAL: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD MILLION)

TABLE 54 GLOBAL:MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 55 GLOBAL: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (KILOTON)

10.1.3 GLOBAL: SYNTHETIC PAPER MARKET, BY APPLICATION

TABLE 56 GLOBAL: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 57 GLOBAL: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 58 GLOBAL: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 59 GLOBAL: MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.1.4 GLOBAL: SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

TABLE 60 GLOBAL: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 61 GLOBAL: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 62 GLOBAL: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 63 GLOBAL: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.2 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: SYNTHETIC PAPER MARKET SNAPSHOT

10.2.1 ASIA PACIFIC: SYNTHETIC PAPER MARKET, BY COUNTRY

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

10.2.2 ASIA PACIFIC: SYNTHETIC PAPER MARKET, BY RAW MATERIAL

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 71 ASIA PACIFIC: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (KILOTON)

10.2.3 ASIA PACIFIC: SYNTHETIC PAPER MARKET, BY APPLICATION

TABLE 72 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 75 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.4 ASIA PACIFIC: SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

TABLE 76 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 77 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.2.5 CHINA

10.2.5.1 China to continue dominating in Asia Pacific market

TABLE 80 CHINA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 81 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 82 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 83 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.2.6 INDIA

10.2.6.1 Increasing demand in manufacturing, food, and pharmaceutical industries to drive synthetic paper market

TABLE 84 INDIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 85 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 86 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 87 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.2.7 JAPAN

10.2.7.1 Increasing governmental regulatory interventions concerning deforestation to drive synthetic paper market

TABLE 88 JAPAN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 89 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 90 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 91 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.2.8 TAIWAN

10.2.8.1 Food & beverage industry drives market

TABLE 92 TAIWAN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 93 TAIWAN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 94 TAIWAN: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 95 TAIWAN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.2.9 SOUTH KOREA

10.2.9.1 Growing packaging industry to boost synthetic paper market in country

TABLE 96 SOUTH KOREA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 97 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 98 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 99 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.2.10 REST OF ASIA PACIFIC

TABLE 100 REST OF ASIA PACIFIC: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 101 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 102 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 103 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.3 EUROPE

10.3.1 EUROPE: SYNTHETIC PAPER MARKET, BY COUNTRY

TABLE 104 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 107 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

10.3.2 EUROPE: SYNTHETIC PAPER MARKET, BY RAW MATERIAL

TABLE 108 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 111 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (KILOTON)

10.3.3 EUROPE: SYNTHETIC PAPER MARKET, BY APPLICATION

TABLE 112 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 115 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.3.4 EUROPE: SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

TABLE 116 EUROPE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 119 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.3.5 GERMANY

10.3.5.1 Increasing demand from printing and paper technology to augment synthetic paper market

TABLE 120 GERMANY: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 121 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 122 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 123 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.3.6 FRANCE

10.3.6.1 Growing applications such as printing and labeling in various end-use industries to boost market

TABLE 124 FRANCE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 125 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 126 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 127 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.3.7 UK

10.3.7.1 Growth of food & beverage as key industry to boost demand for synthetic paper

TABLE 128 UK: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 129 UK: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 130 UK: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 131 UK: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.3.8 ITALY

10.3.8.1 Increase in chemical industries and export of food items to drive the market

TABLE 132 ITALY: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 133 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 134 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 135 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.3.9 SPAIN

10.3.9.1 Changing food habits to drive synthetic paper market

TABLE 136 SPAIN: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 137 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 138 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 139 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.3.10 RUSSIA

10.3.10.1 Automotive and construction industries to drive market

TABLE 140 RUSSIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 141 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 142 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 143 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.3.11 REST OF EUROPE

TABLE 144 REST OF EUROPE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 145 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 146 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 147 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.4 NORTH AMERICA

10.4.1 NORTH AMERICA: SYNTHETIC PAPER MARKET, BY REGION

TABLE 148 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 149 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 150 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 151 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

10.4.2 NORTH AMERICA: SYNTHETIC PAPER MARKET, BY RAW MATERIAL

TABLE 152 NORTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 153 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD MILLION)

TABLE 154 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 155 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (KILOTON)

10.4.3 NORTH AMERICA: SYNTHETIC PAPER MARKET, BY APPLICATION

TABLE 156 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 157 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 158 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 159 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4.4 NORTH AMERICA: SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

TABLE 160 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 161 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 162 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 163 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.4.5 US

10.4.5.1 Increased preference for packaged food is expected to drive synthetic paper market

TABLE 164 US: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 165 US: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 166 US: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 167 US: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.4.6 CANADA

10.4.6.1 Rising demand for durable substrates for outdoor applications is expected to drive market growth

TABLE 168 CANADA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 169 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 170 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 171 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.4.7 MEXICO

10.4.7.1 Increasing number of paper packaging industries to drive market growth

TABLE 172 MEXICO: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 173 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 174 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 175 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.5 SOUTH AMERICA

10.5.1 SOUTH AMERICA: SYNTHETIC PAPER MARKET, BY REGION

TABLE 176 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 177 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 178 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 179 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

10.5.2 SOUTH AMERICA: SYNTHETIC PAPER MARKET, BY RAW MATERIAL

TABLE 180 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 181 SOUTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD MILLION)

TABLE 182 SOUTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 183 SOUTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (KILOTON)

10.5.3 SOUTH AMERICA: SYNTHETIC PAPER MARKET, BY APPLICATION

TABLE 184 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 185 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 186 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 187 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5.4 SOUTH AMERICA: SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

TABLE 188 SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 189 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 190 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 191 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.5.5 BRAZIL

10.5.5.1 Growing need for an alternative to pulp paper to drive synthetic paper market in Brazil

TABLE 192 BRAZIL: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 193 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 194 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 195 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.5.6 ARGENTINA

10.5.6.1 Government's step to promote exports positively impacts Argentinian market

TABLE 196 ARGENTINA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 197 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 198 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 199 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.5.7 REST OF SOUTH AMERICA

TABLE 200 REST OF SOUTH AMERICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 201 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 202 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 203 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.6 MIDDLE EAST & AFRICA

10.6.1 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET, BY COUNTRY

TABLE 204 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 205 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 207 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

10.6.2 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET, BY RAW MATERIAL

TABLE 208 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 209 MIDDLE EAST & AFRICA: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD MILLION)

TABLE 210 MIDDLE EAST & AFRICA: MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 211 MIDDLE EAST & AFRICA: MARKET SIZE, BY RAW MATERIAL, 2020–2027 (KILOTON)

10.6.3 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET, BY APPLICATION

TABLE 212 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 213 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 214 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 215 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.6.4 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET, BY END-USE INDUSTRY

TABLE 216 MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 217 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 218 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 219 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.6.5 SAUDI ARABIA

10.6.5.1 Increasing opportunities in end-use industries and availability of crude oil to fuel synthetic paper market

TABLE 220 SAUDI ARABIA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 221 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 222 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 223 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.6.6 SOUTH AFRICA

10.6.6.1 Growth in pharmaceutical industry to fuel market

TABLE 224 SOUTH AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 225 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 226 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 227 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.6.7 UAE

10.6.7.1 Substantial growth of printing applications to fuel synthetic paper market UAE

TABLE 228 UAE: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 229 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 230 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 231 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.6.8 REST OF MIDDLE EAST & AFRICA

TABLE 232 REST OF MIDDLE EAST & AFRICA: SYNTHETIC PAPER MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 233 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 234 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 235 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 157)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 33 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENT AND ACQUISITION AS KEY GROWTH STRATEGY, 2017–202O

11.3 MARKET RANKING

FIGURE 34 MARKET RANKING OF KEY PLAYERS, 2020

11.3.1 PPG INDUSTRIES INC.

11.3.2 SEIKO EPSON CORPORATION

11.3.3 AGFA-GEVAERT CORPORATION

11.3.4 YUPO CORPORATION

11.3.5 ARJOBEX SAS

11.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 35 REVENUE ANALYSIS FOR KEY COMPANIES IN SYNTHETIC PAPER MARKET

11.5 MARKET SHARE ANALYSIS

TABLE 236 SYNTHETIC PAPER MARKET: MARKET SHARES OF KEY PLAYERS

FIGURE 36 SHARE OF LEADING COMPANIES IN MARKET

11.6 COMPANY EVALUATION QUADRANT

FIGURE 37 MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

11.6.1 STARS

11.6.2 PERVASIVE

11.6.3 EMERGING LEADERS

11.6.4 PARTICIPANTS

11.7 COMPETITIVE BENCHMARKING

TABLE 237 SYNTHETIC PAPER MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 238 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

FIGURE 38 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 39 BUSINESS STRATEGY EXCELLENCE

11.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

11.8.1 PROGRESSIVE COMPANIES

11.8.2 RESPONSIVE COMPANIES

11.8.3 STARTING BLOCKS

11.8.4 DYNAMIC COMPANIES

FIGURE 40 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

11.9 COMPETITIVE SCENARIO AND TRENDS

11.9.1 DEALS

TABLE 239 SYNTHETIC PAPER MARKET: DEALS, JANUARY 2019–DECEMBER 2020

11.9.2 OTHERS

TABLE 240 MARKET: NEW PRODUCT DEVELOPMENT, SEPTEMBER 2017-SEPTEMBER 2020

12 COMPANY PROFILES (Page No. - 168)

12.1 KEY COMPANIES

(Business overview, Products and solutions, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

12.1.1 PPG INDUSTRIES, INC.

TABLE 241 PPG INDUSTRIES, INC.: BUSINESS OVERVIEW

FIGURE 41 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

TABLE 242 PPG INDUSTRIES, INC.: PRODUCT OFFERED

12.1.2 SEIKO EPSON CORPORATION

TABLE 243 SEIKO EPSON CORPORATION: BUSINESS OVERVIEW

FIGURE 42 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

TABLE 244 SEIKO EPSON CORPORATION: PRODUCT OFFERED

12.1.3 AGFA-GEVAERT GROUP

TABLE 245 AGFA-GEVAERT GROUP: BUSINESS OVERVIEW

FIGURE 43 AGFA-GEVAERT GROUP: COMPANY SNAPSHOT

TABLE 246 AGFA-GEVAERT GROUP: PRODUCT OFFERED

TABLE 247 AGFA-GEVAERT GROUP: DEALS

12.1.4 YUPO CORPORATION

TABLE 248 YUPO CORPORATION: BUSINESS OVERVIEW

TABLE 249 YUPO CORPORATION: PRODUCT OFFERED

TABLE 250 YUPO CORPORATION: OTHERS

12.1.5 ARJOBEX SAS

TABLE 251 ARJOBEX SAS: BUSINESS OVERVIEW

TABLE 252 ARJOBEX SAS: PRODUCT OFFERED

TABLE 253 NIPPON STEEL & SUMITOMO METAL CORPORATION: DEALS

12.1.6 AMERICAN PROFOL INC.

TABLE 254 AMERICAN PROFOL INC.: BUSINESS OVERVIEW

TABLE 255 AMERICAN PROFOL INC.: PRODUCT OFFERED

12.1.7 HOP INDUSTRIES CORPORATION

TABLE 256 HOP INDUSTRIES CORPORATION: BUSINESS OVERVIEW

TABLE 257 HOP INDUSTRIES CORPORATION: PRODUCT OFFERED

12.1.8 RELYCO SALES, INC.

TABLE 258 RELYCO SALES, INC.: BUSINESS OVERVIEW

TABLE 259 RELYCO SALES, INC.: PRODUCT OFFERED

12.1.9 TRANSILWRAP COMPANY, INC.

TABLE 260 TRANSILWRAP COMPANY, INC.: BUSINESS OVERVIEW

TABLE 261 TRANSILWRAP COMPANY, INC.: PRODUCT OFFERED

TABLE 262 TRANSILWRAP COMPANY, INC.: OTHERS

12.1.10 MDV PAPIER-UND KUNSTSTOFFVEREDELUNG GMBH

TABLE 263 MDV PAPIER-UND KUNSTSTOFFVEREDELUNG GMBH: BUSINESS OVERVIEW

TABLE 264 MDV PAPIER-UND KUNSTSTOFFVEREDELUNG GMBH: PRODUCT OFFERED

12.2 OTHER PLAYERS

12.2.1 COSMO FILMS LTD.

TABLE 265 COSMO FILMS LTD.: COMPANY OVERVIEW

12.2.2 NEENAH INC.

TABLE 266 NEENAH INC.: COMPANY OVERVIEW

12.2.3 TOYOBO CO. LTD.

TABLE 267 TOYOBO CO. LTD.: COMPANY OVERVIEW

12.2.4 HWASEUNG INDUSTRIES CO., LTD.

TABLE 268 HWASEUNG INDUSTRIES CO., LTD: COMPANY OVERVIEW

12.2.5 INNOVIA FLIMS

TABLE 269 INNOVIA FLIMS: COMPANY OVERVIEW

12.2.6 NAN YA PLASTICS CORPORATION

TABLE 270 NAN YA PLASTICS CORPORATION: COMPANY OVERVIEW

12.2.7 VALERON STRENGTH FILMS

TABLE 271 VALERON STRENGTH FILMS: COMPANY OVERVIEW

12.2.8 ALUMINIUM FÉRON GMBH & CO. KG

TABLE 272 ALUMINIUM FÉRON GMBH & CO. KG: COMPANY OVERVIEW

12.2.9 HUANYUAN PLASTIC FILM CO., LTD.

TABLE 273 HUANYUAN PLASTIC FILM CO., LTD.: COMPANY OVERVIEW

12.2.10 TAMERICA PRODUCTS INC.

TABLE 274 TAMERICA PRODUCTS INC.: COMPANY OVERVIEW

12.2.11 RUIAN RIFO PACKAGING MATERIAL CO., LTD.

TABLE 275 RUIAN RIFO PACKAGING MATERIAL CO., LTD.: COMPANY OVERVIEW

12.2.12 KAVERI METALLISING & COATING INDUSTRIES PVT. LTD.

TABLE 276 KAVERI METALLISING & COATING INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

12.2.13 SHIJIAZHUANG DADAO PACKAGING MATERIALS CO.LTD.

TABLE 277 SHIJIAZHUANG DADAO PACKAGING MATERIALS CO.LTD.: COMPANY OVERVIEW

12.2.14 ELASTIN INTERNATIONAL CORP.

TABLE 278 ELASTIN INTERNATIONAL CORP.: COMPANY OVERVIEW

12.2.15 MASTERPIECE GRAPHIX

TABLE 279 MASTERPIECE GRAPHIX: COMPANY OVERVIEW

*Details on Business overview, Products and solutions, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 196)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

Paper Market Overview

Paper Market Trends

Top Companies in Paper Market

Paper Market Impact on Different Industries

Speak to our Analyst today to know more about Paper Market!

The study involved four major activities in estimating the current market size for the synthetic paper market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Synthetic Paper Market Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Synthetic Paper Market Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding various trends related to process, end-use sector, and region. Stakeholders from the demand side, such as horticulture, pharmaceutical, transportation and industrial, and other companies of the customer/end users who are using synthetic paper were interviewed to understand the buyers’ perspective on suppliers, products, service providers, and their current use of synthetic paper and outlook of their business, which will affect the overall market.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Synthetic Paper Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the synthetic paper market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Synthetic Paper Market Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Synthetic Paper Market Report Objectives

- To define, describe, and forecast the global synthetic paper market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the synthetic paper market based on raw material, application and end-use

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, South America, and Middle East & Africa along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisitions, collaborations, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Synthetic Paper Market Report Available Customizations

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Synthetic Paper Market