Specialty Paper Market by Type (Decor Paper, Release Liner Paper, Packaging Paper, and Printing Paper), Application (Building & Construction, Industrial, Packaging & Labeling, and Printing & Writing), Raw Material (Pulp, Fillers & Binders, Additives, and Coatings), & by Region - Global Trends & Forecasts to 2020

[227 Pages Report] Specialty papers are special grades of paper which are possess of specific characteristics and properties designed for specific end use. The raw material used for specialty paper are pulp (from wood chips, recycled paper, wood pulp, and cotton fiber), which is fed into the paper-making machine; after that, the paper is coated with specialty chemicals for preparing it for a specific use. Specialty paper has emerged as a lucrative segment for the paper industry. From paper currency to coffee filters, décor papers, insulation paper, and carbonless copy paper, they are present in the daily lives of consumers.

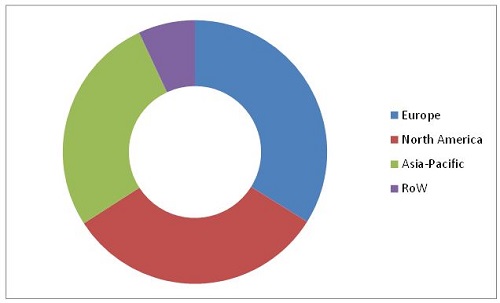

Europe dominated the market in 2014, which accounted for around ~33% in terms of volume of the total specialty paper market. On the other hand, Asia-Pacific is projected to be the fastest-growing market for the period considered for this study, due to growing demand for specialty products and increasing awareness among people. In terms of applications, packaging & labeling is projected to be the largest market for specialty paper from 2015 to 2020; however, the market is also projected to be the fastest-growing for the period under study. In North America, the U.S. accounted for the largest market share in terms of value and volume among all countries across the world.

Specilaty Paper Market Share (Volume), by Region, 2014

Source: Expert Interviews and MarketsandMarkets Analysis

This report estimates the size of the specialty paper market in terms of volume (KT). In this report, the market has been segmented broadly on the basis of type, application, raw material, and region. The market drivers, restraints, opportunities, and challenges, and product price trends have been discussed in detail. The share of participants in the overall market has been discussed in detail.

Scope of the Report

This research report categorizes the specialty paper market based on type, application, and region.

Based on type, the market has been segmented as follows:

- Décor paper

- Release Liner paper

- Packaging paper

- Printing paper

- Others including medical grade paper, insulation paper, automotive filter paper, security paper and currency check paper)

Based on application, the market has been segmented as follows:

- Building & construction

- Industrial

- Packaging & labeling

- Printing & writing

- Others (including medical application, automobile filter application, and banking application)

Based on raw material, the market has been segmented as follows:

- Pulp

- Fillers & Binders

- Additives

- Coatings

- Others (specialty fiber filings, bleaching chemicals, cotton, linen, and bonding chemicals)

Based on region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (Israel, Chile, UAE, and Colombia)

Specilaty paper is one of the most important segment of paper and play a very significiant role for the industries such as packaging, printing, construction and labeling. Specialty paper is manufactured and sometimes, normal paper converted into special paper with use of chemicals. The specialty paper is in specific grades and is intended to use for special purpose. Specialty paper are gaining significance due to increasing end-use application and improving lifestyle and economy in countries such as India, China, Japan, Brazil, and Argentina.

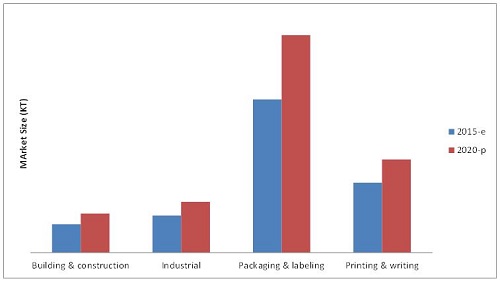

Speciality Paper Market Size, by Application, 2015 Vs. 2020 (KT)

E - Estimated; P - Projected

Source: Expert Interviews and MarketsandMarkets Analysis

The specialty paper market, in terms of volume, is projected to reach 34,879.08 KT by 2020, growing at a CAGR of around 6.59% from 2015. The market was dominated by Europe in 2014, which accounted for around ~33% of the total specialty paper market in terms of volume. On the other hand, Asia-Pacific is projected to be the fastest-growing market for the period considered for this study, due to growing demand for specialty products and increasing awareness among people. In terms of application, packaging & labeling is projected to be the largest market for specialty paper from 2015 to 2020; however, the market is also projected to grow at the highest CAGR for the period under study. Printing & writing are projected to grow at a CAGR of 5.89% for the period under review, owing to increasing consumers’ concern regarding lesser use of paper and paper made products the market is growing at a very low pace. In 2014,Printing & writing segment accounts for the second-largest share in the specialty paper market; the market tends to gain popularity in the next five years due to consumers’ increasing preference for laminated wooden sheets and wallpapers for residential as well as commercial interiors.

The specialty paper market is characterized by intense competition due to the presence of a large number of both large- and small-scale firms. Expansions, investments, acquisitions, agreements, partnerships, joint ventures, and new product launches are the key strategies adopted by market players to ensure their growth in the market. The market is dominated by players such as International Paper (U.S.), ITC Ltd. (India), Stora Enso (Finland), Nippon Paper Group (Japan), Mondi Plc. (South Africa), and Sappi Ltd. (South Africa).

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Periodization Considered for the Specialty Paper Market

1.4 Base Currency Considered for the Specialty Papers Market

1.5 Base Unit Considered for the Specialty Paper Market

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 24)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.2.1 Breakdown of Primaries, By Company Type, Designation & Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Overview of the Parent Industry

2.2.3 Demand-Side Analysis

2.2.3.1 Rising Population

2.2.3.1.1 Increase in Middle-Class Population, 2009-2030

2.2.3.2 Developing Economies, GDP (Purchasing Power Parity), 2013

2.2.4 Supply-Side Analysis

2.2.4.1 Regulations

2.2.4.2 Research & Development

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Market Share Estimation

2.6 Research Assumptions & Limitations

2.6.1 Limitations of the Research Study

3 Executive Summary (Page No. - 35)

3.1 Evolution of Specialty Paper

3.2 Packaging Paper to Lead the Specialty Paper Industry

3.3 Packaging & Labeling Projected to Be the Fastest-Growing Market By 2020

3.4 Asia-Pacific: Best Market for Investment

3.5 Europe: Leading Market for Specialty Paper

3.6 Investments & Expansions and Mergers & Acquistions Were the Key Growth Strategies

4 Premium Insights (Page No. - 41)

4.1 Attractive Opportunities in Specialty Paper Market

4.2 Packaging Paper Segment to Grow at the Highest Rate Over the Next Five Years

4.3 Packaging & Labeling Application Accounted for the Largest Share in the Asia-Pacific Region

4.4 Growth Prospects in the Market

4.5 Asia-Pacific Region to Provide Immense Potential for Specialty Paper Market Growth

4.6 China & Japan: High Growth Markets

5 Market Overview (Page No. - 47)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Specialty Paper Market By Type

5.2.2 Specialty Papers Market, By Application

5.2.3 Specialty Paper Market, By Raw Material

5.2.4 Specialty Papers Market, By Geography

5.3 Market Dynamics

5.3.1.1 Increasing Urban Population and Development of Food & Beverage Sector Key Drivers for Specialty Paper Market

5.3.2 Drivers

5.3.2.1 Increasing Urban Population

5.3.2.2 Developing Economies Transforming Into Colossal Markets

5.3.2.3 Development of Food & Beverage Sector

5.3.3 Restraints

5.3.3.1 Shortage of Raw Materials

5.3.3.2 Stringent Government Rules & Regulations

5.3.4 Opportunities

5.3.4.1 Developing Countries New Destinations for Expansion

5.3.4.2 Big Opportunity in Nano Technology

5.3.5 Challenges

5.3.5.1 Infrastructural Challenges in Developing Countries

6 Industry Trends (Page No. - 58)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Major Value Addition Takes Place in Production Process of Specialty Paper

6.3 Supply Chain Analysis

6.3.1 Prominent Companies

6.3.2 Small & Medium Enterprises

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers:

6.4.5 Intensity of Competitive Rivalry:

7 Specialty Paper Market, By Type (Page No. - 65)

7.1 Introduction

7.2 Specialty Paper Market By Type

7.2.1 Packaging Paper: Wrapping the World Around

7.3 Décor Paper

7.3.1 Décor Paper: By Region

7.3.1.1 Asia-Pacific: Mammoth Market for Décor Paper

7.3.2 Décor Paper: By Application

7.3.2.1 Building & Construction Development: the Key Driver for Décor Paper

7.4 Release Liner Paper

7.4.1 Release Liner Paper: By Region

7.4.1.1 Europe: Leader in Release Liner Paper Production

7.4.2 Release Liner Paper: By Application

7.4.2.1 Packaging & Labeling: Highly Prospective Application for Release Liner Paper

7.5 Packaging Paper

7.5.1 Packaging Paper : By Region

7.5.1.1 North America: Biggest Market for Packaging Paper

7.5.2 Packaging Paper: By Application

7.5.2.1 New Growth Opportunities in Industrial Application

7.6 Printing Paper

7.6.1 Printing Paper: By Region

7.6.1.1 Asia-Pacific: Ray of New Hope

7.6.2 Printing Paper By Application

7.6.2.1 Digitization Causing Lower Growth Rate for Printing Paper

7.7 Other Specialty Papers

8 Specialty Paper Market, By Raw Material (Page No. - 82)

8.1 Introduction

8.2 Specialty Paper Market, By Raw Material

8.2.1 Pulp: Key Raw Material in Specialty Paper Manufacturing

8.3 Pulp

8.3.1 Mechanical Pulp

8.3.2 Chemical Pulp

8.3.3 Pulp Market, By Region

8.3.3.1 Europe: Biggest Supplier of Paper Pulp

8.3.4 Pulp Market, By Type

8.3.4.1 Packaging Paper Biggest Market for Pulp

8.4 Fillers & Binders

8.4.1 Asia-Pacific:Fastest-Growing Market for Fillers & Binders

8.4.2 Fillers & Binders, By Region

8.4.2.1 Asia-Pacific: High Growth Market

8.4.3 Fillers & Binders, By Type

8.4.3.1 Release Liners & Packaging Paper: High Growth Segments

8.5 Coatings

8.5.1 North America: Fastest-Growing Market for Coatings

8.5.2 Coatings, By Region

8.5.2.1 North America: High Growth Market

8.5.3 Coatings in Specialty Paper Market, By Type

8.5.3.1 Décor Paper: Extensive Opportunities for High Revenue Generation

8.6 Additives

8.6.1 Additives, By Region

8.6.1.1 North America: High Growth Opportunity for Specialty Paper, Additives Manufacturers

8.6.2 Additives Market, By Type

8.6.2.1 High Growth Rate in Décor and Packaging Paper

8.7 Others

9 Specialty Paper Market, By Application (Page No. - 100)

9.1 Introduction

9.1.1 Packaging & Labeling Colosal Market for Specialty Paper

9.2 Building & Construction Application

9.2.1 Building & Construction Application, By Region

9.2.1.1 Asia-Pacific: High-Growth Market for Building & Construction Application

9.2.2 Building & Construction Application By Type

9.2.2.1 Décor Paper: Potential Segment for Building & Construction Application

9.3 Industrial Application

9.3.1 Europe: The Key Market for Industrial Application

9.3.2 Industrial Application, By Type

9.3.2.1 Packaging Paper: High Potential Segment for Industrial Application

9.4 Packaging & Labeling

9.4.1 Packaging & Labeling Market, By Region

9.4.1.1 North America: Land of Opportunities for Packaging & Labeling Application

9.4.2 Packaging & Labeling Market, By Type

9.4.2.1 Release Liners: Fastest-Growing Segment

9.5 Printing & Writing

9.5.1 Printing & Writing By Region

9.5.1.1 Europe: Dominating Market for Printing & Writing

9.5.2 Printing & Writing Application By Type

9.5.2.1 Digitization: Great Threat for Printing & Writing

9.6 Others

10 Specialty Paper Market, By Region (Page No. - 115)

10.1 Introduction

10.1.1 Geographic Snapshot (2015–2020): Rapidly Growing Markets are Emerging as New Hot Spots

10.1.2 Specialty Paper Market By Region

10.1.2.1 Europe: Colosal Market for Specialty Paper

10.2 Asia-Pacific

10.2.1 Asia-Pacific Accounts for A Significiant Share of the Global Specialty Paper Market

10.2.2 Asia-Pacific: Specialty Paper Market, By Country

10.2.2.1 China: The Mamoth Consumer of Specialty Paper in Asia-Pacific

10.2.3 Asia-Pacific: Specialty Papers Market, By Type

10.2.3.1 Packaging Paper in High Demand in Asia-Pacific

10.2.4 Asia-Pacific: Specialty Paper Market, By Application

10.2.4.1 Packaging & Labeling: New Horizon for Expansion

10.2.5 Asia-Pacific: Specialty Papers Market, By Material

10.2.5.1 Fillers & Binders: Fastest Growing Segment

10.2.6 Australia

10.2.6.1 Australia: Specialty Paper Market, By Type

10.2.6.1.1 New Opportunities in Packaging Paper

10.2.6.2 Australia: Specialty Papers Market, By Application

10.2.6.2.1 Packaging & Labeling Biggest Market for Specialty Paper in Australia

10.2.7 China

10.2.7.1 China: Specialty Paper Market, By Type

10.2.7.1.1 Décor Paper: Dominant Segment in China

10.2.7.2 China: Specialty Papers Market, By Application

10.2.7.2.1 Building & Construction: High Potential Application for Specialty Paper in China

10.2.8 India

10.2.8.1 India: Specialty Paper Market, By Type

10.2.8.1.1 Décor and Packaging Paper: Leading Bandwagons in India

10.2.8.2 India: Specialty Papers Market, By Application

10.2.8.2.1 Building & Construction: Extensive Growth Opportunities for Specialty Paper

10.2.9 Japan

10.2.9.1 Japan: Specialty Paper Market, By Type

10.2.9.1.1 Packaging Paper: Fastest Growth Rate

10.2.9.2 Japan: Specialty Paper Market, By Application

10.2.9.2.1 Slow Groth Rate for Printing and Writing Application on Account of Digitisation

10.2.10 Rest of Asia-Pacific

10.2.10.1 Rest of Asia-Pacific: Specialty Paper Market, By Type

10.2.10.1.1 Packaging Paper: High Growth Opportunities

10.2.10.2 Rest of Asia-Pacific: Specialty Papers Market, By Application

10.2.10.2.1 Packaging Paper: High Growth Opportunities

10.3 Europe

10.3.1 Europe Largest Consumer of Specialty Paper

10.3.2 Europe Largest Specialty Paper Market, By Country

10.3.2.1 Germany: Goliath Consumer for Specialty Paper in Europe

10.3.3 Europe Largest Specialty Papers Market, By Type

10.3.3.1 Packaging Paper: Performance Packed High Revenue Segment

10.3.4 Europe Specialty Paper Market, By Application

10.3.4.1 Building & Construction: Emerging From Setback of Economic Crisis of 2014

10.3.5 Europe: Specialty Papers Market, By Material

10.3.5.1 Biggest Pulp Producer

10.3.6 France

10.3.6.1 France Specialty Paper Market, By Type

10.3.6.1.1 Décor Paper: Emerging Segment in France

10.3.6.2 France Specialty Papers Market, By Application

10.3.6.2.1 Printing & Writing Application: Slowest Growth in France

10.3.7 Germany

10.3.7.1 Germany Specialty Paper Market, By Type

10.3.7.1.1 Packaging and Décor Paper: Highest Revenue Generators

10.3.7.2 Germany Specialty Papers Market, By Application

10.3.7.2.1 Fmcg Sector: Driving Demand for Packaging Application

10.3.8 Poland

10.3.8.1 Poland Specialty Paper Market, By Type

10.3.8.1.1 Packaging Paper: Dominating Poland

10.3.8.2 Poland Specialty Papers Market, By Application

10.3.8.2.1 Printing & Writing: Slowest Growing Segment in Poland

10.3.9 Russia

10.3.9.1 Russia Specialty Paper Market, By Type

10.3.9.1.1 Packaging & Décor: High Growth Segments

10.3.9.2 Russia Specialty Papers Market, By Application

10.3.9.2.1 Packaging and Labeling: Fastest Growing Market

10.3.10 The U.K.

10.3.10.1 U.K. Specialty Paper Market, By Type

10.3.10.1.1 Printing Paper: Slower Growth Rate

10.3.10.2 U.K. Specialty Paper Market, By Application

10.3.10.2.1 Packaging Gaining Momentum Due to Retail Sector

10.3.11 Rest of Europe

10.3.11.1 Rest of Europe: Specialty Paper Market, By Type

10.3.11.1.1 Décor Paper: Fastest Growing Segment

10.3.11.2 Rest of Europe: Specialty Papers Market, By Application

10.4 North America

10.4.1 North America: Specialty Papers Market, By Country

10.4.1.1 U.S.: Collosal Market in the World

10.4.2 North America: Specialty Paper Market, By Type

10.4.2.1 Packaging Paper: Biggest Revenue Generator

10.4.3 North America: Specialty Papers Market, By Application

10.4.3.1 Building & Construction: High Growth Opportunities

10.4.4 North America: Specialty Paper Market, By Material

10.4.4.1 Fillers & Binders and Additives: High Growth Segments

10.4.5 The U.S

10.4.6 The U.S.: Largest Share in the North American Specialty Paper Market

10.4.6.1 The U.S.: Specialty Paper Market, By Type

10.4.6.1.1 Packaging Paper: Fastest Growing Segment

10.4.6.2 The U.S.: Specialty Papers Market, By Application

10.4.6.2.1 Packaging & Labeling: Colosal Segment

10.4.7 Mexico

10.4.7.1 Mexico: Specialty Paper Market, By Type

10.4.7.1.1 Packaging and Release Liners: Fastest Growth Opportunities

10.4.7.2 Mexico: Specialty Papers Market, By Application

10.4.7.2.1 Building & Construction: New Horizon for Expansion

10.4.8 Canada

10.4.8.1 Canada: Specialty Paper Market, By Type

10.4.8.2 Canada: Specialty Papers Market, By Application

10.4.8.2.1 Packaging & Labeling: High Growth Markets

10.5 Rest of The World

10.5.1 Rest of The World: Specialty Paper Market, By Country

10.5.1.1 Brazil: Rapid Growth Market

10.5.2 Rest of The World: Specialty Papers Market, By Type

10.5.2.1 Décor and Packaging Paper: Fastest Growing Segments

10.5.3 Rest of The World: Specialty Paper Market, By Application

10.5.3.1 Packaging & Labeling: Fastest Growing Application

10.5.4 Argentina

10.5.4.1 Argentina: Specialty Paper Market, By Type

10.5.4.1.1 Décor Paper: Driven By Increasing Construction Activity

10.5.4.2 Argentina: Specialty Papers Market, By Application

10.5.4.2.1 Packaging & Labeling: Consumer Products Driving Demand

10.5.5 Brazil

10.5.5.1 Brazil: Specialty Paper Market, By Type

10.5.5.1.1 Food Processing Sector: Driving Demand for Specialty Paper

10.5.5.2 Brazil: Specialty Papers Market, By Application

10.5.6 South Africa

10.5.6.1 South Africa: Specialty Paper Market, By Type

10.5.6.1.1 Packaging Paper in High Demand

10.5.6.2 South Africa: Specialty Papers Market, By Application

10.5.6.2.1 Packaging Paper in High Demand

10.5.7 Other Countries in RoW

10.5.7.1 Other Countries in RoW: Specialty Paper Market, By Type

10.5.7.1.1 High Potential, But Slower Growth

10.5.7.2 Other Countries in RoW: Specialty Paper Market, By Application

11 Company Profile (Page No. - 173)

11.1 Introduction

11.2 International Paper Company

11.2.1 Business Overview

11.2.2 Product Offerings

11.2.3 Key Strategy

11.2.3.1 Acquisition

11.2.4 Recent Development

11.2.5 SWOT Analysis

11.2.6 MnM View

11.3 Stora ENSO

11.3.1 Business Overview

11.3.2 Product Offerings

11.3.3 Key Strategy

11.3.3.1 Expansion

11.3.4 Recent Developments

11.3.5 SWOT Analysis

11.3.6 MnM View

11.4 Nippon Paper Group, Inc

11.4.1 Business Overview

11.4.2 Product Offerings

11.4.3 Key Strategies

11.4.3.1 Innovation

11.4.3.2 Expansion

11.4.4 Recent Developments

11.4.5 SWOT Analysis

11.4.6 MnM View

11.5 Mondi PLC.

11.5.1 Business Overview

11.5.2 Product Offerings

11.5.3 Key Strategy

11.5.3.1 Acquisitions

11.5.4 Recent Developments

11.5.5 SWOT Analysis

11.5.6 MnM View

11.6 Sappi Ltd.

11.6.1 Business Overview

11.6.2 Product Offerings

11.6.3 Key Strategies

11.6.3.1 Expansion

11.6.4 Recent Developments

11.6.5 SWOT Analysis

11.6.6 MnM View

11.7 ITC Ltd.

11.7.1 Business Overview

11.7.2 Product Offerings

11.7.3 Key Strategy

11.7.3.1 Partnership & Collaboration

11.7.4 Recent Developments

11.8 Domtar Corporation

11.8.1 Business Overview

11.8.2 Product Offerings

11.8.3 Key Strategy

11.8.3.1 Acquisition

11.8.4 Recent Developments

11.9 Glatfelter

11.9.1 Business Overview

11.9.2 Product Offerings

11.9.2.1 Recent Developments

11.10 Fedrigoni

11.10.1 Business Overview

11.10.2 Product Offerings

11.10.3 Key Strategy

11.10.3.1 Acquisition

11.10.4 Recent Development

11.11 Munksjo Group

11.11.1 Business Overview

11.11.2 Munksjo Group

11.11.3 Key Strategy

11.11.3.1 Innovation

11.11.4 Recent Developments

List of Tables (163 Tables)

Table 1 Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 2 Specialty Papers Market Size, By Type, 2013–2020 (KT)

Table 3 Décor Paper Market Size, By Region, 2013–2020 ($Million)

Table 4 Décor Paper Market Size, By Region, 2013–2020 (KT)

Table 5 Décor Paper Specialty Papers Market Size, By Application, 2013–2020 ($Million)

Table 6 Décor Paper Market Size, By Application, 2013–2020 (KT)

Table 7 Release Liner Paper Market Size, By Region, 2013–2020 ($Million)

Table 8 Release Liner Market Size, By Region, 2013–2020 (KT)

Table 9 Release Liner Paper Market Size, By Application, 2013–2020 ($Million)

Table 10 Release Liner Paper Market Size, By Application, 2013–2020 (KT)

Table 11 Packaging Paper Market Size, By Region, 2013–2020 ($Million)

Table 12 Packaging Paper Market Size, By Region, 2013–2020 (KT)

Table 13 Packaging Paper Market Size, By Application, 2013–2020 ($Million)

Table 14 Packaging Paper Market Size, By Application, 2013–2020 (KT)

Table 15 Printing Paper Market Size, By Region, 2013-2020 ($Million)

Table 16 Printing Paper Market Size, By Region,2013–2020 (KT)

Table 17 Printing Paper Market Size, By Application, 2013–2020 ($Million)

Table 18 Printing Paper Market Size, By Application, 2013–2020 (Kiloton)

Table 19 Other Specilaty Papers Market Size, By Region, 2013–2020 ($Million)

Table 20 Other Specialty Papers Market Size, By Region, 2013–2020 (KT)

Table 21 Specialty Papers Market Size, By Raw Material, 2013–2020 ($Million)

Table 22 Specialty Paper Market Size, By Raw Material, 2013–2020 (KT)

Table 23 Pulp in Specialty Paper Market Size, By Region, 2013–2020 ($Million)

Table 24 Pulp in Specialty Papers Market Size, By Region, 2013–2020 (KT)

Table 25 Pulp in Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 26 Pulp in Specialty Papers Market Size, By Type, 2013–2020 (KT)

Table 27 Fillers & Binders in Specialty Paper Market Size, By Region, 2013–2020 ($Million)

Table 28 Fillers & Binders in Specialty Papers Market Size, By Region, 2013–2020 ( KT)

Table 29 Fillers & Binders in Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 30 Fillers & Binders in Specialty Papers Market Size, By Type, 2013–2020 (KT)

Table 31 Coatings in Specialty Paper Market Size, By Region, 2013–2020 ($Million)

Table 32 Coatings in Specialty Papers Market Size, By Region, 2013–2020 (KT)

Table 33 Coatings in Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 34 Coatings in Specialty Papers Market Size, By Type, 2013–2020 (KT)

Table 35 Additives in Specialty Paper Market Size, By Region, 2013–2020 ($Million)

Table 36 Additives in Specialty Papers Market Size, By Region, 2013–2020 (KT)

Table 37 Additives in Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 38 Additives in Specialty Papers Market Size, By Type, 2013–2020 (KT)

Table 39 Other Raw Materials in Specialty Paper Market Size, By Region, 2013–2020 ($Million)

Table 40 Other Raw Materials in Specialty Papers Market Size, By Region, 2013–2020 (KT)

Table 41 Specialty Paper Market Size, By Application, 2013–2020 ($Million)

Table 42 Specialty Papers Market Size, By Application, 2013–2020 (KT)

Table 43 Building & Construction Application Market Size, By Region, 2013–2020 ($Million)

Table 44 Building & Construction Application Market Size, By Region, 2013–2020 (KT)

Table 45 Building & Construction Application Market Size, By Type, 2013–2020 ($Million)

Table 46 Building & Construction Application Market Size, By Type, 2013–2020 (KT)

Table 47 Industrial Application Market Size, By Region, 2013–2020 ($Million)

Table 48 Industrial Application Market Size, By Region, 2013–2020 (KT)

Table 49 Industrial Application Market Size, By Type, 2013–2020 ($Million)

Table 50 Industrial Application Market Size, By Type, 2013–2020 (KT)

Table 51 Packaging & Labeling Market Size, By Region, 2013–2020 ($Million)

Table 52 Packaging & Labeling Market Size, By Region, 2013–2020 (KT)

Table 53 Packaging & Labeling Application Market Size, By Type, 2013–2020 ($Million)

Table 54 Packaging & Labeling Application Market Size, By Type, 2013–2020 (KT)

Table 55 Printing & Writing Application Market Size, By Region, 2013–2020, ($Million)

Table 56 Printing & Writing Application Market Size, By Region, 2013–2020 (KT)

Table 57 Printing & Writing Application Market Size, By Type, 2013–2020 ($Million)

Table 58 Printing & Writing Application Market Size, By Type, 2013–2020 (KT)

Table 59 Other Applications Market Size, By Region, 2013–2020 ($Million)

Table 60 Other Applications Market Size, By Region,2013–2020 (KT)

Table 61 Specialty Paper Market Size, By Region, 2013–2020 ($Million)

Table 62 Specialty Papers Market Size, By Region, 2013–2020 (KT)

Table 63 Asia-Pacific: Specialty Paper Market Size, By Country, 2013–2020 ($Million)

Table 64 Asia-Pacific: Specialty Paper Market Size, By Country, 2013–2020 (KT)

Table 65 Asia-Pacific: By Market Size, By Type, 2013–2020 ($Million)

Table 66 Asia-Pacific: By Market Size, By Type, 2013–2020 (KT)

Table 67 Asia-Pacific: By Market Size, By Application, 2013–2020 ($Million)

Table 68 Asia-Pacific By Market Size, By Application, 2013–2020 (KT)

Table 69 Asia-Pacific By Market Size, By Material, 2013–2020 ($Million)

Table 70 Asia-Pacific By Market Size, By Material, 2013–2020 (KT)

Table 71 Australia: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 72 Australia: By Market Size, By Type, 2013–2020 (KT)

Table 73 Australia: By Market Size, By Application, 2013–2020 ($Million)

Table 74 Australia: By Market Size, By Application, 2013–2020 (KT)

Table 75 China: Specialty Paper Market Size, By Type, 2013–2020($Million)

Table 76 China: By Market Size, By Type, 2013–2020 (KT)

Table 77 China: By Market Size, By Application, 2013–2020($Million)

Table 78 China: By Market Size, By Application, 2013–2020 (KT)

Table 79 India: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 80 India: By Market Size, By Type, 2013–2020 (KT)

Table 81 India: By Market Size, By Application, 2013–2020 ($Million)

Table 82 India: By Market Size, By Application, 2013–2020 (KT)

Table 83 Japan: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 84 Japan: By Market Size, By Type, 2013–2020 (KT)

Table 85 Japan: By Market Size, By Application, 2013–2020 ($Million)

Table 86 Japan: By Market Size, By Application, 2013–2020 (KT)

Table 87 Rest of Asia-Pacific: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 88 Rest of Asia-Pacific: By Market Size, By Type, 2013–2020 (KT)

Table 89 Rest of Asia-Pacific: By Market Size, By Application, 2013–2020 ($Million)

Table 90 Rest of Asia-Pacific: By Market Size, By Application, 2013–2020 (KT)

Table 91 Europe: Specialty Paper Market Size, By Country, 2013–2020 ($Million)

Table 92 Europe: By Market Size, By Type, 2013–2020 ($Million)

Table 93 Europe: By Market Size, By Type,2013–2020(KT)

Table 94 Europe: By Market Size, By Application, 2013–2020 ($Million)

Table 95 Europe: By Market Size, By Application, 2013–2020 (KT)

Table 96 Europe: By Market Size, By Application, 2013–2020 ($Million)

Table 97 Europe: By Market Size, By Application, 2013–2020 (KT)

Table 98 France: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 99 France: By Market Size, By Type, 2013–2020 (KT)

Table 100 France: By Market Size, By Application, 2013–2020 ($Million)

Table 101 France: By Market Size, By Application, 2013–2020 (KT)

Table 102 Germany: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 103 Germany: By Market Size, By Type, 2013–2020 (KT)

Table 104 Germany: By Market Size, By Application, 2013–2020 ($Million)

Table 105 Germany: By Market Size, By Application, 2013–2020 (KT)

Table 106 Poland: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 107 Poland: By Market Size, By Type, 2013–2020 (KT)

Table 108 Poland: By Market Size, By Application,2013–2020 ($Million)

Table 109 Poland: By Market Size, By Application, 2013–2020 (KT)

Table 110 Russia: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 111 Russia: By Market Size, By Type, (KT)

Table 112 Russia: By Market Size, By Application, ($Million)

Table 113 Russia: By Market Size, By Application, (KT)

Table 114 The U.K: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 115 The U.K: By Market Size, By Type (KT)

Table 116 The U.K: By Market Size, By Application ($Million)

Table 117 The U.K: By Market Size, By Application (KT)

Table 118 Rest of Europe: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 119 Rest of Europe: By Market Size, By Type (KT)

Table 120 Rest of Europe: By Market Size, By Application ($Million)

Table 121 Rest of Europe: By Market Size, By Application (KT)

Table 122 North America: Specialty Paper Market Size, By Country, 2013–2020 ($Million)

Table 123 North America: Market Size, By Country,2013–2020 (KT)

Table 124 North America: Market Size, By Type, 2012-2019 ($Million)

Table 125 North America: Market Size, By Type, 2013–2020 (KT)

Table 126 North America: Market Size, By Application, 2013–2020 ($Million)

Table 127 North America: Market Size, By Application,2013–2020 (KT)

Table 128 North America: Market Size, By Material,2013–2020 ($Million)

Table 129 North America: Market Size, By Material, 2013–2020 (KT)

Table 130 The U.S. : Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 131 The U.S. : Market Size, By Type,2013–2020 (KT)

Table 132 The U.S. : Market Size, By Application,2013–2020 ($Million)

Table 133 The U.S. : Market Size, By Application,2013–2020 (KT)

Table 134 Mexico: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 135 Mexico: Market Size, By Type, 2013–2020 (KT)

Table 136 Mexico: Market Size, By Application, 2013–2020 ($Million)

Table 137 Mexico: Market Size, By Application, 2013–2020 (KT)

Table 138 Canada: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 139 Canada: Market Size, By Type, 2013–2020 (KT)

Table 140 Canada: Market Size, By Application ($Million)

Table 141 Canada: Market Size, By Application (KT)

Table 142 RoW: Specialty Paper Market Size, By Country, 2013–2020 ($Million)

Table 143 RoW: Market Size, By Country, 2013–2020 (KT)

Table 144 RoW: Market Size, By Type, 2013–2020 ($Million)

Table 145 RoW: Market Size, By Type, 2013–2020 (KT)

Table 146 RoW: Market Size, By Application, 2013–2020 ($Million)

Table 147 RoW: Market Size, By Application, 2013–2020 (KT)

Table 148 Argentina: Specialty Paper Market Size, By Type, 2013–2020($Million)

Table 149 Argentina: Market Size, By Type, 2013–2020(KT)

Table 150 Argentina: Market Size, By Application, 2013–2020($Million)

Table 151 Argentina: Market Size, By Application, 2013–2020(KT)

Table 152 Brazil: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 153 Brazil: Market Size, By Type,2013–2020 (KT)

Table 154 Brazil: Market Size, By Application,2013–2020 ($Million)

Table 155 Brazil: Market Size, By Application,2013–2020 (KT)

Table 156 South Africa: Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 157 South Africa: Market Size, By Type, 2013–2020 (KT)

Table 158 South Africa: Market Size, By Application, 2013–2020 ($Million)

Table 159 South Africa: Market Size, By Application, 2013–2020 (KT)

Table 160 Other RoW Countries : Specialty Paper Market Size, By Type, 2013–2020 ($Million)

Table 161 Other RoW Countries: Market Size, By Type, 2013–2020 (KT)

Table 162 Other RoW Countries: Market Size, By Application, 2013–2020 ($Million)

Table 163 Other RoW Countries: Market Size, By Application, 2013–2020 (KT)

List of Figures (59 Figures)

Figure 1 Specialty Paper Market Segmentation

Figure 2 Research Design

Figure 3 Projected GDP Per Capita, By Region, 2014–2019 ($Million)

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Specialty Paper Market Snapshot, By Type, 2015 vs 2020 ($Million)

Figure 7 Specialty Papers Market Size, By Application, 2015–2020 ($Million)

Figure 8 Specialty Paper Market Trend, By Region, 2015–2020

Figure 9 Specialty Papers Market, By Region, 2014

Figure 10 Specialty Paper Market Share (Developments), 2011–2015

Figure 11 Specialty Papers Market Scenario

Figure 12 Specialty Paper Market Size, By Type, 2014–2020 (KT)

Figure 13 Asia-Pacific Specialty Paper Market Size, By Application, 2013 (KT)

Figure 14 Specialty Paper Market Growth Prospects,2015–2020 (KT)

Figure 15 Life Cycle Analysis, By Region, 2014

Figure 16 Asia-Pacific: Specialty Paper Market Scenario, 2014

Figure 17 Evolution of Specialty Paper

Figure 18 Specialty Paper Market Dynamics

Figure 19 Specialty Papers Market Drivers: Impact Analysis

Figure 20 Percentage of Urban Population in World

Figure 21 Specialty Paper Market Restraints: Impact Analysis

Figure 22 Specialty Paper Market Opportunities: Impact Analysis

Figure 23 Specialty Papers Market Challenges: Impact Analysis

Figure 24 Share of Infrastructure Investment in Developing Countries

Figure 25 Value Chain of Analysis Specialty Paper

Figure 26 Supply Chain of Paper Industry

Figure 27 Porter’s Five Forces Analysis

Figure 28 Specialty Paper Market, By Type: A Snapshot

Figure 29 Décor Paper Market Size, By Region, 2015–2020 (KT)

Figure 30 Release Liner Paper Market Size, By Region, 2015–2020 ($Million)

Figure 31 Packaging Paper Market Size, By Region, 2015–2020 ($Million)

Figure 32 Printing Paper Market Size, By Region, 2015–2020 ($Million)

Figure 33 Pulp in Specialty Paper Market Size, By Region, 2015 vs. 2020 ($Million)

Figure 34 Fillers & Binders in Specialty Paper Market Size, By Region, 2015–2020 ($Million)

Figure 35 Coatings in Specialty Papers Market Size, By Region, 2015–2020 ($Million)

Figure 36 Coatings in Specialty Paper Market Share , By Type , 2014 ($Million)

Figure 37 Specialty Paper Market, By Application: A Snapshot

Figure 38 Building & Construction: Second-Fastest-Growing Segment

Figure 39 Packaging & Labeling: Fastest-Growing Segment

Figure 40 Specialty Paper Market Growth Analysis, 2015–2020 ($Million)

Figure 41 Asia-Pacific: Fastest Growing Market for Specialty Paper, 2014 (KT)

Figure 42 Europe: Specialty Paper Snapshot, 2014 (KT)

Figure 43 U.S.: Specialty Papers Market, A Snapshot (KT)

Figure 44 Geographic Revenue Mix of Top 5 Market Players

Figure 45 International Paper Company: Company Snapshot

Figure 46 International Paper: SWOT Analysis

Figure 47 Stora ENSO: Company Snapshot

Figure 48 Storaenso: SWOT Analysis

Figure 49 Nippon Paper Group: Company Snapshot

Figure 50 Nippon Paper Group: SWOT Analysis

Figure 51 Mondi Group: Company Snapshot

Figure 52 Mondi PLC: SWOT Analysis

Figure 53 Sappi Ltd.: Company Snapshot

Figure 54 Sappi Ltd.: SWOT Analysis

Figure 55 ITC Ltd.: Company Snapshot

Figure 56 Domtar Corporation: Company Snapshot

Figure 57 Glatfelter: Company Snapshot

Figure 58 Fedrigoni: Company Snapshot

Figure 59 Munksjo Group: Company Snapshot

Growth opportunities and latent adjacency in Specialty Paper Market